Global Flexible Paper Market

Market Size in USD Billion

CAGR :

%

USD

48.67 Billion

USD

66.86 Billion

2024

2032

USD

48.67 Billion

USD

66.86 Billion

2024

2032

| 2025 –2032 | |

| USD 48.67 Billion | |

| USD 66.86 Billion | |

|

|

|

|

What is the Global Flexible Paper Market Size and Growth Rate?

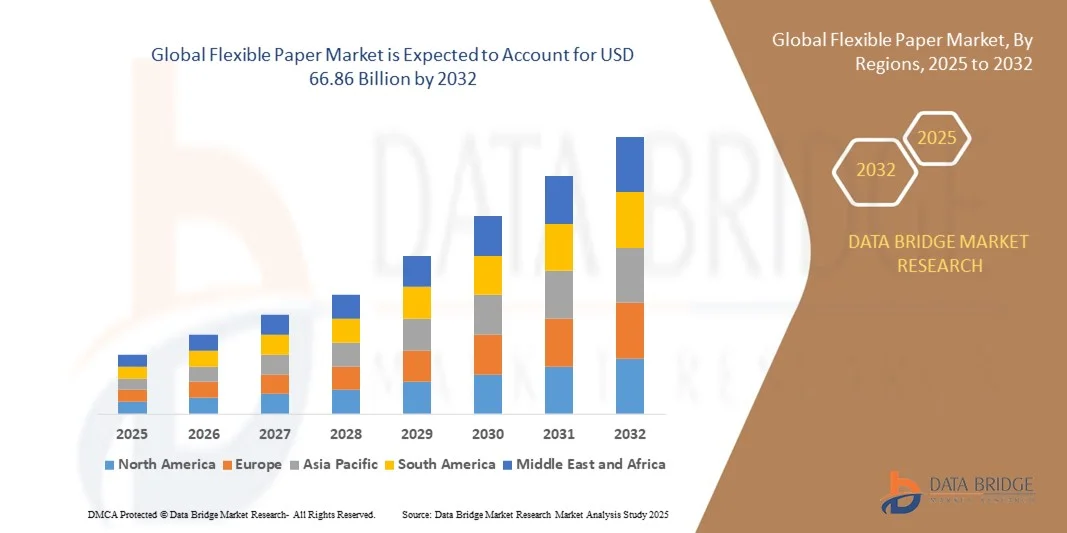

- The global flexible paper market size was valued at USD 48.67 billion in 2024 and is expected to reach USD 66.86 billion by 2032, at a CAGR of 4.05% during the forecast period

- Major factors that are expected to boost the growth of the flexible paper market in the forecast period are the rise in the demand of flexible paper packaging in the electronics industries. Furthermore, the increase in the need for folding cartons in the premium snacks and alcoholic drinks packaging is further anticipated to propel the growth of the flexible paper market

What are the Major Takeaways of Flexible Paper Market?

- The rise in the need for eco-friendly and sustainable packaging is further estimated to cushion the growth in the flexible paper market. On the other hand, the rise in the expense of production is further projected to impede the growth of the flexible paper market in the timeline period

- In addition, the growing need for of packed food will further provide potential opportunities for the growth of the of packed food in the coming years. However, the accessibility of replacement in the market might further challenge the growth of the flexible paper market in the near future

- Asia-Pacific dominated the flexible paper market with the largest revenue share of 34.49% in 2024, driven by the growing demand for industrial and consumer packaging, expanding manufacturing hubs, and increasing adoption of sustainable packaging solutions

- The North America Flexible Paper market is poised to grow at the fastest CAGR of 9.65% during 2025–2032, driven by the rising adoption of sustainable and recyclable packaging, growing demand from the food and pharmaceutical industries, and technological advancements in manufacturing processes

- The Sack Kraft Paper segment dominated the market with the largest revenue share of 42.5% in 2024, driven by its strength, durability, and wide adoption in packaging applications across multiple industries such as food, chemicals, and construction

Report Scope and Flexible Paper Market Segmentation

|

Attributes |

Flexible Paper Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Flexible Paper Market?

Sustainability and Smart Packaging Integration

- A major and rapidly accelerating trend in the global flexible paper market is the growing emphasis on sustainability combined with smart packaging solutions. Companies are increasingly integrating eco-friendly materials and digital features to enhance functionality while reducing environmental impact

- For instance, several flexible paper packaging solutions now incorporate QR codes or NFC tags, allowing consumers to access product information, track freshness, or engage with brand loyalty programs. This digital integration improves convenience and creates interactive consumer experiences

- Smart sensors embedded in flexible paper packaging can monitor temperature, humidity, and product integrity, enabling real-time feedback for manufacturers and distributors. Such innovations enhance supply chain efficiency and ensure higher product quality

- The seamless combination of sustainability and smart technology in flexible paper packaging also aligns with regulatory requirements and rising consumer demand for eco-conscious products, positioning these solutions as a preferred choice for FMCG, food, and beverage industries

- Companies such as Huhtamaki, Tetra Pak, and Mondi are developing next-generation flexible paper solutions that balance recyclability, biodegradability, and smart functionality, setting a new standard in the packaging industry

- The trend towards intelligent, sustainable, and interactive packaging is fundamentally reshaping consumer expectations, driving widespread adoption across commercial and retail sectors

What are the Key Drivers of Flexible Paper Market?

- The growing awareness of environmental sustainability and the shift towards biodegradable, recyclable, and compostable materials are primary drivers boosting the flexible paper market

- For instance, in 2024, Huhtamaki Group introduced eco-friendly flexible paper packaging solutions with high barrier properties to replace single-use plastics, enhancing brand appeal while meeting regulatory mandates

- The rising e-commerce and ready-to-eat food sectors are increasingly demanding flexible, lightweight, and durable packaging that maintains product freshness and reduces transportation costs

- Advanced flexible paper solutions with smart features, such as temperature-sensitive indicators and QR-enabled tracking, further drive adoption among manufacturers seeking supply chain visibility and enhanced consumer engagement

- Convenience factors such as resealable pouches, stand-up pouches, and easy-to-open designs, coupled with customizable printing for branding, encourage companies to shift from conventional packaging to flexible paper

- Overall, the combination of sustainability, functionality, and digital integration is stimulating significant demand across food, beverage, pharmaceutical, and personal care industries

Which Factor is Challenging the Growth of the Flexible Paper Market?

- Limited recycling infrastructure and the higher cost of advanced flexible paper solutions compared to conventional packaging pose a significant challenge to market growth

- In some regions, consumers and businesses remain hesitant to adopt premium sustainable packaging due to perceived higher expenses or lack of awareness about environmental benefits

- Ensuring consistent material quality and maintaining barrier properties while using biodegradable or compostable substrates can be technically challenging, sometimes affecting product shelf life

- Regulatory inconsistencies across regions, particularly regarding compostability, recyclability, and food safety standards, also hinder global adoption of flexible paper solutions

- Overcoming these challenges requires investments in research and development, public awareness campaigns, and expansion of recycling and collection infrastructure. Companies that successfully balance cost, sustainability, and functionality are expected to lead the market in the coming years

How is the Flexible Paper Market Segmented?

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the flexible paper market is segmented into Uncoated Paper, Coater Paper, Sack Kraft Paper, and Gift Wraps. The Sack Kraft Paper segment dominated the market with the largest revenue share of 42.5% in 2024, driven by its strength, durability, and wide adoption in packaging applications across multiple industries such as food, chemicals, and construction. Businesses prefer sack kraft paper for its high tear resistance, moisture tolerance, and cost-effectiveness, making it ideal for bulk packaging.

The Gift Wraps segment is anticipated to witness the fastest CAGR of 22.3% from 2025 to 2032, fueled by rising consumer demand for premium packaging and decorative paper solutions in retail, e-commerce, and gifting applications. Growth is further supported by trends in seasonal packaging, customizable prints, and sustainable wrapping options, which are driving innovation in design and functionality. Overall, sack kraft paper continues to dominate while gift wraps represent the fastest-growing type segment globally.

- By Application

On the basis of application, the flexible paper market is segmented into Food and Beverages, Chemicals and Fertilizers, Pharmaceuticals, Automotive and Allied Industries, Electrical and Electronics, Consumer Goods, and Others. The Food and Beverages segment accounted for the largest market revenue share of 44.8% in 2024, driven by the extensive use of flexible paper in packaging perishable and non-perishable products, maintaining freshness, and meeting safety standards. Flexible paper packaging ensures lightweight, durable, and recyclable solutions, making it highly suitable for the FMCG and retail sectors.

The Pharmaceuticals segment is expected to witness the fastest CAGR of 23.1% from 2025 to 2032, propelled by the increasing demand for safe, tamper-evident, and regulatory-compliant packaging for medicines and health products. Growing awareness of drug safety, combined with the need for eco-friendly packaging solutions, is driving innovation and adoption in this segment. While food and beverages dominate revenue, pharmaceutical applications represent the fastest-growing opportunity for flexible paper globally.

Which Region Holds the Largest Share of the Flexible Paper Market?

- Asia-Pacific dominated the flexible paper market with the largest revenue share of 34.49% in 2024, driven by the growing demand for industrial and consumer packaging, expanding manufacturing hubs, and increasing adoption of sustainable packaging solutions

- Consumers and businesses in the region highly value cost-effective, durable, and eco-friendly Flexible Paper options that cater to industries such as food and beverages, pharmaceuticals, and consumer goods

- The widespread adoption is further supported by rising disposable incomes, rapid urbanization, and strong manufacturing capabilities, establishing Flexible Papers as a preferred choice for both commercial and industrial applications

China Flexible Paper Market Insight

The China flexible paper market captured the largest revenue share of 81% in 2024 within Asia-Pacific, fueled by high industrial output, increasing e-commerce demand, and government initiatives promoting sustainable packaging solutions. The country’s position as a manufacturing hub ensures ready availability of high-quality flexible paper for domestic and export markets. The growing demand in food, pharmaceuticals, and consumer goods sectors continues to drive market expansion.

Japan Flexible Paper Market Insight

The Japan flexible paper market is projected to grow at a substantial CAGR during the forecast period, supported by technological advancements in packaging machinery and increasing emphasis on eco-friendly and recyclable paper products. The country’s aging population and demand for convenience are driving the adoption of premium and functional Flexible Paper solutions in both industrial and consumer segments.

India Flexible Paper Market Insight

The India flexible paper market is expected to expand at a considerable CAGR over the forecast period, fueled by rapid urbanization, rising disposable incomes, and increased industrial activity. Government initiatives promoting sustainable packaging and the growing presence of multinational food and FMCG companies are encouraging widespread adoption of Flexible Paper solutions.

Which Region is the Fastest Growing Region in the Flexible Paper Market?

The North America flexible paper market is poised to grow at the fastest CAGR of 9.65% during 2025–2032, driven by the rising adoption of sustainable and recyclable packaging, growing demand from the food and pharmaceutical industries, and technological advancements in manufacturing processes. The region’s focus on reducing plastic use and increasing regulatory support for eco-friendly packaging is accelerating market growth.

U.S. Flexible Paper Market Insight

The U.S. flexible paper market is witnessing strong growth due to the increasing demand for sustainable packaging solutions in e-commerce, retail, and industrial sectors. Adoption of functional and specialty Flexible Papers for consumer goods and pharmaceuticals, combined with innovations in high-performance packaging, is driving revenue expansion.

Canada Flexible Paper Market Insight

The Canada flexible paper market is expected to expand at a noteworthy CAGR during the forecast period, supported by rising consumer preference for environmentally friendly packaging and government-led initiatives promoting sustainability. Industrial applications in food, pharmaceuticals, and chemicals are driving growth across both commercial and manufacturing segments.

Which are the Top Companies in Flexible Paper Market?

The flexible paper industry is primarily led by well-established companies, including:

- Huhtamaki Group (Finland)

- International Paper (U.S.)

- DS Smith (U.K.)

- NIPPON PAPER INDUSTRIES CO., LTD (Japan)

- Oji Holdings Corporation (Japan)

- Georgia-Pacific (U.S.)

- Packaging Corporation of America (U.S.)

- Detmold Group (Australia)

- Magnum Packaging (U.S.)

- Mondi (U.K.)

- Tetra Pak International (Sweden)

- Smurfit Kappa (Ireland)

- WestRock Company (U.S.)

- Sonoco Products Company (U.S.)

- Bryce Corporation (U.S.)

- Visy (Australia)

- Pratt Industries, Inc (U.S.)

What are the Recent Developments in Global Flexible Paper Market?

- In February 2025, Amcor completed its merger with Berry Global, creating a larger and more diversified platform for paper-based flexible solutions, strengthening its global presence and product offerings. This strategic merger is expected to enhance operational efficiency and market competitiveness

- In January 2025, Huhtamaki India hosted Think Circle, highlighting guidance on flexible packaging recycling and promoting sustainable practices within the industry. The initiative reinforced the company’s commitment to environmental responsibility and circular economy principles

- In January 2025, International Paper finalized the USD 7.2 billion acquisition of DS Smith, expanding its global reach in corrugated and flexible products. This acquisition is expected to enhance the company’s production capabilities and market penetration across multiple regions

- In December 2024, Stora Enso ramped up production at its Oulu mill following a USD 1.13 billion capacity upgrade, boosting the European supply of coated kraft paper. This expansion is projected to meet rising regional demand and support growth in sustainable packaging solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Flexible Paper Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Flexible Paper Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Flexible Paper Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.