Global Fine Needle Aspiration Market

Market Size in USD Billion

CAGR :

%

USD

1.24 Billion

USD

1.99 Billion

2025

2033

USD

1.24 Billion

USD

1.99 Billion

2025

2033

| 2026 –2033 | |

| USD 1.24 Billion | |

| USD 1.99 Billion | |

|

|

|

|

Fine Needle Aspiration Market Size

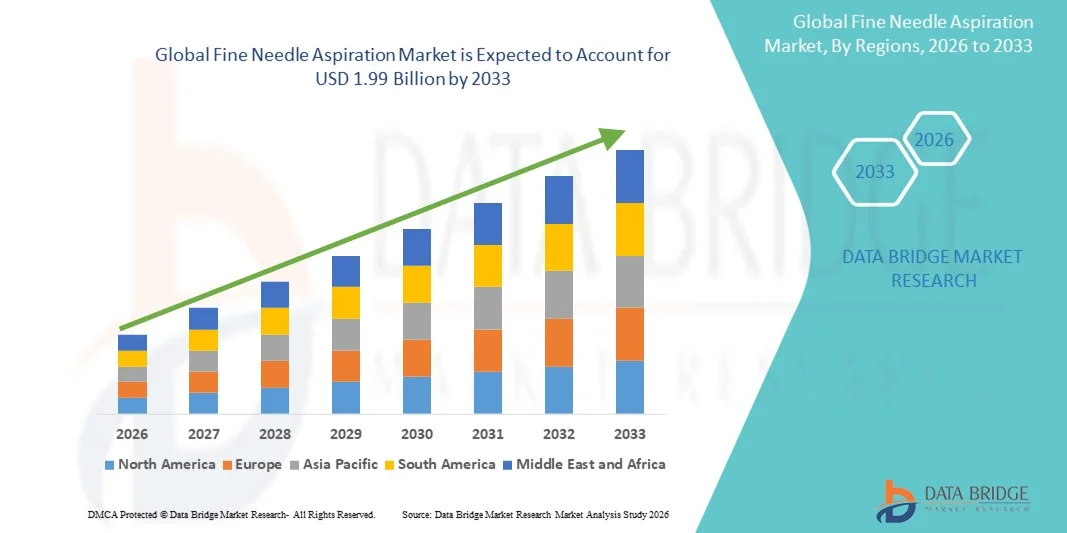

- The global fine needle aspiration market size was valued at USD 1.24 billion in 2025 and is expected to reach USD 1.99 billion by 2033, at a CAGR of 6.10% during the forecast period

- The market growth is largely fueled by increasing adoption of minimally invasive diagnostic techniques and advancements in imaging technologies, leading to more accurate and timely detection of various cancers and nodules

- Furthermore, rising demand for outpatient procedures, reduced patient recovery time, and growing awareness about early cancer diagnosis are accelerating the uptake of Fine Needle Aspiration solutions, thereby significantly boosting the industry's growth

Fine Needle Aspiration Market Analysis

- Fine Needle Aspiration (FNA), a minimally invasive diagnostic procedure for sampling cells from tumors or nodules, is increasingly crucial in early cancer detection and disease diagnosis due to its accuracy, rapid results, and reduced patient recovery time

- The escalating demand for FNA is primarily fueled by growing awareness of early cancer diagnosis, the rise of outpatient procedures, and technological advancements in imaging and needle guidance systems

- North America dominated the fine needle aspiration market with the largest revenue share of approximately 43.3% in 2025, supported by high healthcare spending, advanced diagnostic infrastructure, and the presence of leading FNA solution providers, with the U.S. driving significant adoption in hospitals and specialized diagnostic centers

- Asia-Pacific is expected to be the fastest growing region in the Fine Needle Aspiration market during the forecast period, projected to expand at a CAGR of 9.1% from 2026 to 2033, driven by increasing cancer incidences, expanding healthcare infrastructure, and growing adoption of minimally invasive diagnostic procedures in countries like India, China, and Japan

- The image-guided procedures segment dominated the largest market revenue share of 61.3% in 2025, driven by superior accuracy, higher diagnostic yield, and reduced complications compared to non-guided procedures

Report Scope and Fine Needle Aspiration Market Segmentation

|

Attributes |

Fine Needle Aspiration Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Carestream Health (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Fine Needle Aspiration Market Trends

Growing Adoption of Minimally Invasive Diagnostic Techniques

- A significant and accelerating trend in the global fine needle aspiration market is the increasing preference for minimally invasive diagnostic procedures over traditional surgical biopsies. Fine needle aspiration (FNA) is being widely adopted due to its precision, reduced patient discomfort, shorter procedure times, and lower complication rates

- For instance, in March 2023, the Mayo Clinic reported the successful implementation of ultrasound-guided FNA techniques for thyroid nodules, improving diagnostic accuracy while minimizing patient recovery time. This adoption is driving the preference for FNA in clinical diagnostics

- Healthcare providers are integrating advanced imaging guidance, such as ultrasound and CT, to enhance the accuracy of needle placement and sample collection

- FNA is increasingly preferred for oncology diagnostics, particularly in detecting breast, thyroid, and lymph node malignancies

- The trend is reinforced by increasing awareness among physicians regarding FNA’s cost-effectiveness compared to excisional or core needle biopsy

- Rising patient demand for outpatient procedures and quicker diagnostic results is also contributing to growth

- Development of automated and portable FNA devices allows physicians to perform procedures in diverse clinical settings

- Integration of FNA with cytopathology labs ensures faster turnaround times for diagnostic results

- Emerging markets are witnessing increased adoption as healthcare infrastructure expands and awareness grows

- The ongoing clinical validation of FNA procedures in detecting early-stage cancers is encouraging broader acceptance

- Minimally invasive nature of FNA supports adoption in pediatric and geriatric populations, reducing procedure-related risks

- Overall, the trend towards precision medicine and minimally invasive diagnostics is fundamentally reshaping the global FNA market

Fine Needle Aspiration Market Dynamics

Driver

Rising Prevalence of Cancer and Chronic Diseases

- The increasing incidence of cancers such as thyroid, breast, and lung cancer is a major driver for the growth of the Fine Needle Aspiration market

- For instance, in January 2024, the American Cancer Society reported a 12% increase in thyroid cancer diagnoses compared to 2022, boosting demand for minimally invasive diagnostic methods like FNA

- FNA provides rapid and reliable cytological assessment, which is critical for early-stage cancer detection and management

- The technique reduces the need for more invasive biopsy procedures, minimizing hospital stays and associated healthcare costs

- Rising awareness among patients and physicians about the safety and efficacy of FNA encourages its adoption

- Integration of FNA in routine diagnostic workflows in hospitals, clinics, and cancer care centers is accelerating market growth

- Increasing availability of ultrasound-guided and image-assisted FNA procedures improves diagnostic precision, further driving demand

- The expansion of clinical research and academic studies using FNA samples also supports growth

- High patient preference for less invasive, outpatient-friendly diagnostic options propels adoption. Growing government initiatives promoting early cancer detection programs are encouraging the use of FNA in national screening campaigns

- Improved training and awareness programs for pathologists and cytologists increase utilization in clinical practice. Overall, the rising prevalence of cancer and chronic diseases directly fuels market demand for FNA procedures

Restraint/Challenge

Limited Sample Size and Risk of Inconclusive Results

- Despite its advantages, Fine Needle Aspiration faces challenges due to the limited quantity of tissue collected, which can result in inconclusive or false-negative results

- For instance, in June 2022, a study published in the Journal of Clinical Pathology highlighted that up to 15% of thyroid FNA procedures required repeat biopsies due to insufficient sampling

- Need for repeat procedures increases patient discomfort and healthcare costs

- Accuracy of FNA is highly dependent on the skill of the physician performing the procedure and the experience of cytopathologists interpreting the samples

- Limited access to trained professionals in emerging regions can hinder adoption

- Adjunct imaging technologies are required in certain cases, adding to operational complexity and cost

- Variability in procedural standards and lack of uniform guidelines across regions can affect diagnostic reliability

In cases of large or deep-seated tumors, FNA may not always provide representative samples - Some patients may prefer core needle biopsy or surgical excision for definitive histopathology, limiting FNA uptake

- Low awareness in rural or underdeveloped regions restricts widespread utilization. Insurance coverage variations for FNA procedures can influence patient access

- Addressing these challenges through enhanced training, standardized protocols, and improved sampling tools is crucial for sustained market growth

Fine Needle Aspiration Market Scope

The market is segmented on the basis of type, organ, procedures, applications, and end user.

- By Type

On the basis of type, the Fine Needle Aspiration market is segmented into reusable and disposable. The reusable segment dominated the largest market revenue share of 55.4% in 2025, owing to its cost-effectiveness over multiple procedures, durability, and compatibility with a wide range of imaging guidance systems. Hospitals and diagnostic centers favor reusable needles due to consistent sharpness, structural reliability, and proven clinical performance over repeated use. The segment is strengthened by established sterilization protocols, regulatory approvals, and the availability of advanced needle designs that reduce tissue trauma. Healthcare professionals prefer reusable FNA needles for high-volume procedures, particularly in oncology diagnostics, as they maintain sample integrity and reduce procedural errors. Adoption is further driven by integration with imaging modalities such as ultrasound and CT. Technological advancements, such as ergonomic handles and precision tips, reinforce dominance. Reusable needles also minimize procedural costs for large hospitals and research institutes, while offering sustainable options for long-term use. Market leadership is supported by strong partnerships between manufacturers and healthcare providers. Overall, reusable FNA needles remain a preferred choice for critical diagnostics and large-scale healthcare facilities.

The disposable segment is expected to witness the fastest CAGR of 22.1% from 2026 to 2033, driven by rising adoption in outpatient clinics, specialty centers, and ambulatory surgical units. Disposable FNA needles reduce the risk of cross-contamination, eliminate the need for sterilization, and simplify workflow, making them ideal for low-resource or high-turnover settings. Growth is fueled by increased awareness of infection control, government initiatives promoting patient safety, and the rising preference for minimally invasive diagnostic procedures. Technological innovations, such as coated needles for enhanced sample collection, further support adoption. Single-use needles also cater to home-based diagnostic setups and smaller clinics where sterilization infrastructure is limited. The convenience and safety associated with disposable FNA needles are attracting more clinicians, particularly in emerging markets. Expansion is reinforced by regulatory approvals for new designs and increased training programs for healthcare professionals. The segment’s rapid uptake is evident in regions like Asia-Pacific, where outpatient diagnostics are growing. Disposable needles are also gaining traction in research institutes conducting molecular and cytological studies.

- By Organ

On the basis of organ, the FNA market is segmented into breast, thyroid, lymph node, salivary glands, and others. The breast segment dominated the largest market revenue share of 38.7% in 2025, driven by the increasing prevalence of breast cancer and the critical need for early, accurate detection. FNA of breast lesions offers rapid cytological results, reducing unnecessary surgical biopsies and enabling timely treatment decisions. Hospitals and diagnostic centers widely adopt breast FNA due to patient comfort, cost-effectiveness, and compatibility with ultrasound-guided procedures. Integration with imaging systems ensures precision sampling, reducing repeat procedures and diagnostic errors. Rising awareness campaigns for breast cancer screening and preventive care further bolster the segment. Advances in cytopathology techniques and needle design enhance sample quality, making the procedure more reliable. The segment benefits from investments in oncology research, routine inclusion of FNA in breast screening protocols, and strong clinician preference. Technological improvements, such as smaller gauge needles, reduce tissue trauma while maintaining diagnostic accuracy. Breast FNA remains a key component in oncology diagnostics, driving market dominance.

The thyroid segment is expected to witness the fastest CAGR of 23.5% from 2026 to 2033, fueled by increasing incidence of thyroid nodules and thyroid cancer globally. Ultrasound-guided thyroid FNA is preferred due to minimal invasiveness, rapid results, and high diagnostic accuracy. Outpatient clinics, specialty centers, and hospitals are expanding thyroid FNA adoption to meet rising demand. Growth is supported by training programs for clinicians and technological innovations in fine-gauge needles that improve sample collection and minimize patient discomfort. Awareness of thyroid health, preventive screening campaigns, and routine check-ups contribute to rapid expansion. Advancements in imaging-guided procedures enhance precision, especially in complex cases. Thyroid FNA adoption is also increasing in emerging economies due to improved healthcare infrastructure and affordability. The segment benefits from integration with molecular testing for cancer diagnostics. Regulatory approvals for advanced needle designs further encourage adoption. Rising preference for outpatient and minimally invasive diagnostic procedures positions thyroid FNA as the fastest-growing organ segment.

- By Procedures

On the basis of procedures, the FNA market is segmented into image-guided and non-image-guided procedures. The image-guided procedures segment dominated the largest market revenue share of 61.3% in 2025, driven by superior accuracy, higher diagnostic yield, and reduced complications compared to non-guided procedures. Hospitals and diagnostic centers rely heavily on ultrasound, CT, and MRI-guided FNA for deep or small lesions. Image-guided procedures reduce repeat biopsies, improve patient safety, and facilitate early diagnosis of cancers and inflammatory conditions. Integration with advanced imaging technologies enhances precision and clinician confidence. Adoption is further supported by training programs for radiologists and cytopathologists. High procedure volumes in oncology, pulmonology, and thyroid diagnostics reinforce dominance. Technological advancements, including real-time imaging and fine-needle designs, further strengthen segment leadership. Image-guided FNA ensures sample integrity, rapid turnaround times, and improved workflow efficiency in hospitals.

The non-image-guided procedures segment is expected to witness the fastest CAGR of 21.8% from 2026 to 2033, driven by adoption in outpatient clinics, small hospitals, and resource-limited regions. Non-image-guided FNA is cost-effective, simple to perform, and widely used for superficial palpable lesions such as lymph nodes and salivary gland swellings. Its rapid diagnostic capability and minimal infrastructure requirement support expansion in emerging markets. Growing awareness of minimally invasive diagnostics and expansion of clinic-based healthcare services contribute to growth. Innovations in needle design and cytology techniques enhance sample quality. Non-image-guided FNA is increasingly used in routine check-ups and point-of-care diagnostics. Its affordability and convenience make it suitable for high-throughput screening programs. Training initiatives for clinicians improve adoption in smaller healthcare centers. Overall, non-image-guided FNA is rapidly growing due to accessibility and efficiency benefits.

- By Applications

On the basis of applications, the FNA market is segmented into pulmonary lesions, gastrointestinal tract lesions and infections, inflammation, and others. The pulmonary lesions segment dominated the largest market revenue share of 42.5% in 2025, driven by the rising prevalence of lung cancer and the demand for minimally invasive biopsy procedures. Hospitals, specialty centers, and diagnostic facilities widely adopt pulmonary FNA for early detection and staging. Integration with CT and ultrasound imaging ensures accurate sampling, reduced complications, and improved patient outcomes. Advances in needle design, including smaller gauge and precision tips, enhance sample quality. Routine use in oncology diagnostics and increased awareness of early cancer detection further strengthen market dominance. Pulmonary FNA is widely used for thoracic lesions, nodules, and masses, with growing adoption in research and clinical trials. The segment benefits from technological innovations in imaging guidance and cytological evaluation.

The gastrointestinal tract lesions and infections segment is expected to witness the fastest CAGR of 22.9% from 2026 to 2033, driven by rising gastrointestinal cancer incidence, inflammatory bowel disease, and infectious lesions globally. FNA provides rapid cytological assessment, facilitating timely treatment planning and patient management. Adoption in outpatient gastroenterology clinics, ambulatory surgical centers, and hospitals is expanding. Technological advancements in endoscopic and imaging-guided FNA improve diagnostic yield. Increased awareness of early GI disease detection, along with growing procedural training for gastroenterologists, supports growth. The segment is particularly growing in emerging markets due to improved healthcare infrastructure. Integration with molecular testing further strengthens the use of FNA in GI diagnostics.

- By End User

On the basis of end user, the FNA market is segmented into hospitals, clinics, ambulatory surgical centers, diagnostic centers, specialty centers, and others. The hospitals segment dominated the largest market revenue share of 46.8% in 2025, driven by high patient volumes, advanced imaging facilities, and trained cytopathologists. Hospitals perform the majority of FNA procedures for oncology, pulmonary, thyroid, and breast diagnostics. Integration with multidisciplinary diagnostic workflows and advanced needle designs ensures accuracy and reliability. Hospitals benefit from higher procedural throughput, better resource allocation, and established regulatory compliance. Adoption is further supported by partnerships with FNA manufacturers and ongoing investment in cancer and diagnostic services.

The clinics segment is expected to witness the fastest CAGR of 23.2% from 2026 to 2033, driven by the growing number of outpatient care facilities, ambulatory centers, and specialty clinics performing minimally invasive diagnostics. Clinics offer faster turnaround times, lower procedural costs, and increased patient convenience, making them preferred settings for early detection and routine monitoring. Technological advancements in portable FNA devices, coupled with training programs for clinicians, support rapid growth. Expansion of healthcare infrastructure in emerging regions further boosts clinic adoption. Regulatory approvals for compact and user-friendly FNA systems encourage uptake. Growing patient awareness and preference for minimally invasive procedures reinforce segment growth.

Fine Needle Aspiration Market Regional Analysis

- North America dominated the fine needle aspiration market with the largest revenue share of approximately 43.3% in 2025

- Supported by high healthcare spending, advanced diagnostic infrastructure, and the presence of leading FNA solution providers

- The market accounted for the majority of the regional share, driven by widespread adoption of FNA procedures in hospitals, specialized diagnostic centers, and oncology clinics, along with continuous technological advancements in FNA needles, cytology preparation kits, and imaging-guided procedures

U.S. Fine Needle Aspiration Market Insight

The U.S. fine needle aspiration market captured the largest revenue share within North America in 2025, fueled by extensive clinical adoption, advanced imaging systems integration, and growing use in oncology, endocrinology, and pathology diagnostics. Increasing prevalence of thyroid, breast, and lung cancers, coupled with rising awareness of minimally invasive diagnostic procedures, is further propelling the market’s growth. Key players are also focusing on innovations in needle design, automation of cytology processing, and integration with digital pathology solutions.

Europe Fine Needle Aspiration Market Insight

The Europe fine needle aspiration market is projected to grow steadily during the forecast period, supported by strong healthcare infrastructure, increasing prevalence of cancer and endocrine disorders, and adoption of minimally invasive diagnostic techniques. The market is witnessing growth across major countries such as Germany, France, and the U.K., with hospitals and specialized diagnostic centers investing in advanced FNA systems and cytology kits to improve diagnostic accuracy and reduce procedural complications.

U.K. Fine Needle Aspiration Market Insight

The U.K. fine needle aspiration market is anticipated to expand at a notable CAGR, driven by increased adoption of minimally invasive procedures, rising cancer screening initiatives, and demand for faster, cost-effective diagnostics. Hospitals and oncology centers are integrating FNA solutions into routine clinical workflows, supported by government programs emphasizing early cancer detection.

Germany Fine Needle Aspiration Market Insight

Germany’s fine needle aspiration market is expected to grow steadily, fueled by well-established healthcare systems, high clinical standards, and strong investment in advanced diagnostic technologies. The country is witnessing growing adoption of image-guided FNA procedures, automation in cytology, and integration with molecular testing platforms, enhancing diagnostic precision.

Asia-Pacific Fine Needle Aspiration Market Insight

The Asia-Pacific fine needle aspiration market is poised to grow at the fastest CAGR of 9.1% from 2026 to 2033, driven by increasing cancer incidence, improving healthcare infrastructure, and rising adoption of minimally invasive diagnostics. Countries like China, India, and Japan are witnessing rapid expansion of hospitals and specialized diagnostic centers, along with growing government initiatives to promote early detection of cancers and endocrine disorders.

Japan Fine Needle Aspiration Market Insight

The Japan fine needle aspiration market is gaining traction due to advanced healthcare systems, high awareness of minimally invasive procedures, and increasing prevalence of thyroid and breast cancers. Integration of FNA procedures with imaging and cytology automation is further enhancing procedural efficiency and diagnostic outcomes.

China Fine Needle Aspiration Market Insight

The China fine needle aspiration market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, rising cancer incidence, and high adoption of minimally invasive diagnostic procedures. Government-led cancer screening programs, expanding hospital networks, and increased availability of advanced FNA solutions are key factors driving market growth in China.

Fine Needle Aspiration Market Share

The Fine Needle Aspiration industry is primarily led by well-established companies, including:

• Carestream Health (U.S.)

• Medtronic (Ireland)

• Argon Medical Devices (U.S.)

• SonoPath (U.S.)

• Cook Medical (U.S.)

• Terumo Corporation (Japan)

• Canon Medical Systems Corporation (Japan)

• Stryker Corporation (U.S.)

• Smith & Nephew (U.K.)

• Fujifilm Holdings Corporation (Japan)

• Pentax Medical (Japan)

• Philips Healthcare (Netherlands)

• Siemens Healthineers (Germany)

• GE Healthcare (U.S.)

• Cardinal Health (U.S.)

• Thermo Fisher Scientific (U.S.)

• Boston Scientific (U.S.)

• Radial Medical Technologies (U.S.)

Latest Developments in Global Fine Needle Aspiration Market

- In May 2024, Cook Medical, a leading U.S. medical device company, launched the EchoTip ClearCore EUS Biopsy Needle — a next‑generation 22‑gauge needle for endoscopic ultrasound‑guided fine needle aspiration and biopsy procedures. This device features a cobalt‑chromium Franseen tip for enhanced sharpness and tissue yield, allowing precise sampling of gastrointestinal lesions, lymph nodes, and mediastinal masses, and is designed to improve diagnostic accuracy and procedural outcomes

- In January 2024, Canon Medical Systems Corporation partnered with Olympus Corporation to co‑develop and commercialize advanced endoscopic ultrasound (EUS) systems aimed at improving diagnostic imaging and supporting minimally invasive fine needle aspiration procedures. This partnership focuses on high‑quality imaging solutions initially in Japan and Europe with plans for expanded global rollout, enhancing the performance of FNA diagnostics in clinical practice

- In December 2025, a study published in Acta Cytologica reported that motorized rotating fine needle aspiration devices significantly increased specimen adequacy compared to conventional manual FNA, with 98% adequacy after two passes versus 58% for standard FNA, underscoring technological improvements in FNA device performance. These findings suggest that new automation and device improvements can materially enhance clinical sampling efficiency and diagnostic yield

- In May 2025, a systematic review in Endocrine highlighted emerging RNA biomarkers in thyroid fine needle aspiration cytology samples, showcasing progress in molecular diagnostics as a complement to traditional cytologic evaluation. This research narrative reflects a broader trend of integrating molecular marker analysis into FNA diagnostic workflows to improve differentiation between malignant and benign thyroid nodules

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.