Global Flexible Plastic Packaging Market

Market Size in USD Billion

CAGR :

%

USD

208.43 Billion

USD

304.44 Billion

2024

2032

USD

208.43 Billion

USD

304.44 Billion

2024

2032

| 2025 –2032 | |

| USD 208.43 Billion | |

| USD 304.44 Billion | |

|

|

|

|

Flexible Plastic Packaging Market Size

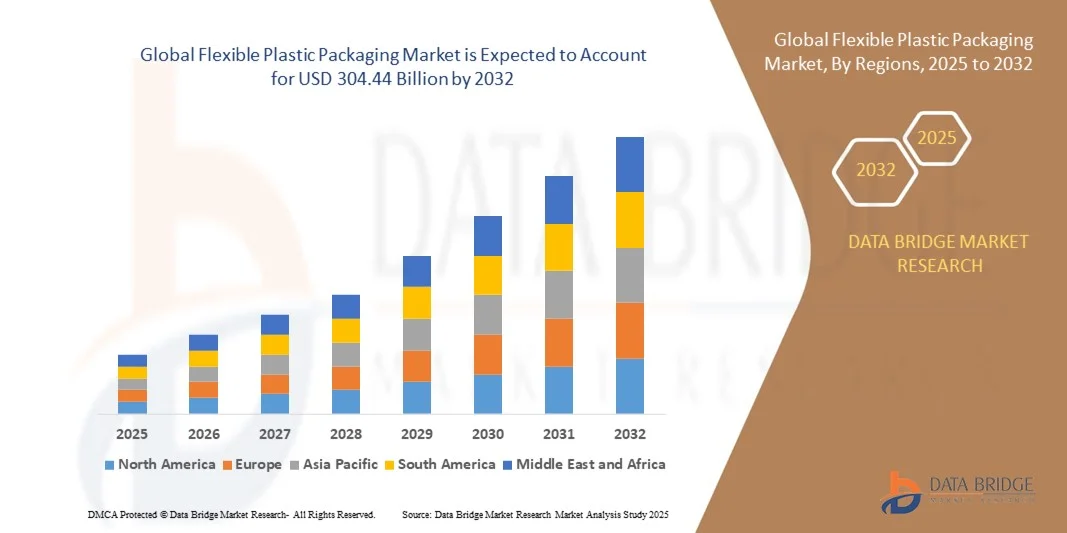

- The global flexible plastic packaging market size was valued at USD 208.43 billion in 2024 and is expected to reach USD 304.44 billion by 2032, at a CAGR of 4.85% during the forecast period

- The market growth is largely fueled by increasing demand for lightweight, durable, and cost-effective packaging solutions across food & beverages, pharmaceuticals, and personal care sectors, driving manufacturers to adopt flexible plastic packaging over traditional rigid formats

- Furthermore, rising consumer preference for sustainable, recyclable, and convenient packaging solutions is accelerating the adoption of innovative flexible plastic formats. These converging factors are enhancing supply chain efficiency, extending product shelf life, and significantly boosting the overall market growth

Flexible Plastic Packaging Market Analysis

- Flexible plastic packaging, offering versatility, durability, and barrier protection, is becoming increasingly essential for modern product packaging across multiple industries. Its ability to preserve product quality, reduce transportation costs, and support convenience features such as resealable and spouted pouches makes it highly attractive to manufacturers and consumers alike

- The escalating demand for flexible plastic packaging is primarily driven by growth in e-commerce, urbanization, changing consumer lifestyles, and increased awareness of sustainable packaging practices, prompting manufacturers to innovate and offer eco-friendly, high-performance solutions

- Asia-Pacific dominated the flexible plastic packaging market with a share of 41.94% in 2024, due to rapid urbanization, growing packaged food consumption, and a strong manufacturing base

- North America is expected to be the fastest growing region in the flexible plastic packaging market during the forecast period due to increasing packaged food consumption, rising pharmaceutical packaging demand, and advancements in flexible packaging technology

- Plastic films segment dominated the market with a market share of 45.5% in 2024, due to its cost-effectiveness, excellent barrier properties, and adaptability across a wide range of packaging formats. Plastic films provide durability, moisture resistance, and compatibility with high-speed packaging machinery, making them highly preferred by manufacturers in food, beverage, and consumer goods sectors. Their ability to support high-quality printing and branding enhances product appeal on retail shelves. In addition, innovations in multi-layer and co-extruded films are contributing to their sustained dominance

Report Scope and Flexible Plastic Packaging Market Segmentation

|

Attributes |

Flexible Plastic Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Flexible Plastic Packaging Market Trends

Rising Demand for Sustainable and Recyclable Packaging Solutions

- The global flexible plastic packaging market is witnessing a strong shift toward sustainability-driven innovations, with manufacturers focusing on recyclable, compostable, and bio-based materials. Growing consumer and regulatory emphasis on reducing environmental impact is pushing companies to adopt eco-conscious packaging alternatives that maintain product integrity and reduce waste generation

- For instance, Amcor plc has expanded its range of recyclable high-barrier packaging films under its AmLite portfolio that align with global circular economy targets. This initiative demonstrates how major producers are addressing increasing consumer demand for sustainable materials while complying with evolving environmental guidelines

- Recyclable flexible packaging formats such as mono-material pouches and polyethylene-based films are gaining traction in food, beverage, and personal care segments. These solutions simplify the recycling process by eliminating layered materials that traditionally posed challenges during waste sorting and processing. The demand for transparent supply chains and easily recyclable solutions is therefore fostering innovation in film compositions and printing technologies

- In addition, brands are emphasizing the use of post-consumer recycled content in flexible plastic packaging to reduce reliance on virgin plastics. This trend is reinforced by corporate sustainability goals and collaborations among packaging producers and recyclers to establish closed-loop systems that support circular economy principles

- Packaging converters are exploring new combinations of bio-based resins and advanced barrier coatings to achieve comparable performance to conventional plastics while minimizing carbon footprint. Such developments are critical to meeting rising sustainability targets without sacrificing product protection or shelf life across numerous end-use industries

- The growing global movement toward sustainability is steadily transforming the flexible plastic packaging landscape. Manufacturers are aligning their research and development strategies with global sustainability frameworks, ensuring that recyclable, lightweight, and resource-efficient packaging becomes a standard requirement across both developed and emerging markets

Flexible Plastic Packaging Market Dynamics

Driver

Growth in E-Commerce and Convenience-Oriented Packaging

- The rapid expansion of e-commerce and shifting consumer habits toward convenience-focused lifestyles are major factors propelling the demand for flexible plastic packaging. Lightweight design, durability, and cost efficiency make it the preferred option for manufacturers and logistics providers aiming to optimize packaging performance in an increasingly digital economy

- For instance, Sealed Air Corporation has developed e-commerce-tailored flexible packaging such as inflatable cushioning and mailer films that protect products during transit while using fewer materials. These innovations demonstrate how manufacturers are responding to the surging demand for compact, flexible formats suitable for fast delivery and handling efficiency

- Flexible packaging offers enhanced barrier properties against moisture, oxygen, and contamination, making it highly effective in maintaining product freshness and safety during extended supply chains. The adaptability of flexible plastics to diverse designs and packaging sizes enhances its appeal in sectors such as food, beverage, personal care, and pharmaceuticals

- In addition, growing urbanization and the rising consumption of single-serve, on-the-go packaging formats are encouraging packaging manufacturers to expand flexible packaging solutions that combine lightweight structure with visual appeal. Consumer preference for resealable, portable, and easy-to-open packages further supports this upward trajectory

- The ongoing digital transformation in retail coupled with sustainability initiatives among logistics companies ensures the long-term relevance of flexible plastic packaging. With advancements in smart printing, durability, and resource efficiency, the market is poised to see sustained expansion across industries leveraging convenience and performance benefits

Restraint/Challenge

Increasing Regulatory Pressure on Single-Use Plastics

- Stringent environmental regulations and policies against single-use plastics across various regions are posing major challenges for the flexible plastic packaging sector. Governments are enforcing stricter recycling mandates, extended producer responsibility schemes, and plastic tax frameworks that compel packaging companies to reassess their material usage and design approach

- For instance, the European Union’s Single-Use Plastics Directive and similar regulations in countries such as India and Canada have restricted or banned certain non-recyclable plastic packaging materials. This regulatory environment is compelling packaging producers such as Berry Global Group to heavily invest in circular packaging technologies to ensure compliance and long-term product viability

- Adhering to these regulations often increases production costs as companies are required to adapt existing manufacturing lines, replace traditional raw materials, and conduct comprehensive sustainability assessments. The shift toward recyclable or bio-based alternatives demands research investments and coordination among supply chain stakeholders to maintain regulatory alignment

- In addition, consumer scrutiny of non-recyclable packaging has intensified, compelling brands to prioritize transparency and environmental accountability in packaging choices. This growing awareness has increased the pressure on companies to offer verified sustainable solutions while keeping pace with functional performance demands

- The evolving regulatory landscape is likely to continue influencing material innovation, sourcing strategies, and recycling infrastructure development in the years ahead. Addressing these challenges through technological advancements, recycling collaborations, and compliance adaptation will be critical for the flexible plastic packaging industry to achieve sustainable growth in competitive global markets

Flexible Plastic Packaging Market Scope

The market is segmented on the basis of type, material, printing technology, and application.

- By Type

On the basis of type, the flexible plastic packaging market is segmented into stand-up pouches, flat pouches, rollstocks, gusseted bags, wicketed bags, wraps, and others. The stand-up pouches segment dominated the market with the largest market revenue share in 2024, driven by their versatility, superior shelf presence, and ability to preserve product freshness. These pouches are widely used across food and beverage, healthcare, and personal care products due to their convenient resealable options and durability. Consumers favor stand-up pouches for their portability and ease of storage, while manufacturers benefit from cost-effective production and branding flexibility. Their compatibility with various filling machines and barrier properties further reinforces their market leadership.

The rollstocks segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for customizable packaging and high-speed automated filling processes. Rollstocks offer flexibility in size, shape, and printability, making them ideal for diverse product lines. The ability to produce multi-layered films that enhance barrier protection and product shelf life is driving adoption. Growth is further supported by rising e-commerce penetration and increasing preference for lightweight, sustainable packaging solutions across food and non-food sectors.

- By Material

On the basis of material, the flexible plastic packaging market is segmented into plastic films, paper, aluminum foil, and bioplastics. The plastic films segment dominated the market with a share of 45.5% in 2024 due to its cost-effectiveness, excellent barrier properties, and adaptability across a wide range of packaging formats. Plastic films provide durability, moisture resistance, and compatibility with high-speed packaging machinery, making them highly preferred by manufacturers in food, beverage, and consumer goods sectors. Their ability to support high-quality printing and branding enhances product appeal on retail shelves. In addition, innovations in multi-layer and co-extruded films are contributing to their sustained dominance.

Bioplastics are expected to witness the fastest CAGR from 2025 to 2032, driven by growing environmental awareness and regulatory push toward sustainable packaging solutions. Bioplastics offer compostable and biodegradable alternatives to conventional plastics, appealing to eco-conscious consumers and businesses. The segment benefits from continuous technological advancements improving material strength, barrier performance, and printability. Increasing adoption by major food and beverage brands seeking sustainable packaging options further accelerates growth.

- By Printing Technology

On the basis of printing technology, the flexible plastic packaging market is segmented into flexography, rotogravure, digital printing, and other printing technologies. The flexography segment dominated the market in 2024, owing to its cost-efficiency, high-speed production capability, and suitability for large-volume runs. Flexography allows vibrant, high-quality printing on various substrates including films, foils, and papers, making it a preferred choice for brand-centric packaging. The technology supports multi-color printing, fast turnaround times, and adaptability to different ink types, enabling manufacturers to meet evolving market demands.

Digital printing is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for shorter production runs, customization, and personalized packaging. Digital printing offers precise color reproduction, variable data printing, and minimal setup requirements, making it ideal for promotional campaigns and small-batch production. The growing adoption of e-commerce and premium product packaging has accelerated the shift toward digital technologies. In addition, ongoing improvements in print speed and cost efficiency are fueling market expansion.

- By Application

On the basis of application, the flexible plastic packaging market is segmented into food and beverage, healthcare, cosmetics and toiletries, industrial and institutional, tobacco products, and other applications. The food and beverage segment dominated the market in 2024, driven by increasing demand for convenient, ready-to-eat, and on-the-go products. Flexible packaging provides superior barrier protection, extended shelf life, and ease of transport, making it highly suitable for perishable and processed foods. Brand visibility, resealable features, and sustainable packaging options further support adoption. Rising urbanization and changing consumer lifestyles continue to reinforce the dominance of this segment.

The healthcare segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the growing need for safe, tamper-evident, and hygienic packaging for pharmaceuticals and medical devices. Flexible packaging solutions in healthcare offer protection from moisture, light, and contamination while enabling compliance with stringent regulatory standards. The expansion of the pharmaceutical industry, increasing home healthcare trends, and rising demand for single-use medical products are key drivers. Advanced materials and smart packaging solutions further contribute to rapid growth in this segment.

Flexible Plastic Packaging Market Regional Analysis

- Asia-Pacific dominated the flexible plastic packaging market with the largest revenue share of 41.94% in 2024, driven by rapid urbanization, growing packaged food consumption, and a strong manufacturing base

- The region’s cost-effective production landscape, increasing adoption of modern packaging machinery, and expanding exports of packaged goods are accelerating market growth

- The availability of skilled labor, supportive government policies, and rising demand for sustainable and convenient packaging solutions are contributing to higher consumption of flexible plastic packaging across both food and non-food sectors

China Flexible Plastic Packaging Market Insight

China held the largest share in the Asia-Pacific flexible plastic packaging market in 2024, owing to its dominance in food processing, e-commerce, and consumer goods manufacturing. The country’s extensive industrial infrastructure, investments in advanced packaging technologies, and strong export orientation are key growth drivers. Rising consumer preference for convenient, resealable, and high-quality packaging further supports market expansion.

India Flexible Plastic Packaging Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by a booming food and beverage industry, expanding pharmaceutical sector, and growing adoption of packaged personal care products. Initiatives promoting domestic manufacturing, coupled with increasing investment in modern packaging lines, are driving market uptake. The surge in organized retail, e-commerce growth, and consumer preference for convenience packaging are accelerating expansion.

Europe Flexible Plastic Packaging Market Insight

The Europe flexible plastic packaging market is expanding steadily, supported by stringent regulatory frameworks, rising demand for sustainable packaging, and strong food and beverage manufacturing sectors. The region emphasizes eco-friendly materials, high-quality standards, and recyclable packaging solutions. Increasing adoption of innovative packaging technologies and premium product packaging is further enhancing market growth.

Germany Flexible Plastic Packaging Market Insight

Germany’s market is driven by advanced food processing and pharmaceutical industries, strong R&D capabilities, and focus on sustainable and high-performance packaging. The country benefits from technological innovations, collaborations between packaging manufacturers and research institutes, and stringent quality standards. Demand is particularly strong for high-barrier films, customized packaging, and premium retail packaging solutions.

U.K. Flexible Plastic Packaging Market Insight

The U.K. market is supported by a mature packaged food and beverage industry, growing sustainability initiatives, and increasing consumer awareness regarding product convenience. Investments in recyclable and compostable packaging, combined with adoption of innovative printing and labeling technologies, are driving growth. Rising e-commerce penetration and demand for personalized packaging are further boosting the market.

North America Flexible Plastic Packaging Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing packaged food consumption, rising pharmaceutical packaging demand, and advancements in flexible packaging technology. Strong focus on sustainability, automation, and smart packaging solutions is accelerating adoption. Growth is also supported by reshoring of manufacturing and increasing collaboration between packaging manufacturers and end-users.

U.S. Flexible Plastic Packaging Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its large packaged food and beverage industry, advanced R&D infrastructure, and significant investment in modern packaging technologies. The country’s focus on sustainable materials, innovative packaging solutions, and consumer convenience is driving market expansion. Presence of leading flexible packaging manufacturers and a robust distribution network further solidify the U.S.'s leading position in the region.

Flexible Plastic Packaging Market Share

The flexible plastic packaging industry is primarily led by well-established companies, including:

- Amcor plc (Switzerland)

- Constantia Flexibles (Austria)

- Sealed Air Corporation (U.S.)

- Bemis Company, Inc. (U.S.)

- Huhtamäki Oyj (Finland)

- Coveris (Austria)

- Sonoco Products Company (U.S.)

- Berry Global Inc. (U.S.)

- Mondi (Austria)

- Clondalkin Group (Ireland)

- Carlyle Investment Management L.L.C. (U.S.)

- Bischof + Klein SE & Co. KG (Germany)

- RPC bpi group (U.K.)

- ProAmpac (U.S.)

- Gascogne Flexible (France)

- Printpack (U.S.)

- Sigma Plastics Group (U.S.)

- American Packaging Corporation (U.S.)

- Glenroy, Inc. (U.S.)

- Cosmo Films Ltd. (India)

Latest Developments in Global Flexible Plastic Packaging Market

- In July 2024, Berry Global Inc. completed a merger with Glatfelter Corporation, resulting in the creation of a new brand named Magnera. This consolidation combined Berry’s Health, Hygiene, and Specialties Global Nonwovens and Films business with Glatfelter’s expertise, forming a stronger entity in high-performance flexible packaging solutions. The merger is expected to enhance Berry’s product portfolio across diverse applications, including healthcare, hygiene, and specialty packaging. By integrating advanced technologies and sustainable materials, the move strengthens the company’s competitive positioning in the global flexible packaging market, accelerates innovation, and enables more comprehensive solutions for environmentally conscious and performance-driven consumers

- In June 2024, Constantia Flexibles partnered with Greiner Packaging to launch a fully home-compostable coffee capsule solution. The new offering combines Greiner's capsule body with Constantia’s EcoPressoLid, creating a 100% compostable product that aligns with consumer preferences for sustainable coffee consumption. This innovation demonstrates the market’s ongoing shift toward eco-friendly packaging solutions and highlights the growing importance of biodegradable and recyclable formats in reducing environmental impact. The launch is expected to boost market adoption of sustainable capsules, strengthen brand reputation, and drive demand in regions with high environmental awareness

- In May 2024, Mondi collaborated with Scan Sverige AB to develop a sustainable packaging solution for Scan’s Pärsons brand cold cuts, including sliced ham, salami, and plant-based alternatives. The collaboration focused on creating packaging that extends product shelf life, ensures food safety, and reduces environmental impact through recyclable materials. This initiative emphasizes the rising trend of integrating sustainable flexible packaging in the food industry, enhancing brand image among eco-conscious consumers while supporting corporate sustainability goals. The solution also positions Mondi as a key partner in the growing market for environmentally responsible food packaging

- In February 2024, Amcor partnered with Stonyfield Organic and Cheer Pack North America to introduce the first all-polyethylene (PE) spouted pouch. This innovative packaging format promotes recyclability by using a single polymer, simplifying the recycling process and contributing to circular economy initiatives. The launch represents a significant step forward in sustainable flexible packaging, demonstrating the industry’s commitment to reducing complex multi-material packaging and increasing the adoption of environmentally friendly alternatives. The pouch is expected to meet rising consumer and regulatory demand for recyclable packaging while enhancing convenience and product protection

- In January 2024, Sealed Air Corporation unveiled a new line of high-barrier stand-up pouches designed specifically for perishable food products. These pouches combine advanced barrier technologies with lightweight, flexible design to improve freshness, extend shelf life, and reduce food waste. The development targets the growing e-commerce and export-oriented food markets by providing packaging that ensures safe transport, maintains quality, and meets sustainability expectations. By addressing both functional performance and environmental considerations, this innovation is likely to accelerate the adoption of advanced flexible packaging solutions across the food and beverage sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL FLEXIBLE PLASTIC PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL FLEXIBLE PLASTIC PACKAGING MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL FLEXIBLE PLASTIC PACKAGING MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 LIST OF KEY PATENTS LAUNCHED

5.2 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.3 LIST OF KEY BUYERS, BY REGION

5.3.1 NORTH AMERICA

5.3.2 EUROPE

5.3.3 ASIA PACIFIC

5.3.4 SOUTH AMERICA

5.3.5 MIDDLE EAST & AFRICA

5.4 PORTER’S FIVE FORCES

5.5 VENDOR SELECTION CRITERIA

5.6 PESTEL ANALYSIS

5.7 REGULATION COVERAGE

5.7.1 PRODUCT CODES

5.7.2 CERTIFIED STANDARDS

5.7.3 SAFETY STANDARDS

5.7.3.1. MATERIAL HANDLING & STORAGE

5.7.3.2. TRANSPORT & PRECAUTIONS

5.7.3.3. HARAD IDENTIFICATION

6 IMPACT OF COVID-19 PANDEMIC ON GLOBAL FLEXIBLE PLASTIC PACKAGING MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTUERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 GLOBAL FLEXIBLE PLASTIC PACKAGING MARKET, BY RAW MATERIAL

7.1 OVERVIEW

7.2 HDPE

7.3 LDPE

7.4 PET

7.5 OTHERS

8 GLOBAL FLEXIBLE PLASTIC PACKAGING MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 STAND-UP POUCHES

8.3 FLAT POUCHES

8.4 GUSSETED

8.5 BAGS

8.6 FILMS

8.7 OTHERS

9 GLOBAL FLEXIBLE PLASTIC PACKAGING MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 FLEXOGRAPHY

9.3 ROTOGRAVURE

9.4 DIGITAL

9.5 OTHERS

10 GLOBAL FLEXIBLE PLASTIC PACKAGING MARKET, BY USAGE

10.1 OVERVIEW

10.2 SINGLE USE

10.3 RE-USABLE

11 GLOBAL FLEXIBLE PLASTIC PACKAGING MARKET,BY SIZE

11.1 OVERVIEW

11.2 SMALL SIZE

11.3 MEDIUM SIZE

11.4 LARGE SIZE

11.5 EXTRA LARGE SIZE

12 GLOBAL FLEXIBLE PLASTIC PACKAGING MARKET,BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 B2B

12.3 B2C

13 GLOBAL FLEXIBLE PLASTIC PACKAGING MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 FOOD AND BEVERAGES

13.2.1 BY PRODUCT

13.2.1.1. STAND-UP POUCHES

13.2.1.2. FLAT POUCHES

13.2.1.3. GUSSETED

13.2.1.4. BAGS

13.2.1.5. FILMS

13.2.1.6. OTHERS

13.3 PERSONAL CARE

13.3.1 BY PRODUCT

13.3.1.1. STAND-UP POUCHES

13.3.1.2. FLAT POUCHES

13.3.1.3. GUSSETED

13.3.1.4. BAGS

13.3.1.5. FILMS

13.3.1.6. OTHERS

13.4 PHARMACEUTICALS

13.4.1 BY PRODUCT

13.4.1.1. STAND-UP POUCHES

13.4.1.2. FLAT POUCHES

13.4.1.3. GUSSETED

13.4.1.4. BAGS

13.4.1.5. FILMS

13.4.1.6. OTHERS

13.5 INDUSTRIAL & CHEMICALS

13.5.1 BY PRODUCT

13.5.1.1. STAND-UP POUCHES

13.5.1.2. FLAT POUCHES

13.5.1.3. GUSSETED

13.5.1.4. BAGS

13.5.1.5. FILMS

13.5.1.6. OTHERS

13.6 CONSTRUCTION

13.6.1 BY PRODUCT

13.6.1.1. STAND-UP POUCHES

13.6.1.2. FLAT POUCHES

13.6.1.3. GUSSETED

13.6.1.4. BAGS

13.6.1.5. FILMS

13.6.1.6. OTHERS

13.7 AGTRICULTURE

13.7.1 BY PRODUCT

13.7.1.1. STAND-UP POUCHES

13.7.1.2. FLAT POUCHES

13.7.1.3. GUSSETED

13.7.1.4. BAGS

13.7.1.5. FILMS

13.7.1.6. OTHERS

13.8 OTHERS

13.8.1 BY PRODUCT

13.8.1.1. STAND-UP POUCHES

13.8.1.2. FLAT POUCHES

13.8.1.3. GUSSETED

13.8.1.4. BAGS

13.8.1.5. FILMS

13.8.1.6. OTHERS

14 GLOBAL FLEXIBLE PLASTIC PACKAGING MARKET, BY GEOGRAPHY

14.1 GLOBAL FLEXIBLE PLASTIC PACKAGING MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.2 NORTH AMERICA

14.2.1 U.S.

14.2.2 CANADA

14.2.3 MEXICO

14.3 EUROPE

14.3.1 GERMANY

14.3.2 U.K.

14.3.3 ITALY

14.3.4 FRANCE

14.3.5 SPAIN

14.3.6 RUSSIA

14.3.7 SWITZERLAND

14.3.8 TURKEY

14.3.9 BELGIUM

14.3.10 NETHERLANDS

14.3.11 REST OF EUROPE

14.4 ASIA-PACIFIC

14.4.1 JAPAN

14.4.2 CHINA

14.4.3 SOUTH KOREA

14.4.4 INDIA

14.4.5 SINGAPORE

14.4.6 THAILAND

14.4.7 INDONESIA

14.4.8 MALAYSIA

14.4.9 PHILIPPINES

14.4.10 AUSTRALIA & NEW ZEALAND

14.4.11 REST OF ASIA-PACIFIC

14.5 SOUTH AMERICA

14.5.1 BRAZIL

14.5.2 ARGENTINA

14.5.3 REST OF SOUTH AMERICA

14.6 MIDDLE EAST AND AFRICA

14.6.1 SOUTH AFRICA

14.6.2 EGYPT

14.6.3 SAUDI ARABIA

14.6.4 UNITED ARAB EMIRATES

14.6.5 ISRAEL

14.6.6 REST OF MIDDLE EAST AND AFRICA

15 GLOBAL FLEXIBLE PLASTIC PACKAGING MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS AND ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

15.7 EXPANSIONS

15.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

17 GLOBAL FLEXIBLE PLASTIC PACKAGING MARKET- COMPANY PROFILES

17.1 PROAMPAC .

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT UPDATES

17.2 AMCOR PLC

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT UPDATES

17.3 GOGLIO SPA

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT UPDATES

17.4 AR PACKAGING

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT UPDATES

17.5 CONSTANTIA FLEXIBLES

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT UPDATES

17.6 ALTANA

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT UPDATES

17.7 SONOCO PRODUCTS COMPANY

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT UPDATES

17.8 FLAIR FLEXIBLE PACKAGING CORPORATION

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT UPDATES

17.9 COVERIS

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT UPDATES

17.1 SEALED AIR

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT UPDATES

17.11 WIPAK GROUP

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT UPDATES

17.12 BISCHOF + KLEIN SE & CO. KG.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT UPDATES

17.13 SCHUR FLEXIBLES

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT UPDATES

17.14 BERRY GLOBAL INC.

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT UPDATES

17.15 CELLPACK AG PACKAGING

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT UPDATES

17.16 SÜDPACK

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT UPDATES

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 RELATED REPORTS

19 QUESTIONNAIRE

20 CONCLUSION

21 ABOUT DATA BRIDGE MARKET RESEARCH

Global Flexible Plastic Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Flexible Plastic Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Flexible Plastic Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.