Global Failure Analysis Market

Market Size in USD Billion

CAGR :

%

USD

5.77 Billion

USD

10.85 Billion

2025

2033

USD

5.77 Billion

USD

10.85 Billion

2025

2033

| 2026 –2033 | |

| USD 5.77 Billion | |

| USD 10.85 Billion | |

|

|

|

|

Failure Analysis Market Size

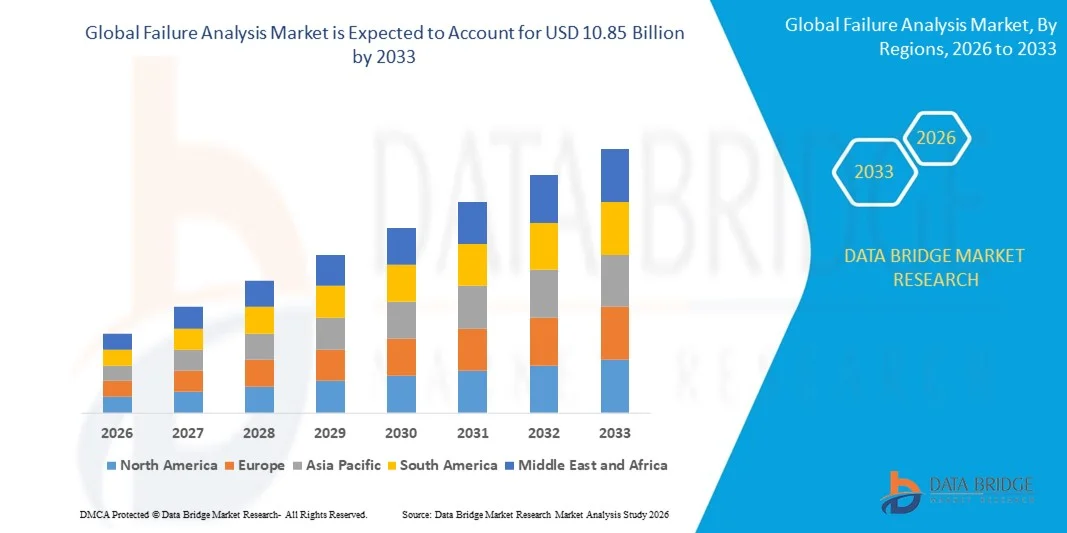

- The global failure analysis market size was valued at USD 5.77 billion in 2025 and is expected to reach USD 10.85 billion by 2033, at a CAGR of 8.20% during the forecast period

- The market growth is largely fuelled by the increasing demand for quality assurance and reliability testing across automotive, aerospace, electronics, and industrial sectors

- Rising adoption of advanced analytical technologies, such as electron microscopy, spectroscopy, and X-ray inspection, is supporting precise defect detection and root cause analysis

Failure Analysis Market Analysis

- The market is witnessing heightened adoption of automated and AI-enabled failure analysis solutions that enhance testing accuracy, reduce turnaround time, and improve decision-making for manufacturers

- Increasing investment in R&D, along with the expansion of semiconductor, automotive, and aerospace industries, is further propelling the demand for advanced failure analysis services and tools

- North America dominated the failure analysis market with the largest revenue share of 35.42% in 2025, driven by the growing need for high-precision quality control across aerospace, automotive, and electronics industries, as well as increased adoption of advanced analytical equipment

- Asia-Pacific region is expected to witness the highest growth rate in the global failure analysis market, driven by expanding industrial infrastructure, growing adoption of semiconductor and electronics manufacturing, and government initiatives supporting high-precision testing technologies

- The Scanning Electron Microscopy (SEM) segment held the largest market revenue share in 2025, driven by its high-resolution imaging capabilities and versatility across multiple industries. SEM systems enable detailed surface analysis, defect detection, and material characterization, making them a popular choice for electronics, aerospace, and automotive sectors

Report Scope and Failure Analysis Market Segmentation

|

Attributes |

Failure Analysis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Failure Analysis Market Trends

Rise of Advanced Material and Component Testing

- The growing adoption of advanced failure analysis techniques is transforming the materials and electronics testing landscape by enabling real-time, precise defect identification. The speed and accuracy of these tools allow for immediate corrective actions, particularly in high-value industries such as aerospace and semiconductors, resulting in improved product reliability and reduced operational losses. Companies are increasingly integrating AI-driven predictive analytics to anticipate failures before they occur, further enhancing operational efficiency and minimizing downtime

- The high demand for rapid failure detection in complex components is accelerating the adoption of automated testing platforms and AI-driven analysis tools. These solutions are particularly effective where manual inspection is time-consuming or prone to error, helping reduce production downtime and improve quality assurance. Regulatory compliance and industry certifications are also motivating firms to adopt advanced failure analysis to meet stringent safety and reliability standards

- The affordability and user-friendliness of modern failure analysis systems are making them attractive for routine quality control and research applications, leading to more frequent testing and faster product development cycles. Companies benefit from improved defect detection without incurring excessive costs or logistical hurdles, enhancing overall operational efficiency. In addition, cloud-based platforms and remote monitoring capabilities allow firms to scale testing operations and share results seamlessly across global teams

- For instance, in 2023, several semiconductor manufacturers in the U.S. reported faster identification of micro-defects after implementing automated scanning electron microscopy and AI-driven failure analysis solutions. These systems allowed early detection of flaws, improving product quality and reducing warranty claims. This adoption also supported faster R&D cycles, enabling quicker market introduction of high-performance components

- While failure analysis technologies are accelerating defect detection and supporting product reliability, their impact depends on continued innovation, operator training, and software integration. Vendors must focus on localized product development, regulatory compliance, and workflow automation to fully capitalize on growing demand. Emerging technologies such as 3D tomography and high-resolution imaging are expected to further expand capabilities and application areas

Failure Analysis Market Dynamics

Driver

Rising Need for High-Precision Quality Control and Defect Mitigation

- The increasing requirement for high-quality, reliable products in industries such as aerospace, automotive, and electronics is pushing manufacturers to adopt advanced failure analysis solutions as a core quality control strategy. Accurate detection enables timely corrective measures and prevents costly recalls. Adoption is further driven by growing consumer expectations for durable, defect-free products and zero tolerance for performance failures

- Companies are increasingly aware of the financial and operational risks associated with undetected defects, including warranty costs, product failures, and regulatory non-compliance. This awareness has led to a more systematic use of failure analysis tools across production lines. In addition, predictive failure analytics are being employed to reduce scrap rates and optimize resource utilization, lowering operational costs

- Industry standards and regulatory guidelines promoting defect-free products are further supporting the implementation of failure analysis techniques. Compliance mandates encourage manufacturers to deploy analytical tools and maintain detailed defect records. Integration with quality management systems (QMS) ensures real-time tracking of failures and supports continuous process improvement initiatives

- For instance, in 2022, European automotive OEMs adopted standardized failure analysis protocols for critical components, boosting demand for advanced microscopy, spectroscopy, and AI-enabled analysis systems. These standards have since been adopted by suppliers across multiple regions, creating uniformity in product quality monitoring and reporting

- While rising quality demands and regulatory support are fueling adoption, organizations must enhance infrastructure, integrate analysis tools with production systems, and train skilled personnel to maximize long-term benefits. Companies investing in cross-functional training and advanced analytics platforms are better positioned to respond to complex failure scenarios

Restraint/Challenge

High Cost of Advanced Analytical Equipment and Skilled Workforce Shortage

- The high price point of sophisticated failure analysis equipment, such as electron microscopes, X-ray systems, and AI-based analytics platforms, makes them inaccessible for small and medium enterprises. Cost remains a major limiting factor for widespread adoption. High installation and maintenance costs, along with frequent calibration requirements, further add to the financial burden for smaller manufacturers

- Many regions face a shortage of trained personnel capable of operating complex analytical instruments and interpreting results. The absence of technical expertise and supporting infrastructure further limits the effective use of failure analysis solutions. Firms are often forced to rely on third-party labs, resulting in longer turnaround times and increased operational risks

- Market penetration is also restricted by long equipment setup times and maintenance requirements, particularly in remote or resource-constrained manufacturing sites. These operational challenges delay defect detection and reduce analysis efficiency. Moreover, stringent safety regulations for handling advanced analytical instruments can further complicate deployment in emerging markets

- For instance, in 2023, assessments across Asian electronics manufacturers revealed that over 60% of small-scale firms lacked skilled operators and access to high-end analytical equipment, hindering adoption. Limited availability of certified training programs exacerbates workforce challenges, restricting the expansion of advanced failure analysis capabilities

- While failure analysis technologies continue to advance, addressing cost, expertise, and integration challenges remains crucial. Stakeholders must focus on affordable solutions, operator training programs, and scalable platforms to unlock long-term market potential. Collaboration with academic institutions and government programs is increasingly being leveraged to bridge the skills gap and ensure sustainable adoption

Failure Analysis Market Scope

The market is segmented on the basis of product, test, technique, technology, application, and customers

- By Product

On the basis of product, the failure analysis market is segmented into Transmission Electron Microscope, Focused Ion Beam Systems, Scanning Electron Microscopy, Dual Beam Systems, and Others. The Scanning Electron Microscopy (SEM) segment held the largest market revenue share in 2025, driven by its high-resolution imaging capabilities and versatility across multiple industries. SEM systems enable detailed surface analysis, defect detection, and material characterization, making them a popular choice for electronics, aerospace, and automotive sectors.

The Transmission Electron Microscope (TEM) segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its ability to provide atomic-level imaging and precise internal structural analysis. TEM is particularly favored in high-tech applications such as nanofabrication, semiconductor research, and advanced materials testing, offering critical insights into micro-defects and enabling early corrective measures.

- By Test

On the basis of test, the market is segmented into Contaminated Analysis, Corrosion Investigation, Fractography, Metallography, Mechanical Testing, Chemical Analysis and Testing, NDT, Weld Testing, Microstructure Evaluation, Adhesive Identification, Coating Contamination, Thermal Mapping, Electrical Overstress (EOS)/Electrostatic Discharge (EDS), Regulatory Compliance Testing, and Others. The Fractography segment held the largest share in 2025, driven by its importance in identifying failure modes and preventing recurring defects in critical components.

The Chemical Analysis and Testing segment is expected to register the fastest growth from 2026 to 2033, propelled by its widespread application in quality control and R&D, particularly in electronics, aerospace, and healthcare equipment. Rapid adoption of automated and AI-assisted chemical testing platforms is further enhancing efficiency and accuracy.

- By Technique

On the basis of technique, the market is segmented into Destructive Physical Analysis, Physics of Failure Analysis, Fault Tree Analysis (FTA), Common-Mode Failure Analysis, Failure Modes Effect Analysis (FMEA), Sneak Circuit Analysis, Software Failure Analysis, and Others. The Failure Modes Effect Analysis (FMEA) segment held the largest share in 2025 due to its systematic approach in identifying and mitigating potential failure points across industries.

The Physics of Failure Analysis segment is projected to witness the fastest growth during 2026–2033, driven by its predictive capabilities that allow organizations to foresee and prevent component failures. Increasing emphasis on reliability and product safety standards is supporting the adoption of PoF techniques across electronics, automotive, and aerospace sectors.

- By Technology

On the basis of technology, the market is segmented into Broad Ion Milling, Focused Ion Milling, Relative Ion Etching, Secondary Ion Mass Spectroscopy, and Energy Dispersive X-Ray Spectroscopy. The Energy Dispersive X-Ray Spectroscopy (EDS) segment held the largest market revenue share in 2025, fuelled by its ability to perform rapid elemental analysis and defect identification with high precision.

The Focused Ion Milling segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its precision material removal and sample preparation capabilities. The integration of FIB with SEM and TEM systems is enhancing resolution and accuracy in failure analysis applications.

- By Application

On the basis of application, the market is segmented into Bio Science, Electronics, Renewable Energy, Agriculture, Oil and Gas, Commercial Aerospace, Defence, Automotive, Construction, Chemical and Pharmaceutical, Healthcare Equipment, Food and Beverage, Mining, Polymer, Paper and Fiber Material, Ceramic and Glass, Nanofabrication, and Others. The Electronics segment held the largest revenue share in 2025, driven by the increasing complexity of semiconductor devices and the critical need for defect detection.

The Renewable Energy segment is projected to witness the fastest growth during 2026–2033, owing to the rapid expansion of solar, wind, and battery technologies, which require stringent failure analysis to ensure efficiency, reliability, and safety.

- By Customers

On the basis of customers, the market is segmented into Fab FA Labs Customers, Fabless FA Labs Customers, Specialty Labs Customers, and Other Customers. The Fab FA Labs Customers segment held the largest share in 2025, driven by the high-volume production of semiconductors and the critical need for consistent defect monitoring.

The Specialty Labs Customers segment is expected to witness the fastest growth from 2026 to 2033, propelled by increasing demand for specialized, high-precision failure analysis services in sectors such as aerospace, defense, and nanotechnology.

Failure Analysis Market Regional Analysis

- North America dominated the failure analysis market with the largest revenue share of 35.42% in 2025, driven by the growing need for high-precision quality control across aerospace, automotive, and electronics industries, as well as increased adoption of advanced analytical equipment

- Companies in the region highly value the accuracy, speed, and integration capabilities of modern failure analysis tools, enabling timely defect detection and enhanced product reliability

- This widespread adoption is further supported by strong R&D infrastructure, high investment in manufacturing quality, and regulatory standards promoting defect-free production, establishing failure analysis as a critical component of operational excellence

U.S. Failure Analysis Market Insight

The U.S. failure analysis market captured the largest revenue share in 2025 within North America, fueled by rapid technological advancements and the increasing adoption of AI-enabled and automated analytical tools. Manufacturers are increasingly prioritizing failure analysis to mitigate warranty costs, enhance product safety, and ensure compliance with stringent industry standards. The growing integration of high-resolution microscopy, spectroscopy, and software-driven analysis platforms further supports market expansion, enabling faster identification of micro-defects and improved manufacturing efficiency.

Europe Failure Analysis Market Insight

The Europe failure analysis market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent quality and regulatory standards across the aerospace, automotive, and electronics sectors. The region’s focus on sustainability, product reliability, and precision engineering is fostering the adoption of advanced failure analysis solutions. European manufacturers are increasingly leveraging automated and AI-based analysis tools to ensure defect-free production, with significant growth observed in both research labs and industrial applications.

U.K. Failure Analysis Market Insight

The U.K. failure analysis market is expected to witness robust growth from 2026 to 2033, driven by the rising demand for high-quality, reliable products and the adoption of smart manufacturing practices. The increasing emphasis on regulatory compliance and defect-free production is encouraging both industrial and research institutions to invest in advanced analytical instruments. The U.K.’s strong focus on innovation, coupled with a well-established manufacturing base, is further stimulating market expansion.

Germany Failure Analysis Market Insight

The Germany failure analysis market is expected to witness substantial growth from 2026 to 2033, fueled by the country’s well-developed industrial sector and focus on precision engineering. Growing awareness regarding product safety, high standards for quality assurance, and the adoption of cutting-edge analytical technologies are promoting the use of failure analysis tools in both manufacturing and research applications. Integration of automated inspection systems with production lines is also becoming prevalent, improving defect detection and process optimization.

Asia-Pacific Failure Analysis Market Insight

The Asia-Pacific failure analysis market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid industrialization, expanding electronics and automotive manufacturing, and increasing R&D investments in countries such as China, Japan, and India. The region’s growing inclination toward high-quality manufacturing and adoption of advanced analytical instruments is accelerating market growth. Furthermore, APAC is emerging as a manufacturing hub for semiconductor, automotive, and aerospace components, enhancing the accessibility and affordability of failure analysis solutions across the region.

Japan Failure Analysis Market Insight

The Japan failure analysis market is expected to witness significant growth from 2026 to 2033 due to the country’s high-technology manufacturing culture and focus on precision engineering. The increasing number of smart factories and connected production facilities is driving the adoption of automated and AI-enabled failure analysis tools. Japan’s strong emphasis on product reliability, coupled with regulatory requirements for defect-free components, is fueling demand across electronics, automotive, and aerospace industries.

China Failure Analysis Market Insight

The China failure analysis market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s rapid industrial growth, expanding electronics and automotive sectors, and high investment in manufacturing quality. China is emerging as a key market for advanced failure analysis solutions, with increasing adoption of automated inspection, microscopy, and AI-driven analytical tools. Government initiatives promoting smart manufacturing and quality standards, alongside strong domestic technology providers, are key factors propelling the market in China.

Failure Analysis Market Share

The Failure Analysis industry is primarily led by well-established companies, including:

- Hitachi High-Tech America, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Carl Zeiss AG (Germany)

- JEOL USA, Inc. (U.S.)

- TESCAN ORSAY HOLDING, a.s. (Czech Republic)

- Bruker (U.S.)

- HORIBA Europe GmbH (Germany)

- Semilab Inc. (U.S.)

- A&D Company, Limited (Japan)

- Motion X Corporation (U.S.)

- Eurofins Scientific (Luxembourg)

- Intertek Group plc (U.K.)

- Oxford Instruments (U.K.)

- RAITH GMBH (Germany)

- Leica Microsystems (Germany)

- Veeco Instruments Inc. (U.S.)

- ACCU TEST LABS (U.S.)

- Meiji Techno America (U.S.)

- Fibics Incorporated (Canada)

- Applied Beams LLC (U.S.)

Latest Developments in Global Failure Analysis Market

- In May 2024, Eurofins EAG Laboratories expanded its materials testing capabilities by opening a new 6,600 square-foot laboratory in Sunnyvale, CA, and enlarging its Syracuse, New York facility by 6,500 square feet. This development enhances the company’s ability to provide comprehensive turnkey battery testing services, covering the entire lifecycle from coin cells to EV battery packs. The expansion strengthens Eurofins’ position as a leading independent battery testing laboratory in the U.S., enabling faster and more precise failure analysis, and supporting the growing demand for reliable battery solutions across automotive and electronics industries

- In October 2021, Eurofins Scientific acquired MASER Engineering BV, a leading failure and reliability testing center in Europe, while retaining the existing executive management as minority shareholders. This acquisition aims to expand Eurofins’ footprint in the European semiconductor and electronic systems sector, creating new opportunities for MASER in international markets. The integration enhances Eurofins’ materials and engineering services portfolio, improving global service capabilities and reinforcing its position in high-precision failure analysis and reliability testing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Failure Analysis Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Failure Analysis Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Failure Analysis Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.