Global Fermentation Chemicals Market

Market Size in USD Billion

CAGR :

%

USD

84.88 Billion

USD

135.28 Billion

2024

2032

USD

84.88 Billion

USD

135.28 Billion

2024

2032

| 2025 –2032 | |

| USD 84.88 Billion | |

| USD 135.28 Billion | |

|

|

|

|

Fermentation Chemicals Market Size

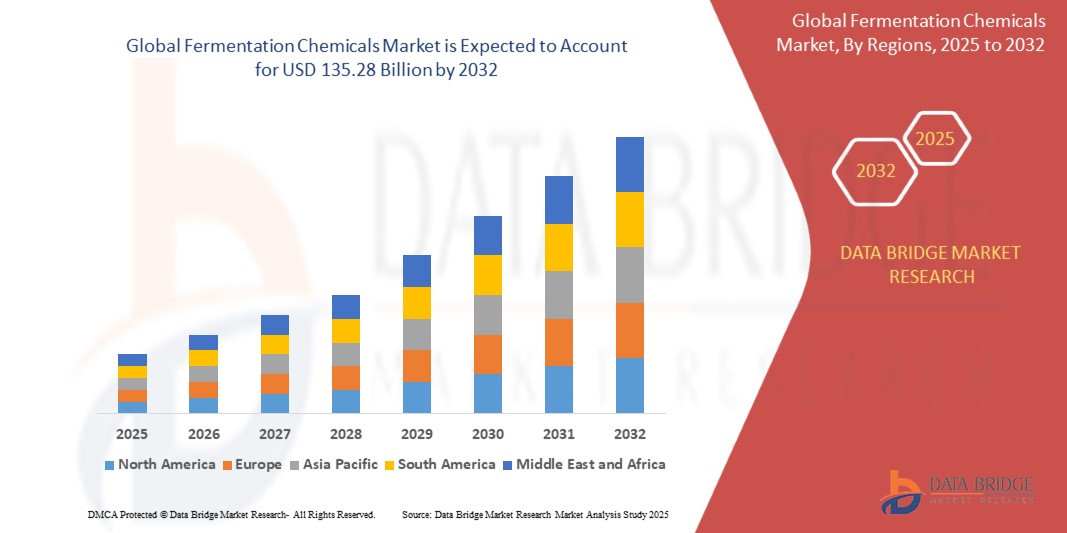

- The global fermentation chemicals market was valued at USD 84.88 billion in 2024 and is expected to reach USD 135.28 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.00%, primarily driven by increasing demand for biofuels

- This growth is driven by factors such as oil price volatility, carbon reduction goals and bio-refinery growth

Fermentation Chemicals Market Analysis

- Fermentation chemicals are bio-based compounds used to initiate or accelerate fermentation processes across various industries. Derived primarily from natural raw materials such as sugar, starches, and biomass, these chemicals include alcohols, organic acids and enzymes. They play a vital role in the production of food and beverages, pharmaceuticals, industrial chemicals, and biofuels, supporting both product efficiency and sustainability goals

- The market is experiencing strong growth due to increasing demand for sustainable and eco-friendly alternatives, expansion of the biofuel industry, and rising adoption across the food & beverage and pharmaceutical sectors. Industries are increasingly turning to fermentation chemicals to reduce reliance on petrochemicals, enhance production efficiency, and meet green regulatory standards

- The fermentation chemicals market is evolving with an emphasis on technological innovation, process optimization, and diversification of feedstocks. As industries focus on lowering environmental impact and improving cost-effectiveness, manufacturers are developing advanced fermentation techniques, utilizing waste biomass, and exploring novel microbial strains for enhanced output and product variety

- For instance, companies such as BASF and DuPont are investing in next-generation fermentation platforms and sustainable feedstock sourcing to support the production of bio-based solvents, acids, and polymers

- The fermentation chemicals market is projected to maintain a robust growth trajectory, driven by increased investment in bio-refineries, rising global demand for biofuels, and expanding applications in personal care, agriculture, and industrial manufacturing. With continuous advancements in fermentation technologies and growing consumer and regulatory preference for sustainable products, the market is expected to see sustained momentum in the coming years

Report Scope and Fermentation Chemicals Market Segmentation

|

Attributes |

Fermentation Chemicals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fermentation Chemicals Market Trends

“Rising Demand in the Food and Beverage Industry”

- One prominent trend in the global fermentation chemicals market is the rising demand in the food and beverage industry

- This trend is driven by the increasing consumer preference for natural ingredients, clean-label products, and functional foods, leading manufacturers to incorporate fermentation-based additives, preservatives, and flavor enhancers

- For instance, companies such as Chr. Hansen and Ajinomoto are expanding their portfolios of fermentation-derived ingredients to meet the demand for healthier, bio-based food solutions

- The growing focus on food safety, nutritional enrichment, and shelf-life extension is expected to further boost the adoption of fermentation chemicals across bakery, dairy, beverage, and plant-based food segments

- As the food and beverage sector evolves, manufacturers are prioritizing sustainable production, ingredient transparency, and microbial innovation. The rising demand for fermented, health-oriented products will continue to shape the use of fermentation chemicals and influence product innovation strategies in the coming years

Fermentation Chemicals Market Dynamics

Driver

“Advancements in Fermentation Technology”

- Advancement in fermentation technology is a key driver of growth in the fermentation chemicals market. Innovations in bioprocessing, microbial engineering, and precision fermentation have significantly improved efficiency, scalability, and product diversity across industries

- This impact is especially notable in sectors such as pharmaceuticals, food and beverage, and biofuels, where advanced fermentation enables the production of high-purity compounds, customized ingredients, and cost-effective alternatives to synthetic chemicals

- With industries aiming to enhance yield, reduce production time, and adopt more sustainable practices, the integration of next-generation bioreactors, real-time process monitoring, and AI-driven optimization has accelerated the use of fermentation-based solutions

- Features such as improved strain performance, substrate flexibility, and reduced environmental impact are reshaping how manufacturers utilize fermentation chemicals, driving investment in R&D and process innovation

- Companies are increasingly partnering with biotech firms and research institutions to co-develop advanced fermentation systems and diversify applications across sectors including agriculture, personal care, and industrial materials

For instance,

- Novozymes and DSM are leveraging synthetic biology and enzyme innovation to enhance fermentation yields and expand their product lines in food enzymes, biopharmaceuticals, and biofuels

- LanzaTech is using gas fermentation technology to convert industrial emissions into valuable chemicals and fuels, representing a breakthrough in sustainable production

- With ongoing R&D, cross-industry collaboration, and a global shift toward greener alternatives, advancements in fermentation technology are expected to remain a major growth driver for the fermentation chemicals market in the years ahead

Opportunity

“Development of Green Industry”

- The development of the green industry presents a significant opportunity for growth in the fermentation chemicals market. As global focus intensifies on sustainability, the demand for eco-friendly and bio-based chemical alternatives is expanding across multiple sectors

- Fermentation-based chemicals, derived from renewable raw materials and produced through low-emission processes, are gaining traction as sustainable substitutes for petrochemical-derived compounds in industries such as packaging, agriculture, textiles, and personal care

- The ability of fermentation processes to support circular economy principles—through waste valorization, carbon recycling, and biodegradable end products—is positioning them as integral to green manufacturing strategies

For instance,

- Evonik Industries is investing in sustainable fermentation platforms for producing specialty chemicals with minimal environmental footprint

- Cargill and BASF are collaborating to develop fermentation-derived bio-based polymers for packaging and industrial applications, supporting carbon reduction goals

- As governments and corporations commit to net-zero targets and stricter environmental regulations, investments in green technology and bioprocessing infrastructure are expected to grow. These shifts will expand the scope and application of fermentation chemicals, reinforcing their role as key enablers of the global green transition

Restraint/Challenge

“Limited Availability of Raw Material Alternatives”

- Limited and inconsistent availability of raw material alternatives poses a significant challenge for the fermentation chemicals market. As industries seek to move away from conventional feedstocks, securing a stable supply of alternative substrates remains difficult due to regional limitations, seasonal variability, and competition with other bio-based sectors

- The fermentation process often relies on agricultural by-products, lignocellulosic biomass, or waste-derived materials, which can fluctuate in quality, availability, and cost depending on climatic conditions, harvesting cycles, and supply chain inefficiencies. These factors hinder large-scale production planning and create uncertainty in operational consistency

- Inadequate infrastructure for collection, processing, and transportation of raw material alternatives further complicates their use, making it challenging for manufacturers to adopt them at a commercial scale

For instance,

- Companies such as Biocon and DSM have faced limitations in sourcing uniform, high-quality biomass for fermentation, impacting process optimization and end-product consistency

- As reliance on non-traditional feedstocks increases, the fermentation chemicals market continues to face supply chain vulnerabilities, regulatory hurdles, and cost pressures, especially in regions with underdeveloped bio-resource networks

Fermentation Chemicals Market Scope

The market is segmented on the basis of product type, form, and application.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Form |

|

|

By Application |

|

Fermentation Chemicals Market Regional Analysis

“North America is the Dominant Region in the Fermentation Chemicals Market”

- North America dominates the fermentation chemicals market, driven by the strong presence of key manufacturers, rising demand for bio-based products, and widespread application of fermentation chemicals across industries such as paper, starch processing, and personal care

- The U.S. holds a significant share due to its well-established industrial fermentation sector, ongoing innovation in enzyme production, and high consumption of fermented products across food, pharmaceutical, and biofuel industries

- A strong focus on sustainability, coupled with corporate and government initiatives to reduce carbon emissions and promote renewable alternatives, is supporting the steady adoption of fermentation-based solutions across North American industries

- With increasing R&D investments, high demand across multiple application areas, and a mature industrial base, North America is expected to maintain its dominance in the global fermentation chemicals market throughout the forecast period 2025–2032

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the fermentation chemicals market, driven by rising disposable incomes, rapid industrialization, and expanding end-use sectors such as food and beverage, pharmaceuticals, and personal care

- Countries such as China and India lead the regional market, supported by strong government support for bio-economy initiatives, a growing number of manufacturing facilities, and increased focus on sustainable production technologies

- Southeast Asian nations are emerging as attractive markets due to rising demand for fermented food and health supplements, improved access to biotechnology infrastructure, and growing consumer awareness of clean-label and eco-friendly products

- With expanding urban populations, industrial growth, and strategic investments in fermentation-based R&D, Asia-Pacific is set to emerge as the fastest-growing region in the fermentation chemicals market over the forecast period 2025–2032

Fermentation Chemicals Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Novozymes A/S (Denmark)

- AB Enzymes GmbH (Germany)

- DuPont de Nemours, Inc. (U.S.)

- Ajinomoto Co., Inc. (Japan)

- BASF (Germany)

- ADM (U.S.)

- Cargill, Incorporated (U.S.)

- Chr. Hansen A/S (Denmark)

- LanzaTech (U.S.)

- MicroBiopharm Japan Co., Ltd. (Japan)

- Tokyo Chemical Industry (India) Pvt. Ltd. (India)

- Biocon (India)

- Evonik Industries AG (Germany)

- Dow (U.S.)

- Lonza (Switzerland)

- Amano Enzyme Inc. (Japan)

- INVISTA (U.S.)

Latest Developments in Global Fermentation Chemicals Market

- In January 2024, Kao Corporation announced the successful fermentative production of bio-based gallic acid from glucose using microorganisms. This breakthrough enhances the availability of sustainably sourced gallic acid, an aromatic compound widely used as an industrial antioxidant and in semiconductor manufacturing. Kao's advancement is expected to strengthen the fermentation chemicals market by improving supply chain stability, reducing reliance on traditional extraction methods, and supporting the growing demand for bio-based industrial ingredients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fermentation Chemicals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fermentation Chemicals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fermentation Chemicals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.