Global First Party Coverage Cyber Insurance Market

Market Size in USD Billion

CAGR :

%

USD

19.67 Billion

USD

85.15 Billion

2025

2033

USD

19.67 Billion

USD

85.15 Billion

2025

2033

| 2026 –2033 | |

| USD 19.67 Billion | |

| USD 85.15 Billion | |

|

|

|

|

First Party Coverage Cyber Insurance Market Size

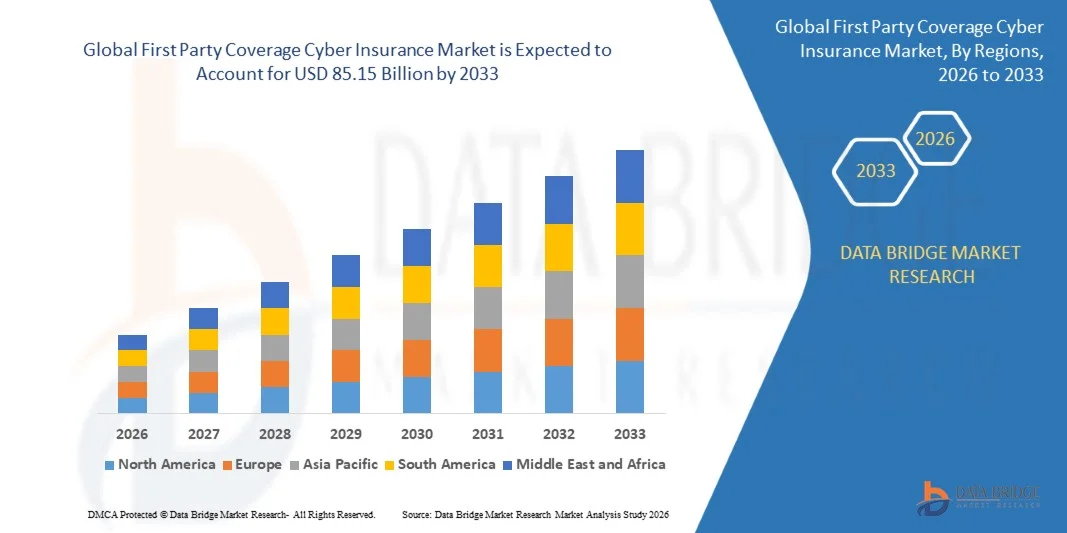

- The global first party coverage cyber insurance market size was valued at USD 19.67 billion in 2025 and is expected to reach USD 85.15 billion by 2033, at a CAGR of 20.10% during the forecast period

- The market growth is largely fueled by the increasing frequency and sophistication of cyberattacks, driving organizations to adopt first party coverage cyber insurance to protect against financial losses, business interruption, and data breaches

- Furthermore, growing digital transformation across industries, combined with heightened regulatory requirements for data protection and breach reporting, is prompting businesses to invest in comprehensive cyber risk coverage. These converging factors are accelerating the adoption of first party cyber insurance, thereby significantly boosting market expansion

First Party Coverage Cyber Insurance Market Analysis

- First party cyber insurance, providing coverage for losses directly incurred by an organization due to cyber incidents, is becoming increasingly essential for enterprises across sectors such as BFSI, healthcare, IT, and e-commerce due to the rising operational, financial, and reputational risks associated with digitalization

- The escalating demand for first party cyber insurance is primarily fueled by growing awareness of cyber risks, the high cost of data breaches, ransomware attacks, and the need for proactive incident response and system recovery solutions. Organizations are increasingly prioritizing policies that offer both financial protection and integrated risk management services

- North America dominated the first party coverage cyber insurance market with a share of 38.5% in 2025, due to increasing digitization across enterprises and rising cybercrime incidents

- Asia-Pacific is expected to be the fastest growing region in the first party coverage cyber insurance market during the forecast period due to rising digital adoption, e-commerce growth, and increased cyberattack incidents across countries such as China, Japan, and India

- Packaged segment dominated the market with a market share of 61.7% in 2025, due to the convenience of integrated coverage that combines cyber insurance with other property and liability policies. Enterprises often favor packaged solutions as they simplify policy management and provide cost efficiencies. The segment’s dominance is further strengthened by insurers offering customizable bundles that cater to specific industry needs and organizational risk profiles. Packaged policies also include complementary risk mitigation tools, increasing overall attractiveness to policyholders

Report Scope and First Party Coverage Cyber Insurance Market Segmentation

|

Attributes |

First Party Coverage Cyber Insurance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

First Party Coverage Cyber Insurance Market Trends

“Rising Adoption of Comprehensive First Party Cyber Insurance Policies”

- A significant trend in the first party coverage cyber insurance market is the growing adoption of comprehensive policies that provide organizations with financial protection against data breaches, ransomware attacks, business interruption, and system restoration. This trend is driven by the escalating frequency and sophistication of cyberattacks across industries, prompting companies to secure coverage that addresses evolving digital risks

- For instance, insurers such as Chubb and AXA XL are offering enhanced first party cyber insurance products that include breach response, forensic investigation, and business interruption coverage, strengthening organizational resilience and minimizing operational disruption. These solutions are gaining traction among enterprises that prioritize proactive risk management and regulatory compliance

- The market is witnessing increased integration of cyber insurance with real-time risk monitoring and incident response services, enabling organizations to identify vulnerabilities and mitigate threats before financial losses occur. This is positioning first party coverage as a critical component of enterprise risk management strategies

- Industries such as BFSI, healthcare, and IT are increasingly adopting first party cyber insurance as part of broader cybersecurity frameworks, where policies complement internal IT security measures to provide holistic protection. This is accelerating uptake across both large enterprises and SMEs

- The growing emphasis on regulatory compliance, including GDPR and other data protection mandates, is further driving adoption, as organizations seek insurance policies that cover fines, penalties, and breach response costs. This trend is reinforcing the market’s growth trajectory and encouraging insurers to develop innovative and tailored policy offerings

- The rise in digital transformation initiatives across sectors, coupled with the growing dependence on cloud, IoT, and connected technologies, continues to fuel demand for comprehensive first party cyber insurance. Organizations recognize these policies as essential for operational continuity, positioning the market for sustained expansion

First Party Coverage Cyber Insurance Market Dynamics

Driver

“Increasing Frequency and Sophistication of Cyberattacks”

- The growing occurrence of cyberattacks, including ransomware, phishing, and system intrusions, is driving the demand for first party coverage cyber insurance. Organizations are increasingly seeking financial protection for direct losses, business interruption, and costs associated with data recovery

- For instance, companies such as Coalition and Beazley provide policies that include real-time monitoring, incident response, and breach recovery services, enabling enterprises to mitigate the financial and operational impact of cyber incidents. The rising complexity of threats, including AI-driven attacks, underscores the importance of comprehensive insurance coverage, further fueling market growth

- Enterprises across BFSI, healthcare, IT, and e-commerce sectors are prioritizing first party cyber coverage to safeguard sensitive data and maintain business continuity. This is increasing policy adoption rates and encouraging insurers to expand coverage options

- The shift to cloud-based systems and remote working models has heightened exposure to cyber risks, reinforcing the need for robust first party coverage. Companies are proactively securing insurance to address potential vulnerabilities arising from distributed IT environments

- The cumulative impact of evolving cyber threats, regulatory pressures, and operational digitization positions first party cyber insurance as an essential risk management tool, ensuring sustained market expansion

Restraint/Challenge

“High Premium Costs and Coverage Complexity”

- The first party coverage cyber insurance market faces challenges due to high premiums and the complex terms of policies, which can limit accessibility for small and medium-sized enterprises. Policies often require detailed risk assessments and the implementation of cybersecurity protocols, adding to operational and administrative costs

- For instance, SMEs seeking coverage from providers such as Hiscox and FireEye may face higher costs due to the perceived risk of cyber exposure and the tailored nature of policies, which include breach response and forensic investigation services. This complexity can deter organizations from adopting comprehensive coverage

- The rapidly changing cyber threat landscape necessitates continuous policy updates, creating additional administrative challenges for insurers and policyholders. This increases underwriting complexity and can lead to discrepancies in coverage understanding

- Premium pricing is influenced by organizational size, industry, digital infrastructure, and historical incident records, making standardized coverage difficult and potentially costly for high-risk sectors. This constrains broader market adoption, particularly among smaller enterprises

- The need for specialized expertise to evaluate risks, coupled with evolving threat vectors, reinforces the challenge of providing cost-effective and comprehensive first party coverage. Organizations must balance budget constraints with the need for robust protection, limiting market penetration

First Party Coverage Cyber Insurance Market Scope

The market is segmented on the basis of component, insurance coverage, insurance type, organization size, end user, and coverage type.

- By Component

On the basis of component, the first party coverage cyber insurance market is segmented into solutions and services. The solutions segment dominated the market with the largest revenue share in 2025, driven by the growing reliance of organizations on advanced risk management platforms to prevent and mitigate cyber threats. Companies often prefer solutions-focused insurance for the integrated tools and analytics they provide, enhancing proactive threat detection and compliance management. The demand is further strengthened by the increasing adoption of digital platforms across enterprises, which necessitates comprehensive cyber risk coverage. Solutions-based insurance offerings often include real-time monitoring, incident response planning, and automated reporting features, which collectively improve the security posture of insured entities.

The services segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by the rising need for expert advisory, incident response, and managed security services. For instance, providers such as Aon offer tailored cyber risk consulting services alongside coverage, helping organizations navigate complex regulatory environments. The growing preference for outsourced expertise and continuous threat management makes services a crucial growth driver in the market.

- By Insurance Coverage

On the basis of insurance coverage, the market is segmented into data breach and cyber liability. The data breach segment dominated the market with the largest revenue share in 2025, owing to the increasing frequency and sophistication of breaches targeting sensitive customer and corporate information. Organizations often prioritize data breach insurance for the financial protection and legal support it offers in the event of unauthorized access. The segment’s growth is supported by regulatory mandates around data protection, driving mandatory coverage for breach-related costs. Insurers are also offering value-added services such as breach response teams and notification support, further boosting adoption.

The cyber liability segment is anticipated to witness the fastest CAGR from 2026 to 2033, driven by rising exposure to financial and reputational losses from cyberattacks. For instance, Chubb provides extensive cyber liability coverage that addresses third-party claims and system failure liabilities, attracting enterprises with complex operational networks. The increasing sophistication of cyber threats in the digital age underscores the importance of comprehensive cyber liability protection, making it a rapidly expanding segment.

- By Insurance Type

On the basis of insurance type, the market is segmented into packaged and standalone policies. The packaged segment dominated the market with the largest revenue share of 61.7% in 2025, owing to the convenience of integrated coverage that combines cyber insurance with other property and liability policies. Enterprises often favor packaged solutions as they simplify policy management and provide cost efficiencies. The segment’s dominance is further strengthened by insurers offering customizable bundles that cater to specific industry needs and organizational risk profiles. Packaged policies also include complementary risk mitigation tools, increasing overall attractiveness to policyholders.

The standalone segment is expected to witness the fastest CAGR from 2026 to 2033, driven by growing demand for specialized coverage focusing solely on cyber risks. For instance, Beazley offers standalone cyber policies tailored for high-risk sectors, providing extensive protection for breaches, ransomware, and business interruption. As organizations recognize the complexity and uniqueness of cyber threats, standalone policies are gaining traction as targeted, flexible insurance solutions.

- By Organization Size

On the basis of organization size, the market is segmented into large enterprises and small and medium-sized enterprises (SMEs). The large enterprise segment dominated the market with the largest revenue share in 2025, owing to the significant volume of sensitive data and high-value digital assets managed by these organizations. Large enterprises often seek comprehensive first party cyber insurance to mitigate financial, operational, and reputational risks from cyber incidents. The segment is further driven by strict regulatory compliance requirements and internal risk management policies that necessitate robust coverage. Providers offer tailored solutions addressing global operations and complex IT infrastructures, ensuring large enterprises maintain operational resilience.

The SME segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by the increasing digitization and cloud adoption among smaller businesses. For instance, Hiscox provides SMEs with scalable cyber insurance plans that include breach response and advisory services, allowing affordable protection against emerging cyber threats. The growing awareness of cyber risks among SMEs and the affordability of flexible plans are key factors driving this segment’s rapid growth.

- By End User

On the basis of end user, the market is segmented into technology providers and insurance providers. The technology provider segment dominated the market with the largest revenue share in 2025, driven by the high dependence of tech companies on digital infrastructure and intellectual property. These organizations often prioritize first party cyber insurance to secure critical data, software, and operational continuity. The segment’s dominance is further supported by the complex regulatory and contractual obligations faced by technology providers globally, creating a heightened demand for comprehensive cyber risk coverage.

The insurance provider segment is anticipated to witness the fastest CAGR from 2026 to 2033, fueled by the rising need for reinsurance, risk pooling, and coverage for claims handling. For instance, Allianz offers specialized cyber insurance products to support other insurers in mitigating financial exposure, helping them manage client claims efficiently. As insurance providers expand their portfolios and focus on cyber risk management solutions, this segment sees accelerating adoption rates.

- By Coverage Type

On the basis of coverage type, the market is segmented into theft and fraud, computer program and electronic restoration, extortion, forensic investigation, and business interruption. The theft and fraud segment dominated the market with the largest revenue share in 2025, owing to the high prevalence of financial cybercrimes targeting enterprises and organizations. Companies often prioritize theft and fraud coverage for the direct financial protection it provides against unauthorized transactions and digital asset theft. The segment benefits from insurers offering dedicated fraud monitoring, response, and recovery services, enhancing overall risk management for policyholders.

The computer program and electronic restoration segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the increasing complexity of digital systems and the critical need to restore affected programs quickly. For instance, Lloyd’s provides coverage that reimburses costs for software restoration and system repair following cyber incidents, supporting uninterrupted business operations. Growing reliance on IT systems and the high cost of recovery services make this coverage type a key growth driver in the market.

First Party Coverage Cyber Insurance Market Regional Analysis

- North America dominated the first party coverage cyber insurance market with the largest revenue share of 38.5% in 2025, driven by increasing digitization across enterprises and rising cybercrime incidents

- Organizations in the region highly prioritize financial protection against data breaches, ransomware attacks, and other cyber threats, fueling strong demand for first party coverage

- The market is further supported by well-established regulatory frameworks, high awareness of cyber risks, and the growing adoption of risk management and incident response solutions

U.S. First Party Coverage Cyber Insurance Market Insight

The U.S. first party coverage cyber insurance market captured the largest revenue share in North America in 2025, fueled by rapid digital transformation initiatives and a strong focus on cybersecurity. Companies are increasingly seeking coverage for data breaches, business interruption, and system restoration to safeguard operations and sensitive data. The growing adoption of cloud computing, IoT, and connected business systems is driving demand for comprehensive cyber insurance policies. Moreover, enterprises are increasingly leveraging policy solutions integrated with risk assessment and incident response services, further boosting market growth.

Europe First Party Coverage Cyber Insurance Market Insight

The Europe first party coverage cyber insurance market is projected to grow at a significant CAGR during the forecast period, primarily driven by stringent data protection regulations and rising awareness of cyber risks among organizations. Increasing digitalization across sectors such as BFSI, healthcare, and e-commerce is fostering the adoption of first party cyber insurance. European companies are emphasizing proactive risk management, including coverage for breach response and forensic investigations. The market is also supported by government initiatives encouraging cybersecurity resilience and insurance adoption in both private and public sectors.

U.K. First Party Coverage Cyber Insurance Market Insight

The U.K. first party coverage cyber insurance market is anticipated to grow at a notable CAGR during the forecast period, driven by the increasing frequency of cyberattacks and regulatory compliance requirements. Businesses across financial services, IT, and retail sectors are adopting cyber insurance to protect against financial losses and reputational damage. The growing integration of cloud services and digital payment systems is further boosting demand for tailored coverage solutions. Moreover, U.K. companies are increasingly leveraging insurance policies with built-in advisory and incident response services, supporting market expansion.

Germany First Party Coverage Cyber Insurance Market Insight

The Germany first party coverage cyber insurance market is expected to expand at a considerable CAGR during the forecast period, fueled by growing digitalization and increasing awareness of cyber risk mitigation. Enterprises are seeking comprehensive coverage for data breaches, ransomware attacks, and system restoration. Germany’s strong industrial and IT infrastructure, combined with regulatory frameworks emphasizing data protection, promotes adoption of first party cyber insurance. Insurers are increasingly offering tailored solutions with risk assessment and recovery services, aligning with local enterprise needs.

Asia-Pacific First Party Coverage Cyber Insurance Market Insight

The Asia-Pacific first party coverage cyber insurance market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising digital adoption, e-commerce growth, and increased cyberattack incidents across countries such as China, Japan, and India. Organizations in the region are increasingly seeking coverage for data breaches, business interruptions, and extortion threats. Government initiatives promoting cybersecurity frameworks, along with rapid urbanization and digital transformation, are boosting market penetration. Furthermore, the emergence of domestic insurers offering affordable and comprehensive first party cyber insurance solutions is expanding access to a broader range of enterprises.

Japan First Party Coverage Cyber Insurance Market Insight

The Japan first party coverage cyber insurance market is gaining traction due to the country’s advanced digital infrastructure and strong regulatory focus on cybersecurity. Organizations are prioritizing coverage for data breaches, ransomware, and system recovery, particularly in financial services and technology sectors. The market is supported by Japan’s high cybersecurity awareness, increasing digital payments, and connected enterprise systems. Companies are also leveraging solutions that combine insurance with advisory and incident response services, driving market growth in both commercial and industrial sectors.

China First Party Coverage Cyber Insurance Market Insight

The China first party coverage cyber insurance market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid digitalization, growing cybercrime, and a rising number of SMEs and large enterprises adopting cyber insurance. The market is driven by the government’s push towards cybersecurity regulations and smart city initiatives. Organizations are increasingly opting for policies covering data breaches, business interruption, and forensic investigation services. Domestic insurers offering tailored, cost-effective first party cyber coverage, alongside increasing awareness of cyber threats, are key factors propelling market growth in China.

First Party Coverage Cyber Insurance Market Share

The first party coverage cyber insurance industry is primarily led by well-established companies, including:

- BitSight Technologies (U.S.)

- TAG Cyber and RedSeal (U.S.)

- SecurityScorecard (U.S.)

- Cyber Indemnity Solutions Ltd (U.K.)

- Cisco (U.S.)

- UpGuard, Inc. (U.S.)

- Microsoft (U.S.)

- Check Point Software Technologies Ltd. (Israel)

- AttackIQ (U.S.)

- SentinelOne (U.S.)

- Symantec Corporation (U.S.)

- Accenture (Ireland)

- Kenna Security (U.S.)

- FireEye, Inc. (U.S.)

- CyberArk Software Ltd. (Israel)

- Foundershield LLC (U.S.)

- Chubb (U.S.)

- AXA XL (France)

- American International Group, Inc. (U.S.)

- The Travelers Indemnity Company (U.S.)

Latest Developments in Global First Party Coverage Cyber Insurance Market

- In October 2025, At‑Bay launched new industry‑first InsurSec solutions that enhance ransomware and financial fraud cyber insurance coverage, introducing combined managed security and insurance offerings that reduce coverage gaps and costs for mid‑market and small businesses. This development strengthens the adoption of first party cyber insurance by providing organizations with more predictable financial protection and integrated security tools, addressing the increasing frequency and severity of cyberattacks. The market impact is significant as it encourages smaller enterprises, traditionally underinsured, to adopt comprehensive cyber risk coverage

- In August 2025, MSIG USA partnered with Coalition to advance cyber risk solutions for multinational clients, enabling the launch of a new cyber insurance program in the U.S. that merges MSIG’s underwriting expertise with Coalition’s real‑time risk monitoring and incident response technologies. This partnership expands the scope and reliability of first party cyber coverage for large enterprises, offering enhanced incident response capabilities and proactive risk management. It is expected to boost market confidence and attract global enterprises seeking integrated solutions to mitigate operational and reputational risks

- In June 2025, Marsh launched the Cyber Unity cyber insurance facility to support European organizations, providing up to €5 million in primary capacity for mid‑sized businesses. This initiative lowers barriers to obtaining first party cyber coverage and encourages broader adoption among companies that previously faced challenges in securing sufficient protection. The development is significant for the European market as it strengthens the insurance infrastructure for SMEs and promotes resilience against financial losses due to cyber incidents

- In May 2025, Coalition expanded its Active Cyber Insurance offerings into the Nordic region, partnering with Allianz to deliver proactive digital risk insurance to businesses in Denmark and Sweden. By combining first party cyber coverage with embedded security tools, this expansion increases market penetration and encourages organizations in the region to adopt comprehensive cyber insurance solutions. The development also positions the Nordic market as a growing hub for innovative cyber insurance products, boosting overall market growth

- In April 2025, Coalition launched its new Active Cyber Policy in the United States, introducing an advanced coverage structure with expanded protections and simplified policy terms to better address evolving digital risks. This launch strengthens first party cyber insurance adoption by offering streamlined, comprehensive solutions that reduce complexity and improve accessibility for U.S. enterprises. The development is expected to drive increased uptake of cyber policies across industries, enhancing overall market growth and resilience

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.