Global Fda Cleared 3d Printed Denture Devices Market

Market Size in USD Million

CAGR :

%

USD

178.20 Million

USD

425.70 Million

2024

2032

USD

178.20 Million

USD

425.70 Million

2024

2032

| 2025 –2032 | |

| USD 178.20 Million | |

| USD 425.70 Million | |

|

|

|

|

FDA-Cleared 3D-Printed Denture Devices Market Size

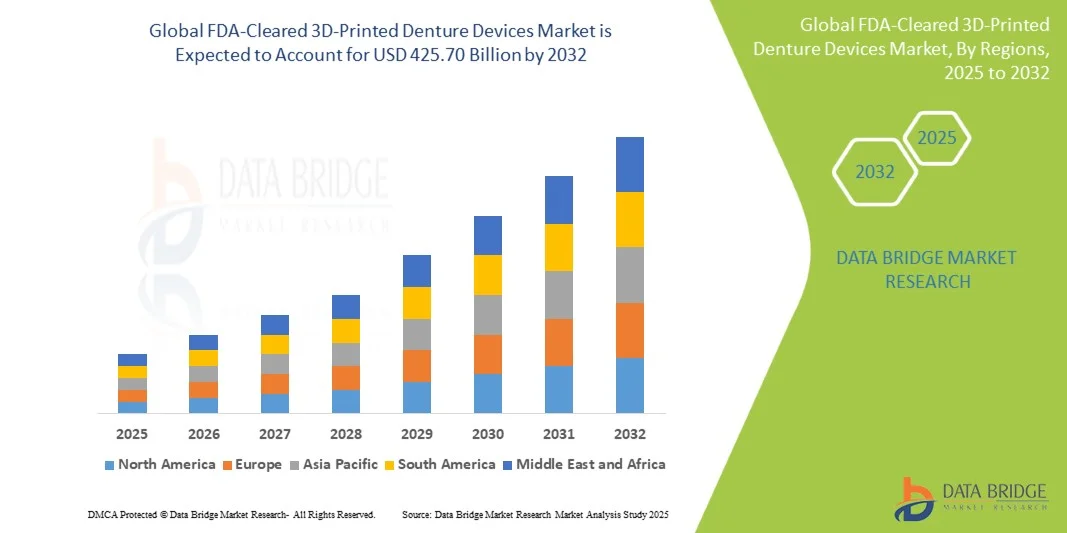

- The FDA-Cleared 3D-Printed Denture Devices Market size was valued at USD 178.20 million in 2024 and is expected to reach USD 425.70 million by 2032, at a CAGR of 11.50% during the forecast period.

- The market growth is largely driven by increasing adoption of digital dentistry solutions and advancements in 3D-printing technologies, enabling faster, more precise, and customizable denture fabrication.

- Furthermore, rising patient demand for personalized, comfortable, and aesthetically superior dental prosthetics is encouraging dental practitioners and laboratories to adopt FDA-cleared 3D-printed denture devices. These converging factors are accelerating market penetration, thereby significantly boosting the industry’s growth.

FDA-Cleared 3D-Printed Denture Devices Market Analysis

- FDA-cleared 3D-printed denture devices, offering digitally fabricated and highly personalized dental prosthetics, are increasingly vital components of modern dental care and restorative treatments in both clinical and at-home settings due to their precision, reduced production time, and improved patient comfort.

- The escalating demand for 3D-printed dentures is primarily fueled by the growing adoption of digital dentistry technologies, increasing prevalence of tooth loss and edentulism, and a rising preference for faster, more customized, and cost-effective dental solutions over traditional methods.

- North America dominated the FDA-Cleared 3D-Printed Denture Devices Market with the largest revenue share of 34.9% in 2024, characterized by early adoption of digital dentistry, high healthcare spending, and a strong presence of key market players, with the U.S. experiencing substantial growth in dental clinics and dental labs integrating 3D-printing solutions, driven by innovations from both established dental companies and startups focusing on biocompatible materials and AI-assisted design.

- Asia-Pacific is expected to be the fastest growing region in the FDA-Cleared 3D-Printed Denture Devices Market during the forecast period due to increasing awareness of oral healthcare, expanding dental infrastructure, and rising disposable incomes.

- The complete dentures segment dominated the market with the largest revenue share of 45.3% in 2024, driven by the high prevalence of edentulism and the widespread need for full-arch prosthetic solutions.

Report Scope and FDA-Cleared 3D-Printed Denture Devices Market Segmentation

|

Attributes |

FDA-Cleared 3D-Printed Denture Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

FDA-Cleared 3D-Printed Denture Devices Market Trends

“Enhanced Convenience Through Digital Dentistry and AI Integration”

- A significant and accelerating trend in the FDA-Cleared 3D-Printed Denture Devices Market is the increasing integration of digital dentistry solutions with artificial intelligence (AI) and advanced scanning technologies. This fusion of technologies is significantly enhancing precision, customization, and overall patient experience in denture fabrication.

- For instance, AI-powered design software can analyze oral scans to create perfectly fitting dentures, reducing manual adjustments and chairside time. Similarly, some 3D printing platforms now offer automated layer optimization and material selection, ensuring durable and comfortable prosthetics with minimal human intervention.

- AI integration in denture design enables features such as predictive modeling for bite alignment, identification of pressure points, and optimization of occlusion patterns. For example, software like 3Shape Dental System uses AI to propose optimal denture designs based on patient-specific anatomical data, improving fit and functionality while reducing production errors. Furthermore, AI-guided workflows accelerate turnaround times, enabling faster delivery of customized dentures.

- The seamless integration of AI and digital scanning systems allows dental professionals to manage the entire denture creation process—from intraoral scanning and CAD design to 3D printing and post-processing—through a single, streamlined workflow, creating a more efficient and patient-friendly experience.

- This trend towards intelligent, automated, and highly precise denture production is fundamentally reshaping patient expectations for oral prosthetics. Consequently, companies such as Dentsply Sirona and Formlabs are developing AI-enabled 3D-printed denture solutions that offer predictive fitting, automated design suggestions, and improved material efficiency.

- The demand for FDA-cleared 3D-printed dentures that leverage AI and digital dentistry integration is growing rapidly across both clinical and commercial sectors, as dental professionals increasingly prioritize patient satisfaction, treatment speed, and cost-effective, high-quality solutions.

FDA-Cleared 3D-Printed Denture Devices Market Dynamics

Driver

“Growing Need Due to Rising Oral Health Concerns and Digital Dentistry Adoption”

- The increasing prevalence of tooth loss, edentulism, and other oral health issues, coupled with the accelerating adoption of digital dentistry solutions, is a significant driver for the heightened demand for FDA-cleared 3D-printed denture devices.

- For instance, in 2024, Dentsply Sirona launched an advanced AI-powered denture design platform that streamlines digital workflows from scanning to 3D printing, enabling dental clinics to offer faster and more precise prosthetic solutions. Such innovations by key companies are expected to drive the market growth during the forecast period.

- As patients become more aware of the benefits of digitally fabricated dentures—such as improved fit, enhanced comfort, and shorter treatment timelines—3D-printed devices provide a compelling upgrade over conventional denture fabrication methods.

- Furthermore, the growing popularity of digital dentistry technologies, including intraoral scanners and CAD/CAM systems, is making 3D-printed dentures an integral component of modern dental practices, offering seamless integration with broader clinical workflows.

- The convenience of faster production, precise customization, and the ability to manage patient cases digitally are key factors propelling the adoption of 3D-printed dentures in both clinical and commercial sectors. The trend towards chairside 3D printing and patient-specific prosthetics further contributes to market growth.

Restraint/Challenge

“Concerns Regarding Regulatory Compliance and High Initial Costs”

- Concerns surrounding stringent regulatory approvals and quality compliance pose a significant challenge to broader market penetration. As 3D-printed denture devices require FDA clearance and adherence to biocompatibility standards, manufacturers face time-consuming and costly regulatory processes, which can slow product launches and adoption.

- For instance, rigorous testing for material safety and clinical performance has made some smaller dental labs hesitant to adopt 3D printing solutions without guaranteed regulatory approval.

- Addressing these regulatory and compliance concerns through transparent certification, robust quality management systems, and post-market monitoring is crucial for building trust among dental professionals. Companies such as 3Shape and Formlabs emphasize FDA clearance and high-quality materials in their marketing to reassure potential buyers.

- Additionally, the relatively high initial investment in 3D printers, AI-enabled design software, and biocompatible printing materials can be a barrier for smaller dental practices, particularly in developing regions or for budget-conscious clinics. While entry-level 3D printing solutions are becoming more affordable, premium systems with advanced AI integration, multiple material options, and rapid printing capabilities often come with a higher price tag.

- Overcoming these challenges through streamlined regulatory pathways, cost-effective solutions, and enhanced awareness of clinical benefits will be vital for sustained market growth.

FDA-Cleared 3D-Printed Denture Devices Market Scope

The market is segmented on the basis of Denture Type, product type, Usability, Material, application, end user.

• By Denture Type

On the basis of denture type, the FDA-Cleared 3D-Printed Denture Devices Market is segmented into complete dentures, partial dentures, and others, including implant-supported dentures, immediate dentures, precision attachments, and snap-on dentures. The complete dentures segment dominated the market with the largest revenue share of 45.3% in 2024, driven by the high prevalence of edentulism and the widespread need for full-arch prosthetic solutions. Complete dentures fabricated via 3D printing offer superior fit, faster production, and improved patient comfort compared to conventional dentures, making them a preferred choice among dental professionals.

The partial dentures segment is expected to witness the fastest CAGR of 22.1% from 2025 to 2032, fueled by the increasing awareness of tooth-preserving restorations and the growing adoption of digital workflows for designing customized partial prosthetics. The aesthetic appeal, precision fit, and time-efficient fabrication of 3D-printed partial dentures are driving their popularity among both clinicians and patients.

• By Product Type

On the basis of product type, the FDA-Cleared 3D-Printed Denture Devices Market is segmented into consumables (e.g., 3D printing resins, milling blocks, denture base polymers), hardware/equipment (e.g., intraoral scanners, CAD/CAM milling machines, 3D printers), and software (e.g., CAD/CAM design programs, AI-driven digital denture planning tools). The consumables segment dominated the market with a revenue share of 47.6% in 2024, as ongoing use of resins and denture base materials ensures continuous demand in dental clinics and labs.

The hardware/equipment segment is projected to witness the fastest CAGR of 23.2% from 2025 to 2032, driven by the increasing adoption of advanced 3D printers, intraoral scanners, and milling systems that enable precise, chairside denture fabrication. Dental professionals are increasingly investing in digital equipment to enhance workflow efficiency, reduce turnaround times, and deliver patient-specific prosthetics with high accuracy.

• By Usability

On the basis of usability, the FDA-Cleared 3D-Printed Denture Devices Market is segmented into removable dentures and fixed dentures. The removable dentures segment held the largest market revenue share of 52.1% in 2024, due to their widespread application in full and partial edentulism cases, and the ease of fabrication using 3D printing workflows. Removable dentures provide cost-effective, adjustable, and patient-friendly solutions, making them highly popular among dental clinics and laboratories.

Fixed dentures are expected to witness the fastest CAGR of 21.8% from 2025 to 2032, supported by rising implant adoption, technological advancements in precision attachment systems, and growing patient preference for stable, permanent prosthetics. 3D-printed fixed dentures reduce manual errors, improve fit, and allow for faster clinical delivery, further driving adoption.

• By Material

On the basis of material, the FDA-Cleared 3D-Printed Denture Devices Market is segmented into resins and plastics. The resins segment dominated the market with a revenue share of 60.2% in 2024, driven by biocompatibility, durability, and compatibility with 3D printing workflows for both complete and partial dentures. Resins allow precise, smooth, and patient-specific prosthetic production, which enhances comfort and reduces post-processing adjustments.

Plastics are expected to witness the fastest CAGR of 20.9% from 2025 to 2032, fueled by innovations in polymer technology and the increasing use of cost-effective materials in dental laboratories for temporary, transitional, or snap-on dentures. Growing demand for lightweight, durable, and affordable denture materials in emerging markets is further accelerating adoption.

• By Application

On the basis of application, the FDA-Cleared 3D-Printed Denture Devices Market is segmented into definitive dentures, immediate dentures (transitional), duplicate/backup dentures, and repair/reline/remake workflows. The definitive dentures segment dominated the market with the largest revenue share of 48.7% in 2024, driven by the need for permanent, long-term prosthetic solutions that benefit from precise 3D-printed customization.

The immediate dentures segment is expected to witness the fastest CAGR of 22.5% from 2025 to 2032, supported by the demand for transitional solutions immediately following tooth extraction, which allow patients to maintain aesthetics and function while definitive dentures are being fabricated. AI-assisted digital workflows enhance fit and reduce clinical adjustment times, driving growth across all applications.

• By End User

On the basis of end user, the FDA-Cleared 3D-Printed Denture Devices Market is segmented into dental clinics, dental hospitals, dental laboratories, dental service organizations (DSOs), and others (academic and training institutes). Dental clinics accounted for the largest market revenue share of 44.9% in 2024, attributed to their high patient volumes and increasing adoption of chairside 3D printing workflows.

Dental laboratories are expected to witness the fastest CAGR of 23.8% from 2025 to 2032, due to growing outsourcing of denture fabrication, increasing investment in advanced 3D printing equipment, and rising demand for precise, customized prosthetics. The trend toward digital workflows, cost-effective production, and improved turnaround times is encouraging laboratories to adopt 3D-printed denture solutions at a faster pace.

FDA-Cleared 3D-Printed Denture Devices Market Regional Analysis

- North America dominated the FDA-Cleared 3D-Printed Denture Devices Market with the largest revenue share of 34.9% in 2024, driven by increasing awareness of digital dentistry, the adoption of advanced dental technologies, and a high prevalence of edentulism among the aging population.

- Dental professionals and clinics in the region increasingly value the precision, customization, and reduced turnaround time offered by 3D-printed denture devices compared to conventional dentures. This is complemented by the growing integration of CAD/CAM systems, intraoral scanners, and AI-driven digital denture planning tools in clinical workflows.

- This widespread adoption is further supported by high disposable incomes, technologically inclined dental practitioners, and well-established dental care infrastructure. Patients and providers are increasingly prioritizing enhanced comfort, improved aesthetics, and efficient chairside solutions, positioning 3D-printed denture devices as a preferred choice across both clinical and laboratory settings.

U.S. 3D-Printed Denture Devices Market Insight

The U.S. 3D-Printed Denture Devices Market captured the largest revenue share of 81% in 2024 within North America, driven by the rapid adoption of digital dentistry solutions and advanced dental technologies. Dental clinics and laboratories are increasingly prioritizing precision, customization, and faster turnaround times offered by 3D-printed dentures. The growing integration of CAD/CAM systems, intraoral scanners, and AI-based design tools, alongside rising patient awareness of digitally fabricated dentures, is further propelling market growth. Additionally, the U.S. benefits from high disposable incomes and a well-established dental care infrastructure, positioning 3D-printed dentures as a preferred choice for both clinical and laboratory applications.

Europe 3D-Printed Denture Devices Market Insight

The Europe 3D-Printed Denture Devices Market is projected to expand at a substantial CAGR during the forecast period, driven by rising awareness of digital dentistry and stringent healthcare regulations. The adoption of 3D-printed dentures is supported by increasing investments in dental clinics, urbanization, and demand for high-precision prosthetics. European consumers and dental professionals value efficiency, patient comfort, and aesthetically superior dentures, promoting adoption across both private clinics and public dental facilities. The market also benefits from government initiatives encouraging innovation and digitalization in dental care.

U.K. 3D-Printed Denture Devices Market Insight

The U.K. market for 3D-printed denture devices is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising trend of digital dentistry and a growing emphasis on patient-specific dental solutions. Increasing concerns about treatment accuracy, faster turnaround times, and enhanced comfort are encouraging dental practitioners to adopt 3D-printed dentures. Additionally, the U.K.’s advanced healthcare infrastructure, robust dental research environment, and strong awareness among patients are expected to continue supporting market growth in both clinical and laboratory settings.

Germany 3D-Printed Denture Devices Market Insight

The Germany 3D-Printed Denture Devices Market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of digital dentistry solutions and the demand for precise, high-quality prosthetics. Germany’s focus on technological innovation, sustainable manufacturing practices, and patient-centric care is encouraging adoption in dental clinics and laboratories. The integration of CAD/CAM systems, intraoral scanning, and AI-assisted denture planning tools is becoming increasingly prevalent, meeting local consumer expectations for efficiency, accuracy, and comfort.

Asia-Pacific 3D-Printed Denture Devices Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR of 24% during the forecast period from 2025 to 2032, driven by rising dental care awareness, increasing urbanization, and growing disposable incomes in countries such as China, Japan, and India. The adoption of 3D-printed dentures is supported by government initiatives promoting digital healthcare and the rapid development of dental infrastructure. Additionally, the region’s position as a manufacturing hub for dental 3D printing materials and equipment is improving affordability and accessibility, further expanding the consumer base.

Japan 3D-Printed Denture Devices Market Insight

The Japan market is gaining momentum due to the country’s high-tech healthcare infrastructure, increasing demand for personalized dental solutions, and rising aging population. Adoption of 3D-printed dentures is driven by the need for faster production, improved fit, and enhanced comfort. Integration of advanced digital dental workflows, including AI-driven design and intraoral scanning, is accelerating growth in both clinical and laboratory settings, supporting a shift toward more patient-centric prosthetic care.

China 3D-Printed Denture Devices Market Insight

The China 3D-Printed Denture Devices Market accounted for the largest revenue share in Asia-Pacific in 2024, fueled by rapid urbanization, an expanding middle class, and increasing awareness of advanced dental care solutions. Rising adoption of digital dentistry technologies in clinics and laboratories, alongside government initiatives promoting healthcare modernization and the emergence of local 3D printing manufacturers, is driving market growth. China’s large patient base and growing demand for precise, cost-effective denture solutions are key factors propelling the widespread adoption of 3D-printed denture devices.

FDA-Cleared 3D-Printed Denture Devices Market Share

The FDA-Cleared 3D-Printed Denture Devices industry is primarily led by well-established companies, including:

- 3Shape (Denmark)

- Ivoclar Vivadent (Liechtenstein)

- Dentsply Sirona (U.S.)

- Straumann Group (Switzerland)

- Formlabs (U.S.)

- BEGO (Germany)

- Dental Wings (Canada)

- Arfona (U.S.)

- SprintRay (U.S.)

- EnvisionTEC / Desktop Metal (Germany/U.S.)

- Vatech (South Korea)

- Roland DG (Japan)

- Kulzer (Germany)

- Rapid Shape (Germany)

- Structo (Singapore)

- Prodways (France)

- NextDent (Netherlands)

- Asiga (Australia)

- Shining 3D (China)

- Zortrax (Poland)

What are the Recent Developments in FDA-Cleared 3D-Printed Denture Devices Market?

- In April 2023, 3Shape, a global leader in digital dental solutions, launched a strategic initiative in South Africa to expand the adoption of its 3D-printed denture technologies in both clinical and laboratory settings. The initiative focuses on improving access to high-precision dentures while offering training programs for dental professionals on CAD/CAM and 3D printing workflows. By leveraging its global expertise and advanced product portfolio, 3Shape aims to address regional dental care challenges while reinforcing its presence in the rapidly growing global 3D-printed denture devices market.

- In March 2023, Ivoclar Vivadent, a leading dental materials and digital solutions provider, introduced its next-generation 3D printing resin for denture fabrication, designed specifically for high-strength, biocompatible prosthetics. This resin enables faster production and enhanced aesthetics, underscoring Ivoclar Vivadent’s commitment to innovation in digital dentistry and patient-centered solutions. The product launch highlights the increasing adoption of advanced 3D printing materials in both clinical and laboratory workflows worldwide.

- In March 2023, Dentsply Sirona successfully implemented a large-scale digital denture program in Bengaluru, India, aimed at modernizing prosthodontic workflows for dental hospitals and clinics. This project leveraged cutting-edge 3D printing and CAD/CAM technologies to improve denture accuracy, reduce production time, and enhance patient satisfaction. The initiative emphasizes the growing significance of digital denture solutions in emerging markets and their role in expanding access to high-quality prosthetics.

- In February 2023, Formlabs, a leading provider of 3D printing systems, announced a strategic partnership with dental laboratories in the U.S. to create a streamlined 3D-printed denture production network. This collaboration aims to enhance workflow efficiency, reduce turnaround times, and ensure consistent quality for dental prosthetics. The initiative highlights Formlabs’ commitment to innovation and operational excellence in the dental industry.

- In January 2023, Straumann Group, a global leader in implant and restorative dentistry, unveiled its AI-powered digital denture planning software at the International Dental Show (IDS) 2023. This advanced software integrates with 3D printing technologies to provide customized, high-precision dentures while allowing dental professionals to simulate and optimize fit before production. The launch underscores Straumann’s dedication to leveraging digital solutions to improve patient outcomes and efficiency in prosthodontic care.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.