Global Farm Product Warehousing And Storage Market

Market Size in USD Billion

CAGR :

%

USD

82.89 Billion

USD

116.97 Billion

2024

2032

USD

82.89 Billion

USD

116.97 Billion

2024

2032

| 2025 –2032 | |

| USD 82.89 Billion | |

| USD 116.97 Billion | |

|

|

|

|

Farm Product Warehousing and Storage Market Size

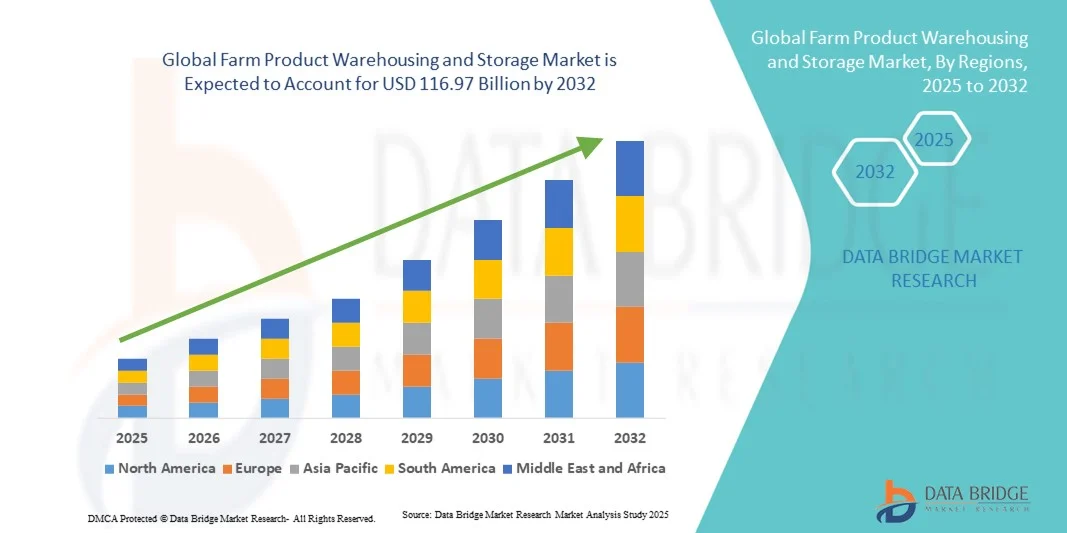

- The global farm product warehousing and storage market size was valued at USD 82.89 billion in 2024 and is expected to reach USD 116.97 billion by 2032, at a CAGR of 4.40% during the forecast period

- The market growth is largely driven by the rising need for efficient agricultural storage infrastructure and the growing demand for temperature-controlled warehousing to reduce post-harvest losses. Increasing global food consumption and the focus on maintaining crop quality through advanced storage systems such as cold chains and climate-controlled warehouses are fueling rapid market expansion

- Furthermore, the surge in government initiatives promoting public–private partnerships, rural warehousing development, and digital supply chain management is strengthening the sector’s foundation. These initiatives are improving storage accessibility for farmers and enterprises, accelerating the adoption of technologically advanced facilities, and boosting overall market growth

Farm Product Warehousing and Storage Market Analysis

- Farm product warehousing and storage facilities play a critical role in ensuring food security, efficient logistics, and reduced agricultural wastage by providing reliable storage for grains, fruits, vegetables, and other perishables. The growing emphasis on modernized infrastructure equipped with IoT sensors, automated handling systems, and smart monitoring technologies is transforming operational efficiency across the agricultural supply chain

- The market’s expansion is also influenced by the increasing integration of cold chain systems, rising agricultural exports, and the entry of logistics giants into farm storage operations. These factors collectively enhance capacity utilization, reduce spoilage rates, and strengthen distribution efficiency, making warehousing and storage a pivotal segment within the global agri-value network

- North America dominated the farm product warehousing and storage market with a share of 32.3% in 2024, due to the strong presence of established agricultural infrastructure, advanced logistics networks, and high adoption of automation in warehousing operations

- Asia-Pacific is expected to be the fastest growing region in the farm product warehousing and storage market during the forecast period due to the rapid expansion of agricultural production, urbanization, and rising food demand in countries such as China, India, and Japan

- Enterprise segment dominated the market with a market share of 57.8% in 2024, due to the extensive warehousing requirements of agribusinesses, food processors, and exporters. These enterprises rely on large-capacity facilities equipped with advanced inventory management and cold-chain systems to ensure product consistency and compliance with international quality standards. The growing trend of contract farming and bulk storage agreements further drives the enterprise segment’s dominance in the market

Report Scope and Farm Product Warehousing and Storage Market Segmentation

|

Attributes |

Farm Product Warehousing and Storage Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Farm Product Warehousing and Storage Market Trends

Adoption of IoT and Automation in Farm Warehousing

- The farm product warehousing and storage market is undergoing significant transformation through the adoption of IoT and automation technologies. These innovations enhance operational efficiency, enable real-time monitoring and inventory management, and reduce post-harvest losses by ensuring optimal storage conditions

- For instance, companies such as ADM and Cargill are integrating automated storage and retrieval systems (ASRS), IoT sensors, and AI-driven predictive analytics in their warehousing to improve traceability, temperature control, and stock rotation accuracy. This integration supports high-value crops and perishable products with stringent quality requirements

- The use of smart warehouses equipped with robotics and digital twin technology enables seamless coordination and reduces labor dependency while improving throughput. IoT-based environmental monitoring systems help maintain ideal temperature and humidity, preventing spoilage and ensuring food safety standards

- In addition, blockchain technology is becoming prevalent in tracking product origin and maintaining transparency through secure, immutable records, further building trust with end consumers and regulators. This digital transformation aligns with global food security goals and sustainability initiatives

- Sustainability-focused upgrades include solar-powered storage units and energy-efficient insulation materials that minimize environmental footprint. These efforts contribute to cost savings and support broader corporate ESG commitments in agriculture logistics

- The continuous technological modernization of farm product warehousing and storage is expected to accelerate market growth, driven by increased demand for precision agriculture, climate resilience, and streamlined supply chains from farm to consumer

Farm Product Warehousing and Storage Market Dynamics

Driver

Growing Government Support for Rural Storage Development

- Government policies and financial incentives aimed at enhancing rural storage infrastructure are significant drivers of the market. These initiatives help reduce post-harvest losses, improve farmer income, and ensure food security by promoting modernized warehousing facilities in key agricultural regions

- For instance, subsidy programs and grants in countries such as India and Brazil encourage the establishment of cold storage units, grain silos, and decentralized storage solutions. These programs often focus on smallholder farmers and cooperatives to increase access to quality storage and reduce reliance on middlemen

- Governments are also facilitating public-private partnerships and implementing regulatory frameworks that support digital transformation and traceability in agricultural supply chains. These measures enhance the efficiency and transparency of farm product storage and distribution

- In addition, rural development schemes aimed at improving transportation and logistics infrastructure complement storage investments, enabling smoother movement of farm produce into markets and reducing time-sensitive spoilage

- Such supportive government interventions stimulate private sector participation and innovation in warehousing solutions, expanding capacity and modernizing practices to meet rising consumer demand for safe, quality food products

- As policy focus on agricultural infrastructure strengthens globally, government-backed projects will remain a cornerstone of market growth and modernization efforts in the farm product warehousing and storage sector

Restraint/Challenge

High Cost of Advanced and Cold Storage Facilities

- The farm product warehousing and storage market is constrained by the high capital and operational expenses related to advanced and temperature-controlled storage facilities. These costs pose significant barriers for small and mid-sized farmers and enterprises, limiting widespread adoption of modern warehousing solutions

- For instance, the installation of cold storage units requires substantial investment in refrigeration equipment, energy supply, and climate control technologies. Companies such as Cargill and CBH Group highlight the high upfront capital cost as a limiting factor for expansion in certain developing regions

- Energy consumption costs for maintaining cold chains and sophisticated control systems further add to operating expenses. Fluctuating energy prices and reliability issues exacerbate the financial burden, particularly in rural and less developed areas

- Moreover, costs associated with integrating IoT systems, automation technology, and training staff for digital warehouse management contribute to entry barriers. The complexity of managing advanced infrastructure requires skilled labor and ongoing maintenance, increasing total cost of ownership

- To mitigate these challenges, market players are exploring modular and scalable storage solutions, renewable energy integration, and government subsidies. Strategic partnerships and technology sharing can also help distribute costs and improve affordability, facilitating broader deployment of efficient and climate-resilient storage infrastructure

Farm Product Warehousing and Storage Market Scope

The market is segmented on the basis of product type, application, and ownership.

- By Product Type

On the basis of product type, the farm product warehousing and storage market is segmented into storage services, handling services, packing services, and others. The storage services segment dominated the market with the largest revenue share in 2024 due to the increasing need for long-term preservation of grains, seeds, fruits, and vegetables amid rising global food demand. Farmers and agribusinesses prefer professional storage facilities to minimize post-harvest losses and maintain crop quality throughout the year. The integration of temperature-controlled and humidity-regulated systems in modern warehouses further enhances the reliability and efficiency of these services, solidifying their market leadership.

The handling services segment is projected to witness the fastest growth rate from 2025 to 2032, driven by the growing demand for efficient logistics and material movement across large-scale agricultural operations. These services are increasingly adopted by enterprises focusing on streamlined supply chains, reduced wastage, and faster delivery timelines. The use of automation technologies such as conveyors, robotic pickers, and smart monitoring systems in handling operations has significantly improved operational efficiency. Rising adoption among commercial farms seeking better turnaround times and reduced labor costs further supports the strong growth of this segment.

- By Application

On the basis of application, the market is segmented into farm and enterprise. The enterprise segment accounted for the largest market revenue share of 57.8% in 2024, attributed to the extensive warehousing requirements of agribusinesses, food processors, and exporters. These enterprises rely on large-capacity facilities equipped with advanced inventory management and cold-chain systems to ensure product consistency and compliance with international quality standards. The growing trend of contract farming and bulk storage agreements further drives the enterprise segment’s dominance in the market.

The farm segment is anticipated to record the fastest growth from 2025 to 2032, supported by the increasing adoption of on-farm storage solutions among small and medium farmers. Rising awareness regarding the benefits of proper crop preservation and reduced dependency on external storage facilities encourages farmers to invest in localized warehousing. Technological advancements such as modular silos and low-cost refrigeration units are making on-farm storage more accessible and cost-effective. This shift toward self-reliant storage practices is expected to transform rural supply chains and strengthen farm-level resilience.

- By Ownership

On the basis of ownership, the market is categorized into private, public, and bonded warehouses. The private ownership segment dominated the market in 2024, accounting for the largest share owing to the strong presence of agribusiness corporations and cooperatives managing their own storage networks. Private warehouses offer greater flexibility in inventory management, pricing, and quality control, which attracts large producers and exporters. Investments in advanced automation, digital tracking, and capacity expansion by private players have reinforced their dominance across major agricultural regions.

The bonded warehouse segment is expected to register the fastest growth during the forecast period from 2025 to 2032, propelled by the expansion of agricultural exports and the need for compliance with international trade regulations. These facilities allow importers and exporters to store goods under customs supervision without immediate duty payments, offering financial flexibility and smoother trade operations. The increasing establishment of bonded warehouses near ports and logistics hubs is creating new opportunities for global agricultural trade. The growing focus on export-oriented agriculture in developing countries is expected to further boost this segment’s growth trajectory.

Farm Product Warehousing and Storage Market Regional Analysis

- North America dominated the farm product warehousing and storage market with the largest revenue share of 32.3% in 2024, driven by the strong presence of established agricultural infrastructure, advanced logistics networks, and high adoption of automation in warehousing operations

- The region benefits from large-scale grain and crop production, supported by efficient cold chain facilities and modern storage technologies ensuring minimal post-harvest losses

- The demand for climate-controlled warehouses and digital monitoring systems continues to grow, ensuring long-term crop preservation and consistent supply chain management

U.S. Farm Product Warehousing and Storage Market Insight

The U.S. captured the largest revenue share in 2024 within North America, attributed to the country’s extensive agricultural output and emphasis on technologically advanced storage infrastructure. Increasing investments in automated grain silos, temperature-controlled warehouses, and AI-based inventory systems are enhancing operational efficiency. The government’s focus on food security and sustainable storage practices further supports market growth. In addition, the expansion of export-oriented crop storage and the growing preference for integrated farm-to-market supply chains are strengthening the U.S. market position.

Europe Farm Product Warehousing and Storage Market Insight

The Europe market is projected to witness steady growth during the forecast period, supported by stringent food quality regulations, increasing agricultural exports, and the modernization of rural storage facilities. European countries are investing in smart warehousing technologies to ensure traceability, quality control, and sustainability across agricultural supply chains. The growing adoption of renewable energy-powered warehouses and eco-friendly insulation materials further enhances operational sustainability.

U.K. Farm Product Warehousing and Storage Market Insight

The U.K. market is expected to grow at a notable CAGR during the forecast period, driven by the increasing demand for efficient grain and produce storage to mitigate food waste and supply chain disruptions. Investments in automated handling and real-time monitoring systems are improving storage performance across agricultural hubs. The shift toward locally sourced produce and government initiatives supporting farm-level storage infrastructure are fostering market growth.

Germany Farm Product Warehousing and Storage Market Insight

Germany’s market is projected to grow steadily, supported by its advanced agricultural logistics and emphasis on digitalized storage systems. The country’s focus on integrating IoT-enabled monitoring, robotic handling, and climate optimization is strengthening warehouse performance. Moreover, the growing need for sustainable, energy-efficient warehousing aligned with environmental standards is propelling adoption in both private and cooperative sectors.

Asia-Pacific Farm Product Warehousing and Storage Market Insight

The Asia-Pacific market is poised to record the fastest CAGR from 2025 to 2032, driven by the rapid expansion of agricultural production, urbanization, and rising food demand in countries such as China, India, and Japan. Government programs promoting modern storage facilities and digital supply chains are significantly contributing to market growth. The proliferation of low-cost modular warehouses and cold storage solutions is improving food preservation and reducing losses across the region.

China Farm Product Warehousing and Storage Market Insight

China accounted for the largest revenue share in the Asia-Pacific market in 2024, fueled by large-scale grain storage projects and rapid investments in rural warehousing modernization. The country’s strong government support for agri-logistics and the presence of major domestic storage service providers are accelerating growth. Increasing exports of agricultural commodities and expansion of cold chain networks are also driving demand for efficient, high-capacity warehouses.

India Farm Product Warehousing and Storage Market Insight

India is projected to be the fastest-growing country in the region, driven by initiatives under schemes such as the Gramin Bhandaran Yojana and Agriculture Infrastructure Fund aimed at improving rural storage capacity. The rising adoption of scientific storage systems, coupled with public-private partnerships in warehousing development, is transforming the country’s agricultural value chain. Growing investments in cold storage and smart logistics further strengthen India’s position as a key growth market.

Farm Product Warehousing and Storage Market Share

The farm product warehousing and storage industry is primarily led by well-established companies, including:

- ADM (U.S.)

- Cargill, Incorporated (U.S.)

- CBH Group (Australia)

- DHL International GmbH (Germany)

- C.H. Robinson Worldwide, Inc. (U.S.)

- CEVA Logistics (France)

- DSV (Denmark)

- A.P. Moller – Maersk (Denmark)

- Schenker Warehouse (Germany)

- Kuehne+Nagel (Switzerland)

- XPO Logistics, Inc. (U.S.)

- Ryder System, Inc. (U.S.)

- NFI Industries (U.S.)

- Americold (U.S.)

- Lineage Logistics Holding, LLC (U.S.)

- NF Global Logistics (India)

- APM Terminals (Netherlands)

- Kane Logistics (U.S.)

- MSC Mediterranean Shipping Company (Liberia) Ltd. (Switzerland)

- Shree Shubham Logistics Limited (India)

Latest Developments in Global Farm Product Warehousing and Storage Market

- In October 2025, Americold Realty Trust completed the acquisition of a 10.7-million-cubic-foot cold storage facility in Houston, Texas, for approximately US $127 million, strengthening its footprint in the U.S. agricultural logistics and cold-chain infrastructure sector. This expansion enhances Americold’s service capacity by around 35,700 pallet positions, enabling improved distribution efficiency and responsiveness to rising food demand. The move reinforces Americold’s leadership in temperature-controlled storage and its strategic positioning to meet increasing demand for secure, scalable food storage facilities across North America

- In July 2025, IEL Limited (formerly Indian Extractions Ltd) announced its diversification into the warehousing and storage sector by acquiring 29,598.89 sq m of land in Lucknow, India, valued at ₹11.80 crore, to develop a modern storage and cold-chain hub. This strategic shift marks the company’s entry into the agricultural storage ecosystem, addressing India’s growing need for regional warehousing capacity. The initiative is expected to strengthen farm-to-market supply chains, reduce post-harvest losses, and attract agribusiness clients seeking efficient storage services in North India

- In April 2025, Snowman Logistics Ltd announced the acquisition of land and warehouse assets in Madhya Pradesh, India, worth approximately ₹200 million, to expand its regional network and boost cold storage capacity. This expansion aims to support the increasing flow of perishable agricultural goods through central India and aligns with the company’s goal of achieving deeper regional integration. The move positions Snowman Logistics to meet the rising demand for temperature-controlled agricultural storage and strengthens its presence in India’s fast-developing food logistics corridor

- In February 2025, Adani Logistics Ltd, a subsidiary of the Adani Group, acquired a 40.25 % stake in Snowman Logistics Ltd for ₹296 crore, marking its entry into the cold-chain warehousing and agri-logistics segment. This acquisition enables Adani to combine its vast logistics infrastructure with Snowman’s established cold-chain operations, creating a more integrated ecosystem for agricultural storage and distribution. The strategic investment enhances both companies’ ability to cater to India’s expanding fresh-produce and processed-food markets through efficient temperature-controlled warehousing

- In January 2025, Americold Realty Trust finalized the US $1.74 billion acquisition of Agro Merchants Group, adding 46 facilities across 10 countries and 236 million cubic feet of refrigerated capacity to its global network. This acquisition significantly broadens Americold’s international reach, making it one of the largest global providers of temperature-controlled warehousing for agricultural and perishable goods. The expansion improves global trade connectivity for farm products and strengthens the company’s competitive edge in cross-border agricultural logistics and cold storage services

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.