Global Flaxseed Gum Market

Market Size in USD Million

CAGR :

%

USD

52.36 Million

USD

73.89 Million

2025

2033

USD

52.36 Million

USD

73.89 Million

2025

2033

| 2026 –2033 | |

| USD 52.36 Million | |

| USD 73.89 Million | |

|

|

|

|

Flaxseed Gum Market Size

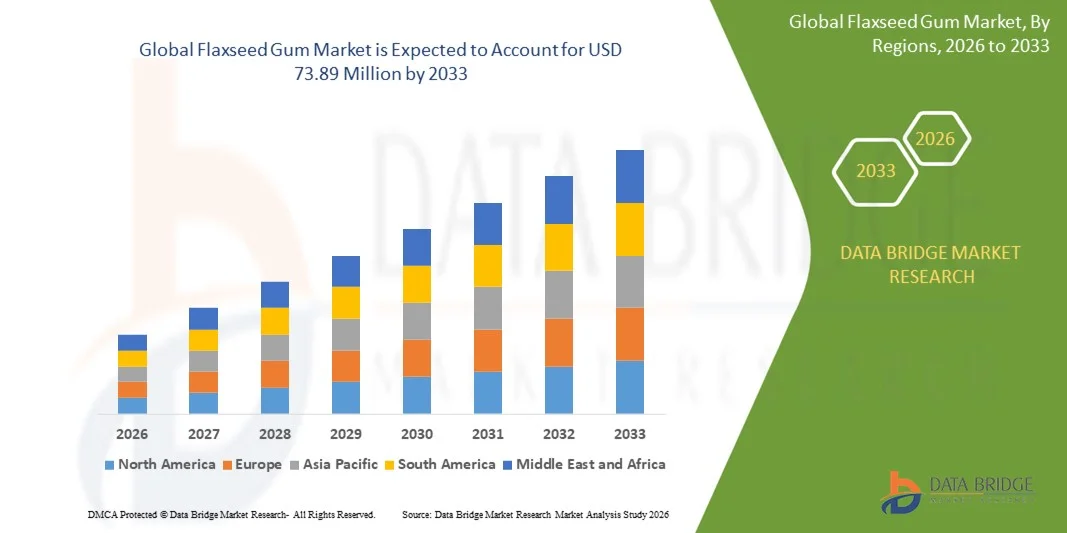

- The global flaxseed gum market size was valued at USD 52.36 million in 2025 and is expected to reach USD 73.89 million by 2033, at a CAGR of 4.40% during the forecast period

- The market growth is largely fuelled by the rising demand for natural, plant-derived hydrocolloids in food, beverage, and cosmetic applications such as stabilizers, thickeners, and emulsifiers

- The increasing preference for clean-label ingredients among manufacturers is further driving adoption, supported by expanding usage of flaxseed gum in bakery, dairy alternatives, and nutraceutical formulations

Flaxseed Gum Market Analysis

- The flaxseed gum market is experiencing steady expansion driven by rising consumer inclination toward natural, vegan, and allergen-free ingredients across global industries

- Manufacturers are increasingly leveraging flaxseed gum for its superior water-binding capacity, viscosity, and nutritional benefits, positioning it as a competitive alternative to synthetic and animal-derived gums

- North America dominated the flaxseed gum market with the largest revenue share in 2025, driven by increasing demand for natural stabilizers, plant-based ingredients, and clean-label formulations across food and personal care applications

- Asia-Pacific region is expected to witness the highest growth rate in the global flaxseed gum market, driven by rapid food industry expansion, increasing health-oriented consumer preferences, and rising adoption of plant-based ingredients

- The Food Grade segment held the largest market revenue share in 2025 driven by its extensive use as a natural stabilizer, thickener, and emulsifier in bakery, dairy alternatives, beverages, and sauces. Rising consumer preference for clean-label ingredients and increasing adoption in plant-based formulations continue to strengthen demand for food-grade flaxseed gum

Report Scope and Flaxseed Gum Market Segmentation

|

Attributes |

Flaxseed Gum Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Flaxseed Gum Market Trends

Rise of Clean-Label and Plant-Based Hydrocolloids

- The growing shift toward clean-label, plant-based hydrocolloids is transforming the flaxseed gum market by enabling manufacturers to develop natural, allergen-free stabilizers and thickeners. This movement aligns with rising consumer awareness of ingredient purity and sustainable sourcing. As a result, companies are increasingly replacing artificial additives with flaxseed gum to enhance product trust and brand transparency

- The rising demand for hydrocolloids in bakery, dairy, beverages, and confectionery applications is accelerating the use of flaxseed gum due to its strong water-binding, emulsifying, and thickening properties. The expanding plant-based food sector is further driving manufacturers to use versatile natural polymers. This trend is creating new opportunities for innovation in clean-label and functional food products

- The affordability, availability, and multifunctionality of flaxseed gum are encouraging its integration into large-scale production across global markets. Manufacturers leverage its cost-effective texturizing capabilities to enhance product stability and sensory profiles. Its compatibility with vegan, gluten-free, and low-fat formulations supports broader adoption in both premium and mass-market product lines

- For instance, in 2023, several European and North American food companies introduced clean-label dairy alternatives and bakery products featuring flaxseed gum, enhancing product texture and nutritional value. These launches contributed to strengthening consumer acceptance in natural ingredient categories. The trend also encouraged regional suppliers to scale up flaxseed gum sourcing and processing capacities

- While flaxseed gum demand continues to rise, sustained growth depends on ongoing R&D, awareness initiatives, and application-specific optimization. Manufacturers must invest in purity enhancement and standardized processing methods to ensure consistent quality. Stronger supply chains and broader industry education will help unlock the full commercial potential of flaxseed gum

Flaxseed Gum Market Dynamics

Driver

Increasing Demand for Natural Stabilizers in Food and Personal Care Industries

- The rising consumer preference for natural, plant-based stabilizers is driving widespread use of flaxseed gum due to its clean-label benefits and functional properties. Its ability to replace synthetic ingredients aligns with evolving wellness and transparency trends. This has boosted adoption across beverages, dairy alternatives, sauces, and bakery items

- Manufacturers across food and personal care industries are integrating flaxseed gum for its emulsifying, thickening, and water-holding capabilities, enhancing both product texture and performance. Its natural origin supports the reformulation of creams, lotions, shampoos, and serums. This shift reflects growing market confidence in botanical polymers compared to synthetic stabilizers

- Supportive government regulations encouraging the use of natural ingredients and clean-label formulations have strengthened market potential across major regions. New regulatory frameworks promote transparency, ingredient traceability, and safety compliance. These policies continue to motivate global manufacturers to prioritize natural hydrocolloids such as flaxseed gum

- For instance, in 2022, several European and Asian food companies complied with new clean-label standards by replacing synthetic stabilizers with natural hydrocolloids such as flaxseed gum. These reforms prompted industry-wide reformulation efforts across dairy, confectionery, and beverage segments. The trend further encouraged suppliers to expand their natural ingredient portfolios

- While rising consumer preference and supportive regulations drive growth, there remains a need for supply consistency, technological advancement, and improved processing methods to ensure long-term adoption. Companies must address extraction challenges to maintain standardized quality. Strategic investment in innovation will remain critical for market expansion

Restraint/Challenge

High Processing Costs and Variability in Raw Material Quality

- The high cost associated with extracting and purifying flaxseed gum, including specialized equipment and labor-intensive processes, limits its accessibility for small-scale manufacturers. These cost challenges reduce competitiveness in price-sensitive markets. As a result, adoption remains concentrated among medium and large industry players

- Variability in flaxseed quality due to climatic, regional, and seasonal factors affects gum yield and consistency, posing challenges for maintaining uniform product standards. This inconsistency increases procurement and processing expenses for manufacturers. It also heightens the need for rigorous quality control across the supply chain

- Market growth is further restricted by competition from established hydrocolloids such as guar gum, xanthan gum, and carrageenan, which often offer lower cost or stronger performance depending on the application. These alternatives hold long-standing commercial acceptance, making market penetration challenging. This competitive landscape pressures pricing strategies for flaxseed gum producers

- For instance, in 2023, several manufacturers in Europe and South America reported production delays due to inconsistent flaxseed quality, causing supply shortages and formulation challenges. These disruptions increased operating costs and delayed new product development timelines. Such fluctuations highlight the importance of improving agricultural and sourcing practices

- While demand remains strong, addressing cost, processing efficiency, and raw material variability is crucial. Enhancing seed cultivation methods and scaling advanced extraction technologies will improve stability. Strengthening supply chains and fostering producer partnerships will be essential to unlock sustainable market growth

Flaxseed Gum Market Scope

The market is segmented on the basis of product type, application, and distribution channel

- By Product Type

On the basis of product type, the flaxseed gum market is segmented into Food Grade, Pharmaceutical Grade, and Industrial Grade. The Food Grade segment held the largest market revenue share in 2025 driven by its extensive use as a natural stabilizer, thickener, and emulsifier in bakery, dairy alternatives, beverages, and sauces. Rising consumer preference for clean-label ingredients and increasing adoption in plant-based formulations continue to strengthen demand for food-grade flaxseed gum

The Pharmaceutical Grade segment is expected to witness the fastest growth rate from 2026 to 2033, supported by its expanding use in drug delivery systems, controlled-release formulations, and natural excipient development. Increasing R&D investments, biocompatibility advantages, and the growing shift toward plant-derived pharmaceutical additives are expected to enhance segment growth

- By Application

On the basis of application, the flaxseed gum market is segmented into Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Animal Feed, and Others. The Food & Beverages segment dominated the market in 2025 driven by the growing use of flaxseed gum in texture enhancement, moisture retention, and stabilization across bakery, dairy alternatives, beverages, and confectionery products. Clean-label trends and rising plant-based production significantly contribute to its strong adoption

The Cosmetics & Personal Care segment is expected to register the fastest growth from 2026 to 2033 due to increasing utilization of flaxseed gum as a natural thickener, emulsifier, and hydrating agent in lotions, creams, shampoos, and serums. Its skin-friendly properties, biodegradable nature, and consumer preference for botanical ingredients are accelerating integration into personal care formulations

- By Distribution Channel

On the basis of distribution channel, the flaxseed gum market is segmented into Online Retail, Supermarkets/Hypermarkets, Specialty Stores, and Others. The Online Retail segment accounted for the largest revenue share in 2025 driven by the rapid expansion of e-commerce platforms, wider product availability, and increased preference for direct-to-consumer purchasing. Competitive pricing, convenience, and access to a broad range of suppliers further supported segment dominance

The Specialty Stores segment is projected to witness the fastest growth rate between 2026 and 2033, attributed to rising consumer demand for premium, certified, and clean-label hydrocolloid products. Specialty outlets offer tailored product guidance, quality-assured selections, and greater transparency, which appeal strongly to buyers in food processing, cosmetics, and nutraceutical sectors

Flaxseed Gum Market Regional Analysis

- North America dominated the flaxseed gum market with the largest revenue share in 2025, driven by increasing demand for natural stabilizers, plant-based ingredients, and clean-label formulations across food and personal care applications

- Consumers in the region highly value the functional, vegan-friendly, and allergen-free properties of flaxseed gum, supporting its adoption in bakery, dairy alternatives, beverages, and cosmetic formulations

- This widespread usage is further supported by strong awareness of natural hydrocolloids, advanced food processing capabilities, and rising interest in sustainable ingredients, positioning flaxseed gum as a preferred natural polymer within the region

U.S. Flaxseed Gum Market Insight

The U.S. flaxseed gum market captured the largest revenue share in 2025 within North America, fueled by the growing demand for plant-based thickeners and natural emulsifiers across food, beverage, and personal care industries. Manufacturers are increasingly prioritizing clean-label stabilizers that meet consumer expectations for transparency and minimal processing. Rising adoption in bakery products, dairy alternatives, and nutritional beverages, combined with an expanding focus on plant-based formulations, continues to propel market growth. In addition, strong R&D activities and the presence of major food manufacturers significantly support the market’s expansion.

Europe Flaxseed Gum Market Insight

The Europe flaxseed gum market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent clean-label regulations and increasing preference for natural hydrocolloids over synthetic additives. The region’s demand is strengthened by the rapid adoption of plant-based dairy, vegan bakery products, and sustainable personal care formulations. European consumers show strong interest in natural, functional polymers that enhance texture and stability. The market is expanding across food processing, cosmetics, and nutraceutical sectors, supported by innovation-driven manufacturers and regulatory emphasis on natural ingredients.

U.K. Flaxseed Gum Market Insight

The U.K. flaxseed gum market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising consumer preference for natural, allergen-free, and plant-derived stabilizers. The country’s expanding market for vegan foods, clean-label beverages, and natural personal care products is significantly boosting demand. Increasing awareness of sustainability, along with the rapid growth of small and mid-sized food manufacturers, is promoting the adoption of flaxseed gum across multiple applications. The U.K.’s evolving retail landscape and strong interest in health-oriented product innovation continue to support market expansion.

Germany Flaxseed Gum Market Insight

The Germany flaxseed gum market is expected to witness one of the fastest growth rates from 2026 to 2033, fueled by high demand for advanced, eco-friendly hydrocolloids in food processing and cosmetics. Germany’s strong manufacturing base, coupled with its emphasis on high-quality, natural ingredients, supports the integration of flaxseed gum into bakery, dairy alternatives, and personal care formulations. The growing preference for sustainable, plant-based polymers aligns well with consumer expectations in the country. Increasing R&D investments and rapid adoption of clean-label standards are further accelerating market growth.

Asia-Pacific Flaxseed Gum Market Insight

The Asia-Pacific flaxseed gum market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid industrial expansion, rising consumption of processed foods, and increasing awareness of natural hydrocolloids. Countries such as China, India, and Japan are experiencing high demand for plant-based ingredients due to shifting dietary preferences and growing adoption of functional foods. The region’s expanding food manufacturing sector, combined with technological advancements and rising disposable incomes, is promoting wider use of flaxseed gum across food, pharmaceuticals, and personal care applications.

Japan Flaxseed Gum Market Insight

The Japan flaxseed gum market is expected to witness strong growth from 2026 to 2033 due to the country’s high demand for precision-formulated, natural, and functional ingredients. Japanese manufacturers prioritize clean-label stabilizers for beverages, bakery items, ready-to-eat foods, and premium skincare products. The integration of plant-based hydrocolloids into health-focused and minimally processed foods is a key contributor to market expansion. In addition, Japan’s technological advancements, aging population, and preference for safe, high-quality ingredients continue to drive the adoption of flaxseed gum.

China Flaxseed Gum Market Insight

The China flaxseed gum market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s rapid expansion of processed food production, fast-growing cosmetics sector, and increasing interest in plant-derived stabilizers. China is one of the leading markets for natural hydrocolloids, and flaxseed gum is gaining strong traction in dairy alternatives, beverages, snacks, and personal care formulations. Large-scale manufacturing capabilities, affordability of plant-based ingredients, and supportive government initiatives promoting natural additives continue to propel the market across the country.

Flaxseed Gum Market Share

The Flaxseed Gum industry is primarily led by well-established companies, including:

• Cargill, Incorporated (U.S.)

• DuPont de Nemours, Inc. (U.S.)

• Ingredion Incorporated (U.S.)

• TIC Gums, Inc. (U.S.)

• Glanbia plc (Ireland)

• ADM (Archer Daniels Midland Company) (U.S.)

• Kerry Group plc (Ireland)

• FMC Corporation (U.S.)

• Ashland Global Holdings Inc. (U.S.)

• CP Kelco (U.S.)

• Agro Gums (India)

• Neelkanth Polymers (India)

• Shree Gum Industries (India)

• Polygal AG (Switzerland)

• Altrafine Gums (India)

• Hebei Huaou Starch Co., Ltd. (China)

• Qingdao Doeast Chemical Co., Ltd. (China)

• Henan Xinxiang No.7 Chemical Co., Ltd. (China)

• Jai Bharat Gum & Chemicals Ltd. (India)

• Lotus Gums & Chemicals (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Flaxseed Gum Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Flaxseed Gum Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Flaxseed Gum Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.