Global Filter Integrity Test Market

Market Size in USD Million

CAGR :

%

USD

98.13 Million

USD

139.87 Million

2025

2033

USD

98.13 Million

USD

139.87 Million

2025

2033

| 2026 –2033 | |

| USD 98.13 Million | |

| USD 139.87 Million | |

|

|

|

|

Filter Integrity Test Market Size

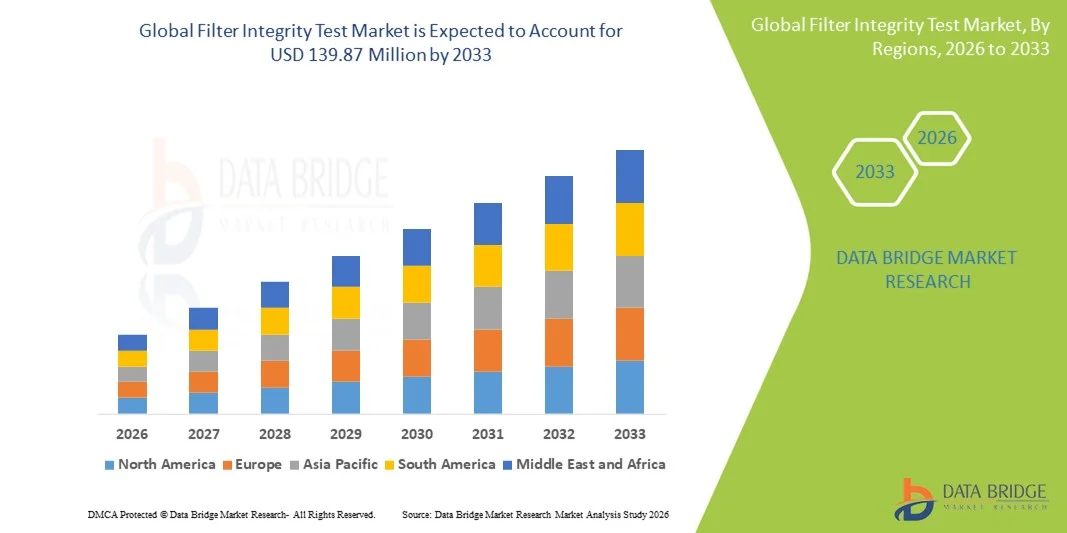

- The global filter integrity test market size was valued at USD 98.13 million in 2025 and is expected to reach USD 139.87 million by 2033, at a CAGR of 4.53% during the forecast period

- The market growth is largely fueled by the growing adoption and technological advancements in filtration validation systems across biopharmaceutical, pharmaceutical, food & beverage, and water treatment industries, leading to increased regulatory compliance and quality assurance in manufacturing processes

- Furthermore, rising demand for accurate, reliable, and automated testing solutions for sterile and critical applications is establishing filter integrity tests as the preferred choice for ensuring filtration efficacy. These converging factors are accelerating the uptake of filter integrity test solutions, thereby significantly boosting the industry's growth

Filter Integrity Test Market Analysis

- Filter integrity tests, providing verification of filtration performance in critical processes, are increasingly vital components of modern quality assurance and compliance systems in biopharmaceutical, pharmaceutical, food & beverage, and water treatment industries due to their ability to ensure sterility, reliability, and regulatory compliance

- The escalating demand for filter integrity tests is primarily fueled by stricter regulatory standards, growing emphasis on product safety and quality, and a rising preference for automated and precise testing solutions over manual methods

- North America dominated the filter integrity test market with the largest revenue share of 39.3% in 2025, characterized by early adoption of advanced filtration technologies, stringent regulatory frameworks, and a strong presence of key industry players, with the U.S. witnessing substantial growth in adoption across biopharma and sterile manufacturing facilities, driven by innovations in automated and digital testing systems

- Asia-Pacific is expected to be the fastest growing region in the filter integrity test market during the forecast period due to increasing biopharmaceutical production, expanding sterile manufacturing infrastructure, and rising investments in quality assurance technologies

- Automated segment dominated the filter integrity test market with a market share of 88.4% in 2025, driven by its established reputation for accuracy, efficiency, and seamless integration into existing manufacturing and quality control workflows

Report Scope and Filter Integrity Test Market Segmentation

|

Attributes |

Filter Integrity Test Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Filter Integrity Test Market Trends

Automation and Digital Monitoring Integration

- A significant and accelerating trend in the global filter integrity test market is the integration of automated testing systems with digital monitoring and data analytics platforms, significantly enhancing accuracy, reliability, and compliance in sterile manufacturing processes

- For instance, Sartorius’ Integrity Test System offers automated integrity testing with real-time reporting, reducing manual errors and ensuring adherence to regulatory requirements

- Digital integration enables features such as real-time monitoring of filter performance, predictive maintenance alerts, and automated documentation for regulatory audits, improving operational efficiency and reducing downtime

- The seamless integration of filter integrity tests with manufacturing execution systems (MES) and laboratory information management systems (LIMS) allows centralized management of quality control processes and traceability of results

- Cloud-based analytics and IoT-enabled filter monitoring are emerging trends, allowing remote access to test data and performance metrics for faster decision-making. Increasing adoption of AI-powered analytics in integrity testing is enabling predictive insights and anomaly detection to prevent contamination risks before they occur

- This trend towards more automated, data-driven, and interconnected testing systems is fundamentally reshaping quality assurance expectations in biopharmaceutical and sterile manufacturing

- The demand for automated and digitally monitored filter integrity solutions is growing rapidly across biopharmaceutical, pharmaceutical, and food & beverage sectors, as companies increasingly prioritize efficiency, accuracy, and regulatory compliance

Filter Integrity Test Market Dynamics

Driver

Increasing Regulatory Pressure and Quality Assurance Requirements

- The rising stringency of regulatory standards and the need for validated filtration processes in biopharmaceutical and sterile manufacturing is a key driver of filter integrity test adoption

- For instance, in March 2025, MilliporeSigma introduced an automated filter integrity testing solution compliant with FDA and EMA guidelines, aimed at improving sterility assurance in biologics production

- As companies seek to minimize contamination risks and meet global quality standards, filter integrity tests provide reliable verification of filter performance and sterility

- Growing demand for high-purity products, combined with the expansion of sterile manufacturing facilities worldwide, is further boosting the adoption of automated and advanced filter integrity testing solutions

- The shift toward single-use and continuous manufacturing processes, alongside the need for real-time process monitoring, is propelling the integration of filter integrity tests into production workflows across the biopharma, pharmaceutical, and food & beverage industries

- Rising investment in biologics and vaccine manufacturing is increasing the requirement for rapid, reliable filter integrity verification, especially in high-volume production facilities

- Collaborative initiatives by regulatory bodies and industry stakeholders to standardize integrity testing protocols are further driving market growth and adoption of advanced testing systems.

Restraint/Challenge

High Implementation Costs and Skilled Workforce Requirements

- The high initial costs associated with automated filter integrity testing systems can hinder adoption, particularly in small-scale facilities or cost-sensitive regions

- For instance, advanced systems from companies such as Pall Corporation and Sartorius require significant capital investment and technical training for operators

- In addition, a shortage of skilled personnel capable of operating and maintaining automated integrity testing systems poses a challenge for widespread deployment

- While manual testing methods remain available, they are labor-intensive, less accurate, and offer limited data traceability compared to automated solutions

- Addressing these challenges through cost optimization, user-friendly interfaces, and workforce training programs is crucial for broader market penetration and sustained growth. Dependence on periodic calibration and maintenance of integrity test systems increases operational downtime and associated costs, creating a barrier for continuous adoption

- Lack of awareness and technical understanding of advanced integrity testing solutions among smaller manufacturers further slows market expansion in emerging regions

- Reducing barriers to adoption by offering scalable, modular, and more affordable solutions will be vital to capture growth opportunities in emerging and developing regions

Filter Integrity Test Market Scope

The market is segmented on the basis of product, type, filter type, mechanism, and end user.

- By Product

On the basis of product, the filter integrity test market is segmented into desktop and handheld systems. The desktop segment dominated the market with the largest revenue share of 52.1% in 2025, driven by its ability to handle high-volume testing with greater accuracy and integration capabilities. Desktop systems are often preferred in pharmaceutical and biopharmaceutical manufacturing facilities for batch testing and compliance with stringent regulatory standards. Their robust design and automation features allow laboratories to perform repeated tests with minimal operator intervention, ensuring consistency and reducing human error. The market also benefits from desktop systems’ compatibility with software for data logging, analysis, and regulatory reporting. Desktop integrity testers are increasingly adopted in quality control labs due to their reliability, repeatability, and support for multiple test types, which makes them suitable for high-stakes sterile processes.

The handheld segment is anticipated to witness the fastest growth rate of 19.5% from 2026 to 2033, fueled by increasing demand for portable and flexible testing solutions in on-site applications. Handheld devices offer convenience for quick verification of filters in smaller production setups or remote locations where space or infrastructure is limited. Their ease of use and rapid deployment capabilities are appealing to contract manufacturing organizations and food & beverage companies. Handheld integrity testers are also increasingly equipped with digital displays and simple interfaces, reducing training requirements and accelerating adoption in emerging markets.

- By Type

On the basis of type, the market is segmented into diffusion test, water flow integrity test, and bubble point test. The bubble point test segment dominated the market with a revenue share of 47.6% in 2025, driven by its recognized accuracy in validating sterilizing-grade filters in pharmaceutical and biopharmaceutical processes. Bubble point tests are widely preferred for liquid filtration systems as they reliably detect membrane defects and ensure sterility assurance levels are met. The method’s established regulatory acceptance across global standards such as FDA, EMA, and WHO guidelines enhances its adoption in quality control laboratories. Its repeatability, precision, and integration with automated desktop testers make bubble point testing the primary choice in large-scale production facilities. Manufacturers often prioritize bubble point testing for critical applications, including vaccine production and injectable drugs, due to its proven reliability and compliance benefits.

The diffusion test segment is expected to witness the fastest CAGR from 2026 to 2033, driven by its simplicity, adaptability to both liquid and air filtration systems, and suitability for in-line process monitoring. Diffusion tests offer quick verification of filter integrity without complex setup, making them attractive for on-site quality checks and smaller production lines. They are gaining popularity in emerging regions where cost-effectiveness and operational flexibility are prioritized. Diffusion tests can be performed with handheld or portable systems, which supports rapid troubleshooting and reduces downtime. Their growing adoption in the food & beverage and microelectronics sectors further contributes to market expansion.

- By Filter Type

On the basis of filter type, the market is segmented into liquid and air filters. The liquid filter segment dominated the market with a revenue share of 61.3% in 2025, driven by its extensive application in pharmaceutical and biopharmaceutical processes requiring sterile liquid filtration. Liquid filters are critical for ensuring product purity in injectable drugs, vaccines, and biologics, which makes integrity testing indispensable. The segment benefits from robust regulatory oversight, encouraging companies to adopt validated testing methods. Liquid filters are also widely used in food & beverage production, water treatment, and high-purity applications, where sterility and consistency are essential. Integration with automated desktop integrity testers enhances testing efficiency and minimizes human error.

The air filter segment is anticipated to witness the fastest growth rate of 18.8% from 2026 to 2033, driven by the increasing use of HEPA and ULPA filters in cleanrooms, microelectronics, and sterile manufacturing facilities. Air filter integrity testing is critical to maintaining contamination-free environments and meeting strict ISO and GMP standards. Growing demand in emerging biopharmaceutical hubs and semiconductor manufacturing units is further fueling adoption. Handheld and portable devices are increasingly employed for on-site testing of air filters in HVAC systems, ensuring real-time compliance and operational efficiency.

- By Mechanism

On the basis of mechanism, the market is segmented into automated and manual systems. The automated segment dominated the market with a revenue share of 88.4% in 2025, driven by the increasing need for high-throughput, accurate, and regulatory-compliant testing in pharmaceutical and biopharmaceutical facilities. Automated systems reduce human error, provide detailed digital records, and can be integrated with MES and LIMS platforms for streamlined operations. They are preferred for large-scale production batches and critical sterile processes where consistent quality and traceability are mandatory. Automated integrity testers also allow simultaneous testing of multiple filters, improving operational efficiency and reducing downtime. Their growing adoption in contract manufacturing organizations and large food & beverage plants underscores their reliability and convenience.

The manual segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by its cost-effectiveness, ease of use, and suitability for small-scale operations. Manual testers are preferred by small biopharma companies, academic laboratories, and emerging markets where budget and infrastructure constraints exist. They offer flexibility for on-site or ad-hoc testing without requiring complex installation or software integration. The simplicity and portability of manual testers make them suitable for quick verification tasks and pilot-scale production lines, supporting broader market adoption.

- By End User

On the basis of end user, the market is segmented into pharmaceutical and biopharmaceutical companies, contract manufacturing organizations (CMOs), food and beverages, microelectronics, and others. The pharmaceutical and biopharmaceutical companies segment dominated the market with a revenue share of 59.4% in 2025, driven by stringent regulatory requirements and the critical need for sterility assurance in drug and biologics production. Integrity testing ensures that filtration processes meet global quality standards, reducing contamination risks and product recalls. Large-scale pharmaceutical manufacturers prefer automated desktop systems for high-throughput testing, while also maintaining robust digital records for audit and compliance purposes. The segment benefits from continuous investments in new drug development and sterile manufacturing facilities, which sustains strong demand.

The contract manufacturing organizations (CMOs) segment is anticipated to witness the fastest growth rate of 20.6% from 2026 to 2033, fueled by outsourcing trends in pharmaceutical and biopharmaceutical production. CMOs require flexible, efficient, and accurate filter integrity testing solutions to serve multiple clients while maintaining compliance with varying regulatory standards. Increasing adoption of modular and automated systems by CMOs allows rapid scalability for diverse production batches. The growing number of CMOs in emerging markets is driving demand for both handheld and desktop systems, supporting faster market growth in this subsegment.

Filter Integrity Test Market Regional Analysis

- North America dominated the filter integrity test market with the largest revenue share of 39.3% in 2025, characterized by early adoption of advanced filtration technologies, stringent regulatory frameworks, and a strong presence of key industry players

- Companies in the region prioritize compliance with FDA, EMA, and other international quality standards, making filter integrity testing an essential part of quality assurance and sterility verification workflows

- This widespread adoption is further supported by early implementation of advanced automated testing systems, high investment in R&D, and a well-established ecosystem of key market players, establishing filter integrity tests as the preferred solution for both pharmaceutical and biopharmaceutical operations

U.S. Filter Integrity Test Market Insight

The U.S. filter integrity test market captured the largest revenue share of 82% in 2025 within North America, driven by the extensive presence of pharmaceutical and biopharmaceutical manufacturing facilities and the need for strict compliance with FDA and ISO standards. Companies are increasingly prioritizing validated filtration processes to ensure sterility and product safety. The rising adoption of automated and digital testing systems, coupled with integration into MES and LIMS platforms, further fuels market growth. In addition, growing investments in biologics, vaccines, and high-purity drug production support the expanding use of filter integrity testing solutions. The trend toward single-use manufacturing and continuous processing is accelerating demand for reliable and repeatable testing systems.

Europe Filter Integrity Test Market Insight

The Europe filter integrity test market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent regulatory requirements from EMA and national authorities. The growing adoption of automated and high-precision testing solutions in pharmaceutical, biopharmaceutical, and food & beverage manufacturing is fostering market growth. Increasing urbanization, combined with demand for validated quality assurance processes, is supporting the expansion of filter integrity testing adoption. The region is experiencing significant growth across large-scale production facilities, contract manufacturing organizations, and research laboratories. Furthermore, the emphasis on traceability, data integrity, and compliance with GMP standards continues to boost market penetration.

U.K. Filter Integrity Test Market Insight

The U.K. filter integrity test market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising investments in sterile manufacturing, biologics, and vaccine production. Concerns regarding contamination control and stringent quality standards are encouraging manufacturers and CMOs to adopt automated and validated testing solutions. The U.K.’s strong regulatory framework, coupled with robust pharmaceutical infrastructure, continues to support market growth. In addition, the growing focus on continuous process monitoring and data-driven quality assurance is increasing the adoption of both desktop and handheld integrity testing systems.

Germany Filter Integrity Test Market Insight

The Germany filter integrity test market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of process validation, contamination prevention, and regulatory compliance. Germany’s well-developed pharmaceutical and biopharmaceutical manufacturing sector, combined with an emphasis on quality, innovation, and environmental sustainability, is promoting the adoption of automated integrity testing systems. Integration with digital quality management platforms and in-line process monitoring is becoming increasingly prevalent. Companies in Germany are increasingly investing in advanced filter testing technologies to meet both national and international sterility and quality standards.

Asia-Pacific Filter Integrity Test Market Insight

The Asia-Pacific filter integrity test market is poised to grow at the fastest CAGR of 23.5% during the forecast period of 2026 to 2033, driven by increasing pharmaceutical and biopharmaceutical production in countries such as China, India, and Japan. Rising regulatory focus, technological advancements, and adoption of automated and handheld testing systems are supporting market growth. The region’s expanding manufacturing infrastructure, coupled with government initiatives promoting quality assurance and digitalization, is driving adoption. Furthermore, Asia-Pacific’s emergence as a manufacturing hub for sterile products and contract manufacturing organizations is increasing accessibility and affordability of filter integrity testing solutions.

Japan Filter Integrity Test Market Insight

The Japan filter integrity test market is gaining momentum due to high standards for quality control, process validation, and sterility assurance in pharmaceutical and biopharmaceutical manufacturing. The market is supported by the growing number of advanced manufacturing facilities and smart laboratory practices. Integration of automated testing systems with digital monitoring and reporting platforms is fueling growth. In addition, the emphasis on compliance with international standards, along with the focus on continuous manufacturing and biologics production, is encouraging adoption in both pharmaceutical and contract manufacturing sectors.

India Filter Integrity Test Market Insight

The India filter integrity test market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid growth of pharmaceutical and biopharmaceutical manufacturing facilities, increasing outsourcing to CMOs, and government initiatives promoting sterile manufacturing practices. India is emerging as a key hub for contract manufacturing and biologics production, driving the demand for automated and handheld filter integrity testing solutions. The availability of cost-effective systems, rising technological adoption, and expansion of domestic manufacturing capabilities are key factors propelling the market. In addition, the push towards quality assurance and compliance with global standards is further supporting adoption in both pharmaceutical and food & beverage industries.

Filter Integrity Test Market Share

The Filter Integrity Test industry is primarily led by well-established companies, including:

- Merck KGaA (Germany)

- Sartorius AG (Germany)

- Meissner Filtration Products, Inc. (U.S.)

- Pall Corporation (U.S.)

- Parker Hannifin Corporation (U.S.)

- Donaldson Company, Inc. (U.S.)

- TSI Incorporated (U.S.)

- 3M (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Filter Integrity Ltd (U.K.)

- Porvair Filtration Group (U.K.)

- Cytiva (U.S.)

- Graver Technologies (U.S.)

- GVS S.p.A. (Italy)

- SPX FLOW, Inc. (U.S.)

- Advantec MFS (Japan)

- Sterlitech Corporation (U.S.)

- Eaton Corporation plc (Ireland)

- STERIS plc (U.S.)

What are the Recent Developments in Global Filter Integrity Test Market?

- In April 2025, Parker Bioscience Filtration (division of Parker Hannifin) launched SciLog NFF+ PF a fully automated Normal Flow Filtration system with onboard Pre‑Use Post‑Sterilization Integrity Testing (PUPSIT), enabling biopharma manufacturers to integrate integrity testing directly into sterile filtration workflows

- In September 2024, Donaldson Company, Inc. launched dedicated filtration services for manufacturers in France, Germany and Austria offering sterile air and liquid filter integrity testing, equipment calibration, compressed air quality measurement (ISO 8573) and comprehensive filter-system maintenance and commissioning support. This move extends integrity testing from being purely a product-based offering to a full “service + maintenance + validation” package for life-sciences and food & beverage customers in Europe

- In February 2023, Parker introduced Valairdata 4 a portable, fully automated aerosol‑challenge integrity test unit for sterile gas filters, designed to quickly and reliably verify filter integrity and minimise contamination risk in food, beverage and sterile‑gas filtration applications

- In December 2021, Pall Corporation released Palltronic Flowstar V, a state-of-the-art filter integrity test instrument intended for critical filtration steps and batch release in GMP manufacturing reflecting ongoing demand for reliable, regulatory‑compliant filter verification tools

- In November 2021, Donaldson acquired Solaris Biotechnology Srl, a bioprocessing equipment maker (bioreactors, tangential flow filtration systems, etc.), to strengthen its presence in the life-sciences market signalling consolidation in filtration and bio-manufacturing, and potentially broadening the scope of filter integrity services within integrated bioprocess workflows

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.