Global Fire Resistant Fabrics Market

Market Size in USD Billion

CAGR :

%

USD

3.54 Billion

USD

5.44 Billion

2024

2032

USD

3.54 Billion

USD

5.44 Billion

2024

2032

| 2025 –2032 | |

| USD 3.54 Billion | |

| USD 5.44 Billion | |

|

|

|

|

Fire Resistant Fabrics Market Size

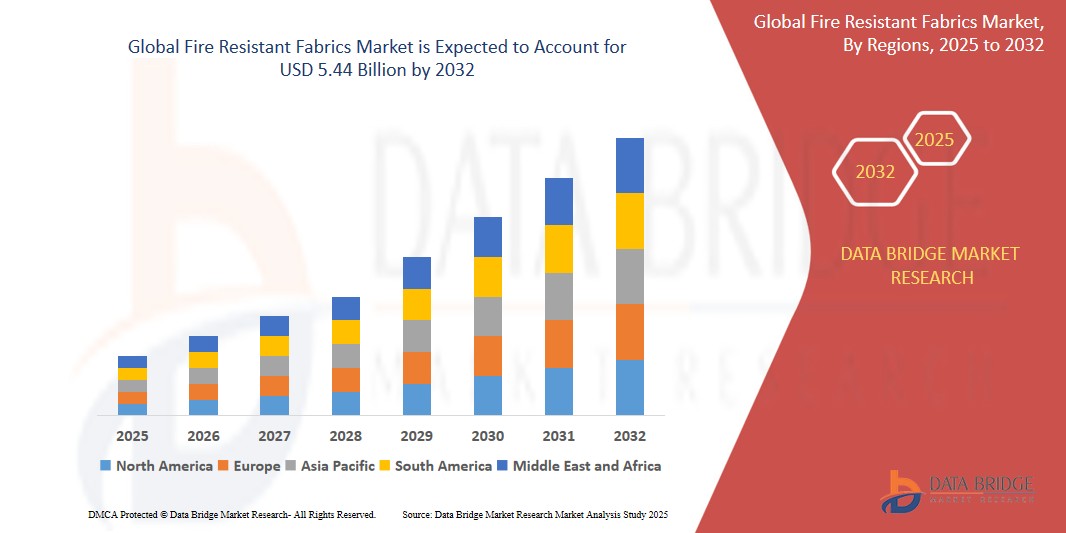

- The Global Fire Resistant Fabrics Market size was valued at USD 3.54 billion in 2024 and is expected to reach USD 5.44 billion by 2032, at a CAGR of 5.48% during the forecast period

- The Global Fire Resistant Fabrics Market is experiencing significant growth due to its increasing applications in industrial safety and defense sectors. Fire resistant fabrics’ durability and protective properties make them ideal for flame-retardant clothing, driving demand across high-risk environments.

- Additionally, the construction and oil & gas industries’ expansion fuels market growth. Fire resistant fabrics are critical for worker safety, especially in regions enforcing strict occupational safety regulations.

Fire Resistant Fabrics Market Analysis

- Fire resistant fabrics are widely used in industrial protective clothing, defense uniforms, and public safety gear. The growing need for flame-resistant materials to reduce workplace hazards significantly boosts demand.

- In construction, automotive, and transport sectors, fire resistant fabrics are essential for enhancing fire safety standards, protecting equipment, and ensuring compliance.

- North America leads the Global Fire Resistant Fabrics Market, holding approximately 35% of the market share in 2024. This dominance is attributed to strong industrial and defense infrastructure, with the U.S. being a major contributor due to high safety standards and demand.

- Asia Pacific is the fastest-growing region in the fire resistant fabrics market, projected to grow at a CAGR of over 8% from 2025 to 2032. Rapid industrialization, urbanization, and infrastructure projects in China, India, and Japan are driving this growth.

- Treated fire-resistant fabrics dominate in 2025 with over 58% market share due to their cost-effectiveness, versatility, and broad application across sectors like construction, utilities, and manufacturing. Their increasing adoption for compliance with safety norms enhances their demand.

Report Scope and Fire Resistant Fabrics Market Segmentation

|

Attributes |

Fire Resistant Fabrics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fire Resistant Fabrics Market Trends

“shift towards sustainable practices”

- The Fire Resistant Fabrics market is experiencing a significant shift towards sustainable practices. This includes the development of eco-friendly formulations and active recycling initiatives aimed at reducing environmental impact. Manufacturers are increasingly focusing on sustainable raw materials and processes to meet growing regulatory requirements and consumer demand for green products.

- There is an increasing demand for customized Fire Resistant Fabrics tailored to specific industrial and commercial applications. Specialty grades of these fabrics are designed to cater to niche markets by offering unique properties such as enhanced durability, flexibility, or chemical resistance, enabling better performance for specific end-use requirements.

- Fire Resistant Fabrics are gaining traction in the electronics sector, particularly for thermal management and protection of sensitive components. Their inherent UV resistance and non-corrosive nature make them ideal for long-term use in solar panels and other renewable energy devices, aligning with the expanding market for clean energy solutions.

- The medical industry remains a significant driver for the Fire Resistant Fabrics market. These fabrics are essential for advanced medical devices, implants, and prosthetic applications. The rising incidence of chronic wounds and the expanding adoption of transdermal drug delivery systems are further boosting demand in this sector.

For instance,

- In December 2024, KCC Silicone and Wuxi Kolmar signed a technical agreement to advance cosmetic raw material research and development in China. This partnership aims to combine the expertise of both companies to drive joint innovation projects and raw material advancements. The collaboration also emphasizes sustainability initiatives to enhance global competitiveness through technological progress.

Fire Resistant Fabrics Market Dynamics

Driver

“Stringent Workplace Safety Regulations Across Industries”

- Fire Resistant Fabrics are increasingly mandated in high-risk work environments such as oil & gas, mining, construction, and manufacturing due to stringent safety regulations. Governments and safety bodies worldwide are enforcing fire safety standards, driving the adoption of certified fire-resistant protective clothing and gear.

- Organizations prioritize worker safety to reduce liability and improve productivity, propelling demand for high-performance fire-resistant fabrics that offer durability, breathability, and protection under extreme conditions.

- The rise in infrastructure and industrial projects across emerging economies like India, Brazil, and Southeast Asia boosts the need for protective apparel, including garments made from Fire Resistant Fabrics. Local regulations and international safety protocols (like NFPA, ISO, and EN standards) further support market growth.

- Manufacturers are investing in R&D to develop lightweight, comfortable, and sustainable fire-resistant fabrics to meet evolving industry standards. This enhances compliance and performance, opening up new application areas beyond industrial use, such as defense and public safety.

For Instance

- In September 2023, DuPont launched a new line of Nomex® Comfort fabrics for industrial protective wear in the Asia-Pacific region, addressing demand for lighter, more comfortable flame-resistant apparel that meets updated safety regulations.

Restraint/Challenge

“High Production Costs and Environmental Compliance Pressure”

- The fire-resistant properties of these fabrics often stem from complex treatment processes or specialty fibers like aramid, modacrylic, and treated cotton blends, which significantly increase production costs. This pricing pressure limits market penetration in low-income regions and restricts usage in non-core applications.

- Increasing global emphasis on sustainability adds compliance challenges for manufacturers. Fire-resistant fabric production involves chemical treatments and energy-intensive methods that must adhere to evolving environmental norms, especially in Europe and North America.

- Many companies are compelled to invest in eco-friendly processes and waste management systems, which require substantial capital and technological upgrades, placing pressure on profitability.

- Furthermore, fluctuating availability and cost of key raw materials, including specialty fibers and chemical finishes, introduce supply risks and margin instability. This particularly affects small- and medium-scale producers, stalling market expansion.

For Instance,

- In August 2023, several mid-sized protective apparel firms in Europe reported delayed order fulfillment due to EU environmental audits and the rising cost of sustainable aramid alternatives, highlighting ongoing challenges in meeting green manufacturing targets.

Fire Resistant Fabrics Market Scope

The market is segmented on the basis of type, application and end user.

- By Type

On the basis of type, the fire resistant fabrics market is segmented into treated fire-resistant fabrics and inherent fire-resistant fabrics. Treated fire-resistant fabrics have further been segmented into fire-resistant cotton, fire-resistant viscose, fire-resistant polyester and fire-resistant nylon 6. Inherent fire-resistant fabrics have further been segmented into aramid, PBI (polybenzimidazole), modacrylic, polyamide and PI (polyimide). Inherent fire-resistant fabrics dominate the market due to their permanent fire resistance and durability, accounting for over 60% share, driven by demand in defense and industrial sectors.

In 2025, Treated fire-resistant fabrics are the fastest-growing segment, registering a CAGR of 7%, driven by cost-effectiveness and rising adoption in protective clothing for construction, oil & gas, and manufacturing sectors.

- By Application

Based on application, the fire resistant fabrics market is segmented into apparel and non-apparel. Apparel has further been segmented into protective clothing. Non-apparel has further been segmented into interior fabric for transportation and household and industrial. Apparel dominates the fire-resistant fabrics market due to high demand for protective clothing in industrial, defense, and firefighting sectors, where safety regulations and worker protection are top priorities.

Non-apparel is the fastest-growing segment, driven by increasing use in curtains, upholstery, and insulation across residential and commercial buildings to enhance fire safety and comply with building regulations.

- By end-user

The end user segment for fire resistant fabrics market is segmented into industrial, defense and public safety services, transport and others. Industrial has further been segmented into construction and manufacturing, oil and gas and others. Defense and public safety services have further been segmented into military and firefighting and law enforcement. Transport has further been segmented into railways, aircraft, marine and automotive. The industrial segment dominates the fire-resistant fabrics market, fueled by stringent safety standards in sectors like oil & gas, chemical, and manufacturing, where workers require durable, flame-resistant protective gear.

The defense and public safety services segment is the fastest growing, propelled by increasing defense budgets and demand for advanced protective clothing for military personnel, firefighters, and emergency responders.

Fire Resistant Fabrics Market Regional Analysis

- North America leads the Global Fire Resistant Fabrics Market, holding approximately 35% of the market share in 2024. This dominance is attributed to strong industrial and defense infrastructure, with the U.S. being a major contributor due to high safety standards and demand.

- The region benefits from strong industrial, defense, and construction sectors, with manufacturers focused on high-performance, lightweight fabrics. Regulatory bodies like OSHA and NFPA enforce fire safety norms, driving consistent demand for certified Fire Resistant Fabrics.

- Rising investment in oil & gas and electric utilities, where worker protection is critical, boosts demand. High disposable income and advanced manufacturing capabilities further accelerate innovation and product adoption in North America..

U.S. Fire Resistant Fabrics Market Insight

In 2025, the U.S. holds approximately 30–32% share of the global market. Growth is driven by robust demand from the defense, industrial safety, and utility sectors. Continued investment in infrastructure and energy, along with strict regulatory oversight, supports market stability and innovation.

Europe Fire Resistant Fabrics Market Insight

Europe’s market is supported by strong demand across construction, industrial, and transport sectors. Environmental regulations such as REACH drive the development of sustainable fire-resistant textiles. Key countries like Germany, France, and the U.K. lead in innovation and safety compliance.

U.K. Fire Resistant Fabrics Market Insight

The U.K. market benefits from fire safety mandates in construction and public transportation. Adoption in defense and aerospace applications is rising. Government funding for R&D and increasing focus on sustainability reinforce the growth of advanced flame-retardant fabric technologies.

Germany Fire Resistant Fabrics Market Insight

Germany sees growing demand from its automotive, engineering, and protective clothing industries. Innovation in eco-friendly flame-retardant treatments and a highly regulated industrial safety framework make Germany a key hub for fire-resistant textile development in Europe.

Asia-Pacific Fire Resistant Fabrics Market Insight

Asia Pacific is the fastest-growing region in the fire resistant fabrics market, projected to grow at a CAGR of over 8% from 2025 to 2032. Rapid industrialization, urbanization, and infrastructure projects in China, India, and Japan are driving this growth.

Japan Fire Resistant Fabrics Market Insight

Japan’s market is driven by strong electronics, automotive, and railway sectors. Demand for high-quality protective gear and innovations in fabric technology support growth. Government incentives for workplace safety and industrial modernization strengthen adoption of advanced materials.

China Fire Resistant Fabrics Market Insight

China leads regional demand with large-scale infrastructure, construction, and industrial expansion. Strict workplace safety laws and rapid urbanization increase the need for protective gear. Strong domestic manufacturing capacity enables cost-effective, high-volume production of fire-resistant textiles.

Fire Resistant Fabrics Market Share

The Fire Resistant Fabrics industry is primarily led by well-established companies, including:

- DuPont (U.S.)

- TEIJIN LIMITED (Japan)

- KANEKA CORPORATION (Japan)

- PBI Performance Products, Inc. (U.S.)

- Koninklijke Ten Cate bv. (Netherlands)

- Westex (U.S.)

- Gun Ei Chemical Industry Co., Ltd. (Japan)

- Huntsman International LLC (U.S.)

- Lenzing AG (Austria)

- Solvay (Belgium)

- W. L. Gore & Associates, Inc. (U.S.)

- Glen Raven, Inc. (U.S.)

- Charles Parsons (Australia)

- Banswara Syntex Limited (India)

- Trevira GmbH (Germany)

- Auburn Manufacturing, Inc. (U.S.)

- Taiwan K.K. Corp. (Taiwan)

- KERMEL (France)

- Newtex Industries, Inc. (U.S.)

- XM FireLine (Lithuania)

Latest Developments in Global Fire Resistant Fabrics Market

- In March 2022, DuPont introduced Nomex Xtreme Performance, a new category of protective solutions for emergency responders. Combining Nomex with Kevlar and high-performance materials like PBO, Nomex Nano, or Nomex Nano Flex, this innovation offers superior thermal protection, moisture management, and resistance to heat, flame, chemicals, cuts, and particulates, enhancing firefighter safety.

- In April 2023, TenCate Protective Fabrics launched Tecasafe 360+, the industry's first inherently flame-resistant stretch fabric. Incorporating XLANCE fibers, it offers enhanced comfort and mobility without compromising safety. This innovation addresses the demand for protective workwear that combines safety with the flexibility and comfort of casual wear.

- In January 2024, At Intersec 2024 in Dubai, Carrington Textiles showcased Flametougher 290AS Flex, a stretch flame-resistant fabric designed for electrical arc flash protection. Made with CORDURA nylon 6,6 and XLANCE fibers, it offers certified strength and elasticity, enhancing safety and comfort for professionals in high-risk environments

- In September 2023, Carrington Textiles unveiled a new range of sustainable flame-resistant fabrics, including blends with 50% LENZING FR fibers. These fabrics offer superior protection and comfort while aligning with sustainability goals, catering to the growing demand for eco-friendly protective textiles in various industries.

- In April 2025, Teijin Carbon introduced Tenax Next™ R2S P513 6mm, an eco-friendly short carbon fiber featuring the company's first digital product passport (DPP). The DPP ensures full transparency and traceability throughout the product's life cycle, aligning with the European Union's sustainability initiatives and promoting responsible manufacturing practices.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fire Resistant Fabrics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fire Resistant Fabrics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fire Resistant Fabrics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.