Global Filling Equipment Market

Market Size in USD Billion

CAGR :

%

USD

21.16 Billion

USD

27.87 Billion

2024

2032

USD

21.16 Billion

USD

27.87 Billion

2024

2032

| 2025 –2032 | |

| USD 21.16 Billion | |

| USD 27.87 Billion | |

|

|

|

|

Filling Equipment Market Size

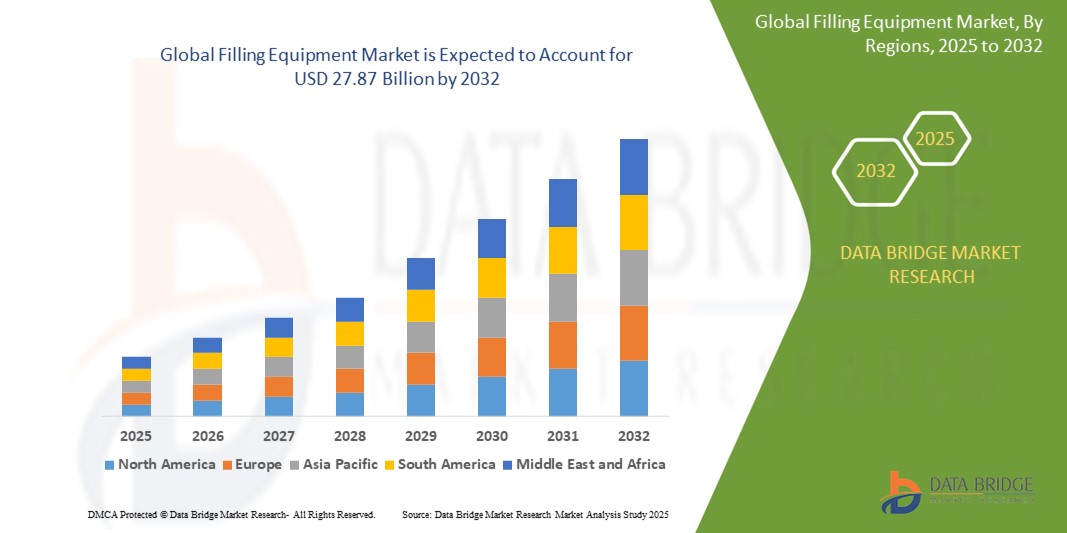

- The global filling equipment market size was valued at USD 21.16 billion in 2024 and is expected to reach USD 27.87 billion by 2032, at a CAGR of 3.50% during the forecast period

- The market growth is largely fuelled by the increasing demand for automation and efficiency in the food and beverage, pharmaceutical, and personal care industries, where consistent and high-speed filling processes are critical

- The expansion of the e-commerce and retail sectors has further increased the demand for packaged goods, accelerating the adoption of advanced filling technologies across global manufacturing operations

Filling Equipment Market Analysis

- The filling equipment market is evolving due to growing consumer demand for packaged and processed goods, leading to technological advancements in machinery to accommodate different container types and viscosities

- Rising adoption of cleanroom-compatible and contamination-free filling systems, particularly in the pharmaceutical sector, is supporting market expansion

- North America dominated the filling equipment market with the largest revenue share in 2024, driven by a robust food and beverage industry, strong presence of leading equipment manufacturers, and advanced packaging standards

- Asia-Pacific region is expected to witness the highest growth rate in the global filling equipment market, driven by expanding food and beverage production, rising demand for processed goods, and technological advancements being adopted by manufacturers across countries such as China, India, and Indonesia

- The rotary fillers segment held the largest market revenue share in 2024 due to their high-speed performance and continuous operation, making them ideal for large-scale beverage and food bottling plants. Their versatility across different container types and ability to maintain consistent fill levels at high output rates support their widespread adoption

Report Scope and Filling Equipment Market Segmentation

|

Attributes |

Filling Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Adoption of Automated Filling Solutions in Emerging Economies • Rising Demand for Sustainable and Eco-Friendly Packaging Equipment |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Filling Equipment Market Trends

“Integration of Smart Technologies in Filling Equipment”

- The growing adoption of IoT in production lines is transforming filling equipment by enabling real-time tracking of performance metrics such as pressure, flow, and liquid levels

- Artificial intelligence is being used for predictive maintenance to reduce downtime and extend equipment life

- Automated diagnostics in smart fillers are minimizing human error, particularly beneficial in food & beverage and pharmaceutical manufacturing

- Robotics are now incorporated to handle repetitive filling, capping, and sealing operations with high accuracy and reduced contamination

- The shift toward Industry 4.0 is encouraging the use of digitally connected, remote-controlled filling systems

- For instance, Coca-Cola’s IoT-connected filling lines in Europe reduced liquid wastage and improved process control

Filling Equipment Market Dynamics

Driver

“Increasing Demand for Packaged and Processed Products”

- Increasing demand for ready-to-eat meals and beverages is pushing manufacturers to adopt faster and more efficient filling solutions

- In the pharmaceutical sector, high-precision sterile fillers are vital for vaccine and injectable production under regulated environments

- Cosmetics and personal care products require machines that can handle a variety of product consistencies, from creams to gels

- Expansion in the frozen and packaged food segment is driving need for versatile and quick-changeover filling lines

- The global surge in e-commerce is pushing manufacturers to upscale production with scalable and automated filling equipment

- For instance, Pfizer’s deployment of advanced sterile fillers during COVID-19 accelerated vaccine packaging at scale

Restraint/Challenge

“High Initial Costs and Maintenance Requirements”

- The initial investment required for automated filling systems is high, making it less accessible for small and medium-sized enterprises

- Maintenance and repair costs for sophisticated equipment can be substantial over time, affecting profitability

- The need for trained technical personnel to operate, calibrate, and troubleshoot complex filling lines is a challenge in emerging economies

- Many manufacturers prefer manual or semi-automatic fillers due to their affordability and easier handling, slowing full automation adoption

- Untrained staff can mishandle advanced systems, leading to frequent breakdowns and low operational efficiency

- For instance, A dairy plant in Indonesia experienced repeated downtimes due to poor staff training on automated fillers, prompting a switch back to semi-automatic systems

Filling Equipment Market Scope

The market is segmented on the basis of type, process type, product type, and application.

- By Type

On the basis of type, the filling equipment market is segmented into rotary fillers, volumetric fillers, aseptic fillers, net weight fillers, and others. The rotary fillers segment held the largest market revenue share in 2024 due to their high-speed performance and continuous operation, making them ideal for large-scale beverage and food bottling plants. Their versatility across different container types and ability to maintain consistent fill levels at high output rates support their widespread adoption.

The aseptic fillers segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for shelf-stable and contamination-free packaging in the dairy, pharmaceutical, and ready-to-drink product segments. Aseptic fillers are gaining popularity for their ability to ensure sterility during the filling process, which is critical for sensitive and perishable products requiring extended shelf life without preservatives.

- By Process Type

On the basis of process type, the market is segmented into manual, semi-automatic, and automatic. The automatic segment accounted for the largest market revenue share in 2024, owing to increasing demand for efficiency, speed, and precision in production lines. These systems are favored for their ability to reduce labor dependency and errors, especially in high-volume packaging facilities.

The semi-automatic segment is expected to witness the fastest growth rate from 2025 to 2032, due to its suitability for small- to medium-scale manufacturers seeking to balance cost-efficiency with moderate automation. These systems are particularly preferred in emerging economies where full automation may be cost-prohibitive.

- By Product Type

On the basis of product type, the filling equipment market is categorized into solid, semi-liquid, and liquid. The liquid segment dominated the market in 2024 as liquid filling is widely required in beverage, dairy, and pharmaceutical applications. The growing consumption of bottled water, juices, and carbonated drinks contributes to this segment's strong performance.

The semi-liquid segment is expected to witness the fastest growth rate from 2025 to 2032, due to rising demand for sauces, lotions, creams, and other viscous products in the personal care and food industries. These applications require specialized fillers that can handle product consistency without compromising speed or hygiene standards.

- By Application

On the basis of application, the market is segmented into food and beverage. The food and beverage segment commanded the largest revenue share in 2024, supported by rising demand for processed and packaged foods across the globe. The expansion of the global beverage industry, including energy drinks, dairy products, and bottled water, has significantly influenced the demand for reliable filling equipment.

Filling Equipment Market Regional Analysis

- North America dominated the filling equipment market with the largest revenue share in 2024, driven by a robust food and beverage industry, strong presence of leading equipment manufacturers, and advanced packaging standards

- Manufacturers in the region prioritize operational efficiency, hygiene compliance, and automation integration, making advanced filling solutions highly desirable

- High demand for ready-to-consume food and beverages, coupled with increasing investments in production facility upgrades, continues to support the growth of filling equipment across both the U.S. and Canada

U.S. Filling Equipment Market Insight

The U.S. filling equipment market accounted for the largest revenue share in North America in 2024, owing to the country’s expansive beverage, dairy, and pharmaceutical industries. With an increasing emphasis on precision filling, reduced waste, and compliance with food safety regulations, companies are investing in advanced technologies such as volumetric and aseptic fillers. Rising demand for customized packaging formats, such as single-serve containers and eco-friendly materials, is also contributing to market expansion. The U.S. continues to lead in adopting fully automated and semi-automated systems that align with lean manufacturing practices.

Europe Filling Equipment Market Insight

The Europe filling equipment market is expected to witness the fastest growth rate from 2025 to 2032, supported by stringent regulatory standards on packaging and hygiene. Rising consumer demand for packaged organic food and sustainable beverages is prompting manufacturers to invest in flexible and clean-in-place (CIP) systems. Countries such as Germany, France, and Italy are focusing on energy-efficient and automated solutions that help reduce production downtime. The modernization of manufacturing facilities and a growing preference for aseptic packaging are key contributors to the region’s market development.

Germany Filling Equipment Market Insight

Germany is expected to hold a significant share in the European filling equipment market due to its strong industrial manufacturing base and leadership in engineering innovations. The country's food and beverage producers emphasize automation and quality control, leading to increased adoption of advanced fillers. Germany also exports a large volume of processed foods and beverages, which drives the demand for reliable and scalable filling equipment that meets international standards. Moreover, the country’s sustainability initiatives are encouraging the shift toward low-energy and low-waste filling systems.

U.K. Filling Equipment Market Insight

The U.K. filling equipment market is expected to witness the fastest growth rate from 2025 to 2032, supported by a strong demand for processed food, ready-to-drink beverages, and health supplements. British manufacturers are focusing on automation, energy efficiency, and compliance with evolving packaging standards, especially in sectors such as dairy and personal care. The growing popularity of sustainable packaging and the push toward circular economy practices are driving the adoption of flexible filling solutions. Furthermore, with the expansion of e-commerce and private-label production, the need for scalable and versatile filling systems is accelerating across the U.K.

Asia-Pacific Filling Equipment Market Insight

The Asia-Pacific filling equipment market is expected to witness the fastest growth rate from 2025 to 2032, propelled by rapid urbanization, rising disposable incomes, and growing demand for packaged food and beverages. Countries such as China, India, and Indonesia are witnessing a surge in food processing and bottling facilities. Government support for local manufacturing and investments in food security are further boosting the region’s capacity for adopting modern filling technologies. The increasing trend toward automation and digitalization in factory operations is also shaping the future of this market in Asia-Pacific.

China Filling Equipment Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, supported by its vast consumer base, technological advancements, and established manufacturing sector. The Chinese market has a high demand for high-speed filling lines, especially for beverages, sauces, pharmaceuticals, and cosmetics. Domestic companies are increasingly adopting automation and artificial intelligence to improve efficiency and meet growing export demands. In addition, the government’s focus on food safety and sustainability is encouraging producers to switch to aseptic and volumetric filling systems that offer both hygiene and precision.

Japan Filling Equipment Market Insight

The Japan filling equipment market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country's emphasis on precision, quality, and technological integration. Japan’s food and beverage industry places high importance on hygiene and packaging efficiency, which boosts demand for aseptic and volumetric fillers. The increasing need for portion control, minimal wastage, and automation in both traditional and convenience food segments is further supporting the market. In addition, Japan’s aging workforce is encouraging the use of semi-automatic and automatic machinery to maintain operational efficiency while ensuring compliance with stringent safety regulations.

Filling Equipment Market Share

The Filling Equipment industry is primarily led by well-established companies, including:

- Marel (Iceland)

- GEA Group (Germany)

- Bühler (Switzerland)

- JBT (U.S.)

- The Middleby Corporation (U.S.)

- Heat and Control, Inc. (U.S.)

- Alfa Laval (Sweden)

- TNA Australia Pty Ltd. (Australia)

- Bucher Industries (Switzerland)

- Equipamientos Cárnicos, S.L (Spain)

- Clextral (France)

- SPX FLOW (U.S.)

- Bigtem Makine (Turkey)

- FENCO Food Machinery (Italy)

- Krones Group (Germany)

- Bettcher Industries, Inc. (U.S.)

- Anko Food Machine Co. Ltd. (Taiwan)

- Heat and Control, Inc. (U.S.)

- BAADER (Germany)

- Dover Corporation (U.S.)

Latest Developments in Global Filling Equipment Market

- In November 2022, Krones, a leading provider of filling and packaging solutions, acquired an 80.5% stake in R+D Custom Automation LLC (R+D). Based in Wisconsin, United States, R+D specializes in designing and manufacturing tools and equipment for container creation and filling in the pharmaceutical sector. With over 40 years of experience, R+D is renowned as a full-service system integrator, offering specialized solutions tailored to the life sciences industry

- In October 2022, Liquibox introduced new Bag-In-Box filling equipment, integrating advanced technology with its extensive expertise in flexible packaging. The launch includes the A-Series and S-Series, which denote automated and semi-automatic options respectively. These machines represent Liquibox's commitment to innovation in filling machinery, catering to diverse needs in the packaging industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Filling Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Filling Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Filling Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.