Global Ferro Manganese Market

Market Size in USD Billion

CAGR :

%

USD

17.29 Billion

USD

27.82 Billion

2024

2032

USD

17.29 Billion

USD

27.82 Billion

2024

2032

| 2025 –2032 | |

| USD 17.29 Billion | |

| USD 27.82 Billion | |

|

|

|

|

Ferro Manganese Market Size

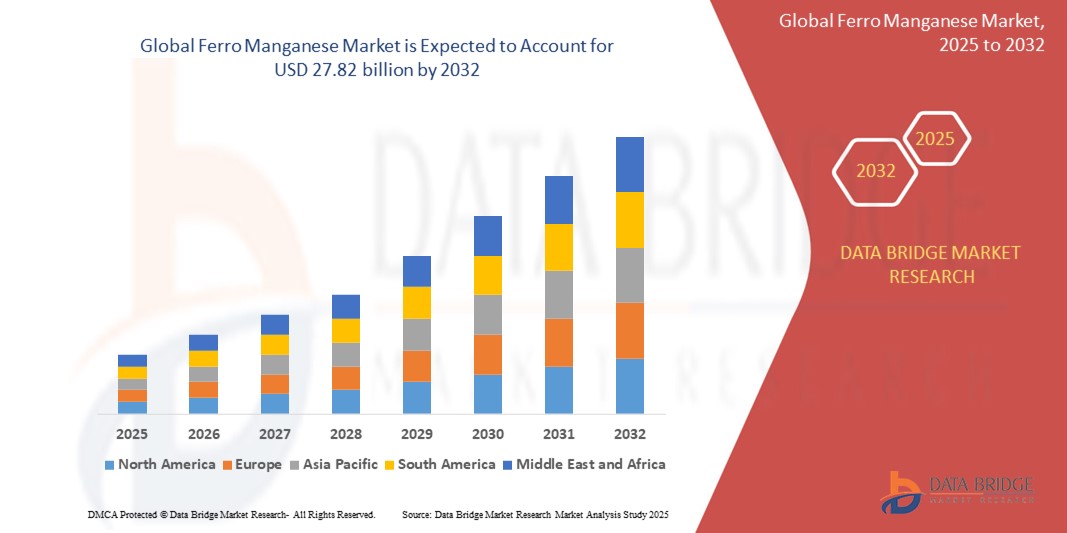

- The global ferro manganese market was valued at USD 17.29 billion in 2024 and is expected to reach USD 27.82 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.50 % primarily driven by the increased demand for steel and alloys, particularly in developing economies

- This growth is driven by factors such as the rising industrialization, infrastructure development, and increasing demand for stainless steel in automotive, construction, and manufacturing sectors

Ferro Manganese Market Analysis

- The Ferro Manganese market has shown significant growth due to its key role in steel production, enhancing properties such as strength and corrosion resistance, which are essential for industries such as automotive and construction

- For instance, large-scale infrastructure projects such as the construction of new railways and bridges in India are contributing to increased demand for steel, and consequently Ferro Manganese

- The demand for high-performance steel alloys has been steadily rising, particularly in developing regions, driving increased consumption of Ferro Manganese in the manufacturing of stainless steel and other specialized alloys. China’s robust steel production for both domestic use and export is a key instance of this trend, making it one of the largest consumers of Ferro Manganese

- Technological advancements in production processes, such as the use of more energy-efficient furnaces, have improved the cost-effectiveness and efficiency of Ferro Manganese production, supporting market growth. A company such as Glencore, which has invested in innovative smelting technologies, exemplifies how these improvements can enhance profitability in Ferro Manganese production

- Real-time instances include the increased adoption of high-strength steel in the automotive industry, with companies such as Tesla and Ford focusing on lighter yet stronger materials for vehicle production, boosting the demand for Ferro Manganese. Tesla’s emphasis on lightweight materials for its electric vehicle models has led to higher consumption of Ferro Manganese to produce the required steel alloys

- With global infrastructure projects ramping up, especially in emerging economies, the market for Ferro Manganese is expected to continue expanding, as steel is a core material in construction and heavy machinery manufacturing

- For instance, the Belt and Road Initiative in China has resulted in substantial demand for steel, driving Ferro Manganese consumption in the construction of roads, ports, and railways across multiple regions

Report Scope and Ferro Manganese Market Segmentation

|

Attributes |

Ferro Manganese Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ferro Manganese Market Trends

“Increasing Demand for High-Strength and Lightweight Steel Alloys”

- The demand for high-strength and lightweight steel alloys is increasing, particularly in the automotive industry

- For instance, Tesla uses advanced steel to reduce the weight of electric vehicles, improving their energy efficiency and range

- In the construction industry, the need for high-performance steel is growing

- For instance, companies such as ArcelorMittal supply specialized steel alloys for infrastructure projects, such as bridges and skyscrapers, where strength and lighter weight reduce costs and increase safety

- The aerospace sector is another key driver, for instance, companies such as Boeing and Airbus use lightweight steel alloys to improve fuel efficiency and reduce emissions, particularly in the production of aircraft components such as fuselages and wings

- As industries demand more durable and corrosion-resistant materials, industries such as heavy machinery and railways are adopting high-strength steel alloys

- For instance, Caterpillar uses advanced steel to enhance the durability of its construction and mining equipment

- The growing adoption of high-performance alloys is leading to higher consumption of Ferro Manganese

- For instance, in the production of these specialized steels, making it a key component in industries focused on innovation and sustainability in materials

Ferro Manganese Market Dynamics

Driver

“Increasing Demand for High-Performance Steel”

- The increasing demand for high-performance steel in industries such as automotive, construction, and infrastructure is driving the growth of the Ferro Manganese market, as Ferro Manganese is essential for enhancing steel's strength, durability, and corrosion resistance

- In the automotive sector, the shift towards lightweight and fuel-efficient vehicles is boosting the need for high-strength steel, which relies heavily on Ferro Manganese

- For instance, electric vehicle manufacturers such as Tesla use high-strength steel to reduce vehicle weight and enhance energy efficiency

- The construction industry also contributes to Ferro Manganese demand, as large-scale infrastructure projects such as bridges, tunnels, and skyscrapers require strong, durable materials. Ferro Manganese helps produce the high-performance steel needed for these demanding applications

- Ferro Manganese is critical for producing various grades of steel, allowing it to meet the diverse needs of different industries. Its versatility ensures it remains a key component in manufacturing materials used in everything from consumer goods to heavy machinery

- As industries such as automotive, construction, and infrastructure continue to grow and innovate, the demand for Ferro Manganese is expected to rise, further solidifying its importance in steel production and driving the market's continued growth

Opportunity

“Growing Focus on Sustainability and Environmental Consciousness”

- The Ferro Manganese market has a significant opportunity arising from the growing emphasis on sustainability within the steel industry, as global initiatives increasingly push for greener, eco-friendly industrial practices, which directly influence Ferro Manganese production

- For instance, the European Union's Green Deal is pushing industries to lower their carbon emissions, encouraging steelmakers to adopt sustainable practices, thus driving demand for cleaner Ferro Manganese production

- The transition to energy-efficient and low-emission technologies is creating a strong demand for more sustainable methods in Ferro Manganese production, such as hydrogen-based reduction processes, which significantly lower carbon emissions compared to traditional methods

- For instances, ArcelorMittal is leading the charge in adopting hydrogen-based steelmaking in its pilot projects, a move that is likely to influence Ferro Manganese producers to follow suit and reduce their environmental impact

- Companies such as ArcelorMittal are at the forefront of this shift, exploring the use of hydrogen in steel production to reduce carbon footprints. Their collaboration with the H2 Green Steel project, which focuses on producing steel with green hydrogen, is an instance of how Ferro Manganese producers could benefit from embracing sustainable methods in response to global decarbonization targets

- The increasing awareness of environmental impact is prompting industries to seek cleaner, more sustainable alternatives. Ferro Manganese producers can capitalize on this by investing in innovations such as electric arc furnaces and hydrogen-based reduction method

- For instances, the use of electric arc furnaces in steel plants, such as those at Nucor Corporation, has reduced the need for traditional blast furnaces, providing an opportunity for Ferro Manganese producers to adopt cleaner technologies

- With governments and regulatory bodies offering incentives and subsidies to support the adoption of greener technologies, Ferro Manganese producers have further opportunities to invest in these methods, boosting the market’s growth as more sustainable practices are integrated into steel production processes

- For instance, U.S. government's tax incentives for clean energy, which encourage manufacturers such as U.S. Steel to invest in cleaner production technologies for Ferro Manganese

Restraint/Challenge

“Volatility of Raw Material Prices”

- One of the major challenges facing the Ferro Manganese market is the volatility of raw material prices, particularly manganese ore, which is a key component in Ferro Manganese production

- For instance, price fluctuations in manganese ore can significantly impact the overall cost structure of Ferro Manganese, leading to unpredictability in pricing for producers and consumers alike

- The supply of manganese ore is concentrated in a few countries, such as South Africa, Australia, and China, which makes the Ferro Manganese market vulnerable to supply chain disruptions

- For instance, in 2021, a shortage of manganese ore due to mining disruptions in South Africa resulted in price hikes, which caused higher production costs for Ferro Manganese manufacturers worldwide

- Fluctuations in global manganese ore prices can directly affect the profitability of Ferro Manganese producers

- For instances, when manganese ore prices rise, producers such as Tata Steel or South32 may face increased production costs, which they may pass on to consumers through higher Ferro Manganese prices, potentially making it less competitive compared to other raw materials or production alternatives

- The reliance on a limited number of manganese ore suppliers increases the Ferro Manganese market’s vulnerability to geopolitical risks, weather-related disruptions, and mining inefficiencies

- For instance, political instability in the Democratic Republic of Congo, one of the key manganese-producing countries, has led to disruptions in the ore supply chain, further exacerbating price volatility

- To mitigate this challenge, Ferro Manganese producers must explore strategies such as securing long-term supply agreements with ore suppliers, investing in mining operations in diverse locations, or developing recycling processes to reuse manganese from scrap steel. Companies such as Vale and Anglo American are increasingly investing in diversification strategies to minimize their exposure to supply chain risks, ensuring stable production costs over time

Ferro Manganese Market Scope

The market is segmented on the basis of grade and application

|

Segmentation |

Sub-Segmentation |

|

By Grade |

|

|

By Application |

|

Ferro Manganese Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Ferro Manganese Market”

- Asia-Pacific dominates the Ferro Manganese market, with China and India playing pivotal roles in driving demand due to their rapidly expanding steel production sectors. China, as the largest global producer and consumer of steel, relies heavily on Ferro Manganese for its vast steel manufacturing needs

- The booming infrastructure and industrial growth in India further boost the demand for Ferro Manganese. With large-scale construction projects such as smart cities and highway developments, India's increasing steel consumption directly supports the growth of Ferro Manganese consumption

- The automotive sector in Asia-Pacific, particularly in China and Japan, significantly contributes to Ferro Manganese demand. China’s automotive industry, including electric vehicle manufacturing by companies such as BYD and NIO, requires high-strength steel that uses Ferro Manganese as a key ingredient

- As the construction industry grows, especially in Southeast Asian countries such as Vietnam and Indonesia, the need for robust steel materials for skyscrapers, bridges, and roads increases, further fuelling the demand for Ferro Manganese

- With continuous industrialization and infrastructure development in the region, including China's Belt and Road Initiative, which connects multiple countries in Asia, Ferro Manganese consumption is expected to remain strong, solidifying Asia-Pacific's leadership in the global market

“Africa is Projected to Register the Highest Growth Rate”

- Africa is the fastest-growing region in the Ferro Manganese market, driven by significant investments in infrastructure and industrial projects. The increasing focus on large-scale construction and manufacturing projects, particularly in countries such as South Africa, has contributed to higher demand for Ferro Manganese for steel production

- Large-scale infrastructure developments, such as road networks, bridges, and commercial buildings, are fuelling the demand for Ferro Manganese. As Africa continues to urbanize and industrialize, the consumption of steel, and subsequently Ferro Manganese, continues to rise

- Africa's market growth is further fuelled by global initiatives such as China’s Belt and Road Initiative, which supports infrastructure development across the continent. This initiative has led to increased investments and development projects that require significant quantities of steel, thus driving Ferro Manganese demand

- Investments from Gulf countries in African industries have also boosted manufacturing and steel consumption. These investments are contributing to the growth of various sectors, leading to a rising demand for Ferro Manganese for steel production

- The region’s abundant manganese reserves provide significant opportunities for market growth, positioning Africa as a key player in Ferro Manganese production. This wealth of resources ensures that Africa will continue to be a significant contributor to the global Ferro Manganese market in the coming years

Ferro Manganese Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Monnet Group (India)

- Tata Steel (India)

- Gulf Manganese Corporation Limited (Australia)

- Ferroglobe (U.K.)

- China Minmetals Corporation (China)

- South32 (Australia)

- OM Holdings Ltd. (Singapore)

Latest Developments in Global Ferro Manganese Market

- In October 2024, Eramet (France) revised its targets for its manganese activities in Gabon. The company announced plans to enhance the capacity and efficiency of its manganese production in Gabon, aiming to increase its output. This development will benefit Eramet by strengthening its market position in the global manganese industry, particularly in Ferro Manganese production. The increased production capacity is expected to meet the growing global demand for manganese, which plays a crucial role in steel manufacturing. The impact on the market is significant as it will ensure a more stable supply of manganese, potentially reducing volatility in pricing and increasing competition among major manganese suppliers

- In October 2024, OM Holdings Ltd. (Singapore) collaborated with South32 (Australia) for a ferroalloy slag repurposing project. The partnership aims to develop innovative methods for repurposing ferroalloy slag, a by-product of Ferro Manganese production, into valuable products. This collaboration will benefit both companies by enhancing their sustainability practices, reducing waste, and creating new revenue streams from repurposed materials. The impact on the market is expected to be positive, as it introduces environmentally friendly solutions while maintaining the production efficiency of Ferro Manganese. In addition, the project aligns with global trends towards more sustainable mining and manufacturing practices, setting a precedent for other industry players to follow

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL FERRO MANGANESE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL FERRO MANGANESE MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 GLOBAL FERRO MANGANESE MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 IMPORT EXPORT SCENARIO

5.2 PRICE TREND ANALYSIS

5.3 RAW MATERIAL ANALYSIS

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 PESTEL ANALYSIS

5.7 REGULATION COVERAGE

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 CLIMATE CHANGE SCENARIO

7.1 ENVIRONMENTAL CONCERNS

7.2 INDUSTRY RESPONSE

7.3 GOVERNMENT’S ROLE

7.4 ANALYST RECOMMENDATIONS

8 GLOBAL FERRO MANGANESE MARKET, BY GRADE,2020-2029, (KILO TONS), (USD MILLION)

8.1 OVERVIEW

8.2 HIGH CARBON

8.2.1 ASP

8.2.2 VALUE

8.2.3 VOLUME

8.3 REFINED

8.3.1 ASP

8.3.2 VALUE

8.3.3 VOLUME

9 GLOBAL FERRO MANGANESE MARKET, BY APPLICATION,2020-2029, (USD MILLION)

9.1 OVERVIEW

9.2 CARBON STEEL

9.3 STAINLESS STEEL

9.4 ALLOY STEEL

9.5 CAST IRON

9.6 OTHERS

10 GLOBAL FERRO MANGANESE MARKET, BY END-USE,2020-2029, (USD MILLION)

10.1 OVERVIEW

10.2 BUILDING & CONSTRUCTION

10.3 SHIP BUILDING

10.4 AUTOMOTIVE & TRANSPORTATION

10.5 CONSUMER GOODS

10.6 MECHANICAL ENGINEERING & HEAVY INDUSTRIES

10.7 OTHERS

11 GLOBAL FERRO MANGANESE MARKET, BY REGION,2020-2029, (KILO TONS), (USD MILLION)

GLOBAL FERRO MANGANESE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

11.2 EUROPE

11.2.1 GERMANY

11.2.2 FRANCE

11.2.3 U.K.

11.2.4 ITALY

11.2.5 SPAIN

11.2.6 RUSSIA

11.2.7 TURKEY

11.2.8 BELGIUM

11.2.9 THE NETHERLANDS

11.2.10 SWITZERLAND

11.2.11 REST OF EUROPE

11.3 ASIA PACIFIC

11.3.1 JAPAN

11.3.2 CHINA

11.3.3 SOUTH KOREA

11.3.4 INDIA

11.3.5 AUSTRALIA

11.3.6 SINGAPORE

11.3.7 THAILAND

11.3.8 MALAYSIA

11.3.9 INDONESIA

11.3.10 PHILIPPINES

11.3.11 REST OF ASIA PACIFIC

11.4 SOUTH AMERICA

11.4.1 BRAZIL

11.4.2 ARGENTINA

11.4.3 REST OF SOUTH AMERICA

11.5 MIDDLE EAST AND AFRICA

11.5.1 SOUTH AFRICA

11.5.2 EGYPT

11.5.3 SAUDI ARABIA

11.5.4 U.A.E

11.5.5 ISRAEL

11.5.6 REST OF MIDDLE EAST AND AFRICA

12 GLOBAL FERRO MANGANESE MARKET,COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12.5 MERGERS & ACQUISITIONS

12.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

12.7 EXPANSIONS

12.8 REGULATORY CHANGES

12.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

13 GLOBAL ORGANIC PEROXIDE INITIATOR MARKET, COMPANY PROFILES

13.1 TATA STEEL LIMITED

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 SWOT ANALYSIS

13.1.4 PRODUCTION CAPACITY OVERVIEW

13.1.5 PRODUCT PORTFOLIO

13.1.6 RECENT UPDATES

13.2 MONET GROUP

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 SWOT ANALYSIS

13.2.4 PRODUCTION CAPACITY OVERVIEW

13.2.5 PRODUCT PORTFOLIO

13.2.6 RECENT UPDATES

13.3 EURASIAN RESOURCES GROUP S.À R.L.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 SWOT ANALYSIS

13.3.4 PRODUCTION CAPACITY OVERVIEW

13.3.5 PRODUCT PORTFOLIO

13.3.6 RECENT UPDATES

13.4 GULF MANGANESE CORPORATION LIMITED

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 SWOT ANALYSIS

13.4.4 PRODUCTION CAPACITY OVERVIEW

13.4.5 PRODUCT PORTFOLIO

13.4.6 RECENT UPDATES

13.5 ERAMET GROUP

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 SWOT ANALYSIS

13.5.4 PRODUCTION CAPACITY OVERVIEW

13.5.5 PRODUCT PORTFOLIO

13.5.6 RECENT UPDATES

13.6 CHINA MINMETALS GROUP CO., LTD.

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 SWOT ANALYSIS

13.6.4 PRODUCTION CAPACITY OVERVIEW

13.6.5 PRODUCT PORTFOLIO

13.6.6 RECENT UPDATES

13.7 SOUTH32

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 SWOT ANALYSIS

13.7.4 PRODUCTION CAPACITY OVERVIEW

13.7.5 PRODUCT PORTFOLIO

13.7.6 RECENT UPDATES

13.8 FERROGLOBE

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 SWOT ANALYSIS

13.8.4 PRODUCTION CAPACITY OVERVIEW

13.8.5 PRODUCT PORTFOLIO

13.8.6 RECENT UPDATES

13.9 OM HOLDINGS LIMITED

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 SWOT ANALYSIS

13.9.4 PRODUCTION CAPACITY OVERVIEW

13.9.5 PRODUCT PORTFOLIO

13.9.6 RECENT UPDATES

13.1 VALE

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 SWOT ANALYSIS

13.10.4 PRODUCTION CAPACITY OVERVIEW

13.10.5 PRODUCT PORTFOLIO

13.10.6 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDIES AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST.

14 CONCLUSION

15 QUESTIONNAIRE

16 RELATED REPORTS

17 ABOUT DATA BRIDGE MARKET RESEARCH

Global Ferro Manganese Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ferro Manganese Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ferro Manganese Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.