Global Feed Plant Based Protein Market

Market Size in USD Billion

CAGR :

%

USD

2.74 Billion

USD

5.65 Billion

2025

2033

USD

2.74 Billion

USD

5.65 Billion

2025

2033

| 2026 –2033 | |

| USD 2.74 Billion | |

| USD 5.65 Billion | |

|

|

|

|

Global Feed Plant Based Protein Market Size

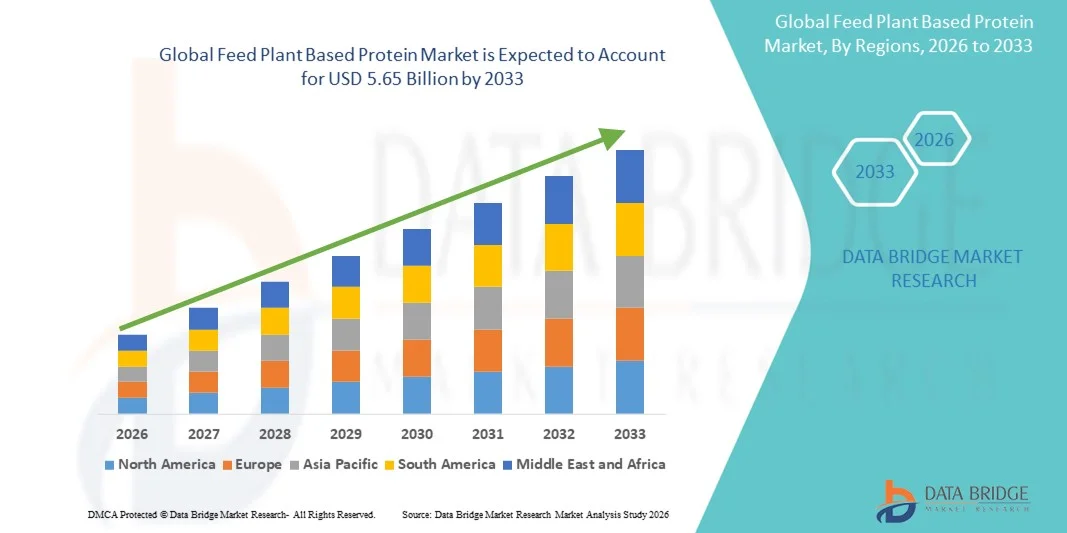

- The Global Feed Plant Based Protein Market size was valued at USD 2.74 billion in 2025 and is projected to reach USD 5.65 billion by 2033, registering a CAGR of 9.45% during the forecast period.

- Market expansion is primarily driven by rising demand for sustainable, nutritious, and cost-effective protein alternatives in animal feed, supported by advancements in plant-based ingredient processing technologies that enhance quality and efficiency.

- Additionally, increasing consumer preference for healthier livestock products, coupled with industry efforts toward reduced environmental impact and improved feed performance, is accelerating the adoption of plant-derived proteins, thereby significantly propelling overall market growth.

Global Feed Plant Based Protein Market Analysis

- Feed plant-based proteins, derived from sources such as soy, pea, canola, and sunflower, are becoming essential components of modern animal nutrition systems in both livestock and aquaculture sectors due to their sustainability, nutrient density, and consistent quality compared to traditional animal-based proteins.

- The rising demand for feed plant-based proteins is primarily driven by the shift toward sustainable feed ingredients, increasing concerns over livestock health, and a growing preference for cost-efficient, reliable, and traceable protein sources among feed manufacturers.

- Europe dominated the Global Feed Plant Based Protein Market with a revenue share of 34% in 2025, supported by strong adoption of high-quality plant protein ingredients, advanced feed production infrastructure, and the presence of leading agribusiness companies, with the U.S. showing rapid uptake due to innovations in processing, fermentation, and functional protein formulation.

- Asia-Pacific is expected to be the fastest-growing region in the Global Feed Plant Based Protein Market during the forecast period, driven by rapid livestock sector expansion, increasing urbanization, and rising disposable incomes that elevate the demand for high-quality animal products.

- The soy segment dominated the market with the largest revenue share of 45.6% in 2025, driven by its high protein content, balanced amino acid profile, wide availability, and cost-effectiveness.

Report Scope and Global Feed Plant Based Protein Market Segmentation

|

Attributes |

Feed Plant Based Protein Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Archer Daniels Midland (ADM) (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Feed Plant Based Protein Market Trends

Enhanced Efficiency Through Advanced Processing and Functional Innovation

- A significant and accelerating trend in the Global Feed Plant Based Protein Market is the deepening integration of advanced processing technologies such as enzymatic treatment, precision fermentation, and fractionation. These innovations are greatly enhancing the digestibility, nutritional value, and functional performance of plant-derived proteins in animal feed.

- For instance, leading producers are incorporating enzyme-assisted extraction to improve protein concentration and reduce antinutritional factors in soy and pea proteins, enabling more efficient nutrient absorption in poultry, swine, and aquaculture feed applications. Similarly, precision-fermented proteins are being adopted for their improved amino acid balance and higher bioavailability.

- Technological advancements also allow for tailored functional properties, such as optimized solubility and improved pellet binding, which support better feed conversion ratios and overall animal growth performance. Companies specializing in plant protein innovation are developing formulations designed to enhance gut health, improve immunity, and provide species-specific nutritional benefits.

- The integration of these advanced technologies into major feed production systems supports centralized, data-driven formulation strategies, allowing feed manufacturers to align plant protein usage with broader goals in livestock efficiency, sustainability, and supply chain stability.

- This shift toward more intelligent, high-performance, and customized protein solutions is fundamentally reshaping expectations for feed-quality standards. As a result, companies are expanding R&D into next-generation plant protein concentrates and isolates that offer improved digestibility and reduced environmental impact.

- Demand for technologically enhanced plant-based feed proteins is rising rapidly across both developed and emerging markets, as producers increasingly prioritize sustainability, efficiency, and consistent nutritional performance in modern animal agriculture.

Global Feed Plant Based Protein Market Dynamics

Driver

Growing Need Due to Rising Sustainability Demands and Livestock Sector Expansion

- The increasing emphasis on sustainability in global agriculture, combined with the rapid expansion of livestock and aquaculture sectors, is a significant driver of the heightened demand for feed plant-based proteins.

- For instance, leading agribusinesses are investing in low-carbon soy, non-GMO pea protein, and renewable crop-based ingredients to support large-scale feed formulations that reduce dependence on fishmeal and animal-derived proteins. Such initiatives by major players are expected to drive market growth throughout the forecast period.

- As producers seek solutions that address environmental concerns, supply chain stability, and nutritional consistency, plant-based proteins offer advantages such as reduced ecological impact, reliable global availability, and improved safety compared to fluctuating animal-based protein sources.

- Furthermore, the growing adoption of modern feed technologies and precision farming is integrating plant-derived proteins into advanced feed systems, supporting balanced nutrition and enhanced animal performance.

- The convenience of consistent supply, cost-effective procurement, and the ability to tailor plant proteins for specific species through processing innovations are key factors propelling the adoption of plant-based feed proteins across poultry, swine, cattle, and aquaculture. Increasing interest in sustainable and traceable feed formulations further supports market expansion.

Restraint/Challenge

Concerns Regarding Nutritional Variability and High Processing Costs

- Concerns surrounding the nutritional variability of plant proteins, particularly their amino acid profiles and the presence of antinutritional factors, pose a significant challenge to broader market penetration. As plant-based feed ingredients may require processing to enhance digestibility, manufacturers must account for variability between sources and crops.

- For instance, fluctuations in protein concentration and fiber content in soy or pea harvests have made some feed producers hesitant to increase reliance on plant protein without consistent quality assurance.

- Addressing these concerns through advanced processing techniques, such as enzymatic treatment, fermentation, and thermal processing, is crucial to improving protein bioavailability and supporting wider adoption. Companies highlight their innovations in extraction and fractionation technologies to reassure feed formulators of consistent quality. Additionally, the relatively high cost of producing refined plant protein concentrates and isolates can be a barrier in price-sensitive markets. While basic protein meals remain affordable, premium high-protein ingredients often require significant technology investments.

- Although production costs are gradually decreasing as technology scales, the perceived price premium for highly processed plant proteins can still hinder widespread adoption, especially in developing regions with tight feed margins.

- Overcoming these challenges through continued innovation, cost-efficient processing, improved crop quality management, and wider industry education will be vital for sustained market growth.

Global Feed Plant Based Protein Market Scope

The feed plant based protein market is segmented on the basis of source, livestock, and type.

- By Source

On the basis of source, the Global Feed Plant Based Protein Market is segmented into soy, wheat, pea, sunflower, and others. The soy segment dominated the market with the largest revenue share of 45.6% in 2025, driven by its high protein content, balanced amino acid profile, wide availability, and cost-effectiveness. Soy remains the preferred choice across poultry, swine, and aquaculture feed due to its proven digestibility and global production scale. Additionally, continuous advancements in non-GMO and low-antinutritional soybean varieties further strengthen its market leadership.

The pea protein segment is expected to witness the fastest CAGR from 2026 to 2033, supported by rising demand for allergen-free, sustainable, and highly digestible protein alternatives. Pea proteins are gaining popularity in premium feed formulations due to improved processing technologies, enhanced amino acid balance, and increasing global production. Sunflower and wheat proteins are also experiencing steady growth as complementary sources in blended feed solutions.

- By Livestock

On the basis of livestock, the market is segmented into pets, swine, ruminants, poultry, and aquatic animals. The poultry segment accounted for the largest market revenue share of 39.8% in 2025, driven by the high global consumption of poultry meat and eggs, rising focus on efficient feed conversion ratios, and strong adoption of plant-based proteins to replace fishmeal and reduce feed costs. Poultry producers increasingly rely on soy, pea, and sunflower protein to support growth performance and maintain nutritional consistency.

The aquatic animals segment is projected to witness the fastest CAGR from 2026 to 2033, fueled by the rapid expansion of aquaculture, demand for sustainable alternatives to fishmeal, and improved digestibility of plant-based proteins through enzymatic and fermentation processing. Pea and soy concentrates are particularly favored for their amino acid profiles suited to fish and shrimp feed. The pets segment is also growing steadily as owners shift toward natural, plant-inclusive pet diets.

- By Type

On the basis of type, the market is segmented into concentrates, isolates, and others. The protein concentrates segment dominated the market with the largest revenue share of 52.3% in 2025, attributed to their cost-effectiveness, broad availability, and suitability for large-scale poultry and swine feed applications. Concentrates offer balanced nutrition and are widely used due to their moderate processing requirements, making them economically viable for feed manufacturers across developed and emerging markets.

The isolates segment is expected to witness the fastest CAGR from 2026 to 2033, driven by rising demand for high-purity proteins in specialized nutrition applications, aquaculture feed, and performance-focused formulations. Isolates provide superior digestibility, low fiber content, and enhanced amino acid availability, supporting improved feed efficiency. Growing investments in precision processing technologies—such as membrane filtration and enzymatic extraction—are also lowering production costs, further boosting the adoption of isolates. The “others” category, including textured proteins and hydrolysates, continues to expand in niche applications.

Global Feed Plant Based Protein Market Regional Analysis

- Europe dominated the Global Feed Plant Based Protein Market with the largest revenue share of 34% in 2025, driven by strong demand for sustainable, high-quality feed ingredients and the region’s advanced livestock production systems.

- Producers in the region place high value on the nutritional consistency, improved digestibility, and environmental benefits offered by plant-based proteins, which integrate seamlessly into modern feed formulations for poultry, swine, cattle, and aquaculture.

- This widespread adoption is further supported by high disposable incomes, well-developed feed manufacturing infrastructure, and strong consumer demand for ethically produced animal products, driving producers to shift toward plant-derived proteins. Additionally, increasing awareness of sustainability, stable supply chains, and regulatory support for reducing reliance on animal-based proteins have established plant-based feed ingredients as a preferred solution across both commercial livestock operations and emerging specialty animal nutrition markets.

U.S. Feed Plant Based Protein Market Insight

The U.S. feed plant based protein market captured the largest revenue share of 81% in 2025 within North America, driven by the rapid expansion of livestock, poultry, and aquaculture industries and rising demand for sustainable, high-quality feed ingredients. Producers increasingly prioritize plant-derived proteins to enhance feed efficiency and reduce dependence on fishmeal and animal-based proteins. Growing consumer preference for ethically produced meat and dairy has pushed feed manufacturers to adopt soy, pea, and sunflower proteins across various feed applications. Moreover, strong investments in advanced processing technologies, such as enzymatic treatment and precision fermentation, further support market growth in the U.S., enabling improved protein digestibility, consistent quality, and cost-effective production.

Europe Feed Plant Based Protein Market Insight

The Europe feed plant based protein market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent sustainability regulations and an increasing focus on reducing the environmental footprint of livestock feed. Rising adoption of plant-based proteins is supported by the region’s shift toward circular agriculture and the growing demand for alternative proteins to replace imported soybean meal. European livestock producers value the nutritional consistency and traceability provided by plant-based proteins. The market is experiencing strong growth across poultry, aquaculture, and swine sectors, with plant-based feed ingredients integrated into both newly formulated and reformulated feed products.

U.K. Feed Plant Based Protein Market Insight

The U.K. feed plant based protein market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising sustainability awareness, evolving agricultural policies, and growing interest in reducing reliance on imported feed ingredients. Heightened concern around environmental impacts, including carbon emissions and land use, is encouraging producers to adopt plant-based proteins such as pea, sunflower, and rapeseed. The U.K.’s livestock and pet food industries are increasingly embracing plant proteins to support improved animal health and feed efficiency. Continued innovation in feed processing and strong demand for locally sourced protein alternatives will further stimulate market expansion.

Germany Feed Plant Based Protein Market Insight

The Germany feed plant based protein market is expected to expand at a considerable CAGR during the forecast period, driven by growing awareness of sustainable livestock production and increasing investment in advanced feed solutions. Germany’s well-developed agricultural infrastructure and strong focus on innovation make it a leading adopter of high-performance plant proteins. Producers are integrating soy, wheat, and pea protein concentrates and isolates into feed formulations to enhance digestibility and reduce dependence on animal-based ingredients. The market also benefits from Germany’s strong emphasis on eco-friendly solutions and traceable supply chains, aligning with consumer expectations for sustainable food systems.

Asia-Pacific Feed Plant Based Protein Market Insight

The Asia-Pacific feed plant based protein market is poised to grow at the fastest CAGR of 24% during 2026–2033, driven by rapid urbanization, rising incomes, and the expansion of livestock and aquaculture sectors across China, India, Japan, and Southeast Asia. Government initiatives promoting sustainable agriculture and efforts to reduce dependency on fishmeal are reinforcing the adoption of plant-based feed proteins. As APAC continues to dominate global feed production, the availability and affordability of soy, pea, and other plant proteins are accelerating regional adoption. Growing demand for poultry, fish, and pet nutrition is further boosting market growth.

Japan Feed Plant Based Protein Market Insight

The Japan feed plant based protein market is gaining momentum due to the country’s strong emphasis on food safety, high-tech agricultural systems, and rising demand for high-quality animal products. Japanese producers prioritize high-digestibility proteins and nutritionally balanced feed ingredients, driving adoption of soy isolates, pea concentrates, and wheat protein. The country’s rapid technological development and growing interest in sustainable livestock practices contribute to steady market expansion. Additionally, Japan’s aging population and increasing pet ownership are supporting demand for premium plant-based proteins in pet food applications.

China Feed Plant Based Protein Market Insight

The China feed plant based protein market accounted for the largest revenue share in Asia Pacific in 2025, driven by the country’s expanding livestock and aquaculture industries, rising disposable incomes, and strong government support for sustainable feed solutions. China is one of the world’s largest producers and consumers of feed ingredients, and plant-based proteins—especially soy and pea—are increasingly incorporated into feed formulations for poultry, swine, fish, and pets. The push toward modernized farming, along with the presence of large domestic manufacturers, enhances the availability and affordability of plant-based feed proteins. China’s rapidly growing middle class and continued investment in feed technology further propel market growth.

Global Feed Plant Based Protein Market Share

The Feed Plant Based Protein industry is primarily led by well-established companies, including:

• Archer Daniels Midland (ADM) (U.S.)

• Cargill Incorporated (U.S.)

• Roquette Frères (France)

• Ingredion Incorporated (U.S.)

• DuPont / IFF (U.S.)

• Tate & Lyle PLC (U.K.)

• Glanbia PLC (Ireland)

• Wilmar International (Singapore)

• Bunge Limited (U.S.)

• CHS Inc. (U.S.)

• Axiom Foods (U.S.)

• Cosucra Groupe Warcoing (Belgium)

• Meelunie B.V. (Netherlands)

• Sonic Biochem (India)

• Shandong Yuwang Ecological Food Industry (China)

• Yantai Shuangta Food (China)

• Siam Agro-Food Industry (Thailand)

• Austrian Grain Management (Austria)

• SunOpta Inc. (Canada)

• Puratos Group (Belgium)

What are the Recent Developments in Global Feed Plant Based Protein Market?

- In April 2024, Archer Daniels Midland (ADM), a global leader in agricultural processing and nutrition, launched a strategic initiative in South Africa focused on strengthening protein availability for livestock and aquaculture producers through its advanced plant-based feed ingredients. This initiative highlights the company’s commitment to delivering high-quality, sustainable protein solutions tailored to regional feed requirements. By leveraging its global expertise and innovative processing technologies, ADM is addressing local supply challenges while reinforcing its position in the rapidly expanding Global Feed Plant Based Protein Market.

- In March 2024, Roquette Frères, a prominent producer of plant-based ingredients, introduced a next-generation pea protein concentrate specifically designed for poultry and swine feed applications. The newly engineered formulation enhances digestibility and supports improved feed conversion ratios, offering a reliable and effective solution for performance-driven livestock operations. This development underscores Roquette’s focus on advancing high-functionality feed proteins that support animal productivity and sustainable farming practices.

- In March 2024, Cargill Incorporated successfully partnered with the Karnataka State animal husbandry authorities to deploy a sustainable feed initiative aimed at improving production efficiency through advanced plant-based protein formulations. This project integrates innovative nutritional solutions to support healthier livestock and reduce environmental impact, reaffirming Cargill’s commitment to driving sustainable transformation in the feed sector. The program highlights the increasing significance of plant-based proteins in building resilient, resource-efficient livestock systems.

- In February 2024, Ingredion Incorporated announced a strategic collaboration with the Mid-Atlantic Feed Association (MAFA) to create a marketplace that provides feed producers with streamlined access to high-quality plant protein concentrates. This initiative enhances supply chain efficiency and supports the adoption of sustainable feed ingredients across the region. The collaboration reflects Ingredion’s dedication to advancing innovation and operational effectiveness within the feed industry.

- In January 2024, Bunge Limited, a leading global agribusiness and food company, unveiled its upgraded soy protein concentrate at the International Production & Processing Expo (IPPE) 2024. The innovative feed-grade protein offers enhanced amino acid availability and improved digestibility for poultry and aquaculture species. This new product highlights Bunge’s commitment to integrating cutting-edge processing technologies to elevate feed quality, offering producers improved nutritional performance while supporting sustainable livestock production.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.