Global Farm Type Dairy Machines And Equipment Market

Market Size in USD Billion

CAGR :

%

USD

10.30 Billion

USD

16.56 Billion

2024

2032

USD

10.30 Billion

USD

16.56 Billion

2024

2032

| 2025 –2032 | |

| USD 10.30 Billion | |

| USD 16.56 Billion | |

|

|

|

|

Farm-Type Dairy Machines and Equipment Market Size

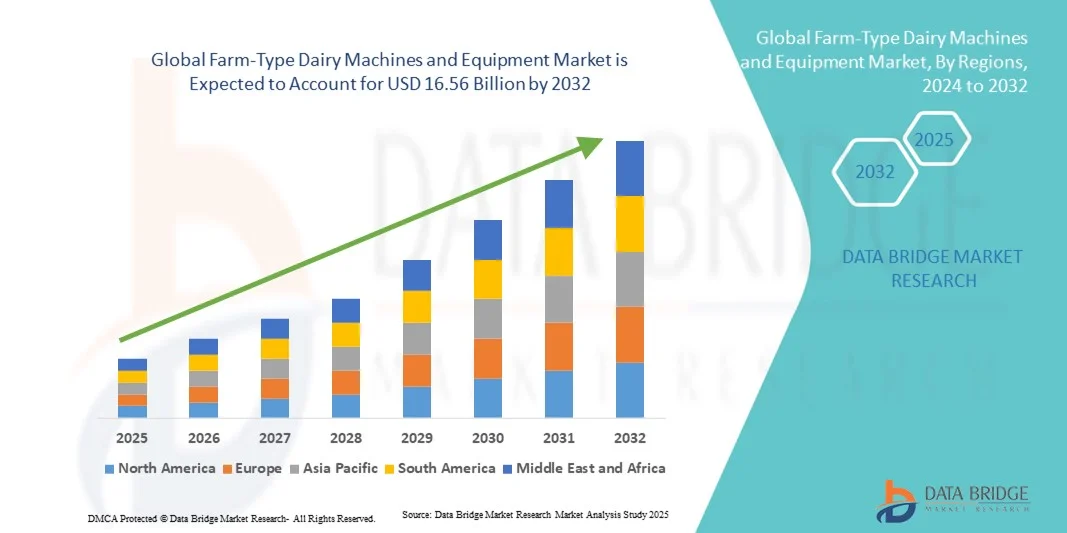

- The global farm-type dairy machines and equipment market size was valued at USD 10.3 billion in 2024 and is expected to reach USD 16.56 billion by 2032, at a CAGR of 6.12% during the forecast period

- The market growth is largely fueled by the increasing mechanization of dairy farming operations and the growing adoption of automated milking, feeding, and monitoring systems aimed at improving productivity and operational efficiency across dairy farms

- Furthermore, rising demand for high-quality milk, coupled with government initiatives promoting dairy infrastructure modernization and subsidies for farm machinery, is driving strong equipment adoption among both organized and emerging dairy sectors. These factors collectively accelerate the shift toward technology-driven dairy production, significantly boosting market expansion

Farm-Type Dairy Machines and Equipment Market Analysis

- Farm-type dairy machines and equipment, including milking systems, feeding machinery, and fodder management tools, are becoming essential components of modern dairy operations due to their ability to enhance yield consistency, improve hygiene, and reduce labor dependency across small and large farms

- The growing need for automation in dairy management, rising herd sizes, and emphasis on sustainability and animal welfare are fueling demand for advanced machinery, positioning the market for steady long-term growth as farms increasingly adopt smart and efficient equipment solutions

- Asia-Pacific dominated the farm-type dairy machines and equipment market in 2024, due to expanding dairy production, government support for farm mechanization, and rapid adoption of automated milking and feeding systems across developing economies

- North America is expected to be the fastest growing region in the farm-type dairy machines and equipment market during the forecast period due to large-scale dairy operations, strong emphasis on automation, and high investment in precision livestock management systems

- Organized dairy sector segment dominated the market with a market share of 61.8% in 2024, due to the rapid expansion of large-scale dairy farms adopting modern milking and processing technologies. The rising focus on quality control, hygienic production, and mechanized operations within organized dairy farms supports higher productivity and efficiency. In addition, favorable government policies, institutional investments, and the emergence of integrated dairy value chains further strengthen the adoption of advanced equipment across organized setups

Report Scope and Farm-Type Dairy Machines and Equipment Market Segmentation

|

Attributes |

Farm-Type Dairy Machines and Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Farm-Type Dairy Machines and Equipment Market Trends

Adoption of Robotic Milking and Automated Feeding Systems

- The farm-type dairy machines and equipment market is witnessing significant innovation driven by the adoption of robotic milking systems and automated feeding technologies. These advancements enable dairy farmers to optimize milk yield, improve animal welfare, and reduce labor dependency, thereby enhancing overall operational efficiency

- For instance, companies such as Lely and DeLaval have developed robotic milking systems that allow cows to be milked at their own pace, leading to increased comfort and productivity. Automated feeding systems integrated with IoT sensors provide precise nutrition management, catering to individual animal needs and further boosting milk production efficiency

- The integration of data analytics and AI with dairy equipment is enabling real-time monitoring of herd health, reproductive cycles, and feed intake. This digital transformation supports proactive farm management and minimizes losses due to illnesses or nutritional deficiencies

- In addition, equipment innovations are focusing on sustainability by enhancing energy efficiency and minimizing waste. Modern dairy machinery incorporates eco-friendly designs aligned with stricter environmental regulations and corporate ESG goals

- Growing interest in smart farming and precision agriculture is encouraging investments in high-tech dairy equipment that supports scalable and sustainable dairy production. The ability to collect and analyze farm data is revolutionizing traditional dairy farming into a more efficient and resilient industry

- The continued adoption of automation and robotics in dairy farming is expected to remain a key market trend, driven by profitability imperatives, labor shortages, and growing consumer demand for high-quality dairy products

Farm-Type Dairy Machines and Equipment Market Dynamics

Driver

Increasing Focus on Improving Milk Yield and Farm Efficiency

- The rising demand for dairy products globally is encouraging dairy producers to adopt advanced machinery that maximizes milk yield and operational efficiency. Improving productivity per animal and reducing labor costs are critical priorities driving equipment modernization on dairy farms

- For instance, automated milking systems and smart feeding technologies by manufacturers such as GEA Group and BouMatic are widely implemented to enhance milking throughput and precision feeding. These solutions result in better herd management, consistent milk quality, and lower operational expenses

- The drive to improve resource utilization and animal health aligns with sustainability goals while supporting profitability. Precise feeding and milking schedules help reduce feed waste, improve reproduction rates, and ensure optimal lactation performance

- Increasing awareness about the benefits of advanced dairy equipment through government programs and cooperative initiatives also stimulates adoption. Producers are motivated to implement technology that delivers measurable improvements in milk production and operational management

- As dairy farming evolves into a technology-driven sector, the focus on efficiency and output optimization will continue to shape procurement and investment decisions for farm machines and equipment, sustaining market growth

Restraint/Challenge

Limited Access to Advanced Technology in Rural Dairy Farms

- Despite technological advances, limited access to modern dairy equipment in rural and low-income farming regions poses a significant challenge. High acquisition costs, lack of technical infrastructure, and insufficient training hinder the diffusion of automated and robotic solutions among smallholder farmers

- For instance, in many developing countries, dairy farms continue to rely on conventional hand-milking and manual feeding practices due to affordability constraints. Companies such as DeLaval and Lely emphasize training and financing programs to bridge this gap, but challenges remain in scaling adoption

- The lack of reliable electricity and internet connectivity in remote rural areas further restricts the implementation of IoT-enabled and automated machinery. This digital divide limits real-time monitoring and data-driven farm management benefits in these regions

- In addition, inadequate local service and maintenance support for advanced machinery increases downtime and reduces trust in technology. Farmers often face difficulties in obtaining spare parts or skilled technicians promptly

- Addressing these limitations requires coordinated efforts involving technology providers, government support programs, and capacity-building initiatives. Facilitating affordable access, infrastructure improvements, and user education will be essential to expand market reach and improve dairy productivity on rural farms

Farm-Type Dairy Machines and Equipment Market Scope

The market is segmented on the basis of sector type, end user, equipment type, and operation.

- By Sector Type

On the basis of sector type, the farm-type dairy machines and equipment market is segmented into organized dairy sector and unorganized dairy sector. The organized dairy sector dominated the market with the largest revenue share of 61.8% in 2024, driven by the rapid expansion of large-scale dairy farms adopting modern milking and processing technologies. The rising focus on quality control, hygienic production, and mechanized operations within organized dairy farms supports higher productivity and efficiency. In addition, favorable government policies, institutional investments, and the emergence of integrated dairy value chains further strengthen the adoption of advanced equipment across organized setups.

The unorganized dairy sector is projected to witness the fastest growth rate from 2025 to 2032 due to increasing efforts by small farmers to modernize production processes. Growing awareness of milk quality standards and the availability of affordable, compact machinery for small-scale operations encourage gradual mechanization. Moreover, the introduction of rural training programs and equipment subsidies by dairy cooperatives and development agencies is accelerating the transition of unorganized players toward semi-mechanized dairy systems.

- By End User

On the basis of end user, the market is segmented into small and medium dairy farmers and processors, large dairy farmers and processors, and retail. The large dairy farmers and processors segment dominated the market in 2024 due to the high adoption of automated systems and integrated machinery to support large-scale production. These enterprises invest heavily in milking equipment, feed systems, and monitoring technologies to enhance efficiency and ensure consistent milk yield. Rising demand for premium dairy products and sustainability-driven automation further reinforces the dominance of this segment.

The small and medium dairy farmers and processors segment is anticipated to register the fastest growth rate during 2025–2032. This growth is supported by the availability of cost-effective equipment, micro-financing options, and the spread of cooperative dairy models. The need to improve operational productivity and reduce manual labor is encouraging small and medium players to adopt portable milking units, feed grinders, and compact fodder machines. Government-backed rural entrepreneurship programs are also fostering equipment uptake in this category.

- By Equipment Type

Based on equipment type, the market is categorized into fodder truck, tractor implements, fodder compacting press, fodder block machine, administrative office equipment, milking equipment, mud pump, baler, pressure washer, fodder mill, generator, tractor, tanks, moveable fence, fodder harvester, reapers, feed basket, loader tractor, feed grinder, milk cans, borewell with motor, electric fencing, semen container, and accessories. The milking equipment segment dominated the market in 2024, owing to the growing emphasis on hygienic and efficient milk extraction. Automated milking machines help minimize contamination risks, optimize milking time, and improve animal health monitoring, making them essential in modern dairy farms. The surge in commercial dairy farming and herd expansion further boosts demand for these systems.

The fodder harvester segment is projected to record the fastest growth from 2025 to 2032 due to the rising need for efficient fodder management to ensure consistent livestock nutrition. Technological advancements in self-propelled and tractor-mounted harvesters enhance productivity and reduce labor dependency. Increasing awareness among farmers about feed quality improvement and its direct impact on milk yield is driving investment in advanced fodder harvesting solutions across emerging dairy markets.

- By Operation

On the basis of operation, the market is segmented into manual, automated, and semi-automated. The automated segment dominated the market in 2024 due to the increasing preference for smart and integrated dairy machinery capable of performing tasks with precision and minimal human intervention. Automated systems ensure consistent milk output, optimize feeding patterns, and support real-time monitoring of livestock health, contributing to higher efficiency and profitability in large-scale farms.

The semi-automated segment is expected to experience the fastest growth rate between 2025 and 2032, driven by its balance between cost efficiency and functional automation. It appeals to mid-sized farms aiming to modernize without full automation investment. The flexibility, reduced labor dependency, and improved control over key dairy operations make semi-automated equipment increasingly popular among farmers transitioning from traditional to mechanized systems.

Farm-Type Dairy Machines and Equipment Market Regional Analysis

- Asia-Pacific dominated the farm-type dairy machines and equipment market with the largest revenue share in 2024, driven by expanding dairy production, government support for farm mechanization, and rapid adoption of automated milking and feeding systems across developing economies

- The region’s strong dairy base, increasing investments in rural infrastructure, and the rise of organized dairy cooperatives are fueling equipment demand

- Growing consumer demand for processed milk, coupled with technological advancement in low-cost dairy machinery, is further accelerating market expansion

China Farm-Type Dairy Machines and Equipment Market Insight

China held the largest share in the Asia-Pacific market in 2024, supported by its large-scale dairy farms, technological modernization, and government incentives for mechanized milk production. The country’s emphasis on improving milk quality, food safety standards, and productivity efficiency drives continuous investment in automated milking systems and feed management equipment. Local manufacturing capabilities and export-oriented dairy machinery production strengthen China’s leading position in the region.

India Farm-Type Dairy Machines and Equipment Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by a growing dairy herd population, government schemes promoting farm automation, and the increasing role of dairy cooperatives. The "Rashtriya Gokul Mission" and "Dairy Entrepreneurship Development Scheme" are key initiatives driving equipment adoption among small and medium farmers. Expanding milk processing capacities and a rising focus on clean and efficient milking practices further enhance market growth potential.

Europe Farm-Type Dairy Machines and Equipment Market Insight

The Europe market is expanding steadily, supported by the high adoption of precision dairy technologies, sustainable farm practices, and strong focus on animal welfare. The presence of advanced dairy industries and government incentives for energy-efficient equipment drive modernization across farms. Technological innovations in robotic milking, feed automation, and farm data analytics are enhancing productivity and sustainability.

Germany Farm-Type Dairy Machines and Equipment Market Insight

Germany’s market is driven by its advanced dairy infrastructure, strong engineering expertise, and continuous innovation in automated dairy systems. The country’s commitment to sustainability, efficient farm management, and export-oriented production supports high machinery demand. The use of smart sensors, robotic milking units, and precision feeding systems is reshaping dairy farm operations, reinforcing Germany’s leadership in European dairy mechanization.

U.K. Farm-Type Dairy Machines and Equipment Market Insight

The U.K. market is supported by an organized dairy sector, growing focus on farm automation post-Brexit, and investments in sustainable and efficient dairy equipment. Increasing emphasis on productivity enhancement, labor efficiency, and improved milk traceability is driving machinery upgrades. The U.K.’s strong R&D focus and adoption of precision dairy technologies position it as a key European market for advanced farm equipment.

North America Farm-Type Dairy Machines and Equipment Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by large-scale dairy operations, strong emphasis on automation, and high investment in precision livestock management systems. The demand for robotic milking machines, automated feeding systems, and IoT-enabled dairy solutions is rapidly increasing across the region. Supportive agricultural financing and advanced dairy technology infrastructure are further boosting market expansion.

U.S. Farm-Type Dairy Machines and Equipment Market Insight

The U.S. accounted for the largest share in the North America market in 2024, supported by its well-established dairy industry, strong technological ecosystem, and continuous investment in farm automation. The focus on enhancing productivity, sustainability, and herd health through connected dairy technologies drives equipment adoption. The presence of leading manufacturers and integrated farm management solutions reinforces the U.S.’s dominant role in regional market growth.

Farm-Type Dairy Machines and Equipment Market Share

The farm-type dairy machines and equipment industry is primarily led by well-established companies, including:

- SPX FLOW, Inc. (U.S.)

- Tetra Laval International S.A. (Switzerland)

- ALFA LAVAL (Sweden)

- JBT Corporation (U.S.)

- Scherjon Equipment Holland B.V. (Netherlands)

- Van den Heuvel Dairy & Food Equipment B.V. (Netherlands)

- Lekkerkerker Dairy & Food Equipment (Netherlands)

- Arumand Steel Industries Pvt. Ltd. (India)

- Waikato Milking Systems NZ LP (New Zealand)

- GEA Group Aktiengesellschaft (Germany)

- Krones AG (Germany)

- I.M.A. Industria Macchine Automatiche S.p.A. (Italy)

- IDMC Limited (India)

- Coperion GmbH (Germany)

- Gemak Ltd. (U.K.)

- FENCO Food Machinery S.r.l. (Italy)

- SEALTECH ENGINEERS (India)

- SSP Pvt. Limited (India)

- SKYLARK ENGINEERS (India)

- PROXES GmbH (Germany)

Latest Developments in Global Farm-Type Dairy Machines and Equipment Market

- In May 2025, GEA Group acquired CattleEye Ltd., a leading AI-based livestock monitoring company from Northern Ireland, to enhance its smart dairy equipment portfolio. This acquisition expands GEA’s capabilities in precision dairy farming by integrating advanced AI for early detection of lameness and animal welfare monitoring. The move strengthens GEA’s position in data-driven dairy automation and supports its strategy to deliver more intelligent, efficiency-focused solutions for large dairy operations

- In April 2025, BouMatic Group completed the acquisition of SAC Group, a full-line producer of milking systems for cows, sheep, and goats. This strategic move broadens BouMatic’s product offering and geographic reach, enabling it to serve a more diverse customer base across Europe and Asia. The acquisition enhances BouMatic’s competitiveness in the global farm-type dairy machines and equipment market by combining SAC’s proven engineering with BouMatic’s automation expertise

- In February 2025, John Deere and DeLaval jointly launched the Milk Sustainability Center (MSC), a digital platform integrating agronomic and dairy performance data. The initiative aims to optimize resource use, improve milk yield efficiency, and promote sustainable farm practices. This collaboration represents a major step toward digital convergence in the dairy sector, strengthening the market for connected dairy equipment and smart farm management systems

- In January 2025, Dairy Conveyor Corporation (DCC Automation) entered a partnership with CADDi, a digital manufacturing solutions provider, to streamline production and supply chain operations. The collaboration focuses on leveraging digital procurement and fabrication analytics to improve the availability and cost efficiency of dairy processing equipment. This partnership is expected to enhance DCC’s operational agility and reduce lead times, positively impacting the market’s ability to meet rising equipment demand

- In December 2024, Godrej Agrovet Ltd. increased its equity stake in Creamline Dairy Products Ltd. to 99.32%, consolidating full control over its dairy operations. This acquisition strengthens Godrej’s presence across the dairy value chain, increasing its demand for advanced processing and farm-level machinery. The move also reflects the growing integration trend in emerging markets, where large dairy processors are investing in equipment modernization to achieve higher productivity and product consistency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.