Global Farm Management Software Market

Market Size in USD Billion

CAGR :

%

USD

3.05 Billion

USD

8.85 Billion

2024

2032

USD

3.05 Billion

USD

8.85 Billion

2024

2032

| 2025 –2032 | |

| USD 3.05 Billion | |

| USD 8.85 Billion | |

|

|

|

|

Farm Management Software Market Analysis

The global farm management software market is experiencing substantial growth driven by technological advancements that continually enhance its capabilities and applications across agricultural sectors worldwide. Increasing automation demands, spurred by labor shortages and the urgent need for operational efficiency, are significant drivers propelling adoption. Furthermore, substantial investments in research and development are accelerating market expansion. However, challenges such as the high initial costs of farm management software and regulatory constraints pose barriers, limiting accessibility for potential users. Despite these obstacles, the market offers promising opportunities, including improved farm productivity, sustainable agricultural practices, and strategic collaborations among industry players to foster innovation and market penetration. Addressing challenges like public perception, ethical considerations, and cybersecurity risks will be critical for ensuring long-term and sustainable market growth.

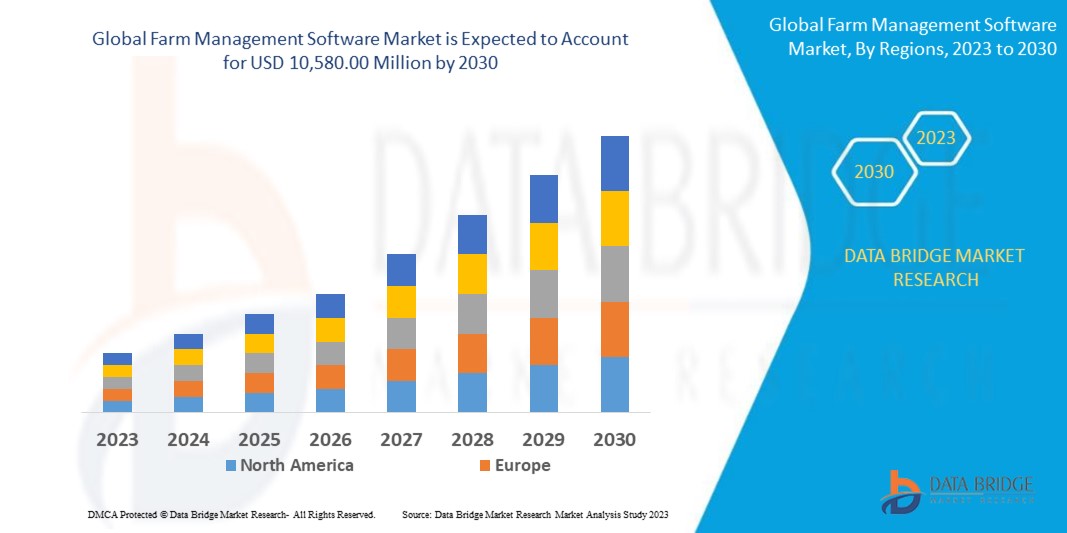

Farm Management Software Market Size

The global farm management software market size was valued at USD 3.05 billion in 2024 and is projected to reach USD 8.85 billion by 2032, with a CAGR of 14.22% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Report Scope and Farm Management Software Market Segmentation

|

Attributes |

Farm Management Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

IBM Corporation, Microsoft, Amazon Web Services, Inc, Google LLC, HP Development Company, L.P., Alibaba Group Holding Limited, SAP SE, Oracle, Dell Inc., Broadcom, Kyndryl Inc., Adobe, Cloud4C, Commvault, Black Box, RACKSPACE TECHNOLOGY, Wolfram, Cloudian Inc., Canadian Cloud Hosting, and IDrive Inc |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Farm Management Software Market Definition

Farm management software is a digital tool designed to assist farmers in planning, monitoring, and analysing all activities on their farms. It integrates various functions such as crop and livestock management, resource allocation, financial tracking, and data analysis to optimize farm operations. By leveraging technologies like IoT, AI, and GPS, farm management software provides real-time data and insights, helping farmers make informed decisions to enhance productivity, efficiency, and sustainability. This software is essential for modern agriculture, enabling precise management of inputs and processes to maximize yields and profitability while minimizing environmental impact

Farm Management Software Market Dynamics

Drivers

- Increasing Demand for Precision Agriculture Solutions

The rising demand for precision agriculture solutions is significantly driving the farm management software market. Precision agriculture leverages technology to monitor and manage field variability, optimizing the use of inputs such as water, fertilizer, and pesticides. By using farm management software, farmers can gather detailed data on soil conditions, crop health, and weather patterns, enabling them to make informed decisions that enhance crop yields and resource efficiency. This detailed data analysis helps in reducing waste, lowering costs, and improving overall farm productivity, making precision agriculture an appealing choice for modern farmers.

- Government Initiatives and Subsidies for Digital Farming

Governments worldwide are increasingly recognizing the potential of digital farming to enhance agricultural productivity and sustainability. By providing initiatives and subsidies, they aim to encourage farmers to adopt advanced technologies such as farm management software, which facilitates efficient resource management and real-time decision-making. These governmental efforts often include financial incentives, grants, and training programs to help farmers overcome the initial cost barriers associated with adopting new technologies. As a result, more farmers are integrating digital tools into their operations, driving the growth of the farm management software market.

Opportunities

- Rising Adoption of Farm Management Software to Minimize Of Labor Cost and Maximize Efficiency

Farm Management Software (FMS) is instrumental in optimizing agricultural operations through enhanced scheduling and task management. This technology enables farmers to automate task assignments, track activities in real-time, and make data-driven decisions. By utilizing FMS, farmers can efficiently allocate resources, ensuring that labor is used where and when it is needed most. This streamlining of operations minimizes idle time, improves productivity, and ensures that essential tasks such as planting, harvesting, and maintenance are performed efficiently and on schedule.

- Increasing Adoption Of AI-Based Predictions for Optimizing Resource Utilization

The increasing adoption of AI-based predictions within farm management software is revolutionizing resource utilization in agriculture. These technologies leverage advanced algorithms to analyze vast amounts of data including weather patterns, soil conditions, crop health metrics, and historical yield data. By accurately predicting optimal planting times, irrigation schedules, and fertilizer application rates, AI enables farmers to maximize resource efficiency and minimize waste. This proactive approach not only enhances crop yields and quality but also reduces operational costs associated with overuse of resources. As AI continues to evolve, its integration into farm management software promises to further streamline decision-making processes, ensuring sustainable agricultural practices and improved profitability for farmers worldwide.

Restraints/Challenges

- High Initial Investment and Implementation Costs for Farm Management Software

The high initial investment and implementation costs associated with farm management software pose significant challenges and act as a restraining factor for broader market adoption. For many farmers, especially smaller operations or those facing financial constraints, the upfront expenses required to acquire and integrate comprehensive software solutions can be prohibitive. These costs encompass not only purchasing the software itself but also the necessary hardware, training, and potential customization to fit specific farm needs. Moreover, the implementation process often requires dedicated resources and time, further adding to the financial burden and operational disruption.

- Complexity and Integration Challenges with Existing Farm Equipment and Systems

Complexity and integration challenges with existing farm equipment and systems are significant restraining factors for the farm management software market. Modern farms often use a variety of equipment and systems, each with its own specifications and data formats. Integrating new farm management software with these diverse systems can be technically challenging and time-consuming, requiring specialized knowledge and resources that many farmers may lack. The complexity of integration can lead to operational disruptions and inefficiencies. Farmers may face difficulties in synchronizing data across different platforms, which can result in inaccurate or incomplete information. This can hinder decision-making processes and reduce the overall effectiveness of the farm management software, ultimately diminishing its perceived value to potential users.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Farm Management Software Market Scope

The market is segmented on the basis of delivery mode, farm size, application, farm production, operating system, pricing category, and user-type. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Delivery Mode

- On-Cloud

- On-Premise

Farm Size

- Mid-Size Farm

- Large Farm

- Small Farm

Application

- Precision Farming

- Precision Livestock

- Precision Forestry

- Precision Aquaculture

- Smart Greenhouse

- Others

Farm Production

- Pre-Production Planning

- Production Planning

- Post-Production Planning

Operating System

- Windows

- Android

- MAC

- IOS

- Linux

- Others

Pricing Category

- Subscription Based

- Free/Ad-Based

- One Time License

User Type

- Farmers

- Agriculture Enterprise

Farm Management Software Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, delivery mode, farm size, application, farm production, operating system, pricing category, and user-type. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America region is expected to dominate in market due to government initiatives and subsidies for digital farming. US is expected to dominate in North America due to its technologically advanced farms, extensive infrastructure. France is expected to dominate in Europe due to increasing demand for precision agriculture solutions. China is expected to dominate in Asia-Pacific due to rising focus on sustainable and environmentally-friendly farming practices.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Farm Management Software Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Farm Management Software Market Leaders Operating in the Market Are:

- GEA Group Aktiengesellschaft

- IBM

- Deere & Company

- TELUS

- Trimble Inc.

- Topcon

- Raven Industries, Inc.

- Cropin Technology Solutions Private Limited

- Climate LLC.

- Ag Leader Technology

- Bushel Inc.

- Farmers Edge Inc.

- Agworld Pty Ltd

- ABACO S.p.A.

- CropX Inc.

- Afimilk Ltd.

- Conservis

- Gatec

- AgJunction LLC

- Shivrai Technologies Pvt. Ltd.

- AGRIVI

- AnimalSoft Kft.

- Field Margin Ltd.

- PickApp

Latest Developments in Farm Management Software Market

- In February 2024, Fieldmargin stands to benefit significantly from its acquisition by Agreena, gaining access to expanded resources and expertise. This partnership will accelerate the development of innovative farming tools and integrate advanced technologies, enhancing support for farmers globally

- In May 2024, PickApp Farming introduced an innovative system ahead of the growing season, providing farmers with accurate data to enhance decision-making. The app enabled easy tracking of crop variety performance, identifying high-yield and quality-defect metrics. It also highlighted top-performing workers and managed labor efficiency by tracking hours worked per block. With a user-friendly interface, farmers accessed clear data presentations, empowering swift and confident decision-making for improved farm management

- In September 2023, GAtec showcased groundbreaking geotechnology solutions at Fenasucro, emphasizing sustainable agriculture practices. Featured products included MAPFY SHIELD for integrated pest management and MAPFY SOIL for precise soil fertility mapping, enhancing operational efficiency and reducing costs for farmers. G1 recognized GAtec's leadership in transforming agriculture through innovative, eco-friendly technologies, underscoring their commitment to sustainability and productivity

- In March 2023, Raven Industries marked a milestone on March 13, 2023, with the acquisition of Augmenta by CNH and its integration into Raven. Augmenta's real-time Variable Rate Application (VRA) technology enhances Raven’s core application control products, providing dynamic insights, scalability, and adaptability. This integration bolsters Raven's farm management software with cutting-edge CVML technology, promoting sustainability, efficiency, and innovation in farming. It also emphasizes the value of emerging technologies beyond ROI, strengthening Raven's market presence and offering farmers optimized operations and environmental stewardship

- In May 2023, ruumi introduced Grazing Fingerprints to simplify reporting on grassland and livestock management, providing real-time transparency into grazing activities on farms. This innovation aimed to streamline the complex task of balancing feed supply and demand throughout the grazing season. Grazing Fingerprints generate unique profiles for each animal group, offering insights into grazing management, grass types, climate impact, and more. This tool enabled farmers to easily summarize and report on key aspects such as grazing season duration, field usage, and rest periods, ultimately enhancing farm management efficiency and sustainability practices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.