Global Filters Market

Market Size in USD Billion

CAGR :

%

USD

96.88 Billion

USD

145.33 Billion

2024

2032

USD

96.88 Billion

USD

145.33 Billion

2024

2032

| 2025 –2032 | |

| USD 96.88 Billion | |

| USD 145.33 Billion | |

|

|

|

|

Filters Market Size

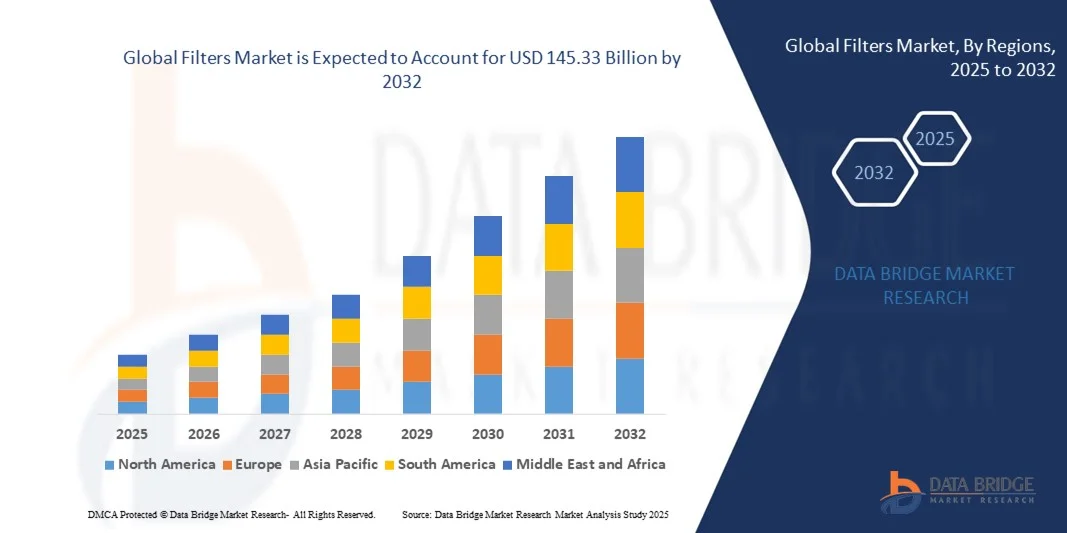

- The global filters market size was valued at USD 96.88 billion in 2024 and is expected to reach USD 145.33 billion by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely fueled by increasing industrialization, expanding automotive production, and rising demand for high-performance filtration systems across automotive, industrial, and utility applications

- Furthermore, stringent environmental and emission regulations, along with growing awareness of air and fluid quality, are driving adoption of advanced filters for both OEM and aftermarket applications. These converging factors are accelerating the uptake of filtration solutions, thereby significantly boosting the industry's growth

Filters Market Analysis

- Filters are devices designed to remove contaminants, particulates, and impurities from air, fluids, or gases, ensuring the efficient operation and longevity of machinery, vehicles, and industrial systems. Filtration solutions include air filters, fluid filters, and engine filters, which are widely deployed across automotive, industrial, consumer, and utility sectors

- The escalating demand for filters is primarily fueled by increasing vehicle production, rapid industrialization, and rising environmental and emission standards, combined with growing maintenance and aftermarket requirements to enhance equipment performance and ensure operational safety

- Asia-Pacific dominated the filters market with a share of 44.5% in 2024, due to rapid industrialization, expanding automotive production, and growing adoption of advanced air and fluid filtration systems

- North America is expected to be the fastest growing region in the filters market during the forecast period due to increasing vehicle production, industrial expansion, and stringent emission and air quality standards

- Transportation segment dominated the market with a market share of 46.5% in 2024, due to the extensive use of filters in automotive, aerospace, and rail sectors. Filters in transportation ensure engine protection, cabin air quality, and regulatory compliance with emission standards. Increasing vehicle production, rising demand for fuel-efficient engines, and stricter emission control mandates have contributed to the high adoption of filters in this segment. Furthermore, the integration of advanced filter technologies in modern vehicles has enhanced performance, reliability, and overall air and fluid quality management

Report Scope and Filters Market Segmentation

|

Attributes |

Filters Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Filters Market Trends

Adoption of IoT-Enabled Filtration Systems

- A major trend shaping the global filters market is the adoption of IoT-enabled filtration systems that integrate sensors and data analytics to monitor performance, optimize efficiency, and predict maintenance needs in real time. These smart filtration solutions are transforming traditional filter applications across industrial, commercial, and automotive sectors by enabling predictive maintenance and reducing downtime

- For instance, Parker Hannifin has developed intelligent filtration systems equipped with IoT-based sensors that transmit data to cloud platforms, allowing users to evaluate pressure levels, contamination rates, and filter saturation remotely. Similarly, Donaldson Company offers the iCue connected filtration monitoring service, which enables predictive servicing and supports greater operational reliability for industrial setups

- IoT integration in filtration systems enhances process transparency by continuously tracking filtration efficiency, flow rates, and environmental parameters such as air quality and particle concentration. This allows operators to make data-driven decisions that minimize energy use, improve system life, and enhance environmental compliance

- Smart filtration solutions are being increasingly adopted in critical industries such as pharmaceuticals, oil and gas, food processing, and manufacturing, where continuous uptime and contamination prevention are essential. These industries benefit from automated alerts that signal when filters need cleaning or replacement, ensuring process consistency and safety

- The combination of IoT, AI, and machine learning within the filtration ecosystem is facilitating autonomous optimization, where systems automatically adjust filtration cycles based on real-time input data. In addition, IoT enhances sustainability by reducing waste and extending filter life through optimized usage and maintenance prediction

- The ongoing shift toward IoT-enabled filtration marks a transformative advancement in how air, liquid, and oil filtration systems are designed, managed, and serviced. As industries focus on digital transformation, connectivity, and predictive performance management, intelligent filters are expected to become standard across sectoral applications, driving long-term market growth

Filters Market Dynamics

Driver

Rising Industrialization and Automotive Production

- Growing industrialization and an expanding automotive sector remain the foremost drivers of global demand for filters, as these industries require advanced filtration solutions to ensure quality control, operational safety, and environmental compliance. The rise of manufacturing activities worldwide is significantly increasing filtration usage for air, water, oil, and gas systems

- For instance, Mann+Hummel supplies a broad range of filters for automotive and industrial applications, supporting major global automakers and manufacturing companies. Their continued investment in high-efficiency engine and cabin air filters reflects how expanding industrial and automotive operations propel filter consumption on a global scale

- In the automotive sector, filters play a crucial role in maintaining engine performance, controlling emissions, and ensuring passenger comfort. With the increasing production of both internal combustion vehicles and hybrids, there is sustained demand for fuel, oil, and cabin filters that enhance engine longevity and air quality inside vehicles

- Industrial sectors such as power generation, chemical processing, and food manufacturing increasingly rely on high-capacity filtration systems to ensure equipment reliability and product purity. The expansion of infrastructure and industrial plants in emerging economies has further strengthened the need for large-scale filtration solutions

- Continued urbanization, regulatory standards for clean environments, and rising production volumes are reinforcing the significance of filters in maintaining operational integrity. The ongoing surge in global automotive production and industrial development ensures that high-performance filtration systems will remain central to efficiency, safety, and sustainability objectives across all major industries

Restraint/Challenge

High Cost of Advanced Filters

- The high cost associated with advanced filtration systems presents a notable challenge for widespread adoption, particularly among cost-sensitive industries and developing regions. Filters equipped with high-efficiency membranes, composite materials, and smart sensor technologies typically involve substantial manufacturing and installation expenditures

- For instance, companies such as Cummins Filtration and Pall Corporation invest heavily in advanced nanofiber and multi-layer technology filters, which, while highly effective, increase overall system costs for consumers and operators. These expenses can deter smaller enterprises from transitioning to next-generation filtration systems, especially when short-term budgets limit capital investment

- Maintenance and replacement costs further add to financial constraints, as specialized parts and sensor components can drive up operating expenses. In sectors where frequent filter servicing is required, cumulative costs over time may outweigh initial system benefits, leading some users to opt for conventional, less advanced alternatives

- The use of proprietary materials, complex manufacturing processes, and tight regulatory compliance for quality certifications also contribute to higher production expenditures. This ultimately makes advanced filters less accessible to end users in small-scale industries, even though they offer superior efficiency and durability

- To address this challenge, manufacturers are focusing on modular design and cost optimization through scalable production, material recycling, and simplified maintenance. While short-term affordability remains a constraint, long-term operational benefits of advanced filters are expected to encourage gradual adoption as industry awareness and technological accessibility improve

Filters Market Scope

The market is segmented on the basis of product type, application, and end-user.

- By Product Type

On the basis of product type, the filters market is segmented into internal combustion engine filters, air filters, and fluid filters. The air filters segment dominated the largest market revenue share of 43% in 2024, driven by increasing demand for efficient air purification and emission control across various industries. Air filters are essential in HVAC systems, automotive cabins, and industrial processes, helping to maintain air quality while protecting machinery from dust and contaminants. The rising focus on environmental regulations and clean air standards has further strengthened the adoption of advanced air filters. In addition, innovations in high-efficiency particulate filters and smart filter monitoring systems are enhancing their effectiveness, convenience, and lifespan, contributing to sustained market dominance.

The internal combustion engine filters segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the growing production of vehicles and stringent engine efficiency and emission standards. Engine filters play a crucial role in preventing engine wear, enhancing fuel efficiency, and ensuring optimal performance. Rising adoption in commercial and passenger vehicles, combined with advancements in filtration technology such as multi-layer and synthetic media filters, is driving their rapid growth. Moreover, increasing aftermarket replacement demand due to engine maintenance requirements further accelerates segment expansion.

- By Application

On the basis of application, the filters market is segmented into transportation, consumer, utility, industrial, and others. The transportation segment dominated the largest market revenue share of 46.5% in 2024, supported by the extensive use of filters in automotive, aerospace, and rail sectors. Filters in transportation ensure engine protection, cabin air quality, and regulatory compliance with emission standards. Increasing vehicle production, rising demand for fuel-efficient engines, and stricter emission control mandates have contributed to the high adoption of filters in this segment. Furthermore, the integration of advanced filter technologies in modern vehicles has enhanced performance, reliability, and overall air and fluid quality management.

The industrial segment is projected to witness the fastest growth rate from 2025 to 2032, driven by the rising adoption of filtration solutions in manufacturing plants, power generation, and chemical processing industries. Industrial filters are critical for maintaining equipment longevity, reducing downtime, and ensuring compliance with safety and environmental standards. Growing industrialization, especially in emerging economies, along with increasing awareness of workplace safety and emission control, is accelerating demand. Technological advancements such as automated filter monitoring and self-cleaning mechanisms are also contributing to the segment’s rapid expansion.

- By End-User

On the basis of end-user, the filters market is segmented into OEM and aftermarket. The OEM segment dominated the largest market revenue share in 2024, driven by the integration of filters into vehicles, machinery, and industrial equipment at the manufacturing stage. OEM filters are preferred for their reliability, compatibility, and compliance with manufacturer specifications. The growing focus on product quality, durability, and environmental regulations has increased the adoption of OEM filters across automotive, industrial, and consumer applications. In addition, rising investments by manufacturers in advanced filtration solutions have further strengthened their dominance in the market.

The aftermarket segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the increasing need for replacement filters due to wear and regular maintenance across automotive and industrial sectors. Aftermarket filters offer flexibility, cost-effectiveness, and availability in diverse specifications to meet different operational requirements. Rising vehicle ownership, extended equipment lifecycles, and growing awareness of preventive maintenance are key factors driving the segment. Moreover, the emergence of e-commerce platforms and online retail channels has improved accessibility, accelerating aftermarket adoption globally.

Filters Market Regional Analysis

- Asia-Pacific dominated the filters market with the largest revenue share of 44.5% in 2024, driven by rapid industrialization, expanding automotive production, and growing adoption of advanced air and fluid filtration systems

- The region’s cost-effective manufacturing landscape, increasing investments in automotive and industrial sectors, and strong presence of OEMs and aftermarket suppliers are accelerating market expansion

- Availability of skilled labor, supportive government policies, and rising environmental and emission regulations are further boosting demand for high-performance filtration solutions across residential, commercial, and industrial applications

China Filters Market Insight

China held the largest share in the Asia-Pacific filters market in 2024, owing to its status as a global hub for automotive manufacturing, industrial equipment production, and robust OEM operations. The country’s extensive industrial base, strong R&D capabilities, and government support for clean energy and emission control technologies are major growth drivers. Rising demand for air and fluid filtration systems in automotive, industrial, and utility applications is further supporting market growth.

India Filters Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing vehicle production, growing industrialization, and expanding infrastructure projects. Government initiatives to enhance environmental standards, coupled with rising investments in filtration technology and aftermarket services, are driving rapid adoption. The growth of e-commerce, pharmaceuticals, and manufacturing sectors is also contributing to robust market expansion across the country.

Europe Filters Market Insight

The Europe filters market is expanding steadily, supported by strict environmental regulations, high demand for air and fluid filtration systems in industrial and automotive sectors, and growing investments in sustainable manufacturing. The region places emphasis on energy efficiency, high-quality filtration, and advanced technologies, particularly in industrial, transportation, and utility applications. Increasing demand for aftermarket replacement filters and integration of IoT-enabled monitoring systems is further enhancing market growth.

Germany Filters Market Insight

Germany’s filters market is driven by its strong automotive and industrial equipment sectors, high standards for product quality, and robust R&D infrastructure. Continuous innovation in filter design, high adoption of OEM and aftermarket solutions, and stringent environmental regulations are strengthening market demand. The country also benefits from a mature distribution network and export-oriented production.

U.K. Filters Market Insight

The U.K. market is supported by a mature automotive and industrial base, increasing focus on sustainability, and growing replacement and maintenance services. Rising adoption of advanced filtration technologies in manufacturing and energy sectors, along with strong aftermarket demand, is driving market growth. Government incentives and collaboration between research institutes and industrial players further bolster innovation and adoption of high-performance filters.

North America Filters Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing vehicle production, industrial expansion, and stringent emission and air quality standards. Rising focus on high-performance filtration systems in automotive, industrial, and utility applications, along with technological advancements such as smart and IoT-enabled filters, is boosting demand. Reshoring of manufacturing operations and increasing aftermarket services are further supporting market expansion.

U.S. Filters Market Insight

The U.S. accounted for the largest share in the North America filters market in 2024, underpinned by its strong automotive industry, advanced industrial base, and extensive R&D infrastructure. High adoption of air, fluid, and engine filtration solutions across OEM and aftermarket segments, coupled with rising environmental compliance and focus on sustainability, is driving market growth. Presence of key manufacturers, wide distribution networks, and technological advancements in filtration systems further solidify the U.S.’s leading position in the region.

Filters Market Share

The filters industry is primarily led by well-established companies, including:

- PARKER HANNIFIN CORP (U.S.)

- MANN+HUMMEL (Germany)

- Cummins Inc. (U.S.)

- Donaldson Company, Inc. (U.S.)

- Aarkays Air Equipment Private Limited. (India)

- Advance International (India)

- Tfi Filtration (India) Private Limited. (India)

- Affinia Group Intermediate Holdings Inc (U.S.)

- Automat Irrigation Private Limited. (India)

- Garuda Impex (India)

- Eaton (Ireland)

- M/s Royal Industries (India)

- M.M. INDUSTRIES. (India)

- D & S Automotive. (India)

- Harjas Auto Industries. (India)

- Kel India Filters. (India)

- Anil Traders (India)

- Bawana. (India)

- Dhamija Enterprises (India)

- Pall Corporation (U.S.)

Latest Developments in Global Filters Market

- In September 2023, Parker Hannifin introduced the new CDFX-B SAP-free water barrier filter, filtration, and condition monitoring solution. The launch of CDFX-B enhances the company’s position in the fuel filtration market by offering a drop-in solution that safely removes water and contaminants, improving fuel system reliability and extending equipment lifespan. This innovation strengthens Parker Hannifin’s portfolio in industrial and automotive filtration solutions, driving adoption across commercial vehicle and industrial applications that require advanced fuel conditioning and monitoring

- In February 2023, Camfil launched its CamPure 8 media in the U.S., designed for the efficient removal of gaseous contaminants and odors, including sulfur dioxide, hydrogen sulfide, formaldehyde, and ethylene. This product expansion boosts Camfil’s presence in the molecular filtration market by addressing critical air quality challenges across industries such as pulp & paper, oil & gas, wastewater treatment, and mining & metal refining. In addition, its use in preserving fruits, flowers, and vegetables enhances demand in the food and agriculture sector, strengthening the company’s multi-industry footprint and market share

- In May 2023, 3M collaborated with Svante Technologies to develop a material capable of trapping and permanently removing carbon dioxide from the atmosphere. 3M’s investment via its venture capital division in Svante’s Series E funding accelerates the commercialization of advanced carbon capture technologies. This partnership positions 3M at the forefront of the emerging direct air capture and industrial point-source filtration markets, addressing sustainability and regulatory demands while opening new growth avenues in high-performance environmental filtration solutions

- In September 2022, Parker-Hannifin Corporation acquired Meggitt PLC to strategically expand its filtration and motion control portfolio. This acquisition enhances Parker-Hannifin’s capabilities in providing integrated filtration solutions and advanced components for aerospace, industrial, and mobility applications. By strengthening its technological offerings and market reach, the acquisition is expected to increase competitive advantage and accelerate growth in high-performance filtration and control markets

- In August 2022, Cummins acquired Meritor, a global supplier of braking, mobility, drivetrain, aftermarket, and electric powertrain solutions. The acquisition broadens Cummins’ components business and its presence in filtration and fluid management systems for commercial vehicles and industrial applications. By integrating Meritor’s capabilities, Cummins can provide comprehensive solutions, enhance product offerings, and capture a larger share of the global filtration and automotive components market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.