Global Fishery Machinery Market

Market Size in USD Million

CAGR :

%

USD

587.36 Million

USD

646.18 Million

2025

2033

USD

587.36 Million

USD

646.18 Million

2025

2033

| 2026 –2033 | |

| USD 587.36 Million | |

| USD 646.18 Million | |

|

|

|

|

What is the Global Fishery Machinery Market Size and Growth Rate?

- The global fishery machinery market size was valued at USD 587.36 million in 2025 and is expected to reach USD 646.18 million by 2033, at a CAGR of1.20% during the forecast period

- Growing in demand for aquaponics and growing trend of smart fishing will emerge as the major factor fostering the growth of fishery machinery market. Also, rising demand for incorporating fish into daily diet owing to nutritional content in fish and growth in the demand for omega-3 fatty acids especially in the developing economies are other factors fostering the growth of fishery machinery market

What are the Major Takeaways of Fishery Machinery Market?

- Growth in the expenditure for research and development proficiencies in regards to new product launches coupled with increasing personal disposable income will further create lucrative and remunerative growth opportunities for the fishery machinery market

- Growing interest for fishing in the developing economies, surging globalization and growing initiatives by the government to promote industrialization will also carve the way for the growth of the fishery machinery market

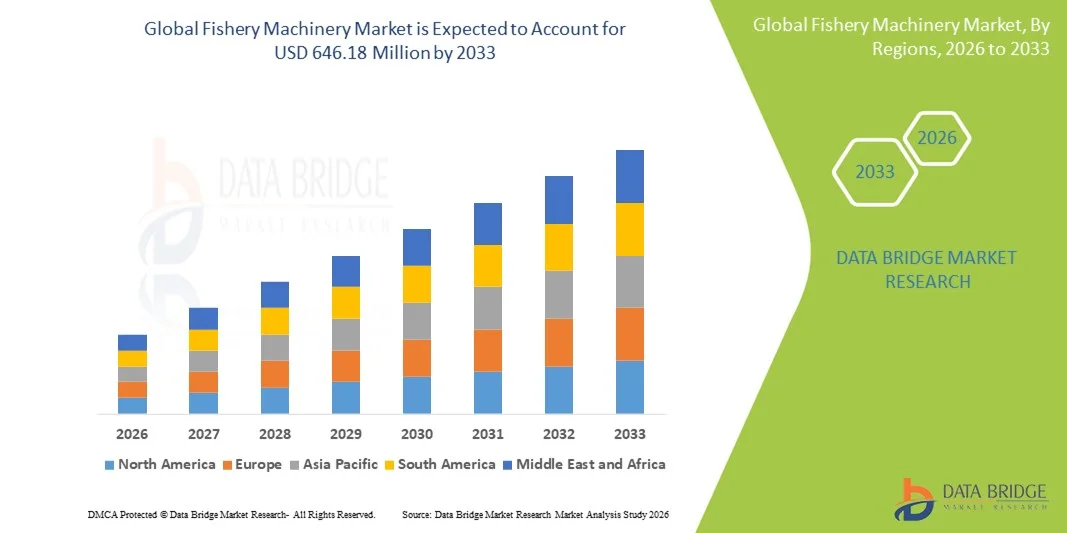

- North America dominated the fishery machinery market with an estimated 39.64% revenue share in 2025, driven by strong presence of large-scale commercial fisheries, advanced seafood processing facilities, and high adoption of automated and energy-efficient fish processing equipment across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 6.49% from 2026 to 2033, driven by rapid expansion of aquaculture, rising seafood consumption, and growing investments in fish processing infrastructure across China, Japan, India, South Korea, and Southeast Asia

- The Filleting Machines segment dominated the market with an estimated 34.6% share in 2025, as these machines are extensively used in commercial fish processing facilities to ensure high precision, uniform cuts, reduced wastage, and improved throughput

Report Scope and Fishery Machinery Market Segmentation

|

Attributes |

Fishery Machinery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Fishery Machinery Market?

Increasing Shift Toward Automated, High-Efficiency, and Digitally Integrated Fishery Machinery

- The fishery machinery market is witnessing growing adoption of automated, sensor-enabled, and digitally controlled equipment designed to improve harvesting efficiency, processing accuracy, and operational safety across fishing and aquaculture operations

- Manufacturers are introducing high-capacity, compact, and energy-efficient machinery integrated with IoT sensors, real-time monitoring systems, and data analytics to optimize fish handling, grading, feeding, and processing activities

- Rising demand for cost-efficient, space-saving, and field-deployable fishery equipment is driving adoption across commercial fishing vessels, aquaculture farms, hatcheries, and onshore processing facilities

- For instance, companies such as Marel, BAADER, GEA Group, and AKVA Group are upgrading their fishery machinery portfolios with automated filleting, sorting, feeding, and processing systems featuring enhanced throughput and digital control

- Increasing need for labor reduction, operational consistency, and compliance with sustainability and food safety standards is accelerating the shift toward automated and digitally integrated fishery machinery

- As fisheries and aquaculture operations scale globally, Fishery Machinery will remain essential for improving productivity, traceability, and overall operational efficiency

What are the Key Drivers of Fishery Machinery Market?

- Rising demand for efficient, reliable, and automated machinery to support large-scale fishing, aquaculture production, and seafood processing operations

- For instance, in 2024–2025, leading manufacturers such as Marel, AKVA Group, and BAADER expanded their machinery offerings with advanced processing, feeding, and monitoring solutions to support high-volume operations

- Growing global consumption of seafood, expansion of aquaculture farming, and increasing focus on food security are boosting demand for modern fishery machinery across the U.S., Europe, and Asia-Pacific

- Advancements in automation, robotics, material handling, and corrosion-resistant equipment design have strengthened machinery durability, efficiency, and lifecycle performance

- Rising adoption of smart aquaculture systems, precision feeding technologies, and automated processing lines is creating sustained demand for technologically advanced fishery machinery

- Supported by investments in sustainable fishing practices, aquaculture modernization, and seafood processing infrastructure, the Fishery Machinery market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Fishery Machinery Market?

- High capital costs associated with advanced, automated, and large-scale fishery machinery limit adoption among small-scale fisheries and emerging aquaculture operators

- For instance, during 2024–2025, fluctuations in steel prices, electronic component costs, and logistics expenses increased overall manufacturing and installation costs for several global machinery suppliers

- Complexity in operating and maintaining automated and digitally integrated equipment increases the need for skilled labor and technical training

- Limited awareness and slower technology adoption in developing regions restrict penetration of advanced fishery machinery

- Competition from manual or semi-automated equipment, along with refurbished machinery options, creates pricing pressure and slows replacement cycles

- To address these challenges, companies are focusing on modular designs, cost-optimized machinery, operator training programs, and after-sales support, supporting broader adoption of fishery machinery worldwide

How is the Fishery Machinery Market Segmented?

The market is segmented on the basis of product type and application type.

- By Product Type

On the basis of product type, the fishery machinery market is segmented into Elevators and Hoppers, Feeders, Head Cutting Machines, Filleting Machines, Skinning Machines, and Others. The Filleting Machines segment dominated the market with an estimated 34.6% share in 2025, as these machines are extensively used in commercial fish processing facilities to ensure high precision, uniform cuts, reduced wastage, and improved throughput. Filleting machines support large-scale seafood processing operations by minimizing manual labor, enhancing hygiene standards, and maintaining consistent product quality. Their widespread adoption across onshore processing plants and industrial fishing operations continues to support segment leadership.

The Feeders segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising adoption of automated feeding systems in aquaculture farms. Increasing focus on precision feeding, reduced feed wastage, optimized growth rates, and integration with smart aquaculture technologies is accelerating demand for advanced feeding machinery globally.

- By Application Type

On the basis of application type, the fishery machinery market is segmented into Agriculture, Aquaculture, Water Treatment, and Others. The Aquaculture segment dominated the market with a 41.2% share in 2025, supported by rapid expansion of fish farming activities, rising global seafood demand, and increasing investment in modern aquaculture infrastructure. Fishery machinery is widely used in aquaculture for feeding, grading, harvesting, and processing operations, enabling higher productivity, better stock management, and improved biosecurity. Automation and digital monitoring further enhance operational efficiency across large-scale farms.

The Water Treatment segment is projected to register the fastest CAGR from 2026 to 2033, driven by growing demand for machinery used in sludge handling, fish waste management, and water quality maintenance. Increasing environmental regulations and focus on sustainable water management practices are boosting adoption across municipal and industrial facilities.

Which Region Holds the Largest Share of the Fishery Machinery Market?

- North America dominated the fishery machinery market with an estimated 39.64% revenue share in 2025, driven by strong presence of large-scale commercial fisheries, advanced seafood processing facilities, and high adoption of automated and energy-efficient fish processing equipment across the U.S. and Canada. The region’s focus on operational efficiency, food safety compliance, and labor cost reduction continues to support strong demand for filleting, skinning, grading, and handling machinery

- Extensive investment in modern aquaculture infrastructure, cold-chain logistics, and sustainable fishing practices is accelerating adoption of technologically advanced fishery machinery across industrial processing plants

- Strong regulatory frameworks, high seafood consumption, and continuous upgrades of processing facilities further reinforce North America’s leadership in the global fishery machinery market

U.S. Fishery Machinery Market Insight

The U.S. is the largest contributor in North America, supported by a well-established seafood processing industry, large aquaculture operations, and strong demand for automation to improve productivity and hygiene standards. Increasing adoption of filleting, portioning, and grading machines across fish and seafood processing plants continues to drive market growth.

Canada Fishery Machinery Market Insight

Canada contributes significantly due to its robust fishing industry, growing aquaculture sector, and strong exports of processed seafood. Investments in modern processing facilities and sustainable fish farming technologies are boosting demand for advanced fishery machinery across the country.

Asia-Pacific Fishery Machinery Market

Asia-Pacific is projected to register the fastest CAGR of 6.49% from 2026 to 2033, driven by rapid expansion of aquaculture, rising seafood consumption, and growing investments in fish processing infrastructure across China, Japan, India, South Korea, and Southeast Asia. Increasing mechanization of fish handling, feeding, and processing operations is accelerating market growth.

China Fishery Machinery Market Insight

China dominates the Asia-Pacific market due to its massive aquaculture production, strong seafood exports, and government support for modernizing fish processing facilities. High demand for automated feeding, filleting, and handling machinery continues to support market expansion.

Japan Fishery Machinery Market Insight

Japan shows steady growth supported by advanced seafood processing technologies, focus on quality and precision, and continuous modernization of fish processing plants.

India Fishery Machinery Market Insight

India is emerging as a high-growth market driven by expanding aquaculture activities, rising seafood exports, and increasing adoption of mechanized processing solutions.

South Korea Fishery Machinery Market Insight

South Korea contributes steadily due to strong demand for advanced fish processing, packaging, and handling equipment supported by a modern seafood industry and export-oriented production.

Which are the Top Companies in Fishery Machinery Market?

The fishery machinery industry is primarily led by well-established companies, including:

- Buck’s Bags Inc. (U.S.)

- Bass Pro Shops (U.S.)

- Pure Fishing, Inc. (U.S.)

- AFTCO (U.S.)

- Aarcom International (U.S.)

- Arenco AB (Sweden)

- GEA Group Aktiengesellschaft (Germany)

- KM Fish Machinery A/S (Denmark)

- Marel (Iceland)

- BAADER (Germany)

- Norfab Equipment Ltd. (Canada)

- Xylem (U.S.)

- Aquaculture Equipment Ltd (U.K.)

- Aquaculture System Technologies, LLC. (U.S.)

- luxsol.ru (Russia)

- CPI Equipment Inc. (U.S.)

- Lifegard Aquatics (U.S.)

- Reef Industries, Inc. (U.S.)

- Aquafarm Equipment AS (Norway)

- Aquaculture of Texas, Inc. (U.S.)

- AKVA group (Norway)

What are the Recent Developments in Global Fishery Machinery Market?

- In June 2025, Mexico launched the Center for Applied Aquaculture Innovation, a global hub offering advanced laboratories, hatchery infrastructure, cutting-edge technologies, and open-ocean project capabilities to support aquaculture research and commercialization, strengthening the country’s position in sustainable aquaculture development

- In May 2025, Guoxin Development Group introduced an upgraded deep-sea aquaculture vessel with a 150,000-metric-ton capacity, building on the 100,000 MT Guoxin 1 model with six additional aquaculture compartments, expanded water-holding capacity, and an integrated solar photovoltaic system, enhancing large-scale and sustainable offshore aquaculture operations

- In April 2025, Kawasaki Heavy Industries Ltd developed a sustainable aquaculture system designed to improve productivity while reinforcing long-term food security, highlighting the company’s focus on environmentally responsible aquaculture technologies

- In October 2024, Deep Trekker and Underwater Contracting Ltd announced a global partnership aimed at advancing aquaculture operations through improved underwater inspection, monitoring, and operational efficiency, supporting modernization across the aquaculture value chain

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.