Global Field Effect Transistor Market

Market Size in USD Billion

CAGR :

%

USD

4.92 Billion

USD

21.31 Billion

2024

2032

USD

4.92 Billion

USD

21.31 Billion

2024

2032

| 2025 –2032 | |

| USD 4.92 Billion | |

| USD 21.31 Billion | |

|

|

|

|

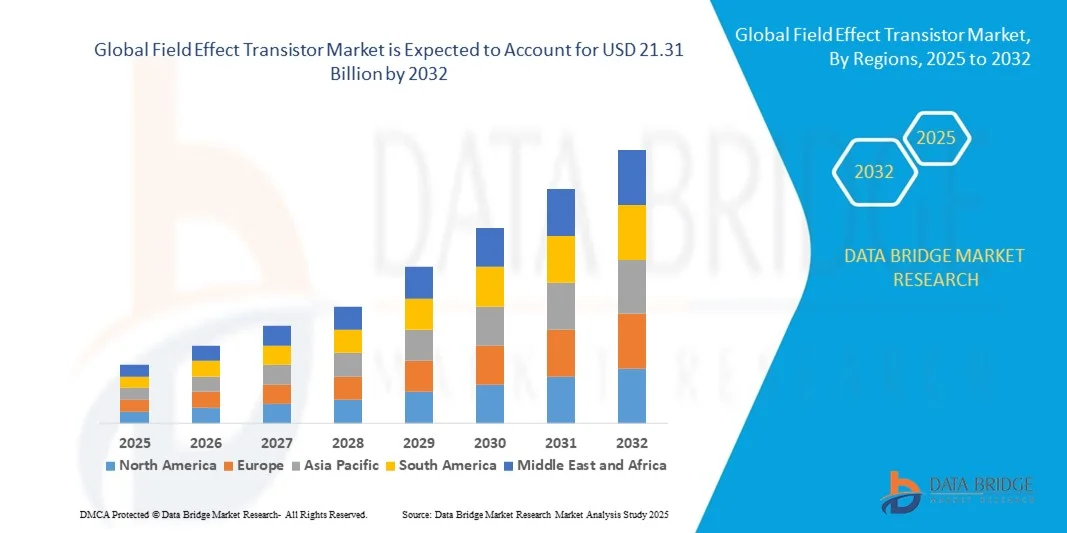

What is the Global Field Effect Transistor Market Size and Growth Rate?

- The global field effect transistor market size was valued at USD 4.92 billion in 2024 and is expected to reach USD 21.31 billion by 2032, at a CAGR of 7.30% during the forecast period

- The growing demand of FET due to stable in temperature and occupy less space, increasing number of initiatives by the government regarding the usages of transistor for maximum applications, mergers and acquisition of various market players, increasing demand of the product due to low cost are some of the major as well as vital factors which will such asly to augment the growth of the field effect transistor market in the projected timeframe

What are the Major Takeaways of Field Effect Transistor Market?

- Rising number of applications of the product in consumer electronics along with field effect transistor is less affected in radiation compared to other transistors which will further contribute by generating immense opportunities that will led to the growth of the field effect transistor market in the above-mentioned projected timeframe

- Complex design of the product along with easy availability of the product substitute in the market which will such asly to act as market restraints factor for the growth of the field effect transistor in the above-mentioned forecasted period. Lack of skilled individual for installation of transistor which will become the biggest and foremost challenge for the growth of the market

- Asia-Pacific dominated the field effect transistor (FET) market with the largest revenue share of 37.2% in 2024, driven by the region’s rapid industrialization, strong semiconductor manufacturing base, and growing adoption of advanced electronic devices

- The North America field effect transistor (FET) market is projected to grow at the fastest CAGR of 11.68% from 2025 to 2032, driven by increasing demand for EVs, renewable energy systems, and advanced communication infrastructure

- The MOSFET segment dominated the market with the largest revenue share of 52.4% in 2024, owing to its widespread use across power electronics, digital circuits, and automotive systems due to high efficiency, low power loss, and scalability

Report Scope and Field Effect Transistor Market Segmentation

|

Attributes |

Field Effect Transistor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Field Effect Transistor Market?

Rising Adoption of GaN and SiC-Based Transistors for High-Efficiency Applications

- A prominent trend in the global field effect transistor (FET) market is the increasing adoption of Gallium Nitride (GaN) and Silicon Carbide (SiC) transistors, which offer higher efficiency, faster switching speeds, and superior thermal performance compared to traditional silicon-based devices. These advanced materials are enabling the miniaturization of electronic components and improving overall energy efficiency in various applications

- For instance, Infineon Technologies AG and STMicroelectronics have launched SiC MOSFETs designed for high-power automotive and industrial applications, such as electric vehicles (EVs), renewable energy systems, and 5G infrastructure. These transistors support higher voltage ratings while reducing energy loss and heat generation

- The growing shift toward energy-efficient power management and high-frequency devices is driving research and investments in GaN and SiC-based field effect transistor. Companies are integrating these materials to meet the performance demands of next-generation electronics, where smaller size and higher power density are critical

- Furthermore, advancements in wafer fabrication and cost-effective manufacturing are making wide bandgap semiconductors increasingly accessible to a broader range of industries. This technological evolution is accelerating the transition from conventional silicon field effect transistor to GaN and SiC solutions

- This trend is expected to reshape the power electronics landscape, as industries move toward high-efficiency, low-loss transistor technologies, particularly for automotive, consumer electronics, and renewable energy systems

What are the Key Drivers of Field Effect Transistor Market?

- The rapid growth of consumer electronics and increasing demand for energy-efficient and high-performance power devices are major drivers propelling the field effect transistor market. Field effect transistor are integral in smartphones, power supplies, amplifiers, and EV powertrains, where performance and reliability are key

- For instance, in March 2024, Mitsubishi Electric Corporation introduced a new series of SiC power modules for EVs to improve power conversion efficiency and reduce charging times. Such innovations are expanding field effect transistor applications in automotive and renewable energy sectors

- The global expansion of 5G networks, data centers, and IoT ecosystems further drives the demand for high-frequency and low-noise field effect transistor used in RF and microwave communication systems. These components enable faster data transmission and improved connectivity across digital infrastructure

- In addition, the increasing focus on electrification and renewable energy adoption—including solar inverters and wind power converters—has accelerated field effect transistor deployment for efficient energy conversion and control. Governments’ emphasis on green technologies continues to amplify this demand

- As industries pursue miniaturized and high-speed components, innovations in semiconductor materials and transistor architectures will remain central to sustaining field effect transistor market growth

Which Factor is Challenging the Growth of the Field Effect Transistor Market?

- The high manufacturing cost of advanced field effect transistor, particularly those based on GaN and SiC materials, poses a major challenge to market growth. These materials require specialized fabrication equipment and processes, which increase production costs compared to traditional silicon-based devices

- For instance, ROHM Co., Ltd. and Fuji Electric Co., Ltd. have faced cost constraints in scaling up SiC transistor production due to expensive substrate materials and low yield rates in wafer fabrication

- Another challenge is the limited availability of raw materials and skilled workforce, which affects the supply chain and delays the commercialization of advanced transistor technologies. This shortage can impact product affordability and accessibility, especially in cost-sensitive markets

- In addition, thermal management and reliability concerns in high-voltage applications can hinder adoption in certain end-use industries. Continuous R&D investment is necessary to improve device stability and long-term performance under harsh conditions

- Overcoming these barriers through cost optimization, material innovation, and strategic manufacturing partnerships will be essential for ensuring sustainable growth and widespread adoption of advanced field effect transistor technologies globally

How is the Field Effect Transistor Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Type

On the basis of type, the field effect transistor market is segmented into JFET (Junction Field Effect Transistor), MESFET (Metal Semiconductor Field Effect Transistor), HEMT (High Electron Mobility Transistor), and MOSFET (Metal Oxide Semiconductor Field Effect Transistor). The MOSFET segment dominated the market with the largest revenue share of 52.4% in 2024, owing to its widespread use across power electronics, digital circuits, and automotive systems due to high efficiency, low power loss, and scalability. MOSFETs are preferred for voltage regulation, switching, and amplification in both consumer and industrial applications.

The HEMT segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its superior electron mobility and high-frequency performance, making it ideal for 5G base stations, radar systems, and advanced RF communication equipment.

- By Application

Based on application, the Field Effect Transistor market is segmented into Analog Switches, Amplifiers, Phase Shift Oscillator, Current Limiter, Digital Circuits, and Others. The Amplifiers segment held the largest market share of 38.6% in 2024, attributed to the extensive use of FETs in audio, RF, and microwave amplification systems where high input impedance and low noise are critical. Amplifier circuits leveraging FETs ensure signal accuracy and efficiency in communication and consumer electronics.

The Digital Circuits segment is projected to grow at the fastest CAGR during 2025–2032, fueled by increasing integration of FETs in logic gates, microprocessors, and switching circuits within computing and semiconductor devices. The trend toward miniaturization and low-power electronics further supports this growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into E-Commerce, Retail Stores, and Others. The E-Commerce segment dominated the market with a 49.3% revenue share in 2024, as manufacturers and distributors increasingly prefer online platforms for global reach, transparent pricing, and wide product availability. The convenience of digital catalogs and quick delivery options drives bulk and custom component purchases by OEMs and small-scale industries.

The Retail Stores segment is expected to register the fastest CAGR from 2025 to 2032, owing to strong demand from local electronics repair shops and small manufacturers seeking immediate component access. Physical retail outlets continue to play a vital role in providing technical support and product validation.

- By End User

On the basis of end user, the Field Effect Transistor market is segmented into Consumer Electronics, Inverter and UPS, Electric Vehicle, Industrial System, and Others. The Consumer Electronics segment dominated the market with the largest share of 41.8% in 2024, driven by high FET utilization in smartphones, tablets, laptops, and power management circuits. The surge in compact and energy-efficient electronic devices continues to propel demand for high-performance transistors.

The Electric Vehicle (EV) segment is anticipated to record the fastest CAGR from 2025 to 2032, supported by the global shift toward transportation electrification. FETs, particularly SiC and GaN-based types, are critical in EV inverters, onboard chargers, and battery management systems to enhance power efficiency and reduce energy loss.

Which Region Holds the Largest Share of the Field Effect Transistor Market?

- Asia-Pacific dominated the field effect transistor (FET) market with the largest revenue share of 37.2% in 2024, driven by the region’s rapid industrialization, strong semiconductor manufacturing base, and growing adoption of advanced electronic devices. Countries such as China, Japan, South Korea, and Taiwan are global hubs for electronic component production, supporting high-volume demand for FETs in consumer electronics, automotive, and industrial applications

- The widespread use of FETs in power management systems, communication infrastructure, and EVs, coupled with rising investments in 5G and renewable energy technologies, continues to drive regional growth. In addition, supportive government initiatives promoting semiconductor self-reliance and energy-efficient systems are strengthening market expansion

- The dominance of Asia-Pacific is further supported by its cost-effective manufacturing ecosystem, robust R&D investments, and the presence of key industry players such as Infineon Technologies AG, STMicroelectronics, and ROHM Co., Ltd., which have established strong supply networks and production facilities in the region.

China Field Effect Transistor Market Insight

The China field effect transistor market held the largest share within Asia-Pacific in 2024, driven by its dominant position in global semiconductor manufacturing and the expanding adoption of FETs across consumer electronics, EVs, and renewable energy sectors. The country’s ongoing push for smart manufacturing and electric mobility is accelerating FET demand, especially for high-power and high-efficiency devices. Government initiatives such as “Made in China 2025” and large-scale investments in semiconductor self-sufficiency are fostering domestic production and innovation. Moreover, collaborations between local manufacturers and international players are enhancing product quality and global competitiveness. China’s growing ecosystem of foundries and chip design companies ensures the steady availability and affordability of FET components.

Japan Field Effect Transistor Market Insight

The Japan field effect transistor market continues to grow steadily, supported by the country’s advanced electronics industry and focus on high-performance components. Japan’s strong emphasis on energy efficiency and miniaturization drives the adoption of FETs in automotive electronics, industrial automation, and communication systems. Japanese manufacturers such as Mitsubishi Electric Corporation and Fuji Electric Co., Ltd. are investing heavily in GaN and SiC-based FETs to meet rising demand for high-frequency and high-efficiency applications. Furthermore, Japan’s leadership in robotics, renewable energy, and 5G infrastructure continues to boost demand for advanced transistor technologies.

India Field Effect Transistor Market Insight

The India field effect transistor market is witnessing robust growth due to rising investments in electronics manufacturing and increasing demand for consumer and automotive electronics. The Indian government’s “Make in India” and PLI (Production Linked Incentive) schemes are fostering semiconductor manufacturing and driving domestic FET production. Growing urbanization and the rising popularity of electric vehicles, smartphones, and IoT-enabled devices are expanding FET usage across end-user industries. In addition, the establishment of new semiconductor fabrication units and design centers is expected to strengthen India’s position as an emerging electronics hub in the Asia-Pacific region.

Which Region is the Fastest Growing Region in the Field Effect Transistor (FET) Market?

The North America field effect transistor (FET) market is projected to grow at the fastest CAGR of 11.68% from 2025 to 2032, driven by increasing demand for EVs, renewable energy systems, and advanced communication infrastructure. The region’s focus on technological innovation and the presence of leading semiconductor companies continue to propel growth. The rising integration of GaN and SiC FETs in automotive, aerospace, and defense applications is accelerating adoption. In addition, robust R&D activities and strong support for clean energy initiatives across the U.S. and Canada are enhancing market expansion. North America’s dominance in high-performance computing, data centers, and 5G deployment also contributes to rising demand for FETs designed for high-speed, energy-efficient power management. The region’s ongoing transition toward sustainable and digital technologies ensures a strong growth outlook for FET adoption across industrial and consumer sectors.

U.S. Field Effect Transistor Market Insight

The U.S. field effect transistor market accounted for the largest revenue share within North America in 2024, driven by strong demand from automotive, defense, and renewable energy sectors. The country’s emphasis on technological innovation and self-reliant semiconductor production has accelerated investments in wide bandgap materials and advanced transistor designs. Major players such as Vishay Intertechnology, Inc and Diodes Incorporated are expanding their product portfolios to meet growing power electronics needs. Furthermore, government-backed initiatives to boost domestic semiconductor manufacturing under the CHIPS and Science Act are expected to reinforce U.S. leadership in FET development and innovation over the coming years.

Which are the Top Companies in Field Effect Transistor Market?

The field effect transistor industry is primarily led by well-established companies, including:

- Mouser Electronics, Inc. (U.S.)

- Sensitron Semiconductor (U.S.)

- SHINDENGEN ELECTRIC MANUFACTURING CO., LTD. (Japan)

- Semiconductor Components Industries, LLC (U.S.)

- Solitron Devices Inc. (U.S.)

- Vishay Intertechnology, Inc. (U.S.)

- NTE Electronics, Inc. (U.S.)

- Infineon Technologies AG (Germany)

- Avago Technologies, Limited. (Singapore)

- NEC Corporation (Japan)

- STMicroelectronics (Switzerland)

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION (Japan)

- Mitsubishi Electric Corporation (Japan)

- Fuji Electric Co., Ltd. (Japan)

- ROHM CO., LTD. (Japan)

- NXP Semiconductors (Netherlands)

- Diodes Incorporated (U.S.)

- IXYS Corporation (U.S.)

- Micro Commercial Components Corp. (U.S.)

- M/A-COM Technology Solutions Inc. (U.S.)

What are the Recent Developments in Global Field Effect Transistor Market?

- In June 2022, TSMC announced the deployment of nanosheets, a type of gate-all-around field-effect transistor (GAAFET) in which a gate surrounds floating transistor fins, in its 2nm process scheduled for production in 2025. In this development, TSMC aims to design innovative transistor layouts that reduce energy consumption in high-performance computing (HPC) applications such as data centers, which significantly contribute to global warming. This initiative is expected to enhance energy efficiency and sustainability in next-generation semiconductor manufacturing

- In March 2022, NXP Semiconductors introduced a new 32T32R discrete solution to accelerate the deployment of 5G radios in urban and suburban regions. In this release, the company utilized its latest gallium nitride (GaN) technology for active antenna systems, complementing its existing GaN power amplifier lineup. In addition, the 32T32R solutions deliver twice the power of 64T64R solutions, making the overall 5G network setup lighter and more compact, while enabling rapid scaling through pin compatibility. This advancement is set to boost the efficiency and adaptability of 5G infrastructure worldwide

- In March 2022, Transphorm, Inc. and TDK-Lambda (a TDK group company) expanded the AC-DC GaN-based PFH500F product line, featuring PFH500F-12 and PFH500F-48 models offering 500-watt power supply. In this product line, Transphorm’s TP65H070LDG, 8x8 PQFN GaN FETs are used to deliver high power density, allowing TDK to employ thin baseplates for efficient cooling. In turn, this innovation resulted in a compact and durable power module suitable for demanding industrial applications, including fanless power supplies, lasers, 5G communication, and digital signage. This collaboration enhances the development of high-efficiency GaN-based power systems across multiple industries

- In July 2021, STMicroelectronics launched a new range of STPOWER RF LDMOS Power Transistors, adding three product series tailored for RF power amplifiers used in industrial and commercial applications. In this expansion, the company focused on enhancing performance, reliability, and power output to meet growing market demand for advanced RF components. In particular, the new series addresses the increasing need for high-efficiency RF power solutions in communication and industrial systems. This launch further strengthens STMicroelectronics’ presence in the RF power transistor segment and supports broader industrial innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Field Effect Transistor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Field Effect Transistor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Field Effect Transistor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.