Global Fatty Amines Market

Market Size in USD Billion

CAGR :

%

USD

3.60 Billion

USD

4.97 Billion

2024

2032

USD

3.60 Billion

USD

4.97 Billion

2024

2032

| 2025 –2032 | |

| USD 3.60 Billion | |

| USD 4.97 Billion | |

|

|

|

|

Fatty Amines Market Size

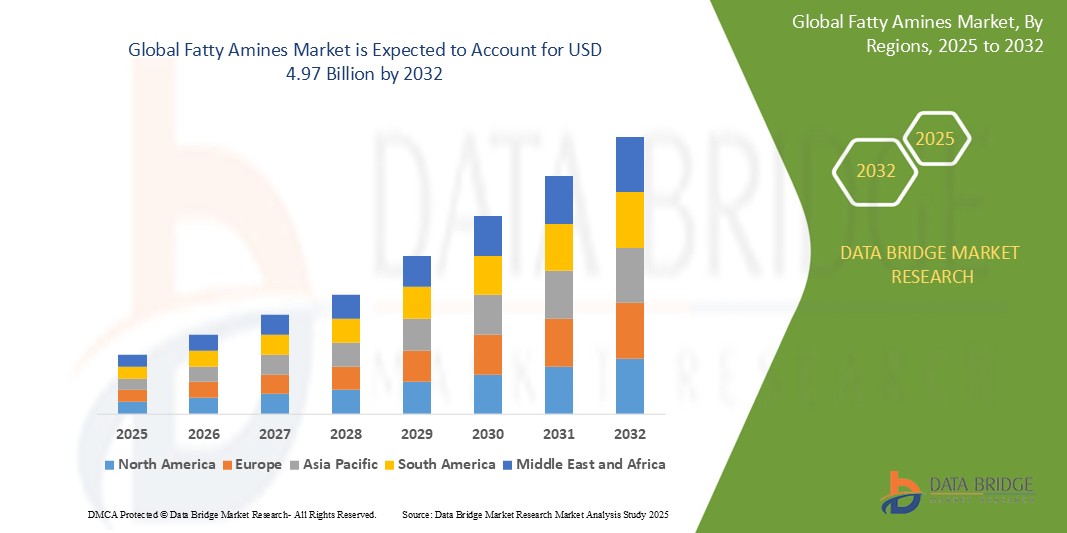

- The global Fatty Amines market was valued at USD 3.60 Billion in 2024 and is expected to reach USD 4.97 Billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.6%, primarily driven by the increasing demand for nylon 6,6

- This growth is driven by increasingly utilizing nylon 6,6 for manufacturing lightweight components such as radiator end tanks, air intake manifolds, and rocker covers.

Fatty Amines Market Analysis

- Fatty amines are organic nitrogen compounds derived from fatty acids, primarily used as key chemical intermediates in various industries including water treatment, agrochemicals, personal care, and oilfield applications

- The demand for fatty amines is significantly driven by their versatility in surfactant production, corrosion inhibition, emulsification, and conditioning across industrial and consumer product sectors

- Asia-Pacific is expected to dominate the Global Fatty Amines Market due to the rapid growth of end-use industries such as agriculture, personal care, and water treatment, alongside the availability of raw materials and low-cost manufacturing

- North America is projected to witness steady growth due to rising demand for fatty amines in oilfield chemicals, wastewater treatment, and increasing focus on sustainable and biodegradable chemical solutions.

- The primary amines segment is expected to dominate the market with a market share of 42.18% in 2025, owing to its extensive use in manufacturing quaternary ammonium compounds and ethoxylates for various chemical formulations

Report Scope and Fatty Amines Market Segmentation

|

Attributes |

Fatty Amines Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fatty Amines Market Trends

“Rising Demand for Bio-Based Fatty Amines”

- The global shift towards sustainable and eco-friendly products is propelling the demand for bio-based Fatty Amines.

- Consumers and industries alike are seeking greener alternatives, leading to increased interest in renewable Fatty Amines sources.

- Major chemical companies are forming strategic partnerships to develop and commercialize bio-based Fatty Amines.

- Innovations in biotechnology are enabling more efficient and cost-effective production of bio-based Fatty Amines.

- For instance, Asahi Kasei and Genomatica have collaborated to produce renewably-sourced nylon 6,6 using bio-based Fatty Amines

- The increasing demand for bio-based Fatty Amines is a significant trend in the global market, driven by sustainability goals, industry collaborations, technological innovations, and supportive regulations. This trend is expected to continue, shaping the future of Fatty Amines production and application.

Fatty Amines Market Dynamics

Driver

“Increasing Demand for Nylon 6,6”

- The automotive sector is increasingly utilizing nylon 6,6 for manufacturing lightweight components such as radiator end tanks, air intake manifolds, and rocker covers.

- This shift aims to enhance fuel efficiency and reduce emissions, thereby boosting Fatty Amines demand.

- Nylon 6,6 fibers are favored in the textile industry for their strength, durability, and resistance to abrasion.

- The growing demand for high-quality textiles in clothing, home furnishings, and technical applications is driving the need for Fatty Amines.

For instance,

- Companies like Ford and BMW have been increasingly using nylon 6,6 components to reduce vehicle weight and improve fuel efficiency, replacing heavier metal parts with durable, lighter nylon-based parts.

- The multifaceted applications of nylon 6,6 across various industries underscore the critical role of Fatty Amines as a foundational chemical, positioning it as a key driver in the global market's growth trajectory.

Opportunity

“Increasing Application in High-Performance Coatings and Adhesives Across Various Industries”

- Fatty Amines-based epoxy curing agents are gaining traction due to their ability to enhance the durability and corrosion resistance of coatings, making them ideal for construction and industrial applications.

- Innovations in epoxy resin formulations have improved the performance of Fatty Amines-based adhesives, offering better mechanical properties and chemical resistance, which are essential for demanding applications.

- The automotive and aerospace sectors are increasingly adopting Fatty Amines-based coatings and adhesives for lightweight and high-strength bonding solutions, contributing to fuel efficiency and performance.

- Fatty Amines-based products are being developed to meet stringent environmental regulations, including low volatile organic compound (VOC) emissions, aligning with global sustainability goals.

For instance,

- Companies like Huntsman Corporation and Evonik Industries have developed epoxy curing agents based on Fatty Amines derivatives (like IPDA – isophorone diamine) for industrial floor coatings and protective marine coatings, offering high chemical resistance and durability.

- The expanding use of Fatty Amines in advanced coatings and adhesives presents a significant growth opportunity, driven by technological advancements and the demand for high-performance, sustainable solutions across multiple industries.

Restraint/Challenge

“Volatility in Raw Material Prices”

- Regulatory bodies like the FDA and EMA require detailed justification for the inclusion of excipients in pharmaceutical formulations. This includes demonstrating safety, efficacy, and necessity, which can be time-consuming and resource-intensive for manufacturers.

- The rigorous standards set by regulatory agencies have led to a shortage of FDA-approved manufacturing sites for sugar-based excipients.

- This limitation restricts production capacity and can delay the introduction of new products to the market.

- Manufacturers must adhere to strict quality control procedures to ensure product consistency and safety. These demands can increase operational costs and require significant investment in quality assurance infrastructure.

- Navigating the complex regulatory landscape is a major challenge for the sugar-based excipients market. While these regulations are essential for ensuring product safety and efficacy, they can also impede market growth and innovation.

Fatty Amines Market Scope

The market is segmented on the basis of application and end user.

|

Segmentation |

Sub-Segmentation |

|

By Carbon Chain Length |

|

|

By Product |

|

|

By Application |

|

In 2025, the water treatment segment is projected to dominate the market with the largest share in the application segment

The water treatment segment is expected to dominate the Global Fatty Amines Market with the largest share of 38.67% in 2025, owing to the increasing global demand for clean and safe water. Fatty amines are widely used as corrosion inhibitors, flocculants, and dispersants in both industrial and municipal water treatment processes. Rising concerns over water pollution, stringent environmental regulations, and growing investments in water infrastructure are driving the application of fatty amines in this sector.

The primary amines segment is expected to account for the largest share during the forecast period in the product market

In 2025, the primary amines segment is expected to dominate the Global Fatty Amines Market with the largest market share of 42.18%. This dominance is attributed to their versatile functionality in diverse applications such as agrochemicals, oilfield chemicals, and personal care products. Their superior reactivity and effectiveness in producing derivatives like quaternary ammonium compounds and ethoxylates make them the most preferred type among manufacturers and end users globally.

Fatty Amines Market Regional Analysis

“North America is the Dominant Region in the Fatty Amines Market”

- North America dominates the Fatty Amines market with a market share of 51.03% in 2025, driven by its strong automotive, construction, and textile industries, which drive high demand for nylon 66, a major application

- U.S. holds a significant share due to advanced chemical manufacturing infrastructure, abundant raw materials, and significant investments in research and development, supporting consistent production and innovation in Fatty Amines applications.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific region is expected to witness the highest growth rate in the Fatty Amines market, driven by increasing demand for Fatty Amines in nylon production and polymer applications

- China is growing with highest CAGR in the region due to affordable labor, access to raw materials, and strategic investments by global players further bolster regional growth

Fatty Amines Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Evonik Industries AG (Germany)

- BASF SE (Germany)

- Asahi Kasei Corporation (Japan)

- Solvay (Belgium)

- Ashland (U.S.)

- Merck KGaA (Germany)

- DuPont (U.S.)

- TORAY INDUSTRIES, INC. (Japan)

- INVISTA (U.S.)

- Radici Partecipazioni SpA (Italy)

- DAEJUNGCHE CHEMICAL & METALS CO., LTD. (South Korea)

- Genomatica, Inc (U.S.)

- Junsei Chemical Co.,Ltd. (Japan)

- Suzhou Sichang Learning Technology Co., Ltd. (China)

- Alfa Aesar, Thermo Fisher Scientific (U.S.)

- Eastman Chemical Company (U.S.)

- Arkema (France)

- Ascend Performance Materials (U.S.)

- Formosa Plastics Corporation (Taiwan)

- Huntsman International LLC (U.S.)

Latest Developments in Global Fatty Amines Market

- In January 2025, Evonik Industries AG announced an expansion of its fatty amine production facility in Marl, Germany, to meet growing global demand for fatty amines used in water treatment, agrochemicals, and personal care applications. The upgrade is expected to increase capacity by 20% and improve energy efficiency by integrating advanced catalytic technology.

- In November 2024, AkzoNobel Specialty Chemicals launched a new range of multifunctional tertiary fatty amines designed for improved performance in textile softeners and antistatic agents. These new amines offer enhanced hydrophilicity, stability, and eco-friendliness, catering to customers seeking sustainable solutions in fabric care.

- In October 2024, Clariant AG signed a strategic partnership with an Indian specialty chemical firm to co-develop bio-based fatty amines for use in hair care and skin conditioning products. The initiative supports Clariant’s commitment to boosting its footprint in Asia-Pacific and aligning product portfolios with natural origin index standards.

- In August 2024, Lonza Group AG invested in a pilot facility in Switzerland to explore algae-derived fatty amines as a sustainable alternative to traditional tallow or palm oil-based sources. The initiative is part of Lonza’s long-term R&D focus on biotechnology-driven specialty ingredients for use in pharma and nutraceutical sectors.

- In June 2024, Solvay SA introduced a high-purity fatty amine derivative specifically designed for flotation processes in mining operations, particularly for iron ore and phosphate extraction. The product offers higher recovery rates and lower environmental impact compared to conventional collectors, supporting the mining industry’s shift toward green beneficiation technologies.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fatty Amines Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fatty Amines Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fatty Amines Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.