Global Farm And Garden Equipment Market

Market Size in USD Billion

CAGR :

%

USD

32.30 Billion

USD

53.45 Billion

2025

2033

USD

32.30 Billion

USD

53.45 Billion

2025

2033

| 2026 –2033 | |

| USD 32.30 Billion | |

| USD 53.45 Billion | |

|

|

|

|

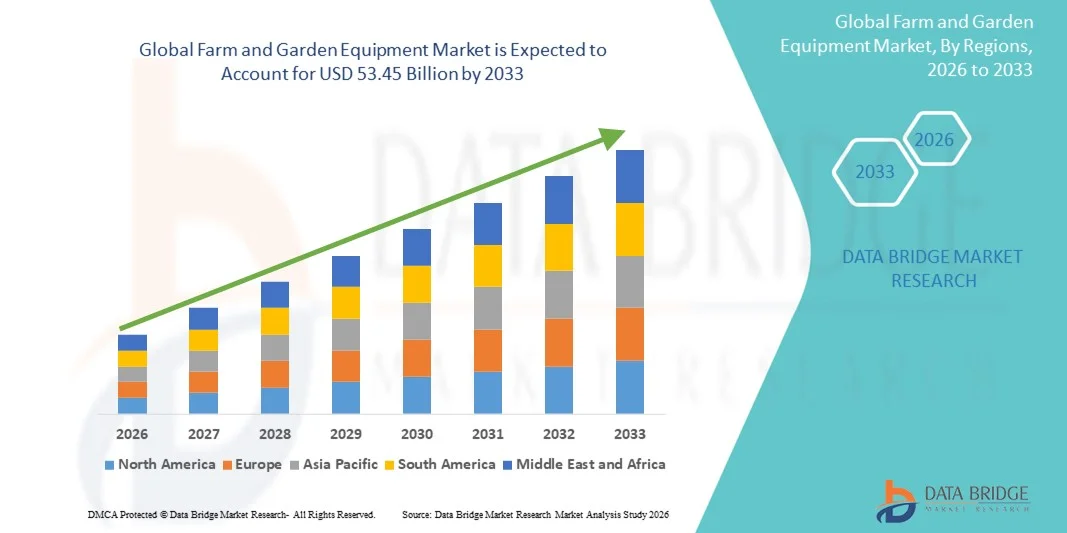

What is the Global Farm and Garden Equipment Market Size and Growth Rate?

- The global farm and garden equipment market size was valued at USD 32.3 billion in 2025 and is expected to reach USD 53.45 billion by 2033, at a CAGR of 6.30% during the forecast period

- Increasing demand for automated water sprinklers and modern designed tools for gardens and lawns, growing adoption of smart gardening techniques which enables gardening simpler and on-time maintenance, increasing awareness among the people regarding the health benefits of gardening activities, various industries and corporate organizations have taken initiatives for conservation of environment by organizing tree plantation programs are some of the vital as well as important factors which will likely to accelerate the growth of the farm and garden equipment market

What are the Major Takeaways of Farm and Garden Equipment Market?

- Increasing number of technological advancements along with rising international trade agreements and increasing consumer spending which will further contribute by generating immense opportunities that will led to the growth of the farm and garden equipment market in the above mentioned projected timeframe

- Disturbance in the retail market along with rising occurrences of natural disasters which will likely to act as market restraints factor for the growth of the farm and garden equipment market

- North America dominated the farm and garden equipment market with the largest revenue share of 45.69% in 2025, driven by the growing adoption of advanced agricultural machinery, lawn care tools, and landscaping equipment across both residential and commercial sectors

- The Asia-Pacific farm and garden equipment market is poised to grow at the fastest CAGR of 8.85% during the forecast period (2026–2033), driven by rapid urbanization, rising disposable incomes, and mechanization in agriculture across countries such as China, Japan, and India

- The Garden Machinery segment dominated the market with the largest revenue share of 38.5% in 2025, driven by the growing use of powered tools such as lawnmowers, trimmers, and chainsaws for both residential and commercial applications

Report Scope and Farm and Garden Equipment Market Segmentation

|

Attributes |

Farm and Garden Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Farm and Garden Equipment Market?

Automation and Electrification Revolutionizing Farm and Garden Equipment

- A key emerging trend in the global farm and garden equipment market is the rapid shift towards automation and electrification, driven by advancements in robotics, AI-powered sensors, and battery technology. This evolution is transforming traditional tools and machinery into efficient, eco-friendly, and intelligent equipment designed for modern agricultural and landscaping applications

- Leading manufacturers are developing autonomous mowers, robotic tillers, and smart irrigation systems that reduce manual labor while optimizing productivity. For instance, Husqvarna AB introduced its Automower NERA series with satellite-based EPOS technology, offering precise, wire-free mowing with advanced route optimization

- The growing adoption of battery-powered and hybrid equipment is further supporting the sustainability shift, reducing carbon emissions and operating noise. Companies such as Deere & Company and STIHL are investing heavily in electric-powered tractors and garden tools to meet the rising demand for environmentally responsible solutions

- In addition, the integration of IoT connectivity and telematics enables remote monitoring, predictive maintenance, and data-driven performance tracking, improving operational efficiency for both small-scale users and large farms

- This trend toward automation and green technology is redefining the future of outdoor maintenance, positioning smart and sustainable equipment as essential for next-generation farming and gardening operations worldwide

What are the Key Drivers of Farm and Garden Equipment Market?

- The rising adoption of smart farming practices and growing consumer interest in home gardening are key forces driving the farm and garden equipment market. With global focus on food security and sustainable agriculture, demand for efficient, high-performance equipment is surging

- In March 2026, Kubota Corporation announced the development of its X Tractor concept — an AI-driven, fully electric, and self-operating tractor designed to address labor shortages and enhance precision agriculture. Such technological innovations are propelling market growth across developed and emerging economies

- The increasing urbanization and popularity of hobby gardening are encouraging households to invest in compact, easy-to-use electric garden tools, promoting market expansion in residential segments

- Furthermore, rising concerns about climate change and energy efficiency are encouraging the shift toward electric and solar-powered lawn mowers, trimmers, and tillers. The growing use of connected devices also allows users to remotely control or schedule operations, further enhancing convenience and productivity

- The combination of smart technology, eco-conscious design, and enhanced operational safety continues to strengthen the market’s position, ensuring consistent growth across agricultural and landscaping applications

Which Factor is Challenging the Growth of the Farm and Garden Equipment Market?

- One of the most significant challenges hindering the Farm and Garden Equipment market growth is the high initial cost and maintenance of advanced machinery, especially for small and mid-scale farmers. The integration of automation, AI, and electric power systems often leads to elevated production and retail prices

- For instance, fully automated robotic mowers and AI-enabled tractors can cost several times more than traditional equipment, limiting accessibility for budget-conscious users in developing regions

- Another key concern is the limited charging infrastructure and battery longevity, which restricts the widespread adoption of electric-powered machines in remote agricultural areas. In addition, the reliance on digital connectivity for IoT-enabled tools raises concerns regarding data privacy and software reliability, deterring some potential buyers

- Manufacturers such as The Toro Company and Husqvarna AB are focusing on developing modular and affordable designs and offering financing options to make smart equipment more accessible

- Overcoming these barriers through cost-effective innovation, enhanced battery performance, and improved connectivity solutions will be crucial to achieving sustained market expansion and greater adoption across all user segments

How is the Farm and Garden Equipment Market Segmented?

The market is segmented on the basis of product type, control type, end user, distribution channel, and operation.

- By Product Type

On the basis of product type, the farm and garden equipment market is segmented into Garden Machinery, Digging Tools, Watering Tools, Cutting/Pruning Tools, Plantation Tools, Cultivating Tools, and Striking Tools. The Garden Machinery segment dominated the market with the largest revenue share of 38.5% in 2025, driven by the growing use of powered tools such as lawnmowers, trimmers, and chainsaws for both residential and commercial applications. Rising demand for electric and battery-powered machinery designed for convenience, efficiency, and eco-friendliness further boosts this segment.

The Cutting/Pruning Tools segment is projected to witness the fastest CAGR from 2026 to 2033, fueled by increasing popularity of gardening as a hobby, expanding landscaping activities, and rising adoption of ergonomic, lightweight designs that improve user comfort and precision.

- By Control Type

On the basis of control type, the market is segmented into Automatic, Semi-Automatic, and Manual. The Manual segment held the largest market share of 42.3% in 2025, owing to the widespread use of simple hand tools such as spades, pruners, and hoes across small farms and household gardens. Their affordability, low maintenance, and ease of use make them a preferred choice in developing regions.

Meanwhile, the Automatic segment is anticipated to register the fastest growth during the forecast period, driven by the increasing adoption of robotic mowers, automated irrigation systems, and smart garden controllers that save time, optimize energy use, and enhance precision in large-scale operations.

- By End User

On the basis of end user, the market is categorized into Residential, Commercial, and Industrial. The Residential segment dominated the Farm and Garden Equipment market with a share of 47.6% in 2025, supported by the growing trend of home gardening, landscaping, and DIY lawn maintenance. The increasing availability of compact and user-friendly electric garden tools has encouraged homeowners to invest in high-quality equipment.

The Commercial segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand from landscaping firms, golf courses, and municipal bodies focused on large-scale garden and park maintenance using advanced, efficient machinery.

- By Distribution Channel

On the basis of distribution channel, the market is divided into Offline and Online. The Offline segment accounted for the largest market share of 61.2% in 2025, attributed to consumer preference for physical inspection, product demonstration, and immediate availability offered by specialty stores, dealerships, and retail outlets.

However, the Online segment is anticipated to exhibit the fastest CAGR from 2026 to 2033, propelled by the rapid growth of e-commerce platforms, expanding internet penetration, and availability of a wider product range at competitive prices, alongside doorstep delivery and customer reviews enhancing purchase confidence.

- By Operation

On the basis of operation, the market is segmented into Walk Behind and Rider. The Walk Behind segment dominated the market with a share of 55.8% in 2025, primarily due to the affordability, compact size, and suitability of these tools for small and medium-sized lawns and gardens. Their easy maneuverability and lower maintenance costs make them highly preferred among residential users.

The Rider segment is forecasted to witness the fastest growth rate from 2026 to 2033, driven by increasing demand from commercial and industrial sectors for large-scale lawn maintenance and field operations, where high efficiency, comfort, and productivity are key priorities.

Which Region Holds the Largest Share of the Farm and Garden Equipment Market?

- North America dominated the farm and garden equipment market with the largest revenue share of 45.69% in 2025, driven by the growing adoption of advanced agricultural machinery, lawn care tools, and landscaping equipment across both residential and commercial sectors. The region’s strong focus on mechanized farming, coupled with the presence of major industry players and technological advancements in garden automation, has significantly enhanced market growth

- Consumers in the region increasingly prefer energy-efficient, low-maintenance, and smart garden equipment, reflecting a growing inclination toward sustainability and productivity. In addition, the rising trend of home gardening and lawn improvement projects among homeowners is fueling the demand for garden machinery and hand tools

- The market expansion is further supported by high disposable incomes, the prevalence of commercial landscaping services, and favorable government initiatives promoting sustainable farming and green spaces, positioning North America as a global leader in the Farm and Garden Equipment industry

U.S. Farm and Garden Equipment Market Insight

The U.S. farm and garden equipment market captured the largest revenue share of 81% in 2025 within North America, propelled by the widespread use of smart and automated agricultural machinery, such as robotic mowers and precision irrigation systems. Rising investments in advanced farming technologies, such as GPS-guided tractors and connected garden equipment, have further strengthened market growth. Consumers’ growing interest in DIY lawn maintenance, sustainable gardening, and urban farming continues to drive demand for compact and battery-operated garden tools. Moreover, leading manufacturers such as Deere & Company and The Toro Company are focusing on developing eco-friendly electric models to cater to environmentally conscious consumers.

Europe Farm and Garden Equipment Market Insight

The Europe farm and garden equipment market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent environmental regulations, increasing urbanization, and a strong push toward electrification of farm machinery. The region’s well-developed infrastructure, coupled with the adoption of precision farming technologies, supports the demand for efficient, low-emission tools. European consumers also prioritize ergonomic design, safety, and energy efficiency, which has accelerated the adoption of automated and cordless garden equipment. Furthermore, the growing trend of landscaping and garden renovation in residential and commercial spaces is contributing to regional market expansion.

U.K. Farm and Garden Equipment Market Insight

The U.K. farm and garden equipment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising interest in home gardening, especially post-pandemic, and an increasing number of sustainable landscaping projects. The government’s initiatives promoting green infrastructure and the popularity of compact, eco-friendly tools among homeowners are also stimulating demand. In addition, the presence of well-established distribution networks and the rapid rise of e-commerce platforms offering a wide range of garden tools have boosted market accessibility across the country.

Germany Farm and Garden Equipment Market Insight

The Germany farm and garden equipment market is expected to expand at a considerable CAGR during the forecast period, fueled by technological innovation, environmental awareness, and strong agricultural practices. Germany’s emphasis on renewable energy and smart agriculture supports the integration of IoT-based irrigation systems, autonomous tractors, and electric-powered garden machinery. In addition, consumers’ preference for premium-quality, durable, and efficient tools aligns with the country’s focus on sustainable development. The expansion of urban green areas and the popularity of community gardens are further driving demand for advanced garden tools and machinery.

Which Region is the Fastest Growing Region in the Farm and Garden Equipment Market?

The Asia-Pacific farm and garden equipment market is poised to grow at the fastest CAGR of 8.85% during the forecast period (2026–2033), driven by rapid urbanization, rising disposable incomes, and mechanization in agriculture across countries such as China, Japan, and India. The growing popularity of gardening as a recreational activity, coupled with government support for smart and sustainable farming, is enhancing market expansion. Moreover, as the region continues to develop as a manufacturing hub for agricultural and garden machinery, the availability of affordable, efficient, and localized equipment is increasing accessibility among small and mid-sized farmers.

Japan Farm and Garden Equipment Market Insight

The Japan farm and garden equipment market is gaining traction due to the nation’s technological sophistication and the need for automation in agriculture amid a declining workforce. Advanced robotics, compact tractors, and AI-integrated irrigation systems are driving modernization across the sector. The rising interest in home gardening and urban farming among Japan’s aging population further supports market growth, as consumers seek low-maintenance, easy-to-use solutions that enhance productivity and convenience.

China Farm and Garden Equipment Market Insight

The China farm and garden equipment market accounted for the largest revenue share in Asia-Pacific in 2025, driven by the country’s rapid urbanization, rising middle-class population, and growing focus on smart agriculture and green infrastructure. China’s strong domestic manufacturing base, coupled with government incentives for modern agricultural practices, is fueling the adoption of both farm and garden equipment. The expansion of smart cities and the growing number of residential landscaping projects have further boosted demand for energy-efficient garden tools and advanced farming solutions, making China a dominant force in the regional market.

Which are the Top Companies in Farm and Garden Equipment Market?

The farm and garden equipment industry is primarily led by well-established companies, including:

- Robert Bosch Power Tools GmbH (Germany)

- Husqvarna AB (publ) (Sweden)

- AriensCo (U.S.)

- Briggs & Stratton, LLC. (U.S.)

- Deere & Company (U.S.)

- Falcon Garden Tools (India)

- Fiskars Group (Finland)

- Honda India Power Products Ltd. (India)

- The Toro Company (U.S.)

- STIGA S.p.A. (Italy)

- ANDREAS STIHL AG & Co. KG (Germany)

- KUBOTA Corporation. (Japan)

- Makita Power Tools India Pvt. Ltd. (India)

- Stanley Black & Decker, Inc. (U.S.)

- MTD Products Inc (U.S.)

- Techtronic Industries Co. Ltd (Hong Kong)

- GARDENA (Germany)

- MTD Products Aktiengesellschaft Geschäftsbereich WOLF-Garten (Germany)

- Emak S.p.A. (Italy)

- Frank Nicol Farm & Garden Machinery Ltd (U.K.)

What are the Recent Developments in Global Farm and Garden Equipment Market?

- In December 2026, XING Mobility received strategic investment from Kubota Corporation, accelerating Kubota’s roadmap for machinery electrification and supporting sustainable agricultural practices. This investment also enables XING Mobility to expedite the development of immersion cooling battery systems, strengthening innovation in electric-powered equipment and future-ready technologies

- In January 2026, CNH Industrial announced that its engine plant in Noida would commence commercial production of Tier-IV and Trem-V engines by September–October, aiming to enhance operations in the off-road construction and agriculture sectors. This milestone reflects CNH Industrial’s commitment to advancing efficiency and meeting growing industry demand

- In January 2026, John Deere partnered with Corteva to provide farmers with customized agronomic solutions, integrating Corteva’s recommendations into the John Deere Operations Center. This collaboration merges digital farming capabilities with agronomic expertise, offering farmers more precise, data-driven solutions to improve productivity and sustainability

- In October 2025, American Honda Motor Co. Inc. unveiled a new lineup of battery-powered lawn mowers, including the HRX, HRN, and HRC walk-behind mowers and a zero-turn-radius (ZTR) mower, all slated for 2026 release. The HRX-BV and HRX-BE models feature a 21-inch NeXite deck and a 4-in-1 Versamow System with Clip Director, enabling mulching, bagging, discharging, and leaf shredding without extra tools. This launch marks a major transition from gas-powered to high-performance electric models in Honda’s portfolio

- In February 2025, Robert Bosch GmbH expanded its Professional 18V System by introducing the GRA 18V2-46 Professional cordless lawnmower, the first model to operate with two 18V batteries simultaneously, allowing professionals to mow areas up to 1,000 m² efficiently. Complementing this, Bosch launched the GAL 18V2-320 Professional dual charger, capable of fully charging two 12.0 Ah batteries in just 55 minutes. These innovations enhance operational efficiency and flexibility for professional outdoor maintenance tasks

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.