Global Fiber Optic Test Equipment Market

Market Size in USD Billion

CAGR :

%

USD

958.16 Billion

USD

1,474.94 Billion

2020

2028

USD

958.16 Billion

USD

1,474.94 Billion

2020

2028

| 2021 –2028 | |

| USD 958.16 Billion | |

| USD 1,474.94 Billion | |

|

|

|

|

Fiber Optic Test Equipment Market Size

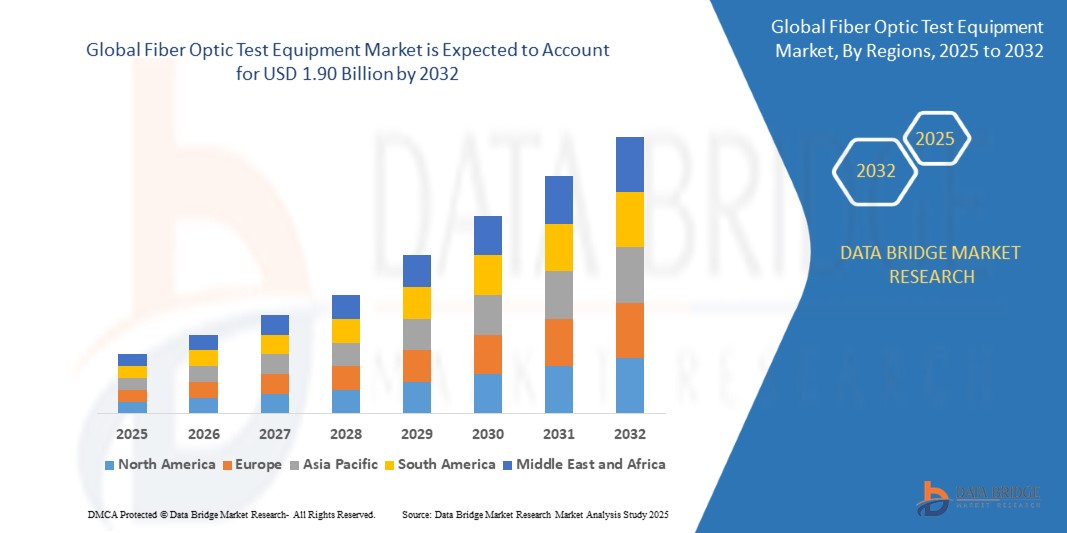

- The global fiber optic test equipment market was valued at USD 1.02 billion in 2024 and is expected to reach USD 1.90 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.1%, primarily driven by the high research optimization and growth in emerging sectors.

- This growth is driven by the rising demand for personalized and engaging customer experiences through technologies like virtual, augmented, and mixed reality.

Fiber Optic Test Equipment Market Analysis

- The global fiber optic test equipment market is growing due to rising demand for high-speed Fiber Optic Test Equipment (FOTE) encompasses tools and systems used to ensure the performance, reliability, and integrity of fiber optic networks, including optical time domain reflectometers (OTDRs), optical power meters (OPMs), and optical spectrum analyzers (OSAs), critical for installation, maintenance, and troubleshooting.

- The demand for FOTE is significantly driven by the global surge in fiber optic network deployments, with over 7,500 data centers worldwide in 2024 and a projected global data production of 180 zettabytes by 2025, necessitating robust testing solutions.

- North America is expected to dominate the Fiber Optic Test Equipment market due to large-scale 5G rollouts and hyperscale data center investments, supported by initiatives like the U.S. Broadband Equity, Access, and Deployment (BEAD) program.

- Asia-Pacific is expected to be the fastest-growing region during the forecast period due to rapid telecommunications infrastructure development in countries like China and India, fueled by initiatives like China’s Digital Silk Road.

Report Scope and Fiber Optic Test Equipment Market Segmentation

|

Attributes |

Fiber Optic Test Equipment Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Russia, Turkey, Netherlands, Norway, Finland, Denmark, Sweden, Poland, Switzerland, Belgium, Rest of Europe, China, Japan, India, South Korea, Australia, Indonesia, Thailand, Malaysia, Singapore, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, U.A.E., Saudi Arabia, South Africa, Egypt, Israel, and Rest of Middle East & Africa |

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, PORTER analysis, and PESTLE analysis. |

Fiber Optic Test Equipment Market Market Trends

“Increasing demand for high-speed and reliable internet connectivity. ”

- The global fiber optic test equipment market is expanding due to increasing demand for high-speed and reliable internet connectivity. As digital services grow, service providers are investing heavily in fiber networks to support data-intensive applications.

- This surge in demand is driving the need for accurate testing tools to ensure optimal network performance. Equipment such as OTDRs, optical power meters, and light sources are essential for installation, maintenance, and troubleshooting.

- Moreover, the rise of cloud computing, IoT, and smart city projects further fuels market growth. Reliable fiber connectivity is crucial, making test equipment a key enabler of modern digital infrastructure.

- For instance, In March 2024 - VeEX Inc. unveiled the RXT- 6800 Advanced 800G Multiservice test module. Based on the RXT-6400400G high-speed test module, the RXT6800 provides the flexibility to test existing interfaces up to a maximum of 800G. This new module is the industry's smallest, most versatile, and most portable 800G field test solution.

- This growing reliance on fiber networks fuels demand for advanced test equipment to ensure efficient installation, maintenance, and performance monitoring. Innovation in portable and cloud-enabled tools is also accelerating adoption.

Fiber Optic Test Equipment Market Market Dynamics

Driver

“Growing 5G deployment and fiber network expansion globally. ”

- The global rollout of 5G networks is significantly accelerating the demand for high-performance fiber optic infrastructure. 5G requires low latency and high bandwidth, which fiber optics can best support.

- To meet these technical requirements, telecom operators are rapidly expanding their fiber networks. This expansion increases the need for precise and reliable fiber optic test equipment during installation and maintenance.

- As countries invest in upgrading their communication infrastructure, the fiber optic test equipment market is benefiting from steady growth. The push for better connectivity is driving long-term demand across regions.

- For instance, in April 2025, Moroccan telecom operators Inwi and Maroc Telecom partnered to accelerate the deployment of fiber optic and 5G infrastructure through two joint ventures, FiberCo and TowerCo. The project, valued at MAD 4.4 billion (USD 458 million), aims to expand fiber connections to 3 million and build 6,000 towers over the next decade. This collaboration also ended a long-standing legal dispute between the two firms. The initiative is set to enhance Morocco’s digital infrastructure, boost connectivity, support digital inclusion, and attract investment, strengthening the country’s position in the North African telecom market.

- As high-speed connectivity becomes critical, the demand for FOTE rises, ensuring robust and efficient networks.

Opportunity

“Rising investments in fiber and 5G infrastructure projects.”

- Rising investments in fiber and 5G infrastructure are creating new opportunities for the global fiber optic test equipment market. Governments and telecom operators are prioritizing network upgrades to meet growing data demands and support digital transformation.

- These investments are driving the need for advanced testing solutions to ensure quality, reliability, and efficiency in network deployment. This boosts demand for tools like OTDRs, power meters, and network analyzers.

- As 5G expands and fiber reaches underserved areas, test equipment providers have the chance to scale globally, enter new markets, and offer tailored solutions for evolving infrastructure needs.

- For instance, In March 2025, Maroc Telecom and Inwi expanded their partnership to accelerate the deployment of fiber-optic and 5G technologies in Morocco. They announced the creation of two joint ventures—FiberCo and TowerCo—each equally owned, to consolidate parts of their passive telecom infrastructure. FiberCo aimed to reach 1 million fiber connections in two years and 3 million in five years, while TowerCo planned to build 2,000 telecom towers in three years and 6,000 in ten years. This initiative presented a strong opportunity for the fiber optic test equipment market by increasing demand for network testing tools, ensuring high-quality infrastructure rollout, and supporting rapid digital expansion in North Africa.

- Brands are redefining audience interaction by blending digital, on-ground, and media platforms. This strategy deepens fan loyalty while delivering consistent, memorable experiences. As demand grows, it presents a strong opportunity for marketers to boost visibility and engagement.

Restraint/Challenge

“High cost of advanced fiber optic test equipment limits adoption ”

- The high cost of advanced fiber optic test equipment presents a significant challenge for market growth, especially in developing regions. Many network operators and service providers face budget constraints that hinder investment in cutting-edge testing tools.

- This cost barrier can result in delayed infrastructure projects or reliance on outdated or less efficient testing methods, which may compromise network performance and reliability. Smaller companies are particularly affected, limiting their ability to compete.

- To overcome this challenge, manufacturers may need to focus on cost-effective solutions or flexible financing models. Addressing affordability will be crucial to ensure widespread adoption and sustained market expansion.

- For instance, The May430 Fiber Optic Network Tester, priced between USD 343 to USD 873 with a minimum order of 10 units, highlights the affordability challenge in the fiber optic test equipment market. For small-scale operators and emerging markets, such upfront costs—combined with limited production capacity and international procurement complexities—can restrict access to advanced testing tools. This reinforces the broader market challenge of high equipment costs limiting adoption, particularly in price-sensitive regions.

- The high cost of advanced fiber optic test equipment continues to be a significant barrier to widespread adoption, especially among small service providers and in developing regions. While technological advancements drive performance, they also inflate prices, making it difficult for many stakeholders to invest in comprehensive testing solutions.

Fiber Optic Test Equipment Market Market Scope

The market is segmented into four notable segments based on product type, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By End User |

|

In 2025, the Optical Time Domain Reflectometer (OTDR) segment is projected to dominate the market with the largest share in the equipment type segment.

The Optical Time Domain Reflectometer (OTDR) segment is expected to dominate the Fiber Optic Test Equipment market with the largest share of 36.5% in 2025 due to its critical role in characterizing and troubleshooting fiber optic networks, driven by 5G and FTTH deployments.

Fiber Optic Test Equipment Market Market Country Analysis

“North America is a Dominant Region in the Global Fiber Optic Test Equipment market”

- North America dominates the fiber optic test equipment market due to its early adoption of advanced communication technologies and well-established telecom infrastructure. The region is home to leading service providers and tech firms that invest heavily in 5G and fiber deployments, driving demand for high-performance test equipment.

- The presence of major market players like VIAVI Solutions, EXFO, and Fluke Corporation boosts innovation and product availability in the region. Their advanced R&D capabilities contribute to the development of cutting-edge testing solutions tailored to meet evolving industry needs.

- Additionally, strong government initiatives supporting broadband expansion, especially in rural areas, and increased funding for digital infrastructure further fuel market growth in North America. This regulatory and financial support enhances overall connectivity, reinforcing the region’s leadership in the global market.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is the fastest-growing market for fiber optic test equipment due to rapid digital transformation and increasing internet penetration across developing countries like India, China, and Southeast Asian nations. These regions are witnessing massive investments in 5G and broadband infrastructure to meet growing data demand.

- Governments across Asia-Pacific are supporting smart city initiatives and national broadband plans, which require extensive fiber network testing and validation. This rising infrastructure deployment creates a strong need for reliable and efficient test equipment to ensure quality and performance.

- Furthermore, the growing presence of local manufacturers offering cost-effective testing solutions, along with increasing collaborations and foreign investments, accelerates market growth. The combination of rising demand, favorable policies, and expanding telecom sectors positions Asia-Pacific as the fastest-growing region by CAGR.

Fiber Optic Test Equipment Market Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- America Fujikura Ltd. (Fujikura Ltd.) (Japan)

- Anritsu Corporation (Japan)

- Deviser Instruments Incorporated (U.S.)

- EXO Inc. (Canada)

- Fluke Corporation (Fortive Corporation) (U.S.)

- Kingfisher International (Australia)

- OZ Optics Ltd. (Canada)

- Terahertz Technologies (U.S.)

- VeEX Inc. (U.S.)

- VIAVI Solutions Inc. (U.S.)

- Yokogawa Test & Measurement Corporation (Japan)

Latest Developments in Fiber Optic Test Equipment Market

- In February 2025, Northeastern University student Alex Zhang, during her co-op at Viavi Solutions in Washington, improved a fiber optic testing device by automating its inspection process. She designed a script to automate the detection of flaws in fiber tips, making the tool—used by companies like AT&T and Boeing—more efficient than manual inspection.

- In April 2025, VeEX Inc. launched the MPM-HD-822 OSFP800 dual port test module as part of its MPA-HD series, expanding its capabilities in high-speed network testing. The new module supported dual native OSFP800 test ports, enabling advanced L2/L3 traffic generation and analysis for 800GE, 400GE, Nx200GE, and Nx100GE applications.

- In April 2025, AFL launched the ApexU.S. X-1, the newest and most compact sealed dome splice closure in its Apex Fiber Optic Closure family. The X-1 was designed to simplify installation for small network and rural FTTx deployments. It supported up to 144 single fibers, 432 mass fusion splices, or 864 SpiderWeb RibbonU.S. fibers and featured a "press-to-release" wedge system for easy and organized cable entry.

- In July 2019, ShinewayTech was awarded the Global Price/Performance Value Leadership Award by Frost & Sullivan for its cost-effective, high-performance fiber optic test equipment. The company’s compact, lightweight, and user-friendly tools—such as its handheld OTDR and optical channel checkers—enabled efficient, real-time testing while reducing operational costs by approximately 30% compared to competitors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.