Global Fintech As A Service Market

Market Size in USD Billion

CAGR :

%

USD

466.26 Billion

USD

1,542.35 Billion

2025

2033

USD

466.26 Billion

USD

1,542.35 Billion

2025

2033

| 2026 –2033 | |

| USD 466.26 Billion | |

| USD 1,542.35 Billion | |

|

|

|

|

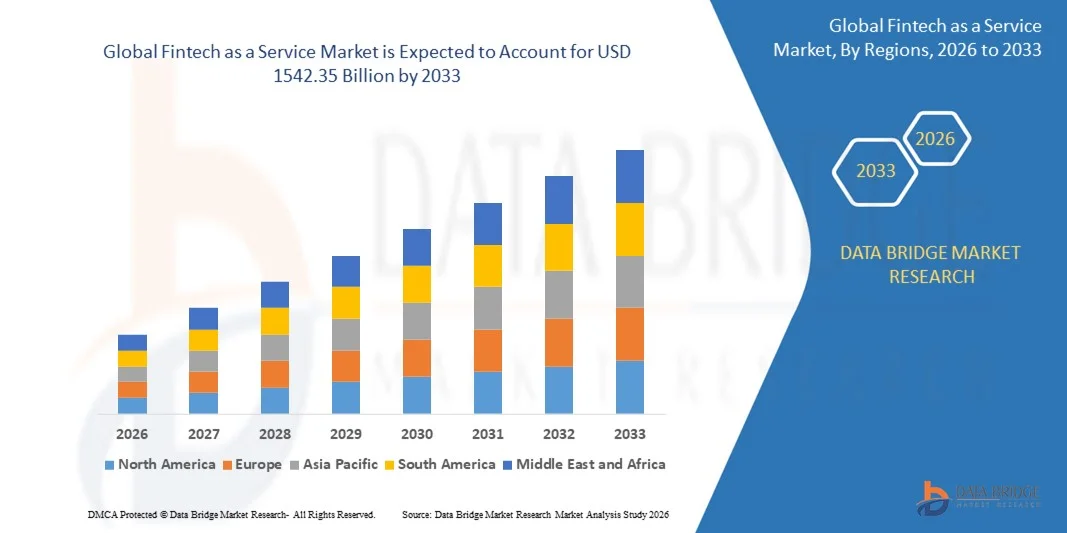

What is the Global Fintech as a Service Market Size and Growth Rate?

- The global fintech as a service market size was valued at USD 466.26 billion in 2025 and is expected to reach USD 1542.35 billion by 2033, at a CAGR of16.13% during the forecast period

- Increasing adoption of cloud-based financial solutions, rising demand for API-driven banking platforms, expansion of digital payments, growing fintech partnerships with banks and non-banking institutions, and the proliferation of mobile banking and embedded finance solutions are key factors driving market growth

What are the Major Takeaways of Fintech as a Service Market?

- Rising integration of AI, blockchain, and RPA technologies in financial services is creating opportunities for scalable, secure, and cost-efficient fintech solutions, accelerating adoption across global banking, lending, and insurance sectors

- Challenges such as data security concerns, regulatory compliance complexity, and lack of skilled technical talent may act as restraints, limiting adoption in certain regions

- North America dominated the fintech as a service market with a 44.69% revenue share in 2025, driven by rapid adoption of digital financial services, embedded fintech solutions, cloud-based platforms, and API integrations across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 12.3% from 2026 to 2033, driven by rapid fintech adoption, growing smartphone penetration, and expanding digital payment infrastructure across China, Japan, India, South Korea, and Southeast Asia

- The Payment segment dominated the market with a 42.3% share in 2025, driven by rising digital transactions, mobile wallets, and e-commerce adoption across global financial ecosystems

Report Scope and Fintech as a Service Market Segmentation

|

Attributes |

Fintech as a Service Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Fintech as a Service Market?

Rising Adoption of API-Driven, AI-Powered, and Cloud-Native Fintech as a Service Solutions

- The Fintech as a Service market is witnessing strong adoption of API-first platforms, AI-enabled automation, and cloud-native architectures, enabling banks, fintech startups, and enterprises to integrate financial services rapidly and efficiently

- Service providers are expanding offerings with modular, multi-functional platforms that support payments, lending, compliance, and fraud monitoring in a seamless ecosystem

- Growing demand for scalable, low-code, and secure financial infrastructure is driving uptake across neobanks, payment gateways, insurance firms, and lending platforms

- For instance, leading companies such as PayPal, Mastercard, Block, Upstart, and Envestnet are enhancing their FaaS portfolios with advanced AI algorithms, cloud-based APIs, and real-time monitoring dashboards

- Increasing need for rapid deployment, real-time analytics, and seamless cross-platform integration is accelerating the shift toward cloud-first, API-integrated fintech solutions

- As financial services continue digital transformation, Fintech as a Service will remain critical for fast onboarding, compliance automation, and end-to-end digital financial operations

What are the Key Drivers of Fintech as a Service Market?

- Rising demand for flexible, secure, and cost-efficient financial infrastructure to support digital payments, lending, and compliance functions across banks, fintech startups, and insurance companies

- For instance, in 2025, companies such as PayPal, Block, Upstart, Envestnet, and Railsbank launched advanced APIs, AI-based fraud detection, and integrated banking platforms to meet enterprise needs

- Growing adoption of digital wallets, cross-border payments, embedded finance, and lending automation across the U.S., Europe, and Asia-Pacific is fueling FaaS demand

- Advances in cloud computing, AI-driven analytics, RPA, and blockchain-enabled financial services have enhanced efficiency, scalability, and reliability

- Increasing focus on compliance automation, real-time reporting, and risk management is driving enterprises to leverage FaaS platforms for seamless operations

- Supported by steady investment in fintech innovation, regulatory technology adoption, and cloud infrastructure expansion, the Fintech as a Service market is expected to witness robust long-term growth

Which Factor is Challenging the Growth of the Fintech as a Service Market?

- High costs of enterprise-grade API platforms, AI solutions, and cloud infrastructure limit adoption for small fintech startups and mid-sized enterprises

- For instance, during 2024–2025, fluctuations in cloud service fees, regulatory compliance costs, and cybersecurity requirements increased operational expenses for several global vendors

- Complexity in integrating legacy banking systems, ensuring multi-jurisdiction compliance, and maintaining secure data flows increases the need for skilled developers and consultants

- Limited awareness of embedded finance, API monetization, and cloud-based banking platforms in emerging markets slows adoption

- Competition from traditional banking-as-a-service, niche fintech solutions, and in-house enterprise development creates pricing pressure and limits differentiation

- To overcome these challenges, companies are investing in modular, low-code APIs, enhanced security protocols, cloud-based analytics, and education programs to expand global adoption of Fintech as a Service

How is the Fintech as a Service Market Segmented?

The market is segmented on the basis of type, technology, application, and end-use.

- By Type

On the basis of type, the Fintech as a Service market is segmented into Payment, Fund Transfer, Loan, and Others. The Payment segment dominated the market with a 42.3% share in 2025, driven by rising digital transactions, mobile wallets, and e-commerce adoption across global financial ecosystems. Payment-as-a-service solutions allow businesses, banks, and fintech startups to integrate real-time payment processing, multi-currency settlement, and cross-border transactions seamlessly. Increasing consumer preference for cashless transactions, contactless payments, and faster settlement services is fueling adoption.

The Loan segment is expected to grow at the fastest CAGR from 2026 to 2033, propelled by embedded lending, buy-now-pay-later solutions, and automated credit scoring platforms. Growing demand for flexible financing, digital lending platforms, and personalized loan offerings across SMEs, e-commerce merchants, and individual consumers continues to drive segment growth. Regulatory support and cloud-based lending infrastructure further strengthen the expansion of this segment globally.

- By Technology

On the basis of technology, the market is segmented into API, Artificial Intelligence (AI), RPA, Blockchain, and Others. The API segment dominated the market with a 45.1% share in 2025, as APIs enable seamless integration of banking, payment, and lending services across digital platforms. APIs facilitate quick deployment of fintech solutions, real-time data exchange, and interoperability with legacy systems, making them crucial for neobanks, insurers, and payment processors.

The Artificial Intelligence segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing adoption of AI-powered fraud detection, credit scoring, and predictive analytics solutions. AI enhances operational efficiency, reduces risk, and enables personalized financial services. Growth is further supported by advances in machine learning algorithms, automation, and cloud-based deployment models, enabling fintech platforms to deliver secure, intelligent, and real-time financial operations.

- By Application

On the basis of application, the market is segmented into KYC Verification, Fraud Monitoring, Compliance & Regulatory Support, and Others. The KYC Verification segment dominated the market with a 38.7% share in 2025, due to stringent anti-money laundering (AML) regulations and growing digital onboarding requirements across banks, fintech platforms, and insurance companies. KYC solutions streamline identity verification, reduce operational risks, and ensure regulatory compliance for digital financial services.

The Fraud Monitoring segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rising cybercrime, phishing attacks, and financial fraud across digital payment networks. Adoption of AI-based fraud detection, machine learning models, and real-time monitoring platforms is driving demand globally. Increasing digital transactions, cross-border payment volumes, and regulatory requirements are further accelerating the integration of advanced fraud prevention solutions in fintech ecosystems.

- By End-use

On the basis of end-use, the market is segmented into Banks, Financial Lending Companies, Insurance, and Others. The Banks segment dominated the market with a 44.2% share in 2025, as financial institutions increasingly leverage FaaS platforms to digitize payments, lending, compliance, and core banking processes. Banks are investing in cloud-based APIs, AI-driven automation, and embedded finance solutions to enhance customer experience, operational efficiency, and regulatory adherence.

The Financial Lending Companies segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by the rapid adoption of digital lending platforms, buy-now-pay-later solutions, and embedded credit offerings. Increasing demand for flexible financing, automated loan processing, and risk-based scoring solutions is driving growth, while cloud-native FaaS platforms ensure scalability, security, and faster deployment across the global lending landscape.

Which Region Holds the Largest Share of the Fintech as a Service Market?

- North America dominated the fintech as a service market with a 44.69% revenue share in 2025, driven by rapid adoption of digital financial services, embedded fintech solutions, cloud-based platforms, and API integrations across the U.S. and Canada. High penetration of mobile banking, neobanks, and payment platforms, combined with strong regulatory support for fintech innovation, continues to fuel regional demand

- Leading companies in North America are launching advanced FaaS solutions with AI-powered fraud detection, KYC automation, real-time payments, and API-driven integrations, strengthening the region’s technological leadership. Continuous investments in digital banking, embedded finance, and enterprise fintech infrastructure support long-term growth

- A robust talent pool, well-established innovation ecosystems, and strong venture funding further reinforce North America’s dominance in the global FaaS market

U.S. Fintech as a Service Market Insight

The U.S. is the largest contributor in North America, supported by extensive fintech R&D, high adoption of digital banking platforms, and widespread use of payment, lending, and compliance-as-a-service solutions. The growing demand for AI-driven fraud monitoring, KYC verification, and cloud-based APIs drives adoption across banks, insurance providers, and financial lending companies. Increasing digital transaction volumes, fintech startups, and strong government backing for financial innovation further expand the market.

Canada Fintech as a Service Market Insight

Canada contributes significantly to regional growth, fueled by rising adoption of cloud-native FaaS platforms, open banking initiatives, and embedded finance solutions. Banks and fintech startups increasingly deploy automated compliance tools, real-time payment gateways, and lending-as-a-service models. Government incentives, a skilled workforce, and innovation hubs in Toronto, Vancouver, and Montreal support accelerated adoption across financial institutions, insurance companies, and neobanks.

Asia-Pacific Fintech as a Service Market

Asia-Pacific is projected to register the fastest CAGR of 12.3% from 2026 to 2033, driven by rapid fintech adoption, growing smartphone penetration, and expanding digital payment infrastructure across China, Japan, India, South Korea, and Southeast Asia. Governments are promoting financial inclusion, digital banking, and open banking frameworks, while rising e-commerce and mobile payment volumes boost demand for FaaS solutions. High adoption of cloud-based APIs, AI-powered fraud detection, and lending-as-a-service platforms accelerates growth across banking, insurance, and lending sectors.

China Fintech as a Service Market Insight

China is the largest contributor to Asia-Pacific, supported by extensive fintech innovation, high smartphone penetration, and strong government initiatives for digital finance. The country’s rapidly growing e-commerce ecosystem, mobile payment adoption, and fintech startups drive demand for payment, lending, and compliance-as-a-service solutions. Local cloud infrastructure and API platforms enhance deployment efficiency and scalability.

Japan Fintech as a Service Market Insight

Japan demonstrates steady growth due to a mature banking sector, advanced fintech infrastructure, and adoption of AI-driven fraud detection and digital KYC solutions. The market benefits from government-backed open banking initiatives, modernization of legacy banking systems, and demand for seamless cross-border payment services.

India Fintech as a Service Market Insight

India is emerging as a key growth hub, driven by a large unbanked population, government-backed digital finance initiatives, and rapidly expanding fintech startups. Increasing adoption of mobile wallets, lending-as-a-service, and automated compliance platforms is propelling the market. Rising smartphone penetration, digital infrastructure development, and venture funding accelerate FaaS adoption across urban and semi-urban regions.

South Korea Fintech as a Service Market Insight

South Korea contributes steadily due to high demand for digital banking, AI-powered financial analytics, and cloud-based API solutions. Rapid adoption of mobile payments, open banking, and fintech platforms in both urban and industrial sectors supports sustained growth. Advanced financial IT infrastructure and government initiatives for digital innovation further strengthen market expansion.

Which are the Top Companies in Fintech as a Service Market?

The fintech as a service industry is primarily led by well-established companies, including:

- PayPal Holdings, Inc.

- Block, Inc. (U.S.)

- Mastercard Incorporated (U.S.)

- Envestnet, Inc. (U.S.)

- Upstart Holdings, Inc. (U.S.)

- Rapyd Financial Network Ltd. (U.K.)

- Solid Financial Technologies, Inc. (U.S.)

- Railsbank Technology Ltd. (U.K.)

- Synctera Inc. (U.S.)

- Braintree (U.S.)

What are the Recent Developments in Global Fintech as a Service Market?

- In July 2025, PayPal partnered with Wix Advance to provide merchants with a consolidated view to streamline payment management, enhance conversions, and meet the growing demand for flexible payment options, strengthening merchant efficiency and payment experiences

- In July 2025, Mastercard partnered with BMO to expand BMO's Global Money Transfer service, powered by Mastercard Move's global money movement capabilities, enabling Canadian clients to send money to nearly 70 locations worldwide, supporting cross-border financial inclusion and faster remittances

- In July 2025, FIS partnered with a subsidiary of Circle Internet Group, Inc. (Circle) to allow financial institutions to conduct transactions in USDC, the world's largest regulated stablecoin, enhancing integration of digital assets with traditional finance and demonstrating FIS's innovation commitment

- In July 2025, Fiserv and PayPal joined forces to develop interoperability between FIUSD and PayPal USD (PYUSD), enabling domestic and international fund transfers, and expanding the adoption of stablecoins and programmable payments globally

- In June 2025, Stripe partnered with Shopify to enable merchants across 34 countries to accept USDC payments on Base using preferred cryptocurrency wallets, supporting global stablecoin adoption and simplifying merchant payment solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.