Global Filter Paper Market

Market Size in USD Billion

CAGR :

%

USD

33.32 Billion

USD

58.11 Billion

2025

2033

USD

33.32 Billion

USD

58.11 Billion

2025

2033

| 2026 –2033 | |

| USD 33.32 Billion | |

| USD 58.11 Billion | |

|

|

|

|

Filter Paper Market Size

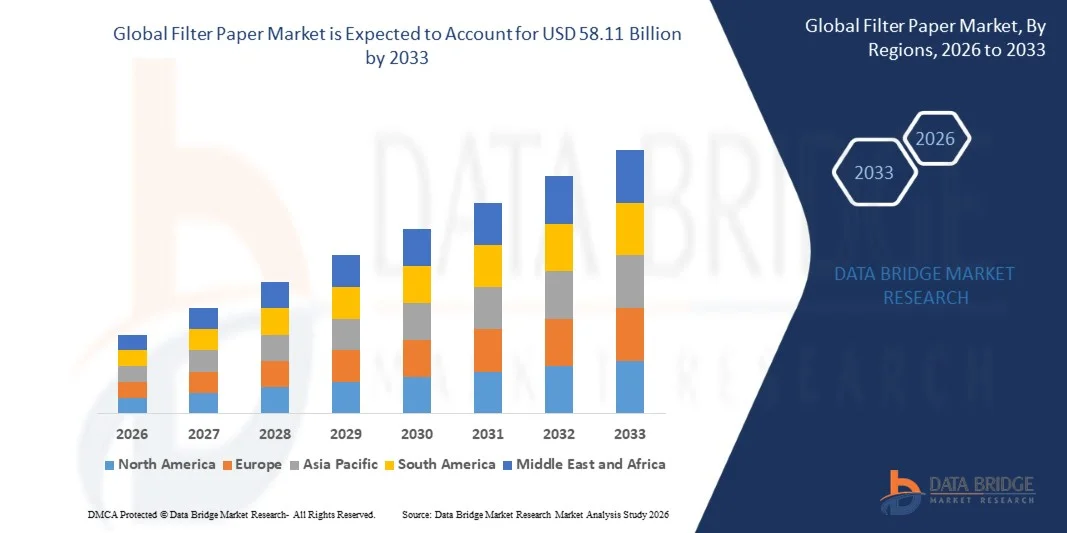

- The global filter paper market size was valued at USD 33.32 billion in 2025 and is expected to reach USD 58.11 billion by 2033, at a CAGR of 7.20% during the forecast period

- The market growth is largely fuelled by the rising demand for filtration solutions across industries such as pharmaceuticals, food & beverages, chemicals, and environmental testing

- Growing emphasis on quality control, purity standards, and improved laboratory testing efficiency is further accelerating the adoption of specialized filter papers

Filter Paper Market Analysis

- The filter paper market is witnessing steady growth due to its essential role in analytical testing, industrial filtration, and product quality assurance across multiple sectors

- Manufacturers are focusing on developing high-performance, chemically resistant, and application-specific filter papers to meet evolving regulatory and industrial requirements

- North America dominated the filter paper market with the largest revenue share in 2025, driven by the strong presence of pharmaceutical, chemical, and food processing industries, along with rising demand for high-precision filtration across manufacturing operations

- Asia-Pacific region is expected to witness the highest growth rate in the global filter paper market, driven by rapid industrial expansion, increasing demand for high-quality filtration systems, and growing manufacturing capabilities

- The PP segment held the largest market revenue share in 2025 driven by its high chemical resistance, durability, and suitability for industrial filtration processes where stability under varying temperatures is required. PP-based filter papers are widely adopted in chemical, pharmaceutical, and food processing operations due to their consistent performance and compatibility with diverse filtration systems.

Report Scope and Filter Paper Market Segmentation

|

Attributes |

Filter Paper Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Filter Paper Market Trends

“Growing Adoption of High-Performance Industrial Filtration Solutions”

• The increasing demand for high-efficiency filtration across industries such as chemicals, pharmaceuticals, food processing, and oil & gas is transforming the filter paper market, as manufacturers seek materials capable of withstanding harsh operating environments. High-performance filter papers enable improved contaminant removal, enhance process reliability, and reduce downtime in industrial applications. This trend is further supported by the shift toward automation-led filtration systems that prioritize accuracy and uninterrupted operation

• Industries operating in stringent regulatory environments are increasingly deploying advanced filter papers to maintain product purity and comply with safety and environmental standards. This adoption is particularly prominent in sectors where precision filtration is essential to prevent equipment damage and ensure quality consistency. The move toward higher compliance benchmarks is prompting manufacturers to innovate filter media with superior porosity and contamination control

• The growing emphasis on operational efficiency and reduced maintenance costs is accelerating the shift toward durable, high-capacity filter papers. Companies benefit from longer replacement cycles, improved efficiency, and lower operational disruptions, which collectively contribute to greater industrial productivity. The adoption of robust filtration materials also enhances equipment life, reducing overall operational expenditure

• For instance, in 2023, several chemical manufacturing plants in Europe upgraded to next-generation cellulose and synthetic fiber-based filter papers, achieving higher filtration throughput, reduced contamination rates, and enhanced safety compliance. These improvements aligned with stricter European environmental norms, increasing the need for stable filtration operations. This transition encouraged other regional plants to explore similar material advancements

• While high-performance filter papers are increasingly used across industries, continued advancements in fiber technology, porosity control, and chemical resistance are essential to meet evolving industrial demands and expand application scope. Manufacturers are now focusing on hybrid fiber compositions to improve filtration consistency across varied operational environments. Such innovation is vital for addressing specialized applications in biotech, oil processing, and high-precision chemicals

Filter Paper Market Dynamics

Driver

“Rising Need for Effective Filtration in Food, Pharmaceutical, and Chemical Industries”

• The growing focus on product safety, purity, and regulatory compliance is driving robust demand for filter paper in industries such as pharmaceuticals, chemicals, and food & beverages. These sectors rely heavily on filtration to eliminate impurities, ensure process integrity, and maintain quality standards. Increasing audits and quality checks across supply chains further strengthen the need for premium filtration solutions

• Manufacturers are increasingly aware of the operational and financial risks associated with inefficient filtration, including batch contamination, equipment wear, and regulatory penalties. This awareness has led to consistent demand for high-quality filter papers capable of meeting strict filtration requirements. The adoption of advanced filtration systems also reduces wastage and supports smoother production cycles

• Regulatory bodies across regions are strengthening quality and safety standards, prompting industries to invest in advanced filtration systems. Policies promoting clean production, reduced emissions, and improved hygiene are further supporting the demand for reliable filter paper solutions. Increased government monitoring of industrial waste and product contamination is reinforcing the shift toward high-performance filtration

• For instance, in 2022, pharmaceutical manufacturers in the U.S. and Europe adopted more stringent filtration protocols, increasing the use of specialized filter papers in drug formulation and quality testing. This resulted from revised regulatory guidelines focusing on material safety and contamination control. The trend has since influenced emerging pharmaceutical markets to enhance their filtration standards

• While regulatory support and rising quality awareness are driving growth, industries must continue focusing on process optimization, material innovation, and filtration efficiency to maintain consistent adoption. Growing investment in R&D for optimized filter structures is expected to support long-term demand. Improvements in testing accuracy and production workflows further enhance the relevance of advanced filter papers

Restraint/Challenge

“Fluctuating Raw Material Prices and Limited Availability of High-Quality Fibers”

• The cost of raw materials such as cellulose, wood pulp, and specialty fibers significantly influences the pricing and production stability of filter papers. Fluctuating raw material availability creates uncertainties for manufacturers, limiting consistent supply and affecting market expansion. These fluctuations also pose challenges for long-term supply contracts and cost management

• Many regions face challenges related to sustainable sourcing and limited access to premium-quality fibers required for high-performance filtration. This restricts manufacturers’ ability to produce uniform, durable filter papers, especially for industries requiring strict performance standards. Environmental regulations on deforestation further limit fiber availability, adding pressure on supply chains

• Supply chain disruptions, transportation delays, and variations in fiber quality further contribute to inconsistent production cycles, affecting timely delivery and overall market competitiveness. These issues are particularly prominent in developing regions where material sourcing is less stable. Manufacturers in these regions often face increased reliance on imported fibers, raising procurement costs

• For instance, in 2023, disruptions in pulp supply across Asia-Pacific led to increased production costs and longer lead times for multiple filter paper manufacturers, impacting downstream industries dependent on precision filtration. The resulting supply instability drove many companies to explore alternative fiber materials. However, such alternatives often require additional processing, increasing overall costs

• While the filter paper market continues to evolve, addressing raw material volatility, improving sustainable sourcing, and enhancing production technology remain essential to unlocking long-term growth potential. Manufacturers are increasingly adopting sustainable forestry practices and fiber recycling to stabilize supply. Innovations in synthetic fiber technology also present opportunities to reduce dependence on natural pulp sources

Filter Paper Market Scope

The market is segmented on the basis of type, application, thickness, and end-user

• By Type

On the basis of type, the filter paper market is segmented into PP, PET, and Others. The PP segment held the largest market revenue share in 2025 driven by its high chemical resistance, durability, and suitability for industrial filtration processes where stability under varying temperatures is required. PP-based filter papers are widely adopted in chemical, pharmaceutical, and food processing operations due to their consistent performance and compatibility with diverse filtration systems.

The PET segment is expected to witness the fastest growth rate from 2026 to 2033 driven by its superior tensile strength, moisture resistance, and ability to maintain structural integrity during high-pressure filtration. PET filter papers are increasingly preferred for applications that require precision, durability, and extended operational lifespan, making them ideal for advanced laboratory and industrial environments.

• By Application

On the basis of application, the filter paper market is segmented into Quantitative Filter Papers and Qualitative Filter Papers. The Quantitative Filter Papers segment accounted for the largest share in 2025 supported by their extensive use in analytical procedures where accurate measurement of precipitates and ash content is required. These papers are widely utilized in scientific research, chemical analysis, and pharmaceutical quality testing due to their high purity and controlled ash content.

The Qualitative Filter Papers segment is projected to grow at a rapid rate from 2026 to 2033 driven by their broad usage in routine filtration tasks across laboratories, academic institutions, and industrial testing environments. Their ability to efficiently separate solids from liquids, combined with cost-effectiveness and versatility, makes them a preferred choice for general-purpose filtration applications.

• By Thickness

On the basis of thickness, the filter paper market is segmented into Up to 0.10 mm, 0.10 mm – 0.15 mm, 0.15 mm – 0.20 mm, and Above 0.20 mm. The 0.10 mm – 0.15 mm segment held the largest market share in 2025 owing to its suitability for a wide range of precision filtration tasks requiring balanced flow rates and particle retention. This thickness range is commonly used across pharmaceutical, food, and chemical industries for consistent and reliable filtration.

The Above 0.20 mm segment is anticipated to grow the fastest from 2026 to 2033 driven by rising demand for high-strength filter papers capable of handling large particle loads and high-viscosity liquids. These thicker filter papers are increasingly used in heavy-duty industrial operations where durability, high absorption capacity, and enhanced mechanical stability are crucial.

• By End-User

On the basis of end-user, the filter paper market is segmented into Pharmaceutical & Biopharmaceutical Manufacturers, Research Institutes, Food & Beverages Manufacturers, and Hospitals & Diagnostic Laboratories. The Pharmaceutical & Biopharmaceutical Manufacturers segment dominated the market in 2025 due to extensive filtration requirements in drug formulation, quality control testing, and raw material purification. Their dependence on high-purity filter papers ensures consistent compliance with global regulatory standards.

The Food & Beverages Manufacturers segment is expected to register the highest growth rate from 2026 to 2033 driven by rising demand for filtration solutions that ensure product safety, clarity, and taste consistency. Increasing adoption of filtration in quality assurance processes, ingredient purification, and contamination prevention is enhancing the use of filter papers across this sector.

Filter Paper Market Regional Analysis

• North America dominated the filter paper market with the largest revenue share in 2025, driven by the strong presence of pharmaceutical, chemical, and food processing industries, along with rising demand for high-precision filtration across manufacturing operations

• Industries in the region increasingly emphasize product purity, regulatory compliance, and quality assurance, which fuels the adoption of advanced filter papers across laboratory, industrial, and commercial applications

• This widespread utilization is further supported by advanced production capabilities, rising investments in R&D, and the growing preference for efficient, durable, and sustainable filtration materials, establishing North America as a leading consumer of filter paper solutions

U.S. Filter Paper Market Insight

The U.S. filter paper market captured the largest revenue share in 2025 within North America, driven by the strong prevalence of pharmaceutical manufacturing, food quality testing, and chemical processing activities. The country’s stringent quality standards and expanding laboratory ecosystem are accelerating the use of premium filtration media. The market is further supported by innovations in fiber technology, enhanced porosity control, and rising investments in analytical testing. In addition, the growing adoption of automated filtration systems and high-purity papers strengthens the U.S. position as a key contributor to regional market growth.

Europe Filter Paper Market Insight

The Europe filter paper market is expected to witness the fastest growth rate from 2026 to 2033, supported by strict environmental regulations and high emphasis on product safety across pharmaceuticals, food processing, and chemical manufacturing. The region’s rapid shift toward clean production and sustainable filtration is fostering demand for advanced filter papers. European industries highly value consistent filtration performance, durability, and compliance with regulatory frameworks. In addition, increasing R&D initiatives and adoption of high-efficiency laboratory consumables are contributing to strong market expansion across both commercial and industrial sectors.

U.K. Filter Paper Market Insight

The U.K. filter paper market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing investments in pharmaceutical R&D, biotechnology innovations, and stringent food safety regulations. The country’s growing focus on laboratory testing, quality assurance, and contamination reduction is propelling the use of specialized filter papers. In addition, the expansion of research institutions and rising adoption of precision filtration in chemical analysis and diagnostics further support market growth, making the U.K. a significant contributor to regional advancements.

Germany Filter Paper Market Insight

The Germany filter paper market is expected to witness the fastest growth rate from 2026 to 2033, fueled by the country’s strong industrial base and emphasis on high-quality, technologically advanced filtration solutions. Germany’s robust chemical, pharmaceutical, and food processing sectors rely extensively on reliable filter papers to maintain stringent quality standards. The nation’s focus on sustainability, innovation, and precision engineering is accelerating the integration of advanced filtration media into various production and laboratory environments, driving steady market expansion.

Asia-Pacific Filter Paper Market Insight

The Asia-Pacific filter paper market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid industrialization, expanding pharmaceutical production, and rising demand for quality testing across food and chemical industries in countries such as China, Japan, and India. Increasing regulatory focus on product safety, growing investments in laboratory infrastructure, and the emergence of large-scale manufacturing hubs are accelerating filtration adoption. The availability of cost-effective materials and rising technological advancements further strengthen APAC’s dominance as a key growth region.

Japan Filter Paper Market Insight

The Japan filter paper market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s advanced technological capabilities, strong pharmaceutical sector, and increasing shift toward precision filtration in research and diagnostics. Japanese industries place high emphasis on purity, efficiency, and reliability, which supports the adoption of specialized filter papers across laboratories and production units. The country’s innovation-driven ecosystem, along with rising investments in chemical analysis and food quality testing, continues to propel market growth.

China Filter Paper Market Insight

The China filter paper market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s rapidly expanding manufacturing sector, large-scale pharmaceutical production, and increasing adoption of filtration in food and chemical industries. China stands as a major producer and consumer of filter paper, supported by strong domestic manufacturing capabilities and rising emphasis on improving product quality. Government-driven industrial modernization, combined with the availability of affordable filtration solutions, plays a significant role in strengthening China’s market position.

Filter Paper Market Share

The Filter Paper industry is primarily led by well-established companies, including:

- GIC Scientific (Country Unknown)

- Advantec MFS, Inc. (U.S.)

- Chmlab Group 2005 S.L. (Spain)

- Filcon Filters (Country Unknown)

- Sartorius AG (Germany)

- Hahnemühle (Germany)

- VWR International, LLC (U.S.)

- The Griff Network (Country Unknown)

- Danaher (U.S.)

- Donaldson Company, Inc. (U.S.)

- Eaton (U.S.)

- PARKER HANNIFIN CORP (U.S.)

- ALFA LAVAL (Sweden)

- Ahlstrom-Munksjö (Finland)

- Sunshine Instruments (Country Unknown)

- J. S. Enterprises (Country Unknown)

- Swastik Scientific Instruments Private Limited (India)

- Kel India Filters (India)

Latest Developments in Global Filter Paper Market

- In May 2024, Pall Corporation introduced a new product development with the launch of its SepraLYTE liquid/gas coalescers, designed to efficiently separate electrolyte aerosols from green hydrogen gas. This solution enhances process reliability, improves purification performance, and supports the growing demand for high-efficiency hydrogen production systems. The advancement is expected to positively impact the market by accelerating adoption of next-generation filtration technologies and strengthening product innovation

- In January 2023, Merck Group announced a product launch with the introduction of a specialized line of filter papers engineered for cleanroom environments, particularly within pharmaceuticals, biotechnology, and food processing. The new filtration range improves contamination control, enhances operational precision, and supports compliance with stringent industry standards. This development is anticipated to boost market growth by increasing demand for high-performance, application-specific filter media

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.