Global Flat Panel Detector Fpd Based X Ray For Cone Beam Computed Tomography Market

Market Size in USD Billion

CAGR :

%

USD

1.08 Billion

USD

2.18 Billion

2024

2032

USD

1.08 Billion

USD

2.18 Billion

2024

2032

| 2025 –2032 | |

| USD 1.08 Billion | |

| USD 2.18 Billion | |

|

|

|

|

Flat Panel Detector (FPD)-Based X-Ray for Cone Beam Computed Tomography (CBCT) Market Size

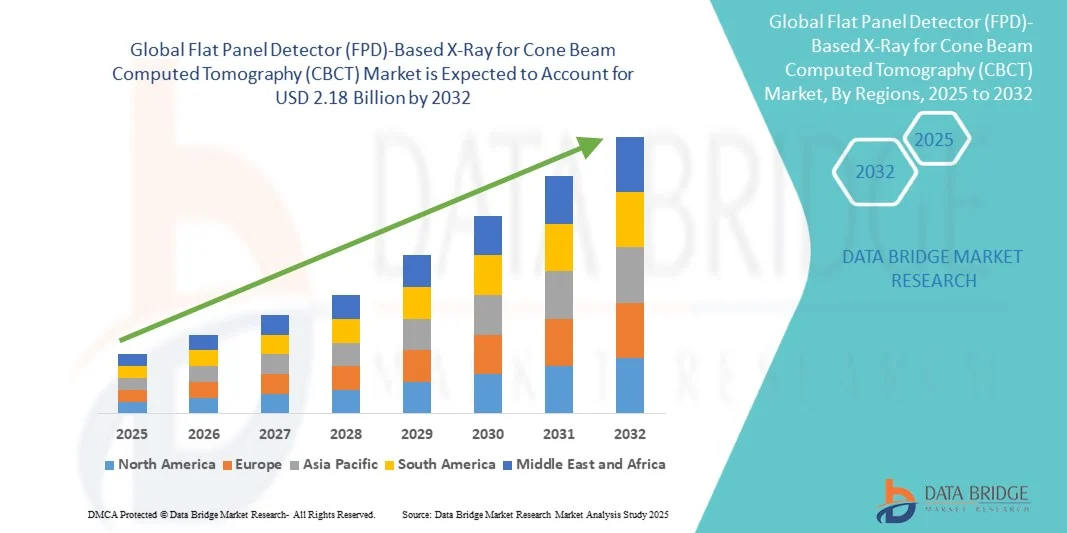

- The global Flat Panel Detector (FPD)-Based X-Ray for Cone Beam Computed Tomography (CBCT) market size was valued at USD 1.08 billion in 2024 and is expected to reach USD 2.18 billion by 2032, at a CAGR of 9.20% during the forecast period

- The market growth is largely driven by the increasing adoption of advanced imaging systems in dentistry, orthopedics, and oncology, as well as the shift toward more accurate, high-resolution diagnostic solutions enabled by FPD-based CBCT technology

- Furthermore, rising demand for minimally invasive diagnostics, coupled with technological advancements that enhance image clarity, reduce radiation dose, and improve workflow efficiency, is positioning FPD-based CBCT systems as the preferred choice in medical imaging. These dynamics are accelerating market penetration and significantly boosting industry growth

Flat Panel Detector (FPD)-Based X-Ray for Cone Beam Computed Tomography (CBCT) Market Analysis

- Flat Panel Flat panel detector (FPD)-based CBCT systems, offering high-resolution 3D imaging with reduced radiation exposure, are becoming increasingly vital in modern diagnostic imaging across dental, orthopedic, and oncology applications due to their precision, efficiency, and ability to integrate seamlessly with digital healthcare workflows

- The escalating demand for FPD-based CBCT is primarily fueled by the rising prevalence of dental disorders, orthopedic injuries, and cancer cases, alongside growing clinical preference for minimally invasive diagnostic imaging techniques

- North America dominated the FPD-based CBCT market with the largest revenue share of 39.8% in 2024, characterized by advanced healthcare infrastructure, early adoption of innovative imaging modalities, and a strong presence of key medical device manufacturers, with the U.S. experiencing substantial growth driven by investments in dental and orthopedic clinics, as well as AI-enabled imaging enhancements

- Asia-Pacific is expected to be the fastest-growing region in the FPD-based CBCT market during the forecast period due to rapid urbanization, increasing healthcare expenditure, and expanding access to advanced imaging technologies in countries such as China and India

- The dental application segment dominated the FPD-based CBCT market with a market share of 45.6% in 2024, driven by the technology’s widespread adoption in orthodontics, implantology, and endodontics, supported by its superior imaging accuracy and patient safety benefits

Report Scope and Flat Panel Detector (FPD)-Based X-Ray for Cone Beam Computed Tomography (CBCT) Market Segmentation

|

Attributes |

Flat Panel Detector (FPD)-Based X-Ray for Cone Beam Computed Tomography (CBCT) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Flat Panel Detector (FPD)-Based X-Ray for Cone Beam Computed Tomography (CBCT) Market Trends

Advancements in AI-Driven Imaging and Workflow Optimization

- A significant and accelerating trend in the global FPD-based CBCT market is the integration of artificial intelligence (AI) for imaging enhancement, workflow automation, and clinical decision support, improving diagnostic accuracy and operational efficiency

- For instance, Planmeca’s AI-powered CBCT systems automatically segment anatomical structures, reducing the time clinicians spend on manual image analysis while enhancing diagnostic clarity

- AI-enabled CBCT platforms provide advanced features such as automated lesion detection, adaptive image reconstruction to minimize artifacts, and intelligent radiation dose management, supporting safer and more effective patient care

- The integration of CBCT imaging with hospital information systems and digital platforms allows centralized data management, enabling clinicians to access and interpret scans alongside patient records in real time

- This trend toward AI-enhanced, interconnected imaging systems is reshaping expectations in medical imaging, with companies such as Carestream Dental developing AI-driven CBCT solutions that improve workflow productivity and diagnostic reliability

- Cloud-based CBCT platforms are gaining traction, allowing remote sharing of scans for tele-dentistry and collaborative treatment planning between specialists in different locations

- The demand for AI-integrated CBCT solutions is growing rapidly across dental, orthopedic, and oncology practices, as healthcare providers increasingly prioritize precision imaging and streamlined patient care delivery

Flat Panel Detector (FPD)-Based X-Ray for Cone Beam Computed Tomography (CBCT) Market Dynamics

Driver

Growing Demand Due to Rising Dental and Orthopedic Imaging Needs

- The increasing prevalence of dental disorders, orthopedic injuries, and cancer cases, coupled with the rising need for precise diagnostic imaging, is a significant driver of the demand for FPD-based CBCT systems

- For instance, in March 2024, Dentsply Sirona expanded its CBCT product line with new FPD-based solutions tailored for orthodontics and implantology, strengthening its position in advanced dental imaging

- As patients and clinicians seek safer diagnostic tools, FPD-based CBCT systems provide advantages such as lower radiation doses, improved image resolution, and faster scan times over traditional CT technologies

- Furthermore, the expanding use of minimally invasive treatment approaches in dentistry and orthopedics increases reliance on accurate CBCT imaging, making it integral to treatment planning

- The versatility of FPD-based CBCT in supporting multiple clinical applications, from endodontics to trauma assessment, is a key factor propelling adoption across hospitals, imaging centers, and specialty clinics

- Rising geriatric population worldwide, with higher susceptibility to dental and bone-related disorders, is expected to drive greater demand for CBCT-based diagnostics

- Growing preference for outpatient imaging centers and standalone dental clinics is fueling demand for compact, cost-efficient CBCT systems equipped with FPD technology

- The trend toward digitalization of healthcare workflows and the growing availability of user-friendly CBCT platforms further contribute to sustained market growth

Restraint/Challenge

High System Costs and Regulatory Compliance Hurdles

- The significant upfront cost of FPD-based CBCT systems and the complexity of regulatory approvals in various regions present challenges to widespread adoption, particularly in resource-constrained markets

- For instance, smaller dental clinics in developing economies often delay investment in CBCT systems due to budget limitations and stringent equipment certification requirements

- The high installation, maintenance, and training costs associated with these systems can discourage healthcare providers from transitioning to advanced imaging solutions

- Furthermore, compliance with evolving international radiation safety regulations and clinical data standards requires continuous investment from manufacturers, adding to cost pressures

- While affordable options are gradually emerging, the perception of CBCT systems as premium technology still limits adoption among price-sensitive users and smaller practices

- Shortages of skilled radiologists and technicians capable of handling CBCT data analysis create operational bottlenecks, particularly in developing healthcare markets

- Data privacy and cybersecurity concerns associated with digital storage and sharing of patient CBCT scans pose an additional barrier, especially as cloud-based imaging solutions expand

- Overcoming these challenges through cost-reduction strategies, improved financing models, and streamlined regulatory pathways will be vital for broader market penetration and sustained growth

Flat Panel Detector (FPD)-Based X-Ray for Cone Beam Computed Tomography (CBCT) Market Scope

The market is segmented on the basis of application, product, and end user

- By Application

On the basis of application, the market is segmented into dental and ENT. The Dental segment dominated the market with the largest revenue share of 45.6% in 2024, driven by its extensive use in orthodontics, implantology, endodontics, and maxillofacial surgery. Dental practitioners increasingly rely on CBCT imaging for its ability to provide precise 3D visualization of bone structures, root canals, and jaw alignment. The superior diagnostic accuracy compared to traditional 2D X-rays makes it an indispensable tool in modern dentistry. Rising prevalence of dental disorders, coupled with growing demand for cosmetic and restorative dental procedures, continues to fuel the segment’s leadership. Furthermore, integration of dental CBCT with digital workflows such as CAD/CAM and 3D printing further strengthens its adoption globally.

The ENT segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the increasing incidence of sinus disorders, ear pathologies, and other head and neck conditions that benefit from high-resolution 3D imaging. ENT specialists are adopting CBCT systems for their ability to deliver detailed visualization of bony structures with lower radiation exposure than conventional CT scans. Growing demand for minimally invasive ENT surgeries and the need for precise preoperative imaging are major contributors to this growth. Technological advances such as AI-assisted image reconstruction and reduced scanning times also make CBCT more attractive for ENT applications. Rising awareness of ENT-related health issues and expanding adoption in outpatient and specialty clinics further support the segment’s rapid expansion.

- By Product

On the basis of product, the market is segmented into sitting, standing, and lying down CBCT systems. The Standing CBCT systems segment dominated the market in 2024, as they are widely used in dental and maxillofacial imaging where patient positioning is crucial for high-quality scans. Standing units are preferred for their ability to capture precise craniofacial images without motion artifacts, making them the standard choice for orthodontists and implantologists. Their compatibility with advanced FPD technology ensures better image resolution and lower dose efficiency. Hospitals and clinics favor standing CBCT due to their established reliability and integration with existing imaging workflows. In addition, manufacturers continue to introduce ergonomic designs in standing CBCT systems to enhance patient comfort and clinical efficiency, reinforcing the segment’s leadership.

The Sitting CBCT systems segment is expected to witness the fastest growth rate from 2025 to 2032, driven by their suitability for patients with limited mobility, children, and elderly populations. Sitting systems improve patient comfort and compliance, which reduces retakes and ensures high-quality imaging outcomes. They are increasingly being adopted in smaller dental practices and diagnostic centers where space and accessibility are critical factors. With growing awareness of patient-centric care, healthcare providers are opting for sitting CBCT systems to accommodate a broader range of patient demographics. Compact and portable designs being introduced by manufacturers are also expanding adoption in emerging markets. The emphasis on inclusive healthcare and enhanced patient experience is expected to accelerate the uptake of sitting CBCT systems globally.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, diagnostic centres, and other end users. The Hospitals segment dominated the market in 2024, as hospitals remain the primary centers for advanced diagnostic imaging and surgical planning. The integration of FPD-based CBCT in hospital settings allows multi-specialty use across dental, orthopedic, oncology, and ENT departments. Hospitals are equipped with the infrastructure and skilled professionals necessary to maximize the utilization of CBCT technology. The growing demand for comprehensive diagnostic capabilities and the availability of funding for advanced imaging technologies support the segment’s dominance. Hospitals also benefit from collaborations with manufacturers for large-scale procurement and access to the latest innovations, ensuring their continued leadership in the CBCT market.

The Clinics segment is projected to grow at the fastest CAGR from 2025 to 2032, propelled by the rising number of dental and specialty clinics adopting CBCT for outpatient imaging. Clinics are increasingly focusing on providing advanced diagnostic services to enhance patient outcomes and attract more patients. FPD-based CBCT systems’ compact designs and relatively lower operational costs make them suitable for private practices and smaller clinical setups. The rising popularity of cosmetic dentistry and personalized treatment planning is also fueling adoption in clinics. Moreover, the trend toward point-of-care imaging and faster turnaround times aligns well with the operational model of clinics. This rapid adoption positions the clinics segment as the fastest-growing in the forecast period.

Flat Panel Detector (FPD)-Based X-Ray for Cone Beam Computed Tomography (CBCT) Market Regional Analysis

- North America dominated the FPD-based CBCT market with the largest revenue share of 39.8% in 2024, characterized by advanced healthcare infrastructure, early adoption of innovative imaging modalities, and a strong presence of key medical device manufacturers, with the U.S. experiencing substantial growth driven by investments in dental and orthopedic clinics, as well as AI-enabled imaging enhancements

- Healthcare providers in the region highly value the superior image quality, reduced radiation dose, and multi-application capabilities of CBCT systems, making them essential for dental, orthopedic, and ENT practices

- This widespread adoption is further supported by favorable reimbursement frameworks, a high prevalence of dental and bone-related disorders, and the growing emphasis on minimally invasive diagnostic solutions, establishing FPD-based CBCT as a preferred imaging modality across hospitals and clinics

U.S. Flat Panel Detector (FPD)-Based X-Ray for Cone Beam Computed Tomography (CBCT) Market Insight

The U.S. FPD-based CBCT market captured the largest revenue share of 79% in 2024 within North America, driven by rapid adoption of advanced imaging systems in dental and orthopedic practices. Healthcare providers are prioritizing accurate diagnostics through high-resolution, low-radiation imaging solutions. The growing trend of outpatient and chairside imaging, combined with the rising demand for 3D imaging in surgical planning, is further fueling market growth. In addition, integration of CBCT systems with digital health platforms and electronic medical records is significantly contributing to the market’s expansion.

Europe Flat Panel Detector (FPD)-Based X-Ray for Cone Beam Computed Tomography (CBCT) Market Insight

The Europe FPD-based CBCT market is projected to expand at a notable CAGR throughout the forecast period, primarily due to supportive healthcare regulations and strong investments in advanced imaging technologies. The growing demand for improved diagnostic accuracy across dental, ENT, and orthopedic practices is fostering adoption. European patients and clinicians are also drawn to CBCT’s efficiency, reduced radiation exposure, and versatility across clinical applications. The market is witnessing growth in both public hospitals and private clinics, with increasing incorporation into routine diagnostics and treatment planning.

U.K. Flat Panel Detector (FPD)-Based X-Ray for Cone Beam Computed Tomography (CBCT) Market Insight

The U.K. FPD-based CBCT market is anticipated to grow at a strong CAGR during the forecast period, fueled by the rising prevalence of dental disorders and the push toward digitized healthcare solutions. Growing awareness among healthcare providers regarding the clinical benefits of CBCT imaging for early diagnosis is accelerating adoption. The integration of AI-driven imaging software, alongside supportive government initiatives in healthcare modernization, is expected to stimulate market growth across both public and private healthcare sectors.

Germany Flat Panel Detector (FPD)-Based X-Ray for Cone Beam Computed Tomography (CBCT) Market Insight

The Germany FPD-based CBCT market is expected to expand at a considerable CAGR during the forecast period, supported by the country’s strong healthcare infrastructure and emphasis on advanced diagnostic tools. Germany’s focus on innovation and sustainability is fostering the uptake of CBCT systems, particularly those offering dose efficiency and superior imaging capabilities. The increasing use of CBCT in dental practices, surgical planning, and research institutions is driving demand, with manufacturers aligning with Germany’s preference for high-quality, precision-driven technologies.

Asia-Pacific Flat Panel Detector (FPD)-Based X-Ray for Cone Beam Computed Tomography (CBCT) Market Insight

The Asia-Pacific FPD-based CBCT market is set to grow at the fastest CAGR of 23% during 2025 to 2032, driven by rising healthcare expenditure, expanding urban populations, and growing awareness of advanced imaging technologies in countries such as China, Japan, and India. The push for better diagnostic accuracy and government-led healthcare digitization programs is supporting adoption. Moreover, APAC’s role as a hub for medical device manufacturing enhances affordability, making CBCT systems more accessible to clinics, hospitals, and diagnostic centers across the region.

Japan Flat Panel Detector (FPD)-Based X-Ray for Cone Beam Computed Tomography (CBCT) Market Insight

The Japan FPD-based CBCT market is gaining traction due to its strong medical technology ecosystem, aging population, and rising need for precise diagnostics. Healthcare providers in Japan value CBCT systems for their integration with other digital imaging and treatment planning solutions. The country’s emphasis on minimally invasive procedures and early diagnosis is fueling market growth. In addition, the widespread use of CBCT in dental and maxillofacial imaging, supported by advanced R&D activities, is propelling adoption across hospitals and specialized clinics.

India Flat Panel Detector (FPD)-Based X-Ray for Cone Beam Computed Tomography (CBCT) Market Insight

The India FPD-based CBCT market accounted for the largest market revenue share in Asia Pacific in 2024, supported by the country’s rapid urbanization, expanding dental tourism industry, and increasing awareness of 3D imaging technologies. Affordable CBCT systems offered by domestic and international manufacturers are driving adoption across mid-sized hospitals and specialty clinics. Government initiatives promoting healthcare modernization and the rising demand for diagnostic solutions in both urban and semi-urban regions are further boosting the market.

Flat Panel Detector (FPD)-Based X-Ray for Cone Beam Computed Tomography (CBCT) Market Share

The Flat Panel Detector (FPD)-Based X-Ray for Cone Beam Computed Tomography (CBCT) industry is primarily led by well-established companies, including:

- PLANMECA OY (Finland)

- Dentsply Sirona (U.S.)

- VATECH (Republic of Korea)

- J. MORITA CORP. (Japan)

- Cefla S.C. (Italy)

- PreXion Inc. (U.S.)

- Carestream Dental LLC (U.S.)

- RAY Co. (Republic of Korea)

- GENORAY Co., Ltd. (Republic of Korea)

- ACTEON (France)

- Detection Technology Plc (Finland)

- Varex Imaging Corporation (U.S.)

- DEXIS (U.S.)

- Gendex (U.S.)

- Xoran Technologies (U.S.)

- MYRAY (Italy)

- Soredex (Finland)

- KaVo Dental (Germany)

- Owandy Radiology (France)

What are the Recent Developments in Flat Panel Detector (FPD)-Based X-Ray for Cone Beam Computed Tomography (CBCT) Market?

- In March 2025, Detection Technology announced the launch of the X-Panel 2520z FOM — a first-of-its-kind 25 × 20 cm IGZO-TFT flat panel detector designed to elevate dental and CBCT imaging through a larger field of view and improved image quality, enabling manufacturers and system integrators to offer higher-resolution CBCT scans with improved workflow and dose efficiency. This launch signals continued detector-level innovation that enables next-generation CBCT systems with broader clinical use cases

- In November 2024, Detection Technology unveiled an expanded portfolio of advanced flat panel X-ray detectors at RSNA 2024, showcasing multiple medical-grade FPDs (including high frame-rate, low-dose and IGZO/TFT models) positioned for applications ranging from surgical imaging to CBCT — reinforcing the trend of detector vendors driving performance gains that CBCT manufacturers can integrate to improve image fidelity, speed, and clinical versatility

- In October 2023, PreXion, Inc. launched the PreXion3D Evolve — a 3-in-1 CBCT/PAN/CEPH imaging platform along with the new Evolve intraoral sensor, providing clinics a unified workflow solution with high-resolution modes (including very small voxel endodontic settings), motion correction, and improved image processing; the package strengthened options for small and mid-sized dental practices to adopt CBCT-capable systems with integrated 2D/3D capability

- In April 2022, Carestream Dental introduced updates (Neo Edition and related releases) aimed at broadening access to CBCT imaging — positioning upgraded CS 8200/CS 9600 family features and cloud/software integrations to bring 3D imaging and enhanced software workflows to more practices; this development underlined the industry push to make CBCT functionality more accessible through software and product variants tailored for different practice sizes

- In September 2021, NEWTOM (QT-Imaging/CEFLA group) held NEWTOM Forum 2021 and continued to publicize and promote its VGi EVO / VGi-series CBCT platforms, highlighting extended FOV capability, ECO-Scan low-dose modes, and expanded clinical applications (maxillofacial, ENT, and head-neck imaging); these product and knowledge-sharing activities helped sustain adoption of FPD-based CBCT technology in clinical communities during the post-pandemic recovery

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.