Global Feed Formic Acid Market

Market Size in USD Million

CAGR :

%

USD

1.36 Million

USD

2.02 Million

2025

2033

USD

1.36 Million

USD

2.02 Million

2025

2033

| 2026 –2033 | |

| USD 1.36 Million | |

| USD 2.02 Million | |

|

|

|

|

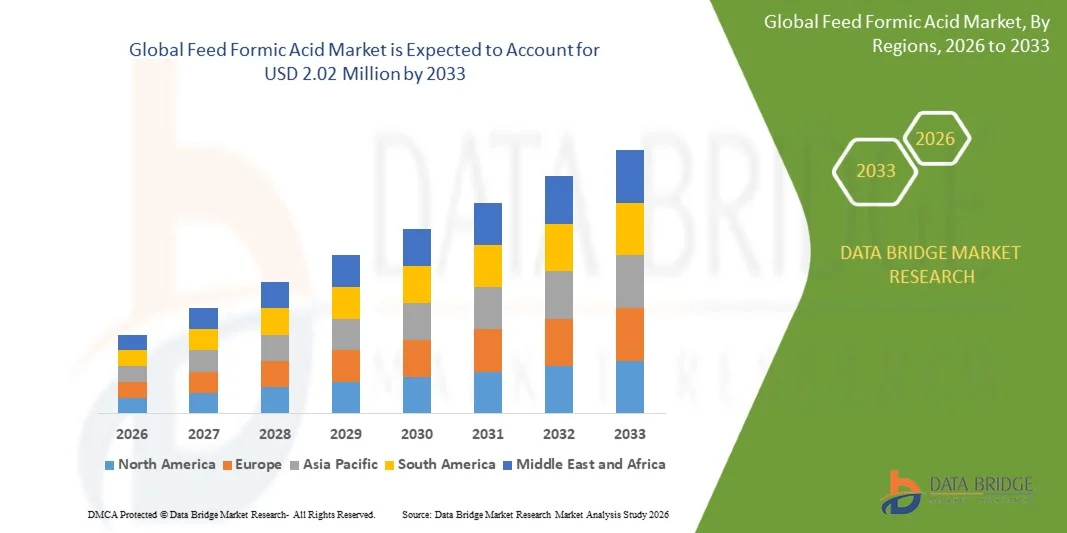

What is the Global Feed Formic Acid Market Size and Growth Rate?

- The global feed formic acid market size was valued at USD 1.36 million in 2025 and is expected to reach USD 2.02 million by 2033, at a CAGR of 5.10% during the forecast period

- Increasing applications of product in pesticide, leather, dyes, pharmaceuticals and rubber industries, increasing demand for preservatives and feed additives, rising demand for tyres and consumer products, rise in consumption of formic acid as an antibacterial agent for animal feed and usage as silage preservative in agriculture, rising demand of the acid due to its superior antibacterial properties, improving standard of living of the people are some of the major as well as vital factors which will such as to augment the growth of the feed formic acid market

What are the Major Takeaways of Feed Formic Acid Market?

- Increasing prevalence of favourable legislations and regulations along with surging levels of investment in the development of formic acid across the value chain which will further contribute by generating massive opportunities that will lead to the growth of the feed formic acid market

- Adverse effects of the product along with availability of cost effective substitutes which will such asly to act as market restraints factor for the growth of the feed formic acid in the above mentioned projected timeframe. Greener chemical processing along with rising number of regulations regarding the usage which will become the biggest and foremost challenge for the growth of the market

- Asia-Pacific dominated the feed formic acid market with a 42.5% revenue share in 2025, driven by strong adoption of natural, nutrient-enriched, and clean-label feed additives across China, Japan, India, and South Korea

- North America is projected to register the fastest CAGR of 8.9% from 2026 to 2033, driven by growing awareness of animal health, feed efficiency, and regulatory compliance in the U.S. and Canada

- The Oxalic Acid segment dominated the market with a revenue share of 61.5% in 2025, supported by its cost-effective production, wide availability, and compatibility with feed additive formulations for livestock, poultry, and aquaculture

Report Scope and Feed Formic Acid Market Segmentation

|

Attributes |

Feed Formic Acid Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Feed Formic Acid Market?

“Rising Demand for Multifunctional and Sustainable Feed Formic Acid”

- The feed formic acid market is witnessing strong growth due to increasing adoption of multifunctional additives that improve animal health, feed efficiency, and nutrient absorption in poultry, swine, and ruminants. Formic acid is increasingly blended with other organic acids and probiotics to enhance performance and feed stability

- Manufacturers are introducing feed acidifiers and preservative systems that support gut health, reduce pathogenic bacteria, and improve feed conversion ratios, meeting demand across livestock, aquaculture, and pet food sectors

- Consumers and livestock operators are prioritizing safe, natural, and environmentally sustainable feed solutions, driving adoption across industrial farms and small-scale operations

- For instance, companies such as BASF, Perstorp, Eastman Chemical, Novus International, and Evonik have expanded their formic acid-based feed solutions for poultry, swine, and ruminant applications

- Growing awareness of animal health, antibiotic reduction, and clean-label feed practices is accelerating global market adoption

- As farmers and feed manufacturers continue seeking multifunctional, sustainable, and performance-enhancing additives, Feed Formic Acid is expected to remain central to innovation in the animal nutrition industry

What are the Key Drivers of Feed Formic Acid Market?

- Rising demand for natural, safe, and multifunctional feed additives is driving strong adoption of Feed Formic Acid globally

- For instance, in 2025, BASF, Perstorp, and Evonik introduced advanced feed acid blends to improve gut health, feed conversion, and pathogen control in livestock and aquaculture

- Increasing global awareness of antibiotic-free feed, livestock health management, and performance optimization is boosting demand across North America, Europe, and Asia-Pacific

- Technological advancements in feed preservation, microencapsulation, and blending techniques have improved stability, efficacy, and palatability of formic acid formulations

- Rising adoption of organic, sustainable, and clean-label feed solutions further contributes to market growth, supported by regulatory and consumer demand for environmentally responsible ingredients

- With ongoing R&D, new product launches, and expanded distribution, the Feed Formic Acid market is expected to maintain robust growth in the coming years

Which Factor is Challenging the Growth of the Feed Formic Acid Market?

- High production and purification costs of concentrated feed-grade formic acid limit affordability in price-sensitive regions

- For instance, during 2024–2025, fluctuations in raw material supply, chemical prices, and energy costs affected production volumes for several manufacturers

- Strict regulatory standards for feed safety, additive registration, and environmental compliance increase operational complexities

- Limited awareness in emerging markets about the benefits of feed acidifiers and gut health restricts widespread adoption

- Strong competition from alternative organic acids, probiotics, and synthetic feed preservatives creates pricing and differentiation pressures

- To overcome these challenges, companies are focusing on cost optimization, regulatory compliance, technical support, and farmer education to expand global adoption of high-quality Feed Formic Acid products

How is the Feed Formic Acid Market Segmented?

The market is segmented on the basis of production method, grade type, and application.

• By Production Method

On the basis of production method, the feed formic acid market is segmented into Oxalic Acid and Carbonylation of Methanol. The Oxalic Acid segment dominated the market with a revenue share of 61.5% in 2025, supported by its cost-effective production, wide availability, and compatibility with feed additive formulations for livestock, poultry, and aquaculture. Oxalic acid-derived formic acid is widely adopted for improving gut health, enhancing nutrient absorption, and controlling pathogenic bacteria in animal feed. Manufacturers prefer this method due to simpler process requirements, stable yield, and ease of integration into commercial feed production.

The Carbonylation of Methanol segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing demand for high-purity, industrial-grade formic acid with precise concentration control. Advancements in carbonylation technology, regulatory approvals, and applications in premium feed solutions are driving growth in this segment globally.

• By Grade Type

On the basis of grade type, the feed formic acid market is segmented into 75%, 80%, 85%, 94%, and 99% concentrations. The 85% grade dominated the market with a revenue share of 63.2% in 2025, driven by its optimal balance of acidity, stability, and cost-effectiveness for livestock and poultry feed applications. This grade ensures effective microbial control, preserves silage quality, and improves feed efficiency, making it the most widely adopted by commercial feed producers.

The 99% grade segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by demand for high-purity feed acid solutions in specialized applications, including aquaculture, veterinary, and precision livestock farming. Increasing focus on quality assurance, regulatory compliance, and high-performance feed additives is fueling the adoption of premium-grade formic acid in North America, Europe, and Asia-Pacific.

• By Application

On the basis of application, the feed formic acid market is segmented into Silage Additive and Preservative. The Silage Additive segment dominated the market with a revenue share of 65.1% in 2025, driven by its critical role in improving feed stability, preventing spoilage, and enhancing nutrient retention in silage for livestock, poultry, and ruminants. Feed manufacturers widely use formic acid as a natural acidifier to maintain microbial balance, reduce pathogenic growth, and improve feed conversion ratios.

The Preservative segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing demand for natural, chemical-free feed preservatives in processed feeds, premixes, and aquaculture diets. Rising health consciousness, clean-label preferences, and growing adoption of multifunctional feed additives are driving rapid adoption globally, particularly in Asia-Pacific and North America.

Which Region Holds the Largest Share of the Feed Formic Acid Market?

- Asia-Pacific dominated the feed formic acid market with a 42.5% revenue share in 2025, driven by strong adoption of natural, nutrient-enriched, and clean-label feed additives across China, Japan, India, and South Korea

- Rising awareness of livestock health, improved feed conversion, and demand for high-quality poultry, aquaculture, and ruminant feed supports widespread adoption. Leading feed manufacturers are expanding formic acid-based solutions with innovations in preservative blends, acidifiers, and silage additive

- Rapid urbanization, increasing disposable incomes, and supportive agricultural policies further strengthen regional growth

China Feed Formic Acid Market Insight

China is the largest contributor in Asia-Pacific, supported by robust feed production infrastructure and high livestock output. Strong demand exists for silage additives, preservatives, and multifunctional feed acids to improve gut health and feed efficiency. Manufacturers are investing in R&D, vertical integration, and eco-friendly production methods to ensure supply stability. Rising government initiatives for sustainable livestock farming and quality assurance, coupled with growing export potential, continue to drive adoption, making China the cornerstone of the Asia-Pacific Feed Formic Acid market.

Japan Feed Formic Acid Market Insight

Japan shows steady growth due to high adoption of feed formic acids in poultry, swine, and aquaculture sectors. Feed manufacturers focus on high-purity formic acid products to meet stringent regulatory standards, enhance nutrient absorption, and improve microbial control in silage and feed mixes. Rising demand for chemical-free, sustainable feed solutions in livestock farming supports market expansion. Strong retail and B2B distribution networks, combined with advanced research in additive formulations, continue to maintain Japan’s stable growth trajectory in the regional market.

India Feed Formic Acid Market Insight

India is emerging as a key growth market in Asia-Pacific, fueled by rising livestock production, poultry expansion, and awareness of gut health for animals. Feed formic acids are increasingly used to enhance silage quality, preserve feed, and improve animal performance. E-commerce penetration, modern feed manufacturing, and small-to-medium farm adoption accelerate market reach. Growing investment in agricultural infrastructure and demand for clean-label feed additives support rapid regional adoption, positioning India as a significant contributor to the Feed Formic Acid market.

South Korea Feed Formic Acid Market Insight

South Korea contributes significantly to Asia-Pacific growth due to rising demand for high-quality livestock feed, aquaculture, and poultry products. Manufacturers are introducing multifunctional formic acid solutions that improve feed safety, stability, and efficiency. Influences from wellness trends, export-oriented livestock products, and government support for sustainable feed additives drive adoption. Strong urban farming initiatives, technological integration in feed production, and premium product development further enhance market expansion, making South Korea an important player in the Asia-Pacific Feed Formic Acid market.

North America Feed Formic Acid Market Insight

North America is projected to register the fastest CAGR of 8.9% from 2026 to 2033, driven by growing awareness of animal health, feed efficiency, and regulatory compliance in the U.S. and Canada. Rising demand for natural acidifiers and preservatives in poultry, swine, and ruminant feed is accelerating adoption. Manufacturers are investing in advanced extraction techniques, clean-label formulations, and multifunctional feed acids. Strong retail and online distribution channels, coupled with technological innovations in feed additive production, enhance accessibility and drive rapid market growth in North America.

Which are the Top Companies in Feed Formic Acid Market?

The feed formic acid industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Perstorp (Sweden)

- Eastman Chemical Company (U.S.)

- GNFC Limited (India)

- Chongqing Chuandong Chemical (Group) Co., Ltd (China)

- LUXI GROUP (China)

- Asahi Kasei Corporation (Japan)

- Shanghai Baijin Chemical Group Co (China)

- Rashtriya Chemicals and Fertilizers Limited (India)

- Shandong Baoyuan Chemical Co., Ltd. (China)

- Wuhan Ruisunny Chemical (China)

- Alfa Aesar (U.S.)

- HELM AG (Germany)

- Celanese Corporation (U.S.)

- Kemira (Finland)

- Yara International (Norway)

- OKCHEM (China)

- BÜFA GmbH & Co. KG (Germany)

- TÜV SÜD (Germany)

- Yucheng Jinhe Industrial Co., Ltd (China)

What are the Recent Developments in Global Feed Formic Acid Market?

- In June 2025, BASF introduced its formic acid (FA) on the eAuction digital platform in China, enabling customers to bid and track auctions in real-time, enhancing procurement efficiency and providing actionable market insights while strengthening BASF’s position as a preferred partner for sustainable intermediates

- In October 2024, BASF secured funding from Germany's Federal Ministry for Economic Affairs and Climate Action to construct the world's most powerful industrial heat pump at its formic acid plant, which is projected to cut greenhouse gas emissions by up to 98% and is set to begin operations in 2027, supporting sustainable chemical production

- In July 2024, scientists from Argonne National Laboratory and the University of Chicago unveiled new tin-based catalysts capable of converting CO2 into valuable chemicals such as ethanol, acetic acid, and formic acid through an electrocatalytic process powered by renewable energy sources such as wind and solar, providing an eco-friendly approach to chemical synthesis

- In July 2024, researchers at AIST and the University of Tsukuba developed an efficient method for directly synthesizing formic acid from CO2 and hydrogen using an iridium catalyst in hexafluoroisopropanol (HFIP), eliminating the need for formate intermediates and offering a simpler, more cost-effective production route

- In April 2023, Virginia Commonwealth University (VCU) pioneered the use of formic acid as a catalyst for thermochemically converting CO2, presenting a cost-effective method to mitigate CO2’s adverse effects while highlighting formic acid’s low toxicity, ease of storage, and potential for efficient CO2 absorption and conversion

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.