Global Fabric Care Market

Market Size in USD Billion

CAGR :

%

USD

116.80 Billion

USD

184.06 Billion

2025

2033

USD

116.80 Billion

USD

184.06 Billion

2025

2033

| 2026 –2033 | |

| USD 116.80 Billion | |

| USD 184.06 Billion | |

|

|

|

|

Fabric Care Market Size

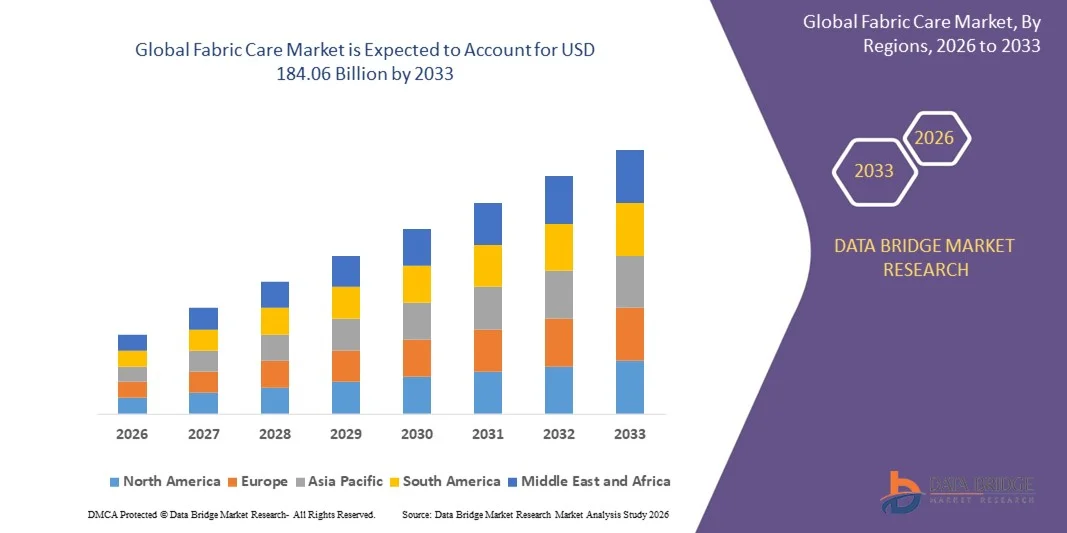

- The global fabric care market size was valued at USD 116.80 billion in 2025 and is expected to reach USD 184.06 billion by 2033, at a CAGR of 5.85% during the forecast period

- The market growth is largely fuelled by the increasing consumer preference for premium laundry solutions and the rising demand for products that enhance fabric longevity and color retention

- Growing adoption of liquid detergents, fabric conditioners, and eco-friendly washing solutions is further accelerating market expansion, supported by continuous product innovation from leading manufacturers

Fabric Care Market Analysis

- The fabric care market is witnessing steady growth due to the expanding global population, heightened hygiene awareness, and increasing disposable incomes influencing premium product purchases

- Companies are focusing on innovative formulations such as plant-based detergents, high-efficiency washing solutions, and fragrance-enhancing products to cater to evolving consumer preferences while strengthening brand differentiation

- North America dominated the fabric care market with the largest revenue share of 38.5% in 2025, driven by increasing adoption of premium laundry solutions, high disposable incomes, and rising awareness of fabric protection and hygiene

- Asia-Pacific region is expected to witness the highest growth rate in the global fabric care market, driven by increasing population, growing urban middle-class, rapid expansion of modern retail, and rising adoption of eco-friendly and advanced laundry solutions

- The powder segment held the largest market revenue share in 2025, driven by its widespread availability, cost-effectiveness, and compatibility with traditional and high-efficiency washing machines. Powder detergents are preferred by households for everyday laundry due to their ease of use and ability to deliver consistent cleaning performance

Report Scope and Fabric Care Market Segmentation

|

Attributes |

Fabric Care Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Reckitt Benckiser Group PLC (U.K.) • Wings (Indonesia) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fabric Care Market Trends

Rise of Advanced and Sustainable Laundry Solutions

- The growing focus on advanced and sustainable laundry solutions is transforming the fabric care market by enabling better stain removal, fabric protection, and energy-efficient washing. Innovative formulations such as liquid detergents, concentrated powders, and fabric conditioners allow for effective cleaning while reducing water and energy usage, improving overall household efficiency. Rising adoption of high-efficiency washing machines is further encouraging consumers to choose formulations designed for optimal performance with less resource consumption, supporting environmental sustainability

- The increasing demand for eco-friendly and biodegradable products is accelerating the adoption of plant-based detergents, enzyme-enhanced powders, and fragrance-free solutions. These products are particularly popular in regions with stringent environmental regulations and growing consumer awareness of sustainable practices. Brands are also launching refill packs, concentrated formulas, and reduced-plastic packaging options to minimize environmental impact, further attracting eco-conscious buyers

- Affordability and ease of use of modern fabric care products are making them attractive for everyday laundry, supporting frequent use without excessive cost. Consumers benefit from formulations that are gentle on fabrics and suitable for a wide range of washing machines, ultimately improving fabric longevity and appearance. Companies are also introducing multi-functional products that combine stain removal, color protection, and fragrance, offering convenience and reducing the need for multiple products

- For instance, in 2023, several households in Europe and North America reported improved fabric care outcomes after switching to enzyme-based detergents and color-protecting conditioners, reducing fabric wear and enhancing clothing lifespan. Surveys indicated increased customer satisfaction and repeat purchases for products offering longer-lasting fabric protection. Retailers are now promoting these advanced formulations through targeted campaigns emphasizing both performance and sustainability

- While advanced and sustainable fabric care solutions are gaining traction, their market growth depends on continued innovation, awareness campaigns, and accessibility. Manufacturers must focus on product differentiation, localized formulations, and effective distribution strategies to fully capitalize on this expanding demand. Collaboration with e-commerce platforms and supermarket chains is also critical to reach wider consumer segments and support consistent product availability

Fabric Care Market Dynamics

Driver

Rising Consumer Awareness and Preference for Premium Fabric Care Products

- Increasing consumer awareness regarding fabric longevity, hygiene, and garment appearance is driving the adoption of advanced laundry products. Premium detergents, conditioners, and stain removers are increasingly preferred for their superior performance and enhanced fabric protection. Health-conscious and quality-focused consumers are actively seeking formulations with gentle ingredients, skin-friendly additives, and high-efficiency cleaning, which is boosting sales of specialized products

- Consumers are willing to invest in specialized formulations for sensitive skin, delicate fabrics, and color retention. The trend is further supported by rising disposable incomes and evolving lifestyle patterns, which emphasize quality laundry care. The demand for innovative, convenient, and ready-to-use solutions such as pre-soak packs, stain sticks, and pods is also encouraging premium product adoption

- Retailers and manufacturers are expanding product availability through online and offline channels, making it easier for consumers to access a wide range of premium and eco-friendly options. Marketing campaigns highlighting the benefits of modern formulations are strengthening consumer trust. Collaborations with laundry service providers and influencer marketing initiatives are further helping to educate consumers on advanced fabric care practices

- For instance, in 2022, several European fabric care brands reported a significant uptick in demand for hypoallergenic and plant-based detergents, driven by growing health-conscious consumer segments. This has led to an increase in product diversification, with brands introducing fragrance-free, organic, and multi-functional detergents tailored to specific consumer needs. Promotional campaigns emphasizing environmental and personal health benefits have been effective in capturing new users

- While consumer preference is driving market growth, continuous product innovation, improved distribution, and cost-effective formulations are essential to sustain long-term adoption. Brands focusing on performance, sustainability, and convenience are likely to capture larger market shares, while smaller players are investing in niche offerings to meet evolving consumer expectations

Restraint/Challenge

High Cost of Premium Products and Limited Awareness in Emerging Regions

- The higher price of premium fabric care products such as enzyme-based detergents, color-protecting conditioners, and fragrance-enhanced formulations limits their adoption among cost-sensitive consumers in emerging markets. Affordability remains a key barrier to widespread usage. In addition, frequent promotions and discounts are required to attract price-conscious households, which impacts profit margins for manufacturers

- In many developing regions, there is limited awareness of advanced laundry solutions, leading consumers to rely on traditional or low-cost detergents. This reduces market penetration for technologically advanced and eco-friendly products. Lack of consumer education regarding benefits such as fabric longevity, energy savings, and color protection further slows adoption of innovative products in rural areas

- Supply chain inefficiencies and inconsistent product availability in rural or remote areas further restrict access to quality fabric care solutions. Limited retail networks and logistical challenges hinder timely delivery of premium offerings. Companies are investing in last-mile distribution strategies, partnerships with local retailers, and mobile delivery solutions to improve reach and product accessibility

- For instance, in 2023, market surveys in Southeast Asia revealed that over 60% of rural households continued to use basic powdered detergents due to cost constraints and lack of awareness about advanced fabric care options. Awareness campaigns and localized marketing initiatives have shown potential to improve adoption rates, but scaling these efforts remains a challenge. Retailers are also exploring bundled products and trial packs to encourage switching to premium solutions

- While the industry continues to innovate, overcoming price sensitivity, awareness gaps, and distribution challenges remains crucial. Companies must focus on localized marketing, affordable formulations, and improved supply chains to unlock long-term growth potential. Collaborative initiatives with NGOs, government programs, and e-commerce platforms can further support market penetration and consumer education across emerging regions

Fabric Care Market Scope

The market is segmented on the basis of form, nature, and sales channel

- By Form

On the basis of form, the fabric care market is segmented into powder, dry sheets, bars/blocks, pacs & tablets, and other forms. The powder segment held the largest market revenue share in 2025, driven by its widespread availability, cost-effectiveness, and compatibility with traditional and high-efficiency washing machines. Powder detergents are preferred by households for everyday laundry due to their ease of use and ability to deliver consistent cleaning performance.

The pacs & tablets segment is expected to witness the fastest growth rate from 2026 to 2033, driven by their convenience, pre-measured dosage, and minimal wastage. These forms are particularly popular among urban consumers seeking time-saving and mess-free laundry solutions, often serving as a preferred choice for premium and eco-friendly detergent offerings.

- By Nature

On the basis of nature, the fabric care market is segmented into synthetic, organic, and others. The synthetic segment held the largest share in 2025, fueled by its strong stain-removal capabilities, low cost, and long shelf life. Synthetic detergents dominate in both residential and commercial laundry settings due to their effectiveness across various water types and washing conditions.

The organic segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising consumer preference for eco-friendly, biodegradable, and skin-sensitive formulations. Organic fabric care products are increasingly adopted in households prioritizing sustainability, natural ingredients, and reduced chemical exposure, particularly in regions with stringent environmental regulations.

- By Sales Channel

On the basis of sales channel, the fabric care market is segmented into wholesalers/distributors, convenience stores, supermarkets/hypermarkets, online stores, independent small stores, and other sales channels. Supermarkets and hypermarkets held the largest revenue share in 2025, driven by wide product assortment, competitive pricing, and strong promotional activities. These channels offer easy access to both premium and mass-market fabric care products.

The online stores segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing e-commerce adoption, growing consumer preference for doorstep delivery, and targeted digital marketing campaigns. Online platforms provide convenience, detailed product information, and access to niche and international brands, making them a popular choice for modern consumers seeking variety and ease of purchase.

Fabric Care Market Regional Analysis

- North America dominated the fabric care market with the largest revenue share of 38.5% in 2025, driven by increasing adoption of premium laundry solutions, high disposable incomes, and rising awareness of fabric protection and hygiene

- Consumers in the region highly value advanced formulations, eco-friendly detergents, and multi-functional products that enhance fabric longevity, color retention, and softness

- This widespread adoption is further supported by well-established retail infrastructure, strong e-commerce penetration, and growing consumer preference for convenient and high-performance laundry solutions

U.S. Fabric Care Market Insight

The U.S. fabric care market captured the largest revenue share in 2025 within North America, fueled by high consumer spending on premium and sustainable laundry products. Rising demand for enzyme-based detergents, color-protecting conditioners, and eco-friendly formulations is driving market expansion. Moreover, the increasing popularity of smart washing machines and laundry appliances that optimize detergent usage is significantly contributing to market growth.

Europe Fabric Care Market Insight

The Europe fabric care market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent environmental regulations, rising consumer preference for plant-based products, and increasing demand for high-efficiency detergents. Urbanization, growing awareness of fabric care, and the push for sustainable laundry solutions are fostering market adoption across residential and commercial segments.

U.K. Fabric Care Market Insight

The U.K. fabric care market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising consumer inclination toward eco-friendly and hypoallergenic laundry products. Awareness about fabric longevity, skin sensitivity, and sustainability is encouraging both households and commercial laundries to adopt premium and organic formulations.

Germany Fabric Care Market Insight

The Germany fabric care market is expected to witness the fastest growth rate from 2026 to 2033, fueled by high consumer awareness of environmentally sustainable products, stringent chemical regulations, and increasing demand for multi-functional detergents. German consumers are increasingly prioritizing fabric protection, stain removal efficiency, and energy-saving formulations, promoting adoption of advanced laundry solutions.

Asia-Pacific Fabric Care Market Insight

The Asia-Pacific fabric care market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising urbanization, increasing disposable incomes, and rapid expansion of organized retail and e-commerce. Countries such as China, Japan, and India are witnessing growing consumer preference for premium and sustainable laundry products, which is boosting market demand.

Japan Fabric Care Market Insight

The Japan fabric care market is expected to witness the fastest growth rate from 2026 to 2033 due to increasing demand for convenience, high awareness of fabric care, and preference for eco-friendly and dermatologically safe detergents. The aging population is also likely to drive demand for easy-to-use laundry products in both residential and commercial settings.

China Fabric Care Market Insight

The China fabric care market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country’s expanding middle-class population, rapid urbanization, and increasing adoption of premium and technologically advanced laundry products. Growing awareness of sustainable laundry practices and the availability of affordable high-performance detergents are key factors propelling market growth.

Fabric Care Market Share

The Fabric Care industry is primarily led by well-established companies, including:

• Reckitt Benckiser Group PLC (U.K.)

• S.C. Johnson & Sons Inc. (U.S.)

• Alicorp (Peru)

• Rohit Surfactants Private Limited (India)

• LG Household & Health Care Ltd (South Korea)

• Wings (Indonesia)

• Lion Corporation (Japan)

• Procter & Gamble (U.S.)

• China Whealthfield’s Lohmann (China)

• Fábrica de Jabón La Corona S.A. de C.V (Mexico)

• Unilever (U.K./Netherlands)

• Church & Dwight Co., Inc. (U.S.)

• Kao Corporation (Japan)

• Henkel Adhesives Technologies India Private Limited (India)

• Amway India Enterprises Pvt. Ltd (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.