Global Feed Anticoccidials For Ruminants Market

Market Size in USD Million

CAGR :

%

USD

345.54 Million

USD

506.64 Million

2024

2032

USD

345.54 Million

USD

506.64 Million

2024

2032

| 2025 –2032 | |

| USD 345.54 Million | |

| USD 506.64 Million | |

|

|

|

|

Feed Anticoccidials for Ruminants Market Size

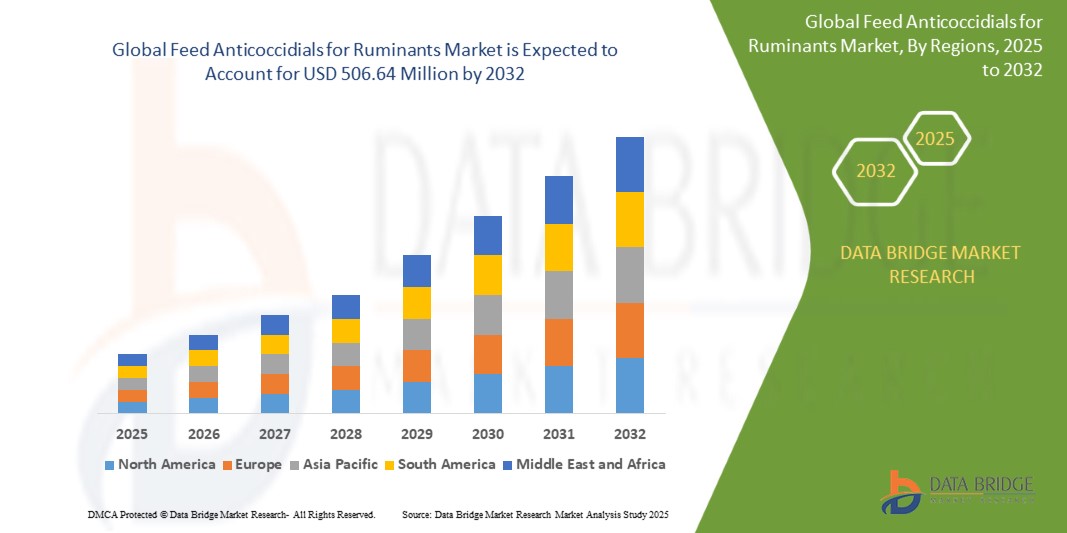

- The global feed anticoccidials for ruminants market size was valued at USD 345.54 million in 2024 and is expected to reach USD 506.64 million by 2032, at a CAGR of 4.90% during the forecast period

- The market growth is largely fuelled by the rising incidence of coccidiosis in livestock and the increasing demand for disease-free and high-quality meat and dairy products

- In addition, growing awareness among farmers regarding livestock health, improved animal husbandry practices, and government initiatives promoting animal welfare and productivity are further supporting market expansion

Feed Anticoccidials for Ruminants Market Analysis

- Rising investments in veterinary healthcare and feed additive innovation are enhancing product efficacy and shelf-life

- Technological advancements in nutritional supplements and growing commercialization of animal-based food products are contributing to long-term market growth

- Asia-Pacific dominates the feed anticoccidials for ruminants market, fuelled by its vast livestock population, rising demand for quality meat and dairy products, and increasing awareness of coccidiosis prevention through medicated feed solutions

- North America region is expected to witness the highest growth rate in the global feed anticoccidials for ruminants market, driven by well-established livestock industry, stringent regulatory standards on animal health and feed safety, and rising investments in animal nutrition innovation

- The calves segment accounted for the largest market revenue share in 2024, driven by the high vulnerability of young animals to coccidial infections during early growth stages. Farmers and producers increasingly adopt preventive feeding programs for calves to reduce early-life morbidity and promote weight gain. The demand for targeted anticoccidial solutions in starter feeds continues to rise, supporting long-term herd health and performance

Report Scope and Feed Anticoccidials for Ruminants Market Segmentation

|

Attributes |

Feed Anticoccidials for Ruminants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Feed Anticoccidials for Ruminants Market Trends

“Growing Shift Towards Natural and Plant-Based Coccidiosis Control”

- There is a rising preference for plant-based anticoccidials such as essential oils, saponins, and tannins due to their antimicrobial and gut health-enhancing benefits

- Regulatory restrictions on synthetic coccidiostats in regions such as the European Union are accelerating the shift toward natural alternatives

- Consumers are increasingly demanding antibiotic-free and organic meat and milk products, driving interest in herbal feed solutions

- Research investment is growing in phytogenic compounds that support immune function and improve resistance to coccidiosis

- For instance, dairy cooperatives in India introducing neem and turmeric-based feed additives to reduce reliance on ionophores in young calves

Feed Anticoccidials for Ruminants Market Dynamics

Driver

“Rising Incidence of Coccidiosis and Increasing Awareness Among Livestock Farmers”

- Coccidiosis remains a leading cause of productivity losses in ruminants, particularly calves, due to reduced weight gain and increased morbidity

- Livestock producers are adopting preventive anticoccidials in feed to maintain herd health and operational profitability

- Governments and veterinary institutions are organizing awareness campaigns on disease management and appropriate feed supplementation

- The expansion of commercial livestock operations, especially in Asia-Pacific and Latin America, is boosting demand for coccidiosis control measures

- For instance, a large cattle feedlot in Brazil reporting a 15% improvement in feed efficiency after introducing routine anticoccidial feed programs

Restraint/Challenge

“Stringent Regulations and Risk of Drug Resistance”

- Several countries are tightening regulations on the use of ionophores and chemical coccidiostats, citing food safety concerns

- Drug resistance in Eimeria species is becoming a concern due to prolonged and unmonitored use of the same anticoccidial compounds

- Regulatory requirements for residue monitoring and withdrawal periods increase compliance costs for manufacturers and producers

- Consumer pressure for residue-free animal products is compelling the industry to explore alternatives, complicating product selection

- For instance, farms in France reporting reduced monensin efficacy, prompting a mandatory shift to anticoccidial rotation strategies to regain control effectiveness

Feed Anticoccidials for Ruminants Market Scope

The market is segmented on the basis of ruminant type, type, and form.

• By Ruminant Type

On the basis of ruminant type, the feed anticoccidials for ruminants market is segmented into calves, dairy cattle, beef cattle, and others. The calves segment accounted for the largest market revenue share in 2024, driven by the high vulnerability of young animals to coccidial infections during early growth stages. Farmers and producers increasingly adopt preventive feeding programs for calves to reduce early-life morbidity and promote weight gain. The demand for targeted anticoccidial solutions in starter feeds continues to rise, supporting long-term herd health and performance.

The dairy cattle segment is expected to witness a fastest growth rate from 2025 to 2032, fueled by the need to prevent productivity losses linked to subclinical coccidiosis. With dairy farms focused on improving milk yield and animal welfare, the use of feed-based anticoccidials is becoming a key part of herd management strategies.

• By Type

On the basis of type, the market is segmented into monensin, salinomycin, narasin, and diclazuril. The monensin segment dominated the market in 2024 due to its wide usage across ruminant species for both therapeutic and growth-promoting purposes. Known for its broad efficacy and cost-effectiveness, monensin remains a popular choice in feed formulations across large-scale operations.

The diclazuril segment is expected to witness a fastest growth rate from 2025 to 2032, driven by its selective action, low toxicity, and minimal residue concerns. Producers are increasingly choosing diclazuril in response to growing regulatory scrutiny and rising consumer preference for safer, residue-free meat and milk products.

• By Form

On the basis of form, the market is segmented into dry and liquid. The dry segment held the largest revenue share in 2024, supported by its ease of mixing in feed mills and stability during storage and transport. Dry anticoccidial products are commonly used in both commercial feed production and on-farm mixing due to convenience and compatibility with bulk feed systems.

The liquid segment is expected to witness a fastest growth rate from 2025 to 2032, driven by its increasing use in precision dosing systems and customized feeding programs. Liquid anticoccidials are gaining traction in modern operations for their uniform distribution in total mixed rations (TMR) and improved absorption in ruminants.

Feed Anticoccidials for Ruminants Market Regional Analysis

- Asia-Pacific dominates the feed anticoccidials for ruminants market, fuelled by its vast livestock population, rising demand for quality meat and dairy products, and increasing awareness of coccidiosis prevention through medicated feed solutions

- Countries in the region are witnessing rapid improvements in animal husbandry practices, supported by growing investments in veterinary healthcare, feed formulation technologies, and rural livestock development programs

- The strong presence of local feed producers and expanding commercial farming operations contribute to the widespread adoption of anticoccidials across both dairy and beef sectors

China Feed Anticoccidials for Ruminants Market Insight

China is expected to hold a substantial share in the Asia-Pacific feed anticoccidials for ruminants market, driven by its massive cattle population, modernization of animal farming practices, and rising demand for safe and efficient meat and dairy production. With growing concern over livestock disease outbreaks and economic losses from protozoal infections, the use of anticoccidial feed additives is becoming increasingly widespread. Government-led initiatives to enhance rural veterinary services and commercial feed quality are further strengthening market growth. In addition, the presence of domestic manufacturers and increasing investment in advanced feed technologies contribute to the country’s market dominance.

Japan Feed Anticoccidials for Ruminants Market Insight

Japan is expected to witness a fastest growth rate from 2025 to 2032, supported by its highly regulated livestock industry and focus on animal health management. Although Japan has a comparatively smaller cattle population, the market is driven by high-value dairy and beef production systems that prioritize disease prevention and feed efficiency. The country’s advanced veterinary infrastructure, emphasis on food safety, and integration of precision farming techniques promote the adoption of specialized feed additives, including anticoccidials. Growing consumer demand for premium, disease-free animal products further supports market development.

North America Feed Anticoccidials for Ruminants Market Insight

North America is expected to witness a fastest growth rate from 2025 to 2032, driven by well-established livestock sectors, stringent biosecurity protocols, and high awareness of feed quality standards. The region is home to key market players offering innovative anticoccidial solutions tailored to commercial production systems. Increasing concern over antimicrobial resistance has prompted a shift towards targeted ionophore-based treatments in feed. The U.S. continues to be a leader in veterinary nutrition research and adoption of performance-enhancing additives.

U.S. Feed Anticoccidials for Ruminants Market Insight

The U.S. is expected to witness a fastest growth rate from 2025 to 2032, driven by a large population of dairy and beef cattle, advanced animal nutrition infrastructure, and increased adoption of precision livestock farming. Coccidiosis remains a common threat to calf and young cattle health, leading producers to integrate anticoccidials in feed as a preventive measure. High commercial awareness, widespread availability of medicated feed, and strict monitoring of livestock health support continued market expansion.

Europe Feed Anticoccidials for Ruminants Market Insight

Europe is expected to witness a fastest growth rate from 2025 to 2032, supported by increased demand for sustainable and residue-free animal feed solutions. The region’s shift away from antibiotic growth promoters is encouraging producers to adopt safer anticoccidials with minimal environmental impact. Rising demand for organic meat and dairy products, particularly in Western Europe, has also driven the development of compliant feed formulations. Countries such as Germany and France are leading the charge in research-backed, regulatory-compliant livestock feed enhancements.

Germany Feed Anticoccidials for Ruminants Market Insight

Germany is expected to witness a fastest growth rate from 2025 to 2032, driven by its robust dairy industry and stringent animal welfare regulations. The country emphasizes feed safety and disease prevention, prompting early adoption of anticoccidial feed additives. Germany’s investment in agricultural innovation, along with rising demand for high-yield cattle breeds, supports the growth of advanced veterinary feed solutions aimed at improving livestock health and productivity.

U.K. Feed Anticoccidials for Ruminants Market Insight

The U.K. feed anticoccidials for ruminants market is expected to witness a fastest growth rate from 2025 to 2032, driven by stringent animal health regulations and an increasing emphasis on sustainable livestock production. The country’s well-established dairy and beef industries are investing in preventive healthcare solutions to minimize productivity losses due to coccidiosis. Rising awareness among livestock farmers about the economic impact of parasitic infections, coupled with ongoing research and veterinary support, is contributing to higher adoption of anticoccidial feed additives. In addition, the U.K.’s focus on antibiotic reduction in animal farming is pushing demand for targeted, effective anticoccidial products that support animal welfare without compromising productivity.

Feed Anticoccidials for Ruminants Market Share

The feed anticoccidials for ruminants industry is primarily led by well-established companies, including:

- Bioproperties Pty Ltd (Australia)

- Ceva (France)

- Elanco (U.S.)

- Impextraco NV (Belgium)

- Kemin Industries, Inc (U.S.)

- Intervet International B.V. (Netherlands)

- Qilu Animal Health Products Co., Ltd. (China)

- Virbac (France)

- Zoetis (U.S.)

- Phibro Animal Health Corporation (U.S.)

- Bayer AG (Germany)

- Huvepharma (Bulgaria)

- Zydus Animal Health (India)

- Merck & Co., Inc. (U.S.)

Latest Developments in Global Feed Anticoccidials for Ruminants Market

- In May 2021, Elanco Animal Health Incorporated (NYSE: ELAN) introduced ZoaShield in the United States. This new product provides poultry producers with a proven, flexible zoalene solution designed to effectively manage and control coccidiosis in a straightforward and manageable manner

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.