Global Feed Starch Market

Market Size in USD Billion

CAGR :

%

USD

3.64 Billion

USD

5.30 Billion

2025

2033

USD

3.64 Billion

USD

5.30 Billion

2025

2033

| 2026 –2033 | |

| USD 3.64 Billion | |

| USD 5.30 Billion | |

|

|

|

|

Feed Starch Market Size

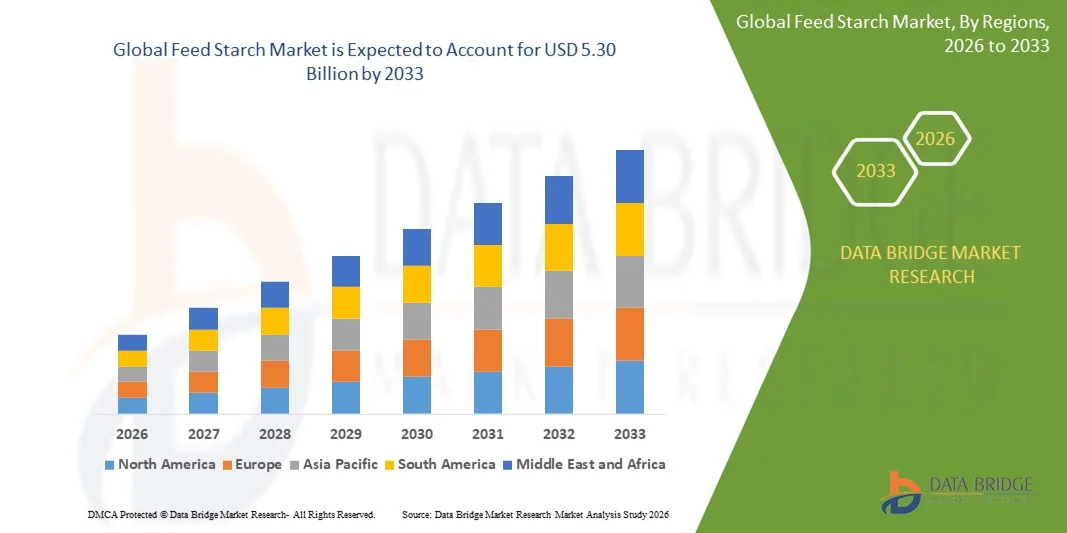

- The global feed starch market size was valued at USD 3.64 billion in 2025 and is expected to reach USD 5.30 billion by 2033, at a CAGR of 4.80% during the forecast period

- The market growth is largely fuelled by the rising incorporation of starch as an energy source in livestock feed formulations

- Increasing demand for cost-efficient feed ingredients to boost animal productivity

Feed Starch Market Analysis

- Growing adoption of processed and functional feed ingredients to enhance nutrient absorption and gut health in livestock

- Rising commercial livestock production, driven by improving meat and dairy consumption trends globally

- North America dominated the feed starch market with the largest revenue share in 2025, driven by strong demand for processed and compound feed across livestock categories. The presence of advanced feed manufacturing facilities and the rising preference for functional ingredients in animal nutrition further support market expansion in the region

- Asia-Pacific region is expected to witness the highest growth rate in the global feed starch market, driven by increasing livestock population, urbanization, rising disposable incomes, and growing awareness of nutritional feed additives

- The corn segment held the largest market revenue share in 2025 driven by its high availability, cost-effectiveness, and superior starch yield, making it the preferred choice for large-scale feed manufacturers. Corn-based starch is widely used in poultry, swine, and ruminant feed due to its digestibility and consistent energy delivery for commercial livestock

Report Scope and Feed Starch Market Segmentation

|

Attributes |

Feed Starch Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• ADM (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Feed Starch Market Trends

Rising Adoption of Functional and Modified Starches in Animal Nutrition

- The increasing incorporation of functional and modified starches in livestock diets is transforming feed formulations by improving digestibility and energy efficiency. These starches enhance nutrient absorption, support gut health, and optimize feed conversion ratios across poultry, swine, and ruminant sectors. Their improved stability and adaptability make them suitable for modern intensive farming environments

- The growing need for performance-oriented feed ingredients in commercial farming is accelerating the demand for starch variants that offer controlled release and improved metabolic utilization. These formulations help animals maintain consistent energy levels and better withstand environmental or dietary stress. As a result, they contribute to predictable growth cycles and overall production efficiency

- Manufacturers are focusing on developing species-specific starch blends that address digestive sensitivities and nutrient absorption challenges. These innovations support precision nutrition and help reduce feed wastage by improving utilization. Such tailored solutions are gaining popularity among feed mills seeking to optimize formulation costs

- For instance, in 2023, several Asian feed mills introduced slow-digesting starch formulations for broilers, which resulted in enhanced weight gain and reduced feed costs due to improved conversion efficiency. These products witnessed strong adoption across integrated poultry farms that prioritize predictable flock performance. Their commercial success encouraged further investment in customized starch technologies

- While modified starches are improving livestock performance, their success will depend on sustained innovation, cost-effectiveness, and enhanced farmer awareness. Manufacturers must create region-specific product portfolios to accommodate variations in raw material availability. Building strong extension networks will also be crucial for increasing adoption in cost-sensitive markets

Feed Starch Market Dynamics

Driver

Increasing Demand for Energy-Dense Feed Ingredients in Commercial Livestock Production

- The rising global demand for high-quality animal protein is pushing farms to prioritize energy-rich feed inputs such as starches, which play a critical role in growth, metabolism, and feed utilization. This trend is especially prominent in poultry and swine operations that rely on rapid turnover cycles. Energy-dense diets enable producers to maximize outputs despite rising production pressures

- Livestock producers are more aware of the productivity benefits associated with starch-enriched feed, such as faster weight gain, improved nutrient absorption, and enhanced animal health. These advantages are encouraging widespread adoption across intensive farming systems, especially in regions facing high feed costs. Improved performance metrics also support better profitability for commercial operations

- Government programs promoting balanced nutrition and improved feed efficiency are further supporting the use of starches. Subsidies, capacity-building programs, and feed quality regulations are strengthening adoption in both developed and emerging markets. Such initiatives help standardize feed practices and elevate livestock productivity at the industry level

- For instance, in 2023, Latin American poultry associations reported higher demand for maize-derived starch in compound feed as producers invested in improving feed conversion amid rising production costs. Adoption was particularly strong among vertically integrated companies seeking to offset fluctuations in global grain markets. This trend further reinforced the role of starch in competitive livestock farming

- While demand is strong, continuous research, improved supply chain stability, and wider veterinarian awareness are essential to ensure long-lasting integration of starch-based feed ingredients. Expanding knowledge dissemination and on-farm demonstrations can help address adoption barriers. Strengthening cross-industry collaboration will also support innovation and consistency in feed production

Restraint/Challenge

Price Volatility of Raw Materials and Limited Availability of High-Quality Starch Sources

- The dependence on crops such as maize, potato, and cassava exposes feed starch manufacturers to raw material price fluctuations driven by climatic uncertainties, trade disruptions, and rising global food demand. These fluctuations directly affect the affordability of finished feed formulations. As a result, feed producers often struggle to maintain stable pricing for farmers

- Many regions face inconsistent access to high-quality starch sources due to limited agricultural productivity or weak supply chain networks. These challenges prevent manufacturers from ensuring reliable output volumes and product uniformity. Seasonal variations further intensify shortages of feed-grade starch across developing markets

- The shortage of advanced processing infrastructure in developing countries further constrains the availability of premium starch products. Limited milling and extraction capabilities reduce producers’ ability to offer standardized, nutrient-rich starch ingredients. This leads to frequent reliance on imports, which adds additional cost and logistical complexity

- For instance, in 2023, Southeast Asian feed producers reported higher production costs due to reduced cassava yields caused by extreme weather, leading to shortages in feed-grade starch supply. This affected both small and large feed mills, prompting shifts toward alternative carbohydrate sources. Such disruptions highlighted the vulnerability of starch-dependent feed systems

- While the market continues to expand, addressing raw material risks, investing in resilient sourcing strategies, and enhancing crop productivity will be key to overcoming these challenges. Improving local cultivation practices and processing capacity can strengthen long-term supply stability. Diversifying starch sources may also reduce dependence on a limited set of crops

Feed Starch Market Scope

The market is segmented on the basis of raw material, function type, form, modification type, and application

- By Raw Material

On the basis of raw material, the feed starch market is segmented into corn, potato, cassava, wheat, and others. The corn segment held the largest market revenue share in 2025 driven by its high availability, cost-effectiveness, and superior starch yield, making it the preferred choice for large-scale feed manufacturers. Corn-based starch is widely used in poultry, swine, and ruminant feed due to its digestibility and consistent energy delivery for commercial livestock.

The cassava segment is expected to witness the fastest growth rate from 2026 to 2033, fuelled by rising production in Asia and Africa and its suitability as a non-grain energy source for feed applications. Cassava starch is gaining popularity in cost-sensitive markets due to its competitive price point and favorable carbohydrate content, supporting improved feed efficiency across various species.

- By Function Type

On the basis of function type, the feed starch market is segmented into thickeners, stabilizers, binders, emulsifiers, and others. The binders segment accounted for the largest market share in 2025 owing to the growing demand for pellet durability and enhanced feed stability in commercial livestock production. Binders play a crucial role in improving feed texture and reducing wastage during consumption.

The emulsifiers segment is expected to grow at the fastest pace during the forecast period, driven by their increasing adoption in high-performance feed formulations requiring improved nutrient dispersion. Emulsifiers are becoming essential in advanced diets designed to enhance fat absorption and overall feed utilization.

- By Form

On the basis of form, the feed starch market is segmented into dry and liquid. The dry form segment dominated the market in 2025 due to its longer shelf life, easy handling, and widespread use in pellet and mash feed manufacturing. Dry starch varieties are preferred across feed mills because of their stable performance and compatibility with large-scale processing systems.

The liquid form segment is projected to experience faster growth from 2026 to 2033, driven by its superior blending capabilities and increasing use in customized feed formulations. Liquid starches offer improved uniformity and ease of incorporation in specialized feed mixes designed for targeted nutritional outcomes.

- By Modification Type

On the basis of modification type, the feed starch market is segmented into physical modification, chemical modification, and resistant starch. The physical modification segment held the largest share in 2025 supported by its safety, cost-efficiency, and suitability for a wide range of species-specific feed applications. Physically modified starches enhance digestibility and energy release without altering the chemical structure.

The resistant starch segment is anticipated to grow at the highest rate during the forecast period, fuelled by its benefits for gut health, microbial balance, and slow-release energy delivery. Resistant starch is gaining traction in premium feed formulations as producers increasingly prioritize digestive wellness and performance efficiency.

- By Application

On the basis of application, the feed starch market is segmented into swine feed, ruminant feed, poultry feed, and others. The poultry feed segment accounted for the largest revenue share in 2025 due to the rising global poultry population and dependence on starch-based ingredients for rapid energy delivery. Poultry producers rely heavily on starch to support growth cycles and improve feed conversion ratios.

The swine feed segment is expected to register the fastest growth between 2026 and 2033, driven by expanding swine production and the increasing integration of modified starches to enhance gut health and nutrient uptake. Swine producers are showing strong interest in starch variants that deliver consistent metabolic support and improved performance outcomes.

Feed Starch Market Regional Analysis

- North America dominated the feed starch market with the largest revenue share in 2025, driven by strong demand for processed and compound feed across livestock categories. The presence of advanced feed manufacturing facilities and the rising preference for functional ingredients in animal nutrition further support market expansion in the region

- Producers such asly prioritize high-quality feed components to enhance digestibility, energy value, and overall livestock performance, boosting the use of starch derived from sources such as corn and wheat

- In addition, the growing focus on precision feeding, improved feed conversion ratios, and increased commercial livestock farming continues to strengthen the demand for feed starch across the region

U.S. Feed Starch Market Insight

The U.S. feed starch market captured the largest revenue share in 2025 within North America, driven by the extensive livestock sector, advanced feed processing technologies, and the rising integration of functional starches to enhance animal health and productivity. The increasing adoption of corn-based starch, paired with strong commercial feed operations and expanding pet food formulations, is further propelling market growth. Moreover, continuous innovation in high-performance feed additives and the widespread use of energy-rich formulations continue to support the market’s momentum.

Europe Feed Starch Market Insight

The Europe feed starch market is expected to witness the fastest growth rate from 2026 to 2033, attributed to stringent quality regulations, growing emphasis on sustainable feed ingredients, and rising demand for high-performance nutrition solutions. The region’s expansion of poultry, swine, and dairy sectors, along with increased adoption of specialty starches for improved digestibility, is accelerating market penetration. Feed producers are also adopting modified and resistant starches to enhance nutrient utilization, supporting growth across both commercial and small-scale farming environments.

U.K. Feed Starch Market Insight

The U.K. feed starch market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising demand for high-quality livestock feed, increasing awareness of feed efficiency, and the expanding commercial animal farming landscape. Growing concerns regarding animal health and productivity are encouraging producers to incorporate energy-dense starch components. The nation’s strong regulatory framework and preference for sustainable feed ingredients are expected to further contribute to market expansion.

Germany Feed Starch Market Insight

The Germany feed starch market is expected to witness the fastest growth rate from 2026 to 2033, propelled by advancements in feed technology, increasing demand for precision nutrition, and the country’s strong livestock and dairy industries. The rising adoption of modified and resistant starches to support gut health and nutrient absorption is gaining traction in the market. In addition, Germany’s emphasis on high-quality, traceable, and eco-friendly feed ingredients supports the increased use of starch across various feed applications.

Asia-Pacific Feed Starch Market Insight

The Asia-Pacific feed starch market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid livestock population growth, rising meat consumption, and expanding feed production capacities in countries such as China, India, and Japan. The region’s push toward modern feed mills, coupled with increasing awareness of nutrition-rich feed formulations, is boosting starch usage. Furthermore, advancements in feed processing, affordability of raw materials such as cassava and corn, and government initiatives supporting livestock productivity are fueling market development.

Japan Feed Starch Market Insight

The Japan feed starch market is expected to witness the fastest growth rate from 2026 to 2033 due to rising demand for high-quality feed, a strong focus on animal health, and steady expansion of the poultry and livestock sectors. The market benefits from Japan’s advanced technological infrastructure, enabling the adoption of specialized starches that support improved feed efficiency. The integration of functional starches with premium feed formulations and precision farming practices is driving continued uptake across the market.

China Feed Starch Market Insight

The China feed starch market accounted for the largest revenue share in Asia-Pacific in 2025, supported by the nation’s massive livestock base, strong commercial feed manufacturing industry, and large-scale adoption of corn and cassava starch in feed formulations. China’s rapid urbanization and rising meat consumption are significantly increasing the demand for energy-rich feed components. In addition, the government’s push for modernized feed production, coupled with the presence of numerous domestic starch manufacturers, continues to drive market growth.

Feed Starch Market Share

The Feed Starch industry is primarily led by well-established companies, including:

• ADM (U.S.)

• Cargill, Incorporated (U.S.)

• Ingredion Incorporated (U.S.)

• Tate & Lyle (U.K.)

• Roquette Frères (France)

• Emsland Group (Germany)

• Avebe (Netherlands)

• Grain Processing Corporation (U.S.)

• AGRANA Beteiligungs-AG (Austria)

• SMS (Thailand)

• SPAC Starch Products (India) Private Limited (India)

• CBH (Australia)

• HL Agro Products Pvt. Ltd. (India)

• Visco Starch (India)

• Vaighai Agro (India)

• Tirupati Starch & Chemicals Ltd. (India)

• Tereos (France)

• Gulshan Polyols Ltd (India)

• Gujarat Ambuja Exports Limited (India)

• KMC (Denmark)

• Angel Starch & Food Pvt. Ltd. (India)

• Shubham Starch Chem Pvt. Ltd. (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Feed Starch Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Feed Starch Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Feed Starch Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.