Global Fabric Protection Market

Market Size in USD Billion

CAGR :

%

USD

1.73 Billion

USD

3.30 Billion

2024

2032

USD

1.73 Billion

USD

3.30 Billion

2024

2032

| 2025 –2032 | |

| USD 1.73 Billion | |

| USD 3.30 Billion | |

|

|

|

|

What is the Global Fabric Protection Market Size and Growth Rate?

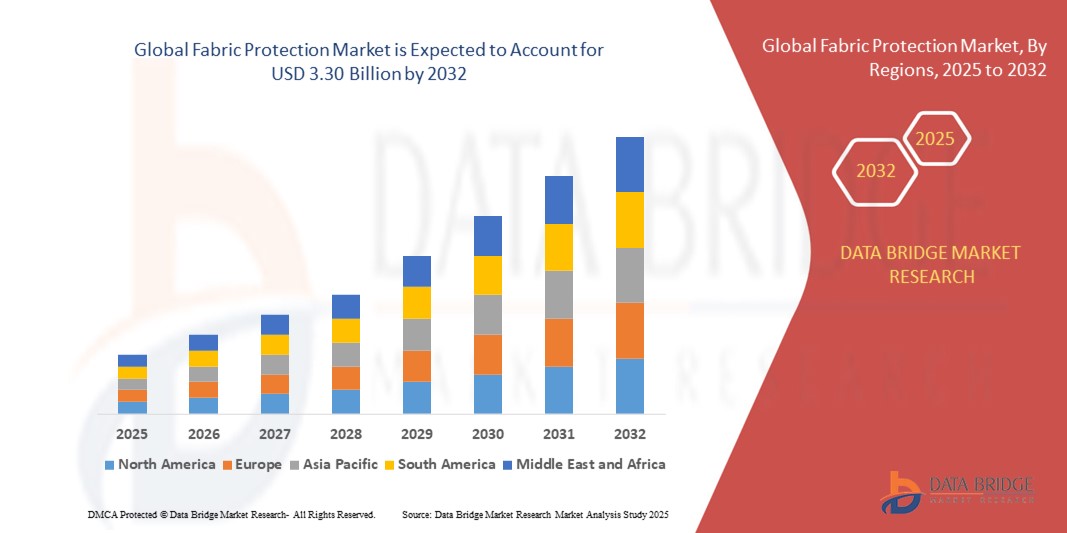

- The global fabric protection market size was valued at USD 1.73 billion in 2024 and is expected to reach USD 3.30 billion by 2032, at a CAGR of 8.40% during the forecast period

- The fabric protection market has witnessed a steady growth trajectory in recent years, driven by increasing consumer awareness about the benefits of safeguarding textiles from stains and spills. The demand for fabric protection solutions has surged as a result of the growing emphasis on prolonging the lifespan of textiles and preserving their aesthetic appeal. The market is characterized by a competitive landscape with key players constantly innovating to introduce advanced and environmentally friendly protection technologies

What are the Major Takeaways of Fabric Protection Market?

- The increasing awareness of the importance of fabric care, driven by a growing focus on sustainability and prolonging the lifespan of textiles, acts as a significant driver for the global fabric protection market. Consumers are becoming more conscious of preserving the quality and appearance of their textiles, leading to a surge in demand for fabric protection solutions

- The continual expansion of the textile industry, coupled with innovations in fabric manufacturing, is a key driver for the fabric protection market. As textiles become more diverse and advanced, the need for effective protection against stains, spills, and other damage becomes imperative, fueling the adoption of fabric protection solutions across various industries

- North America dominated the fabric protection market with the largest revenue share of 33.4% in 2024, driven by strong demand from the furniture, automotive, and textile industries

- Asia-Pacific fabric protection market is poised to grow at the fastest CAGR of 5.87% during 2025–2032, driven by rapid urbanization, growing middle-class population, and increasing demand for smart and sustainable home care solutions

- The water-based segment dominated the market with the largest revenue share of 58.4% in 2024, primarily due to its eco-friendly nature, low toxicity, and increasing compliance with global environmental regulations

Report Scope and Fabric Protection Market Segmentation

|

Attributes |

Fabric Protection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Fabric Protection Market?

Sustainability and Eco-Friendly Formulations

- A key and fast-growing trend in the global fabric protection market is the rising shift toward eco-friendly, non-toxic, and biodegradable coatings that align with consumer preference for sustainable products. Increasing concerns over harmful chemicals such as PFCs (perfluorocarbons) in traditional protectors are driving innovation

- Leading companies are launching water-based and plant-derived formulations that deliver strong stain and spill resistance while minimizing environmental impact. This is particularly in demand across home textiles, automotive upholstery, and premium fashion segments

- For instance, Nikwax (U.K.) offers a complete range of PFC-free waterproofing and fabric care solutions, widely adopted by outdoor apparel and gear brands for safe and sustainable protection

- The adoption of green chemistry in fabric protection enhances market competitiveness and helps brands meet evolving regulatory requirements in regions such as Europe and North America, where chemical safety standards are strict

What are the Key Drivers of Fabric Protection Market?

- The rising consumer awareness about fabric durability and stain resistance, coupled with growing investments in textile innovation and home care, is a major driver for the market

- For instance, in January 2024, 3M (U.S.) expanded its Scotchgard™ brand portfolio with sustainable stain-repellent technologies designed for home and automotive use, strengthening its global footprint

- The expanding textile and automotive industries are fueling demand for high-performance protective coatings that extend the lifespan of fabrics, furniture, and vehicle interiors

- Furthermore, the premiumization trend in home furnishings and apparel is pushing consumers toward products that combine luxury aesthetics with protective functionality, reinforcing market growth

- The growth of DIY applications and the increasing availability of easy-to-use sprays and wipes are also expanding adoption across residential and commercial segments

Which Factor is Challenging the Growth of the Fabric Protection Market?

- A major challenge for the fabric protection market is the regulatory scrutiny on chemical formulations due to the environmental and health risks associated with fluorochemicals traditionally used in stain repellents

- For instance, the European Chemicals Agency (ECHA) has imposed strict guidelines on PFC use, creating compliance hurdles and increasing R&D costs for manufacturers

- High-profile studies linking certain fabric protectors to water and soil contamination have made some consumers wary, leading to a preference for untreated or natural fabrics

- In addition, the relatively higher cost of advanced eco-friendly protectors compared to conventional chemical-based products poses a barrier in price-sensitive markets

- While innovation is helping reduce these gaps, consumer skepticism and the premium pricing of sustainable products may slow adoption. Overcoming these hurdles through cost-effective green alternatives, consumer education, and transparent labeling will be crucial for long-term growth

How is the Fabric Protection Market Segmented?

The market is segmented on the basis of type, application, and end-user.

- By Type

On the basis of type, the fabric protection market is segmented into water-based and solvent-based solutions. The water-based segment dominated the market with the largest revenue share of 58.4% in 2024, primarily due to its eco-friendly nature, low toxicity, and increasing compliance with global environmental regulations. Consumers are increasingly shifting toward sustainable and non-hazardous fabric protection products for use in households and commercial establishments. Their easy application, low odor, and suitability for delicate fabrics have further enhanced adoption.

The solvent-based segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its strong stain resistance and long-lasting protective qualities. Solvent-based coatings remain highly favored in heavy-duty applications such as upholstery in restaurants, offices, and automotive interiors, where fabrics are exposed to high levels of wear and tear. Despite environmental concerns, advancements in low-VOC solvent-based formulations are supporting their growth.

- By Application

On the basis of application, the fabric protection market is segmented into apparels, footwear, and upholstery. The apparel segment dominated the market with the largest revenue share of 46.9% in 2024, driven by rising consumer spending on premium and luxury clothing and the growing demand for stain- and water-resistant garments. Fashion brands and textile manufacturers are increasingly adopting fabric protection treatments to enhance product durability and appeal.

The footwear segment is projected to record the fastest CAGR from 2025 to 2032, supported by rising demand for protective sprays and coatings that preserve the appearance and lifespan of shoes, particularly in urban regions with varying weather conditions. Sports and outdoor footwear brands are also incorporating advanced fabric protection to provide consumers with superior water repellency and stain resistance. Upholstery remains a steady segment, with growth fueled by rising residential and commercial furnishing demand.

- By End-User

On the basis of end-user, the fabric protection market is segmented into household and commercial users. The household segment held the largest revenue share of 61.2% in 2024, driven by rising consumer awareness regarding fabric care, the easy availability of DIY sprays and coatings, and the surge in demand for protective solutions for garments, footwear, and home furnishings. Growth in online retail platforms offering affordable, eco-friendly products is further boosting adoption in this segment.

The commercial segment is expected to witness the fastest CAGR from 2025 to 2032, owing to the increasing need for fabric protection in hospitality, healthcare, and corporate sectors. Restaurants, hotels, and office spaces heavily rely on upholstery and textile protection to maintain aesthetics, reduce maintenance costs, and extend fabric life. The push toward sustainability and the use of fabric protection services in large-scale commercial establishments will continue to drive strong growth.

Which Region Holds the Largest Share of the Fabric Protection Market?

- North America dominated the fabric protection market with the largest revenue share of 33.4% in 2024, driven by strong demand from the furniture, automotive, and textile industries

- Consumers in the region highly value durability, stain resistance, and premium home care solutions, making fabric protection products a key preference for households and businesses

- This adoption is further supported by high disposable incomes, brand-conscious consumers, and strong retail penetration, positioning North America as the global leader in the market

U.S. Fabric Protection Market Insight

U.S. fabric protection market captured the largest revenue share of 81% in 2024 within North America, fueled by rising consumer inclination towards eco-friendly, long-lasting fabric care solutions. Strong presence of leading brands, coupled with increasing demand for premium automotive and upholstery care, drives growth. Moreover, the rapid expansion of e-commerce platforms and DIY cleaning solutions is significantly boosting the U.S. market.

Europe Fabric Protection Market Insight

Europe fabric protection market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent quality standards, growing textile exports, and consumer awareness about sustainable solutions. Increasing adoption in residential, commercial, and hospitality sectors is fueling demand. The region’s focus on eco-conscious, chemical-free coatings further strengthens its market positioning.

U.K. Fabric Protection Market Insight

U.K. fabric protection market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by rising home renovation trends, premium furniture purchases, and growing awareness about stain protection. The country’s robust retail and e-commerce ecosystem, along with demand from the automotive sector, is expected to accelerate growth.

Germany Fabric Protection Market Insight

Germany fabric protection market is expected to expand at a considerable CAGR, fueled by its strong automotive industry, sustainability-driven consumer behavior, and innovation in textile coatings. Increasing adoption across residential and commercial applications, combined with advanced R&D in protective materials, is shaping the German market landscape.

Which Region is the Fastest Growing in the Fabric Protection Market?

Asia-Pacific fabric protection market is poised to grow at the fastest CAGR of 5.87% during 2025–2032, driven by rapid urbanization, growing middle-class population, and increasing demand for smart and sustainable home care solutions. The region’s manufacturing strength and availability of cost-effective products are making fabric protection more accessible to a wider consumer base.

Japan Fabric Protection Market Insight

Japan fabric protection market is gaining traction due to the country’s high demand for convenience, advanced cleaning technologies, and eco-conscious consumer trends. Increasing adoption in smart homes, premium furniture, and automotive interiors is fueling growth. Japan’s innovation-driven approach supports steady expansion of this sector.

China Fabric Protection Market Insight

China fabric protection market accounted for the largest revenue share in Asia-Pacific in 2024, supported by rapid urbanization, strong domestic production, and rising demand for affordable protective solutions. Growth in the real estate, automotive, and textile industries, combined with the government’s push towards smart and sustainable cities, is propelling the market forward.

Which are the Top Companies in Fabric Protection Market?

The fabric protection industry is primarily led by well-established companies, including:

- 3M (U.S.)

- RPM International (U.S.)

- Shield Industries (U.S.)

- Guardsman (U.S.)

- Vectra (U.S.)

- Actichem (Australia)

- Ultra-Guard (U.S.)

- SC Johnson (U.S.)

- Chemical Guys (U.S.)

- ProtectME (Australia)

- NANO-Z COATING (U.S.)

- Nikwax (U.K.)

- Gold Eagle (U.S.)

- KLEEN (U.S.)

- XO2 Pty Ltd (Australia)

- Crep Protect (U.K.)

What are the Recent Developments in Global Fabric Protection Market?

- In January 2023, TenCate Protective Fabrics, a leader in flame-resistant textiles, launched Tecasafe 360+, the industry’s first inherently flame-resistant stretch fabric, setting a new benchmark for safety and comfort in protective clothing. This innovation highlights the company’s commitment to advancing performance-driven fabric solutions

- In April 2021, TechStyles, a division of South Carolina-based AFF Group, introduced a range of new products aimed at addressing key industry challenges such as rising costs, longer lead times, inconsistent quality, product availability, and high minimum orders, positioning itself as a change-maker in the coated fabrics market. This move underscores the company’s vision to revolutionize the coated fabrics industry

- In March 2021, Spartanburg-based AFF TechStyles unveiled TechArt, a digitally printed coated fabric that adds to its portfolio of textile products, featuring both pre-developed designs and customizable imagery to cater to diverse consumer needs. This development reinforces AFF TechStyles’ role in merging creativity with advanced textile technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fabric Protection Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fabric Protection Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fabric Protection Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.