Global Finance Cloud Market

Market Size in USD Billion

CAGR :

%

USD

155.40 Billion

USD

462.30 Billion

2024

2032

USD

155.40 Billion

USD

462.30 Billion

2024

2032

| 2025 –2032 | |

| USD 155.40 Billion | |

| USD 462.30 Billion | |

|

|

|

|

Finance Cloud Market Size

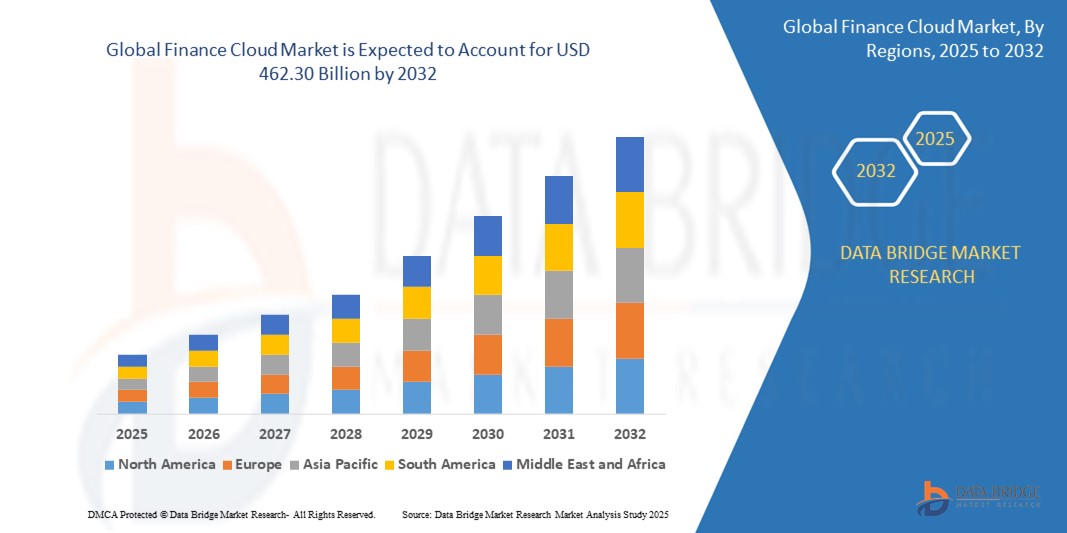

- The global Finance Cloud market size was valued at USD 155.40 billion in 2024 and is expected to reach USD 462.30 billion by 2032, at a CAGR of 14.60% during the forecast period

- The Finance Cloud market is rapidly expanding as financial institutions adopt cloud solutions to enhance agility, scalability, and compliance. Key drivers include growing demand for real-time data analytics, secure digital banking, and cost-effective infrastructure. Cloud platforms enable seamless integration of AI and automation, improving customer experience and operational efficiency. All these factors drive the market growth during the forecast period.

Finance Cloud Market Analysis

- The Finance Cloud Market refers to cloud-based financial services platforms that allow institutions to manage operations, data, and customer interactions more efficiently than traditional on-premise systems. These platforms are transforming how banks, insurance firms, and fintech companies deliver personalized services, enhance compliance, and scale operations securely and cost-effectively. Their flexibility, in contrast to rigid legacy infrastructure, is accelerating digital transformation across the financial sector.

- Major factors expected to boost the growth of the Finance Cloud Market during the forecast period include rising demand for real-time data processing, regulatory compliance automation, and the growing shift toward digital banking services. The increasing deployment of AI and machine learning for risk assessment, fraud detection, and customer insights, along with the need for remote financial services, are further anticipated to propel market expansion.

- Asia Pacific is expected to dominate the Finance Cloud Market due to rapid digitalization in the banking sector, government support for fintech infrastructure, and the high adoption of mobile financial platforms. The region’s increasing internet penetration and growing population of tech-savvy consumers will further support market growth during the forecast period.

- North America is projected to be the fastest-growing region in the Finance Cloud Market due to early adoption of advanced technologies, strong cybersecurity frameworks, and rising investments in cloud infrastructure by financial institutions. Additionally, demand for scalable, agile, and cost-effective solutions is driving a shift away from traditional IT models toward finance-specific cloud platforms.

- The solution segment is anticipated to lead the Finance Cloud Market, with a projected market share of around 59.9% during the forecast period. This dominance is attributed to increasing reliance on cloud-native applications for risk management, core banking operations, compliance reporting, and customer analytics. Enhanced security, integration capabilities, and continuous innovation are further reinforcing the adoption of finance cloud solutions across the global market.

Report Scope and Finance Cloud Market Segmentation

|

Attributes |

Finance Cloud Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Finance Cloud Market Trends

“Expansion of AI-Powered, Cloud-Native Financial Platforms”

- Finance Cloud technologies are shifting toward highly scalable, AI-driven solutions that deliver real-time insights, automate routine processes, and enhance customer engagement across banking, insurance, and asset management platforms.

- Innovations in natural language processing (NLP), robotic process automation (RPA), and predictive analytics are allowing institutions to modernize legacy systems while reducing operational costs and improving compliance efficiency.

- For instance, in 2025, several global banks reported a significant drop in operational risk incidents after integrating intelligent risk engines into their finance cloud infrastructure, leading to faster credit decisioning and fraud detection.

- The trend is driven by increasing demand for agile digital infrastructure, paperless onboarding, and proactive financial services that align with rising customer expectations for on-demand, personalized experiences.

Finance Cloud Market Dynamics

Driver

“Growing Demand for Secure, Scalable, and Compliant Financial Infrastructure”

- Financial institutions are transitioning from on-premise systems to cloud-based environments to support scalability, reduce IT overheads, and ensure data availability during fluctuating market conditions.

- With increased pressure from global regulators, finance cloud platforms now embed compliance tools, audit-ready reporting, and encrypted data sharing—making them critical for maintaining operational integrity.

- The ability to integrate real-time data feeds, risk analytics, and client services into a single digital framework is transforming the way institutions operate, boosting responsiveness and agility.

For instance,

- In March 2025, financial organizations reported a significant increase in uptime and service continuity after migrating their core operations to multi-cloud environments—especially during volatile economic periods.

- The rise in remote advisory services, digital wallets, and decentralized finance (DeFi) platforms further underscores the need for robust, cloud-first solutions in the financial ecosystem.

Opportunity

“Digitization of Financial Services in Emerging Economies”

- Emerging markets are witnessing a rapid acceleration in digital banking adoption due to increasing mobile penetration, supportive fintech policies, and underserved populations demanding accessible financial services.

- Finance Cloud solutions offer cost-effective, modular infrastructure for financial institutions and startups to launch digital products without heavy capital investment.

- Cloud-native financial platforms can be deployed in weeks, support multiple currencies and languages, and scale dynamically to meet rising consumer demands.

For instance,

- March 2025, several central banks in developing regions began pilot testing digital currency infrastructure on secure finance cloud platforms, enabling broader financial inclusion and cashless economic initiatives.

- This trend presents a massive opportunity for cloud service providers to support the next wave of financial innovation and economic inclusion across Asia, Africa, and Latin America.

Restraint/Challenge

“Complex Regulatory Landscape and Data Sovereignty Concerns”

- The Finance Cloud Market faces challenges due to fragmented global regulations, especially concerning cross-border data transfers, financial reporting standards, and consumer privacy.

- Financial institutions must comply with overlapping rules from multiple jurisdictions, which increases the complexity of cloud deployment and often requires region-specific configurations.

- Concerns around data sovereignty, especially in regions with strict localization laws, hinder full-scale cloud adoption and may limit multi-cloud or hybrid cloud flexibility.

For instance,

- In June 2024, several financial institutions experienced delays in their cloud rollout plans due to new regulations requiring local data residency and third-party audit trails. These updated regulatory measures, aimed at ensuring data sovereignty and security, created challenges for cloud service providers. As a result, many organizations had to reconfigure their cloud infrastructure to meet compliance standards. This regulatory shift has impacted the speed of digital transformation in the financial sector.

- Navigating certification requirements (e.g., ISO, SOC, PCI-DSS) and maintaining real-time compliance with changing financial policies remains an operational and legal challenge for finance cloud adopters.

Finance Cloud Market Scope

The market is segmented on the basis type, application, deployment model, sub-industry and organization size.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By Deployment Model |

|

|

By Sub-Industry |

|

|

By Organization Size |

|

In 2025, the solution is projected to dominate the market with a largest share in by type segment

The solution segment is expected to dominate the Finance Cloud market, with a market share of 59.9% during the forecast period. The increasing demand for scalable, secure, and agile cloud platforms. Financial institutions are adopting cloud solutions to enhance operational efficiency, improve data analytics, ensure compliance, and offer personalized services. These solutions are transforming traditional financial operations, enabling real-time decision-making, automation, and seamless customer experiences.

The revenue management is expected to account for the largest share during the forecast period in Finance Cloud market

In 2025, the revenue management segment in the Finance Cloud Market is projected to hold the largest share of approximately 41.1%. Finance Cloud Market is gaining momentum as organizations seek advanced tools for pricing, billing, and monetizing financial products and services. Cloud-based revenue management solutions allow for dynamic pricing, efficient contract management, and real-time revenue recognition, helping financial institutions optimize their revenue streams and ensure accurate, compliant financial reporting.

Finance Cloud Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Finance Cloud Market”

- Asia-Pacific dominates the Finance Cloud Market, driven by rapid digital transformation in financial services, increasing mobile banking adoption, and growing demand for cloud-native solutions in countries like China, India, and Japan.

- China and India are significant contributors due to their large, fast-growing fintech ecosystems, heavy investments in digital infrastructure, and increasing smartphone penetration, which fuels cloud-based financial services.

- Japan, with its strong technological foundation and early adoption of cloud solutions, plays a pivotal role in driving innovations in financial services, including AI-powered analytics, risk management, and digital payment systems.

- The region’s dominance is further supported by government initiatives promoting digital banking, e-wallets, and nationwide efforts to enhance financial inclusion and modernize legacy systems in both private and public sectors.

“North America is Projected to Register the Highest CAGR in the Finance Cloud Market”

- North America is expected to experience the fastest growth in the Finance Cloud Market, driven by increasing demand for secure, scalable financial solutions, cloud-based regulatory compliance tools, and data analytics platforms.

- The U.S. leads the region due to its advanced financial infrastructure, high adoption rates of cloud technologies, and a significant shift toward digital banking, AI-driven financial services, and blockchain innovations.

- The integration of cloud solutions in wealth management, digital payment systems, and real-time financial data analytics is accelerating demand across the region.

- Additionally, the region benefits from a robust startup ecosystem, investment in fintech research and development, and a strong emphasis on cybersecurity, supporting the long-term growth of cloud-based financial solutions.

Finance Cloud Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- AWS (US)

- Microsoft (US)

- Google (US)

- IBM (US)

- Salesforce (US)

- Tencent (China)

- Oracle (US)

- Alibaba (China)

- Workday (US)

- SAP (Germany)

- HPE (US)

- VMware (US)

- Cisco (US)

- Huawei (China)

- ServiceNow (US)

- DXC technology (US)

- SAGE Group (UK)

- Snowflake (US)

- Nutanix (US)

- Acumatica (US)

- RapidScale (US)

- AtemisCloud (US)

- Rambase (Norway)

- OVHcloud (France)

Latest Developments in Global Finance Cloud Market

- In January 2025, JP Morgan Chase announced its ambitious plan to move 75% of its infrastructure to the cloud by 2026, focusing on enhancing its financial services with real-time data processing, AI-driven insights, and improved customer experience. The company is partnering with leading cloud providers to strengthen its digital banking operations and enhance data security across its services.

- In March 2025, Goldman Sachs unveiled its cloud-based risk management platform designed to provide real-time risk analysis and predictive modeling for investment portfolios. The platform leverages AI and machine learning to enhance financial decision-making, streamline compliance workflows, and reduce operational risks in trading and asset management.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.