Global Farm Tire Market

Market Size in USD Billion

CAGR :

%

USD

9.21 Billion

USD

22.01 Billion

2025

2033

USD

9.21 Billion

USD

22.01 Billion

2025

2033

| 2026 –2033 | |

| USD 9.21 Billion | |

| USD 22.01 Billion | |

|

|

|

|

What is the Global Farm Tire Market Size and Growth Rate?

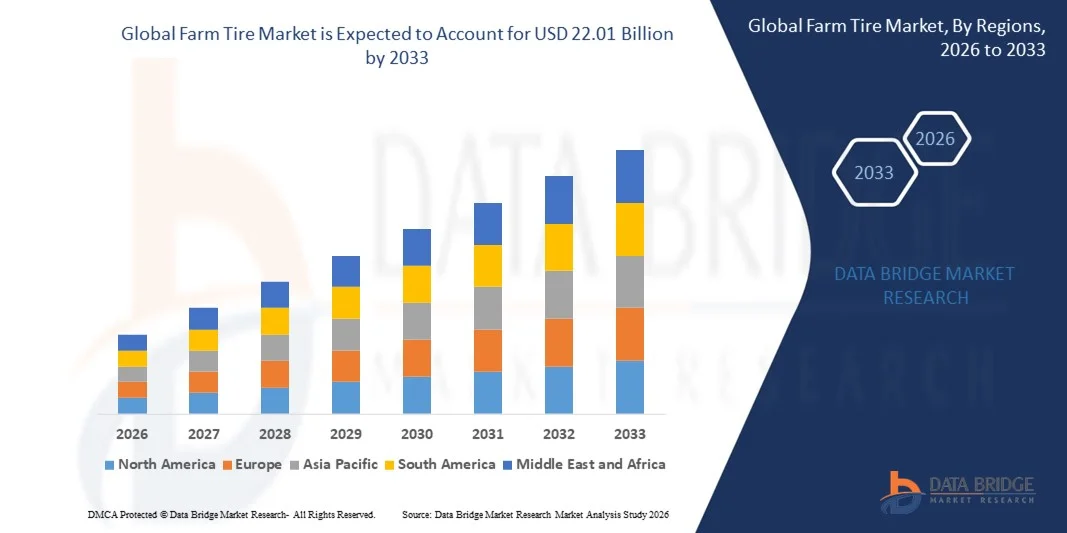

- The global farm tire market size was valued at USD 9.21 billion in 2025 and is expected to reach USD 22.01 billion by 2033, at a CAGR of11.50% during the forecast period

- Increasing number of agricultural activities, rising demand of food, growing awareness among farmers over the adoption of advanced farming techniques over traditional farming, rising demand for agricultural machinery from emerging economies, increasing penetration of farm vehicles in agriculture industry, increasing adoption of advanced technologies by farmers to increase agricultural yield are some of the major as well as vital factors which will such asly to augment the growth of the farm tire market

What are the Major Takeaways of Farm Tire Market?

- Increasing prevalence of favourable trade policies along with rapid urbanization which will further contribute by generating massive opportunities that will lead to the growth of the farm tire market

- Volatility in the prices of raw material along with government promoting sustainable farming practices to reduce harmful environmental impacts of various agricultural practices which will such asly to act as market restraints factor for the growth of the farm tire

- North America dominated the farm tires market with a 44.65% revenue share in 2025, driven by high levels of farm mechanization, large-scale commercial agriculture, and widespread adoption of high-horsepower tractors and harvesters across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 7.9% from 2026 to 2033, driven by rapid agricultural mechanization, rising food demand, and increasing adoption of tractors and harvesters across China, India, Japan, Southeast Asia, and Australia

- The Radial Tire segment dominated the market with a 52.6% share in 2025, owing to its superior traction, longer tread life, reduced rolling resistance, and ability to operate at lower inflation pressures

Report Scope and Farm Tire Market Segmentation

|

Attributes |

Farm Tire Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Farm Tire Market?

Increasing Shift Toward High-Speed, Compact, and PC-Based Farm Tires

- The farm tires market is witnessing a growing shift toward high-speed, compact, and radial farm tires designed to support modern agricultural equipment operating at higher transport speeds and variable field conditions

- Manufacturers are increasingly introducing low-compaction, wide-base, and IF/VF (Increased Flexion / Very High Flexion) tires that enable higher load capacity at lower inflation pressures

- Rising adoption of precision farming, GPS-enabled tractors, and advanced harvesting machinery is driving demand for tires offering improved traction, durability, and soil protection

- For instance, companies such as Bridgestone, MICHELIN, Continental, Trelleborg, and BKT have expanded their portfolios with high-speed radial farm tires optimized for tractors, harvesters, and sprayers

- Increasing focus on fuel efficiency, reduced soil compaction, and longer tire life is accelerating the replacement of traditional bias tires with advanced radial designs

- As farm machinery becomes faster, heavier, and more technology-driven, high-performance farm tires will remain critical for productivity, sustainability, and operational efficiency

What are the Key Drivers of Farm Tire Market?

- Rising demand for high-load, high-speed farm tires to support modern tractors, combine harvesters, and self-propelled sprayers

- For instance, during 2024–2025, leading manufacturers such as MICHELIN, Bridgestone, and Trelleborg introduced new IF/VF tire models focused on load optimization and soil preservation

- Growing adoption of mechanized farming, precision agriculture, and smart farming technologies is boosting tire demand across the U.S., Europe, and Asia-Pacific

- Advancements in rubber compounds, tread design, and carcass construction have enhanced durability, traction, and fuel efficiency

- Increasing emphasis on soil health and sustainable agriculture is driving demand for low-compaction tire solutions

- Supported by rising agricultural productivity needs and ongoing farm modernization, the Farm Tires market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Farm Tire Market?

- High costs associated with advanced radial, IF, and VF farm tires limit adoption among small and medium-scale farmers

- For instance, during 2024–2025, volatility in natural rubber prices and higher manufacturing costs increased farm tire pricing across multiple regions

- Limited awareness regarding proper tire selection, inflation management, and performance benefits restricts optimal usage in emerging markets

- Harsh operating conditions, uneven terrains, and improper maintenance can lead to premature tire wear and reduced lifecycle performance

- Competition from low-cost bias tires and retreaded alternatives creates pricing pressure for premium tire manufacturers

- To overcome these challenges, companies are focusing on cost-optimized designs, farmer education programs, and region-specific tire solutions to drive broader adoption of advanced farm tires

How is the Farm Tire Market Segmented?

The market is segmented on the basis of product, pressure, horsepower, application, and distribution channel.

- By Product

On the basis of product, the farm tires market is segmented into Radial Tires, Bias Tires, Municipal Tires, Implement Cross Ply Tires, and Other Products. The Radial Tire segment dominated the market with a 52.6% share in 2025, owing to its superior traction, longer tread life, reduced rolling resistance, and ability to operate at lower inflation pressures. Radial tires are widely adopted across modern tractors, harvesters, and high-horsepower agricultural machinery, particularly in mechanized farming regions. Their capability to reduce soil compaction while improving fuel efficiency makes them the preferred choice for precision agriculture.

The Bias Tire segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand from cost-sensitive markets, small-scale farms, and applications requiring higher sidewall strength. Bias tires continue to witness adoption in emerging economies due to affordability, ease of repair, and suitability for rugged terrains.

- By Pressure

Based on pressure, the farm tires market is segmented into High Pressure, Low Pressure, and Extra Low Pressure tires. The Low Pressure segment dominated the market with a 45.1% share in 2025, supported by increasing focus on soil health, crop yield optimization, and sustainable farming practices. Low-pressure tires enable better weight distribution, reduce soil compaction, and improve traction in wet and soft field conditions, making them ideal for tractors and harvesters.

The Extra Low Pressure segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rapid adoption of IF and VF tire technologies. These tires allow higher loads at significantly lower inflation pressures, supporting larger and heavier farm machinery. Rising demand for high-speed operations, reduced field passes, and enhanced productivity is accelerating the shift toward extra low-pressure farm tires globally.

- By Horsepower

On the basis of horsepower, the market is segmented into 0–80 HP and 81–200 HP categories. The 0–80 HP segment accounted for the largest market share of 48.3% in 2025, as these tractors are extensively used by small and medium-scale farmers across Asia-Pacific, Latin America, and Africa. Their affordability, versatility, and suitability for diverse farming activities drive consistent tire replacement demand in this category.

The 81–200 HP segment is expected to register the fastest growth from 2026 to 2033, supported by increasing adoption of high-horsepower tractors for large-scale commercial farming. Expansion of mechanized agriculture, contract farming, and large-acreage cultivation in North America and Europe is boosting demand for durable, high-load farm tires designed for powerful equipment and intensive operations.

- By Distribution Channel

By distribution channel, the farm tires market is segmented into Original Equipment Manufacturers (OEMs) and Aftermarket. The Aftermarket segment dominated the market with a 57.4% share in 2025, driven by frequent tire replacement cycles, harsh operating conditions, and growing awareness regarding timely maintenance. Farmers increasingly rely on aftermarket channels for replacement, upgrades, and customization based on specific crop and terrain requirements.

The OEM segment is anticipated to grow at the fastest CAGR from 2026 to 2033, supported by rising sales of new tractors, harvesters, and agricultural equipment. OEM-fitted advanced radial and IF/VF tires are gaining traction as manufacturers focus on delivering integrated, performance-optimized machinery solutions. Growth in farm mechanization and equipment financing programs further strengthens OEM demand.

- By Application

Based on application, the market is segmented into Harvesters, Tractors, Loaders, Drill, Forestry, Irrigation, Implements, and Other Applications. The Tractors segment dominated the market with a 41.9% share in 2025, owing to their extensive use across plowing, tilling, sowing, and transportation activities. Continuous tractor usage leads to high tire wear, driving steady replacement demand.

The Harvesters segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rising adoption of combine harvesters and self-propelled equipment. These machines require high-load, low-compaction tires to operate efficiently during peak harvesting seasons. Increasing focus on operational efficiency and labor reduction is accelerating demand for advanced farm tires in harvesting applications.

Which Region Holds the Largest Share of the Farm Tire Market?

- North America dominated the farm tires market with a 44.65% revenue share in 2025, driven by high levels of farm mechanization, large-scale commercial agriculture, and widespread adoption of high-horsepower tractors and harvesters across the U.S. and Canada. Strong focus on productivity, yield optimization, and sustainable farming practices continues to support demand for advanced radial and low-compaction farm tires

- Leading manufacturers in North America are introducing IF and VF tires, high-speed radial designs, and precision agriculture–optimized tread patterns, enhancing traction, durability, and soil protection. Continuous investment in modern agricultural equipment and replacement cycles strengthens regional market leadership

- High farmer awareness, strong dealership networks, and well-established aftermarket channels further reinforce North America’s dominant position in the global Farm Tires market

U.S. Farm Tires Market Insight

The U.S. is the largest contributor within North America, supported by extensive use of mechanized farming equipment, large farm sizes, and high adoption of advanced tractors, combine harvesters, and self-propelled sprayers. Growing emphasis on reducing soil compaction, improving fuel efficiency, and maximizing equipment uptime is accelerating demand for premium radial and IF/VF farm tires. Presence of leading agricultural equipment OEMs, strong aftermarket penetration, and continuous replacement demand due to intensive field usage further drive market growth across the country.

Canada Farm Tires Market Insight

Canada contributes significantly to regional growth, driven by increasing mechanization across grain, oilseed, and row crop farming. Adoption of high-horsepower tractors and harvesting equipment in large-acreage farms boosts demand for durable, high-load farm tires. Seasonal farming cycles, harsh operating conditions, and growing awareness of soil preservation support steady replacement demand. Government support for modern agriculture and sustainable farming practices further strengthens market adoption.

Asia-Pacific Farm Tires Market

Asia-Pacific is projected to register the fastest CAGR of 7.9% from 2026 to 2033, driven by rapid agricultural mechanization, rising food demand, and increasing adoption of tractors and harvesters across China, India, Japan, Southeast Asia, and Australia. Expansion of commercial farming, government subsidies for farm equipment, and improving rural infrastructure are significantly boosting demand for farm tires. Rising awareness regarding productivity enhancement and soil health is accelerating the shift toward radial and low-pressure tire solutions.

China Farm Tires Market Insight

China is the largest contributor within Asia-Pacific due to large-scale agricultural production, increasing mechanization, and strong government initiatives supporting modern farming equipment. Rising adoption of mid- and high-horsepower tractors, combined with expanding replacement demand, is driving market growth. Local tire manufacturing capabilities and competitive pricing further support widespread adoption.

Japan Farm Tires Market Insight

Japan shows steady growth supported by advanced farming techniques, high equipment quality standards, and growing adoption of compact and specialty agricultural machinery. Demand for high-performance, durable farm tires is driven by precision farming practices and limited arable land, requiring efficiency-focused solutions.

India Farm Tires Market Insight

India is emerging as a major growth hub, driven by increasing tractor penetration, government-backed mechanization programs, and expanding rural infrastructure. Rising demand from small and mid-sized farms, coupled with growing awareness of productivity-enhancing tire solutions, is accelerating market growth.

South Korea Farm Tires Market Insight

South Korea contributes steadily due to increasing adoption of mechanized farming, smart agriculture initiatives, and compact farm equipment. Demand for reliable, long-lasting farm tires is supported by modernization of agricultural practices and rising labor costs.

Which are the Top Companies in Farm Tire Market?

The farm tire industry is primarily led by well-established companies, including:

- Bridgestone (Japan)

- MICHELIN (France)

- Continental AG (Germany)

- Sumitomo Rubber Industries, Ltd. (Japan)

- Hankook Tire & Technology Co., Ltd. (South Korea)

- Balkrishna Industries Limited (BKT) (India)

- Titan International, Inc. (U.S.)

- Trelleborg Wheel Systems Czech Republic a.s. (Czech Republic)

- TBC Corporation (U.S.)

- Apollo Tyres (India)

- MRF (India)

- JK TYRE & INDUSTRIES LTD (India)

- CEAT Ltd. (India)

- The Carlstar Group, LLC. (U.S.)

- Specialty Tires of America, Inc. (U.S.)

- YOHT. (Japan)

- Superking Manufacturers (Tyre) Pvt. Ltd. (India)

- Trelleborg AB (Sweden)

- Asian Tire Factory Limited (Bangladesh)

- MRL Tyres Limited (India)

What are the Recent Developments in Global Farm Tire Market?

- In May 2025, BKT announced a strategic five-year plan to strengthen its footprint in the off-highway tire market through investments in new production facilities and expansion into additional tire categories, with a strong focus on Asia-Pacific and other emerging regions, signaling the company’s long-term commitment to capacity expansion and market share growth

- In September 2024, Michelin launched the Michelin XDR 4 SPEED ENERGY™ tire, an energy-efficient radial solution for high-horsepower tractors that reduces fuel consumption and CO₂ emissions through optimized tread design and advanced rubber compounds, highlighting the growing emphasis on sustainability and operational efficiency in large-scale farming

- In August 2024, Trelleborg Tires introduced the Adaptive Tire Management System (ATMS), enabling real-time monitoring of tire pressure, load, and temperature to improve traction, performance, and soil protection, underscoring the rising integration of digital technologies in modern agricultural operations

- In October 2023, Continental AG expanded its agricultural tire portfolio by adding new sizes to the TractorMaster and CompactMaster AG/EM series to support larger and more powerful machinery, reflecting increasing demand for tires compatible with high-capacity farm equipment

- In May 2023, Bridgestone broadened its VX-R TRACTOR tire range by introducing 23 new sizes across the 65, 70, and 85 series, incorporating Enliten technology to improve sustainability without compromising performance, demonstrating the industry’s shift toward eco-efficient yet high-performance farm tire solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.