Global Flame Resistant Fr Coveralls Market

Market Size in USD Billion

CAGR :

%

USD

2.79 Billion

USD

4.00 Billion

2024

2032

USD

2.79 Billion

USD

4.00 Billion

2024

2032

| 2025 –2032 | |

| USD 2.79 Billion | |

| USD 4.00 Billion | |

|

|

|

|

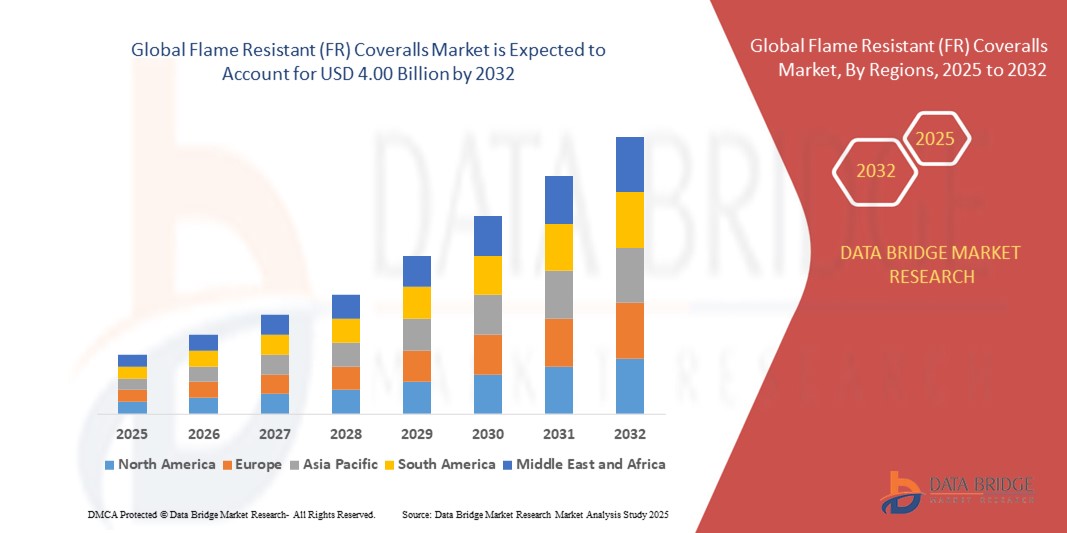

What is the Global Flame Resistant (FR) Coveralls Market Size and Growth Rate?

- The global flame resistant (FR) coveralls market size was valued at USD 2.79 billion in 2024 and is expected to reach USD 4.00 billion by 2032, at a CAGR of 4.60% during the forecast period

- The essential factors contributing to the growth of the global flame resistant (FR) coveralls market in the forecast period of 2025 to 2032. The growth of the market can be attributed to the increasing demand for flame resistant (FR) coveralls owning to the fire-fighting, military, chemical, petrochemical, electrical, others applications across the global level. In addition, the increasing awareness of workplace safety will also propel the market growth in the forecast period

What are the Major Takeaways of Flame Resistant (FR) Coveralls Market?

- Stringent safety regulations and standards set by government bodies and occupational safety organizations mandate the use of flame-resistant clothing in various industries. Compliance with these regulations drives the demand for flame-resistant coveralls

- Growing awareness among employers and employees regarding the importance of workplace safety has led to an increased adoption of flame-resistant coveralls. This is especially true in industries where workers are exposed to fire or electrical hazards

- North America dominated the flame resistant (FR) coveralls market with the largest revenue share of 33.58% in 2024, driven by stringent workplace safety regulations, high adoption of advanced protective gear, and the presence of leading FR fabric manufacturers

- Asia-Pacific Flame Resistant (FR) Coveralls market is expected to grow at the fastest CAGR of 11.02% from 2025 to 2032, driven by rapid industrialization, rising investments in oil & gas, mining, and infrastructure sectors, and increased worker safety awareness

- The Nomex coveralls segment dominated the market with the largest revenue share of 57.4% in 2024, owing to its superior flame resistance, durability, and performance in high-heat and high-risk industrial environments

Report Scope and Flame Resistant (FR) Coveralls Market Segmentation

|

Attributes |

Flame Resistant (FR) Coveralls Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Flame Resistant (FR) Coveralls Market?

Advancements in Lightweight and High-Performance Fabric Technologies

- A significant and accelerating trend in the global flame resistant (FR) coveralls market is the growing adoption of advanced lightweight, breathable, and durable flame-resistant fabrics that enhance both protection and comfort for end users. This shift is driven by the need to meet stringent safety standards while improving wearability in challenging work environments

- For instance, DuPont’s latest Nomex Comfort fabric offers improved moisture management and breathability without compromising on flame resistance, making it suitable for extended use in industrial settings. Similarly, LENZING AG has introduced eco-friendly FR fiber blends that provide high thermal protection while reducing garment weight

- Integration of nanotechnology and advanced fiber engineering enables fabrics that maintain flame resistance after repeated washing, while improving flexibility and reducing heat stress. This is particularly important in sectors such as oil & gas, mining, and electrical utilities where worker mobility and comfort are crucial

- The development of multi-functional FR coveralls with additional properties such as chemical splash resistance, anti-static performance, and water repellency is expanding their applicability across industries

- Companies such as 3M and Solvay are investing in R&D to develop FR materials that combine safety, sustainability, and comfort, reflecting the rising demand for eco-conscious protective apparel

- This trend towards high-performance, lightweight FR coveralls is redefining industry expectations and driving innovation in fabric technology, enabling employers to enhance workforce safety without compromising productivity

What are the Key Drivers of Flame Resistant (FR) Coveralls Market?

- The increasing enforcement of workplace safety regulations across industries such as oil & gas, mining, manufacturing, and electrical utilities is a major driver of FR coverall demand

- For instance, in March 2024, Milsuch asn & Company announced the launch of a new FR fabric line designed to exceed NFPA 2112 and EN ISO 11612 standards, aimed at meeting the safety needs of high-risk industrial workers

- Rising awareness of occupational hazards and the growing importance of personal protective equipment (PPE) are prompting companies to invest in advanced FR apparel for employee safety and compliance

- The expansion of industries in emerging economies and the increasing number of infrastructure and energy projects are creating new demand for FR coveralls

- The growing preference for protective clothing that offers both compliance and comfort is driving innovations in lighter, more breathable fabrics. The ability to customize FR coveralls with corporate branding and functional features is also contributing to adoption in both small and large enterprises

- In addition, the rising trend towards sustainable manufacturing and recyclable materials is influencing procurement decisions, further boosting market growth

Which Factor is challenging the Growth of the Flame Resistant (FR) Coveralls Market?

- The relatively high cost of advanced FR coveralls compared to conventional workwear is a key barrier to adoption, particularly for small businesses and organizations in cost-sensitive markets

- For instance, high-performance FR garments made with premium fibers such as Nomex or PBI often command a significant price premium over standard cotton blends, which can deter budget-conscious buyers

- Comfort trade-offs in older FR technologies, including heavier weight and reduced breathability, have also limited adoption among workers who prioritize mobility and wearability

- The challenge of counterfeit or substandard FR garments in some markets poses a safety risk and erodes consumer trust. Ensuring product authenticity through certification and supply chain transparency remains a critical industry priority

- In addition, fluctuating raw material costs, particularly for specialty fibers, can impact pricing and profit margins for manufacturers

- Overcoming these challenges will require continued innovation in cost-effective, high-comfort FR fabrics, increased worker education on the importance of certified protection, and stricter regulatory enforcement to eliminate unsafe alternatives from the market

How is the Flame Resistant (FR) Coveralls Market Segmented?

The market is segmented on the basis of product type, end-user industry, flame resistance standards, size and fit, and distribution channel.

- By Product Type

On the basis of product type, the flame resistant (FR) coveralls market is segmented into flame resistant cotton coveralls and Nomex coveralls. The Nomex coveralls segment dominated the market with the largest revenue share of 57.4% in 2024, owing to its superior flame resistance, durability, and performance in high-heat and high-risk industrial environments. Its ability to maintain structural integrity without melting or dripping under extreme conditions has made it a preferred choice for oil & gas, petrochemical, and firefighting applications.

The flame resistant cotton coveralls segment is projected to witness the fastest CAGR from 2025 to 2032, driven by rising demand for cost-effective and comfortable FR solutions in low- to moderate-risk workplaces.

- By End-User Industry

On the basis of end-user industry, the market is segmented into oil and gas and manufacturing. The oil and gas segment accounted for the largest market share of 44.6% in 2024, driven by the sector’s stringent safety regulations, frequent exposure to flammable materials, and need for reliable personal protective equipment (PPE) during both onshore and offshore operations.

The manufacturing segment is anticipated to record the fastest growth rate from 2025 to 2032, supported by increasing adoption of FR coveralls in welding, metal fabrication, and chemical processing facilities.

- By Flame Resistance Standards

On the basis of flame resistance standards, the market is segmented into NFPA 70E and ASTM F1506. The NFPA 70E segment led the market with a share of 53.8% in 2024, reflecting its widespread adoption for protection against electrical arc flash hazards in utility, electrical maintenance, and industrial sectors.

The ASTM F1506 segment is expected to see the highest CAGR during the forecast period, driven by its growing application in compliance-focused industries such as manufacturing and chemical processing.

- By Size and Fit

On the basis of size and fit, the market is segmented into regular fit and relaxed fit. The regular fit segment dominated in 2024 with a market share of 61.5%, attributed to its balanced design that offers both comfort and safety compliance, making it suitable for a wide range of workers in various industries.

The relaxed fit segment is expected to expand at the fastest pace from 2025 to 2032, as it gains popularity among workers seeking greater mobility and comfort during long working hours.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into online and offline. The offline segment captured the largest share of 65.2% in 2024, supported by buyer preferences for physical product inspection, size verification, and immediate availability—particularly for bulk industrial orders.

The online segment is projected to record the fastest CAGR during 2025–2032, propelled by the expansion of e-commerce platforms, streamlined procurement processes, and the growing adoption of digital purchasing in industrial sectors.

Which Region Holds the Largest Share of the Flame Resistant (FR) Coveralls Market?

- North America dominated the flame resistant (FR) coveralls market with the largest revenue share of 33.58% in 2024, driven by stringent workplace safety regulations, high adoption of advanced protective gear, and the presence of leading FR fabric manufacturers

- Workers in sectors such as oil & gas, mining, and manufacturing in the region prioritize FR coveralls for their compliance with safety standards and enhanced thermal protection

- The market growth is further fueled by high disposable incomes, rising industrial safety awareness, and a strong focus on worker welfare, positioning FR coveralls as a standard requirement across multiple hazardous industries

U.S. Flame Resistant (FR) Coveralls Market Insight

U.S. flame resistant (FR) coveralls market captured the largest revenue share of 81% in 2024 within North America, supported by the country’s extensive oil & gas operations, strong regulatory frameworks such as OSHA, and increasing corporate emphasis on worker safety. Growth is further propelled by technological innovations in lightweight, breathable FR fabrics and rising demand from the utilities and construction sectors. The presence of key manufacturers and the expansion of distribution networks strengthen the market’s dominance.

Europe Flame Resistant (FR) Coveralls Market Insight

Europe flame resistant (FR) coveralls market is projected to grow at a substantial CAGR during the forecast period, driven by strict EU safety regulations, growing industrial activities, and the modernization of protective gear. The demand is further supported by increasing adoption in petrochemical, electrical, and defense industries. In addition, the shift toward sustainable, eco-friendly FR fabrics is influencing market trends, with a strong presence of advanced manufacturing facilities across the region.

U.K. Flame Resistant (FR) Coveralls Market Insight

U.K. market is expected to expand steadily, supported by stringent workplace safety laws, the growth of the renewable energy sector, and rising adoption in construction and oil & gas. Increasing awareness of occupational hazards and demand for high-quality, multi-layer FR protective clothing are driving growth. The country’s strong import network also ensures availability of innovative FR solutions.

Germany Flame Resistant (FR) Coveralls Market Insight

Germany’s market is expanding at a notable pace, fueled by its strong industrial base, especially in manufacturing, chemicals, and energy. The integration of advanced, ergonomic designs and eco-conscious materials into FR coveralls aligns with the country’s sustainability goals. Strict enforcement of worker safety norms and the push for technologically advanced PPE continue to shape the market landscape.

Which Region is the Fastest Growing Region in the Flame Resistant (FR) Coveralls Market?

Asia-Pacific flame resistant (FR) coveralls market is expected to grow at the fastest CAGR of 11.02% from 2025 to 2032, driven by rapid industrialization, rising investments in oil & gas, mining, and infrastructure sectors, and increased worker safety awareness. Government safety mandates, combined with growing domestic manufacturing capabilities, are expanding the availability and affordability of FR coveralls across the region.

Japan Flame Resistant (FR) Coveralls Market Insight

Japan’s market growth is supported by high safety compliance in manufacturing, shipbuilding, and energy sectors. The country’s strong innovation culture promotes the use of lightweight, high-performance FR fabrics, often integrated with comfort-enhancing designs for long wear. The aging workforce is also increasing demand for ergonomically designed PPE.

China Flame Resistant (FR) Coveralls Market Insight

China held the largest revenue share in Asia-Pacific in 2024, driven by its vast industrial workforce, stringent safety regulations in high-risk sectors, and rapid urbanization fueling construction activities. Domestic production capacity, coupled with government initiatives to improve workplace safety, ensures high market penetration. The availability of competitively priced FR coveralls also boosts adoption in both domestic and export markets.

Which are the Top Companies in Flame Resistant (FR) Coveralls Market?

The flame resistant (FR) coveralls industry is primarily led by well-established companies, including:

- DuPont (U.S.)

- Milsuch asn & Company (U.S.)

- Huntsman International LLC (U.S.)

- LENZING AG (Austria)

- Evonik Industries AG (Germany)

- Solvay (Belgium)

- TOYOBO CO., LTD (Japan)

- VF Corporation (U.S.)

- DuPont (U.S.)

- Glen Raven, Inc. (U.S.)

- Lakeland Inc (U.S.)

- Kimberly-Clark (U.S.)

- 3M (U.S.)

What are the Recent Developments in Global Flame Resistant (FR) Coveralls Market?

- In February 2024, Florida firefighters introduced a new fire-resistant apparel company that provides affordable, hassle-free uniforms for firefighters. FILO Apparel offers PFAS-free Nomex uniforms and clothing for both men and women, with direct-to-consumer pricing that is up to 56 percent lower on average than traditional firefighter uniform suppliers, making high-quality protective gear more accessible to first responders

- In January 2024, LyondellBasell (LYB) launched its all-in-one flame-retardant compound, Petrothene T3XL7420, designed to deliver substantial cost savings while streamlining manufacturing processes. This innovation also enhances the quality of end products for wire producers in the automotive and appliance sectors, reinforcing the company’s role as a key solutions provider for industrial safety

- In June 2023, Birla Cellulose, a unit of Grasim Industries Limited under the Aditya Birla Group, unveiled Birla SaFR at ITMA 2023 in Milan, Italy. This groundbreaking product reflects the company’s strategic vision to expand its offerings for the technical textile industry, setting a new benchmark in sustainable flame-resistant solutions

- In April 2023, Teijin Ltd. announced the launch of Tenax, a woven carbon fiber fabric coated with a thermoplastic polymer, available as fully impregnated and consolidated sheets made from multiple layers. This development marks a significant step in delivering advanced fire-resistant materials for high-performance applications

- In April 2023, Royal TenCate N.V. introduced Tecasafe 360, the first inherently flame-resistant (FR) stretch fabric on the market, combining inherent flame resistance with stretch for enhanced comfort. This launch underscores the company’s commitment to innovation in protective apparel fabrics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Flame Resistant Fr Coveralls Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Flame Resistant Fr Coveralls Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Flame Resistant Fr Coveralls Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.