Global Feed Flavonoids Market

Market Size in USD Billion

CAGR :

%

USD

595.16 Billion

USD

1,151.52 Billion

2025

2033

USD

595.16 Billion

USD

1,151.52 Billion

2025

2033

| 2026 –2033 | |

| USD 595.16 Billion | |

| USD 1,151.52 Billion | |

|

|

|

|

Global Feed Flavonoids Market Size

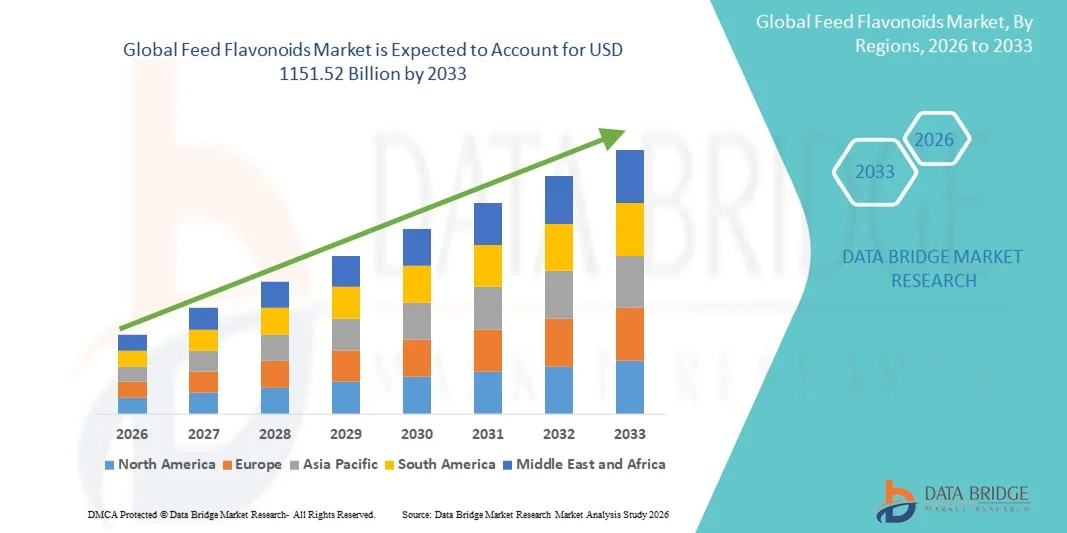

- The global Feed Flavonoids Market size was valued at USD 595.16 billion in 2025 and is expected to reach USD 1151.52 billion by 2033, at a CAGR of 8.60% during the forecast period.

- The market growth is largely fueled by the increasing awareness of animal health and nutrition, coupled with the rising demand for natural feed additives to enhance livestock performance and immunity.

- Furthermore, growing consumer preference for safe and high-quality animal-derived products, along with advancements in feed formulation technologies, is driving the adoption of flavonoid-based feed solutions. These factors are accelerating market expansion, thereby significantly boosting the industry’s growth.

Global Feed Flavonoids Market Analysis

- Feed flavonoids, naturally occurring plant compounds used as dietary supplements in animal feed, are increasingly recognized for their role in improving livestock health, growth performance, and immunity in both poultry and livestock production systems due to their antioxidant, anti-inflammatory, and antimicrobial properties.

- The escalating demand for feed flavonoids is primarily fueled by the growing awareness of animal health and productivity, rising consumer preference for natural and safe feed additives, and stricter regulations on synthetic growth promoters and antibiotics in animal feed.

- North America dominated the Global Feed Flavonoids Market with the largest revenue share of 35.8% in 2025, characterized by well-established livestock farming, stringent food safety regulations, and the presence of key industry players, with the U.S. witnessing substantial growth in flavonoid-enriched feed adoption driven by innovations in feed formulations and functional additive blends.

- Asia-Pacific is expected to be the fastest-growing region in the Global Feed Flavonoids Market during the forecast period due to increasing livestock production, rising consumer awareness about animal-derived food quality, and expanding investments in sustainable and natural feed solutions.

- The Flavanols segment dominated the market with the largest revenue share of 38.5% in 2025, owing to their well-documented antioxidant and antimicrobial properties, which improve livestock immunity, gut health, and growth performance.

Report Scope and Global Feed Flavonoids Market Segmentation

|

Attributes |

Feed Flavonoids Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Feed Flavonoids Market Trends

Enhanced Livestock Performance Through Precision Nutrition

- A significant and accelerating trend in the global Feed Flavonoids Market is the increasing integration of precision nutrition technologies and data-driven feed formulations. This fusion of science and technology is significantly enhancing the efficiency, health, and productivity of livestock operations.

- For instance, flavonoid-enriched feed blends can be precisely tailored based on species, growth stage, and production goals, allowing poultry and livestock farmers to optimize growth rates, improve immune response, and enhance overall feed conversion ratios. Similarly, feed additive companies such as DSM and Adisseo offer specialized flavonoid formulations designed for targeted antioxidant or anti-inflammatory effects.

- Integration with digital feed management systems enables features such as monitoring livestock health parameters, tracking feed intake patterns, and adjusting flavonoid levels in real time to maximize benefits. For example, some advanced systems use AI to analyze animal performance data and suggest optimal flavonoid supplementation strategies, reducing wastage and improving farm profitability.

- The seamless incorporation of flavonoid-based feed additives with broader animal nutrition programs facilitates a holistic approach to livestock management. Through a single platform, farmers can manage feed composition alongside vitamins, minerals, and probiotics, creating a unified and optimized nutritional strategy.

- This trend towards more intelligent, tailored, and science-backed feed solutions is fundamentally reshaping expectations for animal nutrition. Consequently, companies such as Alltech and Kemin are developing precision flavonoid supplements with features such as optimized dosing, enhanced bioavailability, and compatibility with automated feed delivery systems.

- The demand for feed flavonoids integrated with precision nutrition technologies is growing rapidly across both poultry and livestock sectors, as producers increasingly prioritize animal health, productivity, and sustainable farming practices.

Global Feed Flavonoids Market Dynamics

Driver

Growing Need Due to Rising Demand for Animal Health and Sustainable Nutrition

- The increasing awareness of livestock health, productivity, and sustainable farming practices, coupled with the accelerating demand for natural feed additives, is a significant driver for the heightened adoption of feed flavonoids.

- For instance, in 2025, DSM announced the launch of a next-generation flavonoid feed additive aimed at enhancing poultry immunity and growth performance while reducing reliance on synthetic growth promoters. Such innovations by key companies are expected to drive market growth during the forecast period.

- As livestock farmers become more aware of the benefits of flavonoid supplementation, these compounds offer advantages such as improved feed conversion ratios, enhanced antioxidant and anti-inflammatory effects, and overall better animal health, providing a compelling alternative to traditional feed additives.

- Furthermore, the growing trend of integrated livestock management and precision nutrition systems is making flavonoid-enriched feed an integral component of modern animal husbandry, allowing seamless incorporation with vitamins, minerals, probiotics, and other feed supplements.

- The convenience of ready-to-use flavonoid formulations, compatibility with automated feeding systems, and the ability to tailor supplementation to specific animal species or production stages are key factors propelling adoption across poultry, swine, and ruminant sectors. The trend towards scientifically optimized feed programs and increasing availability of user-friendly flavonoid products further contribute to market growth.

Restraint/Challenge

Concerns Regarding Cost and Regulatory Compliance

- The relatively high cost of some flavonoid-enriched feed additives compared to conventional feed solutions poses a significant challenge to broader market adoption, particularly for small-scale or price-sensitive livestock farmers.

- For instance, premium flavonoid formulations from companies such as Alltech and Adisseo, while highly effective, may be less accessible in developing regions due to higher initial investment requirements.

- Addressing regulatory compliance and ensuring consistent quality are also crucial challenges, as feed additives are subject to strict local and international regulations regarding safety, efficacy, and labeling. Non-compliance or inconsistent quality can reduce farmer confidence and hinder adoption.

- While prices are gradually becoming more competitive and new cost-effective formulations are emerging, the perception of premium pricing and regulatory hurdles can still limit widespread use, especially among small or resource-constrained farms.

- Overcoming these challenges through cost optimization, consistent product quality, regulatory adherence, and farmer education on the benefits of flavonoids will be vital for sustained market growth.

Global Feed Flavonoids Market Scope

Feed flavonoids market is segmented on the basis of product type and form.

- By Product Type

On the basis of product type, the Global Feed Flavonoids Market is segmented into Anthocyanidins, Flavanols, Flavones, Flavan-3-ols, Flavanones, Isoflavones, Chalcones, and Others. The Flavanols segment dominated the market with the largest revenue share of 38.5% in 2025, owing to their well-documented antioxidant and antimicrobial properties, which improve livestock immunity, gut health, and growth performance. Flavanols are widely incorporated into poultry, swine, and ruminant feed formulations due to their versatility and proven efficacy in enhancing feed efficiency and overall productivity.

The Isoflavones segment is anticipated to witness the fastest growth rate of 21.3% from 2026 to 2033, driven by increasing demand for natural growth promoters and rising awareness among livestock farmers about hormone-regulating and reproductive benefits. The growth of isoflavone-enriched feed is further supported by regulatory encouragement for natural additives and the expanding trend of functional feed formulations designed for specific animal health outcomes.

- By Form

On the basis of form, the Global Feed Flavonoids Market is segmented into Powder and Liquid. The Powder segment dominated the market with the largest revenue share of 65.2% in 2025, primarily due to its ease of storage, longer shelf life, and convenient incorporation into conventional feed manufacturing processes. Powdered flavonoids allow precise dosing, consistent distribution within feed, and compatibility with automated feed mixers, making them highly preferred by large-scale livestock and poultry producers.

The Liquid segment is expected to witness the fastest CAGR of 22.0% from 2026 to 2033, driven by the increasing adoption of liquid feed supplements in precision feeding systems and integrated livestock management platforms. Liquid flavonoids facilitate rapid absorption, targeted supplementation, and compatibility with water-soluble feed additives, which improves feed efficiency and animal performance. The rising trend of customized liquid feed formulations for high-value animals and intensive farming systems is further propelling market growth in this segment.

Global Feed Flavonoids Market Regional Analysis

- North America dominated the Global Feed Flavonoids Market with the largest revenue share of 35.8% in 2025, driven by the well-established livestock industry, high awareness of animal health and nutrition, and the growing demand for natural and functional feed additives.

- Livestock farmers in the region prioritize flavonoid-enriched feed for its proven benefits in improving immunity, growth performance, and overall productivity, as well as reducing reliance on synthetic growth promoters and antibiotics.

- This widespread adoption is further supported by advanced feed manufacturing infrastructure, strong presence of key industry players, and the availability of high-quality flavonoid formulations, establishing feed flavonoids as a preferred choice for poultry, swine, and ruminant nutrition programs in both commercial and industrial farming operations.

U.S. Feed Flavonoids Market Insight

The U.S. feed flavonoids market captured the largest revenue share of 81% in 2025 within North America, fueled by the growing focus on animal health, sustainable farming practices, and rising demand for natural feed additives. Livestock producers are increasingly prioritizing immune-boosting and performance-enhancing supplements in poultry, dairy, and swine diets. The rising preference for functional and antibiotic-free feed solutions, combined with robust research and development by leading feed additive companies, further propels the feed flavonoids market. Moreover, the growing integration of flavonoids with other nutraceutical feed additives is significantly contributing to market expansion.

Europe Feed Flavonoids Market Insight

The Europe feed flavonoids market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strict regulations on antibiotic use in animal feed and increasing awareness of animal welfare. The region’s shift towards sustainable livestock farming and the demand for high-quality meat and dairy products is fostering the adoption of flavonoid-enriched feed. European producers are also leveraging feed flavonoids to improve livestock productivity, immunity, and overall health, with significant adoption across poultry, swine, and dairy sectors.

U.K. Feed Flavonoids Market Insight

The U.K. feed flavonoids market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising focus on sustainable animal nutrition and functional feed solutions. Additionally, consumer concerns about food safety and quality are encouraging producers to adopt natural feed additives like flavonoids. The U.K.’s advanced livestock industry and well-established regulatory framework for animal nutrition are expected to continue supporting market growth.

Germany Feed Flavonoids Market Insight

The Germany feed flavonoids market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of natural feed solutions and the growing adoption of sustainable livestock farming practices. Germany’s emphasis on innovation, research, and environmental sustainability promotes the use of flavonoid-enriched feed across poultry, swine, and dairy segments. The integration of feed flavonoids into functional and performance-enhancing diets is also gaining traction in both commercial and small-scale farming operations.

Asia-Pacific Feed Flavonoids Market Insight

The Asia-Pacific feed flavonoids market is poised to grow at the fastest CAGR of 24% during the forecast period of 2026 to 2033, driven by rising livestock production, increasing urbanization, and growing demand for high-quality meat, dairy, and aquaculture products in countries such as China, India, and Japan. The region’s expanding livestock sector, combined with government initiatives supporting sustainable and efficient feed practices, is driving the adoption of feed flavonoids. Furthermore, as APAC emerges as a major hub for feed additive production, the affordability and accessibility of flavonoid-enriched feed are increasing across the region.

Japan Feed Flavonoids Market Insight

The Japan feed flavonoids market is gaining momentum due to the country’s emphasis on livestock health, high-quality food production, and functional feed adoption. Japanese producers are increasingly integrating flavonoids with other nutraceutical feed additives to enhance poultry, swine, and aquaculture performance. Moreover, the demand for natural and sustainable feed solutions is rising in response to strict food safety regulations and consumer preferences for high-quality animal products.

China Feed Flavonoids Market Insight

The China feed flavonoids market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid growth in livestock and aquaculture production, urbanization, and rising demand for high-quality meat, dairy, and aquatic products. China stands as one of the largest markets for feed additives, and flavonoids are increasingly incorporated into commercial feed formulations. The focus on antibiotic-free feed, government support for sustainable livestock farming, and strong domestic feed additive manufacturers are key factors driving market growth in China.

Global Feed Flavonoids Market Share

The Feed Flavonoids industry is primarily led by well-established companies, including:

• DSM Nutritional Products (Netherlands)

• ADM Animal Nutrition (U.S.)

• Cargill (U.S.)

• BASF SE (Germany)

• Novus International (U.S.)

• DuPont Nutrition & Biosciences (U.S.)

• Nutreco N.V. (Netherlands)

• Evonik Industries (Germany)

• Kemin Industries (U.S.)

• Zhejiang NHU Co., Ltd. (China)

• Anhui Seawave Biotechnology Co., Ltd. (China)

• Purina Animal Nutrition (U.S.)

• Biomin GmbH (Austria)

• Lallemand Animal Nutrition (Canada)

• Phytobiotics Futterzusatzstoffe GmbH (Germany)

• Adisseo (France)

• Alltech Inc. (U.S.)

• Furst-McNess Company (U.S.)

• Nutriad International (Belgium)

• Zhejiang Huijia Bioengineering Co., Ltd. (China)

What are the Recent Developments in Global Feed Flavonoids Market?

- In April 2024, DSM Nutritional Products, a global leader in animal nutrition, launched a strategic initiative in South Africa aimed at improving livestock health and productivity through its advanced feed flavonoid solutions. This initiative underscores the company’s dedication to delivering innovative, natural feed additives tailored to the unique nutritional needs of the regional livestock industry. By leveraging its global expertise and cutting-edge product portfolio, DSM Nutritional Products is not only addressing local challenges but also reinforcing its position in the rapidly growing global Feed Flavonoids Market.

- In March 2024, Cargill, a major global feed producer, introduced a new flavonoid-enriched feed formulation specifically designed for poultry and swine farms. The innovative product aims to enhance immunity, improve growth performance, and promote overall animal health. This advancement highlights Cargill’s commitment to developing science-backed, natural feed solutions that support sustainable and efficient livestock production.

- In March 2024, ADM Animal Nutrition successfully implemented a large-scale flavonoid supplementation program for commercial dairy farms in India, aimed at improving milk yield and herd health. This initiative harnesses state-of-the-art feed additive technologies to optimize nutrition and animal well-being, underscoring ADM’s dedication to using innovation to drive productivity and sustainability in livestock farming.

- In February 2024, Kemin Industries, a leading provider of natural feed additives, announced a strategic partnership with the China Feed Industry Association to promote flavonoid-enriched feed solutions for poultry and aquaculture producers. This collaboration is designed to enhance animal health, streamline feed supplementation practices, and improve farm-level productivity. The initiative underscores Kemin’s commitment to driving innovation and operational efficiency within the livestock and aquaculture sectors.

- In January 2024, BASF SE, a global leader in nutritional solutions, unveiled a new line of flavonoid-based feed additives for poultry and swine at the International Feed Expo 2024. These advanced formulations enable producers to improve animal immunity and growth performance naturally, reflecting BASF’s commitment to integrating advanced nutritional science into sustainable livestock feed solutions while addressing the increasing demand for antibiotic-free and functional feeds.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.