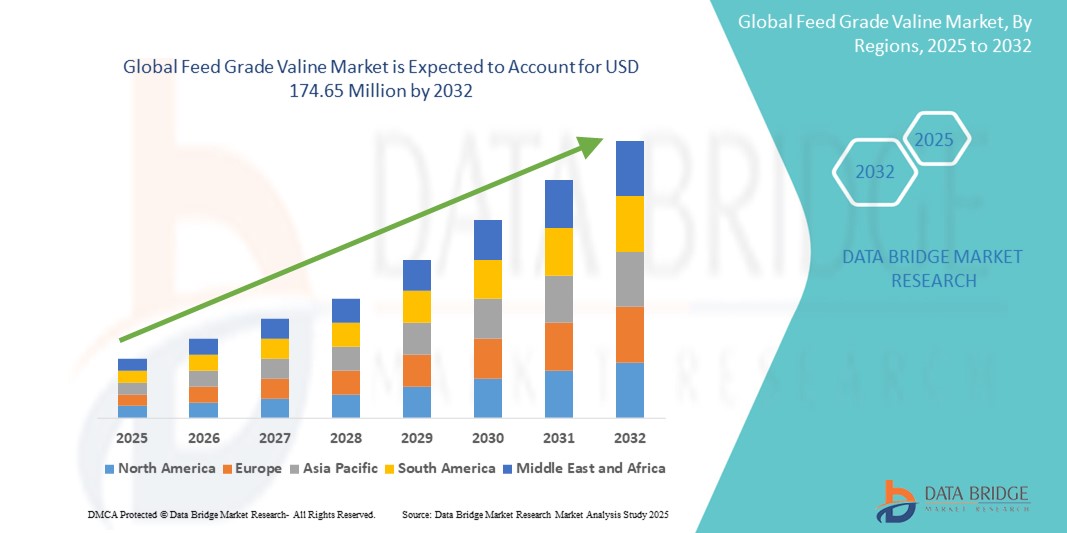

Global Feed Grade Valine Market

Market Size in USD Million

CAGR :

%

USD

116.42 Million

USD

174.65 Million

2024

2032

USD

116.42 Million

USD

174.65 Million

2024

2032

| 2025 –2032 | |

| USD 116.42 Million | |

| USD 174.65 Million | |

|

|

|

|

What is the Global Feed Grade Valine Market Size and Growth Rate?

- The global feed grade valine market size was valued at USD 116.42 million in 2024 and is expected to reach USD 174.65 million by 2032, at a CAGR of 5.20% during the forecast period

- The global feed grade valine market is experiencing steady growth, driven by increasing demand for high-quality animal feed additives across various livestock and poultry sectors. Valine, as a crucial branched-chain amino acid (BCAA), plays a vital role in enhancing protein synthesis and muscle development in animals, thereby improving overall growth performance and health

- The market's growth is further supported by rising global meat consumption and dairy production, which necessitate the use of effective nutritional supplements such as feed grade valine to meet growing demand for animal protein

What are the Major Takeaways of Feed Grade Valine Market?

- The expansion of commercial animal farming practices, especially in emerging economies, is accelerating the adoption of specialized feed additives such as valine. This growth is driven by increasing per capita meat consumption and a shift towards intensive farming methods to meet rising protein demands

- Feed grade valine enhances feed efficiency and nutrient absorption, supporting higher yields and improved animal health outcomes. As economies industrialize and dietary patterns evolve, there is a growing reliance on feed additives that can optimize feed conversion ratios and sustainably increase agricultural productivity, driving market growth

- North America dominated the feed grade valine market with the largest revenue share of 33.47% in 2024, owing to the high consumption of amino acid–fortified feed for improved livestock productivity, particularly in swine and poultry sectors

- Asia-Pacific feed grade valine market is set to expand at the fastest CAGR of 7.45% from 2025 to 2032, fueled by rapid livestock industrialization, increasing meat consumption, and rising awareness of feed efficiency in major economies such as China, India, and Japan

- The L Type segment dominated the feed grade valine market with the largest market revenue share of 64.3% in 2024, owing to its superior bioavailability and efficiency in animal nutrition

Report Scope and Feed Grade Valine Market Segmentation

|

Attributes |

Feed Grade Valine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Feed Grade Valine Market?

“Rising Adoption of Valine in Sustainable Animal Nutrition”

- A major trend in the global feed grade valine market is the growing focus on sustainable and precision animal nutrition. Feed-grade valine, a branched-chain amino acid, is increasingly used as a protein substitute to reduce crude protein levels in animal feed without compromising performance

- This shift is driven by the need to lower nitrogen excretion, reduce environmental impact, and improve feed efficiency—especially in swine and poultry diets

- For instance, Evonik and Ajinomoto have introduced highly pure L-valine products that support sustainable farming practices by reducing the reliance on traditional protein sources such as soybean meal

- In addition, the use of synthetic amino acids such as valine allows producers to formulate low-protein diets that meet exact nutritional requirements, contributing to improved animal health and reduced feed costs

- The trend reflects a broader industry movement toward eco-friendly and cost-efficient animal husbandry, particularly in Europe and North America, where environmental regulations are tightening

- This transition towards precision nutrition and sustainability is redefining feed formulations, encouraging R&D investments, and creating long-term growth opportunities for feed-grade valine suppliers

What are the Key Drivers of Feed Grade Valine Market?

- The rising global demand for animal protein, especially pork and poultry, is fueling the need for optimized feed formulations that enhance growth rates and feed efficiency

- For instance, in January 2023, CJ CheilJedang expanded its amino acid production capacity in response to surging demand from the animal feed industry across Asia and Latin America

- Increased awareness among feed manufacturers and livestock producers about the benefits of valine in reducing crude protein content—while maintaining performance—has strengthened product uptake

- The push for sustainable agriculture and environmental compliance in regions such as Europe is driving adoption, as valine reduces nitrogen output and contributes to cleaner livestock operations

- Furthermore, improved cost-efficiency, easier digestibility, and compatibility with other amino acids such as lysine and methionine are making feed-grade valine a critical additive in commercial feed applications

Which Factor is challenging the Growth of the Feed Grade Valine Market?

- One of the key challenges is the fluctuation in raw material prices and production costs associated with fermentation-based valine manufacturing

- For instance, rising costs of corn and glucose—common substrates in fermentation—can significantly impact the profit margins of valine producers, especially in Asia

- In addition, the limited awareness in developing markets about the benefits of valine in feed formulations compared to more established amino acids such as lysine and threonine slows adoption

- Regulatory hurdles and variation in feed additive approvals across regions also pose challenges to global expansion, particularly in markets with complex registration processes

- Furthermore, the price sensitivity among small-scale farmers in emerging economies makes it difficult to justify the upfront cost of synthetic valine, despite long-term benefits

- Overcoming these barriers will require increased educational outreach, localized marketing efforts, and price optimization strategies to boost adoption and improve market penetration

How is the Feed Grade Valine Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Type

On the basis of type, the feed grade valine market is segmented into L Type, D Type, and DL Type. The L Type segment dominated the feed grade valine market with the largest market revenue share of 64.3% in 2024, owing to its superior bioavailability and efficiency in animal nutrition. L-valine is a key essential amino acid required for muscle metabolism, tissue repair, and nitrogen balance in livestock, especially pigs and poultry.

The DL Type segment is anticipated to witness the fastest CAGR from 2025 to 2032, due to its increasing use in cost-sensitive formulations where a racemic mix can still provide beneficial metabolic outcomes. Its relatively lower production cost also makes it an attractive option in price-competitive markets.

- By Product Type

On the basis of product type, the feed grade valine market is segmented into Liquid and Powder. The Powder segment accounted for the largest market revenue share of 71.8% in 2024, driven by its stability, longer shelf life, and ease of blending with feed formulations. Powdered valine is widely used by premix manufacturers and feed mills due to its compatibility with automated mixing systems.

The Liquid segment is projected to register the highest growth rate from 2025 to 2032, owing to its improved absorption efficiency and rising preference in precision livestock farming where liquid supplements are administered through water-soluble systems.

- By Application

On the basis of application, the feed grade valine market is segmented into Pig, Poultry, Aquaculture, Ruminants, and Others. The Pig segment dominated the market with a revenue share of 42.6% in 2024, as valine plays a critical role in muscle development, feed intake regulation, and immune function in swine. Rising demand for high-efficiency swine production and the need to reduce crude protein levels in pig diets further drive this segment.

The Aquaculture segment is expected to witness the fastest CAGR during the forecast period, driven by the expanding aquaculture industry and the push for sustainable, plant-based feed ingredients where valine is crucial for optimal growth performance in species such as shrimp and tilapia.

- By Distribution Channel

On the basis of distribution channel, the feed grade valine market is segmented into Direct Sales and Distributors. The Distributors segment accounted for the largest market revenue share of 58.9% in 2024, due to the established networks and reach of feed additive suppliers through third-party agents and regional dealers. Distributors also offer value-added services such as technical support and logistics efficiency.

The Direct Sales segment is anticipated to grow at the highest CAGR from 2025 to 2032, fueled by large-scale livestock integrators and feed manufacturers preferring direct procurement for better price control and product customization.

- By Production Method

On the basis of production method, the feed grade valine market is segmented into Fermentation and Chemical Synthesis. The Fermentation segment dominated the market with the highest revenue share of 81.4% in 2024, attributed to the eco-friendly nature, high purity levels, and cost-effectiveness of microbial fermentation processes. With growing regulatory push toward sustainable production methods, fermentation-based valine continues to gain traction.

The Chemical Synthesis segment is expected to register moderate growth, primarily driven by its use in regions with limited fermentation infrastructure or where cost-sensitive production alternatives are preferred.

Which Region Holds the Largest Share of the Feed Grade Valine Market?

- North America dominated the feed grade valine market with the largest revenue share of 33.47% in 2024, owing to the high consumption of amino acid–fortified feed for improved livestock productivity, particularly in swine and poultry sectors

- The region benefits from the presence of major feed manufacturers, advanced livestock farming practices, and a strong regulatory framework supporting the inclusion of essential amino acids in animal nutrition

- The demand is further fueled by rising meat consumption, awareness about animal health, and the increasing use of performance-enhancing feed additives, solidifying North America’s leadership in the global feed grade valine market

U.S. Feed Grade Valine Market Insight

The U.S. feed grade valine market dominated the North American market in 2024, driven by advanced livestock management systems and high adoption of precision nutrition techniques. The expanding poultry and swine industries are supported by robust R&D activities and partnerships among feed producers and biotech firms. In addition, the shift toward antibiotic-free feed additives strengthens the demand for valine as a growth promoter and health enhancer in animal diets.

Europe Feed Grade Valine Market Insight

The Europe feed grade valine market is projected to grow steadily during the forecast period, propelled by stringent regulations regarding animal feed safety and a growing shift toward sustainable farming. Rising consumer demand for high-quality, organic, and antibiotic-free meat drives the need for amino acid supplementation in feed. Countries such as Germany, France, and the Netherlands are leading adopters, supported by a well-structured feed supply chain and emphasis on animal welfare.

U.K. Feed Grade Valine Market Insight

The U.K. feed grade valine market is anticipated to witness notable growth, spurred by the rising demand for nutrient-optimized feed in livestock farms and aquaculture facilities. Government initiatives promoting local meat production and sustainable agriculture, along with rising awareness of feed efficiency and animal growth performance, are key growth factors. The demand is especially significant in pig and poultry segments where valine plays a crucial role in protein synthesis.

Germany Feed Grade Valine Market Insight

The Germany feed grade valine market is expected to grow consistently due to the country’s leadership in feed innovation and biotechnology. High standards for feed quality, along with a proactive approach toward reducing environmental emissions from livestock farming, promote the use of synthetic amino acids such as valine. Strong collaborations between feed manufacturers and research institutes also contribute to optimized feed formulations and market expansion.

Which Region is the Fastest Growing Region in the Feed Grade Valine Market?

Asia-Pacific feed grade valine market is set to expand at the fastest CAGR of 7.45% from 2025 to 2032, fueled by rapid livestock industrialization, increasing meat consumption, and rising awareness of feed efficiency in major economies such as China, India, and Japan. In addition, government support for protein-rich diets, investments in animal husbandry, and growing exports of meat products are accelerating demand for valine-enriched feed. The presence of cost-effective manufacturers and local production facilities also enhances market accessibility across the region.

Japan Feed Grade Valine Market Insight

The Japan feed grade valine market is gaining traction due to the country’s focus on high-quality meat and seafood production. With advanced feed formulation technologies and a mature aquaculture sector, valine is being increasingly used to improve feed conversion ratios and animal growth rates. Moreover, Japan’s aging agricultural workforce is encouraging efficient and automated feeding practices, driving further demand for precision nutrients such as valine.

China Feed Grade Valine Market Insight

The China feed grade valine market held the largest revenue share in Asia-Pacific in 2024, driven by its massive livestock population and increasing demand for high-efficiency feed ingredients. China’s expanding feed manufacturing sector, along with its transition to more sustainable and standardized farming practices, promotes the adoption of valine. The government’s push toward self-sufficiency in meat production and the presence of key domestic amino acid producers further stimulate market growth.

Which are the Top Companies in Feed Grade Valine Market?

The feed grade valine industry is primarily led by well-established companies, including:

- CJ CheilJedang (South Korea)

- Evonik (Germany)

- Ajinomoto (Japan)

- Daesang (South Korea)

- ADM (U.S.)

- NB Group (China)

- Meihua Group (China)

- Ningxia Eppen (China)

- Star Lake Bioscience (China)

- Polifar Group (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.