Global Flow Chemistry Market

Market Size in USD Billion

CAGR :

%

USD

1.56 Billion

USD

3.93 Billion

2024

2032

USD

1.56 Billion

USD

3.93 Billion

2024

2032

| 2025 –2032 | |

| USD 1.56 Billion | |

| USD 3.93 Billion | |

|

|

|

|

Flow Chemistry Market Size

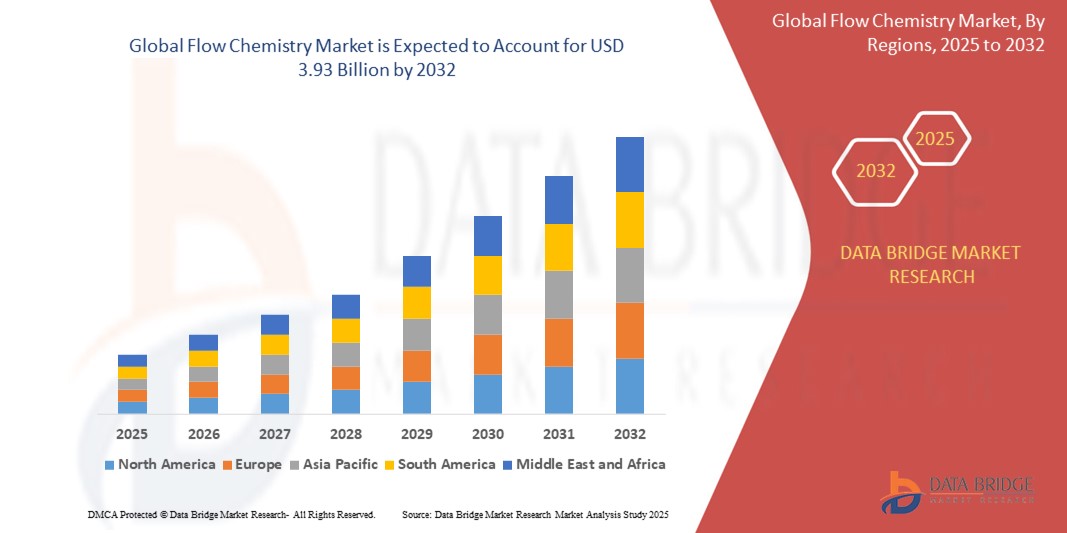

- The global flow chemistry market was valued at USD 1.56 billion in 2024 and is expected to reach USD 3.93 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 10.8%, primarily driven by the increasing demand for green and sustainable manufacturing processes

- This growth is driven by factors such as continuous flow systems improve yield and safety while supporting seamless scale-up, making them ideal for sustainable industrial production

Flow Chemistry Market Analysis

- Flow chemistry is basically a process in which chemical reactions are performed reactions between reactive compounds in a single flowing stream and used for hydrogenation, oxidation, halogenation and diazotization reactions. Under this, reagents are continuously pumped through a reactor and the product is continuously collected.

- The factors such as growth in the chemical industry and widespread adoption of micro reactors in the pharmaceutical industry are the root cause of the flow chemistry market growth rate.

- North America is expected to dominate the flow chemistry market due to the growing pharmaceutical industry and continuous technological innovation.

- Asia-Pacific is expected to be the fastest growing region in the flow chemistry market during the forecast period due to high demand for cosmetics, soaps, and detergents which drives the chemical industry, thus further increasing demand for flow chemistry market.

- Chemical industries segment is expected to dominate the market with a market share of 39.2% due to the ability to safely conduct hazardous reactions within closed systems enhances worker safety and regulatory compliance, making flow chemistry appealing for chemical synthesis.

Report Scope and Flow Chemistry Market Segmentation

|

Attributes |

Flow Chemistry Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Flow Chemistry Market Trends

“Adoption of Continuous Flow Processes in Pharmaceutical Manufacturing”

- Continuous flow chemistry significantly reduces reaction times and enhances heat and mass transfer compared to traditional batch processing—making it highly attractive for pharmaceutical companies seeking cost and time efficiency.

- Regulatory bodies like the U.S. FDA and EMA are encouraging the use of continuous manufacturing in drug production due to its improved product consistency and reduced contamination risks.

- Flow chemistry systems allow seamless scale-up from lab to industrial scale with minimal revalidation, ideal for agile drug development and small-batch specialty medicines.

- For instance, in 2023, Pfizer and GSK reported expanded use of flow chemistry systems in small-molecule API production, citing improved yield and sustainability. Additionally, Snapdragon Chemistry (acquired by Cambrex) is developing continuous flow solutions for pharma innovators

- As pharmaceutical manufacturers push for faster, greener, and more controllable production methods, the adoption of continuous flow chemistry is becoming a foundational trend driving the global market’s growth.

Flow Chemistry Market Dynamics

Driver

“Increasing Demand for Green and Sustainable Manufacturing Processes”

- Flow chemistry enables precise control over reaction parameters, reducing waste, emissions, and energy usage compared to batch processes.

- Global environmental regulations (e.g., REACH in Europe, EPA in the U.S.) are pushing industries—especially pharmaceuticals and chemicals—to adopt cleaner technologies.

- Continuous flow systems improve yield and safety while supporting seamless scale-up, making them ideal for sustainable industrial production.

- Major pharmaceutical companies like Novartis and GlaxoSmithKline have integrated flow chemistry into their green chemistry initiatives to reduce process footprints.

For instance,

- Novartis partnered with MIT to develop a continuous manufacturing system using flow chemistry, reducing production times and environmental impact.

- As sustainability becomes central to corporate strategy and investor preference, flow chemistry's green profile positions it as a critical enabler of future-ready manufacturing.

Opportunity

“Expanding Role in Green and Sustainable Chemical Manufacturing”

- Flow processes often require less solvent, generate fewer byproducts, and operate at lower energy consumption levels than traditional batch methods.

- Continuous systems enable easy separation and reuse of expensive or sensitive catalysts, increasing sustainability and lowering costs.

- Flow reactors are well-suited for biomass-derived and CO₂-based feedstocks, facilitating green chemistry applications.

- Companies are under pressure to improve their environmental profiles; adopting flow chemistry supports compliance with ESG metrics and circular production models.

For instance,

- Novartis reported reducing waste by over 50% in a key pharmaceutical intermediate using flow technology.

- Researchers at the University of Cambridge used immobilized catalysts in flow to improve atom economy in fine chemical synthesis.

- BASF employs flow chemistry to convert bio-based raw materials into intermediates for eco-friendly surfactants.

- With global emphasis on sustainable manufacturing, flow chemistry offers a practical and profitable path for chemical producers to meet green targets while maintaining competitiveness.

Restraint/Challenge

“High Initial Capital Investment”

- Flow chemistry requires advanced reactors, pumps, sensors, and control systems. These are significantly more expensive than conventional batch processing equipment.

- Most pharmaceutical and chemical plants are built around batch processing. Retrofitting flow chemistry systems into these environments requires major redesigns and costly process validation.

- Operating and maintaining flow chemistry systems demands specialized training in process automation and continuous manufacturing, adding to labor and training expenses.

- Due to the high upfront costs, many SMEs hesitate to adopt flow chemistry, despite its long-term efficiency and safety benefits. This limits market penetration.

- While flow chemistry offers advantages like faster reaction times and improved safety, the high initial investment acts as a significant barrier, slowing widespread adoption—particularly in price-sensitive or developing markets.

Flow Chemistry Market Scope

The market is segmented on the basis of technology, reactor type, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Technology |

|

|

By Reactor Type |

|

|

By End User |

|

In 2025, the chemical industries segment is projected to dominate the market with a largest share in end user segment

The chemical industries segment is expected to dominate the market with the largest share of 39.2% in 2025 due to the ability to safely conduct hazardous reactions within closed systems enhances worker safety and regulatory compliance, making flow chemistry appealing for chemical synthesis. With increasing emphasis on green chemistry, flow chemistry's ability to reduce environmental impact through efficient resource utilization and waste reduction contributes to its adoption in the chemical sector.

The pharmaceuticals are expected to account for the highest CAGR during the forecast period in technology market

In 2025, the pharmaceuticals segment is expected to account for the highest CAGR due to flow chemistry enables faster synthesis of Active Pharmaceutical Ingredients (APIs), reducing time-to-market for new drugs. This efficiency is crucial for pharmaceutical companies aiming to expedite drug discovery and development processes.

Flow Chemistry Market Regional Analysis

“North America is the Dominant Region in the Flow Chemistry Market”

-

North America dominates the flow chemistry market, due to the growing pharmaceutical industry and continuous technological innovation

- The U.S. holds a significant share 72.13%, due to strong presence in pharmaceutical and chemical sectors, which are primary adopters of flow chemistry technologies.

- The U.S. has a well-established R&D ecosystem that fosters innovation in chemical synthesis technologies, supporting the adoption of continuous flow processes.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific region is expected to witness the highest growth rate in the flow chemistry market, driven by high demand for cosmetics, soaps, and detergents which drives the chemical industry, thus further increasing demand for flow chemistry market

- India is expected to lead the growth due to robust pharmaceutical and chemical sectors are increasingly adopting flow chemistry to enhance production efficiency and meet the growing demand for generic drugs.

- With rising concerns about pollution and a push for greener technologies, Indian industries are turning to flow chemistry for its efficiency and reduced environmental impact.

Flow Chemistry Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Biotage (Sweden)

- AM Technology (U.K.)

- CEM Corporation (U.S.)

- Syrris Ltd (U.K.)

- Vapourtec Ltd. (U.K.)

- ThalesNano Inc. (Hungary)

- H.E.L Group (U.K.)

- Uniqsis Ltd (U.K.)

- Chemtrix (Netherlands)

- Zhengzhou Well-known Instrument & Equipment Co. Ltd. (China)

- FutureChemistry (Netherlands)

- Corning Incorporated (U.S.)

- Parr Instrument Company (U.S.)

- Cambridge Reactor Design Ltd (U.K.)

- Lonza (Switzerland)

- PDC Machines Inc. (U.S.)

- Little Things Factory GmbH (Germany)

- YMC Co., Ltd. (Japan)

Latest Developments in Global flow chemistry market

-

In December 2023, AGI Group completed the acquisition of Chemtrix B.V. This acquisition is expected to enhance AGI Group’s capabilities in the flow chemistry sector, particularly in pilot-scale and commercial manufacturing applications.

- In July 2023, H.E.L Group announced a collaboration with IIT Kanpur to support sustainable energy initiatives driven by the institute. The partnership focuses on establishing new testing laboratories dedicated to research in novel chemistry development, battery storage, and thermal property analysis.

- In May 2021, Lonza (Switzerland) entered a partnership with Codexis (U.S.), a leading enzyme engineering company, to jointly develop and commercialize enzymatic methods using flow chemistry for the synthesis of pharmaceutical intermediates and active pharmaceutical ingredients (APIs).

- In March 2021, Thermo Fisher Scientific (U.S.) announced the acquisition of Qiagen N.V. (Netherlands), a key provider of sample and assay technologies for molecular diagnostics, applied testing, and academic research. This acquisition aims to enhance Thermo Fisher’s footprint in the rapidly growing molecular diagnostics market.

- In August 2021, Lonza (Switzerland) acquired Parchem Fine & Specialty Chemicals (U.S.), a prominent supplier of specialty chemicals and custom manufacturing services. This move supports Lonza’s strategy to expand its specialty chemicals portfolio and apply its expertise in flow chemistry to deliver more efficient and sustainable solutions for its customers.

- In October 2020, PerkinElmer (U.S.) agreed to provide automation solutions for the research and production of small molecules and biotherapeutics—including flow chemistry technologies—to the U.K.-based Medicines Manufacturing Innovation Centre.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Flow Chemistry Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Flow Chemistry Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Flow Chemistry Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.