Global External Cloud Automotive Cyber Security Services Market

Market Size in USD Billion

CAGR :

%

USD

3.40 Billion

USD

12.02 Billion

2024

2032

USD

3.40 Billion

USD

12.02 Billion

2024

2032

| 2025 –2032 | |

| USD 3.40 Billion | |

| USD 12.02 Billion | |

|

|

|

|

External Cloud Automotive Cyber Security Services Market Size

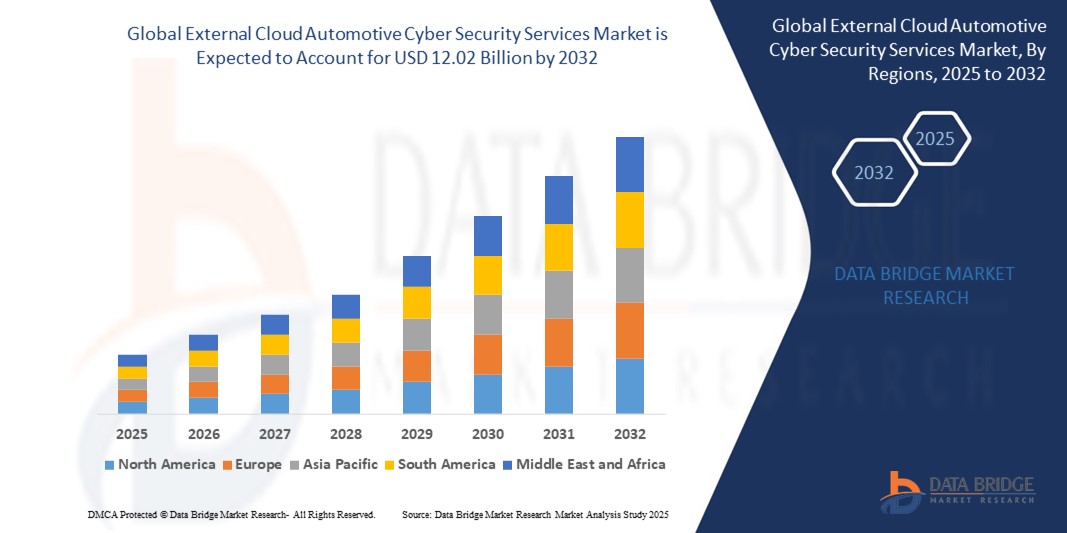

- The global external cloud automotive cyber security services market size was valued at USD 3.4 billion in 2024 and is expected to reach USD 12.02 billion by 2032, at a CAGR of 17.1% during the forecast period

- The market growth is largely fueled by the rapid adoption of connected and autonomous vehicle technologies, increasing reliance on cloud-based automotive services, and rising cybersecurity threats targeting vehicle communication and control systems

- Furthermore, stringent regulatory requirements for automotive data protection, growing consumer concerns over privacy and safety, and the expansion of vehicle-to-everything (V2X) infrastructure are prompting OEMs and fleet operators to implement robust external cloud cybersecurity solutions. These combined dynamics are accelerating market growth and reinforcing the need for scalable, cloud-native automotive cybersecurity frameworks

External Cloud Automotive Cyber Security Services Market Analysis

- External cloud automotive cyber security services encompass a range of security solutions and protocols designed to protect connected vehicles' electronic systems, communication networks, algorithms, and user data from malicious attacks or unauthorized access, particularly focusing on cloud-based systems and services. These services aim to safeguard the increasing connectivity and software systems within vehicles from cyber threats, thereby enhancing the overall safety, data integrity, and reliability of modern automotive technologies.

- The increasing need for these services is primarily driven by the growing adoption of connected and autonomous vehicles, which inherently expands the landscape of potential cyber vulnerabilities. Furthermore, the rising frequency and sophistication of cyberattacks targeting the automotive industry, coupled with stringent government regulations and a growing consumer awareness of data privacy and vehicle safety, are creating a significant demand for robust external cloud-based cybersecurity services to ensure comprehensive protection and threat mitigation

- North America dominated the external cloud automotive cyber security services market with a share of 42.6% in 2024 due to growing demand for smart automotive solutions in the region

- Asia-Pacific is expected to be the fastest growing region in the external cloud automotive cyber security services market with a share of during the forecast period due to rapid digital transformation of the automotive sector across China, Japan, South Korea, and India

- Wireless network security segment dominated the market with a market share of 43.0% n 2024 due to the expansion of V2X communications and 5G-based vehicle connectivity. As vehicles increasingly rely on wireless channels for updates, diagnostics, and navigation, securing these communication pathways has become vital, especially against data interception and spoofing

Report Scope and External Cloud Automotive Cyber Security Services Market Segmentation

|

Attributes |

External Cloud Automotive Cyber Security Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

External Cloud Automotive Cyber Security Services Market Trends

“Increasing Connectivity and Digitalization of Vehicles”

- A significant and accelerating trend in the global external cloud automotive cyber security services market is the increasing connectivity and digitalization of vehicles, reflecting the broader shift toward software-defined vehicles, over-the-air updates, and integrated cloud platforms. As vehicles become more reliant on external data exchanges for infotainment, diagnostics, and autonomous functionality, the need for advanced cloud-based cybersecurity solutions is becoming paramount

- For instance, major companies such as Continental AG and Harman International (a Samsung subsidiary) are actively developing cloud-integrated cyber defense systems to secure vehicle communications and data. Continental's Automotive Edge platform integrates cybersecurity functions for connected vehicle systems, while Harman’s Shield Auto Cybersecurity offers real-time cloud monitoring and threat detection. Similarly, Blackberry’s QNX platform, widely used in in-vehicle systems, is increasingly coupled with its Cylance AI-based cloud cybersecurity services to address evolving threats

- The increasing digital footprint of modern vehicles is exposing them to new vulnerabilities, such as remote code execution, data breaches, and system manipulation. Features such as remote diagnostics, vehicle-to-cloud synchronization, and autonomous driving functions are highly dependent on secure cloud connections, making cloud-based security solutions a critical requirement. Rising consumer expectations for seamless digital services and the proliferation of connected vehicle models are accelerating the pace of this transformation

- This trend is not limited to luxury or premium brands; mass-market automakers are also investing in external cloud cybersecurity as standard connectivity becomes more pervasive. Cloud-based threat detection, intrusion prevention, and secure over-the-air update capabilities are being adopted across a growing range of vehicle categories, supported by real-time monitoring and compliance solutions from specialized security vendors

- Consequently, companies such as Tesla, Ford, and BMW are leveraging partnerships with cybersecurity providers to bolster their connected car platforms. Tesla's frequent software updates rely on secure cloud infrastructure, while Ford's BlueCruise and BMW's ConnectedDrive services incorporate multi-layered cloud security mechanisms to protect vehicle integrity and user data across distributed networks

- The demand for external cloud cybersecurity services is rapidly expanding across OEMs, Tier 1 suppliers, and mobility service providers, as vehicles increasingly operate as connected digital platforms. This trend is fundamentally reshaping the automotive cybersecurity landscape, driving innovation and compelling the industry to prioritize cloud-native security architectures to safeguard the future of mobility

External Cloud Automotive Cyber Security Services Market Dynamics

Driver

“Rising Cybersecurity Concerns”

- Rising cybersecurity concerns across the automotive industry are a significant driver for the growing demand for external cloud automotive cyber security services, as modern vehicles become more connected and susceptible to digital threats targeting both user data and vehicle control systems

- For instance, major cybersecurity firms such as Upstream Security provide cloud-based threat intelligence and monitoring solutions specifically tailored for connected vehicles, detecting real-time anomalies and protecting fleets from large-scale cyberattacks. Similarly, GuardKnox and AUTOCRYPT offer specialized cloud-integrated automotive cybersecurity platforms designed to shield software-defined vehicles from intrusion, manipulation, and unauthorized access

- As automakers increasingly integrate features such as remote diagnostics, infotainment streaming, autonomous driving capabilities, and over-the-air (OTA) updates, they face greater exposure to potential threats such as ransomware, firmware tampering, and data breaches. This growing threat landscape is compelling OEMs to adopt external cloud-based cyber defenses that can scale across vehicle models and regions

- Furthermore, the rise in reported incidents of vehicle-related cyberattacks and vulnerabilities is prompting regulatory bodies to introduce stricter cybersecurity compliance standards, such as UNECE WP.29, which mandates risk management throughout a vehicle’s lifecycle. These frameworks are accelerating the need for robust cloud-driven security infrastructure

- The demand for reliable, scalable, and adaptive cloud cyber security services is growing steadily as stakeholders across the automotive value chain seek to mitigate the increasing risks of vehicle connectivity. This trend is pushing the industry toward proactive investment in cloud-native security technologies, reshaping the landscape of connected vehicle protection

Restraint/Challenge

“Legacy Systems Challenge Cybersecurity Integration”

- Legacy in-vehicle systems and outdated electronic control unit (ECU) architectures pose a significant challenge to the seamless integration of external cloud automotive cyber security services, potentially limiting their effectiveness in protecting older vehicle models. The lack of uniformity across vehicle platforms hinders the implementation of modern, cloud-based security solutions at scale

- For instance, major cybersecurity providers such as AUTOCRYPT and Karamba Security often face hurdles when deploying advanced cloud-based protection to older vehicle models lacking the computing power or connectivity protocols needed to support modern security frameworks. Similarly, Upstream Security has highlighted the integration gaps posed by fragmented automotive software ecosystems, especially in fleets with mixed generations of hardware

- Addressing these challenges requires automakers and cybersecurity vendors to retrofit legacy systems with intermediary gateways or software patches that enable partial compatibility with cloud services. However, such retrofitting can be costly, complex, and may not provide full-spectrum threat protection, leaving some systems vulnerable

- Further complicating the issue is the extended lifecycle of many vehicles, especially in emerging markets, where older models continue to operate for years without the infrastructure needed for continuous security updates or remote diagnostics. This increases long-term cybersecurity risks and complicates regulatory compliance

- The challenge of securing legacy systems underscores the importance of developing flexible, backward-compatible cybersecurity architectures. For the external cloud automotive cyber security services market to achieve widespread adoption, providers must innovate ways to protect aging vehicle platforms while maintaining interoperability with next-generation systems

External Cloud Automotive Cyber Security Services Market Scope

The market is segmented on the basis of security, application, vehicle, and electric vehicle.

- By Security

On the basis of security, the market is segmented into endpoint security, application security, and wireless network security. The wireless network security segment accounted for the largest market revenue share 43.0% in 2024, driven by the expansion of V2X communications and 5G-based vehicle connectivity. As vehicles increasingly rely on wireless channels for updates, diagnostics, and navigation, securing these communication pathways has become vital, especially against data interception and spoofing.

The endpoint security segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the increasing need to protect vehicle endpoints such as ECUs and telematics units from cyberattacks. As modern vehicles integrate more cloud-connected features, the risk of unauthorized access grows, making endpoint security a critical layer. Automakers are increasingly prioritizing endpoint protection as part of their broader cybersecurity strategies.

- By Application

On the basis of application, the market is segmented into telematics system, infotainment system, powertrain system, body control & comfort system, communication system, and ADAS and safety system. The infotainment system segment held the largest market revenue share of 36.57% in 2024, driven by the widespread integration of connected features such as navigation, voice assistants, real-time traffic updates, and streaming services in modern vehicles. These systems frequently interface with external networks and cloud platforms, increasing their vulnerability to cyber threats and driving demand for advanced cybersecurity services.

The ADAS and safety system segment is projected to experience the fastest growth at a CAGR of 22.6% from 2025 to 2032, due to the rising deployment of autonomous driving features and the critical need to secure real-time data exchange between sensors and control units. The integrity of ADAS functions, including collision avoidance and lane assistance, is essential to passenger safety, prompting investments in robust external cybersecurity services.

- By Vehicle

On the basis of vehicle, the market is segmented into passenger car and commercial vehicle. The passenger car segment captured the largest market revenue share in 2024, attributed to the rapid adoption of connected technologies and increasing consumer demand for in-vehicle internet access and mobile app integration. Leading OEMs are integrating external cloud cybersecurity solutions to enhance passenger safety and brand reputation.

The commercial vehicle segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by the growth of connected logistics fleets and the need to prevent remote hijacking or data theft. Secure cloud-based services are increasingly used by fleet operators to protect communication and operational data, ensure compliance, and reduce cybersecurity-related downtime.

- By Electric Vehicle

On the basis of electric vehicle, the market is segmented into battery electric vehicle (BEV), hybrid electric vehicle (HEV), and plug-in hybrid electric vehicle (PHEV). The battery electric vehicle segment dominated the largest revenue share in 2024, as BEVs are typically built with highly integrated digital systems, increasing exposure to cloud-based threats. Automakers are equipping BEVs with advanced cybersecurity frameworks to ensure secure OTA updates and digital interfaces.

The plug-in hybrid electric vehicle segment is projected to register the fastest CAGR from 2025 to 2032, driven by the convergence of dual powertrain management and remote energy monitoring. PHEVs require sophisticated cybersecurity layers to protect both cloud-based diagnostics and user data as digital services become more embedded in vehicle operation.

External Cloud Automotive Cyber Security Services Market Regional Analysis

- North America dominated the external cloud automotive cyber security services market with the largest revenue share of 42.6% in 2024, driven by the growing demand for smart automotive solutions in the region

- Furthermore, increased government support and investment to counter cyberattacks in the automotive industry are also significant factors fueling market growth in North America

U.S. External Cloud Automotive Cyber Security Services Market Insight

U.S. market captured the largest revenue share in 2024 within North America, driven by the widespread deployment of connected vehicle technologies and the rapid growth of cloud-based automotive services. OEMs and fleet operators are increasingly investing in external cloud cybersecurity solutions to protect critical systems such as infotainment, telematics, and ADAS. The strong presence of cybersecurity vendors, coupled with strict regulatory requirements on automotive data protection, continues to support market expansion in the country.

Europe External Cloud Automotive Cyber Security Services Market Insight

Europe market is projected to grow at a robust CAGR during the forecast period, propelled by growing regulatory scrutiny and the emphasis on securing connected and autonomous vehicle infrastructure. Rising adoption of V2X communication, coupled with stringent GDPR compliance mandates, is encouraging automotive manufacturers to implement advanced cloud-based cybersecurity services. The market is also benefitting from collaborative efforts between automakers and tech firms to address evolving cyber threats across vehicles’ digital ecosystems.

U.K. External Cloud Automotive Cyber Security Services Market Insight

U.K. market is expected to witness steady growth, supported by the country's strategic focus on intelligent mobility and cybersecurity. Government-backed initiatives aimed at securing connected vehicle platforms are encouraging OEMs to adopt robust external cloud security frameworks. In addition, the rising penetration of electric vehicles and connected car services is increasing the demand for scalable and cloud-integrated cybersecurity solutions across the automotive sector.

Germany External Cloud Automotive Cyber Security Services Market Insight

Germany's market is anticipated to expand significantly, driven by its status as an automotive innovation hub and a strong advocate for data privacy. As German automakers accelerate their shift toward software-defined vehicles, the need to secure external cloud services integrated with infotainment, telematics, and ADAS is intensifying. The country’s rigorous cybersecurity standards and investment in smart mobility infrastructure further reinforce its leadership in automotive cyber defense solutions.

Asia-Pacific External Cloud Automotive Cyber Security Services Market Insight

The Asia-Pacific market is projected to register the fastest CAGR from 2025 to 2032, fueled by the rapid digital transformation of the automotive sector across China, Japan, South Korea, and India. Rising production and adoption of connected and electric vehicles, along with government-led smart mobility initiatives, are driving demand for advanced external cloud cybersecurity services. The region’s robust automotive manufacturing base and increasing emphasis on data protection are key contributors to market acceleration.

Japan External Cloud Automotive Cyber Security Services Market Insight

Japan’s market is gaining traction as connected and autonomous vehicle technologies become more prevalent. The country’s high-tech automotive landscape and regulatory emphasis on cybersecurity readiness are prompting automakers to enhance their cloud-based protection layers. In addition, Japan’s focus on seamless mobility and its growing elderly population are contributing to the adoption of secure, cloud-managed in-vehicle systems.

China External Cloud Automotive Cyber Security Services Market Insight

China accounted for the largest market revenue share in the Asia-Pacific region in 2024, supported by its dominant automotive manufacturing capacity, rapid 5G rollout, and aggressive expansion of smart city initiatives. The rising number of connected and electric vehicles is increasing exposure to cyber risks, thereby driving demand for cloud-based cybersecurity services. Domestic automakers and tech giants are investing heavily in cloud infrastructure to deliver secure, scalable in-vehicle services, reinforcing China’s leadership in the market.

External Cloud Automotive Cyber Security Services Market Share

The external cloud automotive cyber security services industry is primarily led by well-established companies, including:

The Major Market Leaders Operating in the Market Are:

- HARMAN International (U.S.)

- Continental AG (Germany)

- DENSO CORPORATION (Japan)

- Aptiv (Ireland)

- NXP Semiconductors (Netherlands)

- Honeywell International Inc. (U.S.)

- Trillium Secure, Inc. (U.S.)

- ETAS (Germany)

- Vector Informatik GmbH (Germany)

- Karamba Security (Israel)

- GUARDKNOX (Israel)

- Upstream Security Ltd. (Israel)

- Lear (U.S.)

- Capricode Oy (Finland)

- Fujitsu (Japan)

- Telefonaktiebolaget LM Ericsson (Sweden)

Latest Developments in Global External Cloud Automotive Cyber Security Services Market

- In April 2024, Argus Cyber Security, a global leader in automotive cybersecurity, successfully conducted vehicle-level penetration testing on the new Ford Trucks F-MAX heavy-duty truck. This testing, which adhered to the UNR 155 cybersecurity regulation, marked a significant milestone for Ford Trucks in attaining type approval certification for the F-MAX model

- In April 2023, Upstream Security, an Israeli startup specializing in automotive cybersecurity, secured an undisclosed investment from Cisco Investments. This investment comes as the demand for internet-connected vehicles and other devices continues to grow. Cisco Investments, the corporate venture capital arm of Cisco Systems, made this strategic investment in Upstream Security to support its growth and development in the automotive cybersecurity sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.