Global Fleet Charging Market

Market Size in USD Billion

CAGR :

%

USD

3.45 Billion

USD

22.39 Billion

2024

2032

USD

3.45 Billion

USD

22.39 Billion

2024

2032

| 2025 –2032 | |

| USD 3.45 Billion | |

| USD 22.39 Billion | |

|

|

|

|

Fleet Charging Market Size

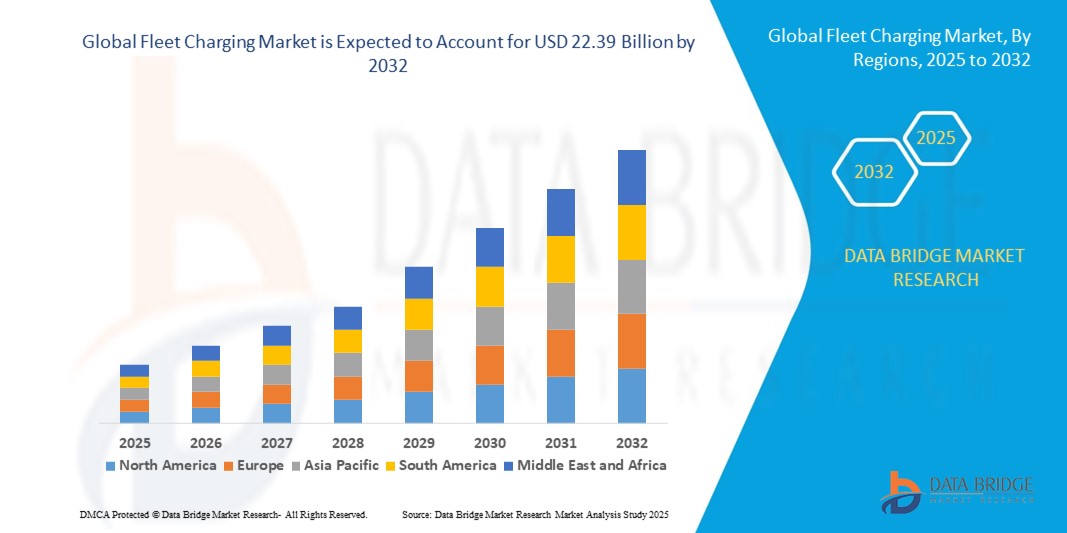

- The global fleet charging market size was valued at USD 3.45 billion in 2024 and is expected to reach USD 22.39 billion by 2032, at a CAGR of 23.1% during the forecast period

- The market growth is largely fueled by the increasing adoption of electric vehicles (EVs) across commercial fleets, including last-mile delivery, trucking, and public transportation, coupled with technological advancements in high-speed and smart charging infrastructure. This shift is driving fleet operators to invest in reliable, scalable, and cost-efficient charging solutions to optimize operational efficiency

- Furthermore, rising emphasis on sustainability, government incentives for electrification, and growing pressure to reduce carbon emissions are establishing fleet charging solutions as a critical component of modern commercial mobility. These converging factors are accelerating the deployment of fleet charging stations, thereby significantly boosting the market’s expansion

Fleet Charging Market Analysis

- Fleet charging solutions provide dedicated electric vehicle charging infrastructure for commercial and corporate fleets, including AC and DC fast chargers, smart energy management systems, and integrated software for monitoring and optimizing charging schedules. These systems enable efficient, cost-effective, and scalable operations for fleets of all sizes

- The escalating demand for fleet charging is primarily fueled by the rapid electrification of logistics, transportation, and service fleets, increasing adoption of high-capacity batteries, and growing focus on reducing operational costs and emissions. Enhanced interoperability, smart charging features, and flexible installation options further drive market growth across residential, urban, and highway fleet applications

- Asia-Pacific dominated the fleet charging market with a share of 67.9% in 2024, due to rapid adoption of electric vehicles, expanding logistics and last-mile delivery fleets, and increasing government initiatives promoting electrification

- North America is expected to be the fastest growing region in the fleet charging market during the forecast period due to rapid electrification of trucking fleets, e-commerce delivery services, and public transportation networks

- Fixed segment dominated the market with a market share of 62.5% in 2024, due to its ability to deliver high power output, reliability, and long-term operational stability for fleet depots. Fleet operators often rely on fixed chargers to simultaneously service multiple vehicles while integrating with energy management and scheduling systems, ensuring optimal charging efficiency. Their robust infrastructure, durability under heavy usage, and compatibility with high-capacity batteries make them indispensable for large fleets. In addition, fixed chargers support advanced monitoring and maintenance features, enhancing operational reliability and minimizing downtime

Report Scope and Fleet Charging Market Segmentation

|

Attributes |

Fleet Charging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Fleet Charging Market Trends

Rising Advancements in Charging Technology

- Continuous innovation in charging technologies, including ultra-fast chargers, wireless charging, and smart-grid integration, is accelerating the adoption of fleet charging solutions by improving charging speed, efficiency, and energy management for electric vehicle (EV) fleets

- For instance, companies such as ABB, Tesla, and ChargePoint are developing advanced fleet charging stations with capabilities such as ultra-high power output, automated scheduling, and vehicle-to-grid (V2G) functionalities that optimize charging costs and grid stability for commercial operators

- Expansion of wireless and inductive charging systems minimizes physical cable dependencies, enabling more flexible and automated charging processes ideal for large fleet operations such as delivery, public transit, and logistics

- Integration of AI and IoT in charging infrastructure allows predictive maintenance, real-time energy consumption analytics, and seamless integration with renewable energy sources, enhancing sustainability and reducing operational costs

- Growing focus on interoperability and standardized charging protocols promotes cross-compatibility of equipment and simplified fleet management across multiple EV brands and models

- Development of modular and scalable charging networks supports the rapid expansion of EV fleets in urban and commercial settings, enabling operators to adapt infrastructure to evolving needs

Fleet Charging Market Dynamics

Driver

Growing Government Incentives and Regulations

- Increasing government support worldwide in the form of subsidies, tax credits, mandates, and emission reduction targets is driving the expansion of fleet charging infrastructure to meet environmental goals and accelerate EV adoption

- For instance, policy frameworks in regions such as the European Union, China, and the United States promote accelerated deployment of public and private fleet charging stations, with programs aimed at electrifying bus depots, delivery vehicles, and municipal fleets supported by companies such as Siemens and EVgo

- Regulatory emphasis on air quality improvement, greenhouse gas emissions reduction, and sustainable urban mobility underpins legislative mandates for fleet electrification, directly influencing infrastructure investments

- Public-private partnerships and grant programs encourage investment in innovative charging technologies and expand network accessibility, especially in underserved and commercial zones

- Increasing regulatory focus on standardization and interoperability ensures efficient coordination between fleet operators, utility providers, and technology vendors to optimize charging ecosystem performance

Restraint/Challenge

Infrastructure Deployment Challenges

- The establishment of widespread, reliable fleet charging infrastructure faces significant challenges, including high installation costs, grid capacity limitations, and logistical complexities related to site selection and integration with existing facilities

- For instance, fleet operators often encounter delays and budget overruns due to utility interconnection hurdles, permitting processes, and coordination requirements with multiple stakeholders during charger deployment

- The necessity for robust power distribution upgrades to support high-capacity fast chargers complicates infrastructure expansion and can limit charger density in urban or constrained locations

- Lack of standardization in charger types, communication protocols, and billing systems creates interoperability issues, increasing operational complexity and limiting seamless user experience

- Continuous technological evolution requires future-proofing charge infrastructure investments, creating uncertainty and hesitation among operators regarding technology obsolescence and upgrade cycles

Fleet Charging Market Scope

The market is segmented on the basis of installation type, type, charging level, and end users.

- By Installation Type

On the basis of installation type, the fleet charging market is segmented into fixed and portable charging stations. The fixed installation segment dominated the largest market revenue share of 62.5% in 2024, driven by its ability to deliver high power output, reliability, and long-term operational stability for fleet depots. Fleet operators often rely on fixed chargers to simultaneously service multiple vehicles while integrating with energy management and scheduling systems, ensuring optimal charging efficiency. Their robust infrastructure, durability under heavy usage, and compatibility with high-capacity batteries make them indispensable for large fleets. In addition, fixed chargers support advanced monitoring and maintenance features, enhancing operational reliability and minimizing downtime.

The portable installation segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising need for flexible, on-demand charging solutions. Portable chargers allow operators to manage temporary deployments, route changes, or emergency charging needs without investing in permanent infrastructure. Their compact design, mobility, and adaptability across diverse vehicle types make them especially appealing for last-mile delivery, service fleets, and urban mobility operations. Increasing adoption is also supported by lower installation costs and the growing preference for scalable solutions in smaller fleets.

- By Type

On the basis of type, the fleet charging market is segmented into AC charging stations and DC charging stations. The DC charging station segment held the largest market revenue share in 2024, driven by its high-speed charging capabilities that minimize vehicle downtime and support continuous fleet operations. DC chargers are particularly essential for large trucks, buses, and other commercial vehicles requiring rapid energy transfer. Their integration with advanced fleet management systems allows operators to monitor charging patterns, optimize schedules, and reduce operational bottlenecks. The growing demand for electrification in freight and public transport further reinforces the dominance of DC fast chargers.

The AC charging station segment is projected to witness the fastest CAGR from 2025 to 2032, driven by its cost-effectiveness, ease of installation, and widespread compatibility with various EV models. AC chargers are ideal for overnight or depot charging, where vehicles are parked for extended periods, allowing fleets to replenish energy without requiring ultra-fast charging infrastructure. Their growing adoption is supported by smaller fleet operators, service companies, and businesses seeking low-maintenance, scalable charging solutions. The flexibility and incremental deployment potential of AC chargers make them an attractive option for fleets transitioning to electric mobility.

- By Charging Level

On the basis of charging level, the fleet charging market is segmented into Level 2 and Level 3 chargers. The Level 3 segment dominated the largest market revenue share in 2024, propelled by the urgent need for high-speed charging solutions that enable minimal downtime for high-utilization commercial fleets. Level 3 chargers, primarily DC fast chargers, support large batteries and long-haul operations by providing rapid energy replenishment, often within 30–60 minutes. Their advanced energy delivery systems, compatibility with diverse vehicle types, and integration with fleet scheduling tools make them indispensable for trucking and public transit operations. The segment’s dominance is further reinforced by the growth of logistics and freight electrification globally.

The Level 2 segment is expected to witness the fastest growth rate from 2025 to 2032, driven by adoption in smaller, urban, and last-mile delivery fleets. Level 2 chargers offer a balanced solution of moderate charging speed and cost-efficiency, suitable for overnight depot charging and planned operational downtime. Their simplicity, safety features, and low installation requirements make them highly scalable for expanding fleets. Growing investments in urban EV infrastructure and increasing government incentives for fleet electrification further boost the adoption of Level 2 charging solutions.

- By End Users

On the basis of end users, the fleet charging market is segmented into service & last-mile companies, trucking companies, public transportation, and others. The trucking companies segment dominated the largest market revenue share in 2024, driven by the rapid electrification of long-haul and regional freight fleets. High-capacity trucks require fast and reliable charging infrastructure to maintain route efficiency and meet tight delivery schedules. The integration of charging solutions with fleet management platforms enables operators to optimize energy usage, reduce operational costs, and monitor fleet performance in real time. The expansion of e-commerce, cross-border logistics, and urban freight demand further strengthens this segment.

The service & last-mile companies segment is projected to witness the fastest CAGR from 2025 to 2032, fueled by surging e-commerce deliveries, urbanization, and the transition to electric fleets in densely populated areas. These fleets benefit from smaller, scalable, and strategically located charging stations that support continuous operations with minimal downtime. The growing focus on sustainability, emission reduction targets, and favorable government policies incentivize adoption among last-mile and service fleet operators. Increasing demand for flexible and mobile charging solutions also contributes to rapid market growth in this segment.

Fleet Charging Market Regional Analysis

- Asia-Pacific dominated the fleet charging market with the largest revenue share of 67.9% in 2024, driven by rapid adoption of electric vehicles, expanding logistics and last-mile delivery fleets, and increasing government initiatives promoting electrification

- The region’s cost-effective manufacturing landscape, rising investments in EV charging infrastructure, and expanding renewable energy integration are accelerating market expansion

- The availability of skilled labor, favorable government policies, and rapid urbanization across developing economies are contributing to increased deployment of fleet charging solutions

China Fleet Charging Market Insight

China held the largest share in the Asia-Pacific fleet charging market in 2024, owing to its leadership in electric vehicle adoption, large-scale logistics operations, and strong government support for electrification. The country’s extensive industrial base, incentives for clean energy infrastructure, and growing deployment of public and private EV charging networks are key growth drivers. Demand is also bolstered by investments in high-capacity DC fast chargers for commercial fleets and integration with smart fleet management systems.

India Fleet Charging Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing electrification of service and last-mile fleets, rising e-commerce deliveries, and expanding investments in charging infrastructure. Government policies under initiatives such as FAME (Faster Adoption and Manufacturing of Electric Vehicles) and increasing interest in sustainable logistics are strengthening the demand for fleet charging solutions. In addition, urbanization, rising fleet electrification pilot projects, and adoption of portable and flexible charging stations are contributing to rapid market growth.

Europe Fleet Charging Market Insight

The Europe fleet charging market is expanding steadily, supported by stringent emission regulations, increasing adoption of electric public transport, and growing investments in high-capacity charging networks. The region emphasizes sustainability, energy efficiency, and smart grid integration for fleet operations. Rising deployment of DC fast chargers for commercial fleets and incentives for low-emission logistics operations further enhance market growth, particularly across Western Europe.

Germany Fleet Charging Market Insight

Germany’s fleet charging market is driven by its leadership in automotive electrification, extensive commercial fleet networks, and strong government incentives for EV adoption. The country’s focus on sustainable transport, research and innovation in high-capacity charging technology, and partnerships between industry and academia are fostering continuous advancements in fleet charging solutions. Demand is particularly strong for heavy-duty electric trucks, public buses, and last-mile delivery fleets.

U.K. Fleet Charging Market Insight

The U.K. market is supported by a growing focus on electrifying commercial fleets, expanding public transportation charging infrastructure, and increased government initiatives promoting low-emission logistics. Strong emphasis on R&D, urban fleet electrification programs, and adoption of innovative charging solutions such as portable and modular chargers are contributing to market expansion. The country continues to play a significant role in implementing sustainable fleet operations in Europe.

North America Fleet Charging Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by rapid electrification of trucking fleets, e-commerce delivery services, and public transportation networks. Increasing adoption of high-capacity DC fast chargers, government incentives for EV infrastructure, and collaborations between fleet operators and technology providers are boosting market growth. Growing reshoring of logistics operations and integration of renewable energy for fleet charging are further accelerating adoption.

U.S. Fleet Charging Market Insight

The U.S. accounted for the largest share in the North America fleet charging market in 2024, underpinned by its expansive commercial and last-mile delivery fleets, robust EV adoption, and strong investment in charging infrastructure. The country’s focus on sustainability, innovation in high-speed charging solutions, and extensive fleet management integration are encouraging widespread deployment. Presence of leading EV manufacturers, energy companies, and a mature infrastructure ecosystem further solidify the U.S.’s leading position in the region.

Fleet Charging Market Share

The fleet charging industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- ChargePoint, Inc. (U.S.)

- Phihong USA Corp. (U.S.)

- EV Safe Charge Inc. (U.S.)

- Tesla (U.S.)

- Electrify America (U.S.)

- Blink Charging Co. (U.S.)

- EVgo Services LLC (U.S.)

- CyberSwitching (U.S.)

- Siemens (Germany)

Latest Developments in Global Fleet Charging Market

- In April 2025, Siemens announced the launch of Depot360 Home Charging Reimbursement in the United States as part of its Managed Services portfolio. This offering allows fleet operators to efficiently reimburse drivers for home charging sessions while minimizing capital expenditures and operational costs. By enabling accurate tracking of home-based charging, Siemens is supporting widespread fleet electrification, particularly for companies with distributed drivers, and facilitating smoother adoption of electric vehicle fleets across diverse commercial sectors

- In March 2025, ChargePoint operator Ionity launched Ionity Fleet, a dedicated solution for corporate fleets operating electric vehicles (EVs). The product offers competitive charging rates and flexible tariff models tailored to various fleet sizes and usage patterns. This launch strengthens the corporate fleet charging segment by providing cost-optimized, scalable charging solutions, enhancing operational efficiency, and accelerating the shift of commercial fleets toward full electrification across Europe and North America

- In October 2023, BP Pulse entered a strategic partnership with Tesla to expand the ultra-fast charging network in the U.S. under a $100 million order. Tesla chargers will be deployed in 2024 across BP Pulse’s network, including BP, Amoco, and ampm sites, Thorntons-branded locations, TravelCenters of America, and BP Pulse Gigahub™ sites near airports and major cities. This collaboration significantly strengthens public and commercial fleet access to high-speed charging, reducing range anxiety and supporting broader EV fleet adoption in urban and long-haul operations

- In October 2023, ChargePoint launched cable conversion kits for existing DC fast chargers, allowing Tesla owners to access public fast charging for the first time. In addition, NACS connection support is being introduced across ChargePoint’s AC and DC solutions. This innovation enhances interoperability within the EV charging ecosystem, broadening the customer base for fast chargers and facilitating seamless fleet operations for mixed-vehicle fleets, particularly those including Tesla vehicles

- In February 2023, Volkswagen Group brand Elli introduced Elli Fleet Charging across Europe, providing intelligent fleet management and cost-optimization tools in Germany, Italy, Spain, and Austria. Within months of its introduction, over 650 German companies and fleet managers adopted the solution. By enabling efficient scheduling, monitoring, and energy cost control, Elli Fleet Charging strengthens EV fleet utilization, reduces operational expenses, and promotes the broader electrification of commercial and corporate vehicle fleets across Europe

- In December 2020, Phihong Technology released the Level 3 DW Series 30kW Wall Mount DC fast charger, designed for commercial fleet management, highway service stations, parking garages, and EV infrastructure providers globally. The charger offers dual connections and up to four times faster charging than conventional 7kW AC chargers, delivering significant operational efficiencies for fleet operators. Its easy installation and customizable setup make it a key enabler for high-demand fleet operations, supporting rapid adoption of electric commercial vehicles

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fleet Charging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fleet Charging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fleet Charging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.