Global Farm Support Services Market

Market Size in USD Billion

CAGR :

%

USD

5.70 Billion

USD

14.02 Billion

2025

2033

USD

5.70 Billion

USD

14.02 Billion

2025

2033

| 2026 –2033 | |

| USD 5.70 Billion | |

| USD 14.02 Billion | |

|

|

|

|

Farm Support Services Market Size

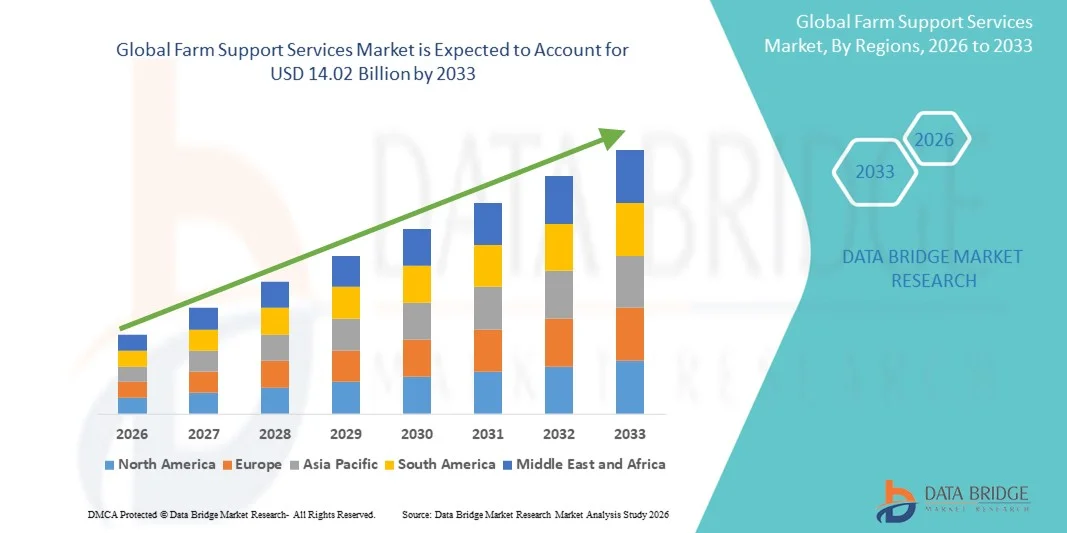

- The global farm support services market size was valued at USD 5.70 billion in 2025 and is expected to reach USD 14.02 billion by 2033, at a CAGR of 11.90% during the forecast period

- The market growth is largely fueled by the increasing adoption of precision agriculture, digital advisory platforms, and mechanized farming solutions that enhance productivity and operational efficiency across diverse farming systems. The integration of IoT, AI, and data analytics is transforming traditional farming into a service-driven, technology-enabled ecosystem, driving demand for advanced farm support services among both smallholder and commercial farmers

- Furthermore, the rising need for sustainable and cost-effective agricultural practices is encouraging farmers to rely on support services for crop management, soil monitoring, and yield optimization. These evolving dynamics are accelerating the adoption of farm support solutions, thereby significantly boosting the market’s overall expansion

Farm Support Services Market Analysis

- Farm support services, encompassing digital advisory, machinery rental, soil testing, data analytics, and supply chain support, are becoming essential components of modern agriculture. These services enable farmers to improve productivity, optimize resource utilization, and reduce input costs, leading to enhanced profitability and resilience against climatic and market fluctuations

- The rising demand for such services is primarily driven by technological advancements in agriculture, government initiatives promoting digital and sustainable farming, and increasing private investments in agritech infrastructure. As a result, the market is witnessing a steady shift toward data-driven and service-oriented agricultural models across both developed and emerging economies

- Asia-Pacific dominated the farm support services market in 2025, due to increasing adoption of modern agricultural practices, growing mechanization in farming, and expanding government programs promoting digital and precision agriculture

- North America is expected to be the fastest growing region in the farm support services market during the forecast period due to widespread adoption of precision agriculture, growing demand for data-based advisory services, and integration of automation and robotics in farm operations

- Post-harvest crop activities segment dominated the market with a market share of 42.8% in 2025, due to the increasing demand for efficient storage, grading, and packaging solutions that reduce food wastage and enhance crop value. The growing emphasis on improving agricultural supply chains and maintaining product quality has strengthened the adoption of post-harvest services across developing economies. Furthermore, the integration of mechanized handling systems and cold chain logistics has enhanced productivity and profitability for farmers, reinforcing the segment’s leadership in the market

Report Scope and Farm Support Services Market Segmentation

|

Attributes |

Farm Support Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Farm Support Services Market Trends

Integration of AI and IoT in Precision Agriculture

- Precision agriculture is being transformed by the integration of artificial intelligence (AI), IoT sensors, and big data analytics, as farm support service providers deliver platforms that optimize input use, crop health monitoring, and yield forecasting. AI-driven systems analyze real-time data from IoT-enabled field sensors, drones, and satellites, generating actionable recommendations for farmers to manage irrigation, fertilization, and pest control with greater accuracy

- For instance, Deere & Company and IBM offer AI-powered decision tools and mobile platforms that process multisensor data for tailored crop management solutions, supporting both large-scale and smallholder farmers. These solutions allow direct translation of field conditions into automated responses, making advanced digital services increasingly accessible and relevant for diverse farm sizes

- Remote sensing combined with IoT connectivity now allows for real-time soil moisture detection, disease surveillance, and weather-based interventions. As a result, resource use can be continuously optimized, waste is minimized, and productivity is improved—even in rapidly changing climate conditions—by leveraging AI models that adapt to local variables and historic trends

- Robotics, autonomous tractors, and AI-guided drones are extending the value of digital farm services by enabling automated scouting, targeted spraying, and precision harvesting. These innovations help address rural labor shortages, while providing scalable solutions for both specialized and broad-acre cropping operations

- Data-driven traceability platforms and blockchain applications are also emerging as anchors of sustainable farming practices, as governments and agribusinesses require detailed input tracking and transparent supply chains for food certification and compliance. This alignment with traceability standards is underpinning the adoption of AI and IoT in global farm support services as the market shifts toward next-generation digital farming

- The integration of AI and IoT within farm support services represents a pivotal market evolution, laying the groundwork for continuous productivity gains, environmental stewardship, and climate-smart agriculture. As digital infrastructure advances, these technologies are set to become must-have features for future-ready agri-services worldwide

Farm Support Services Market Dynamics

Driver

Rising Government Initiatives for Digital and Sustainable Farming

- Government policies emphasizing food security, resource efficiency, and environmental sustainability are major drivers catalyzing the digital transformation of farm support services. National programs and grants aimed at adopting AI-enabled, precision solutions provide funding, training, and incentives for technology adoption across agricultural regions

- For instance, initiatives by the U.S. Department of Agriculture (USDA) have increased support for digital tool deployment and on-farm connectivity, while Yara International and Bayer collaborate with government-backed platforms to offer AI-enabled input management services as part of sustainability mandates. These collaborations help bridge gaps in digital literacy and infrastructure in target communities

- Regulations tied to climate adaptation and carbon reduction further encourage service providers to develop digital solutions for crop risk assessment, water management, and emission mitigation, ensuring regulatory compliance and resilience to climate variability. Public funding supports pilot projects involving remote sensing, AI, and data-driven crop forecasting, which are then scaled to market through private sector partnerships

- International collaboration, knowledge-sharing, and rural digitalization grants are accelerating the deployment of precision agriculture technologies in both developing and advanced agricultural economies. These initiatives create favorable environments for agri-tech start-ups and established firms to expand support services and technology access to under-served farming communities

- Continued investment in policy integration, digital platforms, and sustainable farm support is building a foundation for resilient, data-driven, and future-proof agricultural systems. As global pressures for food and climate security intensify, government-driven innovation will remain critical for scaling digital precision farming worldwide

Restraint/Challenge

Limited Digital Infrastructure in Rural Areas

- Limited digital infrastructure in rural and remote regions continues to hinder the widespread adoption of AI and IoT-enabled farm support services. Inadequate connectivity, especially in less-developed markets, restricts real-time data collection, remote monitoring, and effective deployment of cloud-based agricultural platforms

- For instance, reports show that large segments of Asia-Pacific and Sub-Saharan Africa remain underserved by high-speed internet, making sustained use of sensor-driven and remotely managed farm systems difficult. This gap results in delayed system responses, interrupted service, and missed opportunities for precision optimization at the farm level

- High costs associated with building rural digital infrastructure, such as broadband internet, data towers, and sensor networks, pose challenges for both service providers and local governments. Limited access to affordable, scalable hardware also increases the implementation barrier for smallholder farmers in such environments

- Inadequate digital skills and technology familiarity among aging rural populations further slow the adoption curve, requiring ongoing investment in training, user support, and community-based digital extension services. Without these efforts, the promise of AI and IoT in farm management will not be fully realized or equitably distributed

- Closing this infrastructure gap through public-private investment, universal connectivity initiatives, and inclusive digital education will be essential to unlock the full value of precision farm support services. Only broad-based digital enablement can ensure that next-generation agri-services drive growth and sustainability across all segments of the agricultural sector

Farm Support Services Market Scope

The market is segmented on the basis of service type, type, and application.

- By Service Type

On the basis of service type, the farm support services market is segmented into post-harvest crop activities, animal support activities, and soil preparation services. The post-harvest crop activities segment dominated the market with the largest revenue share of 42.8% in 2025, driven by the increasing demand for efficient storage, grading, and packaging solutions that reduce food wastage and enhance crop value. The growing emphasis on improving agricultural supply chains and maintaining product quality has strengthened the adoption of post-harvest services across developing economies. Furthermore, the integration of mechanized handling systems and cold chain logistics has enhanced productivity and profitability for farmers, reinforcing the segment’s leadership in the market.

The animal support activities segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising global demand for dairy and meat products and the need for better livestock management solutions. Services such as breeding assistance, health monitoring, and feed optimization are gaining traction as farmers seek to increase yield efficiency and animal welfare. The integration of IoT-enabled tracking and veterinary support systems further boosts operational precision, while growing investments in animal husbandry modernization across emerging economies strengthen this segment’s rapid expansion.

- By Type

On the basis of type, the farm support services market is categorized into crops and livestock. The crops segment dominated the market in 2025, driven by extensive agricultural acreage and the rising adoption of scientific farming practices. Increasing government initiatives aimed at improving crop productivity through precision farming and sustainable techniques have further propelled service demand. Moreover, the growing reliance on expert advisory, crop insurance, and pest management services to mitigate climate-related risks supports this segment’s dominant position.

The livestock segment is expected to record the fastest growth rate from 2026 to 2033, owing to increasing global consumption of animal-based products and the need for efficient livestock management. Enhanced focus on animal genetics, disease prevention, and feed optimization has driven the expansion of professional farm support services in this segment. In addition, growing technological integration through wearable sensors and automated feeding systems has improved productivity and health monitoring, boosting the growth of livestock-related services in both developed and emerging markets.

- By Application

On the basis of application, the farm support services market is segmented into agricultural research, agricultural extension, agricultural credit, and agricultural marketing. The agricultural research segment dominated the market in 2025, driven by increasing public and private investment in developing high-yield and climate-resilient crop varieties. The adoption of digital technologies such as data analytics and biotechnology tools has enhanced the effectiveness of research initiatives, leading to improved resource utilization and productivity. Rising collaborations between research institutions and agribusinesses have further strengthened innovation and market competitiveness in this segment.

The agricultural marketing segment is anticipated to witness the fastest growth rate from 2026 to 2033, supported by the digital transformation of agricultural trade and the emergence of e-marketplaces. The growing demand for transparent pricing, reduced intermediaries, and better access to end consumers is driving farmers to adopt marketing support services. In addition, government programs promoting digital agriculture and rural connectivity are enhancing market participation for smallholders, contributing to the rapid growth of agricultural marketing services worldwide.

Farm Support Services Market Regional Analysis

- Asia-Pacific dominated the farm support services market with the largest revenue share 2025, driven by increasing adoption of modern agricultural practices, growing mechanization in farming, and expanding government programs promoting digital and precision agriculture

- The region’s cost-effective labor force, rising demand for crop advisory and maintenance solutions, and expanding agritech startups offering digital platforms and machinery rentals are fueling market growth

- Supportive agricultural policies, increasing focus on sustainable farming, and the integration of IoT and AI technologies in farm operations across developing economies are contributing to the regional market’s expansion

China Farm Support Services Market Insight

China held the largest share in the Asia-Pacific farm support services market in 2025 due to its strong agricultural base, rapid adoption of smart farming technologies, and government-driven initiatives for agricultural modernization. The nation’s focus on digital platforms for crop management, pest monitoring, and yield optimization is driving service adoption. Continuous investment in rural infrastructure and agri-fintech solutions is also enhancing efficiency across the sector.

India Farm Support Services Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing farmer awareness of modern support services, the growth of agritech startups, and initiatives under the “Digital Agriculture Mission.” Government-backed programs such as PM-KISAN and FPO development schemes are strengthening rural support infrastructure. Rising smartphone penetration and demand for mobile-based advisory and farm management services are further accelerating market expansion.

Europe Farm Support Services Market Insight

The Europe market is expanding steadily, supported by advanced agricultural practices, increasing adoption of farm management software, and emphasis on sustainability and carbon-efficient farming. The Common Agricultural Policy (CAP) is encouraging adoption of precision agriculture and support solutions aimed at improving yield and environmental performance. High demand for consultancy and data-driven decision-making tools is boosting market growth across major economies.

Germany Farm Support Services Market Insight

Germany’s market growth is driven by its strong agricultural engineering sector, high digitalization rates, and large-scale implementation of precision farming and crop monitoring systems. Collaborative projects between technology providers, cooperatives, and universities are promoting innovation in farm automation and predictive analytics. The focus on reducing input costs and improving productivity through advanced support services is reinforcing the country’s leadership in the region.

U.K. Farm Support Services Market Insight

The U.K. market is supported by a mature agricultural technology ecosystem, growing focus on sustainable farming, and government efforts to modernize farm support structures post-Brexit. Rising adoption of AI-powered farm management systems and data platforms is enhancing operational efficiency. Increasing collaborations between agritech firms and research institutions are strengthening the country’s position in the European market for digital and consulting-based farm support services.

North America Farm Support Services Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by widespread adoption of precision agriculture, growing demand for data-based advisory services, and integration of automation and robotics in farm operations. Supportive government incentives for sustainable and regenerative farming practices are further driving market growth. Partnerships between technology firms, cooperatives, and farm equipment manufacturers are improving service delivery and adoption across the region.

U.S. Farm Support Services Market Insight

The U.S. accounted for the largest share in the North America market in 2025, supported by its technologically advanced farming systems, large-scale agribusiness operations, and early adoption of digital advisory and analytics tools. Increasing investments in AI, IoT, and satellite-based crop monitoring solutions are enhancing productivity and decision-making capabilities. The presence of key service providers, robust research networks, and innovation-driven policies continue to strengthen the U.S.’s leading position in the regional market.

Farm Support Services Market Share

The farm support services industry is primarily led by well-established companies, including:

- Hailiang Group (China)

- Al-Futtaim (U.A.E.)

- Taylor Farms Foodservice (U.S.)

- FRONTIER AGRICULTURE LTD (U.K.)

- Nutrien Ag Solutions, Inc. (Canada)

- AGT Food and Ingredients (Canada)

- Olam International (Singapore)

- Corteva (U.S.)

- Anicom AG (Switzerland)

- Syngenta Crop Protection AG (Switzerland)

- Bühler AG (Switzerland)

- BASF SE (Germany)

- DLF Seeds A/S (Denmark)

- The Andersons, Inc. (U.S.)

- SINOCHEM GROUP CO., LTD. (China)

- GRUMA (Mexico)

- Toroyo (Japan)

- KUBOTA Corporation (Japan)

- AgJunction Inc. (U.S.)

- Agrinavia (Denmark)

- DICKEY-john (U.S.)

- EFC Systems (U.S.)

- Farmers Edge Inc. (Canada)

- Iteris, Inc. (U.S.)

Latest Developments in Global Farm Support Services Market

- In November 2025, Arya.ag launched 25 Smart Farm Centres (SFCs) across India, integrating IoT-enabled soil testing, drone-based crop monitoring, and climate-smart advisory services. This initiative is significantly enhancing the accessibility of modern farm support tools for smallholder farmers, strengthening rural service delivery, and promoting data-driven decision-making. The move is expected to accelerate digital adoption in India’s farm support ecosystem and reinforce Arya.ag’s leadership in integrated agri-solutions

- In October 2025, Bayer partnered with the Common Service Centre (CSC-SPV) and Gram Unnati to deliver agri-inputs and digital advisory services to over 500,000 smallholder farmers through rural CSC networks. This partnership is transforming last-mile delivery of agricultural support services, improving farmer productivity, and expanding the reach of agronomic advisory across underserved regions. It also demonstrates growing collaboration between global agribusinesses and government-backed digital platforms to strengthen the farm support infrastructure

- In September 2025, the Kerala Startup Mission (KSUM) launched the AgriNext initiative, supporting 150 agritech startups focused on providing technology-enabled farm support services and benefiting more than 40,000 farmers. This program is catalyzing innovation in precision farming, sustainable agriculture, and service-based agritech models. By connecting startups with farmer-producer organizations, it is fostering scalable support ecosystems that enhance productivity and climate resilience in the regional agricultural landscape

- In August 2025, CropX Technologies acquired AcclYm, an enterprise agricultural intelligence company, to strengthen its capabilities in data analytics and farm management services. This acquisition is expanding CropX’s service portfolio to include advanced predictive tools and enterprise-level insights for agribusinesses. The integration of AcclYm’s data platforms is expected to boost global competitiveness and enable precision-based decision-making across large-scale farming operations, thereby advancing digital transformation in farm support services

- In July 2025, Agribazaar expanded its platform by launching an AI and satellite data-powered farm advisory vertical, transitioning from a trading-focused platform to a full-scale digital farm support ecosystem. This development is driving higher engagement among its 700,000+ registered farmers by offering customized insights on soil health, weather, and crop yield optimization. The expansion highlights the market’s shift toward analytics-driven farm services, enabling better risk management and operational efficiency across the agricultural value chain

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.