Global Flavours And Enhancers For Frozen Bakery Market

Market Size in USD Billion

CAGR :

%

USD

2.59 Billion

USD

3.97 Billion

2024

2032

USD

2.59 Billion

USD

3.97 Billion

2024

2032

| 2025 –2032 | |

| USD 2.59 Billion | |

| USD 3.97 Billion | |

|

|

|

|

Flavours and Enhancers for Frozen Bakery Market Size

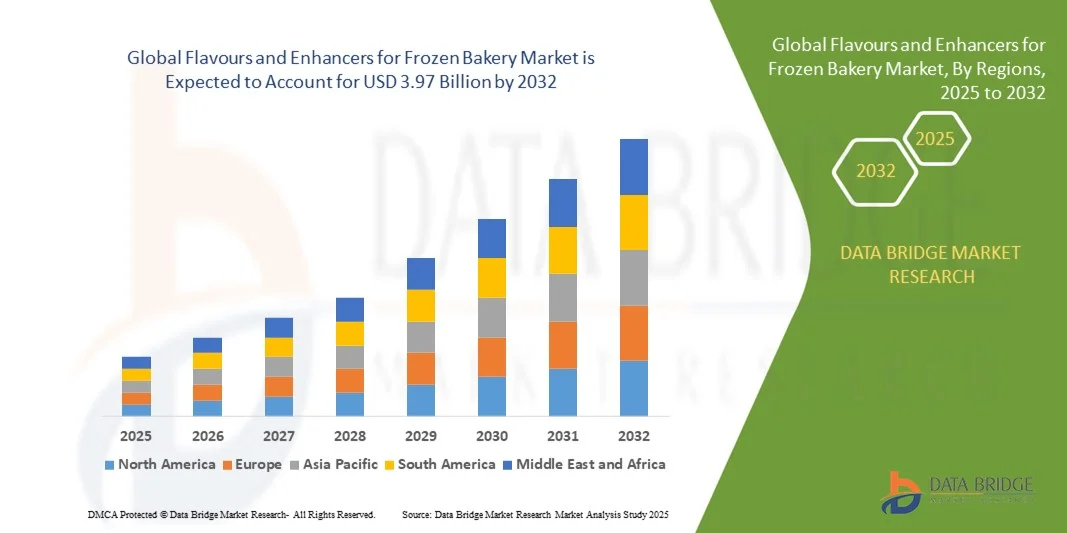

- The global flavours and enhancers for frozen bakery market size was valued at USD 2.59 billion in 2024 and is expected to reach USD 3.97 billion by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is largely fueled by the rising demand for convenient and ready-to-bake frozen bakery products, driving manufacturers to adopt advanced flavors and enhancers that maintain consistent taste, aroma, and texture after freezing and baking

- Furthermore, increasing consumer preference for natural, clean-label, and health-conscious ingredients is encouraging the development of innovative flavor solutions, which is expanding the adoption of both natural and artificial enhancers across frozen bakery products

Flavours and Enhancers for Frozen Bakery Market Analysis

- Flavours and enhancers, used to improve taste, aroma, and overall sensory appeal in frozen bakery items, are becoming critical in ensuring product quality and consumer satisfaction, especially in breads, cakes, pastries, and pizza crusts

- The escalating demand is primarily driven by the need to deliver consistent flavor and freshness in large-scale production, growing popularity of frozen bakery goods in retail and foodservice channels, and the focus on premiumization and product differentiation through innovative flavor formulations

- Europe dominated the flavours and enhancers for frozen bakery market with a share of 37.08% in 2024, due to increasing consumer preference for premium bakery products and a growing focus on clean-label, natural ingredients

- Asia-Pacific is expected to be the fastest growing region in the flavours and enhancers for frozen bakery market during the forecast period due to rising urbanization, increasing disposable incomes, and expanding retail and foodservice channels in countries such as China, Japan, and India

- Artificial segment dominated the market with a market share of 57.5% in 2024, due to its cost-effectiveness, consistent flavor profile, and longer shelf life compared to natural variants. Manufacturers in the frozen bakery industry often prefer artificial flavors and enhancers due to their stability under freezing and baking conditions, ensuring uniform taste across large-scale production. Furthermore, advancements in food chemistry have enabled artificial flavor compounds to closely mimic natural profiles, maintaining consumer satisfaction while optimizing production efficiency

Report Scope and Flavours and Enhancers for Frozen Bakery Market Segmentation

|

Attributes |

Flavours and Enhancers for Frozen Bakery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Flavours and Enhancers for Frozen Bakery Market Trends

Rising Preference for Clean-Label and Natural Flavors

- The flavours and enhancers segment for frozen bakery products is witnessing strong growth driven by increasing consumer preference for clean-label and natural flavoring solutions. Growing health awareness and interest in ingredient transparency are pushing manufacturers to replace artificial additives with plant-derived, minimally processed flavor compounds

- For instance, Givaudan and Kerry Group have expanded their portfolios to include natural flavors derived from fruits, herbs, and spices tailored for frozen bakery applications such as breads, pastries, and cookies. These innovations maintain robust taste profiles while meeting clean-label requirements and regulatory standards

- Advancements in extraction and encapsulation technologies are enabling the production of natural flavors that can withstand the temperature fluctuations, moisture variations, and extended shelf life demands of frozen bakery products without compromising quality. This ensures consistent taste delivery across the product’s lifecycle

- Frozen bakery manufacturers are increasingly leveraging natural flavors to differentiate products in competitive markets. By pairing clean-label flavor profiles with functional enhancers such as natural leavening agents or texture improvers, they can boost product appeal while aligning with consumer wellness trends

- The adoption of natural, allergen-free, and non-GMO flavors is extending beyond premium bakery lines into mainstream frozen product categories. This expansion reflects a shift in consumer expectations for everyday food options to meet both taste satisfaction and health-conscious standards

- The rising preference for clean-label and natural flavors is reshaping the frozen bakery landscape, positioning product authenticity and ingredient integrity as key drivers of market competitiveness and consumer loyalty

Flavours and Enhancers for Frozen Bakery Market Dynamics

Driver

Growing Demand for Convenient Frozen Bakery Products

- Increasing urbanization, busy lifestyles, and rising consumer interest in ready-to-bake or ready-to-eat frozen bakery goods are fueling market growth. Demand for convenience is driving innovation in flavors and enhancers to ensure quick preparation products deliver fresh-baked taste and texture

- For instance, Puratos has developed flavor-enhancing solutions specifically for frozen bread and pastry lines that retain aroma and mouthfeel after baking from frozen state. This highlights the importance of specialized flavor development in meeting modern convenience food expectations

- Frozen bakery products benefit from enhancers that maintain product softness, moisture retention, and flavor richness, ensuring consistent quality even after extended storage periods. These functionalities are critical as consumers expect gourmet-level taste and freshness from easy-to-use products

- The growth of café-style bakery experiences at home has boosted the use of complex flavor profiles such as artisan bread notes, buttery pastry aromas, and rich dessert accents. Enhancers allow these flavors to maintain their intensity through freezing and quick bake cycles

- As convenience-driven bakery consumption continues to rise globally, flavors and enhancers will play a pivotal role in creating products that satisfy consumer expectations for quality, consistency, and indulgence without sacrificing preparation ease

Restraint/Challenge

Ensuring Flavor Stability During Freezing and Baking

- Maintaining flavor integrity through the freezing, storage, and baking process is a key technical challenge in the frozen bakery segment. Natural flavor compounds can degrade or change intensity under extreme temperature variations, impacting product consistency and consumer experience

- For instance, companies such as Symrise and Sensient Technologies invest in advanced encapsulation methods to protect flavor molecules during freezing and release them optimally during baking. These techniques help overcome volatility and degradation issues in sensitive flavor profiles

- Moisture migration, oxidation, and interaction with other bakery ingredients during prolonged storage can diminish flavor potency, necessitating precise formulation controls and stabilizer use to preserve targeted taste outcomes

- The use of clean-label flavors without synthetic stabilizers increases the difficulty of ensuring long-term preservation, as manufacturers must balance natural ingredients with functional performance requirements during freezing and baking

- Addressing these challenges will require continued research into natural flavor stabilization technologies, improved ingredient compatibility, and tailored processing methods. Achieving consistent flavor delivery across multiple stages of frozen bakery preparation will be crucial for maintaining consumer satisfaction and brand trust

Flavours and Enhancers for Frozen Bakery Market Scope

The market is segmented on the basis of type, ingredients, form, and application.

- By Type

On the basis of type, the Flavours and Enhancers for Frozen Bakery market is segmented into natural and artificial. The artificial segment dominated the market with the largest revenue share of 57.5% in 2024, attributed to its cost-effectiveness, consistent flavor profile, and longer shelf life compared to natural variants. Manufacturers in the frozen bakery industry often prefer artificial flavors and enhancers due to their stability under freezing and baking conditions, ensuring uniform taste across large-scale production. Furthermore, advancements in food chemistry have enabled artificial flavor compounds to closely mimic natural profiles, maintaining consumer satisfaction while optimizing production efficiency.

The natural segment is projected to witness the fastest growth rate from 2025 to 2032, driven by rising consumer preference for clean-label, health-conscious bakery products. Growing awareness regarding synthetic additives and the shift toward plant-based and organic ingredients are fueling the adoption of natural flavors and enhancers. Manufacturers are increasingly investing in natural flavor extraction and fermentation technologies to meet this demand while retaining authentic taste and aroma in frozen bakery goods.

- By Ingredients

On the basis of ingredients, the market is segmented into glutamate, acidulant, yeast extract, hydrolysed vegetable proteins, and others. The glutamate segment held the largest market share in 2024, driven by its widespread use as a flavor enhancer that intensifies umami and savory notes in bakery items. Glutamate-based enhancers improve the overall taste perception in frozen bakery products while maintaining cost efficiency for manufacturers. Their compatibility with other flavor compounds and proven safety profile have established glutamate as a key ingredient in flavor formulation.

The yeast extract segment is expected to register the fastest growth during 2025–2032, fueled by growing demand for natural and nutrient-rich flavor sources. Yeast extracts are rich in amino acids and nucleotides that contribute to complex, savory flavors without synthetic additives. As the trend toward natural flavor systems strengthens, yeast extract is gaining traction among clean-label frozen bakery manufacturers seeking to enhance mouthfeel and aroma authenticity.

- By Form

On the basis of form, the market is segmented into powder, liquid, and others. The powder segment dominated the market in 2024, owing to its high stability, easy storage, and better dispersion in dry bakery mixes. Powdered flavors and enhancers are widely preferred in frozen bakery production lines due to their extended shelf life, consistent performance during freezing and baking processes, and convenient handling in automated manufacturing systems. This segment also benefits from its suitability for bulk production and lower transportation costs.

The liquid segment is projected to experience the fastest growth through 2032, driven by the growing preference for easy-to-blend formulations that deliver stronger flavor intensity. Liquid flavors and enhancers allow for more precise dosing and faster incorporation in dough and fillings, improving product consistency. Their ability to retain aromatic strength during baking and freezing makes them ideal for premium and artisanal frozen bakery products.

- By Application

On the basis of application, the market is segmented into frozen breads, frozen cakes, frozen pastry, frozen pizza crust, and other frozen bakery products. The frozen bread segment accounted for the largest revenue share in 2024, supported by the global popularity of frozen breads as convenient, ready-to-bake staples. Flavors and enhancers play a vital role in improving crust aroma, texture, and shelf life, ensuring freshly baked taste even after prolonged freezing. Rising demand from quick-service restaurants and retail bakeries for flavor-stable bread formulations further boosts this segment.

The frozen pastry segment is expected to witness the fastest growth from 2025 to 2032, driven by growing consumer appetite for indulgent, ready-to-bake premium bakery items. Flavors and enhancers are used extensively in pastries to enrich fillings, improve sweetness balance, and enhance the buttery aroma of dough. The segment benefits from product innovation in natural and compound flavors tailored for puff pastry and croissant applications, aligning with the trend toward premiumization and gourmet frozen bakery offerings.

Flavours and Enhancers for Frozen Bakery Market Regional Analysis

- Europe dominated the flavours and enhancers for frozen bakery market with the largest revenue share of 37.08% in 2024, driven by increasing consumer preference for premium bakery products and a growing focus on clean-label, natural ingredients

- European manufacturers are investing in innovative flavors and enhancers to meet demand for consistent taste, longer shelf life, and high-quality frozen bakery offerings

- The region’s well-established frozen bakery industry, coupled with strong retail infrastructure and high consumer awareness, supports the widespread adoption of both natural and artificial flavor solutions

France Flavours and Enhancers for Frozen Bakery Market Insight

The France market captured the largest share in Europe in 2024, fueled by the popularity of artisanal and gourmet frozen bakery products. Consumers increasingly demand high-quality flavors and enhancers that maintain authentic taste after freezing and baking. French manufacturers are focusing on both natural and artificial solutions to cater to evolving preferences in frozen breads, pastries, and cakes, driving the growth of the market.

Germany Flavours and Enhancers for Frozen Bakery Market Insight

The Germany market is projected to grow at a notable CAGR during the forecast period, supported by rising demand for frozen bakery items in both retail and foodservice channels. The emphasis on premiumization, innovative flavors, and natural ingredient adoption is pushing manufacturers to integrate advanced flavoring solutions. In addition, Germany’s strong frozen bakery supply chain ensures consistent availability of enhanced products to meet consumer expectations.

U.K. Flavours and Enhancers for Frozen Bakery Market Insight

The U.K. market is expected to expand steadily due to increasing consumption of frozen bakery products in households and QSRs. Consumers are showing preference for enriched flavors and aroma in frozen breads, cakes, and pastries. The growth is further supported by retail innovations, product launches with natural flavor systems, and adoption of ready-to-bake frozen bakery solutions that cater to convenience-driven lifestyles.

North America Flavours and Enhancers for Frozen Bakery Market Insight

The North America market is witnessing moderate growth, driven by the adoption of frozen bakery products in retail and foodservice sectors. U.S. and Canada manufacturers are emphasizing artificial flavors for cost-effectiveness and stability during freezing, while natural flavors are gaining traction due to increasing clean-label trends. The market benefits from advanced production technologies and a growing demand for indulgent frozen bakery offerings.

Asia-Pacific Flavours and Enhancers for Frozen Bakery Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during 2025–2032, driven by rising urbanization, increasing disposable incomes, and expanding retail and foodservice channels in countries such as China, Japan, and India. Consumers are adopting frozen bakery products rapidly, fueling demand for flavor and enhancer solutions that ensure product quality and consistent taste. Manufacturers are focusing on both natural and artificial formulations to cater to diverse flavor preferences across the region.

China Flavours and Enhancers for Frozen Bakery Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the growing middle class, rapid urbanization, and increased consumption of frozen bakery products. Domestic manufacturers are investing in innovative flavoring solutions to maintain taste and aroma post-freezing, supporting market expansion across frozen breads, cakes, and pastries.

Japan Flavours and Enhancers for Frozen Bakery Market Insight

The Japan market is gaining momentum due to high consumer demand for premium frozen bakery products with authentic flavors. The focus on quality, innovation, and convenience is driving adoption of both natural and artificial enhancers. Japanese manufacturers are increasingly integrating advanced flavor solutions in frozen pastry, breads, and cakes to meet evolving taste preferences and support export opportunities.

Flavours and Enhancers for Frozen Bakery Market Share

The flavours and enhancers for frozen bakery industry is primarily led by well-established companies, including:

- Givaudan (Switzerland)

- International Flavours and Fragrances, Inc. (U.S.)

- Firmenich SA (Switzerland)

- Symrise (Germany)

- MANE (France)

- Takasago International Corporation (Japan)

- Sensient Technologies Corporation (U.S.)

- Huabao International Holdings Limited (China)

- T.HASEGAWA CO., LTD. (Japan)

- Keva Flavours Pvt. Ltd. (India)

- Kerry Group plc (Ireland)

- FLAVORCAN INTERNATIONAL INC. (U.S.)

- ROBERTET (France)

- Cargill, Incorporated (U.S.)

- ADM (U.S.)

- BASF SE (Germany)

- Tate & Lyle (U.K.)

- Flavorchem Corporation (U.S.)

- Veera Fragrances Private Limited (India)

Latest Developments in Global Flavours and Enhancers for Frozen Bakery Market

- In June 2025, Aryzta expanded its frozen bakery portfolio by introducing a line of organic frozen pastries and breads, including sourdough and specialty pastries. This move was aimed at capturing the growing consumer demand for organic and clean-label bakery options. The launch strengthened Aryzta’s presence in the premium frozen bakery segment, enhancing brand perception and boosting market share. By offering products that retain authentic taste and texture after freezing, Aryzta positioned itself to meet the rising preference for healthier, high-quality bakery choices, particularly in Europe and North America

- In June 2024, Tate & Lyle completed the acquisition of CP Kelco, a specialty ingredient manufacturer, for $1.8 billion. This strategic acquisition enabled Tate & Lyle to enhance the texture and flavor profile of frozen bakery products, particularly low-fat and low-sugar offerings. By integrating CP Kelco’s nature-based ingredient expertise, Tate & Lyle strengthened its product innovation capabilities, improved its competitiveness in the frozen bakery market, and addressed growing consumer demand for healthier, premium bakery products. The deal also expanded the company’s global reach and production capacity

- In July 2023, Tate & Lyle launched a novel sweetener blend designed to enhance flavor intensity in frozen bakery items without increasing sugar content. This product innovation responded directly to rising consumer awareness of health and dietary concerns, particularly around sugar intake. By providing sweeteners that maintain taste and mouthfeel while supporting lower-calorie formulations, Tate & Lyle enabled frozen bakery manufacturers to offer indulgent yet healthier products, driving adoption among retail and foodservice segments

- In June 2023, Givaudan entered into a strategic partnership with Frumar to develop sustainable flavoring solutions for frozen bakery products. This collaboration focused on incorporating eco-friendly and ethically sourced ingredients into flavor formulations, addressing growing consumer demand for sustainability in food products. By integrating these practices, Givaudan strengthened its market position as a provider of innovative, environmentally responsible flavor solutions, supporting both large-scale commercial manufacturers and premium frozen bakery brands seeking sustainable product differentiation

- In January 2023, Cargill introduced a new line of clean-label flavor enhancers for frozen bakery products. This initiative targeted the increasing consumer preference for transparency, natural ingredients, and health-conscious products. The clean-label enhancers offered stable performance during freezing and baking, ensuring consistent taste and quality across bakery items. By aligning its product offerings with the shift toward natural and minimally processed ingredients, Cargill reinforced its presence in the frozen bakery market and supported manufacturers in meeting evolving consumer expectations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Flavours And Enhancers For Frozen Bakery Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Flavours And Enhancers For Frozen Bakery Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Flavours And Enhancers For Frozen Bakery Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.