Global Fertility Services Market

Market Size in USD Billion

CAGR :

%

USD

21.80 Billion

USD

39.46 Billion

2024

2032

USD

21.80 Billion

USD

39.46 Billion

2024

2032

| 2025 –2032 | |

| USD 21.80 Billion | |

| USD 39.46 Billion | |

|

|

|

|

Global Fertility Services Market Size

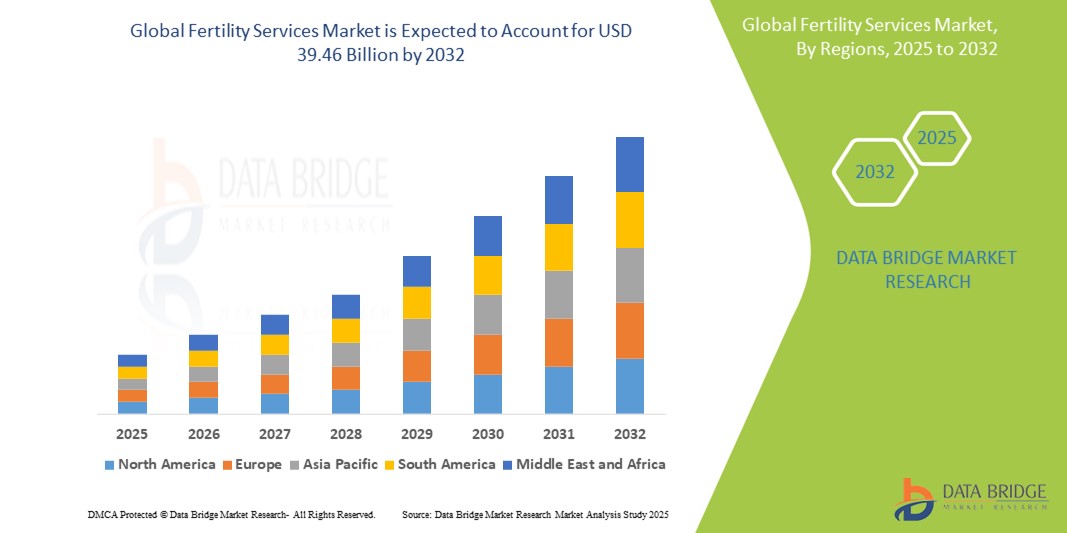

- The global fertility services market was valued at USD 21.80 billion in 2024 and is expected to reach USD 39.46 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.70%, primarily driven by the anticipated launch of advanced fertility therapies and innovative treatment options

- This growth is driven by factors such as rising infertility rates, delayed parenthood trends, and advancements in assisted reproductive technologies

Global Fertility Services Market Analysis

- The global fertility market encompasses a range of treatments and technologies aimed at assisting individuals and couples with reproductive challenges. Key solutions include in-vitro fertilization (IVF), intrauterine insemination (IUI) and fertility preservation techniques

- The demand for fertility treatments is significantly driven by rising infertility rates, lifestyle changes, and an increasing trend of delayed parenthood. In addition, growing awareness and accessibility to assisted reproductive technologies (ART) contribute to market expansion

- The North America region stands out as one of the dominant regions in the fertility market, supported by advanced healthcare infrastructure, high adoption of fertility treatments, and increasing insurance coverage for ART procedures

- For instance, the number of IVF cycles performed annually in the U.S. has been steadily increasing, with fertility clinics and specialized centers driving innovations in reproductive medicine

- Globally, fertility treatments rank among the most critical segments of the reproductive health industry, with IVF leading as the most widely utilized ART. These treatments play a pivotal role in helping individuals achieve parenthood and addressing reproductive health concerns

Report Scope and Fertility Services Market Segmentation

|

Attributes |

Fertility Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fertility Services Market Trends

“Advancements in AI and Digital Health for Fertility Treatments”

- One prominent trend in the global fertility market is the increasing integration of artificial intelligence (AI) and digital health solutions in fertility treatments

- These technologies enhance the accuracy and efficiency of assisted reproductive techniques (ART) by improving embryo selection, optimizing treatment protocols, and personalizing fertility care

- For instance, AI-powered embryo grading systems help embryologists identify the most viable embryos for implantation, increasing the success rates of IVF procedures

- Digital health platforms also enable remote fertility monitoring, telehealth consultations, and data-driven insights, making fertility treatments more accessible and tailored to individual patient need

- This trend is transforming the fertility landscape by improving treatment success rates, reducing costs, and increasing access to fertility care worldwide

Fertility Services Market Dynamics

Driver

“Rising Infertility Rates Driving Demand for Fertility Treatments”

- The increasing prevalence of infertility due to factors such as lifestyle changes, delayed parenthood, hormonal imbalances, and underlying medical conditions is significantly contributing to the demand for fertility treatments

- As more individuals and couples face reproductive challenges, the need for assisted reproductive technologies (ART) such as in-vitro fertilization (IVF), intrauterine insemination (IUI), and fertility preservation techniques continues to grow

- Lifestyle factors, including stress, obesity, smoking, and environmental pollutants, have been linked to declining fertility rates in both men and women, further emphasizing the demand for advanced reproductive solutions

- The ongoing advancements in reproductive medicine, including improved embryo freezing techniques, genetic screening, and AI-driven embryo selection, are enhancing success rates and making fertility treatments more effective and accessible

- As infertility rates continue to rise globally, the demand for fertility treatments is increasing, ensuring better reproductive outcomes for individuals seeking parenthood

For instance,

- In June 2022, according to an article published by the World Health Organization (WHO), infertility affects nearly 1 in 6 people globally, highlighting the growing need for fertility interventions and reproductive healthcare services. This trend acts as a key driver for the global fertility market, increasing the demand for ART procedures

- In March 2023, the Centers for Disease Control and Prevention (CDC) reported that the average age of first-time mothers in the U.S. has risen significantly, with more women opting for childbearing later in life. This shift contributes to higher demand for fertility treatments, as age-related fertility decline becomes a concern

- As a result of the rising infertility rates and the increasing awareness of fertility treatment options, there is a significant surge in demand for ART services worldwide

Opportunity

“Enhancing Fertility Treatments with Artificial Intelligence Integration”

- AI-powered fertility solutions are revolutionizing assisted reproductive technologies (ART) by improving embryo selection, optimizing treatment protocols, and personalizing fertility care to enhance success rates

- AI algorithms can analyze embryo development in real time, predicting the likelihood of successful implantation and reducing the chances of failed cycles, thus improving patient outcomes

- In addition, AI-driven fertility tools can assist in hormone level monitoring, genetic screening, and data-driven decision-making, helping fertility specialists tailor treatments to individual patient needs for better result

For instance,

- In In February 2024, according to an article published in the Journal of Assisted Reproduction and Genetics, AI-based embryo grading systems demonstrated higher accuracy in selecting viable embryos for IVF, increasing pregnancy success rates while reducing the number of cycles needed for conception

- In September 2023, according to an article published by the National Institutes of Health (NIH), AI-driven predictive models have been integrated into fertility clinics, enabling personalized treatment plans based on patient history, genetic factors, and hormone levels, ultimately enhancing the efficiency of ART procedures

- The integration of AI in fertility treatments can lead to higher success rates, reduced time to conception, and improved patient experiences. By leveraging AI-powered diagnostics and predictive analytics, fertility specialists can offer more precise and effective treatments, significantly advancing the global fertility market

Restraint/Challenge

“High Treatment Costs Hindering Market Accessibility”

- The high cost of fertility treatments poses a significant challenge for market growth, particularly affecting the affordability and accessibility of assisted reproductive technologies (ART) for individuals and couples, especially in developing regions

- The procedures such as in-vitro fertilization (IVF) and egg freezing can cost thousands to tens of thousands of dollars per cycle, making it financially burdensome for many patients

- This substantial financial barrier can deter individuals from seeking fertility treatments or completing multiple cycles, which are often necessary for a successful pregnancy, thereby limiting market expansion

For instance,

- In October 2024, according to an article published by the American Society for Reproductive Medicine (ASRM), the average cost of a single IVF cycle in the U.S. ranges between USD 12,000 and USD 25,000, excluding medication expenses. The lack of widespread insurance coverage further restricts access to fertility care

- Consequently, these cost-related limitations result in disparities in access to fertility treatments, with only a portion of the population able to afford ART procedures. This financial burden hinders market penetration and restricts the overall growth of the global fertility market

Fertility Services Market Scope

The market is segmented on the basis of type, procedure, services, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Procedure |

|

|

By Services |

|

|

By End Users

|

|

Fertility Services Market Regional Analysis

“North America is the Dominant Region in the Fertility Services Market”

- North America dominates the fertility market, driven by advanced healthcare infrastructure, high adoption of assisted reproductive technologies (ART), and a strong presence of leading fertility clinics and research institutions

- U.S. holds a significant share due to rising infertility rates, delayed parenthood trends, and increasing awareness of fertility treatments such as in-vitro fertilization (IVF) and egg freezing

- The availability of well-established insurance coverage for fertility treatments in certain states, along with growing investments in reproductive medicine research, further strengthens market growth

- In addition, the increasing number of fertility clinics, advancements in AI-driven embryo selection, and a growing trend of fertility tourism contribute to the continuous expansion of the market in this region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to witness the highest growth rate in the fertility market, driven by improving healthcare infrastructure, rising infertility rates, and increasing awareness about ART procedures

- Japan, with its advanced medical research and government-backed initiatives to address declining birth rates, remains a crucial market for ART adoption and fertility preservation services

- China and India, with their large populations and growing middle class, are witnessing increased government and private sector investments in fertility clinics and ART services. The expanding presence of global fertility service providers and increasing affordability of fertility treatments further contribute to market growth

Fertility Services Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Olympus Corporation (Japan)

- The Cooper Companies, Inc. (U.S.)

- Instituto Bernabeu (Spain)

- Virtus Health (Australia)

- CooperSurgical Inc. (U.S.)

- Vitrolife (Sweden)

- Care Fertility (U.K.)

- INVO Bioscience (U.S.)

- Monash IVF Australia (Australia)

- FERTILITY FOCUS LIMITED (U.S.)

- Carolinas Fertility Institute (U.S.)

- Apollo Hospitals (India)

- Merck KGaA (Germany)

- LABOTECT GMBH (Germany)

- Medicover AB (Sweden)

- Genea Fertility (India)

- Progyny, Inc. (U.S.)

- AIVF (Israel)

- Jilla IVF (India)

- Eugin Group (Spain)

Latest Developments in Global Fertility Services Market

- In January 2025, Merck announced the launch of its next-generation fertility treatment, a novel hormone therapy designed to improve ovarian stimulation outcomes for women undergoing in-vitro fertilization (IVF). The new therapy leverages advanced recombinant technology to enhance egg maturation while reducing side effects associated with traditional hormone treatments

- In October 2024, at the ASRM 2024 conference, CooperSurgical unveiled its latest AI-powered embryo selection tool, designed to improve implantation success rates by analysing embryo quality with higher precision. The company also presented data supporting the use of time-lapse imaging and AI algorithms to optimize IVF outcomes

- In September 2024, Ferring Pharmaceuticals received FDA approval for a ground breaking oral gonadotropin therapy, offering a more patient-friendly alternative to traditional injectable fertility drugs. The therapy aims to simplify treatment protocols while maintaining high efficacy in ovarian stimulation

- In September 2024, Igenomix launched an innovative non-invasive embryo testing technology, which allows for the genetic screening of embryos without the need for biopsy. This advancement provides a safer and more accurate way to assess embryo viability, improving success rates for couples undergoing fertility treatments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.