Global Fiber Optics Market

Market Size in USD Billion

CAGR :

%

USD

7.36 Billion

USD

15.45 Billion

2024

2032

USD

7.36 Billion

USD

15.45 Billion

2024

2032

| 2025 –2032 | |

| USD 7.36 Billion | |

| USD 15.45 Billion | |

|

|

|

|

Fiber Optics Market Size

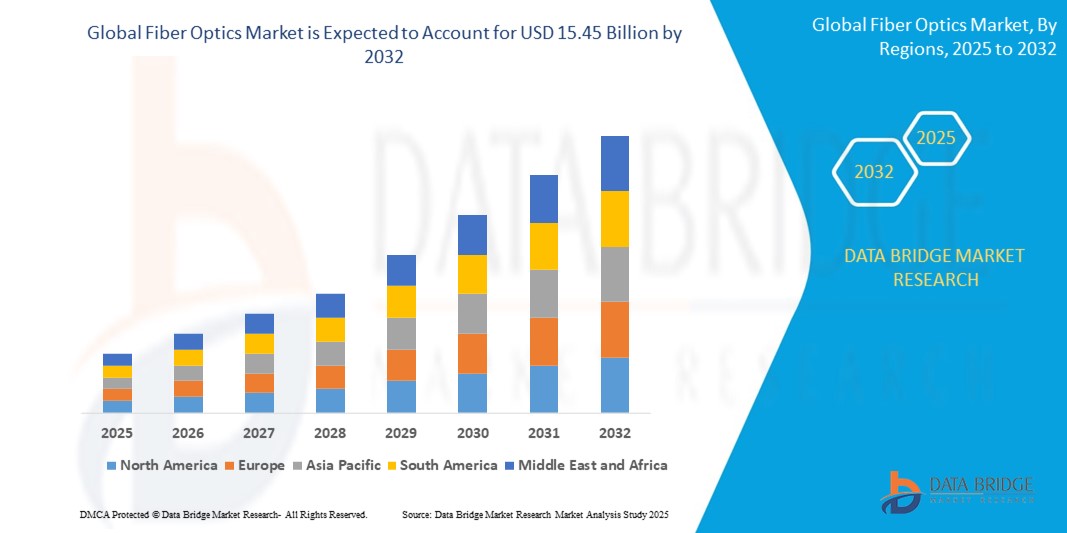

- The global fiber optics market was valued at USD 7.36 billion in 2024 and is expected to reach USD 15.45 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 9.70% primarily driven by the increasing demand for high-speed internet and communication networks

- This growth is driven by factors such as the expanding applications in telecommunications, data centers, and broadband infrastructure

Fiber Optics Market Analysis

- The fiber optics market is expanding rapidly due to the increasing demand for high-speed internet and reliable communication systems, essential for modern digitalization and the internet of things

- For instance, the expansion of 5G networks by companies like Verizon and T-Mobile is heavily dependent on fiber optics for backhaul infrastructure

- Telecommunications companies, such as Verizon and AT&T, are investing heavily in fiber optic networks to provide faster broadband services

- For instance, in 2021, Verizon committed to rolling out fiber broadband to 15 million homes in the U.S., signaling the growing reliance on fiber optics for next-generation internet connectivity

- Data centers are increasingly adopting fiber optics for efficient data transmission, especially as cloud computing and online services like Amazon Web Services and Microsoft Azure require high-performance connectivity. Microsoft’s data centers are a prime instance, where fiber optics enable high-speed data transfers between global hubs

- In healthcare, fiber optics are used for advanced medical imaging, endoscopy, and telemedicine, helping to enhance diagnostic capabilities and patient care through faster, more accurate data transfer

- For instance, fiber optic cables are vital in high-resolution imaging systems like MRI machines and in telemedicine consultations for remote diagnosis

- The automotive sector is also embracing fiber optics for connected vehicles and autonomous driving technologies, with companies like Tesla and Waymo relying on high-speed data transfer for real-time decision-making systems. Tesla’s autonomous driving systems utilize fiber optics to handle the vast amounts of data generated by sensors and cameras on their vehicles

Report Scope and Fiber Optics Market Segmentation

|

Attributes |

Fiber Optics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Fiber Optics Market Trends

“Increasing Shift Towards Higher-Speed Internet and More Efficient Data Transmission”

- The increasing demand for higher-speed internet is driving the adoption of fiber optics, as traditional copper cables can no longer meet the high bandwidth requirements of modern digital services like streaming and video conferencing

- Telecommunications companies such as Verizon and AT&T are investing heavily in fiber optic infrastructure to provide faster internet speeds

- For instance, AT&T’s Fiber program aims to bring gigabit-speed internet to millions of households across the U.S.

- The rollout of 5G networks is a significant driver of this trend, with fiber optics being used extensively for 5G backhaul networks. In cities such as San Francisco, fiber optics play a critical role in supporting 5G connectivity, enabling faster and more reliable data transmission

- Remote work and online education have accelerated the need for faster internet connections, particularly in areas with high data usage. This has led to increased fiber optic deployments in suburban and rural areas, with companies such as Google Fiber expanding their services to underserved regions

- Fiber optics are also crucial for enhancing data transfer speeds in cloud computing and e-commerce platforms, such as Amazon Web Services, where businesses rely on ultra-fast, low-latency connections for real-time transactions and operations

Fiber Optics Market Dynamics

Driver

“Increasing Demand for Reliable Communication Networks”

- The increasing demand for reliable communication networks is being driven by the global reliance on digital technologies for various industries, from telecommunications to healthcare and education

- For instance, during the pandemic, educational institutions such as Harvard and Stanford accelerated their use of online learning platforms, which heavily depend on fast and reliable internet connectivity

- Telecom giants such as Verizon and AT&T are significantly investing in fiber optic infrastructure to meet the growing need for high-speed, uninterrupted internet services. In 2021, AT&T announced its Fiber program, which aims to expand its service to 15 million homes across the U.S., providing faster internet to customers in urban and rural areas alike

- As remote work becomes more common, especially during and after the COVID-19 pandemic, the need for stable and fast communication has surged. Fiber optics are essential in providing reliable internet connections for telecommuting, video conferencing, and cloud-based work. Companies such as Zoom and Microsoft Teams saw huge spikes in usage, highlighting the growing need for robust networks

- In healthcare, fiber optics play a vital role in enabling telemedicine and the fast transmission of medical records

- For instance, Mayo Clinic uses fiber optic networks to link its facilities and provide telemedicine consultations, ensuring that patients receive timely care even remotely

- Financial institutions, such as JPMorgan Chase and Bank of America, use fiber optic networks to support secure and fast transactions. Fiber optics allow for real-time trading and banking services, which are crucial for financial markets such as the New York Stock Exchange and NASDAQ, where speed and reliability are critical to success

Opportunity

“Increasing Adoption of Fiber Optics in Rural and Underserved Areas”

- The increasing adoption of fiber optics in rural and underserved areas presents a huge growth opportunity for the fiber optics market, as many regions have historically lacked high-speed internet access

- The U.S. Federal Communications Commission's (FCC) Rural Digital Opportunity Fund is a prime instance of how governments are investing in broadband expansion to rural areas, aiming to provide reliable internet to over 8 million people in underserved communities

- By providing fiber optic networks to these areas, companies can tap into new customer bases

- For instance, local internet providers such as Frontier Communications have expanded fiber services to rural areas, allowing residents to access better internet speeds for work, education, and entertainment

- The expansion of fiber optics in rural regions enables economic growth by facilitating telecommuting, online education, and e-commerce

- For instance, rural schools in the U.S. are increasingly using fiber internet to offer virtual classes and improve educational outcomes

- Industries such as agriculture, healthcare, and e-learning stand to benefit from high-speed internet access in rural areas. Healthcare facilities are using fiber optics for telemedicine, such as rural clinics in India using fiber connections for virtual consultations with specialists across the country

Restraint/Challenge

“High Cost and Complexity of Installation”

- One of the primary challenges in the fiber optics market is the high cost and complexity of installation, especially in rural and remote areas, where existing infrastructure is often lacking

- In urban environments, laying fiber optic cables involves navigating through existing infrastructure such as roads, buildings, and utility lines, which can significantly increase costs and installation time

- For instance, the rollout of fiber networks in cities such as New York or Los Angeles requires dealing with complex zoning and roadwork regulations

- Rural areas present even greater challenges due to the absence of pre-existing network infrastructure, making fiber optic deployment more expensive and logistically difficult

- For instance, Frontier Communications, which faced difficulties in rolling out fiber in remote areas of California due to the lack of existing infrastructure and the need for extensive land acquisition

- Local regulations, zoning laws, and land acquisition issues further complicate the deployment process

- For instance, in many parts of Europe, the installation of fiber networks faces delays due to regulatory approval processes, which can slow down the expansion of high-speed internet access

- The high cost of fiber optic equipment, including cables, connectors, and network devices, is a barrier for smaller service providers

- For instance, in rural regions of India, small internet providers struggle to meet the capital costs of deploying fiber optic networks, limiting their ability to offer broadband services in underserved areas

Fiber Optics Market Scope

The market is segmented on the basis of type, cable type, and application

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Cable Type |

|

|

By Application |

|

Fiber Optics Market Regional Analysis

“North America is the Dominant Region in the Fiber Optics Market”

- North America dominates the global fiber optics market due to its robust industrial infrastructure and the presence of major market players such as Verizon, AT&T, and Comcast

- The region's advanced technology sector has significantly boosted the adoption of fiber optics, particularly in telecommunications, supporting the growing demand for high-speed internet

- The U.S. is a key contributor, driven by the need for faster, more reliable internet in both urban and rural areas, spurring fiber optic network expansion

- The automotive industry in North America also plays a crucial role, as it increasingly relies on fiber optics for enhanced connectivity, data transfer, and the development of smart vehicle technologies

- The established presence of fiber optic providers and the ongoing demand for faster and more efficient communication systems solidify North America's dominant position in the market

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to see significant growth in the fiber optics market, driven by strong government support for digital infrastructure and broadband expansion

- Countries such as India and China are making large-scale investments in telecommunications, increasing the adoption of fiber optics to meet the growing demand for internet connectivity

- The region's automotive industry is also contributing to the rise in fiber optics demand, as manufacturers require high-speed data transfer for smart vehicles and advanced automotive technologies

- With a large population pool and substantial untapped markets, particularly in rural and remote areas, Asia-Pacific presents ample opportunities for fiber optic expansion and adoption

- The surge in research and development across various industries and increasing investments in fiber optic infrastructure make Asia-Pacific a critical region for the future growth of the fiber optics market

Fiber Optics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- TE Connectivity (Switzerland)

- Corning Incorporated (U.S.)

- Molex (U.S.)

- Amphenol Corporation (U.S.)

- Infinite Electronics International, Inc. (U.S.)

- Hitachi Information & Telecommunication Engineering, Ltd (Japan)

- Radiall (France)

- Delaire USA (U.S.)

- Belden Inc. (U.S.)

- Panduit (U.S.)

- HIROSE ELECTRIC CO., LTD. (Japan)

- Ratioplast-Electronics (Germany)

- RS COMPONENTS PTE LTD (Singapore)

- 3M (U.S.)

- Nexans (France)

- LEONI AG (Germany)

- Glenair, Inc. (U.S.)

- Extron (U.S.)

- CommScope (U.S.)

Latest Developments in Global Fiber Optics Market

- In January 2023, Prysmian Group acquired Warren & Brown, an Australian leader in telecommunication network connectivity products. This acquisition strengthens Prysmian's position in the Asia-Pacific telecom market, expanding its fiber optic and connectivity solutions. By integrating Warren & Brown's advanced products, Prysmian aims to enhance its service offerings and increase market share. The deal will improve telecommunications infrastructure in the region, driving growth and innovation in the sector while expanding access to high-performance connectivity solutions

- In June 2023, Corning Inc. announced a joint venture with SGD Pharma to open a new glass tubing facility in India and expand access to Corning's Velocity Vial technology. This collaboration aims to enhance the production of high-quality glass vials for the pharmaceutical industry. By establishing the new facility, the companies intend to increase manufacturing capacity and improve access to advanced vial solutions in India. This venture will benefit both parties by strengthening their presence in the growing Indian pharmaceutical market, while also providing better access to critical drug packaging technologies. The move is expected to positively impact the market by enhancing supply chain capabilities and meeting the increasing demand for high-performance pharmaceutical packaging

- In June 2023, Corning Inc. and SGD Pharma announced a joint venture to open a new glass tubing facility in India and expand access to Corning's Velocity Vial technology. This initiative aims to enhance the production of high-quality glass vials used in the pharmaceutical industry. By establishing the new facility, the companies plan to increase manufacturing capacity and improve access to advanced vial technologies, particularly in India. The partnership is expected to strengthen Corning's position in the Indian market while meeting the growing demand for reliable and efficient pharmaceutical packaging. This development will positively impact the market by improving supply chain capabilities and supporting the expansion of the pharmaceutical packaging sector in the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fiber Optics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fiber Optics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fiber Optics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.