Global Fats Oil Market

Market Size in USD Billion

CAGR :

%

USD

1.05 Billion

USD

4.74 Billion

2024

2032

USD

1.05 Billion

USD

4.74 Billion

2024

2032

| 2025 –2032 | |

| USD 1.05 Billion | |

| USD 4.74 Billion | |

|

|

|

|

Fats and Oil Market Size

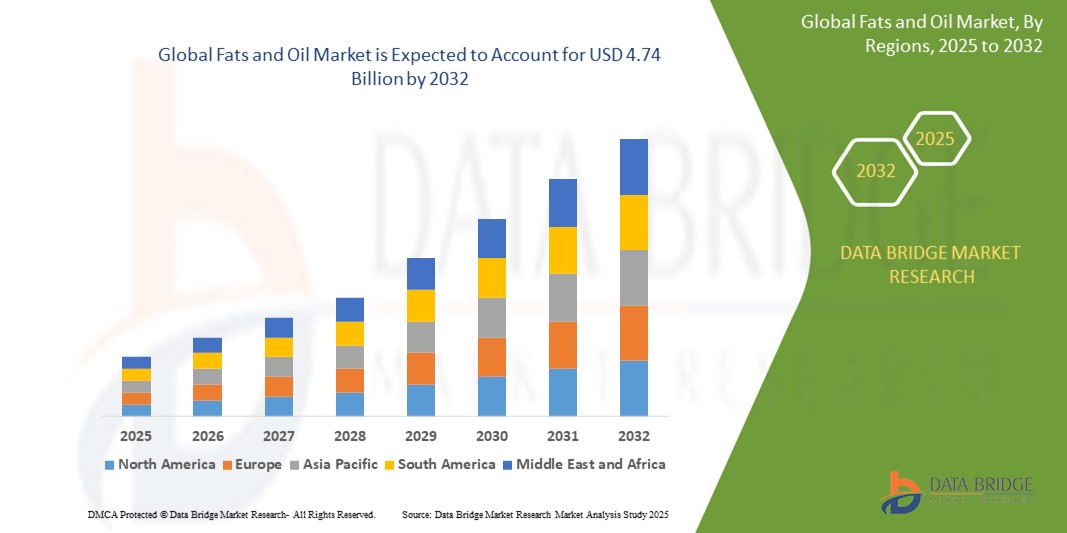

- The global active, smart, and intelligent packaging market is projected to grow significantly in the coming years. According to Market Data Forecast, the market size is expected to reach USD 1.05 billion in 2024 and expand to USD 4.74 billion by 2032, reflecting a compound annual growth rate (CAGR) of 7.8% during the forecast period.

- This growth is driven by factors such as the rising global consumption of processed and convenience foods, growing awareness of the health benefits associated with certain types of fats and oils, and increasing demand from the food service and bakery sectors. The expansion of retail chains and food delivery services, coupled with technological advancements in oil extraction and refining processes, is further fueling the growth of the Fats and Oil Market.

Fats and Oil Market Analysis

- The Fats and Oil Market comprises a wide range of edible oils and animal fats used in food preparation, industrial processing, and biodiesel production, playing a critical role in global food and energy systems.

- The market is primarily driven by growing demand for processed and convenience foods, increasing consumption of vegetable oils like palm, soybean, and sunflower oil, and heightened awareness of health-oriented edible oils such as olive and canola.

- Asia-Pacific dominates the Fats and Oil Market, supported by high consumption in countries like India, China, and Indonesia, where dietary habits and expanding food processing industries contribute to growing demand.

- North America and Europe follow, with a strong focus on healthy and sustainable fats and oils, increasing demand for non-GMO and organic variants, and regulatory emphasis on trans-fat elimination.

- The food industry segment holds the largest market share, driven by widespread usage of fats and oils in bakery, confectionery, dairy, and snack products. Innovations in low-trans fat formulations and fortified oils are enhancing nutritional profiles and fueling segment growth.

Report Scope and Fats and Oil Market Segmentation

|

Attributes |

Active, Smart and Intelligent Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fats and Oil Market Trends

“Rising Demand for Health-Oriented Oils and Sustainable Sourcing Practices”

- A significant trend in the fats and oil market is the growing consumer shift toward healthier oil alternatives such as olive oil, avocado oil, and high-oleic vegetable oils, driven by increased awareness of nutrition and cardiovascular health.

- Consumers are increasingly looking for products that are low in saturated fats and trans fats, prompting manufacturers to reformulate offerings and expand portfolios with organic, non-GMO, and cold-pressed oil variants.

- For instance, leading producers are launching fortified edible oils with omega-3, vitamin D, and antioxidant properties to cater to health-conscious consumers, particularly in urban markets across Asia-Pacific and North America.

- Simultaneously, there is a rising focus on sustainable sourcing and traceability, with companies investing in certified palm oil and responsible supply chain practices, aligning with global ESG (Environmental, Social, and Governance) goals.

Fats and Oil Market Dynamics

Driver

“Increasing Demand for Healthier and Functional Edible Oils”

- The rising consumer preference for health-conscious food choices is significantly boosting the demand for functional and nutrient-rich fats and oils, particularly those that support heart health, weight management, and disease prevention.

- Consumers are shifting away from traditional saturated fats such as palm oil and butter, opting instead for oils like olive, canola, flaxseed, and sunflower, which are rich in unsaturated fats and essential fatty acids.

- The demand is further amplified by the growing trend toward plant-based diets and clean-label products, driving producers to innovate and introduce fortified, organic, and cold-pressed oil variants.

For instance,

- In March 2024, Cargill announced an expansion of its high-oleic canola oil production to meet growing demand from the foodservice sector, citing consumer interest in oils with better oxidative stability and health profiles.

- As a result, the fats and oil market is witnessing a strong surge in demand for premium, health-oriented oils, encouraging companies to invest in R&D, sustainable sourcing, and transparent labeling to meet evolving consumer expectations.

Opportunity

“Rising Opportunities in Bio-Based and Sustainable Oil Production”

- The increasing global emphasis on sustainability and eco-friendly production practices is opening new avenues for bio-based and sustainable fats and oils across food, cosmetics, and industrial applications.

- Consumers and manufacturers alike are seeking oils derived from renewable sources such as algae, soy, and coconut, which offer lower environmental impact and align with green product labeling.

- Bio-based oils are gaining popularity not only for their reduced carbon footprint but also for their functional benefits in health, performance, and versatility across end-use sectors.

For instance,

- In February 2024, Bunge and Chevron announced a joint venture to produce renewable oils from plant-based sources, focusing on the biofuel and food industries to meet growing demand for sustainable alternatives.

- With increasing regulatory support and consumer awareness, the shift toward sustainable oils is creating new growth opportunities for manufacturers focused on ethical sourcing, carbon reduction, and circular economy practices.

Restraint/Challenge

“Volatility in Raw Material Prices and Supply Chain Disruptions”

- The fats and oil market faces significant constraints due to the high volatility in raw material prices, such as palm oil, soybean oil, and sunflower oil, which are heavily influenced by geopolitical tensions, climate variability, and trade regulations.

- Fluctuating commodity prices impact profit margins and make long-term strategic planning difficult for manufacturers and suppliers, especially in price-sensitive markets.

- Supply chain disruptions—driven by unpredictable weather events, labor shortages, and export restrictions—further strain the availability of raw materials, leading to inconsistent production and delivery schedules.

For instance,

- According to the United States Department of Agriculture (USDA), in 2023, adverse weather conditions in Southeast Asia led to a 5% drop in palm oil production, contributing to a surge in global prices and reduced export volumes.

- As a result of these factors, companies in the fats and oil market must continuously navigate pricing uncertainty and logistical challenges, limiting their ability to invest in innovation and market expansion.

Fats and Oil Market Scope

The market is segmented on the basis type, form, source, level..

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By Form |

|

|

By Source

|

|

In 2025, the fats is projected to dominate the market with a largest share in application segment

Fats, as a critical component in food processing and manufacturing, are experiencing growing demand due to their functional and sensory roles in food products, including texture, flavor enhancement, and shelf-life stability.

The food is expected to account for the largest share during the forecast period in technology market

The food industry continues to be the primary consumer of fats and oils, driven by increasing global demand for processed, baked, and convenience foods, especially in emerging economies.

Fats and Oil Market Regional Analysis

“North America Holds the Largest Share in the Fats and Oil Market”

- North America dominates the global fats and oil market, supported by a robust food processing industry, increasing consumer demand for convenience and packaged foods, and the widespread use of various edible oils and fats across multiple sectors.

- The U.S. leads the region’s market share due to high consumption levels of bakery, confectionery, and fast food products, where fats and oils play a crucial functional and sensory role.

- Rising health consciousness has also spurred demand for premium oils like canola, olive, and avocado oil, as consumers shift toward healthier dietary choices.

- Technological advancements in oil extraction, refining, and fortification, along with strong retail distribution channels, further bolster the regional market.

- Additionally, North America’s biofuel sector, especially in the U.S., is witnessing increased use of vegetable oils in biodiesel production, contributing to the diversified application of fats and oils in the region.

“Asia-Pacific is Projected to Register the Highest CAGR in the Fats and Oil Market”

- The Asia-Pacific region is expected to register the highest growth rate in the fats and oil market, driven by increasing urbanization, rising disposable incomes, and an expanding middle class, especially in countries like China, India, and Southeast Asia.

- With a growing preference for processed and packaged food, coupled with rising demand for healthier cooking oils such as olive, sunflower, and palm oil, the region is witnessing rapid consumption growth.

- China and India, with their large populations, are at the forefront of this expansion. Both countries are experiencing a shift in consumer preferences toward healthier oils, such as olive and rice bran oil, driven by increasing health awareness and dietary changes.

- India, in particular, is witnessing a surge in demand for oils due to the increasing adoption of packaged food products, expansion of the retail sector, and a growing focus on home cooking. The government’s initiatives to promote the use of high-quality edible oils further contribute to market growth.

- Southeast Asia, with its strong presence in palm oil production, continues to play a significant role in the global fats and oils market. The region’s agricultural expertise and palm oil export growth continue to fuel demand in both food and non-food applications.

- The Asia-Pacific market is also benefiting from the region's increasing production of biodiesel, which utilizes oils and fats as raw materials, further expanding the market scope beyond food applications.

Fats and Oil Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Archer Daniels Midland Company (U.S.)

- Bunge Limited (U.S.)

- Cargill, Incorporated (U.S.)

- Wilmar International Limited (Singapore)

- Olam International (Singapore)

- Associated British Foods plc (UK)

- Conagra Brands, Inc. (U.S.)

- IOI Corporation Berhad (Malaysia)

- Unilever PLC (UK/Netherlands)

- Ajinomoto Co., Inc. (Japan)

- Nisshin OilliO Group, Ltd. (Japan)

- Ruchi Soya Industries Ltd. (India)

- PT SMART Tbk (Indonesia)

- Marico Limited (India)

- Borges International Group (Spain)

Latest Developments in Global Fats and Oil Market

- In January 2025, Wilmar International Limited, a leading global agribusiness group, announced the expansion of its palm oil processing facility in Southeast Asia. The new facility incorporates advanced sustainable practices, including energy-efficient equipment and waste management systems. This development is expected to improve palm oil yield while reducing the environmental impact of production. The company aims to address increasing global demand for palm oil, particularly in food and biodiesel production.

- In December 2024, Cargill Incorporated introduced a new line of plant-based oils derived from innovative crops such as camelina and mustard seeds. These oils are positioned as alternatives to traditional vegetable oils, offering a healthier, more sustainable option for consumers. The company highlighted the oils’ high stability and nutritional benefits, catering to the growing demand for clean-label products in both food and cosmetics industries.

- In November 2024, Archer Daniels Midland (ADM) launched a new series of high-oleic sunflower oils aimed at enhancing food flavor and extending shelf life. These oils have a higher monounsaturated fat content, which aligns with the rising consumer preference for healthier fats. The new oils are expected to be especially popular in the snack food and restaurant sectors, where shelf stability and frying performance are key.

- In October 2024, Olam Group, a global food and agri-business company, introduced a sustainable sourcing initiative for its palm oil supply chain. The initiative focuses on increasing traceability, reducing deforestation, and improving labor conditions in palm oil plantations. This move is part of Olam’s broader sustainability commitment to reduce the environmental impact of its products while meeting the growing demand for responsibly sourced fats and oils.

- In September 2024, Bunge Limited announced the acquisition of a state-of-the-art refining plant in Brazil, aiming to increase its production capacity for soybean and canola oils. The new facility is designed to support the growing demand for vegetable oils in the Latin American market, particularly for use in packaged foods and health-conscious products. The plant also includes innovations in waste reduction and energy efficiency, contributing to Bunge's sustainability goals.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fats Oil Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fats Oil Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fats Oil Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.