Global Flat Panel Displays Market

Market Size in USD Billion

CAGR :

%

USD

167.40 Billion

USD

290.00 Billion

2024

2032

USD

167.40 Billion

USD

290.00 Billion

2024

2032

| 2025 –2032 | |

| USD 167.40 Billion | |

| USD 290.00 Billion | |

|

|

|

|

Flat Panel Displays Market Size

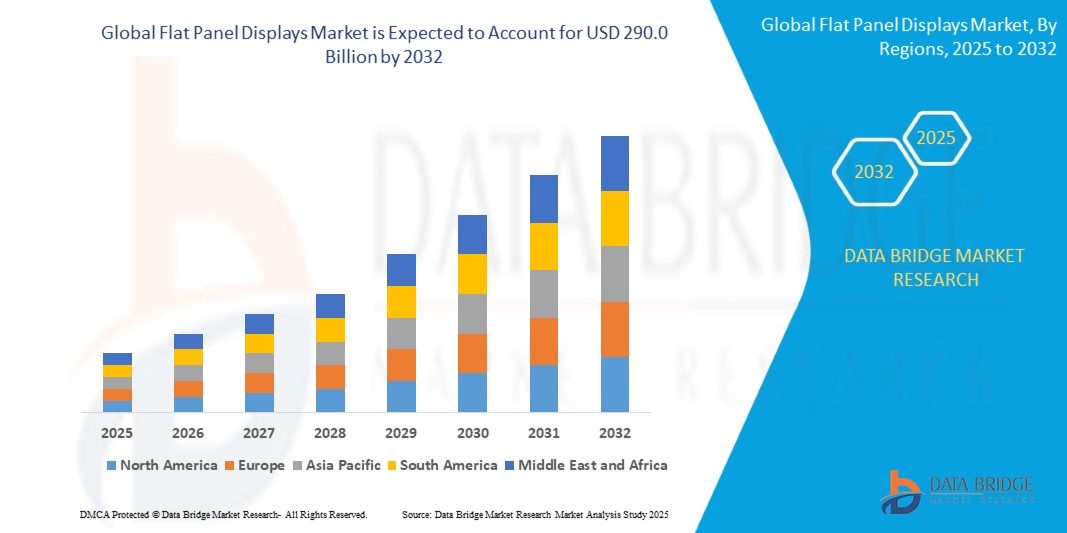

- The Global Flat Panel Displays Market Size was valued at USD 167.4 Billion in 2024 and is expected to reach USD 290.0 Billion by 2032, at a CAGR of 8.2% during the forecast period

- The Global Flat Panel Displays Market is growing due to advancements in display technologies (like OLED and Quantum Dot), rising consumer demand for high-resolution screens in devices like smartphones and TVs, and expanding use in industries such as automotive, healthcare, and digital signage.

Flat Panel Displays Market Analysis

- The Global Flat Panel Displays Market is witnessing significant growth as industries such as automotive, consumer electronics, healthcare, and industrial automation increasingly adopt advanced display technologies. This trend is being driven by the rising demand for high-resolution visuals, compact and energy-efficient display modules, and the integration of smart features into everyday devices. As a result, flat panel displays essential components for visual interfaces have become a cornerstone in modern digital design across a variety of sectors.

- Technological advancements in display systems are a primary catalyst for this market’s growth. Innovations in OLED, AMOLED, micro-LED, and quantum dot technologies are enabling superior image quality, lower power consumption, and thinner, more flexible screens. The shift from traditional cathode-ray tube (CRT) and basic LCDs to next-generation flat panel displays in emerging markets is further accelerating adoption. Moreover, the integration of touch-sensitive controls, adaptive brightness, and energy-efficient backlighting is enabling enhanced user interaction and greater device performance across different environments.

- The demand for sleeker, smarter, and more energy-efficient devices is reshaping the flat panel display landscape. In the automotive sector, digital instrument clusters, infotainment systems, and head-up displays are becoming standard, requiring robust and responsive displays. In the consumer electronics domain, the trend is shifting toward ultra-high-definition (UHD) TVs, foldable smartphones, and wearable displays that deliver immersive experiences. Industrial and healthcare sectors are also incorporating advanced displays for monitoring, diagnostics, and automation control.

- Despite strong momentum, the market faces a few restraints. These include the high manufacturing cost of advanced technologies such as OLED and micro-LED, which may limit affordability and mass-market penetration. Additionally, supply chain disruptions, the complexity of production processes, and fluctuations in raw material prices can pose challenges for manufacturers in meeting demand and maintaining profitability.

- Nonetheless, the future outlook remains optimistic. Growth in developing regions, increasing demand for consumer electronics, expansion of smart automotive technologies, and innovations in foldable and transparent displays are expected to create new opportunities. As flat panel display technology becomes more intelligent, efficient, and integrated with connected ecosystems, the Global Flat Panel Displays Market is well-positioned for sustained expansion over the coming years.

Report Scope and Flat Panel Displays Market Segmentation

|

Attributes |

Flat Panel Displays Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Flat Panel Displays Market Trends

Rapid Uptake of OLED & Micro‑LED Technologies

- The global flat panel displays market is undergoing a transformative shift with the increasing adoption of OLED (Organic Light-Emitting Diode) and Micro‑LED technologies. OLED displays are widely favored for their superior contrast ratios, deep blacks, wider viewing angles, and thinner form factors compared to traditional LCDs. These features make OLEDs ideal for premium smartphones, smart TVs, and wearable devices. In particular, the ability of OLEDs to deliver vibrant colors and consume less power in dark-mode usage has significantly boosted their demand across consumer electronics.

- Meanwhile, Micro‑LED technology is emerging as a next-generation alternative to both OLED and LCD. Micro‑LEDs consist of microscopic LEDs that can emit their own light, offering even higher brightness, longer lifespan, and energy efficiency without the burn-in issues associated with OLEDs. This makes them especially attractive for applications such as augmented reality (AR), virtual reality (VR), and high-end commercial displays. Their fast response times and durability also make them suitable for outdoor and automotive environments.

- The growing focus on energy efficiency, thin and flexible displays, and superior visual experience is further propelling the shift towards these technologies. Companies like Samsung, LG Display, and BOE are heavily investing in OLED and Micro‑LED R&D and production capacity to meet rising global demand. As manufacturing costs continue to decrease and scalability improves, OLED and Micro‑LED are expected to dominate future display innovations across sectors.

Flat Panel Displays Market Dynamics

Driver

Rising Demand for Consumer Electronics

- One of the most significant drivers of the Global Flat Panel Displays Market is the surging demand for consumer electronics worldwide. Products such as smartphones, tablets, laptops, smartwatches, and televisions increasingly rely on high-quality, energy-efficient, and visually superior displays. As consumer preferences shift toward larger screen sizes, higher resolutions, and sleeker designs, manufacturers are adopting advanced flat panel display technologies like OLED, AMOLED, and Micro-LED to meet these expectations.

- In particular, the proliferation of smartphones and wearable devices has intensified the demand for compact, high-performance displays that offer vivid colors, deep contrasts, and low power consumption. Likewise, the popularity of streaming services and gaming has led to a surge in demand for ultra-high-definition (UHD) televisions and monitors, further propelling flat panel display adoption.

- Moreover, remote work and digital learning trends, accelerated by global shifts during and after the COVID-19 pandemic, have increased reliance on laptops, tablets, and computer monitors all of which are key application areas for flat panel displays. As a result, display panel makers are continuously innovating to deliver thinner, lighter, and more responsive screens that can adapt to various consumer electronics use cases.

- This ongoing growth in consumer electronics especially in emerging markets with rising disposable incomes continues to act as a strong catalyst for the expansion of the global flat panel displays market.

Restraint/Challenge

High Manufacturing, R&D Costs and Short Product Life Cycles and Rapid Tech Obsolescence

- One of the major challenges in the global flat panel displays market is the high cost associated with manufacturing and research & development (R&D). Cutting-edge display technologies such as OLED, AMOLED, Micro-LED, and QD-OLED require sophisticated fabrication techniques, highly controlled environments, and costly raw materials like rare earth elements, organic compounds, and specialized semiconductors. This makes the production process capital-intensive and limits the number of companies that can afford to compete in this space.

- Moreover, R&D investments are critical to remain competitive, as companies constantly seek to improve panel brightness, resolution, flexibility, energy efficiency, and durability. The need to develop thinner, lighter, and foldable displays, as well as integration with smart technologies and sensors, further adds to the development burden. For smaller players or those with limited financial resources, these high upfront costs present a significant entry barrier and can limit their market participation or innovation capabilities.

- The flat panel display industry is characterized by extremely short product life cycles, driven by rapid advancements in technology and ever-evolving consumer preferences. Newer display formats like 8K resolution, foldable screens, transparent displays, and Micro-LED panels are continuously entering the market, pushing older technologies toward obsolescence at a fast pace.

- This constant innovation cycle forces manufacturers to update product lines frequently, increasing costs for tooling, design, marketing, and inventory management. For end-users and OEMs (Original Equipment Manufacturers), this also creates the risk of investing in technologies that may soon become outdated, impacting sales and margins. Additionally, it puts pressure on supply chains and increases the risk of unsold inventory or depreciation in product value.

- In such a fast-moving market, companies must balance innovation with cost-efficiency and sustainability, which is increasingly difficult given the speed of change and the scale of investment required.

Flat Panel Displays Market Scope

The market is segmented on the basis of Technology, Application, End-user and Display Size.

- By Technology

The flat panel displays market is segmented into LCD, OLED, LED, and Quantum Dot technologies. LCD (Liquid Crystal Display) continues to dominate due to its wide availability and cost-effectiveness, especially in mass-market TVs, monitors, and smartphones. OLED (Organic Light-Emitting Diode) technology is gaining significant traction owing to its superior contrast, flexibility, and energy efficiency, particularly in high-end smartphones and premium televisions. LED (Light-Emitting Diode) displays are used in both backlighting (in LCDs) and in direct-view applications such as digital signage and large format displays. Quantum Dot displays, known for their enhanced color accuracy and brightness, are increasingly adopted in 4K and 8K television segments, providing an improved visual experience.

- By Application

Applications of flat panel displays span across Smartphones and Tablets, Television and Digital Signage, PC and Laptop, Smart Wearables, and Vehicle Displays. Smartphones and tablets are the largest consumers of display panels, driving volume and innovation due to their high refresh rates and vibrant color needs. Television and digital signage represent a mature yet evolving segment, with growth fueled by 4K/8K demand and digital advertising trends. PCs and laptops continue to adopt higher-resolution and thinner displays to cater to hybrid work and gaming. Smart wearables, including smartwatches and fitness bands, are witnessing rising adoption of small, low-power OLED and Micro-LED panels. Vehicle displays, such as digital instrument clusters, infotainment systems, and head-up displays, are expanding with the automotive industry's move toward smart and connected vehicles.

- By End-user

The market is categorized by end-users such as Consumer Electronics, Automotive, Healthcare, Retail and Advertisement, BFSI (Banking, Financial Services, and Insurance), and Industrial. Consumer electronics dominate the market with constant demand for newer, more advanced display features. The automotive sector is a growing application area with the integration of high-tech display solutions into both luxury and mainstream vehicles. In healthcare, high-resolution displays are essential for imaging, diagnostics, and patient monitoring. Retail and advertisement are leveraging digital signage and interactive displays for dynamic promotions and customer engagement. BFSI institutions utilize flat panels in ATMs, digital kiosks, and branch displays, while industrial applications require rugged displays for factory automation, control systems, and data monitoring.

- By Display Size

Based on display size, the market is segmented into <10 Inches, 10–20 Inches, 20–30 Inches, 30–40 Inches, and >40 Inches. Displays less than 10 inches are primarily used in smartphones, smartwatches, and handheld devices. The 10–20 inch range serves tablets, small monitors, and automotive interfaces. 20–30 inch displays are popular in desktop monitors, mid-sized TVs, and industrial equipment. The 30–40 inch segment is relevant to televisions and mid-range digital signage. Displays larger than 40 inches are commonly used in home entertainment systems, commercial signage, and collaborative display environments like conference rooms or retail billboards.

Flat Panel Displays Market Regional Analysis

- North America holds a significant share of the global flat panel displays market, driven by strong demand for advanced consumer electronics, smart TVs, laptops, and high-end smartphones. The region is also home to key technology giants and early adopters of emerging display technologies like OLED and Micro-LED. Additionally, increasing investments in digital signage across retail, transport, and public infrastructure, along with the integration of automotive displays in connected vehicles, are boosting market growth. The U.S. dominates the regional market due to its robust innovation ecosystem and high consumer purchasing power.

- Europe represents a mature yet steadily growing market for flat panel displays. The region emphasizes sustainability and energy-efficient technologies, favoring OLED and Quantum Dot panels in consumer and commercial applications. The automotive sector, especially in Germany and France, is adopting advanced in-car display systems, enhancing demand. Moreover, digital transformation in healthcare, BFSI, and industrial sectors is creating consistent growth opportunities for display technologies. The region also benefits from a highly developed infrastructure supporting smart city initiatives and interactive public displays.

- Asia-Pacific is the largest and fastest-growing market for flat panel displays, led by countries such as China, Japan, South Korea, and India. This region is the global manufacturing hub for flat panel displays, housing major producers like Samsung Display, LG Display, BOE Technology, and AUO. Rapid urbanization, rising disposable incomes, and strong demand for smartphones, televisions, and laptops are driving consumption. Additionally, government initiatives promoting smart cities, 5G infrastructure, and industrial automation are fueling the need for advanced display systems. China leads in volume, while South Korea and Japan dominate in innovation and exports.

- The flat panel displays market in Latin America is experiencing moderate growth, mainly driven by the rising penetration of smart TVs, mobile devices, and digital signage in urban centers. Countries like Brazil and Mexico are leading regional demand, supported by growing middle-class populations and increasing access to internet services and digital content. However, economic volatility and limited local manufacturing capacity continue to pose challenges. Investments in retail technology and smart advertising solutions are gradually pushing demand for flat panel displays in this region.

- The Middle East and Africa region is an emerging market for flat panel displays, with increasing adoption in retail, hospitality, and transportation sectors. Digital transformation initiatives and large infrastructure projects in the UAE, Saudi Arabia, and South Africa are creating opportunities for digital signage, control room displays, and interactive panels. While the consumer electronics segment is growing, it is still limited by lower disposable income and import dependence. However, as internet penetration rises and smart city projects expand, the demand for advanced display technologies is expected to grow steadily.

United States

The U.S. leads the flat panel displays market in North America, driven by strong demand from the consumer electronics, automotive, aerospace, and defense sectors. Growth is fueled by rising adoption of OLED and microLED technologies, along with innovation in high-resolution and energy-efficient displays for smartphones, TVs, and AR/VR devices.

Germany

Germany anchors the European market with a focus on high-end automotive and industrial applications. The integration of advanced display technologies in premium vehicles and industrial equipment, along with strong R&D capabilities, supports steady market demand and innovation.

China

China dominates the Asia-Pacific flat panel displays market as the world’s largest producer and consumer. Massive investments in OLED, LCD, and flexible display production, government support for the semiconductor and electronics industries, and the presence of key players like BOE and Visionox underpin its global leadership.

India

India is an emerging market with increasing demand for TVs, smartphones, tablets, and digital signage. Government initiatives like “Make in India,” growth in consumer electronics manufacturing, and rising disposable incomes are driving domestic consumption and production of flat panel displays.

South Korea

South Korea maintains a leading position in the global market through its technological advancements in OLED, AMOLED, and QLED displays. Major players like Samsung and LG Display continue to invest in next-gen display tech for smartphones, TVs, and wearable devices, ensuring South Korea's dominance in high-end segments.

Flat Panel Displays Market Share

The Global Flat Panel Displays industry is primarily led by well-established companies, including:

- Samsung Electronics Co., Ltd. (Suwon, South Korea)

- LG Display Co., Ltd. (Seoul, South Korea)

- BOE Technology Group Co., Ltd. (Beijing, China)

- AU Optronics Corp. (Hsinchu, Taiwan)

- Innolux Corporation (Miaoli, Taiwan)

- Sharp Corporation (Sakai, Osaka, Japan)

- Japan Display Inc. (JDI) (Tokyo, Japan)

- Tianma Microelectronics Co., Ltd. (Shenzhen, China)

- Visionox Technology Inc. (Gu’an, Hebei, China)

- HannStar Display Corporation (Taipei, Taiwan)

Latest Developments in Global Flat Panel Displays Market

- In June 2025, Samsung unveiled the Odyssey OLED G6, the world’s first 500 Hz OLED gaming monitor, marking a major leap in display refresh rates for e-sports and high-end gaming.

- In May 2025, Samsung Display introduced ultra-bright OLED panels for laptops and smartphones, achieving up to 5,000 nits peak brightness, improving visibility and battery efficiency in mobile devices.

- In April 2025, Omdia forecasted that Mini-LED backlit LCD TVs would surpass OLED TVs in unit shipments by the end of the year, signaling a strong market shift toward high-brightness, cost-effective alternatives.

- In February 2025, LG Display launched its next-gen stacked WOLED panel, improving brightness by 33% and simplifying manufacturing by reducing the number of layers.

- In January 2025, global manufacturers showcased a wave of automotive Micro-LED innovations at CES, including curved, transparent, and foldable dashboard displays tailored for electric and autonomous vehicles.

- In February 2025, analysts declared 2025 as the breakthrough year for Micro-LED mass production, with manufacturers such as BOE, AUO, and Tianma ramping up pilot production lines for smartwatches, TVs, and AR applications.

- In May 2025, during SID (Touch Taiwan), Aledia demonstrated nanowire Micro-LED displays with enhanced brightness and efficiency for AR and ultra-high-resolution signage applications.

- In May 2025, display giants including Innolux, AUO, TCL CSOT, and Unilumin revealed transparent, modular, and gesture-sensing Micro-LED displays, aimed at commercial, automotive, and retail environments.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL FLAT PANEL DISPLAYMARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL FLAT PANEL DISPLAYMARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 MULTIVARIATE MODELLING

2.2.6 STANDARDS OF MEASUREMENT

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL FLAT PANEL DISPLAYMARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 TECHNOLOGY LANDSCAPE

6 IMPACT OF COVID-19 PANDEMIC ON THE GLOBAL FLAT PANEL DISPLAYMARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVIF-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTUERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 GLOBAL FLAT PANEL DISPLAY MARKET,BY TECHNOLOGY

7.1 OVERVIEW

7.2 OLED

7.2.1 AMOLED DISPLAY

7.2.2 PMOLED DISPLAY

7.2.3 OTHERS

7.3 LCD

7.3.1 PMLCD (PASSIVE MATRIX LIQUID CRYSTAL DISPLAY)

7.3.2 AMLCD (ACTIVE MATRIX LIQUID CRYSTAL DISPLAY)

7.3.3 THIN FILM TRANSISTOR LIQUID CRYSTAL DISPLAY (TFT LCD)

7.3.4 OTHERS

7.4 LED

7.4.1 CONVENTIONAL LED DISPLAYS

7.4.2 SURFACE MOUNTED LED DISPLAYS

7.5 QUANTUM DOT

7.5.1 IN-CHIP

7.5.2 ON-CHIP

7.5.3 ON-PANEL

7.5.4 IN-PANEL

7.5.5 OTHERS

7.6 PLASMA DISPLAY

7.7 OTHERS

8 GLOBAL FLAT PANEL DISPLAY MARKET,BY RESOLUTION

8.1 OVERVIEW

8.2 8K

8.3 4K

8.4 HD

8.4.1 WQHD

8.4.2 FHD

8.5 UHD

8.6 VGA

8.7 XGA

8.8 SXGA

8.9 WSXGA

8.1 UXGA

8.11 WUXGA

8.12 OTHERS

9 GLOBAL FLAT PANEL DISPLAY MARKET,BY COLOR

9.1 OVERVIEW

9.2 BLACK AND WHITE

9.3 MONOCHROME

9.4 COLOR (RGB)

10 GLOBAL FLAT PANEL DISPLAY MARKET,BYMOUNTING TYPE

10.1 OVERVIEW

10.2 CHASSIS MOUNT

10.3 POLE MOUNT

10.4 WALL MOUNT

10.5 PANEL MOUNT

10.6 YOKE MOUNT

10.7 RACK MOUNT

10.8 OTHERS

11 COLORGLOBAL FLAT PANEL DISPLAY MARKET,BYINSPECTION EQUIPMENT

11.1 OVERVIEW

11.2 ARRAY TEST

11.3 CELL TEST

11.4 MODULE TEST

11.5 OTHERS

12 GLOBAL FLAT PANEL DISPLAY MARKET,BYDISPLAY SIZE

12.1 OVERVIEW

12.2 LESS THAN 10 INCHES

12.3 10 - 20 INCHES

12.4 20 – 30 INCHES

12.5 30 - 40 INCHES

12.6 40 - 50 INCHES

12.7 50 – 60 INCHES,

12.8 GREATER THAN 60 INCHES

13 GLOBAL FLAT PANEL DISPLAY MARKET,BYAPPLICATION

13.1 OVERVIEW

13.2 SMARTPHONE & TABLET

13.2.1 OLED

13.2.2 QUANTUM DOT

13.2.3 PLASMA DISPLAY

13.2.4 LED

13.2.5 LCD

13.2.6 OTHERS

13.3 SMART WEARABLE

13.3.1 OLED

13.3.2 QUANTUM DOT

13.3.3 PLASMA DISPLAY

13.3.4 LED

13.3.5 LCD

13.3.6 OTHERS

13.4 TELEVISION AND DIGITAL SIGNAGE

13.4.1 OLED

13.4.2 QUANTUM DOT

13.4.3 PLASMA DISPLAY

13.4.4 LED

13.4.5 LCD

13.4.6 OTHERS

13.5 PC & LAPTOP

13.5.1 OLED

13.5.2 QUANTUM DOT

13.5.3 PLASMA DISPLAY

13.5.4 LED

13.5.5 LCD

13.5.6 OTHERS

13.6 VEHICLE DISPLAY

13.6.1 OLED

13.6.2 QUANTUM DOT

13.6.3 PLASMA DISPLAY

13.6.4 LED

13.6.5 LCD

13.6.6 OTHERS

13.7 OTHERS

13.7.1 OLED

13.7.2 QUANTUM DOT

13.7.3 PLASMA DISPLAY

13.7.4 LED

13.7.5 LCD

13.7.6 OTHERS

14 GLOBAL FLAT PANEL DISPLAYMARKET,BYVERTICAL

14.1 OVERVIEW

14.2 CONSUMER ELECTRONICS

14.2.1 OLED

14.2.2 LCD

14.2.3 LED

14.2.4 QUANTUM DOT

14.2.5 PLASMA DISPLAY

14.2.6 OTHERS

14.3 HEALTHCARE

14.3.1 OLED

14.3.2 LCD

14.3.3 LED

14.3.4 QUANTUM DOT

14.3.5 PLASMA DISPLAY

14.3.6 OTHERS

14.4 RETAIL& HOSPITALITY

14.4.1 OLED

14.4.2 LCD

14.4.3 LED

14.4.4 QUANTUM DOT

14.4.5 PLASMA DISPLAY

14.4.6 OTHERS

14.5 BFSI

14.5.1 OLED

14.5.2 LCD

14.5.3 LED

14.5.4 QUANTUM DOT

14.5.5 PLASMA DISPLAY

14.5.6 OTHERS

14.6 MILITARY & DEFENSE

14.6.1 OLED

14.6.2 LCD

14.6.3 LED

14.6.4 QUANTUM DOT

14.6.5 PLASMA DISPLAY

14.6.6 OTHERS

14.7 EDUCATION

14.7.1 OLED

14.7.2 LCD

14.7.3 LED

14.7.4 QUANTUM DOT

14.7.5 PLASMA DISPLAY

14.7.6 OTHERS

14.8 AUTOMOTIVE

14.8.1 OLED

14.8.2 LCD

14.8.3 LED

14.8.4 QUANTUM DOT

14.8.5 PLASMA DISPLAY

14.8.6 OTHERS

14.9 OTHERS

15 GLOBAL FLAT PANEL DISPLAY MARKET, BY REGION

15.1 GLOBAL FLAT PANEL DISPLAYMARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.1.1 NORTH AMERICA

• U.S.

• CANADA

• MEXICO

15.1.2 EUROPE

• GERMANY

• FRANCE

• U.K.

• ITALY

• SPAIN

• RUSSIA

• TURKEY

• BELGIUM

• NETHERLANDS

• SWITZERLAND

• REST OF EUROPE

15.1.3 ASIA PACIFIC

• JAPAN

• CHINA

• SOUTH KOREA

• INDIA

• AUSTRALIA

• SINGAPORE

• THAILAND

• MALAYSIA

• INDONESIA

• PHILIPPINES

• REST OF ASIA PACIFIC

15.1.4 SOUTH AMERICA

• BRAZIL

• ARGENTINA

• REST OF SOUTH AMERICA

15.1.5 MIDDLE EAST AND AFRICA

• SOUTH AFRICA

• EGYPT

• SAUDI ARABIA

• U.A.E

• ISRAEL

• REST OF MIDDLE EAST AND AFRICA

15.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

16 GLOBAL FLAT PANEL DISPLAYMARKET,COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: EUROPE

16.2 MERGERS & ACQUISITIONS

16.3 NEW PRODUCT DEVELOPMENT & APPROVALS

16.4 EXPANSIONS

16.5 REGULATORY CHANGES

16.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17 GLOBAL FLAT PANEL DISPLAYMARKET, SWOT AND DBMR ANALYSIS

18 GLOBAL FLAT PANEL DISPLAYMARKET, COMPANY PROFILE

18.1 PANASONIC CORPORATION

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 GEOGRAPHIC PRESENCE

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 CRYSTAL DISPLAY SYSTEMS LTD

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 GEOGRAPHIC PRESENCE

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 LG DISPLAY CO., LTD

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 GEOGRAPHIC PRESENCE

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 SHARP NEC DISPLAY SOLUTIONS OF AMERICA, INC.

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 GEOGRAPHIC PRESENCE

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 SONY CORPORATION OF AMERICA

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 GEOGRAPHIC PRESENCE

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 AU OPTRONICS CORP.

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 GEOGRAPHIC PRESENCE

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENTS

18.7 UNIVERSAL DISPLAY

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 GEOGRAPHIC PRESENCE

18.7.4 PRODUCT PORTFOLIO

18.7.5 RECENT DEVELOPMENTS

18.8 APPLIED MATERIALS, INC.

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 GEOGRAPHIC PRESENCE

18.8.4 PRODUCT PORTFOLIO

18.8.5 RECENT DEVELOPMENTS

18.9 TOKYO ELECTRON LIMITED

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 GEOGRAPHIC PRESENCE

18.9.4 PRODUCT PORTFOLIO

18.9.5 RECENT DEVELOPMENTS

18.1 INNOLUX CORPORATION

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 GEOGRAPHIC PRESENCE

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENTS

18.11 EMERGING DISPLAY TECHNOLOGIES

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 GEOGRAPHIC PRESENCE

18.11.4 PRODUCT PORTFOLIO

18.11.5 RECENT DEVELOPMENTS

18.12 JAPAN DISPLAY INC.

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 GEOGRAPHIC PRESENCE

18.12.4 PRODUCT PORTFOLIO

18.12.5 RECENT DEVELOPMENTS

18.13 E INK HOLDINGS INC.

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 GEOGRAPHIC PRESENCE

18.13.4 PRODUCT PORTFOLIO

18.13.5 RECENT DEVELOPMENTS

18.14 TOSHIBA TEC CORPORATION

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 GEOGRAPHIC PRESENCE

18.14.4 PRODUCT PORTFOLIO

18.14.5 RECENT DEVELOPMENTS

18.15 BOE JAPAN CO.,LTD.

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 GEOGRAPHIC PRESENCE

18.15.4 PRODUCT PORTFOLIO

18.15.5 RECENT DEVELOPMENTS

18.16 VIEWSONIC CORPORATION

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 GEOGRAPHIC PRESENCE

18.16.4 PRODUCT PORTFOLIO

18.16.5 RECENT DEVELOPMENTS

18.17 BENQ

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 GEOGRAPHIC PRESENCE

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT DEVELOPMENTS

18.18 PROMETHEAN LIMITED

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 GEOGRAPHIC PRESENCE

18.18.4 PRODUCT PORTFOLIO

18.18.5 RECENT DEVELOPMENTS

18.19 PRODISPLAY

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 GEOGRAPHIC PRESENCE

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPMENTS

18.2 PLANAR

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 GEOGRAPHIC PRESENCE

18.20.4 PRODUCT PORTFOLIO

18.20.5 RECENT DEVELOPMENTS

19 CONCLUSION

20 QUESTIONNAIRE

21 RELATED REPORTS

22 ABOUT DATA BRIDGE MARKET RESEARCH

Global Flat Panel Displays Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Flat Panel Displays Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Flat Panel Displays Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.