Global Flaxseed Oil Market

Market Size in USD Billion

CAGR :

%

USD

5.54 Billion

USD

7.30 Billion

2024

2032

USD

5.54 Billion

USD

7.30 Billion

2024

2032

| 2025 –2032 | |

| USD 5.54 Billion | |

| USD 7.30 Billion | |

|

|

|

|

Flaxseed Oil Market Size

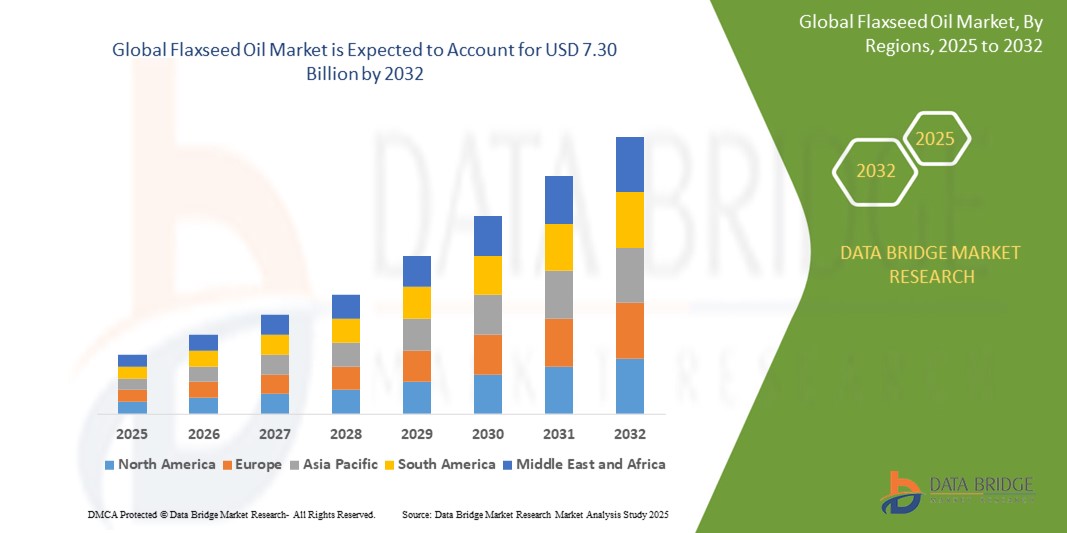

- The global flaxseed oil market size was valued at USD 5.54 billion in 2024 and is expected to reach USD 7.30 billion by 2032, at a CAGR of 3.50 % during the forecast period

- The market growth is primarily driven by rising health consciousness among consumers and increasing awareness of the nutritional benefits of flaxseed oil, including its rich content of omega-3 fatty acids, which support heart and skin health

- Moreover, expanding applications of flaxseed oil in dietary supplements, cosmetics, and functional foods are significantly enhancing its commercial appeal, contributing to market expansion

- These converging factors are accelerating the demand for high-quality, cold-pressed, and organic flaxseed oil, thereby significantly boosting the industry's growth globally

Flaxseed Oil Market Analysis

- Flaxseed oil, known for its high omega-3 fatty acid content, is increasingly gaining popularity across the health, nutraceutical, and personal care sectors, owing to growing awareness about its cardiovascular, anti-inflammatory, and skin health benefits among consumers in both developed and developing regions

- The escalating demand for plant-based and functional foods is a major driver for the flaxseed oil market, as more consumers seek clean-label and vegetarian sources of essential fatty acids, spurring product innovation and expanded applications in fortified foods, beverages, and dietary supplements

- North America dominates the flaxseed oil market with the largest revenue share of 40.01% in 2025, supported by strong consumer inclination toward organic and natural health products, widespread availability of dietary supplements, and growing adoption of flaxseed oil in both edible and cosmetic formulations in the U.S. and Canada

- Asia-Pacific is expected to be the fastest-growing region in the flaxseed oil market during the forecast period due to increasing health awareness, rapid urbanization, rising middle-class income, and an expanding base of health-conscious consumers in countries such as China, India, and Japan

- The organic flaxseed oil segment is projected to dominate the market with a share of 43.2% in 2025, driven by rising consumer trust in chemical-free, non-GMO products and a surge in demand from premium nutritional product manufacturers and personal care brands globally

Report Scope and Flaxseed Oil Market Segmentation

|

Attributes |

Flaxseed Oil Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Flaxseed Oil Market Trends

“Growing Demand for Sustainability and Clean-Label Products”

- A significant and accelerating trend in the global Flaxseed Oil market is the rising consumer demand for sustainable, organic, and clean-label products. This shift is driven by increasing health awareness, environmental concerns, and greater transparency expectations from consumers regarding sourcing and production processes

- For instances, many flaxseed oil producers are now investing in organic and non-GMO certifications to meet growing demand in premium markets such as North America and Europe. Brands such as Barlean’s and Spectrum Naturals prominently market their sustainability credentials, using eco-friendly packaging and emphasizing carbon-neutral operations

- Sustainable farming practices are becoming integral to the flaxseed oil supply chain. Companies are working directly with farmers to encourage regenerative agriculture, crop rotation, and minimal pesticide use. These efforts not only enhance soil health and biodiversity but also appeal to environmentally conscious consumers looking to support green brands

- Transparency initiatives such as blockchain-based traceability are also emerging. Some manufacturers are using blockchain technology to let consumers trace their flaxseed oil from farm to bottle—verifying origin, extraction methods, and sustainability claims in real time via QR codes on packaging

- The demand for cold-pressed and unrefined flaxseed oil is growing, as consumers associate these products with higher nutrient retention and fewer chemical processes. These clean-label formulations are especially popular among vegan, gluten-free, and paleo diet followers, reinforcing their position in the natural health food segment

- Packaging innovation is also playing a role. Many companies are shifting to biodegradable or recyclable bottles and using minimalist label designs to communicate purity and environmental responsibility. Additionally, flaxseed oil is being featured in multifunctional health products, such as plant-based supplements and skincare lines, further reinforcing the trend toward holistic, clean living

- This strong preference for sustainable and clean-label flaxseed oil is reshaping product development, marketing, and distribution strategies. As consumers increasingly seek natural, ethical, and transparent health solutions, flaxseed oil brands are aligning their practices to meet this demand while maintaining competitive differentiation in a crowded wellness market

Flaxseed Oil Market Dynamics

Driver

“Growing Need Due to Rising Health Awareness and Functional Nutrition Demand”

- The increasing global focus on preventive health and nutrition is a significant driver for the rising demand for Flaxseed Oil. Consumers are becoming more aware of the health benefits associated with flaxseed oil, including its high content of omega-3 fatty acids, antioxidants, and anti-inflammatory properties, which support heart health, skin vitality, digestion, and hormonal balance

- For instance, the surge in lifestyle-related disorders such as cardiovascular diseases, obesity, and diabetes has led consumers to seek out natural, plant-based supplements such as flaxseed oil to complement balanced diets and active lifestyles. Brands such as Nature’s Bounty and NOW Foods are expanding their flaxseed oil product lines to meet this growing interest in functional health solutions

- The adoption of flaxseed oil is also being fueled by the growing popularity of vegan, vegetarian, and flexitarian diets, which look for plant-based sources of omega-3 as alternatives to fish oil. This has broadened flaxseed oil’s appeal across diverse demographic groups, including younger, health-conscious consumers

- In addition, food and beverage manufacturers are incorporating flaxseed oil into functional foods, such as fortified dairy alternatives, nutrition bars, and salad dressings. The growing demand for clean-label and naturally sourced ingredients has made flaxseed oil a preferred choice in the development of health-focused food innovations

- The increased accessibility of flaxseed oil through e-commerce platforms, health food stores, and pharmacies—alongside consumer education efforts—has further expanded its reach in both developed and emerging markets. The rising awareness campaigns by nutritionists and wellness influencers also continue to drive the product’s visibility and perceived value.

Restraint/Challenge

“Limited Shelf Life, Taste Sensitivity, and Price Fluctuations”

- Despite its numerous benefits, the limited shelf life and high sensitivity of flaxseed oil to light, heat, and oxidation present challenges to both manufacturers and consumers. Improper storage can degrade its nutritional value and flavor, making it less appealing for mainstream consumption and complicating distribution logistics

- The distinctive nutty flavor of flaxseed oil can also be a barrier for some consumers, particularly when used in food applications. Unlike more neutral-tasting oils such as canola or sunflower, flaxseed oil may not easily integrate into a wide variety of dishes without altering the taste, which can limit its culinary versatility

- From a production standpoint, price volatility of flaxseed due to changing agricultural yields, weather conditions, and global supply chain disruptions can affect the cost and availability of flaxseed oil. This is particularly concerning in regions where flaxseed is not a staple crop and must be imported

- Furthermore, the premium positioning of flaxseed oil—especially cold-pressed or organic-certified variants—makes it less accessible to price-sensitive consumers. In developing economies, where consumer priorities often lean toward affordability, flaxseed oil competes with lower-cost edible oils that lack its nutritional advantages but offer broader culinary applicability

- To overcome these challenges, industry players are focusing on improved packaging (opaque, airtight bottles), flavor-masked formulations, and innovative blends that combine flaxseed oil with other oils to enhance shelf life and palatability. Education around storage and usage best practices, along with efforts to stabilize pricing through localized sourcing, will be key to driving broader adoption

Flaxseed Oil Market Scope

The market is segmented on the basis of products, type, application, and distribution channel.

By Products

On the basis of products, the Flaxseed Oil market is segmented into organic and inorganic. The organic segment dominates the largest market revenue share of 43.2% in 2025, driven by its increasing consumer preference for natural and health-beneficial products. Consumers often prioritize organic flaxseed oil for its perceived purity, nutritional benefits, and absence of synthetic additives. The market also sees strong demand for organic products due to rising awareness about sustainable farming practices and certifications that assure quality and safety

The inorganic segment is anticipated to witness the fastest growth rate of 21.7% from 2025 to 2032, fueled by its cost-effectiveness and widespread availability. Inorganic flaxseed oil finds extensive application in industrial and commercial sectors where large volumes are required at competitive prices. Its growing use in formulations and manufacturing processes contributes to the segment’s robust growth outlook

• By Type

On the basis of type, the Flaxseed Oil market is segmented into cold-pressed, hot-pressed, and extraction. The cold-pressed segment held the largest market revenue share in 2025, driven by its superior nutritional profile and minimal processing that retains essential fatty acids and antioxidants. Cold-pressed flaxseed oil is preferred by health-conscious consumers and is commonly used in dietary supplements, cosmetics, and specialty food products

The hot-pressed segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its higher yield and suitability for industrial applications such as paints, varnishes, and other manufacturing processes. Hot-pressed flaxseed oil offers cost advantages and functional properties desirable for large-scale production

• By Application

On the basis of application, the Flaxseed Oil market is segmented into flooring, processed food, cosmetics, pharmaceuticals, paints and varnishes. The processed food segment accounted for the largest market revenue share in 2024, driven by the rising demand for healthy cooking oils and functional food ingredients. Flaxseed oil’s rich omega-3 content and health benefits encourage its inclusion in dietary products, baking, and packaged food formulations

The cosmetics segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the growing use of flaxseed oil in skincare and haircare products. Its moisturizing, anti-inflammatory, and antioxidant properties make it a favored ingredient in natural and organic cosmetic formulations

• By Distribution Channel

On the basis of distribution channel, the Flaxseed Oil market is segmented into direct sales, online retail, and supermarkets/hypermarkets specialty stores. The supermarkets/hypermarkets segment held the largest market revenue share in 2025, driven by the extensive reach and convenience offered to consumers seeking flaxseed oil in physical retail locations. These channels benefit from strong consumer footfall and the ability to offer product variety

The online retail segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing adoption of e-commerce platforms and consumer preference for doorstep delivery. Online retail provides opportunities for product education, customer reviews, and access to niche and premium flaxseed oil brands

Flaxseed Oil Market Regional Analysis

- North America dominates the flaxseed oil market with the largest revenue share of 40.01% in 2025, driven by increasing consumer awareness of heart health, dietary supplementation, and natural wellness trends. The region benefits from high demand for plant-based omega-3 alternatives and a robust nutraceutical industry

- Consumers in the region are increasingly incorporating flaxseed oil in their diets through supplements, functional foods, and cold-pressed oils for health and beauty applications. The shift toward clean-label and organic products further accelerates the market’s momentum

- This widespread adoption is supported by high disposable incomes, a strong distribution network, and the popularity of e-commerce platforms, making flaxseed oil easily accessible across both urban and rural markets

U.S. Flaxseed Oil Market Insight

The U.S. flaxseed oil market captured the largest revenue share of 81% within North America in 2025, fueled by high health awareness and the growing popularity of natural superfoods. The rising incidence of lifestyle-related diseases has led to increased demand for omega-3-rich flaxseed oil supplements and functional products. Consumers prefer flaxseed oil in various forms, including capsules, bottled oil, fortified food products, and personal care items. Leading companies are also investing in cold-pressed and organic variants to cater to premium wellness-focused consumers

Europe Flaxseed Oil Market Insight

The European flaxseed oil market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the increasing demand for vegan and plant-based nutrition, as well as the integration of flaxseed oil in cosmetics and skincare products. Countries such as Germany, the UK, France, and the Netherlands are leading adopters, backed by environmental sustainability preferences and high market penetration of organic products. Flaxseed oil is also gaining traction in functional baking ingredients and dairy alternatives

U.K. Flaxseed Oil Market Insight

The UK flaxseed oil market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising vegetarianism and clean-label trends. With a surge in demand for heart-healthy oils and a proactive consumer base focused on wellness, flaxseed oil is becoming a staple in both culinary and cosmetic use cases. Increased product visibility across health food stores and online retail channels also supports market expansion

Germany Flaxseed Oil Market Insight

The German flaxseed oil market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s long-standing preference for natural remedies and herbal supplements. Germany’s strong herbal product market and inclination toward sustainable agriculture promote the use of flaxseed oil in both edible and non-edible segments. Local manufacturers emphasize organic certification and environmentally friendly packaging to appeal to eco-conscious consumers

Asia-Pacific Flaxseed Oil Market Insight

The Asia-Pacific flaxseed oil market is poised to grow at the fastest CAGR of over 24% in 2025, driven by rapid urbanization, an expanding middle class, and rising health awareness in countries such as India, China, Japan, and Australia. Flaxseed oil is increasingly used in Ayurvedic preparations, skin care routines, and nutritional supplements, especially in India and China. The region is also seeing growth in domestic flaxseed cultivation and low-cost manufacturing, making the product more affordable and accessible

Japan Flaxseed Oil Market Insight

The Japan flaxseed oil market is gaining momentum due to the country’s focus on anti-aging solutions, cardiovascular health, and nutraceuticals. Japanese consumers favor functional health foods and are drawn to cold-pressed and non-GMO flaxseed oil options. High levels of product innovation and cross-industry applications, particularly in cosmeceuticals and wellness beverages, are further enhancing demand

China Flaxseed Oil Market Insight

The China flaxseed oil market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising disposable incomes, traditional medicine applications, and a shift toward healthier lifestyles. China is a leading producer and exporter of flaxseed oil, with strong government support for domestic agriculture. Increased demand in both the food and personal care industries, along with the country’s rapidly growing e-commerce platforms, supports robust market growth

Flaxseed Oil Market Share

The flaxseed oil industry is primarily led by well-established companies, including:

- Cargill Incorporated (U.S.)

- ADM (Archer Daniels Midland Company) (U.S.)

- Healthy Oilseeds Grain Millers, Inc. (U.S.)

- Bartoline Limited (U.K.)

- Rapunzel Naturkost (Germany)

- Gustav Heess Oleochemische Erzeugnisse GmbH (Germany)

- Henry Lamotte Oils GmbH (Germany)

- Natural Factors Nutritional Products Ltd. (Canada)

- Krishi Oils Limited (India)

- Natrol, LLC (U.S.)

- Pharmavite (U.S.)

- Nature’s Bounty (U.S.)

- Heze Zonghoo Jianyuan Biotech Co., Ltd. (China)

- Shape Foods Inc. (U.S.)

- Nature's Way Products (U.S.)

- Rexall Sundown, Inc. (U.S.)

- Blackmores Limited (Australia)

- GNC Holdings, LLC (U.S.)

- Linwoods Health Foods (U.K.)

- Roquette Frères (France)

- Fonterra Co-operative Group (New Zealand)

Latest Developments in Global Flaxseed Oil Market

- In June 2025, Solgar launched a new dietary supplement featuring organic, cold-pressed flaxseed oil in softgel form. This product is designed to support cardiovascular, immune, and skin health by providing a rich source of Omega-3 fatty acids. The formulation ensures purity and nutritional integrity, making it a valuable addition to daily wellness routines

- In June 2025, SHIRO introduced a sensitive face and body oil featuring flaxseed oil, formulated to soothe and protect delicate skin. This product offers a mild nutty aroma with a soft cedarwood scent and is suitable for both skin and scalp care. The oil blends effortlessly, providing hydration and nourishment while maintaining a lightweight texture

- In May 2025, Latvia-based Iecavnieks & Co. announced an expansion of its operations, reinforcing its commitment to sustainability and environmental responsibility. The company, known for producing flaxseed oil and other natural health products, aims to enhance production capacity while maintaining high-quality standards. This growth aligns with its mission to provide eco-friendly and nutritious products to a broader market

- In March 2025, flaxseed oil companies pursued strategic acquisitions to reinforce domestic supply chains, addressing tariff challenges and ensuring a stable raw material supply. This approach enhances operational efficiency and secures long-term sustainability in the industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL FLAXSEED OIL MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL FLAXSEED OIL MARKETSIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL FLAXSEED OIL MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 RAW MATERIAL SOURCING ANALYSIS

5.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING ANALYSIS

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 BRAND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 GLOBAL FLAXSEED OIL MARKET, BY OIL TYPE, 2022-2031 (USD MILLION) (KILO TONS)

11.1 OVERVIEW

11.2 BROWN FLAXSEED OIL

11.3 GOLDEN FLAXSEED OIL

12 GLOBAL FLAXSEED OIL MARKET, BY PRODUCT TYPE , 2022-2031 (USD MILLION)

12.1 OVERVIEW

12.2 CONVENTIONAL

12.3 ORGANIC

13 GLOBAL FLAXSEED OIL MARKET, BY NATURE , 2022-2031 (USD MILLION)

13.1 OVERVIEW

13.2 GMO

13.3 NON-GMO

14 GLOBAL FLAXSEED OIL MARKET, BY EXTRACTION METHOD, 2022-2031 (USD MILLION)

14.1 OVERVIEW

14.2 COLD PRESSED/MECHANICAL PRESSING

14.3 SOLVENT EXTRACTION

14.4 SUPERCRITICAL CO2 EXTRACTION

14.5 SUBCRITICAL EXTRACTION

14.6 OTHERS

15 GLOBAL FLAXSEED OIL MARKET, BY APPLICATION , 2022-2031 (USD MILLION)

15.1 OVERVIEW

15.2 FOOD

15.2.1 FOOD, BY TYPE

15.2.1.1. BAKERY

15.2.1.1.1. BAKERY, BY TYPE

15.2.1.1.1.1 BREAD & ROLLS

15.2.1.1.1.2 CAKES, PASTRIES & TRUFFLE

15.2.1.1.1.3 TART & PIES

15.2.1.1.1.4 BROWNIES

15.2.1.1.1.5 BISCUIT, COOKIES & CRACKERS

15.2.1.1.1.6 OTHERS

15.2.1.2. DAIRY PRODUCTS

15.2.1.3. PROCESSED FOOD

15.2.1.3.1. PROCESSED FOOD, BY TYPE

15.2.1.3.1.1 READY MEALS

15.2.1.3.1.2 SAUCES, DRESSINGS AND CONDIMENTS

15.2.1.3.1.3 SOUPS

15.2.1.3.1.4 JAMS, PRESERVES & MARMALADES

15.2.1.3.1.5 OTHERS

15.2.1.4. CONFECTIONERY

15.2.1.4.1. CONFECTIONERY, BY TYPE

15.2.1.4.1.1 HARD-BOILED SWEETS

15.2.1.4.1.2 MINTS

15.2.1.4.1.3 GUMS & JELLIES

15.2.1.4.1.4 CHOCOLATE

15.2.1.4.1.5 CHOCOLATE SYRUPS

15.2.1.4.1.6 CARAMELS & TOFFEES

15.2.1.4.1.7 OTHERS

15.2.1.5. FROZEN DESSERTS

15.2.1.6. FUCNTIONAL FOOD

15.2.1.7. CONVENIENCE FOOD

15.2.1.7.1. CONVENIENCE FOOD, BY TYPE

15.2.1.7.1.1 INSTANT NOODLES

15.2.1.7.1.2 PIZZA & PASTA

15.2.1.7.1.3 SANCKS& EXTRUDED SNACKS

15.2.1.7.1.4 OTHERS

15.2.2 FOOD, BY FLAXSEED OIL TYPE

15.2.2.1. BROWN FLAXSEED OIL

15.2.2.2. GOLDEN FLAXSEED OIL

15.3 DIETERY SUPPLEMENTS

15.3.1 DIETERY SUPPLEMMENTS, BY TYPE

15.3.1.1. IMMUNITY SUPPLEMENTS

15.3.1.2. BONE AND JOINT HEALTH SUPPLEMENTS

15.3.1.3. OVERALL WELLBEING SUPPLEMENTS

15.3.1.4. BRAIN HEALTH SUPPLLEMNTS

15.3.1.5. SKIN HEALTH SUPPLEMENTS

15.3.1.6. OTEHRS

15.3.2 DIETARY SUPPLEMENTS, BY FLAXSEED OIL TYPE

15.3.2.1. BROWN FLAXSEED OIL

15.3.2.2. GOLDEN FLAXSEED OIL

15.4 PHARMACEUTICAL

15.4.1 PHARMACEUTICAL, BY FLAXSEED OIL TYPE

15.4.1.1. BROWN FLAXSEED OIL

15.4.1.2. GOLDEN FLAXSEED OIL

15.5 PAINTS & VARNISHES

15.5.1 PAINTS & VARNISHES, BY FLAXSEED OIL TYPE

15.5.1.1. BROWN FLAXSEED OIL

15.5.1.2. GOLDEN FLAXSEED OIL

15.6 PERSONAL CARE

15.6.1 PERSONAL CARE, BY TYPE

15.6.1.1. HAIR CARE

15.6.1.2. SKIN CARE

15.6.2 PERSONAL CARE, BY FLAXSEED OIL TYPE

15.6.2.1. BROWN FLAXSEED OIL

15.6.2.2. GOLDEN FLAXSEED OIL

15.7 COSMETIC

15.7.1 COSMETIC, BY TYPE

15.7.1.1. FACE CREAM

15.7.1.2. FACE SERUMS

15.7.1.3. LIP CARE AND LIPSTICK PRODUCTS

15.7.1.4. OTHERS

15.7.2 COSMETIC, BY FLAXSEED OIL TYPE

15.7.2.1. BROWN FLAXSEED OIL

15.7.2.2. GOLDEN FLAXSEED OIL

15.8 OTHERS

16 GLOBAL FLAXSEED OIL MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

16.1 OVERVIEW

16.2 DIRECT

16.3 INDIRECT

17 GLOBAL FLAXSEED OIL MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17.5 MERGERS & ACQUISITIONS

17.6 NEW PRODUCT DEVELOPMENT & APPROVALS

17.7 EXPANSIONS & PARTNERSHIP

17.8 REGULATORY CHANGES

18 GLOBAL FLAXSEED OIL MARKET, BY GEOGRAPHY, 2022-2031 (USD MILLION) (KILO TONS)

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

18.1 NORTH AMERICA

18.1.1 U.S.

18.1.2 CANADA

18.1.3 MEXICO

18.2 EUROPE

18.2.1 GERMANY

18.2.2 U.K.

18.2.3 ITALY

18.2.4 FRANCE

18.2.5 SPAIN

18.2.6 SWITZERLAND

18.2.7 NETHERLANDS

18.2.8 BELGIUM

18.2.9 RUSSIA

18.2.10 TURKEY

18.2.11 NORWAY

18.2.12 SWEDEN

18.2.13 FINLAND

18.2.14 DENMARK

18.2.15 POLAND

18.2.16 REST OF EUROPE

18.3 ASIA-PACIFIC

18.3.1 JAPAN

18.3.2 CHINA

18.3.3 SOUTH KOREA

18.3.4 INDIA

18.3.5 AUSTRALIA

18.3.6 SINGAPORE

18.3.7 THAILAND

18.3.8 INDONESIA

18.3.9 MALAYSIA

18.3.10 PHILIPPINES

18.3.11 VIETNAM

18.3.12 TAIWAN

18.3.13 REST OF ASIA-PACIFIC

18.4 SOUTH AMERICA

18.4.1 BRAZIL

18.4.2 ARGENTINA

18.4.3 REST OF SOUTH AMERICA

18.5 MIDDLE EAST AND AFRICA

18.5.1 SOUTH AFRICA

18.5.2 UAE

18.5.3 SAUDI ARABIA

18.5.4 EGYPT

18.5.5 ISRAEL

18.5.6 OMAN

18.5.7 QATAR

18.5.8 BAHRAIN

18.5.9 KUWAIT

18.5.10 REST OF MIDDLE EAST AND AFRICA

19 GLOBAL FLAXSEED OIL MARKET, SWOT & DBMR ANALYSIS

20 GLOBAL FLAXSEED OIL MARKET, COMPANY PROFILES

20.1 CARGILL INCORPORATED

20.1.1 COMPANY OVERVIEW

20.1.2 REVENUE ANALYSIS

20.1.3 GEOGRAPHICAL PRESENCE

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENTS

20.2 ADM

20.2.1 COMPANY OVERVIEW

20.2.2 REVENUE ANALYSIS

20.2.3 GEOGRAPHICAL PRESENCE

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENTS

20.3 HEALTHY OILSEEDS GRAIN MILLERS, INC.

20.3.1 COMPANY OVERVIEW

20.3.2 REVENUE ANALYSIS

20.3.3 GEOGRAPHICAL PRESENCE

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPMENTS

20.4 BARTOLINE LIMITED

20.4.1 COMPANY OVERVIEW

20.4.2 REVENUE ANALYSIS

20.4.3 GEOGRAPHICAL PRESENCE

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPMENTS

20.5 RAPUNZEL NATURKOST

20.5.1 COMPANY OVERVIEW

20.5.2 REVENUE ANALYSIS

20.5.3 GEOGRAPHICAL PRESENCE

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENTS

20.6 GUSTAV HEESS OLEOCHEMISCHE ERZEUGNISSE GMBH

20.6.1 COMPANY OVERVIEW

20.6.2 REVENUE ANALYSIS

20.6.3 GEOGRAPHICAL PRESENCE

20.6.4 PRODUCT PORTFOLIO

20.6.5 RECENT DEVELOPMENTS

20.7 HENRY LAMOTTE OILS GMBH

20.7.1 COMPANY OVERVIEW

20.7.2 REVENUE ANALYSIS

20.7.3 GEOGRAPHICAL PRESENCE

20.7.4 PRODUCT PORTFOLIO

20.7.5 RECENT DEVELOPMENTS

20.8 NATURAL FACTORS NUTRITIONAL PRODUCTS LTD.

20.8.1 COMPANY OVERVIEW

20.8.2 REVENUE ANALYSIS

20.8.3 GEOGRAPHICAL PRESENCE

20.8.4 PRODUCT PORTFOLIO

20.8.5 RECENT DEVELOPMENTS

20.8.6

20.8.7

20.9 KRISHI OILS LIMITED

20.9.1 COMPANY OVERVIEW

20.9.2 REVENUE ANALYSIS

20.9.3 GEOGRAPHICAL PRESENCE

20.9.4 PRODUCT PORTFOLIO

20.9.5 RECENT DEVELOPMENTS

20.1 NATROL, LLC

20.10.1 COMPANY OVERVIEW

20.10.2 REVENUE ANALYSIS

20.10.3 GEOGRAPHICAL PRESENCE

20.10.4 PRODUCT PORTFOLIO

20.10.5 RECENT DEVELOPMENTS

20.11 ROQUETTE FRÈRES.

20.11.1 COMPANY OVERVIEW

20.11.2 REVENUE ANALYSIS

20.11.3 GEOGRAPHICAL PRESENCE

20.11.4 PRODUCT PORTFOLIO

20.11.5 RECENT DEVELOPMENTS

20.12 ONTERRA CO-OPERATIVE GROUP

20.12.1 COMPANY OVERVIEW

20.12.2 REVENUE ANALYSIS

20.12.3 GEOGRAPHICAL PRESENCE

20.12.4 PRODUCT PORTFOLIO

20.12.5 RECENT DEVELOPMENTS

20.13 BIORIGINAL

20.13.1 COMPANY OVERVIEW

20.13.2 REVENUE ANALYSIS

20.13.3 GEOGRAPHICAL PRESENCE

20.13.4 PRODUCT PORTFOLIO

20.13.5 RECENT DEVELOPMENTS

20.14 FOODS ALIVE

20.14.1 COMPANY OVERVIEW

20.14.2 REVENUE ANALYSIS

20.14.3 GEOGRAPHICAL PRESENCE

20.14.4 PRODUCT PORTFOLIO

20.14.5 RECENT DEVELOPMENTS

20.15 THE SKIN SCIENCE COMPANY

20.15.1 COMPANY OVERVIEW

20.15.2 REVENUE ANALYSIS

20.15.3 GEOGRAPHICAL PRESENCE

20.15.4 PRODUCT PORTFOLIO

20.15.5 RECENT DEVELOPMENTS

20.16 BOTANIC INNOVATIONS, LLC.

20.16.1 COMPANY OVERVIEW

20.16.2 REVENUE ANALYSIS

20.16.3 GEOGRAPHICAL PRESENCE

20.16.4 PRODUCT PORTFOLIO

20.16.5 RECENT DEVELOPMENTS

20.17 CONNOLIS

20.17.1 COMPANY OVERVIEW

20.17.2 REVENUE ANALYSIS

20.17.3 GEOGRAPHICAL PRESENCE

20.17.4 PRODUCT PORTFOLIO

20.17.5 RECENT DEVELOPMENTS

20.18 SPACK INTERNATIONAL

20.18.1 COMPANY OVERVIEW

20.18.2 REVENUE ANALYSIS

20.18.3 GEOGRAPHICAL PRESENCE

20.18.4 PRODUCT PORTFOLIO

20.18.5 RECENT DEVELOPMENTS

20.19 AG INDUSTRIES

20.19.1 COMPANY OVERVIEW

20.19.2 REVENUE ANALYSIS

20.19.3 GEOGRAPHICAL PRESENCE

20.19.4 PRODUCT PORTFOLIO

20.19.5 RECENT DEVELOPMENTS

20.2 SHAPE FOODS INC.

20.20.1 COMPANY OVERVIEW

20.20.2 REVENUE ANALYSIS

20.20.3 GEOGRAPHICAL PRESENCE

20.20.4 PRODUCT PORTFOLIO

20.20.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

21 RELATED REPORTS

22 CONCLUSION

23 QUESTIONNAIRE

24 ABOUT DATA BRIDGE MARKET RESEARCH

Global Flaxseed Oil Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Flaxseed Oil Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Flaxseed Oil Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.