Global Fairtrade Food And Beverages Market

Market Size in USD Million

CAGR :

%

USD

334.87 Million

USD

707.46 Million

2024

2032

USD

334.87 Million

USD

707.46 Million

2024

2032

| 2025 –2032 | |

| USD 334.87 Million | |

| USD 707.46 Million | |

|

|

|

|

What is the Global Fairtrade Food and Beverages Market Size and Growth Rate?

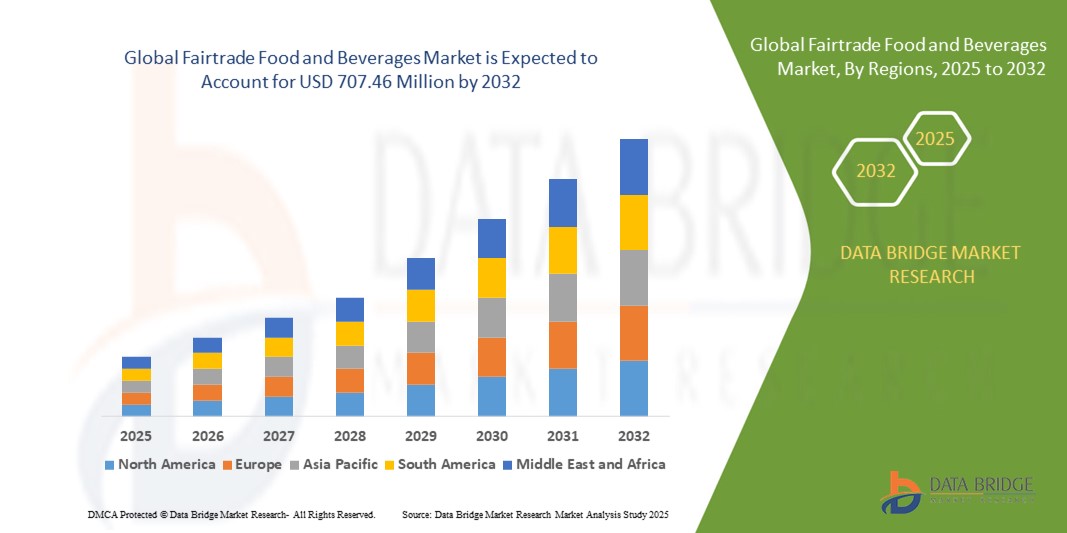

- The global fairtrade food and beverages market size was valued at USD 334.87 million in 2024 and is expected to reach USD 707.46 million by 2032, at a CAGR of 9.8% during the forecast period

- Fairtrade food and beverages refers to the process of manufacturing the food and beverages items free of forced labor or poor working conditions for laborers. This system generally involves the production of cocoa, coffee, bananas, tea, and sugar

What are the Major Takeaways of Fairtrade Food and Beverages Market?

- The rise in the concern about the environment is a major factor expected to the boost the growth of the fairtrade food and beverages market in the forecast period of 2025 to 2032. Furthermore, the increasing demand for sustainable food, high demand of demand for innovative products, increasing presence as well as the high demand for coffee are also expected to fuel the expansion of fairtrade food and beverages market in the above-mentioned forecast period

- North America dominated the fairtrade food and beverages market with the largest revenue share of 39.17% in 2024, driven by increasing consumer preference for ethically sourced products, heightened awareness of sustainability, and strong retail penetration of Fairtrade-certified items

- Asia-Pacific fairtrade food and beverages market is poised to grow at the fastest CAGR of 9.14% during the forecast period 2025–2032, driven by rising urbanization, increasing disposable incomes, and growing consumer awareness regarding ethical and sustainable products

- The coffee segment dominated the market with the largest revenue share of 38.5% in 2024, driven by the global preference for ethically sourced coffee and increasing awareness of Fairtrade-certified products among consumers

Report Scope and Fairtrade Food and Beverages Market Segmentation

|

Attributes |

Fairtrade Food and Beverages Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Fairtrade Food and Beverages Market?

Rising Demand for Ethical and Sustainable Consumption

- A major and accelerating trend in the global fairtrade food and beverages market is the growing consumer focus on ethically sourced, sustainable, and socially responsible products. Fairtrade certification ensures that farmers and workers receive fair wages and work under ethical conditions, which strongly resonates with today’s socially conscious buyers

- For instance, brands such as Ben & Jerry’s and Divine Chocolate have expanded their Fairtrade-certified offerings, appealing to ethically minded consumers while strengthening their sustainability commitments

- Increasing awareness about climate change and labor exploitation in developing countries has made sustainability a core purchasing factor. Fairtrade-certified food and beverages provide transparency in sourcing and production, ensuring both environmental and social accountability

- Retailers and e-commerce platforms are also highlighting Fairtrade products to meet consumer demand, with supermarkets in Europe and North America allocating dedicated sections for Fairtrade-certified goods

- This trend is reshaping consumer expectations, pushing companies to align their operations with ESG (Environmental, Social, and Governance) principles, which enhances both market share and brand loyalty

What are the Key Drivers of Fairtrade Food and Beverages Market?

- The increasing consumer preference for ethically produced and sustainably sourced food and beverages is a primary driver of the market’s growth. Rising awareness of fair wages, labor rights, and environmentally responsible practices are influencing buying decisions globally

- For instance, in March 2023, Nestlé U.K. & Ireland announced its expansion of Fairtrade-certified coffee and cocoa sourcing, reinforcing its commitment to responsible supply chains and strengthening its market position

- Growing demand for organic and natural food products, particularly in developed regions, is also supporting Fairtrade adoption. Consumers perceive Fairtrade certification as a mark of authenticity and sustainability, which drives premium pricing opportunities

- The expansion of retail and e-commerce channels dedicated to ethical consumption, along with strong advocacy from NGOs and sustainability organizations, further accelerates the penetration of Fairtrade food and beverages

- In addition, younger demographics, especially millennials and Gen Z, are emerging as key consumers, prioritizing sustainability and transparency when choosing food and beverage products. This generational shift is expected to maintain long-term market momentum

Which Factor is Challenging the Growth of the Fairtrade Food and Beverages Market?

- One of the major challenges facing the fairtrade food and beverages market is the higher price point of certified products compared to conventional alternatives. The certification process and adherence to ethical standards often lead to increased costs, making these products less affordable for price-sensitive consumers

- For instance, Fairtrade-certified chocolate and coffee brands often retail at a noticeable premium, limiting their adoption in markets with lower disposable incomes

- Limited consumer awareness in emerging economies further hampers growth, as many buyers remain unfamiliar with the Fairtrade label and its long-term benefits. This lack of awareness reduces willingness to pay extra for certified goods

- In addition, supply chain complexities and the costs associated with certification can discourage smaller producers from entering the Fairtrade system, thereby limiting the availability of diverse products

- Overcoming these challenges will require consumer education campaigns, government support for sustainable sourcing, and initiatives to make Fairtrade certification more accessible and affordable. By addressing these barriers, the market can expand its reach and strengthen its impact on global ethical consumption

How is the Fairtrade Food and Beverages Market Segmented?

The market is segmented on the basis of type and mode of distribution.

- By Type

On the basis of type, the fairtrade food and beverages market is segmented into coffee, tea, chocolate, bananas, honey, sugar, fruit juice, wine, and snacks. The coffee segment dominated the market with the largest revenue share of 38.5% in 2024, driven by the global preference for ethically sourced coffee and increasing awareness of Fairtrade-certified products among consumers. Fairtrade coffee is particularly popular in North America and Europe, where consumers are willing to pay a premium for sustainable sourcing, environmental protection, and social impact. The growing café culture and specialty coffee shops have further fueled demand for Fairtrade coffee varieties.

The chocolate segment is expected to witness the fastest CAGR of 22% from 2025 to 2032, supported by rising consumer awareness of ethical cocoa sourcing, increased demand for premium chocolate products, and campaigns highlighting Fairtrade certifications. The trend toward guilt-free indulgence and sustainability-driven gifting occasions is boosting the segment’s adoption across global markets.

- By Mode of Distribution

On the basis mode of distribution, the fairtrade food and beverages market is segmented into online and offline channels. The offline segment held the largest market revenue share of 65% in 2024, fueled by widespread supermarket availability, retail chains, and dedicated Fairtrade sections in brick-and-mortar stores. Consumers continue to value the tactile experience of shopping, where product certifications, freshness, and packaging can be verified in person. Supermarkets in Europe and North America have expanded Fairtrade product displays, increasing visibility and driving sales.

The online segment is expected to witness the fastest CAGR of 24% from 2025 to 2032, driven by the rapid adoption of e-commerce platforms and increasing digital literacy. Online channels provide convenience, subscription services, and access to a wider product range, enabling consumers to purchase Fairtrade food and beverages from anywhere. Growth is further propelled by targeted marketing campaigns, social media promotions, and collaborations between online retailers and Fairtrade-certified brands.

Which Region Holds the Largest Share of the Fairtrade Food and Beverages Market?

- North America dominated the fairtrade food and beverages market with the largest revenue share of 39.17% in 2024, driven by increasing consumer preference for ethically sourced products, heightened awareness of sustainability, and strong retail penetration of Fairtrade-certified items

- Consumers in the region highly value product traceability, ethical sourcing, and the environmental and social benefits associated with Fairtrade certification

- This widespread adoption is further supported by high disposable incomes, established retail infrastructure, and the presence of major Fairtrade-promoting campaigns, establishing Fairtrade products as a preferred choice for both residential and commercial buyers

U.S. Fairtrade Food and Beverages Market Insight

In the U.S., the fairtrade food and beverages market captured the largest revenue share of 78% within North America in 2024. Growth is fueled by rising consumer awareness of ethical sourcing and sustainability. Specialty coffee shops, cafés, and premium retail outlets are increasingly promoting Fairtrade-certified products, while subscription and e-commerce platforms enhance accessibility. Consumers prioritize traceability, social impact, and environmentally responsible production. Government campaigns and NGO initiatives supporting fair trade practices further boost adoption. The U.S. remains a mature market, with continuous growth expected due to evolving consumer preferences toward ethical, high-quality food and beverage products.

Europe Fairtrade Food and Beverages Market Insight

The Europe fairtrade food and beverages market is projected to expand at a substantial CAGR, primarily driven by regulatory support for sustainable sourcing and heightened consumer awareness regarding ethical consumption. Urbanization and increasing demand for certified food products foster adoption across retail chains, specialty stores, and hospitality sectors. The region shows significant growth in both established and emerging markets due to preference for premium, traceable, and environmentally responsible products.

U.K. Fairtrade Food and Beverages Market Insight

In the U.K., the fairtrade food and beverages market is expanding steadily due to rising consumer awareness about ethical sourcing, sustainability, and social responsibility. Retailers, supermarkets, and online platforms are actively promoting certified Fairtrade products. Government initiatives and Fairtrade campaigns play a key role in educating consumers and boosting adoption. Urban populations, cafés, and specialty stores are increasingly offering ethically sourced food and beverage options, supporting market growth. The focus on premium, traceable, and environmentally responsible products aligns with consumer demand for transparency. Overall, the U.K. market demonstrates strong potential for sustained growth driven by ethical consumption trends.

Germany Fairtrade Food and Beverages Market Insight

In Germany, the fairtrade food and beverages market is witnessing notable growth due to heightened consumer focus on sustainability and fair trade practices. Retail chains, specialty outlets, and cafés are increasingly offering certified Fairtrade products, while online platforms expand accessibility. Government support for sustainable agriculture and ethical sourcing strengthens consumer confidence. Awareness campaigns highlighting social and environmental benefits are driving adoption across urban and semi-urban areas. Consumers prefer traceable, high-quality products with environmental responsibility, supporting premium pricing. Germany’s market benefits from a mature retail ecosystem and strong ethical consumer base, positioning it as a key growth hub for Fairtrade food and beverages in Europe.

Which Region is the Fastest Growing Region in the Fairtrade Food and Beverages Market?

Asia-Pacific fairtrade food and beverages market is poised to grow at the fastest CAGR of 9.14% during the forecast period 2025–2032, driven by rising urbanization, increasing disposable incomes, and growing consumer awareness regarding ethical and sustainable products. Government initiatives promoting sustainable agriculture and fair trade certification are supporting adoption.

Japan Fairtrade Food and Beverages Market Insight

In Japan, the fairtrade food and beverages market is gaining momentum due to rising urbanization, health-conscious lifestyles, and a growing preference for ethical consumption. Specialty stores, supermarkets, and online platforms are expanding Fairtrade product availability. Consumers increasingly value products with transparent sourcing, environmental responsibility, and social impact. Government initiatives promoting sustainable agriculture and corporate ethical responsibility enhance market adoption. E-commerce platforms and subscription services further facilitate accessibility across urban centers. With the increasing presence of cafés and retail outlets offering Fairtrade-certified options, Japan is positioned as a fast-growing market in Asia, driven by consumer demand for high-quality, responsibly sourced food and beverages.

China Fairtrade Food and Beverages Market Insight

In China, the fairtrade food and beverages market accounted for the largest revenue share in the Asia-Pacific region in 2024. Growth is fueled by rapid urbanization, an expanding middle class, and rising awareness of sustainability and ethical consumption. E-commerce platforms and online marketplaces are key drivers of accessibility, offering Fairtrade-certified products to urban and semi-urban consumers. Cafés, specialty stores, and retail chains are increasingly adopting ethically sourced food and beverages. Government policies supporting sustainable agriculture and fair trade further encourage market penetration. China’s market is expected to grow rapidly, driven by rising disposable incomes and increasing consumer preference for socially responsible products.

Which are the Top Companies in Fairtrade Food and Beverages Market?

The fairtrade food and beverages industry is primarily led by well-established companies, including:

- Bimbo (Mexico)

- Ingredion (U.S.)

- Kellogg's Company (U.S.)

- Mars Incorporated (U.S.)

- PepsiCo (U.S.)

- Starbucks (U.S.)

What are the Recent Developments in Global Fairtrade Food and Beverages Market?

- In October 2022, Promoitalia, a cosmetic product company, announced the launch of iWave, a unique body microwave contouring device, which has demonstrated safe and effective fat reduction results, reinforcing the company’s commitment to innovative body treatment solutions

- In November 2021, Lancer Skincare, the premier Beverly Hills-based international skincare brand, partnered with the tech startup ByondXR to launch The Virtual Lancer Dermatology Shop, providing consumers with a digital platform to experience in-home dermatology services, marking a significant step toward virtual skincare solutions

- In March 2020, Scottish skin tech firm Cutitronics expanded its operations in Europe just ahead of its commercial launch, focusing on collaboration with leading skincare brands in the region, positioning the company for strategic growth and increased market presence

- In June 2020, L’Oréal announced the global launch of Perso, an AI-based skincare device, aimed at expanding its product portfolio in skincare devices, highlighting the company’s investment in intelligent, personalized beauty solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fairtrade Food And Beverages Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fairtrade Food And Beverages Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fairtrade Food And Beverages Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.