Global Extruder And Compounding Machine Market

Market Size in USD Billion

CAGR :

%

USD

74.37 Billion

USD

102.57 Billion

2024

2032

USD

74.37 Billion

USD

102.57 Billion

2024

2032

| 2025 –2032 | |

| USD 74.37 Billion | |

| USD 102.57 Billion | |

|

|

|

|

Extruder and Compounding Machine Market Size

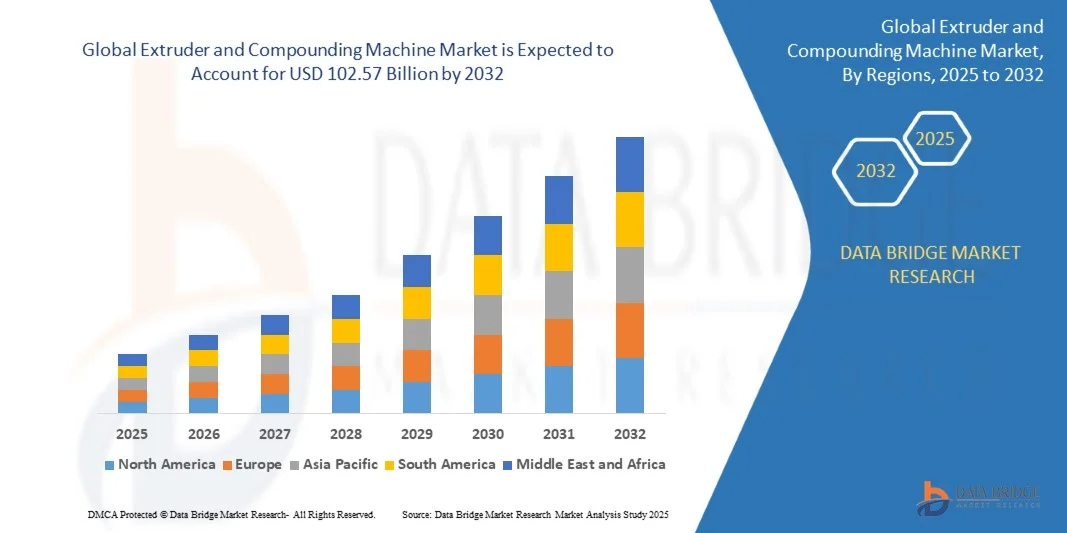

- The Extruder and Compounding Machine Market size was valued at USD 74.37 billion in 2024 and is projected to reach USD 102.57 billion by 2032, growing at a CAGR of 4.10% during the forecast period.

- Market expansion is primarily driven by increased demand across automotive, packaging, and construction industries, where high-performance and custom polymer processing solutions are increasingly required.

- Additionally, technological advancements in twin-screw and co-rotating extruders, combined with rising adoption of energy-efficient and automated machinery, are fueling the market. These innovations are enhancing productivity and flexibility, thereby accelerating global adoption and supporting robust industry growth.

Extruder and Compounding Machine Market Analysis

- Extruder and compounding machines, essential for processing plastics, rubber, and other materials, play a critical role in numerous industries including automotive, packaging, construction, and electronics due to their ability to produce high-quality, uniform materials with improved efficiency and customization.

- The surging demand for extruder and compounding machines is primarily driven by increasing industrialization, growing demand for plastic products, rapid advancements in polymer processing technologies, and the need for energy-efficient and high-output machinery in manufacturing operations.

- North America dominated the Extruder and Compounding Machine Market with the largest revenue share of 38.05% in 2024, bolstered by the presence of leading manufacturers, a mature industrial base, and a strong focus on automation and technological innovation, especially in the United States where adoption of high-performance compounding lines is accelerating in automotive and medical sectors.

- Asia-Pacific is expected to be the fastest-growing region in the Extruder and Compounding Machine Market during the forecast period, fueled by rapid urbanization, expansion of end-user industries such as packaging and construction, and increased investments in infrastructure development, especially in China and India.

- The twin-screw segment dominated the Extruder and Compounding Machine Market with a market share of 44.4% in 2024, driven by its superior mixing capability, high throughput, and versatility in handling a wide range of materials, making it a preferred choice across various high-performance applications.

Report Scope and Extruder and Compounding Machine Market Segmentation

|

Attributes |

Extruder and Compounding Machine Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Extruder and Compounding Machine Market Trends

Enhanced Efficiency Through AI and Smart Automation Integration

- A significant and accelerating trend in the Extruder and Compounding Machine Market is the deepening integration of artificial intelligence (AI) and smart automation technologies within extrusion and compounding systems. This convergence is greatly improving operational efficiency, predictive maintenance, and process optimization across manufacturing sectors.

- For instance, Coperion’s advanced twin-screw extruders now feature AI-enabled process monitoring systems that analyze real-time data to automatically adjust processing parameters, ensuring consistent product quality and minimizing material waste. Similarly, Leistritz AG integrates smart control systems that allow remote monitoring and auto-calibration to optimize screw performance during high-volume production runs.

- AI integration in extrusion and compounding machines enables predictive maintenance by analyzing wear patterns, motor performance, and material flow in real time. For example, Steer Engineering utilizes AI algorithms to detect early signs of component degradation, helping to reduce unplanned downtime and extend machine lifespan. These intelligent systems can also adjust torque and temperature settings dynamically based on the polymer characteristics being processed.

- The integration of extrusion systems with centralized industrial control platforms, such as SCADA or MES (Manufacturing Execution Systems), allows manufacturers to monitor and manage multiple production lines from a single interface. This facilitates coordinated operations across the production floor, including automation of feeder systems, die changes, and cooling sequences.

- This trend toward more intelligent, connected, and self-optimizing machines is transforming how manufacturers approach polymer processing. Companies like Davis-Standard and Milacron are at the forefront, embedding AI-driven control units that allow real-time adjustment and machine learning-based optimization based on historical data and specific material behaviors.

- The demand for extruders and compounding machines with advanced AI integration and smart factory compatibility is rapidly increasing, particularly in high-demand sectors such as automotive, electronics, medical devices, and sustainable packaging, where precision, consistency, and efficiency are non-negotiable.

Extruder and Compounding Machine Market Dynamics

Driver

Growing Need Due to Industrial Expansion and Demand for High-Performance Materials

- The increasing demand for high-performance plastic and polymer-based materials across industries such as automotive, construction, electronics, medical devices, and packaging is a major driver for the rising adoption of extruder and compounding machines. This trend is further supported by global industrial expansion, especially in emerging economies where manufacturing capacities are being rapidly scaled.

- For instance, in March 2024, Coperion GmbH announced the expansion of its high-throughput compounding line tailored for battery material processing, a strategic move reflecting the booming demand in electric vehicle (EV) production. This type of innovation is expected to significantly accelerate market growth over the forecast period.

- As industries shift toward advanced materials with specific thermal, mechanical, or barrier properties, the need for customized compounding solutions has intensified. Extruders and compounders equipped to handle reinforced polymers, biodegradable plastics, and multi-material blends are becoming essential components in modern manufacturing.

- Additionally, the trend toward automated, continuous manufacturing processes is fueling demand for extruder and compounding machines that support high-volume, energy-efficient, and low-waste operations. These systems enable manufacturers to maintain consistency and precision in product output while reducing overall operational costs.

- The integration of smart control systems, modular designs, and adaptability for a variety of material inputs makes these machines particularly attractive to industries looking to future-proof their production lines. As demand for sustainability and material innovation rises, these machines are playing a pivotal role in meeting regulatory, quality, and performance standards.

Restraint/Challenge: High Capital Investment and Technical Complexity

- Despite growing demand, the high initial capital investment required for purchasing and installing advanced extruder and compounding machines presents a significant barrier, particularly for small and medium-sized enterprises (SMEs) and manufacturers in developing markets.

- For instance, a complete high-performance twin-screw extrusion line integrated with advanced control systems can represent a substantial upfront cost, often making it inaccessible for startups or cost-sensitive operations. The requirement for specialized infrastructure (e.g., high-voltage power systems, climate control, and space optimization) further compounds this issue.

- Moreover, technical complexity associated with modern extrusion and compounding systems—including material-specific screw designs, temperature and pressure calibration, and multi-stage processing—can be daunting for facilities lacking trained personnel. Improper operation can lead to material waste, equipment damage, or production downtime.

- The shortage of skilled labor, particularly in emerging markets, creates an additional bottleneck, as successful operation and maintenance of these machines require specialized training and process knowledge.

- To address these challenges, leading manufacturers such as Davis-Standard and Leistritz AG are investing in training programs, modular machinery, and entry-level systems designed for flexibility and ease of use. Nonetheless, overcoming the cost and complexity barriers remains crucial to expanding market reach, particularly in fast-growing but resource-constrained regions.

Extruder and Compounding Machine Market Scope

The market is segmented on the basis of product, application, end-user.

- By Product

On the basis of product, the Extruder and Compounding Machine Market is segmented into Single Screw, Twin Screw, and Ram Extruders. The Twin Screw segment dominated the market with the largest revenue share of 44.4% in 2024, driven by its superior mixing efficiency, high output capacity, and versatility in processing a wide range of polymers and additives. Twin screw extruders are widely adopted in applications requiring precise control over temperature, pressure, and shear forces, making them ideal for industries such as automotive, medical, and packaging.

The Ram Extruders segment is expected to witness the fastest CAGR from 2025 to 2032, primarily due to increasing demand in specialized applications such as PTFE and high-viscosity materials. These extruders offer high compaction force, making them suitable for materials that are difficult to process with conventional screw mechanisms. Innovations in material science and increased use of high-performance plastics are expected to further drive this segment’s growth.

- By Application

On the basis of application, the market is segmented into Specialist Plastics, PVC Cable, Master Batch Production, Flooring Sheet, and Others. The Specialist Plastics segment held the largest market revenue share in 2024, accounting for 38.7%, owing to the rising demand for advanced plastic compounds with customized properties across industries such as aerospace, automotive, electronics, and healthcare. Extrusion and compounding machines are crucial in processing high-performance plastics like PEEK, PPS, and fluoropolymers, which require precise temperature and pressure control.

The Master Batch Production segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by the increasing use of masterbatches in color, filler, and additive applications. As industries seek more efficient and uniform color and additive dispersion in plastic products, compounding systems tailored for masterbatch production are gaining traction. Demand is particularly strong in packaging, agriculture, and construction sectors, where large-volume and consistent quality output are essential.

- By End-User

On the basis of end-user, the Extruder and Compounding Machine Market is segmented into the Plastic Industry, Food Industry, Chemical Industry, Medical/Pharmaceutical, and Others. The Plastic Industry segment dominated the market in 2024, holding the largest revenue share of 46.5%, supported by robust global demand for plastic products in automotive components, packaging materials, and consumer goods. The plastic industry extensively uses extrusion and compounding systems to enhance material characteristics and enable the use of recycled polymers, contributing to both performance and sustainability goals.

The Medical/Pharmaceutical segment is projected to grow at the fastest CAGR from 2025 to 2032, due to the rising adoption of precision extrusion systems for medical tubing, implants, and drug-delivery devices. Regulatory requirements and the need for sterile, high-quality production are pushing manufacturers to invest in advanced compounding machines with closed-loop control systems. The demand for biocompatible and specialty polymers further supports the expansion of this segment.

Extruder and Compounding Machine Market Regional Analysis

- North America dominated the Extruder and Compounding Machine Market with the largest revenue share of 38.05% in 2024, driven by strong industrial infrastructure, advanced manufacturing capabilities, and significant investments in polymer processing technologies.

- Manufacturers in the region prioritize high-output, energy-efficient extrusion and compounding systems to meet the growing demand for advanced materials in sectors such as automotive, aerospace, packaging, and medical devices. The widespread implementation of Industry 4.0 technologies and automation is further enhancing productivity and operational efficiency.

- This dominance is also supported by the presence of leading market players, a skilled workforce, and a high level of R&D activity focused on process optimization and material innovation. The increasing use of engineered plastics and custom compounds across various applications continues to drive adoption of sophisticated extruder and compounding equipment, positioning North America as a key hub in the global market landscape.

U.S. Extruder and Compounding Machine Market Insight

The U.S. Extruder and Compounding Machine Market captured the largest revenue share of 82% in 2024 within North America, driven by the country’s advanced manufacturing infrastructure, significant investments in polymer research, and the rapid adoption of Industry 4.0 technologies. U.S.-based manufacturers are increasingly turning to high-performance extrusion and compounding equipment to meet rising demand for specialty plastics and sustainable materials in industries such as automotive, medical, and packaging. The presence of leading global players, such as Milacron and Davis-Standard, reinforces the U.S.'s strong market position. Additionally, the trend toward automation, energy efficiency, and digital process control continues to shape the future of extruder deployment in both large-scale and mid-sized manufacturing environments.

Europe Extruder and Compounding Machine Market Insight

The Europe Extruder and Compounding Machine Market is projected to expand at a substantial CAGR throughout the forecast period, supported by growing regulatory focus on sustainable materials and recycling, along with rising demand for advanced plastics in automotive, construction, and consumer electronics. The region benefits from strong R&D capabilities and a robust base of high-precision engineering firms. Countries like Germany, Italy, and France are witnessing increased investment in circular economy initiatives, boosting demand for compounding solutions that support the reprocessing of recycled polymers. Furthermore, Europe’s emphasis on energy efficiency and strict emissions standards is driving manufacturers to upgrade existing extrusion lines with smart, eco-friendly alternatives.

U.K. Extruder and Compounding Machine Market Insight

The U.K. Extruder and Compounding Machine Market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by demand from the packaging, medical, and electronics sectors. British manufacturers are adopting advanced compounding machines to develop custom polymer blends with enhanced functionality, such as flame retardancy, conductivity, and biodegradability. The country’s focus on innovation and sustainability is pushing the adoption of machinery that supports the production of recyclable and bio-based materials. Additionally, the integration of digital twin technologies and smart sensors is gaining popularity, enabling real-time process monitoring and optimization in U.K.-based extrusion facilities.

Germany Extruder and Compounding Machine Market Insight

The Germany Extruder and Compounding Machine Market is expected to expand at a considerable CAGR during the forecast period, propelled by the country's engineering excellence, automation leadership, and strong presence of automotive and chemical industries. Germany is a global hub for high-performance compounding, with a particular focus on thermoplastic elastomers, engineering plastics, and specialty compounds. The market is also benefitting from increased adoption of smart manufacturing practices and modular extrusion systems designed for rapid changeover and reduced downtime. Environmental regulations and an emphasis on closed-loop recycling systems are further contributing to the demand for high-precision, energy-efficient machines.

Asia-Pacific Extruder and Compounding Machine Market Insight

The Asia-Pacific Extruder and Compounding Machine Market is poised to grow at the fastest CAGR of 24% during the forecast period from 2025 to 2032, driven by rapid industrialization, infrastructure development, and booming demand for plastic products across sectors. Countries such as China, India, Japan, and South Korea are investing heavily in manufacturing upgrades and smart factory initiatives, creating significant demand for advanced extrusion and compounding technologies. The region’s growing role as a global manufacturing hub, coupled with supportive government initiatives and a strong domestic machinery base, is accelerating market growth. Rising use of engineering plastics in automotive, electronics, and construction also fuels the need for tailored compounding solutions.

Japan Extruder and Compounding Machine Market Insight

The Japan Extruder and Compounding Machine Market is gaining momentum as manufacturers seek advanced machinery capable of producing high-precision components for electronics, automotive, and medical devices. Japan’s reputation for high-quality production standards and innovation drives the adoption of cutting-edge extrusion systems, particularly twin-screw models that support complex compounding requirements. The country's focus on energy conservation, automation, and space-efficient machinery is influencing market dynamics. Additionally, the aging population and labor shortages are encouraging the shift toward automated, low-maintenance extruders designed for continuous, high-efficiency output with minimal manual intervention.

China Extruder and Compounding Machine Market Insight

The China Extruder and Compounding Machine Market accounted for the largest market revenue share in Asia Pacific in 2024, underpinned by the country's dominant position in global plastic manufacturing and exports. With growing demand for consumer goods, automotive parts, electronics, and packaging, Chinese manufacturers are rapidly adopting high-throughput extrusion and compounding equipment. Government initiatives supporting industrial modernization and sustainability are further promoting the use of energy-efficient machines and recycled material processing lines. Local manufacturers are also gaining ground through cost-competitive offerings and improved technological capabilities, while international players continue to expand their presence through joint ventures and localized production.

Extruder and Compounding Machine Market Share

The extruder and compounding machine industry is primarily led by well-established companies, including:

- Coperion GmbH (Germany)

- The Japan Steel Works, Ltd. (Japan

- Leistritz AG (Germany

- KraussMaffei Group GmbH (Germany)

- Toshiba Machine Co., Ltd. (Japan)

- Battenfeld-Cincinnati (Austria)

- JSW Plastics Machinery Inc. (Japan)

- CPM Extrusion Group (U.S.)

- Brabender GmbH & Co. KG (Germany)

- Steer Engineering Pvt. Ltd. (India)

- Milacron LLC (U.S.)

- Davis-Standard, LLC (U.S.)

- ENTEK Manufacturing LLC (U.S.)

- USEON Extrusion Machinery Co., Ltd. (China)

- Nanjing Haisi Extrusion Equipment Co., Ltd. (China)

- Mitsubishi Heavy Industries, Ltd. (Japan)

- Thermo Fisher Scientific Inc. (U.S.)

- Euro Machinery ApS (Denmark)

- Buss AG (Switzerland)

- BC Extrusion Holding GmbH (Germany)

What are the Recent Developments in Extruder and Compounding Machine Market?

- In April 2023, Coperion GmbH, a global leader in compounding and extrusion technologies, announced the expansion of its manufacturing facility in Stuttgart, Germany. This strategic initiative is aimed at increasing production capacity for high-performance twin-screw extruders, addressing rising global demand across industries such as automotive, packaging, and pharmaceuticals. By enhancing its manufacturing infrastructure and R&D capabilities, Coperion is reinforcing its leadership in the Extruder and Compounding Machine Market while supporting innovation in high-precision polymer processing solutions.

- In March 2023, Leistritz Extrusionstechnik GmbH, a key player in advanced compounding systems, launched its next-generation ZSE MAXX-HD twin-screw extruder series, specifically engineered for high-output applications and sustainable materials processing. The new line integrates intelligent control systems for real-time monitoring and offers modular configurations for easier customization. This product introduction reflects Leistritz’s commitment to delivering energy-efficient and versatile solutions to meet the evolving needs of polymer processors across diverse industries.

- In March 2023, Davis-Standard LLC completed the acquisition of Extrusion Technology Group (ETG), strengthening its global portfolio in extrusion equipment and services. The acquisition enhances Davis-Standard’s capabilities in the medical, blown film, and profile extrusion markets, while expanding its geographic footprint in Europe and Asia. This move aligns with the company's growth strategy focused on technology leadership, aftermarket support, and global service accessibility within the Extruder and Compounding Machine Market.

- In February 2023, Milacron Holdings Corp., a leader in plastics processing technologies, announced the introduction of its newly upgraded TCM Twin-Screw Compounding Series, tailored for high-performance engineering resins. Designed with enhanced torque capacity, improved wear resistance, and intuitive touchscreen controls, the new machines address increasing demand for specialized compounding solutions in automotive lightweighting, electronics, and medical components. This launch underscores Milacron’s commitment to delivering innovation-driven solutions for next-generation material processing.

- In January 2023, KraussMaffei Berstorff, a prominent name in extrusion technology, unveiled its iCOM Digital Twin Platform for compounding machines at the Interplastica Trade Fair in Moscow. This cutting-edge platform enables real-time simulation, predictive maintenance, and process optimization through AI-driven analytics. The initiative reflects KraussMaffei’s dedication to digitizing the extrusion process and promoting smart manufacturing practices. It positions the company as a forward-thinking innovator within the evolving landscape of the Extruder and Compounding Machine Market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.