Global Extracorporeal Membrane Oxygenation Market

Market Size in USD Million

CAGR :

%

USD

601.50 Million

USD

871.90 Million

2025

2033

USD

601.50 Million

USD

871.90 Million

2025

2033

| 2026 –2033 | |

| USD 601.50 Million | |

| USD 871.90 Million | |

|

|

|

|

Extracorporeal Membrane Oxygenation Market Size

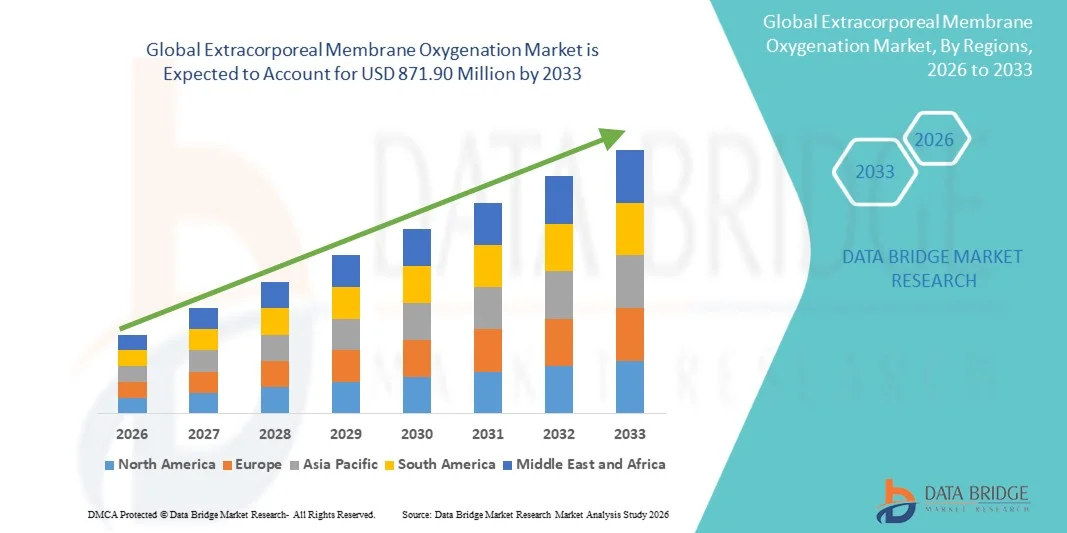

- The global extracorporeal membrane oxygenation market size was valued at USD 601.5 Million in 2025 and is expected to reach USD 871.90 Million by 2033, at a CAGR of 4.75% during the forecast period

- The market growth is largely fueled by the rising incidence of cardiovascular and respiratory failures, increasing prevalence of chronic obstructive pulmonary disease (COPD), cardiac arrest cases, and the growing need for advanced life-support technologies in critical care units. Continuous technological advancements in ECMO systems, such as improved pump efficiency, enhanced oxygenators, and more compact, portable devices, have further strengthened adoption across global healthcare facilities

- Furthermore, the expanding use of ECMO in neonatal and pediatric care, along with increasing utilization in emergency medicine, extracorporeal cardiopulmonary resuscitation (ECPR), and post-cardiac surgery support, is significantly accelerating the uptake of ECMO solutions. Rising investments in critical care infrastructure and the growing availability of specialized ECMO centers are also contributing to the industry’s rapid growth

Extracorporeal Membrane Oxygenation Market Analysis

- Extracorporeal membrane oxygenation (ECMO), a critical life-support technology used for patients with severe cardiac and respiratory failure, is increasingly becoming an essential component of advanced critical care due to its ability to provide prolonged cardiac and pulmonary support. The rising incidence of acute respiratory distress syndrome (ARDS), chronic lung diseases, cardiac arrest, and neonatal respiratory disorders is significantly boosting the adoption of ECMO systems across hospitals worldwide

- The accelerating demand for ECMO is primarily driven by technological advancements such as portable ECMO devices, improved pump and oxygenator performance, reduced risk of complications, and integration with advanced patient monitoring systems. The growing establishment of ECMO centers and increasing awareness of extracorporeal cardiopulmonary resuscitation (ECPR) are further supporting market expansion

- North America dominated the extracorporeal membrane oxygenation market with the largest revenue share of 35% in 2025, supported by advanced healthcare infrastructure, high ICU capacity, a strong presence of ECMO-trained specialists, and increasing adoption of ECMO for adult, pediatric, and neonatal critical care. The U.S. leads the region with growing use in cardiac surgery centers, trauma care, and emergency medicine

- Asia-Pacific is expected to be the fastest-growing region, projected to expand at a CAGR during the forecast period, driven by rising rates of respiratory diseases, improvements in hospital infrastructure, increasing neonatal complications, and growing investments in ECMO training programs across China, India, Japan, and South Korea

- The adult segment held the largest market revenue share of 55.4% in 2025, primarily due to the high incidence of acute respiratory distress syndrome (ARDS), cardiogenic shock, myocarditis, and post-cardiac surgery complications

Report Scope and Extracorporeal Membrane Oxygenation Market Segmentation

|

Attributes |

Extracorporeal Membrane Oxygenation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Extracorporeal Membrane Oxygenation Market Trends

“Technological Advancements Enhancing Clinical Efficiency and Patient Outcomes”

- A significant and accelerating trend in the global extracorporeal membrane oxygenation (ECMO) market is the rapid advancement of ECMO system technologies, including improved pump designs, oxygenators, and automated monitoring systems that enhance patient safety and clinical outcomes

- Leading manufacturers are integrating advanced real-time monitoring, hemodynamic sensors, and automated flow regulation systems that reduce manual intervention and improve precision during critical-care procedures

- For instance, next-generation ECMO platforms now incorporate automated air-detection systems, integrated pressure sensors, and smarter alarm management to minimize complications such as hemolysis or thrombosis

- The transition toward compact and portable ECMO devices is also shaping the market, enabling deployment in emergency departments, ambulatory environments, and even during inter-facility transport

- These portable systems allow critically ill patients with cardiac or respiratory failure to receive ECMO support earlier in their clinical course, improving survival rates

- The trend toward specialized ECMO centers, expanded training programs, and increased adoption in pediatric and neonatal care is strengthening global clinical acceptance

- Furthermore, advancements in membrane oxygenators with longer durability and improved biocompatibility are reducing the frequency of circuit changes and lowering infection risks

- Significant R&D investment in wear-resistant pump heads and long-term oxygenation membranes is boosting the reliability of continuous ECMO therapy

- Overall, the shift toward smarter, more efficient, and safer ECMO technologies is reshaping clinical protocols and expanding utilization beyond traditional ICU settings

Extracorporeal Membrane Oxygenation Market Dynamics

Driver

“Rising Incidence of Cardiopulmonary Disorders and Growing Adoption in Critical Care”

- The increasing prevalence of severe cardiac and respiratory conditions, including ARDS, cardiogenic shock, and advanced heart failure, is a major driver of global ECMO market growth

- ECMO is increasingly being adopted as a life-saving therapy in ICUs, operating rooms, and emergency care units, especially for patients who do not respond to conventional ventilation or cardiac support

- For instance, several global hospitals have reported expanded ECMO capacity following pre- and post-pandemic surges in respiratory failure cases, demonstrating strong clinical reliance on the technology

- The growing number of cardiac surgeries and rising use of ECMO in extracorporeal cardiopulmonary resuscitation (ECPR) further support market demand

- The adoption of ECMO in pediatric and neonatal care is also increasing due to its effectiveness in treating congenital heart defects and persistent pulmonary hypertension in newborns

- Increasing public health investments, expansion of specialized ECMO care units, and government funding for critical care infrastructure are strengthening market growth

- The rising number of trained perfusionists, cardiologists, and critical care specialists capable of managing ECMO circuits is improving procedural availability

- Increasing survival rates associated with early ECMO initiation are encouraging healthcare providers to integrate it into standard treatment pathways

- Overall, the escalating need for advanced life-support therapies is boosting global ECMO deployment across high-acuity care settings

Restraint/Challenge

“High Costs, Technical Complexity, and Risks Associated with ECMO Procedures”

- The high cost of ECMO systems, disposable circuits, oxygenators, and ongoing maintenance serves as a major barrier, particularly for hospitals in developing regions

- ECMO therapy requires highly trained specialists, including perfusionists, intensivists, and critical care nurses, creating operational complexity and staffing challenges

- For instance, several healthcare facilities worldwide report staffing shortages that limit their ability to expand ECMO services despite rising patient demand

- The risks associated with ECMO — including bleeding, infection, thrombosis, mechanical failure, and hemolysis — also create hesitation among clinicians and patients

- Managing complications requires strict protocols, continuous monitoring, and sophisticated equipment, adding to overall treatment costs

- Reimbursement limitations and lack of insurance coverage in many countries further constrain ECMO adoption, especially in low-resource healthcare systems

- In addition, the need for specialized ICU infrastructure and emergency backup systems raises the overall investment burden for hospitals

- While advancements in automated monitoring and biocompatible materials are reducing risks, ECMO therapy remains costly and logistically demanding

- Overcoming these challenges through improved clinical training, government funding, and cost-effective ECMO system innovations will be essential for sustaining long-term market expansion

Extracorporeal Membrane Oxygenation Market Scope

The market is segmented on the basis of component, patient population, age group, modality, indication, end user, and distribution channel.

• By Component

On the basis of component, the Extracorporeal Membrane Oxygenation market is segmented into pumps, oxygenators, controllers, cannula, and accessories. The oxygenators segment accounted for the largest market revenue share of 38.5% in 2025, owing to its critical function in exchanging oxygen and carbon dioxide in the patient’s blood during ECMO procedures. Advanced oxygenators, particularly those with polymethylpentene (PMP) membranes, provide improved gas exchange, biocompatibility, and reduced hemolysis, making them essential for prolonged ECMO support. Hospitals and tertiary care centers heavily rely on oxygenators for adult, pediatric, and neonatal patients. Their versatility in both venovenous (VV) and venoarterial (VA) ECMO applications drives widespread adoption. Regulatory approvals, clinical reliability, and consistent performance reinforce their leading position. Oxygenators are also favored for their role in emergency ECMO interventions, including post-cardiac surgery support and ARDS management. Ongoing innovations focus on enhancing membrane durability and efficiency. High adoption in developed regions, coupled with increasing awareness in emerging markets, sustains market dominance. The segment’s critical clinical importance and integration with advanced ECMO consoles further consolidate its market share.

The pumps segment is expected to witness the fastest CAGR of 8.9% from 2026 to 2033, driven by the growing adoption of centrifugal and low-shear pumps, which minimize blood trauma and improve patient safety. Pumps are crucial for regulating blood flow during ECMO, especially in high-risk adult and pediatric patients. The expansion of mobile and transport ECMO programs has increased demand for compact, portable, and highly reliable pump systems. Technological advancements such as automated flow control, integrated monitoring, and low hemolysis designs are accelerating adoption. Hospitals and specialized ICUs are investing in pumps for both VV-ECMO and VA-ECMO applications. Rising prevalence of cardiogenic shock, respiratory failure, and congenital heart disorders supports growth. Emerging markets are increasingly procuring pumps for neonatal and pediatric ECMO units. Portable ECMO setups with efficient pumps are now widely deployed in emergency response, supporting rapid patient transfer. High survival rates and reduced complications with advanced pumps drive their fast-growing adoption. The need for reliable, continuous-flow systems reinforces investment in innovative pump technologies.

• By Patient Population

On the basis of patient population, the market is segmented into infant, adult, and pediatric. The adult segment held the largest market revenue share of 55.4% in 2025, primarily due to the high incidence of acute respiratory distress syndrome (ARDS), cardiogenic shock, myocarditis, and post-cardiac surgery complications. Adult ECMO adoption surged during the COVID-19 pandemic, where VV-ECMO and VA-ECMO systems were widely deployed for severe respiratory and cardiac cases. Hospitals focus on advanced adult ECMO consoles integrated with high-performance oxygenators and pumps for continuous monitoring. Long-term ECMO support and bridge-to-transplant procedures further drive adult segment growth. Advanced training programs for ICU staff ensure efficient utilization. Regulatory approvals, insurance coverage, and clinical guidelines support adoption. Improved survival outcomes in adults reinforce the segment’s dominance. Multidisciplinary ECMO teams and tertiary hospital infrastructure enhance treatment quality. Post-acute care programs and growing awareness of ECMO benefits further consolidate market share.

The infant segment is projected to witness the fastest CAGR of 9.4% from 2026 to 2033, due to rising congenital heart defects, neonatal respiratory distress syndrome, and persistent pulmonary hypertension. Specialized neonatal ECMO circuits and cannulas reduce blood volume and minimize complications. Hospitals and NICUs are increasingly adopting ECMO to improve survival rates for critically ill neonates. Technological innovations, including smaller oxygenators and low-flow pumps, support safe and effective neonatal treatment. Awareness programs for neonatologists and healthcare professionals boost adoption. Growth is also driven by expansion of neonatal ECMO programs in emerging economies. Portable ECMO systems for neonatal transport enhance patient outcomes. Continuous improvement in safety protocols and training ensures increasing confidence among clinicians. Availability of government grants and insurance reimbursement accelerates adoption. Long-term prognosis improvements further encourage investment in neonatal ECMO.

• By Age Group

On the basis of age group, the market is segmented into neonates, pediatrics, and adults. The adult segment accounted for the largest market revenue share of 52.7% in 2025, driven by the prevalence of severe respiratory and cardiac conditions requiring prolonged ECMO support. Hospitals prefer adult ECMO due to advanced ICU infrastructure and trained multidisciplinary teams. VV-ECMO is commonly used for ARDS, whereas VA-ECMO is adopted for cardiac complications. Availability of sophisticated oxygenators and pumps enhances clinical outcomes. Post-pandemic cases, including COVID-19-related respiratory failure, reinforce adoption. Reimbursement and insurance coverage support market growth. High procedure volumes, repeat use of ECMO components, and hospital trust in advanced systems consolidate dominance. Clinical success stories and low complication rates encourage continued investment.

Pediatrics is expected to witness the fastest CAGR of 8.1% from 2026 to 2033, driven by congenital heart defects, pediatric respiratory failure, and post-surgical needs. Pediatric ECMO adoption benefits from low-volume circuits, smaller cannula sizes, and reduced extracorporeal blood exposure. Hospitals and pediatric ICUs are expanding ECMO programs, supported by government initiatives. Advanced pumps and oxygenators tailored for children improve outcomes. Clinical evidence demonstrating survival and reduced complications accelerates adoption. Portable ECMO units allow safer patient transfer within hospitals. Training programs for pediatric ECMO specialists ensure effective implementation. Increased awareness in emerging regions further drives growth.

• By Modality

On the basis of modality, the market is segmented into venovenous (VV), venoarterial (VA), and arteriovenous (AV) ECMO. VV-ECMO accounted for the largest market revenue share of 49.8% in 2025, as it is preferred for severe respiratory failure without cardiac compromise. Hospitals rely on VV-ECMO for ARDS, pneumonia, and refractory hypoxemia. Dual-lumen cannulas, low-resistance oxygenators, and advanced monitoring systems improve patient outcomes. Clinical guidelines recommend VV-ECMO for adult and pediatric ARDS. Post-COVID-19 pandemic utilization increased globally. Tertiary hospitals with ICU infrastructure maintain leadership. Regulatory approvals, clinical trust, and successful outcomes reinforce market dominance. Training and certification programs enhance VV-ECMO adoption. Hospital investment in VV-ECMO units ensures reliable care.

ECPR is expected to witness the fastest CAGR of 10.5% from 2026 to 2033, driven by adoption in refractory cardiac arrest scenarios. Hospitals implement mobile ECMO units for rapid deployment. ECPR improves survival and neurological recovery rates compared to conventional CPR. Technological improvements in cannula design, oxygenators, and pumps support safe and effective treatment. Multidisciplinary rapid-response teams enhance adoption. Awareness campaigns and professional society guidelines further promote use. Expansion into emergency care and developing regions accelerates market growth.

• By Indication

On the basis of indication, the market is segmented into respiratory disorders, cardiac disorders, and extracorporeal cardiopulmonary resuscitation (ECPR). Respiratory disorders accounted for the largest market revenue share of 46.1% in 2025, primarily due to the high prevalence of ARDS, severe pneumonia, and hypoxemic respiratory failure globally. VV-ECMO is widely preferred for mechanically ventilated patients, as it provides effective oxygenation and carbon dioxide removal while minimizing cardiac stress. Advanced oxygenators and low-shear pumps enhance patient safety and outcomes. Hospitals with well-equipped ICUs and trained personnel dominate this segment, reinforced by post-pandemic demand for ECMO support. The segment benefits from established clinical guidelines, widespread availability of oxygenators and pumps, and integration with advanced monitoring systems. Tertiary care centers utilize respiratory ECMO extensively in adult and pediatric cases. Emergency preparedness for respiratory crises further boosts adoption. Continuous R&D in membrane technology and oxygenator efficiency maintains leadership. Awareness campaigns and training programs for clinicians strengthen the segment’s position. High procedure volumes and proven survival benefits consolidate dominance.

Extracorporeal cardiopulmonary resuscitation (ECPR) is expected to witness the fastest CAGR of 11.2% from 2026 to 2033, driven by the increasing adoption in refractory cardiac arrest cases and critical emergencies. ECPR significantly improves neurological outcomes and survival rates compared to conventional CPR, prompting hospitals to invest in specialized ECMO units. Mobile ECMO systems facilitate rapid bedside deployment, particularly in emergency departments and high-volume cardiac centers. Rapid cannulation protocols and standardized operating procedures reduce procedural risks and enhance adoption. Multidisciplinary rapid-response teams, including cardiologists, intensivists, and perfusionists, ensure effective implementation. Awareness campaigns, professional society recommendations, and published clinical outcomes further promote use. Hospitals in emerging markets are gradually expanding ECPR programs. Advanced oxygenators, low-shear pumps, and compact cannulas designed for rapid deployment contribute to segment growth. Training programs for emergency ECMO use increase clinician confidence. Government and private hospital initiatives for cardiac emergency preparedness support adoption. The increasing prevalence of in-hospital cardiac arrests globally underlines the rising demand.

• By End User

On the basis of end user, the market is segmented into hospitals, clinics, diagnostic centers, and others. Hospitals accounted for the largest market revenue share of 63.4% in 2025, driven by the presence of advanced ICU infrastructure, trained multidisciplinary teams, and the capability to manage complex ECMO procedures. Hospitals perform the majority of adult, pediatric, and neonatal ECMO interventions, including post-cardiac surgery, severe ARDS, and refractory heart failure cases. Availability of advanced oxygenators, pumps, and integrated monitoring consoles further strengthens hospital dominance. High procedure volumes and tertiary care facilities ensure continuous adoption. Clinical protocols, post-ECMO care programs, and outcome tracking are well-established in hospitals. Government and private healthcare funding, insurance coverage, and accreditation standards support hospital adoption. Hospitals also invest in mobile ECMO units for emergency deployment. Experienced perfusionists and ECMO coordinators contribute to procedural success. Awareness campaigns and guideline dissemination further consolidate market share.

Diagnostic centers are expected to witness the fastest CAGR of 9.7% from 2026 to 2033, driven by the increasing need for pre-ECMO assessments, post-procedure monitoring, and diagnostic evaluations of critically ill patients. These centers provide advanced imaging, blood gas analysis, and hemodynamic monitoring, which complement ECMO therapy. Referral networks from hospitals to diagnostic centers enhance workflow efficiency. Emerging markets are investing in diagnostic facilities to improve ECMO patient outcomes. Technological advancements, including portable imaging and monitoring devices, support rapid assessments. Training programs for diagnostic staff on ECMO-related procedures boost adoption. Increased awareness of early intervention and outcome tracking drives demand. Diagnostic centers often collaborate with hospitals to provide continuous patient monitoring. Expansion of pediatric and neonatal ECMO programs contributes to segment growth. Cost-effective solutions in diagnostic centers attract small-scale clinics. Integration with telemedicine platforms enables remote evaluation, accelerating adoption.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into direct and retail. Direct sales accounted for the largest market revenue share of 71.2% in 2025, primarily due to the high cost, technical complexity, and requirement for on-site training for ECMO devices. Hospitals prefer direct procurement to ensure warranties, equipment integration, and access to service support. Long-term service contracts, training, and on-site installation strengthen adoption. Advanced ECMO consoles, oxygenators, pumps, and cannulas are mostly procured through direct sales due to the critical nature of therapy. Direct distribution ensures supply chain reliability and immediate technical assistance. Hospital ECMO programs rely on regular updates, maintenance, and component replacements. Established relationships with manufacturers support repeat purchases. Regulatory approvals and hospital audits reinforce trust in direct procurement. Intensive training for multidisciplinary teams is easier with direct sales. Hospitals in emerging markets also prefer direct channels for complex ECMO setups. Patient safety, reliability, and integration with ICU infrastructure drive continued direct channel dominance.

Retail or indirect channels are expected to witness the fastest CAGR of 8.4% from 2026 to 2033, fueled by growing demand for cannulas, accessories, and consumables via distributors. Smaller hospitals, clinics, and diagnostic centers increasingly rely on retail channels for easy access to consumables and modular components. Indirect channels enable rapid replenishment of oxygenators, pumps, and monitoring accessories. Distributor networks provide reach to remote or emerging markets where direct sales are limited. Retail channels support cost-effective procurement of non-critical components. Hospitals and clinics benefit from flexible delivery schedules, bulk purchases, and local stock availability. Growth in pediatric and neonatal ECMO units drives demand for specialized consumables via retail. Online B2B platforms and local distributors enhance accessibility. Training and technical guidance by distributors improve confidence in using ECMO consumables. Retail adoption is further supported by partnerships with regional healthcare providers. Expansion in emerging economies ensures continued growth.

Extracorporeal Membrane Oxygenation Market Regional Analysis

- North America dominated the extracorporeal membrane oxygenation market with the largest revenue share of 35% in 2025

- Supported by advanced healthcare infrastructure, high ICU capacity, a strong presence of ECMO-trained specialists, and increasing adoption of ECMO for adult, pediatric, and neonatal critical care

- The market leads the region with growing use in cardiac surgery centers, trauma care, and emergency medicine

U.S. Extracorporeal Membrane Oxygenation Market Insight

The U.S. extracorporeal membrane oxygenation market captured the largest revenue share within North America in 2025, driven by high adoption of ECMO in critical care units, extensive use in cardiovascular and respiratory support, and robust clinical research initiatives. Rising awareness among healthcare professionals, growing investment in ECMO training programs, and increasing demand for minimally invasive cardiopulmonary support procedures are further propelling market growth.

Europe Extracorporeal Membrane Oxygenation Market Insight

The Europe extracorporeal membrane oxygenation market is projected to expand at a substantial CAGR during the forecast period, driven by the rising incidence of cardiac and respiratory disorders, well-established healthcare systems, and the presence of specialized ECMO centers. Adoption is further fueled by increasing government initiatives to improve critical care infrastructure and growing clinical awareness of ECMO benefits.

U.K. Extracorporeal Membrane Oxygenation Market Insight

The U.K. extracorporeal membrane oxygenation market is expected to grow steadily, supported by the expansion of critical care services, increased utilization in neonatal and pediatric units, and growing clinical research programs focused on ECMO outcomes. The government’s emphasis on advanced healthcare technologies and the presence of specialized ECMO training programs are key growth drivers.

Germany Extracorporeal Membrane Oxygenation Market Insight

Germany’s extracorporeal membrane oxygenation market is anticipated to expand at a considerable CAGR, driven by high healthcare spending, advanced medical infrastructure, and a strong focus on technological innovations in cardiopulmonary support. The country’s network of specialized ECMO centers and growing clinical adoption in adult and pediatric care further support market expansion.

Asia-Pacific Extracorporeal Membrane Oxygenation Market Insight

The Asia-Pacific extracorporeal membrane oxygenation market is poised to grow at the fastest CAGR during the forecast period, driven by rising rates of respiratory diseases, neonatal complications, and cardiac disorders. Increasing investments in hospital infrastructure, growing awareness of ECMO therapy, and the expansion of ECMO training programs across China, India, Japan, and South Korea are expected to boost market adoption.

Japan Extracorporeal Membrane Oxygenation Market Insight

The Japan ECMO market is gaining momentum due to advanced healthcare infrastructure, high incidence of cardiovascular and respiratory disorders, and the increasing number of specialized critical care centers. ECMO adoption is further supported by government initiatives promoting neonatal and adult ECMO programs, along with investments in staff training and advanced equipment.

China Extracorporeal Membrane Oxygenation Market Insight

China’s extracorporeal membrane oxygenation market accounted for the largest revenue share in Asia-Pacific in 2025, owing to rising cases of respiratory and cardiac diseases, increasing hospital capacity, and enhanced clinical expertise. Government support for critical care modernization, expansion of neonatal intensive care units, and growing awareness among healthcare providers are key factors propelling market growth.

Extracorporeal Membrane Oxygenation Market Share

The Extracorporeal Membrane Oxygenation industry is primarily led by well-established companies, including:

- Medtronic (U.S.)

- Getinge AB (Sweden)

- LivaNova PLC (U.K.)

- Terumo Corporation (Japan)

- Xenios AG (Germany)

- Maquet (Sweden)

- Medos Medizintechnik AG (Germany)

- Abbott (U.S.)

- Sorin Group (Italy)

- Hemovent GmbH (Germany)

- Nipro Corporation (Japan)

- Fresenius Medical Care AG & Co. KGaA (Germany)

- Baxter International Inc. (U.S.)

- Spectrum Medical (U.S.)

- Becton Dickinson and Company (U.S.)

- Nova Biomedical (U.S.)

- Eurosets Srl (Italy)

- Cannuflow GmbH (Germany)

- Inspire Medical Systems (U.S.)

- ECMO Medical Systems (U.S.)

Latest Developments in Global Extracorporeal Membrane Oxygenation Market

- In July 2021, Xenios AG, a subsidiary of Fresenius Medical Care, received approval from China’s National Medical Products Administration (NMPA) for its Xenios Console and patient kits for ECMO therapy, enabling broader clinical use of its ECMO systems in Chinese hospitals and expanding access to critical cardiopulmonary support technologies

- In November 2022, LivaNova PLC announced that it received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its next‑generation LifeSPARC Advanced Circulatory Support system, authorizing the platform’s use for extracorporeal membrane oxygenation therapy in the U.S. and enhancing its critical care device portfolio

- In April 2023, Abbott secured two additional clearances from the U.S. FDA for its CentriMag Blood Pump, extending its indication for longer‑term use in adult patients requiring extracorporeal membrane oxygenation, thereby increasing clinical flexibility and therapeutic timeframes for critically ill patients

- In July 2023, BreathMo, a state‑of‑the‑art ECMO system utilizing advanced maglev technology, was introduced at the ASAIO Conference, representing a significant innovation in portable and high‑performance extracorporeal life support solutions aimed at meeting complex clinical needs in critical care settings

- In January 2024, Maquet‑Getinge Group announced the launch of its new MQA‑flex ECMO machine, engineered for improved patient mobility and simplified transport within hospital environments, aimed at enhancing operational flexibility for critical care teams

- In March 2024, Medtronic entered into a strategic partnership with UK‑based NHS Blood and Transplant to enhance the availability and accessibility of ECMO therapy across the United Kingdom using Medtronic’s ROTAFLOW ECMO system, expanding clinical reach in national health services

- In May 2024, Hemovent GmbH announced that its integrated portable pneumatic ECMO system, the MOBYBOX, completed its first commercial deployments in multiple European markets—demonstrating exceptional portability during intra‑hospital and inter‑hospital transfers

- In May 2024, Abbott Laboratories expanded its ECMO product portfolio with the launch of a new oxygenator designed to improve performance and clinical outcomes for patients requiring extended extracorporeal support

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.