Global Extended Reach Drilling Technology Market

Market Size in USD Million

CAGR :

%

USD

686.53 Million

USD

1,077.82 Million

2025

2033

USD

686.53 Million

USD

1,077.82 Million

2025

2033

| 2026 –2033 | |

| USD 686.53 Million | |

| USD 1,077.82 Million | |

|

|

|

|

Extended Reach Drilling Technology Market Size

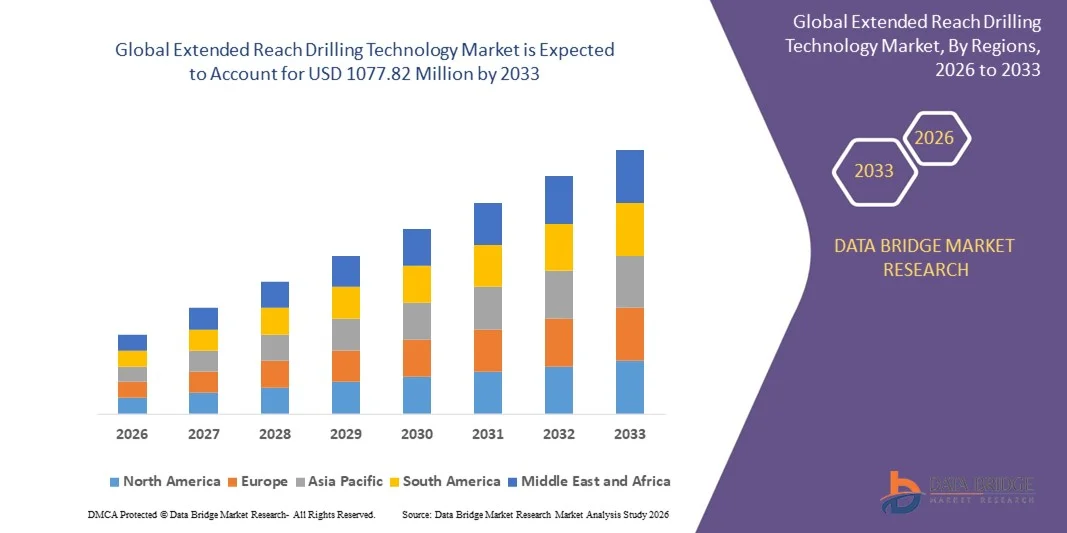

- The global extended reach drilling technology market size was valued at USD 686.53 million in 2025 and is expected to reach USD 1077.82 million by 2033, at a CAGR of 5.8% during the forecast period

- The market growth is largely fueled by the increasing demand for accessing challenging and remote hydrocarbon reservoirs, coupled with technological advancements in drilling equipment, rotary steerable systems, and measurement while drilling (MWD) solutions, leading to enhanced operational efficiency and precision in both onshore and offshore projects

- Furthermore, rising investment by oil & gas operators to optimize reservoir recovery, reduce non-productive time, and minimize environmental footprint is establishing ERD technologies as a preferred solution for complex drilling operations. These converging factors are accelerating the adoption of ERD solutions, thereby significantly boosting the industry’s growth

Extended Reach Drilling Technology Market Analysis

- Extended Reach Drilling technologies, enabling horizontal and vertical extended drilling, are increasingly vital components of modern exploration and production strategies in both conventional and unconventional oil & gas fields due to their ability to reach previously inaccessible reserves, improve wellbore stability, and enhance overall project economics

- The escalating demand for ERD solutions is primarily fueled by growing energy requirements, the need for deeper and longer wells, technological advancements in drilling components and digital solutions, and an increasing focus on operational efficiency and safety in complex reservoir environments

- North America dominated extended reach drilling technology market with a share of 37.3% in 2025, due to a well-established oil & gas infrastructure, increasing exploration activities, and the adoption of advanced drilling technologies

- Asia-Pacific is expected to be the fastest growing region in the extended reach drilling technology market during the forecast period due to increasing offshore and onshore exploration in countries such as China, India, and Australia

- Onshore segment dominated the market with a market share of 61.7% in 2025, due to the extensive deployment of ERD in shale gas, tight oil, and unconventional hydrocarbon fields. Onshore ERD provides cost advantages, easier logistics, and better control over drilling operations compared to offshore drilling. For instance, Baker Hughes has implemented advanced onshore ERD solutions in North American shale basins to enhance reservoir access and optimize production. The segment also benefits from government initiatives supporting domestic energy exploration and rising investments in energy infrastructure. The versatility of onshore ERD technology to handle complex terrains and long lateral wells further reinforces its dominance. Advanced rig designs and automation solutions continue to increase operational efficiency for onshore projects

Report Scope and Extended Reach Drilling Technology Market Segmentation

|

Attributes |

Extended Reach Drilling Technology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Extended Reach Drilling Technology Market Trends

Growing Use of Horizontal and Extended Reach Drilling

- The increasing adoption of horizontal and extended reach drilling (ERD) is a major trend in the global ERD market, driven by the need to access complex and remote hydrocarbon reservoirs while optimizing operational efficiency and reducing surface footprint. This approach allows operators to reach multiple targets from a single location, significantly lowering infrastructure costs and minimizing environmental disturbance

- For instance, Schlumberger’s FlexTrend rotary steerable systems have been deployed in North American shale plays, allowing operators to drill extended reach wells with higher accuracy and efficiency while improving project economics. Such deployments demonstrate the ability of advanced ERD technologies to enhance well productivity and reduce operational risks

- The trend is further supported by the integration of advanced measurement while drilling (MWD) and logging while drilling (LWD) systems, providing real-time downhole data to enhance decision-making and reduce non-productive time. These systems enable operators to monitor well conditions continuously and adjust drilling parameters dynamically, improving overall operational performance

- Horizontal and extended reach drilling also facilitates development of unconventional reservoirs such as tight oil and shale gas fields, maximizing resource recovery and improving overall well productivity. The ability to access these previously hard-to-reach reserves has made ERD an essential strategy for operators aiming to optimize project returns and reduce surface impact

- Operators are increasingly leveraging ERD to optimize drilling operations in offshore and deepwater projects, further reinforcing the adoption of this technology. The application of ERD in complex offshore environments enhances drilling efficiency, reduces environmental disruption, and supports safe operations in challenging conditions

- The continued focus on achieving longer lateral wells with improved precision and reduced environmental impact is establishing ERD as an essential component of modern exploration and production strategies. Companies are investing in advanced ERD tools and techniques to improve efficiency, reliability, and cost-effectiveness across both onshore and offshore projects

Extended Reach Drilling Technology Market Dynamics

Driver

Advancements in Rotary Steerable and MWD/LWD Systems

- Technological advancements in rotary steerable systems (RSS) and MWD/LWD solutions are key drivers of ERD market growth, enabling operators to drill longer, more complex wells with higher precision and reliability. These advancements reduce operational risks and enhance wellbore stability, which is crucial for both onshore and offshore drilling projects

- For instance, Halliburton’s GeoPilot RSS provides precise directional control and integrates with MWD/LWD tools to deliver continuous downhole data, allowing operators to optimize well trajectory and reduce non-productive time. Such innovations demonstrate how advanced systems improve operational efficiency and support safe, cost-effective drilling

- These technologies improve wellbore stability, minimize operational risks, and enhance drilling efficiency, which are critical for both onshore and offshore projects. They also enable better reservoir targeting, ensuring higher hydrocarbon recovery and improved economic performance for drilling operators

- The growing demand for accessing deeper and unconventional reservoirs has accelerated the adoption of advanced RSS and MWD/LWD solutions. Operators are increasingly relying on these technologies to navigate complex formations and maintain operational efficiency while managing costs

- Continuous innovation in high-performance drilling tools and solutions is strengthening market growth, as companies focus on providing reliable and efficient ERD technologies to meet evolving exploration and production demands. Ongoing R&D ensures that ERD solutions continue to address the challenges of complex reservoirs while improving operational productivity

Restraint/Challenge

High Costs and Operational Complexity

- The high capital expenditure required for ERD projects and the technical complexity of executing extended reach wells pose significant challenges for market growth. Large investments in specialized equipment and skilled personnel increase project costs and may limit adoption among smaller operators

- For instance, deploying advanced RSS and MWD/LWD systems involves substantial investment in equipment, skilled workforce, and maintenance, limiting adoption for smaller operators. Such financial and operational burdens can hinder market penetration, particularly in emerging regions

- The intricate planning, monitoring, and management of horizontal and extended reach wells demand expertise and advanced software, increasing operational risk and project costs. Operators must carefully coordinate drilling parameters and continuously assess downhole conditions to ensure safety and efficiency

- In addition, wellbore stability issues, torque and drag management, and the handling of real-time downhole data create operational challenges, particularly in complex geological formations. These technical difficulties require specialized training and advanced monitoring systems to prevent delays and costly errors

- While technology is improving operational efficiency, the combination of high upfront costs and specialized skills continues to be a barrier to wider adoption. Overcoming these challenges through enhanced automation, improved training, and cost-effective ERD solutions will be essential to support sustained market growth

Extended Reach Drilling Technology Market Scope

The market is segmented on the basis of type of reach, component, application, technology, and end user.

- By Type of Reach

On the basis of type of reach, the extended reach drilling (ERD) technology market is segmented into horizontal reach and vertical depth. The horizontal reach segment dominated the market with the largest market revenue share of 55.6% in 2025, driven by the increasing demand for accessing reservoirs located far from the wellhead and the need to minimize surface footprint in environmentally sensitive areas. Horizontal drilling allows operators to reach multiple target zones from a single location, reducing the cost of drilling multiple wells. The segment also benefits from technological advancements in directional drilling tools and real-time monitoring systems that improve accuracy and efficiency. The growing adoption of horizontal drilling in shale oil and gas fields further reinforces its dominance. In addition, horizontal ERD reduces operational risks and maximizes reservoir exposure, making it a preferred choice for onshore and offshore projects.

The vertical depth segment is anticipated to witness the fastest growth rate of 18.9% from 2026 to 2033, fueled by increasing exploration in ultra-deepwater and unconventional reserves. Vertical ERD allows energy companies to access deeper formations with advanced downhole equipment and robust drilling techniques. For instance, Schlumberger has developed innovative vertical reach solutions that enhance drilling efficiency and reduce non-productive time. The segment is gaining traction in regions with deep hydrocarbon formations, and ongoing R&D efforts aim to improve drilling precision and operational safety. Operators are increasingly adopting vertical ERD for its capability to handle complex geological formations, thus driving market expansion.

- By Component

On the basis of components, the extended reach drilling technology market is segmented into drilling equipment, measurement while drilling (MWD) systems, logging while drilling (LWD) systems, and motors and drive systems. The drilling equipment segment dominated the market with the largest revenue share of 48.7% in 2025, driven by the demand for robust drill strings, stabilizers, and top drive systems that support longer reach and high-torque operations. Drilling equipment is critical for operational efficiency and reliability in both onshore and offshore projects. The segment also benefits from continuous innovations in drill bits, casing tools, and automation technologies that reduce downtime. For instance, National Oilwell Varco offers advanced drilling rigs and equipment designed for extended reach applications, improving overall well performance. Growing investments in complex oil and gas projects contribute to the strong demand for high-quality drilling equipment. The reliability and durability of these components remain a key factor in their market dominance.

The MWD systems segment is expected to witness the fastest CAGR of 20.3% from 2026 to 2033, driven by the need for real-time data on well trajectory, formation evaluation, and drilling performance. MWD tools enable precise directional control and allow operators to make informed decisions during drilling operations. For instance, Halliburton’s MWD solutions provide continuous monitoring of critical parameters, improving drilling accuracy and reducing risks. Increasing complexity of reservoirs and growing adoption of digital drilling practices accelerate demand for MWD systems. The segment also benefits from integration with LWD systems and advanced analytics platforms. The focus on optimizing drilling efficiency and minimizing non-productive time fuels rapid market growth for MWD components.

- By Application

On the basis of application, the extended reach drilling technology market is segmented into onshore and offshore. The onshore segment dominated the market with the largest market revenue share of 61.2% in 2025, driven by the extensive deployment of ERD in shale gas, tight oil, and unconventional hydrocarbon fields. Onshore ERD provides cost advantages, easier logistics, and better control over drilling operations compared to offshore drilling. For instance, Baker Hughes has implemented advanced onshore ERD solutions in North American shale basins to enhance reservoir access and optimize production. The segment also benefits from government initiatives supporting domestic energy exploration and rising investments in energy infrastructure. The versatility of onshore ERD technology to handle complex terrains and long lateral wells further reinforces its dominance. Advanced rig designs and automation solutions continue to increase operational efficiency for onshore projects.

The offshore segment is anticipated to witness the fastest growth rate of 17.6% from 2026 to 2033, fueled by increasing deepwater and ultra-deepwater exploration activities. Offshore ERD technology allows operators to access challenging reservoirs with minimal surface disruption and reduced environmental impact. For instance, TechnipFMC has deployed innovative offshore ERD solutions to drill extended reach wells in deepwater fields with enhanced precision. The segment also benefits from advancements in floating rigs, subsea equipment, and real-time monitoring systems. Growing global energy demand and exploration in untapped offshore reserves support rapid adoption. Offshore ERD continues to gain traction due to its ability to maximize reservoir exposure while optimizing costs.

- By Technology

On the basis of technology, the extended reach drilling technology market is segmented into rotary steerable systems, mud motors, and advanced drill bits. The rotary steerable systems segment dominated the market with the largest revenue share of 52.4% in 2025, driven by its superior directional control, increased drilling speed, and ability to maintain wellbore stability in extended reach applications. These systems allow operators to drill longer lateral wells with high precision, reducing the need for multiple wells and optimizing reservoir recovery. For instance, Schlumberger’s rotary steerable systems provide real-time feedback and automated adjustments to enhance drilling accuracy. The segment also benefits from technological innovations in downhole sensors and automation that improve performance and reduce operational risks. Growing adoption in complex geological formations further strengthens the dominance of rotary steerable technology. Its compatibility with both onshore and offshore ERD projects makes it a preferred solution globally.

The mud motors segment is expected to witness the fastest CAGR of 19.8% from 2026 to 2033, driven by its ability to provide high torque at the bit while drilling extended reach wells. Mud motors enhance drilling efficiency and allow operators to navigate complex formations with reduced wear on drill strings. For instance, NOV provides advanced mud motor solutions that improve drilling speed and reduce non-productive time. The segment is gaining traction in deepwater and unconventional reservoirs due to its operational reliability and adaptability. Growing focus on enhancing drilling performance and minimizing operational costs accelerates market adoption. Mud motors also complement rotary steerable systems, further fueling their demand.

- By End User

On the basis of end users, the extended reach drilling technology market is segmented into oil & gas companies, service providers, and government and regulatory bodies. The oil & gas companies segment dominated the market with the largest revenue share in 2025, driven by their extensive exploration and production activities in both onshore and offshore regions. Energy companies prioritize ERD technologies to maximize reservoir access, optimize production, and reduce drilling costs. For instance, ExxonMobil has adopted advanced ERD solutions across its global projects to improve drilling efficiency and recoverable reserves. The segment benefits from continuous investment in digital drilling solutions and automation technologies that enhance operational performance. Regulatory compliance and risk mitigation in complex drilling operations further strengthen the dominance of oil & gas companies as key end users. Their focus on long-term production optimization ensures sustained demand for ERD technologies.

The service providers segment is anticipated to witness the fastest growth rate of 18.2% from 2026 to 2033, fueled by the rising demand for specialized ERD solutions and contract drilling services. Service providers offer expertise, equipment, and operational support to optimize drilling performance for oil & gas companies. For instance, Weatherford provides integrated ERD services, including drilling equipment, MWD, and LWD solutions, to enhance efficiency in complex projects. The segment benefits from technological advancements and growing adoption of outsourced drilling solutions. Increasing collaborations between service providers and operators accelerate the deployment of ERD technologies. Service providers continue to expand their offerings to meet the evolving needs of global exploration and production activities.

Extended Reach Drilling Technology Market Regional Analysis

- North America dominated the extended reach drilling technology market with the largest revenue share of 37.3% in 2025, driven by a well-established oil & gas infrastructure, increasing exploration activities, and the adoption of advanced drilling technologies

- Operators in the region highly value the efficiency, precision, and cost-effectiveness offered by ERD solutions for accessing complex reservoirs and unconventional hydrocarbon deposits

- This widespread adoption is further supported by high investment in R&D, technologically advanced drilling equipment, and the growing need to maximize reservoir recovery, establishing ERD technologies as a favored solution for both onshore and offshore projects

U.S. Extended Reach Drilling Technology Market Insight

The U.S. extended reach drilling technology market captured the largest revenue share in 2025 within North America, fueled by extensive shale exploration, deepwater drilling projects, and the adoption of rotary steerable systems and MWD/LWD solutions. Companies are increasingly prioritizing horizontal and extended reach wells to enhance production while reducing environmental footprint. For instance, Schlumberger and Baker Hughes have deployed advanced ERD technologies to optimize drilling performance and reduce non-productive time. The focus on digital drilling solutions, real-time monitoring, and automation further propels market growth. Moreover, government policies supporting domestic energy production and investments in unconventional fields are sustaining demand for ERD solutions.

Europe Extended Reach Drilling Technology Market Insight

The Europe extended reach drilling technology market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing offshore exploration in the North Sea and stringent environmental and safety regulations. The adoption of advanced drilling technologies ensures efficient reservoir access with minimal ecological impact. European operators are also investing in rotary steerable systems and mud motors to optimize drilling performance. For instance, TechnipFMC provides innovative ERD solutions tailored for offshore environments. The market growth is supported by well-developed energy infrastructure, technological expertise, and a strong focus on sustainability across oil & gas operations.

U.K. Extended Reach Drilling Technology Market Insight

The U.K. extended reach drilling technology market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising focus on offshore oil fields and energy security. Advanced ERD technologies are increasingly adopted for complex reservoir access and production optimization. Concerns regarding operational efficiency and environmental compliance encourage oil & gas operators to invest in precision drilling solutions. For instance, BP has leveraged ERD technologies to enhance production from mature fields. The country’s emphasis on innovation, technological adoption, and regulatory compliance continues to support ERD market expansion.

Germany Extended Reach Drilling Technology Market Insight

The Germany extended reach drilling technology market is expected to expand at a considerable CAGR during the forecast period, fueled by growing exploration and drilling projects in both conventional and unconventional fields. Germany’s strong industrial base, engineering expertise, and focus on technological innovation drive the adoption of advanced drilling components and systems. ERD technologies integrated with real-time monitoring and automation are increasingly implemented to improve operational safety and efficiency. For instance, Wintershall Dea and other operators are investing in ERD solutions for deep and complex reservoirs. Sustainable and eco-conscious drilling practices further strengthen market growth in the country.

Asia-Pacific Extended Reach Drilling Technology Market Insight

The Asia-Pacific extended reach drilling technology market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by increasing offshore and onshore exploration in countries such as China, India, and Australia. Rising energy demand, coupled with the need to optimize hydrocarbon recovery from complex reservoirs, is accelerating the adoption of ERD technologies. For instance, Halliburton has implemented ERD solutions in offshore blocks in Australia to enhance drilling precision and efficiency. Government initiatives supporting energy infrastructure, the development of deepwater fields, and increasing investments in digital drilling solutions are key factors driving rapid growth. The availability of skilled workforce and expanding service provider network further supports market adoption.

Japan Extended Reach Drilling Technology Market Insight

The Japan extended reach drilling technology market is gaining momentum due to the country’s increasing offshore energy exploration and technological advancement in precision drilling solutions. Japanese operators emphasize operational efficiency and safety while exploring complex reservoirs. Integration of ERD with advanced MWD/LWD systems allows for real-time monitoring and optimized well trajectories. For instance, JGC Corporation and other local players are leveraging ERD technologies to maximize reservoir recovery. Growing demand for energy security and offshore resource development drives ERD adoption across the residential and industrial sectors.

China Extended Reach Drilling Technology Market Insight

The China extended reach drilling technology market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid expansion in offshore and onshore hydrocarbon fields, rising energy consumption, and technological adoption. Horizontal and vertical extended reach drilling solutions are increasingly utilized to improve reservoir accessibility and production efficiency. For instance, Sinopec and CNPC have deployed advanced ERD technologies to optimize complex drilling operations. The push towards energy security, combined with government support for offshore exploration, domestic manufacturing of drilling equipment, and technological collaboration, is significantly propelling market growth in China.

Extended Reach Drilling Technology Market Share

The extended reach drilling technology industry is primarily led by well-established companies, including:

- Schlumberger Limited (U.S.)

- Halliburton (U.S.)

- Baker Hughes Company (U.S.)

- Weatherford International (U.S.)

- National Oilwell Varco (U.S.)

- TechnipFMC (U.K.)

- Transocean (Switzerland)

- Valaris (U.K.)

- Seadrill (Bermuda)

- Nabors Industries (Bermuda)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.