Global Financial Analytics Market

Market Size in USD Billion

CAGR :

%

USD

10.99 Billion

USD

24.09 Billion

2024

2032

USD

10.99 Billion

USD

24.09 Billion

2024

2032

| 2025 –2032 | |

| USD 10.99 Billion | |

| USD 24.09 Billion | |

|

|

|

|

Financial Analytics Market Size

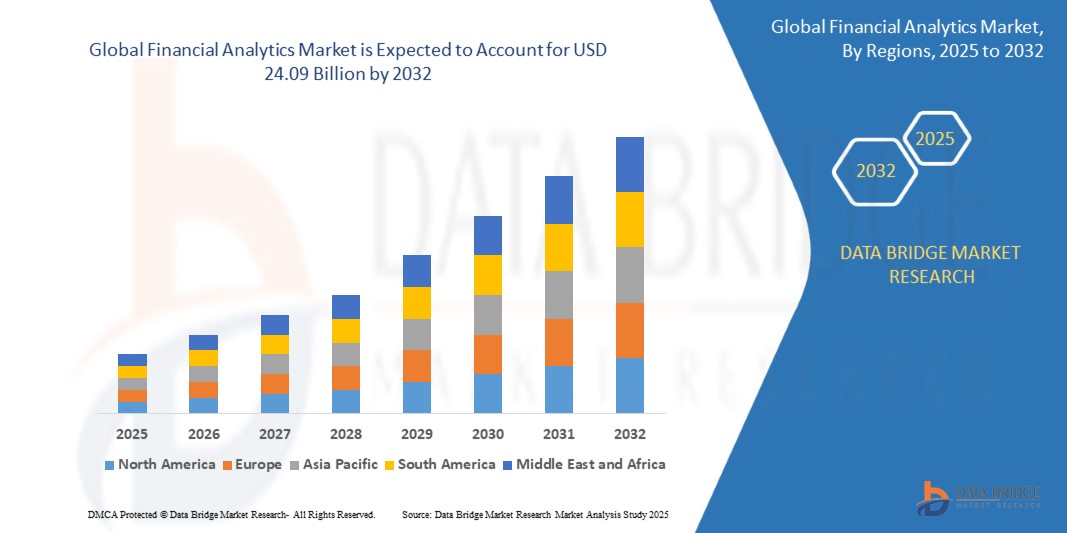

- The global financial analytics market was valued at USD 10.99 billion in 2024 and is expected to reach USD 24.09 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 10.30%, primarily driven by the increasing adoption of data-driven decision-making and real-time analytics

- This growth is driven by factors such as the rising demand for predictive analytics in financial operations, integration of AI and ML technologies, and the growing need for risk management and regulatory compliance across banking, insurance, and investment sectors

Financial Analytics Market Analysis

- Financial analytics involves the use of data mining, predictive modeling, machine learning, and statistical tools to analyze financial data and generate insights that support strategic decision-making. These solutions are essential for budgeting, forecasting, risk management, and profitability analysis across sectors such as banking, insurance, investment, and corporate finance

- The demand for financial analytics is significantly driven by the growing need for real-time data insights, increasing regulatory compliance requirements, and the rapid digital transformation across financial institutions. More than half of the global demand is generated by the banking and financial services sector, especially in regions with mature financial ecosystems and high digital adoption

- The North America region stands out as a dominant region for financial analytics solutions, supported by its robust financial infrastructure, large volume of financial transactions, and early adoption of advanced data analytics platforms

- For instance, financial institutions in the U.S. are investing heavily in AI-powered analytics platforms to enhance fraud detection, improve customer experience, and automate reporting processes—leading to increased operational efficiency and competitiveness

- Globally, financial analytics platforms are now regarded as one of the most critical components in modern financial technology stacks, second only to core banking systems. They play a pivotal role in enabling organizations to optimize performance, forecast trends, and make data-driven decisions with greater confidence

Report Scope and Financial Analytics Market Segmentation

Attributes |

Financial Analytics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Financial Analytics Market Trends

“Increased Adoption of AI and Cloud-Based Financial Analytics Platforms”

- One prominent trend in the global financial analytics market is the accelerated adoption of artificial intelligence (AI) and cloud-based platforms to enhance financial decision-making and operational agility

- These advanced technologies empower organizations to automate complex data analysis, uncover actionable insights in real time, and improve forecasting accuracy across various financial functions such as budgeting, planning, and risk assessment

- For instance, AI-driven predictive analytics allows financial teams to identify emerging risks, spot market opportunities, and optimize investments, offering a competitive advantage in fast-paced financial environments

- Cloud integration enables scalability, cost-efficiency, and remote accessibility of financial data and analytics tools. It supports collaboration across departments and geographies, while also ensuring data security and compliance with global financial regulations

- This trend is transforming traditional financial operations into agile, data-first environments, significantly boosting efficiency, transparency, and strategic responsiveness. As a result, the demand for AI and cloud-integrated financial analytics solutions continues to rise across both large enterprises and mid-sized organizations globally

Financial Analytics Market Dynamics

Driver

“Growing Demand Due to Rising Complexity in Financial Decision-Making”

- The increasing complexity of financial decision-making in today’s dynamic business environment is a key driver contributing to the growing demand for financial analytics solutions

- Organizations across industries face challenges such as volatile market conditions, changing regulatory landscapes, inflationary pressures, and competitive disruptions, all of which require real-time, data-driven insights for effective financial planning and strategy

- Financial analytics tools provide enhanced visibility, faster reporting, and predictive capabilities, enabling decision-makers to assess risk, optimize investments, improve cash flow, and align resources with business goals. These tools are becoming essential in navigating high-stakes financial scenarios

- The rise in digital transactions and increased financial data volume further underscores the need for advanced analytics platforms that can process and interpret large datasets quickly and accurately

For instance,

- In a 2023 Deloitte survey, 82% of CFOs reported plans to increase investment in analytics capabilities to better support strategic initiatives and manage uncertainty

- According to PwC’s Global Finance Trends 2024 report, over 70% of finance leaders identified advanced analytics and AI-driven tools as critical to improving decision-making and managing risks

- As businesses increasingly rely on proactive and forward-looking financial insights to maintain a competitive edge, the demand for advanced financial analytics platforms is expected to surge, fueling market growth throughout the forecast period

Opportunity

“Transforming Financial Decision-Making with Artificial Intelligence Integration”

- The integration of artificial intelligence (AI) in financial analytics platforms presents a significant opportunity to transform how organizations handle financial planning, forecasting, risk management, and performance evaluation

- AI-powered financial analytics systems can automate complex tasks, detect patterns in vast datasets, and deliver real-time, predictive insights that help CFOs and finance teams make more strategic and informed decisions

- AI algorithms can continuously monitor key financial indicators, flag anomalies or risks (such as cash flow issues or fraud), and recommend corrective actions based on historical trends and current market conditions

- In addition, AI-driven tools support scenario modeling and stress testing, enabling organizations to prepare for economic uncertainties, regulatory changes, and evolving business environments with greater agility

For instance,

- In January 2025, a report by McKinsey & Company highlighted that companies implementing AI in financial operations experienced up to a 25% reduction in forecasting errors and significantly enhanced accuracy in budget allocations

- In October 2024, Oracle launched its AI-powered “Fusion Analytics Warehouse” for finance teams, integrating machine learning to improve cash flow forecasting and automate variance analysis, demonstrating the growing enterprise focus on intelligent finance platforms

- The integration of AI in financial analytics not only improves operational efficiency but also leads to better risk mitigation, faster decision-making, and improved shareholder value. As finance departments evolve into strategic hubs within organizations, the demand for AI-enhanced analytics platforms will continue to rise, unlocking substantial growth opportunities across global markets

Restraint/Challenge

“High Implementation Costs and Integration Complexity Hindering Adoption”

- The high cost of implementing advanced financial analytics solutions continues to pose a significant challenge, especially for small and medium-sized enterprises (SMEs) and organizations with limited IT budgets

- Comprehensive financial analytics platforms—especially those powered by AI, machine learning, and real-time data processing—often require substantial investment in software licensing, skilled personnel, infrastructure upgrades, and data integration efforts across various departments and legacy systems

- This financial barrier can deter organizations from fully embracing advanced analytics tools, leading many to rely on basic spreadsheets or outdated systems that lack the capabilities needed for modern financial management

For instance,

- According to a 2023 survey by KPMG, CFOs identified data integration from multiple systems and lack of in-house analytics expertise as key obstacles that delay digital transformation in financial functions

- As a result, these limitations can create disparities in analytics adoption across industry sectors and geographic regions, slowing down market penetration and innovation. Addressing these challenges through cost-effective, modular solutions and enhanced training programs will be crucial for unlocking the full growth potential of the financial analytics market

Financial Analytics Market Scope

The market is segmented on the basis type, organization size, deployment type, end-user, component, and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Organization Size |

|

|

By Deployment Type |

|

|

By End-User |

|

|

By Component |

|

|

By Application

|

|

Financial Analytics Market Regional Analysis

“North America is the Dominant Region in the Financial Analytics Market”

- North America dominates the financial analytics market, driven by a highly developed financial services sector, strong digital infrastructure, and early adoption of advanced analytics technologies across industries

- The United States holds a significant market share due to the widespread use of AI-powered analytics tools in banking, insurance, and corporate finance, as well as the increasing complexity of regulatory requirements that demand robust financial reporting and compliance solutions

- The region benefits from the presence of major technology and analytics providers such as Oracle, IBM, Microsoft, and SAS Institute, along with a strong ecosystem of fintech startups that are continuously innovating in financial data processing and automation

- In addition, favorable government policies supporting digital transformation, well-established financial governance frameworks, and large-scale investments in cloud-based analytics platforms are fueling continued growth

- The growing emphasis on real-time decision-making, automation, and data transparency makes North America a leading region for innovation and adoption in the financial analytics space, positioning it as a global hub for next-generation finance solutions

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the financial analytics market, driven by rapid digitization of financial services, increasing adoption of cloud computing, and a growing emphasis on real-time data-driven decision-making

- Countries such as China, India, and Japan are emerging as major growth engines due to their expanding financial sectors, rising fintech innovation, and increased investments in data infrastructure by both governments and enterprises

- Japan, with its mature financial ecosystem and tech-savvy business environment, continues to lead in the adoption of AI-powered analytics for portfolio optimization, regulatory compliance, and enterprise performance management

- India and China, supported by their large and digitally engaged populations, are seeing a surge in demand for advanced analytics solutions across banking, insurance, and e-commerce sectors

- Moreover, the region is benefiting from government-led financial inclusion initiatives, rapid growth in mobile payments, and increasing regulatory oversight, all of which necessitate the use of scalable and intelligent financial analytics platforms

- As businesses in Asia-Pacific continue to evolve digitally and strive for operational agility, the demand for advanced financial analytics solutions is poised to accelerate, positioning the region as a key contributor to global market expansion

Financial Analytics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- SAP SE (Germany)

- IBM (U.S.)

- Oracle Corporation (U.S.)

- TIBCO Software Inc. (U.S.)

- MicroStrategy Inc. (U.S.)

- Deloitte (U.S.)

- Hitachi Consulting Corporation (Japan)

- Information Builders (U.S.)

- Fair Isaac Corporation (FICO) (U.S.)

- Microsoft Corporation (U.S.)

- Symphony Teleca Corp. (U.S.)

- Teradata Corp (U.S.)

- Tableau Software Inc. (U.S.)

- Rosslyn Analytics Ltd. (U.K.)

- SAS Institute Inc. (U.S.)

- Google (U.S.)

- Domo, Inc. (U.S.)

- Birst, Inc. (U.S.)

- GoodData Corporation (U.S.)

- Zoho Corporation Pvt. Ltd. (India)

Latest Developments in Global Financial Analytics Market

- In June 2023, MicroStrategy Incorporated, a leading business intelligence software provider, expanded its partnership with Microsoft Corporation, a global technology leader. Through this collaboration, MicroStrategy’s advanced analytics solutions will be integrated with Microsoft’s Azure OpenAI Service, empowering enterprises to fully leverage their data and unlock deeper insights

- In May 2023, QlikTech International AB, a provider of business intelligence solutions, acquired Talend Inc., a developer specializing in data integration and management software. This acquisition is set to enhance QlikTech’s capabilities across key areas including data quality, transformation, application connectivity, and API services

- In February 2023, Alteryx introduced new self-service and enterprise-grade features to its analytics cloud platform, aimed at helping customers make faster, data-driven business decisions. The upgraded platform delivers a modern, user-friendly interface while maintaining robust data governance standards

- In October 2022, Oracle, a prominent provider of cloud applications and platform services, unveiled new product innovations within its comprehensive data and analytics solutions portfolio to help customers drive better and faster decision-making. The enhancements include access to a prebuilt library of nearly 2,000 KPIs, dashboards, and reports, enabling organizations to accelerate insights and improve performance analysis

- In November 2022, IBM Corporation, a global leader in computer technology and IT consulting, launched a new software solution designed to help enterprises eliminate data and analytics silos. The release aims to enable organizations to accelerate data-driven decision-making by providing more unified and accessible analytics capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL FINANCIAL ANALYTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL FINANCIAL ANALYTICS MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 MULTIVARIATE MODELLING

2.2.6 STANDARDS OF MEASUREMENT

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL FINANCIAL ANALYTICS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

5.2 PENETRATION AND GROWTH POSPECT MAPPING

5.3 COMPETITOR KEY PRICING STRATEGIES

5.4 TECHNOLOGY ANALYSIS

5.4.1 KEY TECHNOLOGIES

5.4.2 COMPLEMENTARY TECHNOLOGIES

5.4.3 ADJACENT TECHNOLOGIES

FIGURE 1 TECHNOLOGY MATRIX

Company Product/Service offered

5.5 COMPANY COMPETITIVE ANALYSIS

5.5.1 STRATEGIC DEVELOPMENT

5.5.2 TECHNOLOGY IMPLEMENTATION PROCESS

5.5.2.1. CHALLENGES

5.5.2.2. INHOUSE IMPLEMENTATION/OUTSOURCED (THIRD PARTY) IMPLEMENTATION

5.5.3 TECHNOLOGY SPEND OF COMPANY

5.5.4 CUSTOMER BASE

5.5.5 SERVICE POSITIONING

5.5.6 CUSTOMER FEEDBACK/RATING (B2B OR B2C)

5.5.7 APPLICATION REACH

5.5.8 SERVICE PLATFORM MATRIX

FIGURE 2 COMPANY COMPARATIVE ANALYSIS

Parameters Company A

Market Share

Growth (%)

Target Audience

Price Structure

Market Strategies

Customer Feedback

Service Positioning

Customer Feedback/Rating

Strategic Development

Acquisitions & its value (USD Million)

Application Reach

FIGURE 3 COMPANY SERVICE PLATFORM MATRIX

5.6 FUNDING DETAILS—INVESTOR DETAILS , REASON OF INVESTMENT FROM INVESTOR

5.7 USED CASES & ITS ANALYSIS

FIGURE 4 USED CASE ANALYSIS

Company Product/Service offered

6 GLOBAL FINANCIAL ANALYTICS MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 SOLUTIONS

6.2.1 DATABASE MANAGEMENT AND PLANNING

6.2.2 FINANCIAL MARKET ANALYTICS

6.2.3 FINANCIAL FUNCTION ANALYTICS

6.3 SERVICES

6.3.1 MANAGED

6.3.2 PROFESSIONAL

6.3.2.1. SUPPORT AND MAINTENANCE

6.3.2.2. TRAINING AND CONSULTING

6.3.2.3. DEPLOYMENT AND INTEGRATION

7 GLOBAL FINANCIAL ANALYTICS MARKET, BY TYPE

7.1 OVERVIEW

7.2 DATABASE MANAGEMENT SYSTEM (DBMS)

7.3 DATA INTEGRATION

7.4 QUERY, REPORTING, AND ANALYSIS

7.5 OTHERS

8 GLOBAL FINANCIAL ANALYTICS MARKET, BY DEPLOYMENT

8.1 OVERVIEW

8.2 ON-PREMISES

8.3 CLOUD

9 GLOBAL FINANCIAL ANALYTICS MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 SMES

9.3 LARGE ORGANIZATIONS

10 GLOBAL FINANCIAL ANALYTICS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 WEALTH MANAGEMENT

10.2.1 CAPITAL MANAGEMENT

10.2.2 ASSET LIABILITY MANAGEMENT

10.2.3 INVESTMENT MANAGEMENT

10.2.4 OTHERS

10.3 GOVERNANCE, RISK, AND COMPLIANCE MANAGEMENT

10.3.1 CREDIT AND MARKET RISK MANAGEMENT

10.3.2 GOVERNANCE AND COMPLIANCE MANAGEMENT

10.4 FINANCIAL FORECASTING AND BUDGETING

10.4.1 CASH FLOW ANALYTICS

10.4.2 REVENUE PREDICTION

10.5 CUSTOMER MANAGEMENT

10.5.1 CUSTOMER EXPERIENCE ANALYTICS

10.5.2 CUSTOMER PROFITABILITY ANALYTICS

10.6 TRANSACTION MONITORING

10.7 CLAIM MANAGEMENT

10.8 FRAUD DETECTION AND PREVENTION

10.9 STOCK MANAGEMENT

10.9.1 DEBT MANAGEMENT

10.9.2 EQUITY MANAGEMENT

10.1 OTHERS

11 GLOBAL FINANCIAL ANALYTICS MARKET, BY END USER

11.1 OVERVIEW

11.2 BFSI

11.2.1 ON-PREMISES

11.2.2 CLOUD

11.3 MANUFACTURING

11.3.1 ON-PREMISES

11.3.2 CLOUD

11.4 AUTOMOTIVE

11.4.1 ON-PREMISES

11.4.2 CLOUD

11.5 RETAIL AND E-COMMERCE

11.5.1 ON-PREMISES

11.5.2 CLOUD

11.6 IT AND TELECOMMUNICATIONS

11.6.1 ON-PREMISES

11.6.2 CLOUD

11.7 TRANSPORTATION AND LOGISTICS

11.7.1 ON-PREMISES

11.7.2 CLOUD

11.8 HEALTHCARE AND PHARMACEUTICALS

11.8.1 ON-PREMISES

11.8.2 CLOUD

11.9 ENERGY AND UTILITIES

11.9.1 ON-PREMISES

11.9.2 CLOUD

11.1 GOVERNMENT

11.10.1 ON-PREMISES

11.10.2 CLOUD

11.11 OTHERS

12 GLOBAL FINANCIAL ANALYTICS MARKET, BY COUNTRY

12.1 GLOBAL FINANCIAL ANALYTICS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.2 NORTH AMERICA

12.2.1 U.S.

12.2.2 CANADA

12.2.3 MEXICO

12.3 EUROPE

12.3.1 GERMANY

12.3.2 FRANCE

12.3.3 U.K.

12.3.4 ITALY

12.3.5 SPAIN

12.3.6 RUSSIA

12.3.7 TURKEY

12.3.8 BELGIUM

12.3.9 NETHERLANDS

12.3.10 SWITZERLAND

12.3.11 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 JAPAN

12.4.2 CHINA

12.4.3 SOUTH KOREA

12.4.4 INDIA

12.4.5 AUSTRALIA AND NEW ZEALAND

12.4.6 SINGAPORE

12.4.7 THAILAND

12.4.8 MALAYSIA

12.4.9 INDONESIA

12.4.10 PHILIPPINES

12.4.11 REST OF ASIA PACIFIC

12.5 SOUTH AMERICA

12.5.1 BRAZIL

12.5.2 ARGENTINA

12.5.3 REST OF SOUTH AMERICA

12.6 MIDDLE EAST AND AFRICA

12.6.1 SOUTH AFRICA

12.6.2 EGYPT

12.6.3 SAUDI ARABIA

12.6.4 U.A.E

12.6.5 ISRAEL

12.6.6 REST OF MIDDLE EAST AND AFRICA

13 GLOBAL FINANCIAL ANALYTICS MARKET,COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.5 MERGERS AND ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

13.7 EXPANSIONS

13.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 GLOBAL FINANCIAL ANALYTICS MARKET, SWOT AND DBMR ANALYSIS

15 GLOBAL FINANCIAL ANALYTICS MARKET, COMPANY PROFILE

15.1 ORACLE

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 GEOGRAPHIC PRESENCE

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 IBM CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 GEOGRAPHIC PRESENCE

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 TERADATA CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 GEOGRAPHIC PRESENCE

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 SAP SE

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 GEOGRAPHIC PRESENCE

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 SAS INSTITUTE INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 GEOGRAPHIC PRESENCE

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ALTERYX

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 GEOGRAPHIC PRESENCE

15.6.4 PRODUCT PORTFOLIO

15.6.5 RECENT DEVELOPMENTS

15.7 FICO

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 GEOGRAPHIC PRESENCE

15.7.4 PRODUCT PORTFOLIO

15.7.5 RECENT DEVELOPMENTS

15.8 GOOGLE LLC

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 GEOGRAPHIC PRESENCE

15.8.4 PRODUCT PORTFOLIO

15.8.5 RECENT DEVELOPMENTS

15.9 ZOHO CRORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 GEOGRAPHIC PRESENCE

15.9.4 PRODUCT PORTFOLIO

15.9.5 RECENT DEVELOPMENTS

15.1 QLIK INTERNATIONAL AB

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 GEOGRAPHIC PRESENCE

15.10.4 PRODUCT PORTFOLIO

15.10.5 RECENT DEVELOPMENTS

15.11 DELOITTE TOUCHE TOHMATSU LIMITED

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 GEOGRAPHIC PRESENCE

15.11.4 PRODUCT PORTFOLIO

15.11.5 RECENT DEVELOPMENTS

15.12 TIBCO SOFTWARE INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 GEOGRAPHIC PRESENCE

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPMENTS

15.13 DOMO INC.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 GEOGRAPHIC PRESENCE

15.13.4 PRODUCT PORTFOLIO

15.13.5 RECENT DEVELOPMENTS

15.14 BIRST INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 GEOGRAPHIC PRESENCE

15.14.4 PRODUCT PORTFOLIO

15.14.5 RECENT DEVELOPMENTS

15.15 GOODDATA CORPORATION

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 GEOGRAPHIC PRESENCE

15.15.4 PRODUCT PORTFOLIO

15.15.5 RECENT DEVELOPMENTS

15.16 MICROSOFT CORPORATION

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 GEOGRAPHIC PRESENCE

15.16.4 PRODUCT PORTFOLIO

15.16.5 RECENT DEVELOPMENTS

15.17 INFORMATION BUILDERS

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 GEOGRAPHIC PRESENCE

15.17.4 PRODUCT PORTFOLIO

15.17.5 RECENT DEVELOPMENTS

15.18 MICROSTRATEGY INCORPORATED

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 GEOGRAPHIC PRESENCE

15.18.4 PRODUCT PORTFOLIO

15.18.5 RECENT DEVELOPMENTS

15.19 ROSSLYN ANALYTICS

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 GEOGRAPHIC PRESENCE

15.19.4 PRODUCT PORTFOLIO

15.19.5 RECENT DEVELOPMENTS

15.2 FAIR ISSAC CORPORATION

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 GEOGRAPHIC PRESENCE

15.20.4 PRODUCT PORTFOLIO

15.20.5 RECENT DEVELOPMENTS

15.21 HITACHI VANTARA CORPORATION

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 GEOGRAPHIC PRESENCE

15.21.4 PRODUCT PORTFOLIO

15.21.5 RECENT DEVELOPMENTS

15.22 SALESFORCE

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 GEOGRAPHIC PRESENCE

15.22.4 PRODUCT PORTFOLIO

15.22.5 RECENT DEVELOPMENTS

15.23 DATAPINE

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 GEOGRAPHIC PRESENCE

15.23.4 PRODUCT PORTFOLIO

15.23.5 RECENT DEVELOPMENTS

15.24 THOUGHTSPOT

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 GEOGRAPHIC PRESENCE

15.24.4 PRODUCT PORTFOLIO

15.24.5 RECENT DEVELOPMENTS

15.25 BOARD

15.25.1 COMPANY SNAPSHOT

15.25.2 REVENUE ANALYSIS

15.25.3 GEOGRAPHIC PRESENCE

15.25.4 PRODUCT PORTFOLIO

15.25.5 RECENT DEVELOPMENTS

15.26 GRAYMATTER SOFTWARE SERVICES INC.

15.26.1 COMPANY SNAPSHOT

15.26.2 REVENUE ANALYSIS

15.26.3 GEOGRAPHIC PRESENCE

15.26.4 PRODUCT PORTFOLIO

15.26.5 RECENT DEVELOPMENTS

15.27 DENOLOGIX INC.

15.27.1 COMPANY SNAPSHOT

15.27.2 REVENUE ANALYSIS

15.27.3 GEOGRAPHIC PRESENCE

15.27.4 PRODUCT PORTFOLIO

15.27.5 RECENT DEVELOPMENTS

15.28 INCORTA INC.

15.28.1 COMPANY SNAPSHOT

15.28.2 REVENUE ANALYSIS

15.28.3 GEOGRAPHIC PRESENCE

15.28.4 PRODUCT PORTFOLIO

15.28.5 RECENT DEVELOPMENTS

15.29 INFRAGISTICS

15.29.1 COMPANY SNAPSHOT

15.29.2 REVENUE ANALYSIS

15.29.3 GEOGRAPHIC PRESENCE

15.29.4 PRODUCT PORTFOLIO

15.29.5 RECENT DEVELOPMENTS

15.3 DATARAILS

15.30.1 COMPANY SNAPSHOT

15.30.2 REVENUE ANALYSIS

15.30.3 GEOGRAPHIC PRESENCE

15.30.4 PRODUCT PORTFOLIO

15.30.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 CONCLUSION

17 QUESTIONNAIRE

18 RELATED REPORTS

19 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.